Lending Club Threatens The Status Quo

March 20, 2014 In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

To this day, I continue to doubt that the overlap will be anything less than substantial. Nik Milanovic of Funding Circle would probably disagree with me. The main argument has been that Lending Club will only target small business owners with good credit, which assumes that businesses with anything less are the only users of merchant cash advances. Not to give anyone’s figures away, but I have seen data to suggest that a large segment of merchant cash advance users have FICO scores in excess of 660. Somewhere along the line we convinced ourselves that merchant cash advances were for businesses with really bad credit. That was never the purpose it was intended for, though it’s true that many applicants have low scores.

Historically, merchant cash advances were for businesses that posed a cash flow risk to banks. Split-processing eliminated that risk by withholding a percentage of card sales automatically through the payment company processing the business’s transactions. Funders today that rely on bank debits for repayment don’t have that safeguard, but they make up for the risk they take by doing something banks don’t do, require payments to be made daily instead of monthly. This allows businesses to manage their cash flow throughout the month and enables the funder to compound their earnings daily. It’s a phenomenon I wrote about in the March/April issue of DailyFunder (Razzle Dazzle Debits & Splits: Daily is the Secret Sauce)

According to the Wall Street Journal, Lending Club will require a minimum of 2 years in business and participation will initially only be open to institutional investors.

Lending Club’s website states that they will recoup funds on a monthly basis via ACH and that interest rates range from 5.9% APR to 29.9% APR + an origination fee. Terms range from 1 to 5 years and there are no early payment penalties.

TechCrunch openly pegs CAN Capital and OnDeck Capital as chief rivals for Lending Club in the space. CAN has enjoyed frontrunner status in the industry since 1998 and while they have been tested in the last 2 years, they haven’t come up against something like this.

In the same Wall Street Journal story, Lending Club’s CEO, Renaud Laplanche lays out who his competitors are with his quote, “The rates provide an alternative to short-term lenders and cash-advance companies that sometimes charge more than the equivalent of 50% annually.”

But will the impact be felt right away? In Laplanche’s interview with Fortune, he claims that it’s very likely they’ll focus on the 750+ FICO segment first, where institutional investors will be comfortable. But make no mistake about it, that will change quick, especially with a probable IPO in the next 8 months.

Is Lending Club really all that big? To draw a comparison, RapidAdvance got a $100 million enterprise valuation when they got bought out by Rockbridge Growth Equity about 6 months ago. Lending Club on the other hand was valued at around $2.3 billion at that time. It took OnDeck Capital 7 years to fund $1 Billion in loans. Lending Club is funding a billion dollars in loans every 3 and a half months. Granted, they’ve all been consumer loans, but let’s not kid ourselves about their capabilities.

Lending Club is funding more consumer loans than the entire merchant cash advance industry is doing combined. Thanks to the peer-to-peer model, they have infinity capital at their disposal. We can pretend that no one with good credit ever applied for a merchant cash advance or we can acknowledge the 3 billion pound gorilla in the room.

Lending Club and other peer-to-peer lenders that follow them will disrupt the alternative business lending status quo.

—

Previous articles on this subject:

Will Peer-to-Peer Lending Burn the Alternative Lending Market?

Lending Club Business Loans are Here

Peer-to-Peer Lending will Meet MCA Financing

Is There Cause for Alarm?

March 8, 2014

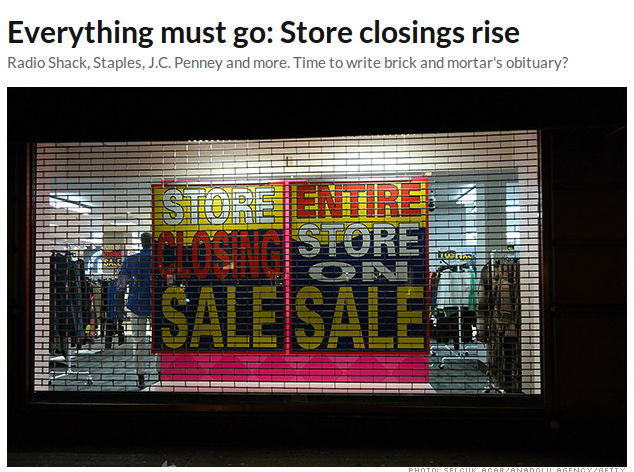

Brick and mortar chain stores died this week, after a long illness. Born along Main Street, raised in shopping malls across post-World War II America, the traditional store enjoyed decades of good health, wealth and steady growth. But in recent years its fortunes have declined. Survived by Amazon.com and online outfits too numerous to list.

