Prospa, Now Valued at $235 Million, is a Major Online Small Business Lender

February 22, 2017 Online small business lending in Australia is taking off, especially for Sydney-based Prospa, who according to the Australian Financial Review, has slightly more than half of the industry’s market share. The company just announced a $25 million (AUD) equity round led by AirTree Ventures that pegged Prospa’s value at $235 million (AUD).

Online small business lending in Australia is taking off, especially for Sydney-based Prospa, who according to the Australian Financial Review, has slightly more than half of the industry’s market share. The company just announced a $25 million (AUD) equity round led by AirTree Ventures that pegged Prospa’s value at $235 million (AUD).

Prospa is significant in that it received early support from US-based Strategic Funding, the same company that just absorbed the US operations of Capify. A 2013 press release said that Strategic would be providing the technology for the electronic servicing, underwriting and cash management of all Prospa Advance accounts in Australia in addition to jointly funding all the merchant cash advances and loans they originated. Sources say however that the arrangement is no longer in effect.

In September 2015, The Carlyle Group, one of the largest private equity firms in the world, participated in a $60 million round for the company. Prospa has now funded more than $250 million to small businesses since inception.

“The market in Australia has been very ripe for alternative finance,” Prospa co-CEO Beau Bertoli said to AltFinanceDaily about 18 months ago. “We see an opportunity for the alternative finance segment to be more dominant in Australia than it is in America.”

The Australian Financial Review cites Bertoli as more recently saying that the market there could grow to at least $20 billion in the next five years.

Similar to offers in the US, Prospa lends between $5,000 to $250,000 for loans up to one year.

WEX and OnDeck Announce Strategic Partnership to Offer Financing to WEX Small Business Customers

January 17, 2017

SOUTH PORTLAND, Maine–(BUSINESS WIRE)–WEX Inc. (NYSE: WEX), a leading provider of corporate and small business payment solutions, and OnDeck® (NYSE: ONDK), a leader in online lending for small business, announced a partnership in which WEX will offer business financing from OnDeck to its small business customers.

WEX is a global, multi-channel provider of corporate payment solutions representing more than 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. The company and its subsidiaries employ more than 2,500 associates who provide services in the Americas, Europe, Australia, and Asia.

“Our partnership with OnDeck will be a huge benefit to our small to mid-sized business customers who will now have access to new sources of financing,” said Brian Fournier, vice president, fleet channel partner, WEX. “The strategic partnership will enable these customers to take advantage of OnDeck’s leading portfolio of products and services.”

“OnDeck is 100 percent focused on helping small businesses seize opportunities, such as hiring employees, funding marketing, or buying inventory,” said Jerome Hersey, vice president, OnDeck. “Our partnership with WEX, an innovator in the payments marketplace, will enable us to offer more small businesses an unparalleled set of choices to meet their financing needs.”

For more information about WEX’s small business offerings, please visit: http://www.wexinc.com/fleet/small-business/.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment solutions. From its roots in fleet card payments beginning in 1983, WEX has expanded the scope of its business into a multi-channel provider of corporate payment solutions representing approximately 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. WEX serves a global set of customers and partners through its operations around the world, with offices in the United States, Australia, New Zealand, Brazil, the United Kingdom, Italy, France, Germany, Norway and Singapore. WEX and its subsidiaries employ more than 2,500 associates. The company has been publicly traded since 2005, and is listed on the New York Stock Exchange under the ticker symbol “WEX.” For more information, visit www.wexinc.com and follow WEX on Twitter at @WEXIncNews.

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the Company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the Company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website www.businessloans.com.

OnDeck, the OnDeck logo, OnDeck Score and OnDeck Marketplace are trademarks of On Deck Capital, Inc.

Contacts

WEX

Rob Gould, 207-523-7429

robert.gould@wexinc.com

or

OnDeck

Jim Larkin, 203-526-7457

jlarkin@ondeck.com

OnDeck Announces New $200 Million Revolving Credit Facility with Credit Suisse

December 9, 2016

NEW YORK, Dec. 9, 2016 /PRNewswire/ — OnDeck® (NYSE: ONDK), the leader in online lending for small business, announced today the closing of a $200 million asset-backed revolving debt facility with Credit Suisse.

