Lending Club Faces Another Subpoena, This Time It’s NY Regulators

May 18, 2016

Adding to its list of woes, New York financial regulators have subpoenaed the lender on its interest rates charged to borrowers in New York. CNBC reports that this matter is unrelated to Laplanche’s exit.

From its CEO resigning on May 9th to being slapped with a Justice department notice the same week, the lender’s reputation has been through a lot of trauma. Its stock tanked more than 8 percent on Tuesday and opened under $4 on Wednesday.

And to add to the heap of bad news, the company evaluated its staffing needs and cancelled its 10-week summer internship program.

Lending Club received a Department of Justice grand jury subpoena on May 9th, according to the company’s quarterly earnings report, the same day that the resignation of their iconic CEO was announced. Grand juries are selected to decide if a criminal indictment should be brought against a party. The timing of the subpoena is suspicious because it leads one to suppose that a federal prosecutor had listened in on the May 9th earnings call, read news reports, decided there might be criminal activity, summoned jurors and issued a subpoena all within hours of the original announcement.

The WSJ, which did a great job reporting the details of the events leading up to Laplanche’s ouster, was not able to pin down the smoking gun that “convinced directors that more drastic action was needed,” just that the board had been “presented with evidence” that Laplanche knew many details of the $22 million loan sale.

A highly likely possibility (and this is just my theory) is that someone at Jefferies, the investment bank that Lending Club fudged the numbers on and ultimately bought $22 million worth of loans back from, tipped off federal authorities as to what took place with the loan sale.

Contrary to what people think about Wall Street, many bankers are scared to death about having knowledge of something that could lead to investors being harmed. Someone at Jefferies (and again just my theory) very well could have been so bothered by what Lending Club did, that they made sure the authorities knew what transpired. In doing so, they would probably have been viewed positively for blowing the whistle on bad behavior.

Cue a prosecutor’s interest, a grand jury, and likely a subpoena to individuals who would’ve had direct knowledge of the transaction. In my opinion, nothing would convince a board of directors more to give their famous CEO 24 hours to resign or be fired than having acquired knowledge of a grand jury investigation.

Cue a prosecutor’s interest, a grand jury, and likely a subpoena to individuals who would’ve had direct knowledge of the transaction. In my opinion, nothing would convince a board of directors more to give their famous CEO 24 hours to resign or be fired than having acquired knowledge of a grand jury investigation.

According to the WSJ, by Thursday, May 5th, Laplanche was removed as board chairman. On May 6th, he resigned. Over the weekend, he emailed friends from a new personal address, and on May 9th it was announced that he had resigned. That same day, Lending Club (the company), received a grand jury subpoena, of what I theorize was probably part of an investigation that was already in progress.

We may never know the full truth, but a seemingly innocent chain of events has clearly spiraled out of control to the point where over the course of a single week, Lending Club’s business model is seemingly coming undone. If nobody wants to buy loans or notes from their marketplace, then they are essentially out of business.

The dearth of interest in buying the loans they originate given the recent news has forced the company to disclose that it might actually have to use its own money to fund loans. No buyers, no business. So what else can they do? For one, they admit that they may need to reduce the volume of loans they originate, and that in doing so, it would likely have material adverse impact on their business.

These consequences have been predicted for years. What happens when investors just don’t want to buy the loans? How could a company where 90% of the income comes from loan origination fees provide continuous value to shareholders in an environment where there are no longer buyers?

Notably, veteran banker Todd Baker has been one of the most vocal on this issue. Six months ago, he publicly challenged SoFi CEO Mike Cagney about the viability of the marketplace model. Cagney had previously addressed Baker in an American Banker article by writing, “It is true that an MPL [Marketplace Lender] needs a buyer to originate loans — without one, the marketplace needs to raise rates until a buyer emerges. If there is no buyer, MPLs simply stop lending — they won’t start originating underwater loans.”

Stop lending?

Seemingly willing to undermine his own assertions, Cagney told the WSJ less than a year later a different story. “In normal environments, we wouldn’t have brought a deal into the market, but we have to lend. This is the problem with our space.” The environment of which he spoke then of course, was one where loan buyer interest was simply not as high as they would’ve liked, and thus it was becoming a “problem.”

Cagney’s reversal played right into Baker’s point, that a marketplace lender has to keep issuing loans to survive. When those loans don’t have organic buyers, at least in SoFi’s case, the weird idea of launching a hedge fund to potentially artificially keep up loan originations was proposed.

For Lending Club, their Plan B to keep things going is to simply buy their own loans if no buyers are available. Lending Club has a strong balance sheet and could potentially have success with this, for a time of course. The problem is that it would be taking on the credit risk of those loans as a result and put its retail note buyers at risk in the process.

Here’s why: When investors use the Lending Club platform, they are lending money to Lending Club and Lending Club is using that money to lend to borrowers. Investor yield might be tied to the performance of the notes they acquire but the credit risk is ultimately Lending Club itself. If Lending Club goes kaput, note holders would have a major problem, one that hasn’t really been a possibility until now because Lending Club hasn’t kept much risk on its balance sheet. That might soon change, according to their recent quarterly earnings report, where they say they might have to balance sheet some loans. Investors then wouldn’t really be participating in some disruptive peer-to-peer sharing economy revolution, but rather become very much like bondholders in an unregulated non-depository financial institution. And that smells horrifyingly risky. Throw in the fact that Lending Club is facing class action lawsuits, one of which alleges them to be a Racketeer Influenced Corrupt Organization. Does this sound like the kind of bond you want to invest in if you’re an unaccredited retail investor?

