6th Avenue Capital Secures $60 Million Commitment For Merchant Cash Advance Funding

November 2, 2017Highly Experienced Executive Team Offers Flexible Financing Options to Small Businesses

New York City – November 2, 2017 – 6th Avenue Capital, LLC (“6th Avenue Capital”), a leading provider of small business financing solutions, announced today its securement of a $60 million commitment from a large institutional investor. The investor made their commitment based on 6th Avenue Capital’s industry-leading underwriting, compliance standards and processes. 6th Avenue Capital will draw from this commitment to offer merchant cash advances to small businesses through its nationwide network of Independent Sales Organizations (“ISOs”) and other strategic partnerships, such as banks and small business associations.

6th Avenue Capital launched formal operations in 2016 to help finance small businesses that are often ineligible for funding due to traditional underwriting criteria. 6th Avenue Capital evaluates each application for funding individually and keeps the merchant’s short and long-term needs in mind including, most importantly, what they can afford. 6th Avenue Capital also understands that small businesses may need funding quickly. The company’s data-driven underwriting processes, expertise and technology can give the merchant secure and equitable approvals of qualified requests and funding within hours.

Leading the team, CEO Christine Chang oversees all strategic aspects of 6th Avenue Capital. She also serves as COO to sister company Nexlend Capital Management, LLC. She brings more than 20 years experience in institutional asset management, including alternative lending. Previously, Chang served as Chief Compliance Officer at Alternative Investment Management, LLC, COO at New York Private Bank & Trust and Vice President at Credit Suisse. She serves on the board of Blueprint Capital Advisors, LLC and Bottomless Closet, a not-for-profit empowering economic self-sufficiency in disadvantaged NYC women.

“Our mission at 6th Avenue Capital is to help small businesses grow, and we continue to expand our existing network of ISO and strategic partners to ensure these businesses have access to capital in hours,” said Chang. “Our leadership team of financial industry experts has extensive experience navigating multiple economic cycles. We know how to serve merchants and how to deliver quickly while meeting the highest operational standards for our investors.”

COO Darren Schulman joined the team in March 2017. Schulman is a 20-year veteran of the alternative finance and banking industries. He is responsible for oversight of 6th Avenue Capital’s origination, underwriting, operations and collections, as well as strategic initiatives. Schulman served previously as COO at Capify (formerly AmeriMerchant), a global small business financing company, and President and CFO at MRS Associates, a Business Process Outsourcing (BPO) company specializing in collections. In addition, Schulman was an Executive Vice President at MTB Bank.

“We form strong relationships with the merchant and consider it essential for our underwriters to speak to every merchant, on every deal, regardless of its size,” said Schulman. “We also make our underwriters available for discussions with ISOs whenever necessary. We are proud to offer competitive volume-based commissions, buyback rates and white label solutions.”

About 6th Avenue Capital, LLC

6th Avenue Capital is changing the small business financing landscape by offering a data-driven underwriting process and fast access to capital. The company employs a unique blend of industry experts and is committed to the highest operating standards, high touch merchant service, including a policy of direct merchant access to underwriters. 6th Avenue Capital is a sister company of Nexlend Capital Management, LLC, a fintech investment management firm founded in 2014 and focused on marketplace lending (consumer loans). For more information, visit www.6thavenuecapital.com.

# # #

OAREX Secures $10,000,000 in Funding, Strengthens Digital Media Presence

October 24, 2017

CLEVELAND, OH – OAREX Capital Markets, Inc. (“OAREX”), a leading non-bank financing institution providing financing for digital media companies, today announced that it has closed on a $10,000,000 line of credit from a group of lenders, led by Arena Investors, LP, a New York-based global investment firm.

OAREX accelerates programmatic advertising revenue for digital publishers such as websites, app developers, ad networks and supply-side platforms. Accelerated cash flow allows media companies to scale their content promotion and user acquisition campaigns, and pay supply side partners and vendors sooner.

“This transaction significantly improves our ability to fund publishers,” Hanna Kassis, founder & CEO said. “It will allow us to continue to provide liquidity in a timely and efficient manner, allowing clients to better match their income with expenses to scale rapidly,” said Kassis.

Since inception, OAREX has helped accelerate programmatic advertising revenue for hundreds of websites and apps, and has purchased millions of dollars in outstanding receivables. “We tailor our service to our clients’ individual needs, making sure they’re positioned for growth,” Kassis said.

Capital & Credit as a Service

OAREX offers a non-loan product, making it appealing to many new digital media companies that are not interested in assuming debt and providing personal guarantees. OAREX accomplishes this by financing publishers’ advertising receivables, providing immediate liquidity for growth. Clients can sign up for one-time funding, or a monthly facility between 6 and 12 months. OAREX funds clients on a weekly or monthly basis, depending on their needs and cash flow.