– CNN 3/7/14

Just a day after Jeremy Brown’s new CEO Corner post appeared on DailyFunder with an overt bubble warning, CNN’s Chris Isidore alluded that the era of brick & mortar retail may be drawing to a close. In Isidore’s brief sensational article, he fingers an overabundance of retail space, a weak economy, and the Internet as the culprits behind Main Street‘s decline.

In the broad alternative business lending industry, the sentiment is quite the opposite. Small business demand for working capital is surging and no one is predicting anything less than stellar growth for the foreseeable future. But is the growth real?

Jeremy Brown is the CEO of Bethesda, MD-based RapidAdvance and he explains the growth may not be what it appears to be on the surface. Some cash providers are overpaying commissions, stretching out terms longer than what their risk tolerance supports, and are growing by funding businesses that have already been funded by someone else (a practice known as stacking).

If the industry collectively booked 50,000 deals in 2013 and increased that to 100,000 deals in 2014, you’d have 100% growth, or at least it would appear that way on the surface. What if the additional 50,000 deals funded this year were not new clients but rather additional advances and loans made to existing clients? It’s a lot easier to give all of your clients money twice instead of acquiring new ones.

This all begs the question, is demand for non-bank financing really growing by leaps and bounds? Or does it just appear that way because those that have already utilized it are demanding more of it?

Brown left his readers with this conclusion, “There will be a rebalancing at some point. And it will not be pretty.”

Chime in with your thoughts about this on DailyFunder.

—–

When Will the Bubble Burst? by Jeremy Brown will also appear in the next print issue of DailyFunder. If you haven’t subscribed to the magazine already, you can do so HERE.

Industry Fun Leads to Charity Funds

January 15, 20142013’s alternative business financing fantasy football competition came to a close near the end of the regular NFL season. There were some tough matchups and upsets, but two Florida based companies pulled through to win it all. The league raised a total of $9,000 from its participants and as per the rules, must be donated in equal halves to non-profit organizations selected by the two winners.

Financial Advantage Group selected the Spring of Tampa Bay, a noble choice since their mission is to prevent domestic violence, protect victims and promote change in lives, families and communities. DailyFunder, the trustee of the competition reached out to the organization late last month and made the donation in a low-key manner as per their request. They did express their gratitude to Scott Williams of Financial Advantage Group on their facebook page however:

Business Financial Services selected Wounded Warrior Project. They wrote their own post about the organization and why they are proud to support that cause on their website here: http://www.businessfinancialservices.com/blog/fantasy-football-for-charity/

Wounded Warrior Project accepted their donation with some pizazz, holding a giant check for a photo-op at the organization’s Jacksonville, FL office.

—-

I personally would like to thank Heather Francis of Merchant Cash Group for being a great competition co-host this year as well all of the participants that contributed funds to make these donations possible:

- Merchant Cash Group

- Benchmark Merchant Solutions

- Yellowstone Capital

- Raharney Capital

- Strategic Funding Source

- Sure Payment Solutions

- Pearl Capital

- United Capital Source

- NVMS

- Entrust Merchant Solutions

- Financial Advantage Group

- Snap Advances

- Business Financial Services

- Integrity Payment Systems

- DailyFunder

- Capital Stack

I’m already looking forward to next season!

How Will Obamacare Affect Small Businesses?

December 12, 2013It’s one thing to assume how small businesses feel about Obamacare and another to hear it straight from the horse’s mouth. New York-based funding provider Merchant Cash and Capital surveyed their clients and this is what they learned:

- Nearly one third of respondents believe the Act will increase operational expenses.

- 40 percent aren’t sure how it will impact their business.

- One in four respondents said they will halt any growth initiatives in the near future as a result of the Act.

Infographic from MCC

Split Funding is Here to Stay

August 21, 2013 I’ll say it for the hundredth¹ time, the advantage of split-funding is the ability to collect payments back from a small business that has traditionally had average, weak, or poor cash flow. Let’s put that into perspective. There is a distinct difference between a working business with poor cash flow and a failing business. A failing business is typically not a candidate for merchant cash advance or similar loan alternatives.