What Laplanche actually did or what a grand jury finds are unimportant in the grand scheme of what’s already been revealed. The only thing that matters is that when buyers dry up (whether for rational or irrational reasons), the entire system’s foundation shakes. The marketplace as it was supposed to be anyway, certainly can’t forever operate as a marketplace when it has shareholders who expect ever-increasing revenues and profits. According to Cagney’s original libertarian fantasy, nothing should theoretically be going on balance sheet. Lending Club should just be lending less, and if there are ultimately no buyers, the company should shut down until such a day that buyers return. One could only imagine that conversation with shareholders.

At the LendIt Conference last month, Renaud Laplanche joked with the crowd about cutting off the sleeves of his Lending Club jacket to make the Lending Club vest he sported on stage during his keynote speech. But was it just the sleeves that were missing? Speaking so confidently, Laplanche projected the authority of an emperor, perhaps one we’ve all been introduced to before.

“Was it really just the sleeves that have been cut away?” You may have thought to yourself for a split second. Or is it possible that the emperor of the marketplace, unbeknownst to the crowd, was simply wearing no clothes at all?

GAME OVER: Is The Marketplace Lending Model Dead?

May 17, 2016

Lending Club received a Department of Justice grand jury subpoena on May 9th, according to the company’s quarterly earnings report, the same day that the resignation of their iconic CEO was announced. Grand juries are selected to decide if a criminal indictment should be brought against a party. The timing of the subpoena is suspicious because it leads one to suppose that a federal prosecutor had listened in on the May 9th earnings call, read news reports, decided there might be criminal activity, summoned jurors and issued a subpoena all within hours of the original announcement.

The WSJ, which did a great job reporting the details of the events leading up to Laplanche’s ouster, was not able to pin down the smoking gun that “convinced directors that more drastic action was needed,” just that the board had been “presented with evidence” that Laplanche knew many details of the $22 million loan sale.

A highly likely possibility (and this is just my theory) is that someone at Jefferies, the investment bank that Lending Club fudged the numbers on and ultimately bought $22 million worth of loans back from, tipped off federal authorities as to what took place with the loan sale.

Contrary to what people think about Wall Street, many bankers are scared to death about having knowledge of something that could lead to investors being harmed. Someone at Jefferies (and again just my theory) very well could have been so bothered by what Lending Club did, that they made sure the authorities knew what transpired. In doing so, they would probably have been viewed positively for blowing the whistle on bad behavior.

Cue a prosecutor’s interest, a grand jury, and likely a subpoena to individuals who would’ve had direct knowledge of the transaction. In my opinion, nothing would convince a board of directors more to give their famous CEO 24 hours to resign or be fired than having acquired knowledge of a grand jury investigation.

Cue a prosecutor’s interest, a grand jury, and likely a subpoena to individuals who would’ve had direct knowledge of the transaction. In my opinion, nothing would convince a board of directors more to give their famous CEO 24 hours to resign or be fired than having acquired knowledge of a grand jury investigation.

According to the WSJ, by Thursday, May 5th, Laplanche was removed as board chairman. On May 6th, he resigned. Over the weekend, he emailed friends from a new personal address, and on May 9th it was announced that he had resigned. That same day, Lending Club (the company), received a grand jury subpoena, of what I theorize was probably part of an investigation that was already in progress.

We may never know the full truth, but a seemingly innocent chain of events has clearly spiraled out of control to the point where over the course of a single week, Lending Club’s business model is seemingly coming undone. If nobody wants to buy loans or notes from their marketplace, then they are essentially out of business.

The dearth of interest in buying the loans they originate given the recent news has forced the company to disclose that it might actually have to use its own money to fund loans. No buyers, no business. So what else can they do? For one, they admit that they may need to reduce the volume of loans they originate, and that in doing so, it would likely have material adverse impact on their business.

These consequences have been predicted for years. What happens when investors just don’t want to buy the loans? How could a company where 90% of the income comes from loan origination fees provide continuous value to shareholders in an environment where there are no longer buyers?

Notably, veteran banker Todd Baker has been one of the most vocal on this issue. Six months ago, he publicly challenged SoFi CEO Mike Cagney about the viability of the marketplace model. Cagney had previously addressed Baker in an American Banker article by writing, “It is true that an MPL [Marketplace Lender] needs a buyer to originate loans — without one, the marketplace needs to raise rates until a buyer emerges. If there is no buyer, MPLs simply stop lending — they won’t start originating underwater loans.”

Stop lending?

Seemingly willing to undermine his own assertions, Cagney told the WSJ less than a year later a different story. “In normal environments, we wouldn’t have brought a deal into the market, but we have to lend. This is the problem with our space.” The environment of which he spoke then of course, was one where loan buyer interest was simply not as high as they would’ve liked, and thus it was becoming a “problem.”

Cagney’s reversal played right into Baker’s point, that a marketplace lender has to keep issuing loans to survive. When those loans don’t have organic buyers, at least in SoFi’s case, the weird idea of launching a hedge fund to potentially artificially keep up loan originations was proposed.

For Lending Club, their Plan B to keep things going is to simply buy their own loans if no buyers are available. Lending Club has a strong balance sheet and could potentially have success with this, for a time of course. The problem is that it would be taking on the credit risk of those loans as a result and put its retail note buyers at risk in the process.