In addition to its other funding sources, OnDeck may now obtain funding under the new credit facility with Credit Suisse, subject to customary borrowing conditions, by accessing $125 million of committed capacity and an additional $75 million of capacity available at the discretion of the lenders.

“OnDeck has emerged as a leading provider of growth capital to small businesses around the country,” said Jon-Claude Zucconi, Managing Director, Credit Suisse. “The team’s innovative vision and commitment to financing is vital to expansion and growth in the small business community.”

Under the facility, loans will be made to Prime OnDeck Receivable Trust II, LLC, or PORT II, a wholly-owned subsidiary of OnDeck, to finance PORT II’s purchase of small business loans from OnDeck. The revolving pool of small business loans purchased by PORT II serves as collateral under the facility. OnDeck is acting as the servicer for such small business loans. The Class A Loans under the facility were rated by DBRS, Inc.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

“This transaction marks a continuation of our financing strategy to diversify funding sources, extend debt maturities, and create additional funding capacity to pave the way for future loan growth,” said Howard Katzenberg, Chief Financial Officer, OnDeck. “We are pleased to have Credit Suisse, a leading global financial institution, support OnDeck in our mission to power the growth of small business through lending technology and innovation.”

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada, and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website BusinessLoans.com.

For more information, please visit www.ondeck.com.

About Credit Ratings

Credit ratings are opinions of the relevant rating agency. They are not facts and are not opinions of OnDeck. They are not recommendations to purchase, sell or hold any securities and can be changed or withdrawn at any time.

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of the private Securities Litigation Reform Act of 1995 and other legal authority. Forward-looking statements include statements about the intended use of proceeds from the new facility and expected optional repayment in full of the existing facility, the extension of debt maturities and the availability of additional funding capacity, all of which are dependent upon compliance with the borrowing and other conditions of the new facility, as well as information concerning OnDeck’s business plans and objectives and financing plans including future loan growth. Forward-looking statements can also be identified by words such as “will,” “enables,” “expects”, “may,” “allows,” “continues,” “believes,” “intends,” “anticipates,” “estimates” or similar expressions. Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on OnDeck’s current beliefs, expectations and assumptions regarding the future of its business, anticipated events and trends, the economy and other future conditions. Moreover, OnDeck does not assume responsibility for the accuracy and completeness of forward-looking statements. As such, they are subject to inherent uncertainties, changes in circumstances, known and unknown risks and other factors that are difficult to predict and in many cases outside OnDeck’s control.

As a result, you should not rely on any forward-looking statements. OnDeck’s expected results may not be achieved, and actual results may differ materially from OnDeck’s expectations. Important factors that could cause actual results to differ from OnDeck’s forward-looking statements are the risks that OnDeck may not be able to manage its anticipated or actual growth effectively, that its credit models do not adequately identify potential risks, and other risks, including those under the heading “Risk Factors” in OnDeck’s Annual Report on Form 10-K for the year ended December 31, 2015, Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 and in other documents that OnDeck files with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov. OnDeck undertakes no obligation to publicly update any forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes in OnDeck’s expectations, except as required by law.

OnDeck, the OnDeck logo and OnDeck Score are trademarks of On Deck Capital, Inc.

Logo – http://photos.prnewswire.com/prnh/20150812/257781LOGO

SOURCE On Deck Capital, Inc.

