Where Alternative Finance Ranks on the Inc 5000 List

September 14, 2017Here’s where your peers rank on the Inc 5000 list for 2017:

| Ranking | Company Name | Growth | Revenue | Type |

| 15 | Forward Financing | 12,893.16% | $28.3M | MCA |

| 47 | Avant | 6,332.56% | $437.9M | Online Consumer Lender |

| 219 | OppLoans | 1,970.22% | $27.9M | Online Consumer Lender |

| 260 | US Business Funding | 1,657.42% | $5.8M | Business Lender |

| 361 | nCino | 1,217.53% | $2.4M | Software |

| 449 | Kabbage | 979.31% | $171.8M | Online Consumer Lender |

| 634 | Lighter Capital | 712.03% | $6.4M | Online Business Lender |

| 694 | Swift Capital | 652.08% | $88.6M | Business Lender |

| 789 | CloudMyBiz | 575.46% | $2.1M | IT Services |

| 1418 | loanDepot | 286.11% | $1.3B | Online Consumer Lender |

| 1439 | Nav | 281.98% | $2.7M | Online Lending Services |

| 1731 | United Capital Source | 224.85% | $8.5M | MCA |

| 1101 | ZestFinance | 165.99% | $77.4M | Online Lending Services |

| 2050 | National Funding | 184.74% | $75.7M | Online Business Lender |

| 2572 | Blue Bridge Financial | 136.73% | $6.6M | Online Business Lender |

| 2708 | Bankers Healthcare Group | 127.51% | $149.3M | Financial Services |

| 2714 | Tax Guard | 127.02% | $9.9M | Financial Services |

| 2728 | Fora Financial | 125.81% | $41.6M | Online Business Lender |

| 2890 | Reliant Funding | 121.61% | $51.9M | Online Business Lender |

| 4005 | Cashbloom | 70.47% | $5.4M | MCA |

| 4945 | Gibraltar Business Capital | 42.08% | $16M | MCA |

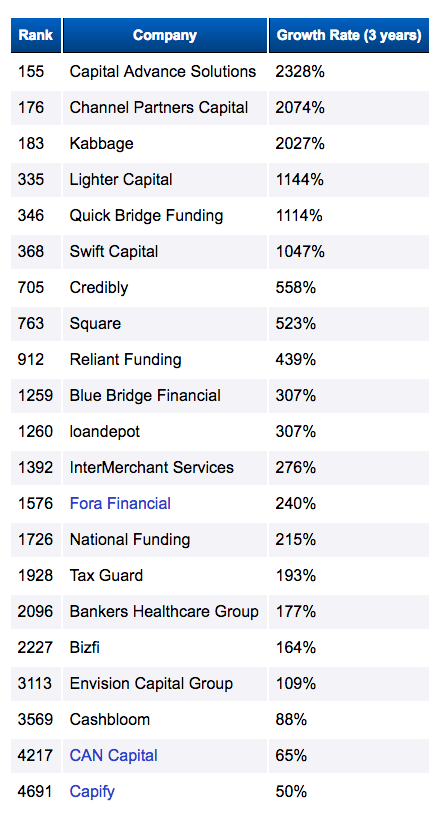

Compare that to last year’s list below:

Of the companies on the 2016 list, Capify and Bizfi were wound down while CAN Capital ceased operations but then later resumed them more than half a year later.

Maxim Commercial Capital Delivered Creative Financing Solutions in Q3 2025

October 13, 2025LOS ANGELES, CALIF. (October 13, 2025) – Maxim Commercial Capital (“Maxim”) announced it countered industry trends during the third quarter of 2025 by delivering essential hard asset secured financing to small and mid-sized businesses across the nation. Maxim is a national provider of loans and leases from $10,000 to $3 million collateralized by class 6 and 8 trucks, trailers, construction and agricultural heavy equipment, and real estate. The company fuels entrepreneurship by offering attractive financing rates and terms for underserved market segments, including startups and borrowers with challenged credit.

“It was a noteworthy quarter for our team,” noted Michael Kianmahd, Maxim’s CEO. “Despite the industry-wide slowdown in originations, we stayed on course to structure and fund deals during trying economic and market conditions. We were thrilled to welcome Lyndon Elam as Chief Operating Officer and continued to develop and roll out performance enhancing technology tools.”