Here’s why: When investors use the Lending Club platform, they are lending money to Lending Club and Lending Club is using that money to lend to borrowers. Investor yield might be tied to the performance of the notes they acquire but the credit risk is ultimately Lending Club itself. If Lending Club goes kaput, note holders would have a major problem, one that hasn’t really been a possibility until now because Lending Club hasn’t kept much risk on its balance sheet. That might soon change, according to their recent quarterly earnings report, where they say they might have to balance sheet some loans. Investors then wouldn’t really be participating in some disruptive peer-to-peer sharing economy revolution, but rather become very much like bondholders in an unregulated non-depository financial institution. And that smells horrifyingly risky. Throw in the fact that Lending Club is facing class action lawsuits, one of which alleges them to be a Racketeer Influenced Corrupt Organization. Does this sound like the kind of bond you want to invest in if you’re an unaccredited retail investor?

What Laplanche actually did or what a grand jury finds are unimportant in the grand scheme of what’s already been revealed. The only thing that matters is that when buyers dry up (whether for rational or irrational reasons), the entire system’s foundation shakes. The marketplace as it was supposed to be anyway, certainly can’t forever operate as a marketplace when it has shareholders who expect ever-increasing revenues and profits. According to Cagney’s original libertarian fantasy, nothing should theoretically be going on balance sheet. Lending Club should just be lending less, and if there are ultimately no buyers, the company should shut down until such a day that buyers return. One could only imagine that conversation with shareholders.

At the LendIt Conference last month, Renaud Laplanche joked with the crowd about cutting off the sleeves of his Lending Club jacket to make the Lending Club vest he sported on stage during his keynote speech. But was it just the sleeves that were missing? Speaking so confidently, Laplanche projected the authority of an emperor, perhaps one we’ve all been introduced to before.

“Was it really just the sleeves that have been cut away?” You may have thought to yourself for a split second. Or is it possible that the emperor of the marketplace, unbeknownst to the crowd, was simply wearing no clothes at all?

Online Small Business Lending Task Force Initiated by the ETA

April 30, 2016 The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

Though you might not have suspected it last week at Transact16, the ETA very much plans to involve themselves in the affairs of marketplace lending. That might not have been obvious from a Bloomberg article that reported that OnDeck, Kabbage and PayPal were forming a splinter organization as an “extension” of the ETA known as the Online Small Business Lending Task Force. Referred to as a new initiative in the announcement, the group’s mission is described as striving to “prevent hasty or overly restrictive regulations.”

But the group’s named lobbyist, Scott Talbott, is also the ETA’s lobbyist. And the three lenders named, were already members of the ETA. When Talbott was asked by AltFinanceDaily to clarify the relationship between the “task force” and the ETA, he said that the two weren’t separate. The “ETA organized its members to lobby on the issue. It’s what we do every day,” he wrote.

The “task force” merely highlights members in the trade group that share a common interest.

Formed in 1990 and comprising of over 550 companies across 7 countries, the ETA has served the payments industry well. OnDeck, Kabbage and PayPal therefore find themselves in good company and led by advocates with well-established government relationships.

Along with the ETA, the online small business lending industry has found support from the Marketplace Lending Association, the Small Business Finance Association, the Commercial Finance Coalition and the Coalition for Responsible Business Finance.

Stairway to Heaven: Can Alternative Finance Keep Making Dreams Come True?

April 28, 2016

The alternative small-business finance industry has exploded into a $10 billion business and may not stop growing until it reaches $50 billion or even $100 billion in annual financing, depending upon who’s making the projection. Along the way, it’s provided a vehicle for ambitious, hard-working and talented entrepreneurs to lift themselves to affluence.

Consider the saga of William Ramos, whose persistence as a cold caller helped him overcome homelessness and earn the cash to buy a Ferrari. Then there’s the journey of Jared Weitz, once a 20 something plumber and now CEO of a company with more than $100 million a year in deal flow.

Their careers are only the beginning of the success stories. Jared Feldman and Dan Smith, for example, were in their 20s when they started an alt finance company at the height of the financial crisis. They went on to sell part of their firm to Palladium Equity Partners after placing more than $400 million in lifetime deals.

Their careers are only the beginning of the success stories. Jared Feldman and Dan Smith, for example, were in their 20s when they started an alt finance company at the height of the financial crisis. They went on to sell part of their firm to Palladium Equity Partners after placing more than $400 million in lifetime deals.

The industry’s top salespeople can even breathe new life into seemingly dead leads. Take the case of Juan Monegro, who was in his 20s when he left his job in Verizon customer service and began pounding the phones to promote merchant cash advances. Working at first with stale leads, Monegro was soon placing $47 million in advances annually.

The industry’s top salespeople can even breathe new life into seemingly dead leads. Take the case of Juan Monegro, who was in his 20s when he left his job in Verizon customer service and began pounding the phones to promote merchant cash advances. Working at first with stale leads, Monegro was soon placing $47 million in advances annually.

Alternative funding can provide a second chance, too. When Isaac Stern’s bakery went out of business, he took a job telemarketing merchant cash advances and went on to launch a firm that now places more than $1 billion in funding annually.

All of those industry players are leaving their marks on a business that got its start at the dawn of the new century. Long-time participants in the market credit Barbara Johnson with hatching the idea of the merchant cash advance in 1998 when she needed to raise capital for a daycare center. She and her husband, Gary Johnson, started the company that became CAN Capital. The firm also reportedly developed the first platform to split credit card receipts between merchants and funders.

BIRTH OF AN INDUSTRY

Competitors soon followed the trail those pioneers blazed, and the industry began growing prodigiously. “There was a ton of credit out there for people who wanted to get into the business,” recalled David Goldin, who’s CEO of Capify and serves as president of the Small Business Finance Association, one of the industry’s trade groups.