“We are not a lender,” Kassis said, “we are a capital partner with the aim of helping clients grow.” OAREX takes a hands-on approach to servicing its clients, despite newly developed back-end technology that allows OAREX to verify receivables instantly. “We believe human interaction is critical to our providing the best service, even in the digital age,” said Kassis. As a value-add, OAREX offers a database to clients of all payment, collection and credit data on ad networks, ad exchanges and other intermediaries in the digital media ecosystem. “If this information can help our clients, then it can only help us by sharing it with them,” said Kassis.

About OAREX Capital Markets, Inc.

OAREX Capital Markets, Inc. (www.oarex.com) provides fast, flexible funding for companies in the digital media ecosystem earning revenue from advertising, affiliates and marketplaces such as the App Store. Established in 2013, OAREX is an acronym for the “Online Advertising Revenue Exchange”, and is located in the heart of Cleveland’s historical Tremont neighborhood. For more information, please contact Hanna Kassis or Taylor Haddix at (855) 466-2739.

About Arena Investors, LP

Arena Investors, LP (www.arenaco.com) is a global investment firm and merchant capital provider that invests across the entire credit spectrum in areas where conventional sources of capital are scarce. Arena focuses on corporate private credit, real estate private credit, commercial & industrial assets, structured finance, consumer assets as well as structured private investments in public securities.

####

CIM Commits Additional $100M to Funding Circle to Help Fuel Small Businesses

March 1, 2017SAN FRANCISCO, March 1, 2017 /PRNewswire/ — Funding Circle, the world’s leading lending platform focused exclusively on small business, today confirmed Community Investment Management (“CIM”), an impact investment firm focused on marketplace lending, will finance an additional $100 million in loans to businesses originated through Funding Circle in the U.S.

The multi-year agreement, which extends the existing relationship between Funding Circle and CIM, will allow Funding Circle to provide a much-needed, further injection of capital into America’s small business sector.

“We are thrilled to extend our partnership with CIM, who shares our values and mission to help small businesses grow and thrive,” said Sam Hodges, co-founder and US managing director at Funding Circle. “Together, through this additional investment, we can help even more businesses access the transparent and responsible financing they need to stimulate job creation and economic growth in their local communities.”

Since launching in 2010, investors at Funding Circle – including 60,000 individuals, financial institutions, government, and the listed Funding Circle SME Income Fund – have helped more than 25,000 businesses globally access $3 billion in transparent and affordable financing. CIM was one of Funding Circle’s earliest institutional partners in the U.S.

“Funding Circle is a leader in innovative lending to small businesses who are underserved by traditional lenders,” said Jacob Haar, Managing Partner at CIM. “We are pleased to expand our relationship to further empower small businesses across the United States with responsible financing.”

About CIM

Community Investment Management (“CIM”) is an impact investment firm focused on marketplace lending. CIM provides responsible and transparent financing to small businesses in the United States in partnership with a select group of technology-driven lenders. CIM combines experience, innovation, and values to align the interests of small business borrowers and investors. More information is available at http://www.cim-llc.com.

About Funding Circle

Funding Circle (www.fundingcircle.com) is the world’s leading lending platform for business loans, matching small businesses who want to borrow with investors who want to lend in the UK, US and Europe. Since launching in 2010, investors at Funding Circle – including 60,000 individuals, financial institutions, the listed Funding Circle SME Income Fund and Government – have lent more than $3 billion to 25,000 businesses globally. Funding Circle has raised $373m in equity capital from the same investors that backed Facebook, Twitter and Airbnb.

Funding Circle announces $100 million equity investment to help thousands more small businesses globally

January 11, 2017

- Round led by Accel, with participation from other existing equity investors

- Investment comes as UK business reached profitability for Q4 2016

- Lending through Funding Circle passes $3 billion globally, benefitting over 25,000 businesses in the UK, US and Europe – creating more than 50,000 new jobs

Funding Circle, the world’s leading lending platform focused exclusively on small business finance, today announced it has raised a further $100 million in equity capital. Led by Accel, the round saw participation from existing Funding Circle investors, including Baillie Gifford, DST Global, Index Ventures, Ribbit Capital, Rocket Internet, Sands Capital Ventures, Temasek and Union Square Ventures.

The new investment follows significant growth at Funding Circle over the last 12 months. Globally, investors on the Funding Circle platform have lent more than $1.4 billion to small businesses in 2016, with approximately $485 million lent in Q4 alone, a record amount for any SME direct lending platform. Additionally, in Q4 Funding Circle UK recorded 90 percent year-on-year growth and reached profitability.

