How Not to Grow Your Merchant Cash Advance Business

August 23, 2011

Advertising and marketing are tricky in any industry. The Merchant Cash Advance space has certainly experienced its fair share of trial and error over the past several years. What works for one company, doesn’t for another.

Many argue that there are no virtually no barriers to entry and this causes problematic issues in competition. Some representatives don’t know what they’re selling, how to sell it, or what can and can’t be said when they’re selling it. There are so many fly by night resellers, that states are running out of LLCs to issue. “Merchant funding capital advance now approved accredited finance business source solutions, LLC” is the going fast! Better Organize it now.

For ones that make it, they have the good leads.

Blake: These are the new leads. These are the Glengarry leads. And to you they’re gold, and you don’t get them. Why? Because to give them to you would be throwing them away. They’re for closers.

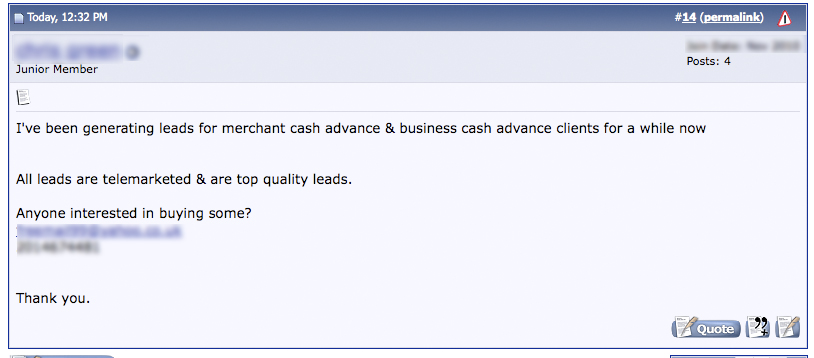

But there is good way to not grow your Merchant Cash Advance business and that is to be so desperate, that you buy actual piles of garbage. These leads are obtained through sources that advertise in this manner:

You can find stuff like these in forums, along with a shady hotmail address, no website and a promise of ‘top quality.’ If your business model is to buy leads, then make sure to have your Ch. 11 papers handy before you purchase these TOP QUALITY LEADS!!!

Also watch out for ‘try before you buy’ schemes: Get 5 trial leads for $50. if you like them, you can purchase a minimum of 100 at a time for a cost of $20 per lead. There are no refunds when you buy them. The 5 trial leads are real. The $2,000 bulk purchase is a flaming pile of crap.

Shelley Levene: The leads are weak.

Hope that helps. I would love to share more insight right now but a payday loan company with a predictive dialer is calling my phone and I’m eager to talk to someone in India who can provide a vague description of the product and have my information sold to 5 companies who swear I had completed a contact form online for car insurance because that’s what their lead sheet says.

-The Merchant Cash Advance Resource

Georgia Funding Statistics – November 2010

August 23, 2011

The below is the number of advances made per funding source in Georgia for the month of November, 2010:

AdvanceMe 16

Merchant Cash and Capital 8

Merchants Capital Access 6

1st Merchant Funding 5

Strategic Funding Source 4

Merchant Capital Source 4

On Deck Capital 2

First Funds 2

Max Advance 2

RapidAdvance 2

AmeriMerchant 2

Snap Advances 1

Business Financial Services 1

American Finance Solutions 1

Bankcard Funding 1

The Business Backer 1

Merchant Cash Group 0

Capital For Merchants 0

Greystone Business Resources 0

EZ Business Cash Advance 0

GRP Funding 0

New York Funding Statistics – November 2010

August 23, 2011New York Funding Statistics – November 2010

Posted on December 4, 2010 at 3:38 PM

The amount of deals funded per funding source for November 2010:

AdvanceMe 26

1st Merchant Funding 9

First Funds 9

Merchant Cash and Capital 8

Strategic Funding Source 7

On Deck Capital 7

Max Advance 7

RapidAdvance 5

Snap Advances 3

EZ Business Cash Advance 3

American Finance Solutions 3

Business Financial Services 2

Merchants Capital Access 2

Bancard Funding 1

The Business Backer 1

GRP Funding 1

Merchant Advance Funding LP 1

Business Consulting Options 1

AmeriMerchant 1

Happy Rock Merchant Solutions 1

Merchant Cash Group 0

Capital For Merchants 0

Greystone Business Resources 0

Merchant Capital Source 0

AdvanceMe: In the Business of Business

August 23, 2011

A guest article by: Rob Olson of Quantum Merchant Services

On The Benefits of Merchant Cash Advance

Sometimes the most difficult part of running your own business is obtaining capital to maintain and sustain ongoing growth. It is a challenging market and bank lending is scarce. Fortunately, there are options.

Funding can be obtained from Merchant Cash Advance firms via an alternative factoring product. These funding firms can usually provide financing from as low as $1,000 up to $250,000 dollars(sometimes more!). This isn’t structured as a loan but rather the business sells their future Visa/MasterCard receivables for a discounted price. The discounted price is the upfront lump sum the business receives. In essence, it is a cash advance on future sales through your merchant account.

The cash is then repaid by diverting a percentage of each credit card transaction back to the funding firm automatically. That percentage is predetermined in the contract and is commonly referred to as the Daily Capture Rate, Holdback Percentage, or Withhold Rate. Since it’s simply a percentage of sales, the amount contributed towards repayment will depend on the business generated. The faster you generate sales, the faster it’s paid back. The slower you generate them, the longer it will take to pay back. It’s truly a superior financial tool.

When you are running your own establishment it can be tough to anticipate when major opportunities will arise. On the flipside, it’s not easy to predict emergencies or sudden negative events either. Preparation for both is crucial. A Merchant Cash Advance can be that back pocket plan. Excellent credit is not required and yet a large percentage of Merchant Cash Advance recipients have excellent credit anyway. Traditional banks can take months to underwrite a loan, time that may cost you.

Merchant Cash Advances are not only easier to obtain but continue to be a speedy solution for businesses in need of cash. It should be added that collateral is also not required. Make sure you choose a trustworthy funding company and we wish your business all the best.

Merchant Cash Advance Application Process – A Guide For Business Owners

August 23, 2011

We are happy to provide business owners with useful information. Since the site can be a bit difficult to navigate, we have compiled a 7 page printable PDF packet that summarizes what to expect when applying for a Merchant Cash Advance.

It includes:

- A sample application of what will be asked

- A list of what documentation is needed and why

- A breakdown on the established methods of repayment

- Contingent requirements that funding providers may have

- Glossary of Terms

The PDF packet can be downloaded here: The Merchant Cash Advance Application Process – A Guide for Business Owners

-The Merchant Cash Advance Resource

Still Curious About a Merchant Cash Advance? The Last Article You Will Ever Need to Read

August 23, 2011

You’ve seen the advertisements, received calls with offers for it, researched it online, but you’re still not sure about Merchant Cash Advance(MCA). Every business needs capital but bank loans just aren’t available. Alternative funding sources are out there and they spend millions of dollars every year trying to reach you. The word “alternative” usually causes business owners to put their guard up. Basically, all non-bank loans warrant skepticisim until proven innocent. We here at the Merchant Cash Advance Resource understand your concerns and would like to answer your questions once and for all. We are not a funding source, reseller, or advertiser and thus maintain an independent perspective on the the MCA industry.

image is the sole property of www.merchantprocessingresource.com

- How Legitimate is it?

- Who is Really Using it?

- How Big is the Industry?

- How Widespread is it?

- What is the Application and Underwriting Process?

- Who are the Most Well Known Providers of it?

- Who is Regulating it?

- What Happens if you Default on it?

- How does it Compare to an SBA Loans?

How Legitimate is a Merchant Cash Advance?