Competitors soon followed the trail those pioneers blazed, and the industry began growing prodigiously. “There was a ton of credit out there for people who wanted to get into the business,” recalled David Goldin, who’s CEO of Capify and serves as president of the Small Business Finance Association, one of the industry’s trade groups.

Many of the early entrants came from the world of finance or from the credit card processing business, said Stephen Sheinbaum, founder of Bizfi. Virtually all of the early business came from splitting card receipts, a practice that now accounts for just 10 percent of volume, he noted.

At first, brokers, funders and their channel partners spent a lot of time explaining advances to merchants who had never heard of them, Goldin said. Competition wasn’t that tough because of the uncrowded “greenfield” nature of the business, industry veterans agreed.

Some of the initial funding came from the funders’ own pockets or from the savings accounts of their elderly uncles. “I’ve met more than a few who had $2 million to $5 million worth of loans from friends and family in order to fund the advances to the merchants,” observed Joel Magerman, CEO of Bryant Park Capital, which places capital in the industry. “It was a small, entrepreneurial effort,” Andrea Petro, executive vice president and division manager of lender finance for Wells Fargo Capital Finance, said of the early days. “A number of these companies started with maybe $100,000 that they would experiment with. They would make 10 loans of $10,000 and collect them in 90 days.”

That business model was working, but merchant cash advances suffered from a bad reputation in the early days, Goldin said. Some players were charging hefty fees and pushing merchants into financial jeopardy by providing more funding than they could pay back comfortably. The public even took a dim view of reputable funders because most consumers didn’t understand that the risk of offering advances justified charging more for them than other types of financing, according to Goldin.

Then the dam broke. The economy crashed as the Great Recession pushed much of the world to the brink of financial disaster. “Everybody lost their credit line and default rates spiked,” noted Isaac Stern, CEO of Fundry, Yellowstone Capital and Green Capital. “There was almost nobody left in the business.”

RAVAGED BY RECESSION

Perhaps 80 percent of the nation’s alternative funding companies went out of business in the downturn, said Magerman. Those firms probably represented about 50 percent of the alternative funding industry’s dollar volume, he added. “There was a culling of the herd,” he said of the companies that failed.

Life became tough for the survivors, too. Among companies that stayed afloat, credit losses typically tripled, according to Petro. That’s severe but much better than companies that failed because their credit losses quintupled, she said.

Who kept the doors open? The firms that survived tended to share some characteristics, said Robert Cook, a partner at Hudson Cook LLP, a law office that specializes in alternative funding. “Some of the companies were self-funding at that time,” he said of those days. “Some had lines of credit that were established prior to the recession, and because their business stayed healthy they were able to retain those lines of credit.”

The survivors also understood risk and had strong, automated reporting systems to track daily repayment, Petro said. For the most part, those companies emerged stronger, wiser and more prosperous when the crisis wound down, she noted. “The legacy of the Great Recession was that survivors became even more knowledgeable through what I would call that ‘high-stress testing period of losses,’” she said.

ROAD TO RECOVERY

The survivors of the recession were ready to capitalize on the convergence of several factors favorable to the industry in about 2009. Taking advantages of those changes in the industry helped form a perfect storm of industry growth as the recession was ending.

The survivors of the recession were ready to capitalize on the convergence of several factors favorable to the industry in about 2009. Taking advantages of those changes in the industry helped form a perfect storm of industry growth as the recession was ending.

They included making good use of the quick churn that characterizes the merchant cash advance business, Petro noted. The industry’s better operators had been able to amass voluminous data on the industry because of its short cycles. While a provider of auto loans might have to wait five years to study company results, she said, alternative funders could compile intelligence from four advances within the space of a year.

That data found a home in the industry around the time the recession was ending because funders were beginning to purchase or develop the algorithms that are continuing to increase the automation of the underwriting process, said Jared Weitz, CEO of United Capital Source LLC. As early as 2006, OnDeck became one of the first to rely on digital underwriting, and the practice became mainstream by 2009 or so, he said.

Just as the technology was becoming widespread, capital began returning to the market. Wealthy investors were pulling their funds out of real estate and needed somewhere to invest it, accounting for part of the influx of capital, Weitz said.

At the same time, Wall Street began to take notice of the industry as a place to position capital for growth, and companies that had been focused on consumer lending came to see alternative finance as a good investment, Cook said.

For a long while, banks had shied away from the market because the individual deals seem small to them. A merchant cash advance offers funders a hundredth of the size and profits of a bank’s typical small-business loan but requires a tenth of the underwriting effort, said David O’Connell, a senior analyst on Aite Group’s Wholesale Banking team.

The prospect of providing funds became even less attractive for banks. The recession had spawned the Dodd-Frank Financial Regulatory Reform Bill and Basel III, which had the unintended effect of keeping banks out of the market by barring them from endeavors where they’re inexperienced, Magerman said. With most banks more distant from the business than ever, brokers and funders can keep the industry to themselves, sources acknowledged.

At about the same time, the SBFA succeeded in burnishing the industry’s image by explaining the economic realities to the press, in Goldin’s view.The idea that higher risk requires bigger fees was beginning to sink in to the public’s psyche, he maintained.

Meanwhile, loans started to join merchant cash advances in the product mix. Many players began to offer loans after they received California finance lenders licenses, Cook recalled. They had obtained the licenses to ward off class-action lawsuits, he said and were switching from sharing card receipts to scheduled direct debits of merchants’ bank accounts.