Maxim experienced a good flow of applications for over-the-road (OTR) used truck and trailer financing during the period. While strong demand held used truck prices steady, many lenders retracted, leaving vendors and buyers scrambling for reliable financing. Funded deals during the period included a $45K 2020 Kenworth T680 with 528K miles for 26% down for a subprime startup owner operator with a 621 FICO; a $48K 2020 Kenworth T680 with 501K miles for 25% down for an experienced subprime owner operator with a 581 FICO; and a $23K 2020 Utility Dry Van for an existing customer with challenged credit for 25% down.

In addition to OTR trucks and trailers, Maxim is a leader in financing vocational trucks, such as tow trucks and dump trucks, and helping borrowers consolidate expensive MCA debt by lending against owned heavy equipment and real estate. As equipment leasing rates became more expensive during the period, Maxim received applications from borrowers with strong contracts seeking to purchase equipment.

Creatively structured deals during the third quarter include 60% purchase financing for a newer, rapidly growing construction company to buy a $40K 2025 Equipter RB4000 to improve efficiency on construction sites. Traditional lenders had turned down the business owner due to her 681 FICO, newly opened $60K auto loan, and $25K in student loan debt. Another startup entrepreneur with a business plan to haul construction material and a committed driver got the $106K 2020 Mack GRANITE 104BR Dump Truck she wanted for 34% down, despite her 541 FICO and discharged bankruptcy from 2018.

“One reason I was attracted to join Maxim is their creative, flexible approach to working with equipment vendors, finance brokers, and borrowers,” said Elam. “Our team takes the time to optimize financing structures, such as by asking about excess equipment or real estate collateral to improve advance rates or helping a borrower understand true affordability based on cash flow. This results in high approval to submission rates which is a key goal for all lenders.”

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners nationwide by providing loans and leases (“financing”) from $10,000 to $3 million secured by trucks, trailers, heavy equipment, and real estate. It funds equipment purchase financings and leases, working capital, and debt consolidations. Maxim’s more creative financing structures leverage equity in real estate and owned heavy equipment to facilitate growth and preserve customers’ cash. As a leading provider of transportation equipment financing, Maxim supports startup and experienced owner-operators and non-CDL small fleet owners by funding loans and leases for class 8 and class 6 trucks, trailers, and reefers. Learn more at www.maximcc.com or by calling 877-776-2946.

###

Contact:

Michael Kianmahd, CEO

Maxim Commercial Capital

michael@maximcc.com

(213) 984-2727

AltFinanceDaily & Reliance Financial Sponsor Major Community Event in Jersey City

September 23, 2025AltFinanceDaily and Reliance Financial have teamed up to support and sponsor one of Jersey City’s signature community events, The Zombie Opera. Produced by local non-profit Undead Arts, The Zombie Opera, an outdoor Halloween-themed opera, is attended by 5,000 people each year in Downtown Jersey City. With the Opera known as a “phenomenal day of community and commerce” both AltFinanceDaily and Reliance Financial are proud to support it and the local business community. This year’s Zombie Opera will take place on October 25 between 6:30 – 8pm at Hamilton Park in Jersey City, NJ.

About AltFinanceDaily

AltFinanceDaily, founded in 2010, operates trade media and events for the small business finance and fintech industries. This is AltFinanceDaily’s 2nd year sponsoring the event.

About Reliance Financial

Reliance Financial is a U.S.-based provider of revenue-based financing solutions offering up to $5,000,000 per transaction. The company is committed to delivering fast, transparent, and flexible funding to growing businesses nationwide. Led by industry veteran Aryeh Miller, Reliance has helped thousands of companies unlock working capital without giving up equity or control.

If you’re interested in joining as a sponsor, email info@debanked.com.

Catching Up With Kalamata

September 18, 2025 Kalamata Capital Group is continuing to fund in Texas through one of its affiliated entities, the company confirms. Kalamata, which recently upsized its 2024 securitization by 25% with notes expandable up to $500 million, offers a variety of funding products to small businesses around the United States. A new law that recently went into effect in Texas has prompted Kalamata and companies like theirs to get the word out to their partners about any applicable adjustments.