Samir Desai, CEO and co-founder of Funding Circle, said: “Funding Circle is changing the financial landscape for small businesses and investors globally, ensuring a better deal for everyone and helping to create a more sustainable and fairer economy. Today’s news is the next step on our journey to create a category-defining company that helps thousands of small businesses access finance and create jobs. Over the next 12 months, lending through the Funding Circle platform will create a further 50,000 new jobs, supporting economic growth in the UK, US and continental Europe.”

Funding Circle facilitates lending to small businesses from investors including 60,000 individuals, local and national government, the European Investment Bank and financial institutions such as pension funds. The investment comes as lending to small businesses through the platform passes $3 billion globally, benefitting over 25,000 businesses and creating 50,000 new jobs.

Funding Circle facilitates lending to small businesses from investors including 60,000 individuals, local and national government, the European Investment Bank and financial institutions such as pension funds. The investment comes as lending to small businesses through the platform passes $3 billion globally, benefitting over 25,000 businesses and creating 50,000 new jobs.

Harry Nelis, Partner at Accel, said: “We’ve been impressed by the Funding Circle team since our early investment in the company. It has achieved significant growth across multiple international markets by delivering an appealing lending option to SMEs and attractive risk-adjusted returns to investors on the platform. This investment makes Funding Circle the largest and best capitalized SME lending platform in the world, and we’re thrilled to continue to support its journey.”

Launched in 2010, the Funding Circle model has opened up small business lending to a wide range of investors, improving competition in the market, creating jobs and reducing dependency on bank lending. This latest investment is recognition of the efficiency of the direct lending model, and its ability to channel much-needed funds to the real economy, while providing investors with attractive, stable returns. In total, Funding Circle has now raised $373 million in equity funding from some of the world’s largest and most respected investors.

By bringing together industry leading risk management and cutting edge technology, creditworthy businesses typically access the capital they need in days rather than months.

About Funding Circle

Funding Circle (www.fundingcircle.com) is the world’s leading lending platform for business loans, matching small businesses who want to borrow with investors who want to lend in the UK, US and Europe. Since launching in 2010, investors at Funding Circle – including 60,000 individuals, financial institutions, the listed Funding Circle SME Income Fund and Government – have lent more than $3 billion to 25,000 businesses globally. Approximately 10 percent of investor money now comes from Government sources, including the British Business Bank, European Investment Bank, KfW, the German government-owned development bank, and local councils across the UK. Funding Circle was the first lending platform to announce a formal referral partnership with Santander, one of the UK’s leading high street banks, and has since announced a similar partnership with RBS. It has raised $373m in equity capital from the same investors that backed Facebook, Twitter and Airbnb.

About Accel

Accel is a leading early- and growth-stage venture capital firm, powering a global community of entrepreneurs. Accel backs entrepreneurs who have what it takes to build a world-class, category-defining business. Founded in 1983, Accel brings more than three decades of experience building and supporting hundreds of companies. Accel’s vision for entrepreneurship and business enables it to identify and invest in the companies that will be responsible for the growth of next-generation industries. Accel has backed a number of iconic global platforms, which are powering new experiences for mobile consumers and the modern enterprise, including Atlassian, Avito, BlaBlaCar, Deliveroo, Dropbox, Etsy, Facebook, Flipkart, Funding Circle, Kayak, QlikTech, Simplivity, Slack, Spotify, Supercell, WorldRemit and others.

CAN Capital’s Collateral ‘Adjustment’

December 24, 2016Last month, CAN Capital disclosed that they had “self-identified that some assets were not performing as expected” on the same day that three of the company’s top executives were put on leave. Since then it’s been reported that a discrepancy arose when CAN’s old systems were not equipped to handle the shift from variable payment advances to fixed payment loans. This is notable given that CAN began doing fixed payment loans all the way back in April 2010.