I’ll say it for the hundredth¹ time, the advantage of split-funding is the ability to collect payments back from a small business that has traditionally had average, weak, or poor cash flow. Let’s put that into perspective. There is a distinct difference between a working business with poor cash flow and a failing business. A failing business is typically not a candidate for merchant cash advance or similar loan alternatives.

Poor cash flow could be the result of paying cash up front for inventory that will take a while to turn over. A hardware store with a healthy 50% profit margin may be able to turn $10,000 worth of inventory into $15,000 in revenue over the course of the next 90 days. The only problem is that the full $10,000 must be paid in full to the supplier on delivery.

Enter the merchant cash advance provider of old that discovers the hardware store has had a fair share of bounced checks in the past, mainly because of the timing of payments going in and out. Cash on hand is tight, the credit score is average, but the profit margin is there. Most lenders would take a pass on financing a transaction that carries legitimate risk such as this one does, that is until the ability to split-fund a payment stream became possible.

Advocates of the ACH method tout that it’s just so much easier to set up a daily debit and scratch their heads and wonder, “man, why didn’t we think of just doing ACH in the first place?”

The thing is, people did think of it and they concluded that for a large share of the merchants out there that needed capital, it didn’t make financial sense to try and debit out payments every day with the hope that there would always be cash available to cover them. Banks have had a hard enough time collecting just one payment a month, so what makes 22 payments in a month so much more likely to work?

I’m not inferring that there is something wrong with the daily ACH system that has taken the alternative business lending industry by storm. There’s plenty of situations for which that may be the best solution, especially for businesses that take little or no credit card payments. My point is that the split-funding method isn’t going to shrivel up and die. It’s here to stay. So long as businesses have electronic payment streams, they will be able to leverage them to obtain working capital.

When it comes to splitting card payments however, it’s important for a business to have faith in the payment processor. Reputation, compatibility with payment technology, and the assurance that the business will be able to conduct sales just as it always has are important. If you’re a funder, ISO, or account rep, it’s your responsibility to make sure that those three factors are addressed. A lot of processors are willing to split payments but they haven’t all made a name for themselves in the industry. Integrity Payment Systems (IPS) comes to mind as one that almost everyone works with and I’ve been in touch with Matt Pohl, the Director of Merchant Acquisition of IPS for some time. He’s been nice enough to share a little bit about what makes a split partner special, and what has made them particularly stand out in the merchant cash advance industry.

Clearly, the role of the credit card processor has diminished over the last couple years when it comes to merchant funding. ACH/Lockbox models have become more prevalent which created a sales mindset that switching a merchant account was more of a hindrance than a necessity. Some argue the decline in profit margin on residuals, due to price compression, made it no longer worth the time and effort to make an aggressive pitch to switch the merchants processing. ISOs also argue that too often merchants have reservations to switch processors because of previous bad experiences, cancellation fees, or because they simply know its not necessary in order to be funded. This is where it’s important to have the RIGHT split partner, not just any split partner

What makes Integrity Payment Systems a “special” split partner is the fact we control the settlement of the merchants funds, in house. IPS is partnered with First Savings Bank (FSB), which allows us a unique way of moving money. Because of our state-of-the-art settlement system and direct access to FSB’s Federal Reserve window, we eliminate the necessity of having layers of financial institutions behind the scenes that merchants funds typically filter through. This is a HUGE benefit to cash advance companies for several reasons. First, we implement the fixed split % when we receive the request, in real time. This allows the deal to be funded quicker. Secondly, since we handle the settlement process we have access to the raw authorization data which allows us to provide comprehensive reporting on a daily basis from the previous days activity. But also we can do true next day deposits, including Friday, Saturday, and Sunday funds available for the merchant on Monday morning. This is especially valuable when selling to restaurants/bars, or any other industry with a lot of weekend volume. Lastly, IPS makes outbound calls to merchants, on behalf of the sales agent and cash company, to download and train the merchant on their terminal. A confirmation email is sent to the agent which includes any batch activity so the deal can fund.

As an added example of this, on the last week of every month, the merchant boarding and sales support team fully understands that our MCA partners have monthly funding goals they need to reach. The IPS team goes above and beyond to ensure merchants get setup properly in time so those accounts can be funded before the month is over. We have a motto at IPS that the sales force are our #1 customers, and nowhere is that more apparent than by the way we take over all the heavy lifting once the agent gets the signatures on our contract. We firmly believe that by helping the agent by taking over the boarding process, that this will allow them to do what they do best, sell more deals!! A lot of competitors expect the agent to be involved in the boarding process, and that’s valuable time that takes them away from selling.