As those advantages – including algorithms, ready cash, a better image and the option of offering loans – became apparent, responsible funders used them to help change the face of the industry. They began to make deals with more credit-worthy merchants by offering lower fees, more time to repay and improved customer service. “The recession wound up differentiating us in the best possible way,” Bizfi’s Sheinbaum said of the changes.

His company found more-upscale customers by concentrating on industries that weren’t hit too hard by the recession. “With real estate crashing, people were not refurbishing their homes or putting in new flooring,” he noted.

Today, the booming alternative finance industry is engendering success stories and attracting the nation’s attention. The increased awareness is prompting more companies to wade into the fray, and could bring some change.

WHAT LIES AHEAD

One variety of change that might lie ahead could come with the purchase of a major funding company by a big bank in the next couple of years, Bryant Park Capital’s Magerman predicted. A bank could sidestep regulation, he suggested, by maintaining that the credit card business and small business loans made through bank branches had provided the banks with the experience necessary to succeed.

Smaller players are paying attention to the industry, too, with varying degrees of success. Predictably, some of the new players are operating too aggressively and could find themselves headed for a fall. “Anybody can fund deals – the talent lies in collecting the money back at a profitable level,” said Capify’s Goldin. “There’s going to be a shakeout. I can feel it.”

Smaller players are paying attention to the industry, too, with varying degrees of success. Predictably, some of the new players are operating too aggressively and could find themselves headed for a fall. “Anybody can fund deals – the talent lies in collecting the money back at a profitable level,” said Capify’s Goldin. “There’s going to be a shakeout. I can feel it.”

Some of today’s alternative lenders don’t have the skill and technology to ward off bad deals and could thus find themselves in trouble if recession strikes, warned Aite Group’s O’Connell. “Let’s be careful of falling into the trap of ‘This time is different,’” he said. “I see a lot of sub-prime debt there.”

Don’t expect miracles, cautioned Petro. “I believe there will be another recession, and I believe that there will be a winnowing of (alternative finance) businesses,” she said. “There will be far fewer after the next recession than exist today.”

A recession would spell trouble, Magerman agreed, even though demand for loans and advances would increase in an atmosphere of financial hardship. Asked about industry optimists who view the business as nearly recession-proof, he didn’t hold back. “Don’t believe them,” he warned. “Just because somebody needs capital doesn’t mean they should get capital.”

Further complicating matters, increased regulatory scrutiny could be lurking just beyond the horizon, Petro predicted. She provided histories of what regulation has done to other industries as an indication of the differing outcomes of regulation – one good, one debatable and one bad.

Good: The timeshare business benefitted from regulation because the rules boosted the public’s trust.

Debatable: The cost of complying with regulations changed the rent-to-own business from an entrepreneurial endeavor to an environment where only big corporations could prosper.

Bad: Regulation appears likely to alter the payday lending business drastically and could even bring it to an end, she said.

Still, regulation’s good side seems likely to prevail in the alternative finance business, eliminating the players who charge high fees or collect bloated commissions, according to Weitz. “I think it could only benefit the industry,” he said. “It’ll knock out the bad guys.”

Transact 16 Photos

April 26, 2016Did you miss Transact 16? It was a little bit different this year for a particular group of regular attendees that have historically relied on credit card processors to “split” transactions. Merchant cash advance as it is known (or was known) has officially evolved into something else. You can read more about that here.

In the meantime, here’s a few photos from the show:

Don't forget to stop by Booth 564 @ETATRANSACT #TRANSACT16 & ask TJ/Maria/Jim how we can help you do great things! pic.twitter.com/Gixc6WJNfV

— RapidAdvance (@Rapid_Advance) April 21, 2016

Where are the rest of the pictures you ask? You should know by now that what happens in Vegas stays in Vegas.

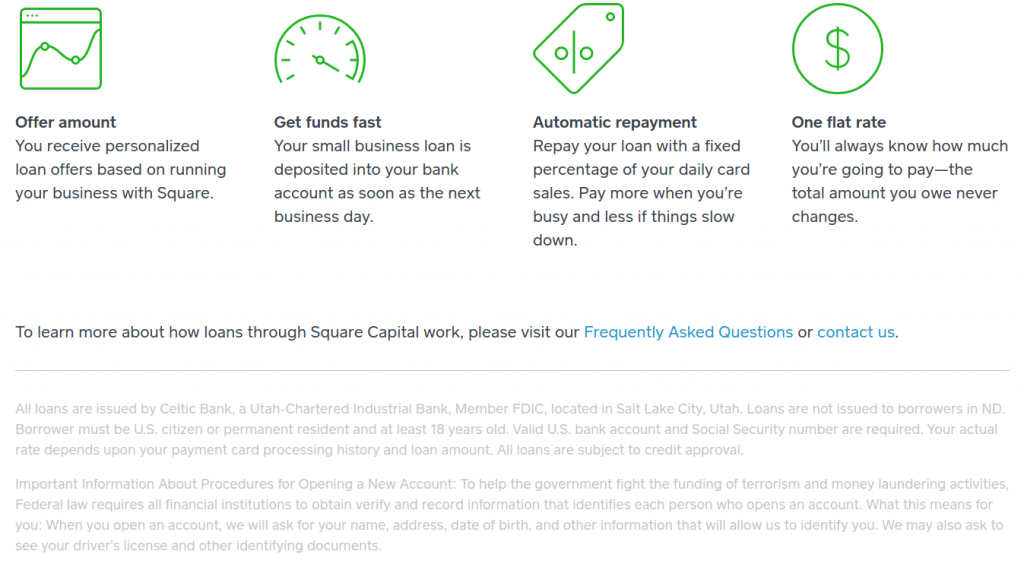

Square Swaps Out Merchant Cash Advances for Business Loans

March 25, 2016 Square’s merchant cash advance program is already among the biggest in the world, but they’ve got even bigger plans, or maybe just different ones.