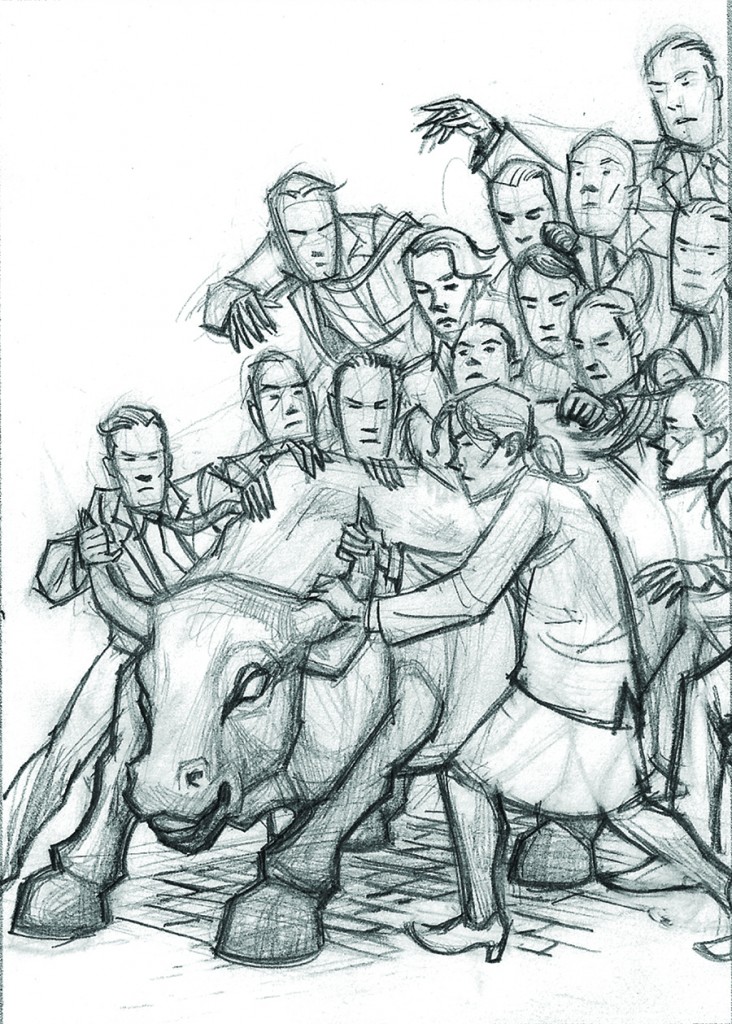

IT’S A BROKER’S WORLD

August 31, 2016

From east to west, small businesses are getting funded. But how they’re found and who they work with depends on where they are. In the US, where brokers tend to have a love/hate relationship with the funding companies they work with, they are no doubt a driving force in the market. In other countries, they might not even exist, are just starting to bloom or they add balance to a mature market. Is the world built for brokers? AltFinanceDaily traveled far and wide to find the answers.

Down under in Australia where American-based merchant cash advance and lending companies have expanded, the ISO (which stands for Independent Sales Office and is synonymous with broker) model has not really followed. David Goldin, CEO of Capify, an international company headquartered in New York, told AltFinanceDaily that there’s very few ISOs in Australia.

He believes that’s because there’s next to no payment processing ISO market there, a foundation that was a major precursor in the US towards the development of ISOs reselling merchant cash advances and business loans.

He believes that’s because there’s next to no payment processing ISO market there, a foundation that was a major precursor in the US towards the development of ISOs reselling merchant cash advances and business loans.

Luke Schmille, President of CapRock Services, echoed same. The Dallas-based company founded Sprout Funding in Australia earlier this summer as part of a joint venture with Sydney-based family office Huntwick Holdings. “Direct marketing is the primary method [of acquiring deal flow],” he said. “The credit card processing space is controlled by several large banks, so you don’t see ISO efforts in the acquiring space either.”

Big bank dominance was only one reason why another country’s emerging alternative small business funding market developed slowly. In Hong Kong, non-bank alternatives like merchant cash advances faced legal uncertainty for a long time. For example, Global Merchant Funding (GMF), once the only merchant cash advance company in the Chinese special administrative region, had been relentlessly pursued for years by the Secretary for Justice for conducting business as a money lender without a license. GMF fought it. And won.

In May of this year, the legality of merchant cash advances ultimately prevailed after the highest court ruled the agreements were not loans. Emboldened, several companies have stepped up their marketing of the product. But whether they’re doing daily debit loans or split-processing merchant cash advances (both of which exist there), marketing tends to be directed at merchants, not a middle market of brokers.