The purchase of future credit card sales(Merchant Cash Advance or MCA) has been mainstream since 1998. At that time, Kennesaw, Georgia based funding source AdvanceMe, held the patent rights to a process known as split funding. The patent was later invalidated and AdvanceMe was immediately joined by industry veterans AmeriMerchant, First Funds (now Principis Capital), Merchant Cash and Capital, Business Financial Services, and Strategic Funding. All of these firms have been operating since before 2006. As of 2011, there are now nearly 40 documented direct providers of capital.

MCA funding providers are backed by big name hedge funds, a few at one point by well known investment bank, Goldman Sachs. MCAs have frequently popped up in the news and are openly endorsed by some of the largest payment networks in the world. See for yourself:

Feb. 11, 2011 – 10 Reasons to Start a Business This Year

Feb. 11, 2011 – 10 Reasons to Start a Business This Year

![]() Sept 1, 2009 – Enterpreneurs Turn to Alternative Finance

Sept 1, 2009 – Enterpreneurs Turn to Alternative Finance

Apr. 2009 – Merchant Cash Advance Financing: The Good, The Bad, and The Ugly

Apr. 2009 – Merchant Cash Advance Financing: The Good, The Bad, and The Ugly

Brochure and advertisement directly From First Data, the largest merchant acquirer in the world.

Brochure and advertisement directly From First Data, the largest merchant acquirer in the world.

![]() Advertisment and endorsement directly from Chase Paymentech

Advertisment and endorsement directly from Chase Paymentech

Program is offered by Evo, one of the nation’s largest credit card processors and winner of the 2009 New York Metro Entrepreneur of the Year Award.

Program is offered by Evo, one of the nation’s largest credit card processors and winner of the 2009 New York Metro Entrepreneur of the Year Award.

Who is Really Using a Merchant Cash Advance?

Nearly every major national retail or restaurant franchise has used a Merchant Cash Advance. A small sample of the names include the following:

- Burger King

- Domino’s Pizza

- Hooters

- Subway

- Dunkin Donuts

- Taco Bell

- Denny’s

- Wendy’s

- Meineke Car Care

- Maaco

- Aamco Transmissions

- Curves Fitness

Data was obtained directly from Secretary of State UCC-1 filing records. More information on franchise funding can be read in one of our previous articles, “Who is Really Getting a $250,000 Merchant Cash Advance?“

How Big is the Industry?

Experts have predicted that more than $1 Billion in MCAs are being provided to businesses every year. We conducted independent research and was able to validate the size to be greater than at least $500 Million in 2010. Check out the study at, “Complete Merchant Cash Advance Statistics 2010“

How Widespread is Merchant Cash Advance?

The MCA product is not limited to the United States. This product is actively growing in:

- Canada

- United Kingdom

- Australia

- Hong Kong

- Singapore

For a list of international funding providers, take a peek at our article at, “Merchant Cash Advance – Canada, UK, and Beyond!“

What is the Application and Underwriting Process Like?

EASY! We recently released a guide for merchants that breaks the process down step by step. Download the guide here.

Who Are the Most Well Known Direct Providers of Merchant Cash Advance?

The biggest names are compiled in our Funding Directory. Many are BBB accredited and a few are Ernst & Young Entrepreneur of the Year award winners.

Who is Regulating the Merchant Cash Advance Industry?

Since MCAs are a purchase/sale of future credit/debit card receivables, lending laws do not apply. However, most firms belong to a self-regulating body known as the North American Merchant Advance Association. As stated on their website, NAMAA’s purpose is to promote competition and efficiency throughout the industry by:

- Providing education and professional development to its members

- Developing ethical standards and best practices guidelines for the industry

- Evaluating and providing education regarding the development and enforcement of intellectual property rights that affect the industry

- Evaluating and developing improvements to existing business methods and practices

- Developing industry relevant products and services

- Engaging in regulatory and legislative advocacy

What Happens if You Default on a Merchant Cash Advance?

In the case of a legitimate business failure, the merchant’s assets tend to be protected. There is significantly less at stake than a bank loan. We covered this topic once before in an article here, “What Happens When you Default on a Merchant Cash Advance?“

How Do Merchant Cash Advances Compare to SBA Loans?