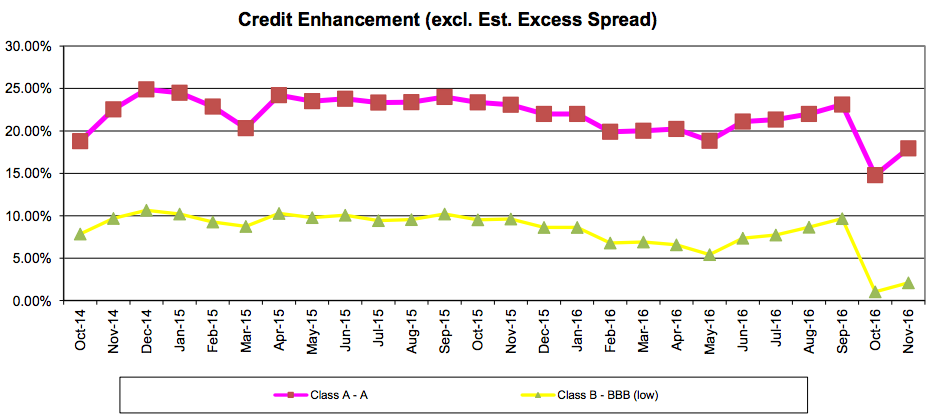

The discrepancy found its way into CAN’s 2014 securitization. S&P Global Ratings recently reported on this that “there was a correction of previously misclassified assets that affected the results of the calculation of [the] adjusted performing asset balance” on CAN Capital Funding LLC Series 2014-1.

Ratings agency DBRS illustrates the collateral dip on CAN’s securitization once the classifications were reported correctly on Series 2014-1 below.

This is the first public glimpse into what CAN’s old systems got wrong and by how much.

The drop triggered a rapid amortization event, potentially causing liquidity issues for CAN, hence why new funding may be paused. The principal balance on the $200 million notes has dropped by nearly $70 million in the last two months, indicating big payouts.

The process to manage a rapid amortization event is described in the original DBRS ratings report. The implications aren’t good given that this appears to be brought on by misclassifying assets rather than a natural deterioration of loan performance.

Last week, CAN laid off nearly half of its employees as it tries to correct course.

Update: On December 25th, AltFinanceDaily published a brief of a newly discovered lawsuit filed against CAN Capital on December 19th by an aggrieved shareholder alleging the company had failed to pay her a $150,000 settlement payment.

Kalamata Capital Chairman Steven Mandis Authors Second Book

September 25, 2016 Kalamata Capital Chairman Steven Mandis is doing more than just approving small businesses up to $750,000 in under 24 hours. He’s also just authored a new book, The Real Madrid Way: How Values Created the Most Successful Sports Team on the Planet.

Kalamata Capital Chairman Steven Mandis is doing more than just approving small businesses up to $750,000 in under 24 hours. He’s also just authored a new book, The Real Madrid Way: How Values Created the Most Successful Sports Team on the Planet.

Not a subject you expected from a tech-driven small business lender? Steven Mandis is not your average industry executive…

Prior to Kalamata, he worked at Goldman Sachs in the investment banking, private equity, and proprietary trading areas. He assisted Hank Paulson and other senior executives on special projects and was a portfolio manager in one of the largest and most successful proprietary trading areas at Goldman. After leaving Goldman, he cofounded a multibillion-dollar global alternative asset management firm that was a trading and investment banking client of Goldman’s.

During the financial crisis, Mandis was a senior adviser to McKinsey & Company before becoming chief of staff to the president and COO of Citigroup and serving on executive, management, and risk committees at the firm.

He’s also an adjunct professor at Columbia Business School, where he teaches classes of MBA and executive MBA students on strategic issues facing investment banks and the European financial crisis.

His first book, What Happened to Goldman Sachs? was widely acclaimed. “Several authors have tackled the question of how Goldman’s culture changed post-1999 but none so deftly as Steven G. Mandis, a banker-turned-sociologist,” wrote the Wall Street Journal. I also read it cover-to-cover myself back in March of 2015.

In Real Madrid, “Mandis is the first researcher to rigorously analyze both the on-the-field and business aspects of a sports team. What he learns is completely unexpected and challenges the conventional wisdom that moneyball-fueled data analytics are the primary instruments of success.”

Former NBA Commissioner David Stern said of the book, “With unprecedented behind-the-scenes access, this book is the most complete study of any sports team ever done–which leads to fascinating conclusions.”

Are you a finance buff? Sports buff? Perhaps both? You’ll want to read his new book.

Does SoFi Want $500 Million for Global Expansion?

September 8, 2016Online lender SoFi is looking to raise $500 million in equity capital to fund new projects and possibly expand to international markets.

The San Francisco-based lender is in talks with investors and maybe just weeks away from finalizing the deal, according to The Wall Street Journal. If the deal goes through, it might be one of the biggest fintech deals of the year, said the report.

SoFi has had an eventful year so far, to say the least. Led by ex-Wells Fargo executive Mike Cagney, the company laid plans in the beginning of the year to start a dating app to appease millennial borrowers, started a hedge fund to buy loans, made a bunch cheeky, controversial commercials, appointed Deutsche Bank’s ex CEO Anshu Jain to its board, made unusual hires, funded $1 billion in student loans and got knee deep in mortgages. SoFi’s strategy since inception has been to stay relevant for its borrowers at every stage of their lives, starting with student loans, personal loans, all the way through to a mortgage.