Gabriel Chung of Hong Kong-based Advanced Express Capital said that there are a handful of large brokers typically comprised of former bankers, but the rest of the broker market is highly fragmented, mostly made up of individual freelancers.

Gabriel Chung of Hong Kong-based Advanced Express Capital said that there are a handful of large brokers typically comprised of former bankers, but the rest of the broker market is highly fragmented, mostly made up of individual freelancers.

Adrian Cook, the Founder and CEO of Hong Kong-based Asia Capital Advance, agreed that marketing is usually aimed at merchants directly but that it’s changing. “Since the market is still very new and MCA is only beginning to gain popularity, brokers on the market are only starting to recognize MCA,” he said. “There is a lot of room for the brokerage market to grow.”

In the UK, where Capify also operates, CEO David Goldin explained that the UK doesn’t have a lot of credit card processing ISOs so there wasn’t a major migration from that business to MCA like there was in the US. But that doesn’t mean there is no middleman market at all.

Paul Mildenstein, executive director of London-based Liberis, said that brokers are an important channel, but not as dominant as they are in the US. “Our brokers are usually members of the NACFB, an organisation in the UK that actively supports and provides operating principles to the furtherance of the commercial finance broker community,” he wrote. The National Association of Commercial Finance Brokers claims to have 1600 members, one among them is Liberis.

Paul Mildenstein, executive director of London-based Liberis, said that brokers are an important channel, but not as dominant as they are in the US. “Our brokers are usually members of the NACFB, an organisation in the UK that actively supports and provides operating principles to the furtherance of the commercial finance broker community,” he wrote. The National Association of Commercial Finance Brokers claims to have 1600 members, one among them is Liberis.

“Many clients want the support of an experienced professional who can discuss the financial options available to them in their specific circumstances,” said Liberis’ CEO, Rob Straathof. “Given relatively low awareness of the Business Cash Advance product in the UK, this means that brokers have a key role to play in educating potential customers on when this is the right option for them,” he added.

Straathof stressed a robust criteria for the brokers they work with and explained that brokers are their eyes and ears in the market. “The relationships we have with them are not transactional, but transformational for our business,” he said.

The NACFB was also praised by Alexander Littner, Managing Director of Chelmsford, Essex-based Boost Capital. The company, which is actually a subsidiary of Coral Springs, FL-based BFS Capital in the US, sees a balance between their use of brokers and their efforts to acquire customers directly.

“As the alternative finance market is still relatively new here in the UK these brokers are important for this independent advice, and to help educate the market and establish trust,” Littner said. “At Boost Capital we work very closely with brokers across the UK, they are a critical part of our growth and fundamental to our ongoing success.”

In the US, brokers play such a dominant role in customer acquisition that some MCA funding companies rely on them to source the entirety of their business. Back in February, Jordan Feinstein of NY-based Nulook Capital told AltFinanceDaily, “We decided that the best way to grow is to build relationships to avoid the overhead, compliance, training and manpower that a sales team would require.” Nulook markets its broker-only approach as a strength.

Others take a more blended approach, like Justin Bakes, CEO of Forward Financing, for example. “While our priority is to self originate, it is essential to create and maintain partnerships in this business,” he said earlier this year.

Notably, no such guiding authority like the UK’s NACFB exists for brokers in the US so it’s not easy to track exactly how many there are or how they operate, but their role in the industry cannot be understated. AltFinanceDaily actually labeled 2015 The Year Of The Broker, when it published an article in its March/April 2015 issue that tried to capture the essence of the industry at the time. Tom McGovern, who was then a VP at Cypress Associates LLC, said of brokers, “They’re like the missionaries of the industry going out to untapped areas of the market.”

But preaching the gospel of alternative funding exists at different stages across the world. And Goldin, whose company Capify operates in four countries including the US, thinks that many middlemen here at home may not ultimately survive. In an interview, he predicted that the stronger ones over time will be acquired by funding companies and that direct marketing will only increase. “I think more and more companies are going to start building their own internal sales forces,” he said.