The Small Business Administration protects banks from defaults for up to 90% of the losses. Despite this wildly generous guarantee, SBA Loans are considered to rank lower than a MCA. How is this is possible and what specific proof is there? Check out our analysis in, “SBA Loan vs. Merchant Cash Advance.“

Conclusion

The Merchant Cash Advance financial product has been in existence for more than a decade and is legitimate, mainstream, endorsed by reputable names, has been used by the most popular franchises in the U.S., is easy to obtain, offers asset protection that loans cannot, is self regulated, and is in many ways BETTER than a loan guaranteed by the SBA. A MCA may not be right for every business, but if it was just uncertainty that was holding you back, fear no more. This thing is for real…

-The Merchant Cash Advance Resource

http://www.merchantcashadvanceresource.com

webmaster@merchantprocessingresource.com

$4 Million Merchant Cash Advance Funded by Strategic Funding Source

August 23, 2011

Very reliable sources indicate that New York based Merchant Cash Advance funder, Strategic Funding Source(SFS), has inked a $4 Million Merchant Cash Advance with a big name business in Las Vegas. Without revealing who the recipient is, they seem to be very pleased with the outcome. They reportedly stated, “Strategic provided us with a very unique financing solution that gave us the final $4 million needed to complete the project and launch the company. Without their help and creativity, especially in this difficult economy, our completion may have not happened.”

To date, this would be the largest Merchant Cash Advance on record. It comes as no surprise that it came from SFS, one of the most experienced firms in the industry. Coincidentally, we recently singled them out in an article (Who is Really Getting a $250,000 Merchant Cash Advance?) as being one of the few firms capable of handling a million dollar deal.

It’s also worth mentioning that SFS is leading the Merchant Cash Advance industry in a new direction, in a way that resembles peer 2 peer(p2p) lending models like Prosper.com. Operating under the name Colonial Funding Network, investors have the ability to contribute their own funds towards a Merchant Cash Advance. The account is then serviced by SFS in return for a fee. Small businesses ultimately benefit since this creates a larger base of funds to draw from. To read more on our thoughts on how the p2p model is reshaping the industry, check out: The Direct Funder Model is SO 2009 or P2P Merchant Cash Advance Model Already Exists. To read up more on SFS and Colonial Funding Network, visit their site directly.

-The Merchant Cash Advance Resource

http://www.merchantcashadvanceresource.com

Photo copyrighted by: 123RF

1st Quarter 2011 Merchant Cash Advance Industry Preview

August 23, 2011Posted on April 3, 2011 at 7:52 PM

As a continuation of the massive popularity of our 2010 full year Merchant Cash Advance funding statistics, we are putting together data for the 1st quarter of 2011. It has not yet been finished but we figured we’d share some of our early findings.

early findings.

Funding appears to be on the rise in almost every state

This is mainly due to increased output by AdvanceMe. They are literally pushing the industry’s figures forward and making up for some firms that have cooled off. First Funds’ (Principis Capital) figures have declined by a large degree and is not operating close to 2010 levels.

Surge in “Starter Advances”

1st Merchant Funding, the most well known provider of starter advances is making significant gains. This may be an indication of tighter underwriting for normal size advances, there being more applicants with terrible credit, or the result of business owners embracing the opportunity to start off small.

California

Funding volume in this state has fallen off a cliff. Our initial estimates show declines of somewhere between 20-50%. This most likely has to do with What’s Going on in California. Normally the most active State for Merchant Cash Advance (was 13% of the entire nation in 2010), a continuation or worsening of this trend will actually shrink the industry as a whole in 2011. Of course the evidence of growth in the remaining 49 states tells the real story of the financial product’s success.

Stay tuned for the statistics…

– The Merchant Cash Advance Resource

Program is offered by NAB, one of the nation’s largest credit card processors and the 2008 Detroit Regional winner of Ernst & Young Entrepreneur of the Year Award.

Program is offered by NAB, one of the nation’s largest credit card processors and the 2008 Detroit Regional winner of Ernst & Young Entrepreneur of the Year Award.