Kalamata Capital Group is continuing to fund in Texas through one of its affiliated entities, the company confirms. Kalamata, which recently upsized its 2024 securitization by 25% with notes expandable up to $500 million, offers a variety of funding products to small businesses around the United States. A new law that recently went into effect in Texas has prompted Kalamata and companies like theirs to get the word out to their partners about any applicable adjustments.

More front and center for the company, however, is the introduction and evolution of Kalamata Cash, its in-house proprietary software.

“We went live with everything, including our syndicator profiles and access to the outside world as well, and that’s been a really exciting development for the company,” said Brandon Laks, co-president at Kalamata, “because instead of licensing software, which the software we were on was great before, it gives us the ability to roadmap exactly what we want to do.”

Kalamata, for example, is 100% broker-driven, and they can custom-tailor the process to best suit their relationships.

“Our brokers can come in and see live calculators,” Laks said, “so when they submit a deal and we send an offer, they can get a live view of what steps are outstanding, they can play around with the sliders and choose their offers.”

And there’s a lot more on the horizon that they’re integrating with and adding on.

Guggenheim Securities served as sole structuring advisor and the sole initial purchaser of the notes in the Kalamata securitization deal. At the time of the announcement, Laks said, “The access to additional capital will allow Kalamata to continue supporting Small Businesses and invest more capital in proprietary technology to stay at the forefront of the small business financing industry.”

Funders Comply With New Texas MCA Law

September 2, 2025As Texas implements the prohibition on ACH debits made by sales-based financing providers, here’s a working list of how funders are acting to comply:

Bitty: offering fixed-term installment loan. (see announcement)

CFG Merchant Solutions: offering fixed-term installment loan. (see announcement)

Merit Business Funding: Exempt from the law due to being a subsidiary of Meridian Bank. (See announcement)

Spartan Capital: offering fixed-term installment loan. (See announcement)

LCF Group: offering small business loans. (See announcement)

Backd Business Funding: offering term loans through their partnership with FinWise Bank.

If you are a sales-based or revenue-based financing provider that is continuing to fund in Texas and would like to be added here, email sean@debanked.com

Idea Financial Hits Milestone, Will Still Fund in Texas

July 9, 2025

Idea Financial, a nationwide small business lender, recently surpassed $1 billion in funding since inception.

“This is a historic milestone,” said Larry Bassuk, president and co-founder of Idea Financial. “Only a few years ago, this company was just a concept with potential. Like many of the small businesses we serve, we started with confidence, grit, and the unyielding belief that we would succeed. Today, I can proudly announce that Idea Financial’s impact on the small business lending community is significant and positive. This moment belongs to our team, past and present, whose dedication has gotten us here.”

Because the company does term loans and lines of credit, it is not impacted by the recently-passed sales-based financing legislation in Texas and will continue to fund there like normal.

For background, Bassuk and Idea Financial CEO Justin Leto, actually started out in the legal profession as attorneys before taking a risk in small business lending. When AltFinanceDaily first interviewed the duo in 2019, they said, “We’re not from the finance space, we’re not from the alternative lending space either, we came at this opportunity with a different approach.”

At that time, Idea had only funded $50 million since inception. Much of Idea’s growth since then can be attributed to their broker business, which it is still growing.

“Brokers and referral partners are critical to Idea’s success,” the company said. “While our borrowers are our clients, we also consider brokers and referral partners as clients by our team. We value their business and have made it a focus to develop close, mutually beneficial relationships with them.”

“We have been so fortunate to work with such a talented team, all of whom have contributed to the incredible growth of Idea,” said Leto. “We identified a problem with small business funding when we embarked on this journey, and we are so proud to have played a role in providing the solution that has fueled so many Main Street success stories.”

The Battle Against MCA in Texas

June 12, 2025David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

Texas, a state associated with limited government intervention and freedom of business to operate and succeed in a capitalist society, stands at a crossroads.

Texas, a state associated with limited government intervention and freedom of business to operate and succeed in a capitalist society, stands at a crossroads.