IPS has opened their doors to every MCA company that wishes to have an exceptional split funding partner/processor. We have all the necessary tools to provide this service the right way, and we want the opportunity to earn the business of every working capital provider out there. You don’t have to listen to a sales pitch from me, because I strongly believe that our reputation in the cash advance space speaks for itself. We would love the opportunity to talk to any MCA provider about a few additional services we offer utilizing our settlement system that will allow ISOs to fund more deals.

– Matt Pohl

(847) 720-1129

Integrity Payment Systems

One thing I can personally attest to about Integrity is their human factor. You can actually meet some of their team and see inside their office in the fun youtube video below:

Getting deals done

Ultimately, the financing business is about getting deals done and there are countless small businesses that just won’t ever be a candidate for ACH repayment. Heck, for many years the merchant cash advance industry wasn’t even a financing industry of its own, but rather it was one of many acquisition tools for merchant account reps. (See: Before it Was Mainstream). Technically it still is. You don’t want to sign up a merchant for processing and then have to move the account because the processor doesn’t split or because there is no dedicated customer service. I’ve been in that situation before personally and it’s a nightmare.

There’s a reason this website which is dedicated mainly to merchant cash advance is called the Merchant Processing Resource. You can’t know everything about cash advance without knowing about merchant processing. Get acquainted!

If you’d like to read the lighter side of Merchant Cash Advance History, you just might want to check out MCA History in Honor of Thanksgiving. 😉

¹ I said it for the 99th time on the Electronic Transactions Association’s Blog in Preserving the Marriage Between Merchant Cash Advance and Payment Processing

The Alternative Business Lending Worker Shortage

July 1, 2013“You open 40 accounts, you start working for yourself. Sky’s the limit.“

Is the dream getting harder to sell? The alternative business lending industry is booming and so much so that many job openings are going unfilled. I am asked on almost a daily basis if I know any experienced sales people that are looking for work. There really aren’t that many people out there with a strong merchant cash advance background and I think it’s impacting how fast this industry can grow. On the one hand, the industry is a lot less sophisticated than it used to be. Hold on for a second and allow me to explain myself. There was a good chunk of time in this business where saying the word, loan could get you fired. Loan?! Are you kidding? We buy future receivables at a discount!

Anyone could sell a prospect on working capital but only a select group of people could explain the purchase of future sales properly all while justifying the relatively high cost. And an even smaller group of people could take the deal to the next step and discuss the merchant’s current 3 tiered or interchange based rates, pick out the junk costs, and sell them on a better deal with a new payment processor. And an even smaller group of people could sell the merchant on the idea of using a new terminal due to PCI compliance issues or acquirer compatibility. And an even smaller group of people could sell or lease the merchant a new terminal instead of swapping out their current one or lending one for free with a multi-year contract. And still an even smaller group of people could convince the underwriter to approve their file in order for the 5 closed sales to even go through. Merchant cash advance in the traditional manner was and is a highly complicated multi-layered sale. The men and women that churn(ed) these deals out month after month on a consistent basis are nothing short of pros. Let’s not forget that payment processors have underwriters too so even after 6 closes, the payment processor could decline the approval of a merchant account, nuking the entire deal from start to finish.

Do you have any idea how comical it was when the mortgage brokers invaded the industry as the housing market neared collapse? They had no idea what they were doing and some of them barely lasted for 90 days before saying “I give up, this makes no sense.”

In today’s market, there’s a faster learning curve. I’d estimate that 55-60% of all new deals being funded with daily repayment in this country are using direct debit ACH to collect. Some funders and brokers lean towards this model so much so that they report funding more than 90% of their deals on ACH. That’s good news for new account reps because there isn’t much to learn about the product. There’s the amount being funded, the cost, and a daily debit to pay it back. Pretty simple stuff. This isn’t to say it’s not a tough sell or that it’s not competitive, because it is both of those things. Companies that swear by the ACH product have a hiring advantage because they don’t necessarily need salespeople with MCA specific experience. Almost any financial sales background will work or even no experience at all.

The smaller part of the industry is a mishmash of the old school sophisticated reps and the newbies that rely on the old schoolers to help them out with anything technical. When companies post ads saying they are looking for MCA sales reps with experience, they’re implying that they want people that can handle the multi-layer sale. A good craigslist ad should say:

Are you hungry?!