One of the fastest growing private lending companies, SoFi’s backers include marquee investors like Peter Thiel, Prosper Loans’ President Ron Suber, Discovery Capital, Softbank and Morgan Stanley.

Splits Glitz or Fritz? – Transact 16 highlighted strange chapter in merchant cash advance history

April 21, 2016

It’s Opposite Day in the alternative business funding industry. Lenders are splitting card payments and merchant cash advance companies are doing ACH debits.

Jacqueline Reses was not an odd choice for Transact 16’s Wednesday morning keynote. Square, the company she works for, has continued to be a hot topic in the payments world for years. But what was striking is that Reses heads the lending division, the group that allows merchants to pay back loans through their future card sales. If that sounds very merchant-cash-advance-like, it’s because that’s exactly the product they used to offer before changing the legal structure behind them.

Split-payments, not ACH payments, have literally propelled Square and PayPal to the top of the charts of the alternative business funding industry. One individual on the exhibit hall floor posited that Square’s ability to originate loans through their payments ecosystem was the company’s real value; Payments itself was secondary. It’s a testament to the opportunities that split-payments affords to (as I argued 3 years ago on the ETA’s blog) a company well positioned to benefit from it.

Meanwhile, the companies at Transact that one would have historically described as merchant cash advance companies have mostly transitioned away from split-payments to ACH. Essentially, Square and PayPal embraced splits as an incredible strength while yesterday’s merchant cash advance companies viewed splits as a handcuff that limited scalability. The payment companies became merchant cash advance companies and the merchant cash advance companies became something else entirely, a diverse breed of loan and future receivable originators operating under a label people are now calling “marketplace lenders.” But even Square and PayPal, arguably the two companies at Transact doing the most split-payment transactions, claim to make loans, not advances.

Merchant Cash Advance as anyone knew it previously is dead

Ten years. That’s the average age of the small business funding companies that exhibited at Transact this week. They are but the last remaining players that probably considered the debit card interchange cap imposed by the Durbin Amendment of Dodd-Frank as being among the most significant legislation that affected their businesses.

A senior representative for one credit card processor told me at the conference that their biggest gripe with new merchant cash advance ISOs today is that they know almost absolutely nothing about merchant accounts. It’s not that they know less, they know nothing, he said.

One company was notably absent from the floor this year, OnDeck. They’ve since embraced the marketplace lending community as their home, just as many others have.

Nine years ago, I overheard a very influential person say that the first company to be able to split payments across the Global, First Data and Paymentech platforms would be crowned the “winner” of the merchant cash advance industry and by extension the wider nonbank small business financing space.

If one were to define the winner as the first company from that era to go public, well then those 3 platforms played no role. OnDeck was the first and they relied on ACH payments the entire way. They also refer to themselves these days as a nonbank commercial lender. If that doesn’t sound very payments-like, it’s because it’s not.

What cause is being Advanced?

At least four coalitions are currently advocating on the marketplace lending industry’s behalf, the Coalition for Responsible Business Finance, the Marketplace Lending Association, the Small Business Finance Association, and the Commercial Finance Coalition. The Transact conference is put on by the Electronic Transactions Association whose tagline is “Advancing Payments Technology.” In an age where new merchant cash advance ISOs know nothing about payments, it’s no wonder there’s a growing disconnect.

Could Transact now be one of the best kept secrets?

A few people from companies exhibiting say that they believed they stood a better chance to land referral relationships from payment companies by being there and that there was still a lot of value in landing those deals. Partnerships like these may be why the average exhibitor has been in business for 10 years while today’s new companies relying solely on pay-per-click, cold calling, or handshakes are falling on hard times.

Some payment processors acknowledged that merchant cash advance companies were still a good source to acquire merchant accounts, though the process by which that happens is not the same as it used to be. A lot of it is referral based now, according to one senior respresentative for a card processor. The funding company funds a deal via ACH and then refers them to the payment guy to try and convert that as an add-on. The residual earnings may not be as good as they used to be but that’s because they don’t have to do any work in this circumstance. In a sense, funders are still leading with cash but instead of the boarding process being mandatory, it’s an entirely separate sale that sometimes works and sometimes doesn’t. In that way, small business funding companies can be a good lead source for payments companies.

When I asked the senior representative if they really had success closing merchant accounts just off of a referral from a funding company, he looked at me incredulously, and said, “you used to do this, of course we do. that’s how this whole industry started.”

“What industry?” I asked.

What industry indeed…