Governor Greg Abbott has until June 22nd to decide whether to sign House Bill 700 into law—a decision that could fundamentally reshape how small businesses access capital in the Lone Star State. If he signs it, or simply lets the deadline pass without action, this sweeping legislation will take effect on September 1, 2025. The action will potentially cut off vital funding sources for thousands of Texas entrepreneurs, in a direct assault on the merchant cash advance industry that has been a lifeline for the people of his state.

The stakes couldn’t be higher. While supporters frame HB 700 as consumer protection, this bill targets sales-based financing—financial tools that have become lifelines for small businesses shut out of traditional bank lending.

Small business owners know the frustration of walking into a bank and walking out empty-handed all too well. Traditional lenders have tightened their belts, especially for newer businesses, minority-owned enterprises, and companies in industries deemed “risky.” When a restaurant owner needs quick capital to fix a broken freezer, or a contractor requires funds to purchase materials for a big job, they can’t wait weeks for a bank’s approval process. They need solutions now.

That’s where alternatives come in. Revenue-based financing provides capital based on future sales, not credit scores or lengthy financial histories. Yes, they can be more expensive than bank loans—but they’re also available when banks say no.

This financing drives business growth, job creation, and the health of Main Street. When small businesses can access capital quickly, they expand, hire employees, and strengthen their communities.

HB 700 goes far beyond simple disclosure requirements. While transparency is important—and most responsible providers already provide clear terms—this bill creates a regulatory maze that could price many providers out of the Texas market entirely.

The bill imposes sweeping new requirements that will fundamentally change how sales-based financing companies operate in Texas. Companies providing commercial sales-based financing must register with the Office of Consumer Credit Commissioner by December 31, 2026, including both direct providers and brokers, with mandatory annual renewals and fees.

For any financing under $1 million, sales-based financing providers must provide extensive disclosures covering everything from total financing amounts and disbursement details to payment schedules, additional fees, prepayment penalties, and even broker compensation arrangements. The operational restrictions go much deeper, voiding confession of judgment clauses entirely and requiring companies to obtain recipient signatures on all disclosures before finalizing any transaction.

Perhaps most problematic is the prohibition on automatic debiting of recipient accounts unless companies hold a “validly perfected first-priority security interest”—a legal standard that’s nearly impossible to meet in practice and effectively kills the streamlined payment processes that make revenue-based financing work for the funders, and by extension, the merchants.

The Finance Commission of Texas gains broad authority to identify and prohibit “unfair, deceptive, or abusive” practices, though interestingly, they cannot set maximum interest rates or fees. Violations carry steep civil penalties of $10,000 each, and the law applies to any provider offering services to Texas recipients via the Internet, regardless of where the company is physically located. These aren’t minor regulatory adjustments—they represent a complete overhaul that could drive legitimate capital providers out of the Texas market entirely.

This isn’t just bureaucratic red tape. It’s a fundamental misunderstanding of how modern business financing works. Revenue-based financing depends on streamlined payment processes tied to daily sales. Without this mechanism, the entire business model becomes unworkable.

If HB 700 becomes law, the consequences will ripple through Texas’s economy. Small businesses already struggling with inflation, labor shortages, and supply chain disruptions will lose access to flexible financing options. Rural businesses, minority-owned enterprises, and startups will be hit hardest—exactly the businesses Texas should be supporting.

The irony is stark. Texas has built its reputation as a business-friendly state, attracting companies fleeing overregulation in other states. HB 700 threatens to undermine that competitive advantage by making it harder for small businesses to access the capital they need to grow.

The voices of actual small business owners have been largely absent from this debate. Many don’t even know this legislation exists, despite its potential impact on their operations. Those who are aware express frustration that lawmakers are making decisions about their financing options without understanding their real-world needs.

Governor Abbott faces a clear choice. He can sign legislation that will likely drive responsible funders out of Texas, or he can recognize that small businesses need access to diverse financing options.

The goal should be protecting businesses from truly predatory practices while preserving their ability to access capital when traditional banks won’t help. That requires nuanced policy, not broad restrictions that treat all alternative finance providers as predators.

The battle against MCA regulation in Texas isn’t really about merchant cash advances—it’s about whether Texas will remain a place where small businesses can find the capital they need to thrive. Governor Abbott’s decision will determine not just the fate of HB 700, but the future of small business financing in Texas.

The countdown has begun. Texas small businesses are watching and waiting.