Square’s merchant cash advance program is already among the biggest in the world, but they’ve got even bigger plans, or maybe just different ones.

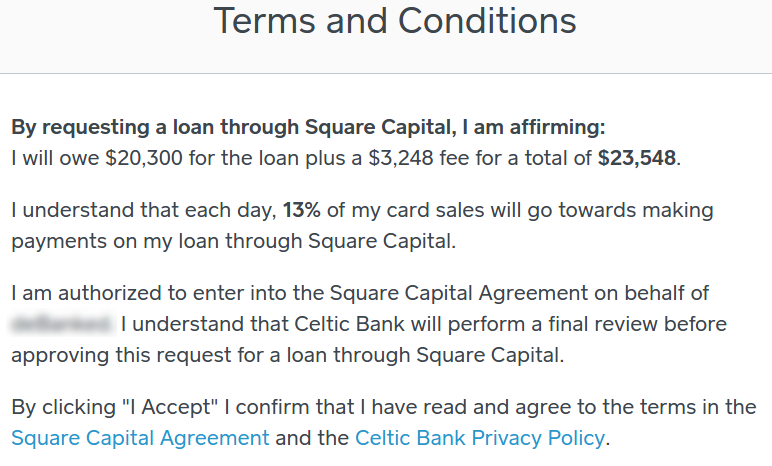

The company announced on Thursday that they will now be offering true business loans as well through a partnership with Celtic Bank, an industrial bank chartered by the State of Utah. The WSJ reports that loan payments will also be made via a split of future credit card sale activity but with the caveat of there ultimately being a fixed term. This is coincidentally how PayPal’s loan product works.

The WSJ makes it seem as if both products will run alongside each other, but a Square merchant revealed to AltFinanceDaily that all of the language on Square Capital’s application portal has changed from advances to loans. Even the promotional materials have changed to reflect that it may take more than just an automated review of historical credit card sales activity to get approved and funded. Also, all Square loans are subject to credit approval, whereas no credit check was required for merchant cash advances. Applicants may be required to produce a photo ID and other documents for further verification. North Dakota businesses are prohibited from borrowing altogether.

Square’s loans require that merchants process at least $10,000 or more a year. Borrowers must pay at least 1/18th of their initial loan balance every 60 days. PayPal by comparison requires that their borrowers pay down 10% of their loan amount every 90 days.

A Square merchant was not able to locate any mention of the merchant cash advance program. It’s all loans now.

Did Square really just add business loans to their arsenal or have they traded MCAs for the bank charter lending model?

Update: 3/25 2:54 PM Square confirmed that they have indeed replaced their merchant cash advance program with the loan program.

Our Square Capital program is transitioning from merchant cash advances to flexible loans. https://t.co/oUyRtNgVSS pic.twitter.com/ELXC7ayJyU

— Square (@Square) March 25, 2016

Why You Shouldn’t Overlook Selling Merchant Processing

January 4, 2016 Prior to daily fixed payment business loans, there was the traditional merchant cash advance (MCA). The MCA, being the only option, required merchants to tie their need for working capital to that of their merchant accounts, either directly or indirectly, through the use of either split-funding or a lockbox account.

Prior to daily fixed payment business loans, there was the traditional merchant cash advance (MCA). The MCA, being the only option, required merchants to tie their need for working capital to that of their merchant accounts, either directly or indirectly, through the use of either split-funding or a lockbox account.

DIRECT OR INDIRECT?

Split-funding is a direct method that requires the merchant to convert their merchant account over to a chosen Independent Sales Organization (ISO), you could also refer to the ISO as a Merchant Service Provider (MSP). The MCA company contracts with an ISO/MSP who then manages the flow of the merchant’s daily credit card processing volume. A percentage is withheld and forwarded to the buyer of those receivables.

The lockbox is an indirect method to manage the flow of funds. Rather than withhold funds from the ISO/MSP, a separate FDIC insured account is established on the side for all credit card processing receipts to settle into initially, with a percentage of that volume going to the buyer and the remaining amount “swept” into the merchant’s operating account.

Nevertheless, whether directly or indirectly, the merchant account of the business owner was the foundation of the MCA approval and facilitation. Because many MCA companies also offer alternative business loans today with fixed payments, a lot of the new broker entrants do not believe that learning about the field of merchant processing is as important today as it was years ago. However, I disagree with this notion, as the purpose of our industry is the long term relationship with the client, and in many ways the traditional MCA product provides more “benefits and value” to the merchant over time than today’s business loan. Just as new broker entrants get to know all about the MCA, they should also get to know all about merchant processing.

OVER TIME, CAN THE MCA BE THE BETTER CHOICE?

The alternative business loan requires no merchant account conversion as it doesn’t tie the merchant account to the facilitation of the working capital transaction. With these loans, a percentage of gross revenues are approved with fixed terms up to 36 months on daily or weekly payments. The main benefit of this product over the MCA is the awareness of payment frequency and quantity upfront, thus, enabling the merchant to better allocate their cash flow.