Other brokers are not convinced that acquisition costs will lead to the death of their businesses, especially if they’ve already found ways to reduce overhead costs. Several brokers have discreetly mentioned running operations from Costa Rica, Nicaragua or elsewhere as a way to keep things profitable. Still more, like Excel Capital Management based in Manhattan, have found that offering a suite of products allows them to monetize more customers. Chad Otar, a managing partner for Excel, said that they recently brokered a $4.9 million SBA loan. MCA is just one of their options these days. “As long as there’s small businesses, there’s always going to be opportunity,” he said.

In the US, the brokers have certainly seized it, but that’s because most funding companies offer big bucks and quick payment to those that are capable of sourcing customers. In other countries, compensation for services rendered might be the responsibility of the broker to arrange with the merchant since it may not be customary for funding providers to pay commissions. That would mean more work and more risk for the broker.

In the US, the brokers have certainly seized it, but that’s because most funding companies offer big bucks and quick payment to those that are capable of sourcing customers. In other countries, compensation for services rendered might be the responsibility of the broker to arrange with the merchant since it may not be customary for funding providers to pay commissions. That would mean more work and more risk for the broker.

Ironically, some brokers in the US will tap into both sides, earning a commission from the funder and charging a fee to the merchant for services rendered. And if the broker has payment processing roots, they can go a step further and earn merchant account residuals as well.

Brokers can’t exist without funding companies willing to support their endeavors, of course. While their prevalence around the world varies, most of the funding companies AltFinanceDaily spoke to, appear eager to nurture the middleman’s role, so long as they act responsibly.

“Brokers in the UK are incredibly important as independent advisors to small businesses on the various sources of finance to suit their needs,” said Littner.

And as long as those customers, wherever they may be, are getting the value they want from a broker, that role, so long as it can continue to be done profitably, will likely have a place in the world for the foreseeable future.

Square Sets Foot in UK with Squareup Europe

July 20, 2016Square is making a jump across the pond to sell its service in the UK.

The payments company incorporated Squareup Europe Ltd in London early last month.

The six year old company started by Twitter chief Jack Dorsey plans to provide payment services in Britain which it began testing last month, Reuters reported.

With a presence in the US, Canada, Japan and Australia, the company provides payment solutions to merchants through its mobile point of sale device on iPhones and iPads.

In the US, Square made the natural transition to offering loans to its customers. In Q2, Square reported a loss of $97 million but raised projections for 2016 revenues from $600 – $620 million to $615 – $635 million. With low customer acquisition costs, Square is well positioned to become an easy choice for merchants who already use the product. The company made 23,000 advances for $153 million in the first quarter before moving on to ditch the MCA program for business loans.

Split-Funding MCA and Daily Debit Loans Are Spreading Across the World

July 4, 2016

When banks say no, merchants all over the world are getting funded via non-bank alternatives that resemble products here in the USA. In Hong Kong for example, a special administrative region of China, there are non-bank businesses that offer merchant cash advances and/or daily debit loans.

Having had the opportunity to visit with some of those funders there last week, I was surprised to learn that we spoke the same language. By that I mean that they price deals with factor rates, work with local finance brokers, underwrite files using recent bank statements, do site inspections and more. They even a have decision issued by the highest court in the land that declared merchant cash advances to be purchases, not loans.

Even the pitch is basically the same. “Banks aren’t lending to small businesses,” I heard time and time again in Hong Kong. And that’s probably not going to change any time soon. While the non-bank business financing scene is starting to take off, merchant cash advances in particular have been around there for about seven years already.

Hong Kong’s population is a little less than a third of the size of Australia, where many US-based funders have been expanding to over the last couple years.

Alternative Funders Continue to Look Down Under

June 29, 2016 Add CapRock Services to the growing list of US-based small business funders that have joined the scene in Australia.

Add CapRock Services to the growing list of US-based small business funders that have joined the scene in Australia.

