Eight Individuals Arrested by FBI in Small Business Loan Carroting Scam

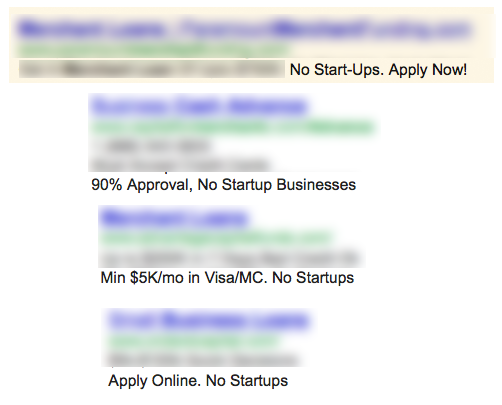

April 18, 2025 Eight individuals have been arrested by the FBI and charged in connection with a scheme to defraud small business owners out of millions of dollars by charging them money in return for a promise of a large line of credit that would never come.

Eight individuals have been arrested by the FBI and charged in connection with a scheme to defraud small business owners out of millions of dollars by charging them money in return for a promise of a large line of credit that would never come.

The individuals charged include: Joseph Rosenthal, Matthew Robertson, Nicholas Smith, James Missry, Paul Cotogno, Blaise Cotogno, Adam Akel, and Nicholas Winter.

As part of the alleged conspiracy the group used the following domain names: oakcapitalgrp.com, oldbridgefunding.com, wsfcap.com, opticapitalgrp.net, and more.

In addition, they used company names and entities that include: Clover Advance Group LLC, FFCG LLC, Advance Source Capital Group dba ASF Capital, WSF Capital Group, Forward Advance LLC, Delta Fund Grp, Oak Capital Grp, United Front Capital, Quick Call Capital, Pine Equities, D&D Equities, ASC Group LLC, and Old Bridge Funding.

“For some victims, the Defendants sent some of the Defendants’ funds to bank accounts provided by the victim,” the criminal complaint states. “The victim was instructed to then repay that same money back to the Defendants over several days, which would in turn improve the victim’s credit score, making the victim more credit-worthy. Further, to secure the loan or line of credit, the victims were required to make a larger, one-time payment comprised of the victim’s own money, which the Defendants typically referred to as a balloon payment. Once the Defendants had recouped their own funds and obtained the victim’s own money via the balloon payment, the Defendants did not extend financing to the victim. Instead, the Defendants kept the victim’s money and broke off communication with the victim.”

The scam had been going on for almost four years, according to the criminal complaint. Several of the names listed above had circulated on an industry message board as likely being involved in a bait and switch LOC fraud scheme.

“These defendants perpetrated a years’ long scheme to defraud hard-working business owners in New Jersey and across the United States, stealing millions of dollars from thousands of victims,” said U.S. Attorney Alina Habba. “These charges reflect our Office’s commitment to holding accountable those who prey on small business owners trying to support their communities and earn a decent living.”

Onset Financial Acquires Channel Forming One of the Largest Independent Equipment Finance Lenders

April 8, 2025 Draper, UT, and Minnetonka, MN (April 8, 2025) – Onset Financial, one of the nation’s fastest-growing independent equipment leasing companies, today announced it has acquired Channel and its subsidiaries, a premier provider of equipment finance and working capital solutions for small business.

Draper, UT, and Minnetonka, MN (April 8, 2025) – Onset Financial, one of the nation’s fastest-growing independent equipment leasing companies, today announced it has acquired Channel and its subsidiaries, a premier provider of equipment finance and working capital solutions for small business.

This strategic acquisition brings together two of the industry’s most innovative and financially strong independent finance companies, creating an unmatched platform with the scale, expertise, and resources to meet the evolving needs of businesses across all segments. For more than 16 years, Onset has been a driving force in equipment finance, facilitating over $5 billion in funding, with more than $1 billion in the past year alone. With a proven track record across industries including manufacturing, healthcare, energy, aviation, and technology, Onset has built a reputation for exceptional deal structuring, capital strength, and a relentless focus on customer and team member success. Recognized as a Monitor Magazine Top 100 and Independent Finance Company, Inc. Magazine Best Workplace, and Salt Lake Tribune Top Workplace, Onset’s growth trajectory and industry leadership continue to set it apart.

Since its founding in 2009, Channel has provided over $3 billion in financing to more than 30,000 businesses, earning widespread recognition for its data and technology-driven approach, deep industry relationships, and commitment to its partners. Its accolades include listing on Inc. Magazine’s Fastest Growing Companies list for 12 consecutive years. The company has also been recognized as a Top Workplace by Inc. Magazine, Minnesota Star Tribune, and on Monitor Magazine’s Top Companies list for both Culture and Leadership, all of which reflect a reputation built on trust, service, and innovation. Channel has developed industry superior systems and processes that enable it to deliver a best-in-class financial product to its partners, enhancing efficiency and service.

By joining forces, Onset and Channel are setting a new standard for what a fiercely independent finance company can achieve. This partnership amplifies their collective ability to be nimble, creative, and hyper-focused on innovation, culture, and lasting partnerships. Importantly, the Channel brand and subsidiaries will continue, and the full leadership team and employees will remain in place, ensuring continuity without any disruption for its partners and customers. Onset gains expanded capabilities in small-ticket financing and exclusive partner-based funding models, while Channel benefits from increased capital access and accelerated growth. Together, they create a dynamic, best- in-class lending platform that combines flexibility, scale, and operational strength to deliver groundbreaking financial solutions with a partner-centric focus.