However, while the traditional merchant cash advance requires the tie-in of the merchant account, there’s no fixed terms nor fixed payments as it correlates with the merchant’s sales cycle, where they deliver more during busy times, less during slow times.

When selling the merchant the long term aspects of the MCA, why not seek to get their MCA funded using the split-funding method rather than a lockbox? Doing so would provide an additional revenue stream within your client portfolio. To properly seek out this opportunity and be able to consult, convince and convert the merchant over to your MCA firm’s ISO/MSP Partner, you want to fully understand what merchant processing is all about.

WHAT IS MERCHANT PROCESSING?

A merchant account is an unsecured line of credit provided to a business from a registered ISO/MSP. The credit line enables the business to benefit from accepting Visa and MasterCard (V/MC) along with other major bankcards from their customer base, to experience the benefits of acceptance which includes better fraud management, higher average tickets, customer loyalty due to convenience, and more. V/MC are just registered card brands that manage a group of banks called “member banks”, which are banks apart of a listing of V/MC bank associations. The member banks pay V/MC dues and assessments to market their brands. You have different types of member banks, you have the Issuing Banks and then you have the ISO/MSP along with the Sponsoring Banks.

The Issuing Banks issue credit cards with credit limits to consumers after they meet credit criteria. On the processing side, you have the registered ISO/MSP and Sponsor Banks, which approve a merchant for a merchant account and process payments through a front-end authorization network, then settles them through a back-end network.

During the processing of a credit card transaction, there’s a couple of different fees that are charged. Interchange is one of the fees charged, which is how the Issuing Banks are paid. These are wholesale prices for every type of card that a merchant could potentially run at the point of sale, with new interchange pricing charts released in April and October of every year. The ISO/MSPs are paid when they mark-up interchange as well as through fees such as an annual fee, statement fee and batch fee.

WHY IS MERCHANT PROCESSING A UNSECURED LINE OF CREDIT?

The merchant account is indeed an unsecured line of credit, because when a merchant’s customer runs an order on their credit card for $500, the merchant would rather have that entire $500 upfront rather than waiting for the customer to pay off their credit card balance in full, which could potentially take years. As a result, the ISO/MSP deposits the amount in their bank account within 48 hours rather than having the merchant wait until their customer pays their credit card balance in full.

Now, if the merchant’s customer initiates a chargeback of the $500 transaction and the merchant loses the case, the $500 would have to be refunded by the merchant plus the costs of the chargeback which includes a chargeback fee and retrieval fee. If the ISO/MSP goes to get the $500 from the merchant and there’s no money in their account (let’s say the merchant has gone out of business), then the ISO/MSP who underwrote the merchant account is on the hook for the charge.

WHY SHOULD YOU SELL MERCHANT PROCESSING?

When using split funding for a merchant cash advance deal, if you switch over their processing to an ISO/MSP that your MCA firm currently split funds with, you are looking at collecting the long term residuals from the processing and the compensation from future merchant cash advance renewals. In addition, split funding is much more efficient than using a lockbox, as a lockbox usually adds 1-2 business days to the settlement process for everyone involved. Withsplit funding, the merchant can continue to receive their processing deposits as normal.

There are different types of payment processing technologies depending on what the merchant needs, if they need a stand-alone solution then that’s available in the form of a landline terminal, wireless terminal, computer software or virtual terminal. If the merchant needs a comprehensive solution then that’s also available in the form of point-of-sale systems or operational management technologies, both of which integrate merchant processing into the system and other operational aspects such as accounting, payroll, human resources, etc.

Why not just have the merchant switch over their processing to an ISO/MSP that your MCA firm currently split funds with, and collect recurring merchant processing residuals along with recurring income from merchant cash advance renewals? After all, recurring income is the lifeblood of our business.

The Broker’s Future Part Two

December 16, 2015THE ROBOTS ARE COMING

Merriam-Webster and Dictionary.com both agree, that a “robot” is a machine that is created to do the work of a person, carrying out a complex series of actions automatically, all controlled by a computer. Sometimes a robot can resemble a human being in likeness, but often times a robot is simply a piece of software, a piece of hardware, a piece of machinery, or a cloud based infrastructure called the internet (online networks). Professor Kaku is a futurist from City College of New York, a futurist is someone who makes what one would consider “fairly accurate” predictions about what the future holds and how these future events might emerge from present day events. Professor Kaku believes the following:

Merriam-Webster and Dictionary.com both agree, that a “robot” is a machine that is created to do the work of a person, carrying out a complex series of actions automatically, all controlled by a computer. Sometimes a robot can resemble a human being in likeness, but often times a robot is simply a piece of software, a piece of hardware, a piece of machinery, or a cloud based infrastructure called the internet (online networks). Professor Kaku is a futurist from City College of New York, a futurist is someone who makes what one would consider “fairly accurate” predictions about what the future holds and how these future events might emerge from present day events. Professor Kaku believes the following:

The job market of the future will consist of those jobs that robots cannot perform. Our blue-collar work is pattern recognition, making sense of what you see. Gardeners will still have jobs because every garden is different. The same goes for construction workers. The losers are white-collar workers, low-level accountants, brokers, and agents.

A RECAP OF PART ONE

Back in June 2015, I did an article for AltFinanceDaily about the Broker’s Future, speculating if the good times were indeed over for the brokers as it pertains to their level of profitability and survivability going forward.

- I examined the 2000 – 2007 and 2008 – 2013 time periods, speculating that the “Era of the Broker” was indeed between the 2000 – 2013 period.