CapRock has formed Sprout Funding as part of a joint venture with Sydney-based family office Huntwick Holdings. Together, they will provide small businesses with loans or revenue-based MCA products up to $100,000.

What’s truly unique is that CapRock will actually be underwriting the deals from their Dallas-based office. And they hope to fund $20 million in two key Australian markets in their first year. Luke Schmille, CapRock’s CEO, told the Dallas Business Journal that he believes the Australian market is very similar to the US. “70 percent of the population is employed by small to medium sized businesses,” he said.

Other funders in Australia that have US-backing include Capify, Prospa via Strategic Funding Source, Kikka Capital via Kabbage, and OnDeck.

Last Fall, John de Bree, the managing director of Capify’s Sydney-based office, told AltFinanceDaily that he was surprised of the American interest in Australia. “The American market’s 15 times the size of ours,” he said.

One of his competitors, Lachlan Heussler, managing director of Spotcap Australia, was not so shocked. “This is a market that will evolve over time, and we think the opportunity is enormous,” he said.

In an email, CapRock’s Schmille, wrote that they were excited about the expansion abroad.

Looking Back & Forging Ahead: A Dialogue With David Goldin

June 23, 2016 DeBanked Magazine recently caught up with David Goldin, the founder, president and chief executive of Capify, a New York based alternative funder. Goldin, who started his business in January 2002 as a credit card processing ISO, has been an outspoken and active participant in the alternative funding space since that time. He is also president of the Small Business Finance Association, the industry trade group that he helped found in 2006. The following is an edited transcript of our discussions.

DeBanked Magazine recently caught up with David Goldin, the founder, president and chief executive of Capify, a New York based alternative funder. Goldin, who started his business in January 2002 as a credit card processing ISO, has been an outspoken and active participant in the alternative funding space since that time. He is also president of the Small Business Finance Association, the industry trade group that he helped found in 2006. The following is an edited transcript of our discussions.

DeBanked: Since you started the business, Capify has grown from a credit card processing ISO into a global company with more than 200 employees in the U.S., U.K., Canada and Australia. Please talk a little about where Capify is today and your future growth plans for the company.

The key here is responsible growth and the responsible providing of capital. Anyone can fund deals. The hard part is collecting the money back, so you have to know how to operate during a down economic cycle. Capify did it very successfully in the last economic downturn. As we move into uncertain times, it seems there’s a greater possibility that the economy is going to get worse over the next 18 months. Even so, we’re working on several new products and new partnerships that we’ll be announcing shortly. Again, the trick is to be responsible about growth. We’re staying laser focused on our business right now and being very selective about where to invest capital in new projects during these uncertain times.

DeBanked: Continuing on the subject of growth, what do you think has been the most significant contributor to the company’s upward progression over the past several years?

I think our underwriting model is what has helped us the most. Our performance data has allowed us to make decisions in tough times and automate our processes further based on historical trends. We have 10-plus-years of performance data in the U.S. and 8-plus-years overseas. Most companies have only three to five years of experience, and most importantly, they haven’t been through an economic downturn.

DeBanked: How has the competitive landscape in the industry changed in the past few years?

Lenders are a different quality now. There is more variation in lenders than ever before—from lower-risk providers of capital to higher-risk providers of capital. Higher-risk providers of capital tend to charge a lot more. They also tend to have very aggressive business practices. The public perception is that all funders are the same—but we all have different business models and ethics in the way we operate our companies. It can be challenging at times to help customers, the media, partners and investors understand the difference between Capify and less scrupulous players.

DeBanked: What do you think the industry will look like in five to 10 years?

I think you’re going to see a lot of consolidation, and I think you’re going to see a whole new variety of products being offered to customers. The customer acquisition cost is too high to only offer one type of product. Similar to banks, alternative funders are going to start offering multiple products, if they aren’t already, and that will help make for a stickier customer and increase the bottom line.