“This acquisition positions us to lead the independent equipment finance space with unmatched resources, expertise, and combined financial strength,” said Justin Nielsen, Founder & CEO of Onset Financial. “The exceptional leadership, industry experience, and culture that the Channel team brings to the table are a perfect match with Onset. Their deep partner network and technology-driven approach, combined with our large-scale leasing capabilities, create a powerhouse of innovation and service. We are excited for the near-term growth opportunities this creates, as we combine forces to build an even stronger future. Together, we’re not just expanding our reach, we’re setting a new standard for excellence, agility, and partnership in the industry.

“This is a defining moment for Channel,” said Brad Peterson, Co-Founder and CEO of Channel. “From my first conversation with Justin, it was clear that Onset operates with a bold, forward-thinking approach that sets them apart. Their vision, leadership, and ability to execute at scale are truly impressive. Our united strength in both financial foundation and proven expertise, positions us extremely well for projected expansion. What excites me most, however, is not just the financial strength they bring, but their entrepreneurial spirit, like-minded culture, and commitment to collaboration. With Onset, we’re ready to build and transform what is possible in our industry for our partners and customers.”

Established in financial strength, industry expertise, and progressive culture, the newly combined organization will offer a powerful alternative to traditional lending institutions, providing businesses with the agility, service, and tailored financing solutions they need to thrive.

Onset’s legal counsel was Ray Quinney & Nebeker. Keefe, Bruyette & Woods, a Stifel Company, served as financial advisor to Channel, and Simpson Thacher & Bartlett LLP served as its legal advisor.

About Onset Financial, Inc.

Founded in 2008, Onset Financial, Inc. is an industry leader in equipment leasing and financing. Onset’s seasoned Management Team has decades of equipment leasing experience and key industry relationships that enable Onset to offer additional flexibility in lease structuring. For more information, please call 801-878-0600 or visit www.onsetfinancial.com.

About Channel

Established in 2009, Channel is a leading full-service independent lender offering a single source solution for both equipment finance and working capital to small businesses. To date, Channel and its subsidiaries have funded over $3 billion to more than 30,000 businesses across the U.S. The organization is comprised of three business divisions that operate from its main office in Minnetonka, MN, along with additional locations in Kennesaw, GA, Mount Laurel, NJ, Des Moines, IA, and Marshall, MN. For more information about Channel, please visit www.channelpartnersllc.com.

Capify Appoints Sam Colclough as Head of Technology to Accelerate Growth in the UK & AU Markets

September 17, 2024 MANCHESTER, 17th September 2024 – Capify, a leading online SME lender, is proud to announce the appointment of Sam Colclough as Head of Technology for both the United Kingdom and Australia. Sam joins Capify at an exciting time for the company, which is experiencing a growth trajectory, leveraging a new £100 million (~$130 mil USD) credit line from Pollen Street Capital, recent senior team appointments and an expanded product suite.

MANCHESTER, 17th September 2024 – Capify, a leading online SME lender, is proud to announce the appointment of Sam Colclough as Head of Technology for both the United Kingdom and Australia. Sam joins Capify at an exciting time for the company, which is experiencing a growth trajectory, leveraging a new £100 million (~$130 mil USD) credit line from Pollen Street Capital, recent senior team appointments and an expanded product suite.

Sam brings a wealth of experience and expertise to Capify. With over 20 years of IT leadership experience, Sam will spearhead Capify’s technological and data-driven innovations, empowering the business to continue its growth across the UK and Australia.

“I’m thrilled to join Capify at such an exciting time,” said Sam Colclough. “Technology is a key enabler of growth, and I’m looking forward to working with the team to further enhance our technology, data & artificial intelligence capabilities. By driving innovation and operational efficiencies, we will continue to deliver exceptional value and support to SMEs across the UK and Australia, helping them to grow and thrive.”

Founded in the UK in 2008 during the global financial crisis, Capify has become a vital financial resource for small and medium-sized businesses. Recognised for its commitment to excellence, Capify was awarded SME Lender of the Year (up to £1m) at the UK Credit Awards last year. Originally launched in the United States in 2002, Capify was one of the world’s first online alternative financing companies for SMEs. Since its creation, Capify has supported over 20,000 businesses and funded over £1.2 billion to help SMEs achieve their growth ambitions.

Capify COO/CFO, John Rozenbroek, said: “We are thrilled to have Sam join the team. His impressive track record of leveraging technology to drive business growth aligns perfectly with our mission. As we look to scale further, Sam’s leadership will be crucial in taking our data and technology to the next level, ensuring we remain at the forefront of innovation in the alternative finance space.”

Capify’s appointment of Sam Colclough underscores the company’s commitment to technological growth and innovation, ensuring it remains at the forefront of the alternative finance industry, delivering unparalleled service and support to SMEs in the UK & Australia.

Abut Capify

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Originally started in the US over twenty years ago, the fintech business now operates in the UK and Australia and has served these markets for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit:

Capify UK – http://www.capify.co.uk

Capify Australia – http://www.capify.com.au

Media enquiries

Ash Yazdani, Marketing Director

ayazdani@capify.com

Two years ago, it was easy to say that the average Merchant Cash Advance (MCA) deal was about $20,000 to $25,000. The claim used to be, funding up to $250,000! And yet very few companies would actually go that high when it came down to it. But now?

Two years ago, it was easy to say that the average Merchant Cash Advance (MCA) deal was about $20,000 to $25,000. The claim used to be, funding up to $250,000! And yet very few companies would actually go that high when it came down to it. But now?

Today was G-Day in the Merchant Cash Advance arena.

Today was G-Day in the Merchant Cash Advance arena.

Banks are lending again but businesses aren’t taking the money… Surprised? We’re not. According to an article in the

Banks are lending again but businesses aren’t taking the money… Surprised? We’re not. According to an article in the