- Then, I examined the current time period which begins around the middle of 2014, that is seeing so much of a mass new entrance of brokers into the space, that AltFinanceDaily had to compose a cover story on the phenomenon for the March/April edition of AltFinanceDaily Magazine. The only issue with this current time period is that, in my sole objective opinion, we are in the “Era of the Strategic Networks”, and no longer in the “Era of the Broker.”

- I concluded the article in June with the following: those just now trying to come in and ride the wave will soon discover that just like with the Stock Market, the real money has already been made and most of the future returns are already capitalized.

AN INTRODUCTION TO PART TWO

My analysis shows that the current time period is all about Strategic Networks, which are mainly three networks to be exact, which include the following, all designed to produce competitive market advantages, positioning, strategies, qualified leads, etc:

- The Center Of Influence Network: this includes entities such as banks, credit unions, processors, accountants, VCs, credit bureaus, etc., that allow access to exclusive leads, exclusive data, equity financing, debt financing, mergers, etc.

- The Mom and Pop Network of random independent agents across the country who resell on a 100% commission basis, providing free marketing in a way that collectively they produce a significant amount of volume (even though individually most of the agents cannot make a living from this activity).

- The Online Network with exclusivity on the growing online marketplace of merchants seeking financing, education and options via the internet.

For Part Two Of The Broker’s Future, I want to focus in on The Online Network, which in my opinion will be one of the main destroyers of opportunities in our space for the majority of brokers going forward.

DEATH OF A B2B SALESMAN

For about $499, you can read a very comprehensive report from Forrester on the death of B2B salespeople. Forrester predicts that by 2020, over 1 million B2B salespeople will lose their jobs to the growing force of IT/Robotics, which includes various forms of technology, automation and of course the internet in general through E-commerce.

In relation to our industry of merchant services, merchant cash advance and alternative business loans, I don’t believe that we have to wait until 2020 to see significant changes, I believe these changes are already in full effect and the major players within our space are the ones that are truly capitalizing on The Online Network, giving them major exclusivity on the growing online marketplace of merchants seeking financing, education and options via the internet.

MERCHANT SERVICES HAS BEEN AFFECTED

The Online Network phenomenon has totally destroyed the feet on the street MLS (merchant level salespeople) over on the merchant services side. Before the rise of the Online Network, MLS were valuable to merchants as information on merchant processing, interchange, how the bankcard transactional process worked, etc., were not readily available and most banks did not handle direct sales of the service. So the MLS would park their car down the street, randomly walk into merchant locations, and provide the education via brochures, terminal samples, etc.

They would explain how the merchant processing process works, how accepting credit cards could boost sales through more impulse purchases and consumer convenience, and more. The MLS would then go over the different options of payment processing technology, commit the merchant to a 24 – 48 month lease of the technology, and make his/her commission off the leasing sales and eventually also off the residuals. However, the rise of the Online Network completely shattered this business model:

- The Online Network now allows the merchant to comprehend merchant services on his own, without the help of the MLS, by researching interchange and conducting his own “rate analysis”. The merchant can also now see the true cost of the processing equipment, thus to no longer sign up for leases for $100 a month for 24 months ($2,400) for a $350 terminal at best.

As a result, the MLS can no longer prospect on “rate savings” nor prospect based on the equipment such as through leases or even through free terminals anymore, due to the merchant’s knowledge that the terminal is worth $350 at best. As a result, the direct sales of merchant services has become a value-add to other services, requiring yesterday’s MLS to transform into something totally different such as a financing or payroll specialist, trying to convert merchant accounts over on the side, as part of the sale.

ALTERNATIVE LENDING HAS BEEN AFFECTED

The merchant cash advance and alternative business loan products are more popular today than they have ever been before, due mainly to the massive media attention that they have received with companies going public, CEOs landing interviews on major media outlets, talking heads debating the products across a number of media mediums, and more. 7 – 15 years ago (2000 – 2008), if you were to look up a product online called “merchant cash advance”, you would not have produced many search results. As a result, to inform and educate the merchant on the product, you needed an actual human being (a broker) to sit down and explain the nuances of said services referred to as “split funding”, “revenue purchases”, and “holdback percentages.”

Compare this to today, where a simple search for “merchant cash advances” gives you pages upon pages of articles, promotional ads that follow you across the internet, company websites, press releases, and more. The merchant can easily learn about the merchant cash advance as well as other new forms of alternative financing by going online and scrolling through the vast amount of information. They can educate themselves on the products, companies, and payback procedures. They can fill out a form and get 10 quotes from 10 companies within a couple of hours and in a lot of cases, receive funding from one of the companies by the next business day. The phenomenon is so big that companies in our space are now just referred to as “Online Lenders,” totally shunning the fact that many operate with traditional brick and mortar locations and still employ brokers to still resell the products like they did “in the old days”.

THE FUTURE

Based on my sole objective analysis, The Future is going to be all about the three networks of Strategic Partnerships, which includes The Online Network. Without a shadow of a doubt, those that control these networks will be the major players going forward, as they will have the leveraged resources, knowledge, experience, financing, and connections that the newer market entrants just do not have.

The 80/20 dynamic will continue, where 20% of the players produce 80% (or more) of the production, and the other 80% of the players will fight over the remaining 20% (or less) of the production, which just will not be enough to sustain profitability going forward.

As fast as these new entrants rush in, will be as fast as they burn out. Burning through their savings and retirement funds, and/or running up the utilization rate on their credit cards, trying to take advantage of a “market opportunity” that they “heard about”, but is pretty much already capitalized on, by those who have been here long before they came on the scene.