Also, there will be significantly fewer funders than there are today and many ISOs will not be able to survive. I think more and more companies are going to start building their own internal sales forces. There are lower default rates and higher renewal rates in the direct model; the ISOs don’t have skin in the game. I think some of the stronger ISOs over time will become part of the larger funding companies.

DeBanked: There seems to be a consensus in the industry that more regulation of alternative financing is inevitable. How is regulation going to change how alternative funders operate and how might it change the competitive landscape?

I think you’ll see a lot more self-regulation before you see actual regulation when it comes to business-to-business lending. Funders are taking self-regulation more seriously and there have been more associations formed to educate policy-makers about the performance rates, default rates, renewal rates, customer satisfaction levels and how the products work.

The one area there could be potential regulation is in providing capital to sole proprietorships. The argument is that tiny businesses may need more assistance than larger companies, and some make the argument that these micro businesses are quasi-consumers. We disagree. We feel that if a sole proprietor is using the capital for his business, it should be considered a business transaction. However, several factors— including rampant media attention, more publicly traded alternative financing companies, tremendous growth of marketplace lending over the past several years and an election year—provide a recipe for all the regulation noise.

DeBanked: What are the biggest risks our industry is facing right now?

We’ve seen the movie before—in 2007 and 2008—when alternative funders didn’t factor in the severity of how an economic downturn could affect their business. The risk is there again. Funders have to be even more responsible. It’s not about how much you fund, it’s about much you collect back. You can’t be super-aggressive during times you think you may be

going into a down period. There could be significant industrywide fallout from irresponsible underwriting.

DeBanked: What advice would you give to new funders entering the market now?

I think the boat has left the dock; I don’t think they will be able to compete with established players in a meaningful way. Someone who really wants to be in the business should look at acquiring several small to medium-sized companies and rolling them up to get scale. It would be very challenging and require many years of investment to start from scratch at this point to build a substantial company. It’s harder now than it was in the past.

DeBanked: Can you talk a little about where you see the future of banks and alternative funders and how they will work together?

I think some banks will want to acquire platforms for speed to market or partner with platforms where the banks provide the capital and the funders service the loans. The latter is the model that J.P. Morgan and On Deck chose. The challenge is that the banks aren’t going to want to take a risk on applicants that don’t fall within the certain credit profile that they are comfortable lending to. While the partnership model will help banks make decisions faster about lending to small businesses, many small businesses will continue to be underserved. This could, in turn, provide an opening for independent funders who are willing to provide capital, albeit at higher rates because you can’t make a profit providing working capital (typically unsecured) at bank rates to the credit and risk profiles of businesses that most alternative funding companies work with today.

DeBanked: Please address the major technology trends shaping the alternative financing industry and what this means for industry players?

My opinion is the technology is ahead of the typical business brick-and-mortar business owner. Whilethe technology exists for business owners to go to a website and provide their personal and business data, we have found most business owners want to speak with a salesperson first, get a comfortable level and then apply online. (Compared with going right to a website and applying without a human involved). However, each year that goes by more and more business owners get more comfortable with technology and a greater percentage of them will look for a completely online experience. Being that it costs millions of dollars and years of time to build these platforms, you have to constantly evolve your platform to stay relevant. You can’t just snap your fingers and have it up and running.

I think the trend for our specific industry is being technology-enabled rather than being pure-bred tech companies. Customers still want to speak to people,but you also have to have viable backend technology so your business is scalable. Technology, such as digital bank statement transmission via various platforms, also helps cut down fraud compared with reviewing manual documents that can easily be forged or “Photoshopped.”

DeBanked: How can alternative funding companies best meet the challenges they are likely to face over the next few years?

I think alternative funders need to focus on more responsible providing of capital. This means really focusing on business owners’ ability to repay, taking a hard look at overburdening them with debt through stacking, for example, and further evaluating the referral sources of business they are getting their deal flow from in order to ensure that business owners get the best possible experience. Furthermore, I think as more alternative funding companies focus more on profitability and not just growth, coupled with the tightening of available institutional capital with an appetite for our industry, you will see some of the recent trends potentially reverse such as extremely high approval rates and industry margin compression.