Must be able to do the following in a single phone call while driving at least 65 MPH on the Brooklyn Queens Expressway regardless of whether or not traffic is backed up:

- Convert a Micros POS system

- Lease an additional wireless terminal for off-premise sales

- Shave 12 basis points off the non-qualified tier (but make it back up by adding a $15 monthly statement fee)

- Close a 150k deal on a 1.40 (but know that the reduced factor rate is coming out of YOUR end)

- Write in a 6% closing fee

- Cut off 47 cars in traffic without hitting them

- Eat a slice of greasy pizza with your left hand without getting a single drop on your lap

Oh and below it will be a note that says “THIS POSITION IS COMMISSION BASED ONLY, NO DRAW, SELF-STARTERS WANTED, HOURS ARE 7-7 Mon-Sat“. Don’t laugh. This was the MCA industry for a time and a lot of people did very well in it. If you wanted to make money, you had to be able to do it all. For some of you, it’s still this way.

Oh and below it will be a note that says “THIS POSITION IS COMMISSION BASED ONLY, NO DRAW, SELF-STARTERS WANTED, HOURS ARE 7-7 Mon-Sat“. Don’t laugh. This was the MCA industry for a time and a lot of people did very well in it. If you wanted to make money, you had to be able to do it all. For some of you, it’s still this way.

And let’s face it, the split-funding market may shrink but it will never die. Split-funding’s advantage is the ability to finance businesses that have poor cash flow. The risk of a bounced check is removed when payments are diverted to the funder by the payment processor. You hear that kids? You should be brushing up on your payment processing-ology.

Even as the ACH market boom continues, there are whispers of woe as funders deal with ACH rejects and closed bank accounts. It’s no surprise then that some companies are looking for pros, not just bodies to put on the telephone. It seems as the product has become less sophisticated, merchants have become more sophisticated. In 2007, I’d be willing to bet that more than 90% of small businesses had never even heard of a merchant cash advance and that was basically the only alternative available. In 2012 I actually did a presentation to a large room of business owners about merchant cash advance and none of them had ever heard of it until I taught them about it. That’s astounding!

Now I don’t think that many more people know about the purchase of future credit card sales in 2013 specifically, but I am inclined to believe that 90% of merchants are at least aware that alternatives to bank loans exist. And when they encounter somebody offering an alternative, they do their homework and check these companies out online. They get 2nd opinions and question why they have to switch processing when four other account reps said they don’t have to. They ask for better deals, longer programs, and they look you up on facebook to see who you really are. This is a different sales environment than what there used to be. The lowest price, the fastest process, or the most charming personality won’t guarantee you’ll win anything. Seeing that you’re backed by Wells Fargo or learning that Peter Thiel is on your company’s board of directors might be the hook, line and sinker for a business with a full plate of options at their disposal. Yes, it’s a different world, a different sale, and even a different product.

Now I don’t think that many more people know about the purchase of future credit card sales in 2013 specifically, but I am inclined to believe that 90% of merchants are at least aware that alternatives to bank loans exist. And when they encounter somebody offering an alternative, they do their homework and check these companies out online. They get 2nd opinions and question why they have to switch processing when four other account reps said they don’t have to. They ask for better deals, longer programs, and they look you up on facebook to see who you really are. This is a different sales environment than what there used to be. The lowest price, the fastest process, or the most charming personality won’t guarantee you’ll win anything. Seeing that you’re backed by Wells Fargo or learning that Peter Thiel is on your company’s board of directors might be the hook, line and sinker for a business with a full plate of options at their disposal. Yes, it’s a different world, a different sale, and even a different product.

Funders and brokers need human resources to keep up with the fast pace of growth and there’s not too many of the old school guys looking for work. Not to mention that fewer people are willing to work on a 100% commission only basis these days. During and after the financial crisis, the herd of out-of-work financial service people flocked to whatever opportunity the could find. It was like you could throw a fishing net in front of the Lehman Brothers entrance and use it to scoop up 50 brokers as they all ran out the door for the last time. Newly minted graduates wanted to build their resumés instead of remaining unemployed. Some people were willing to work all 31 days of a month just for the opportunity even if they walked away with zero dollars at the end of it. Although the economy hasn’t recovered much, that hunger has relaxed and job seekers are being a bit more selective of the opportunities they choose. They want a base salary (even if small), benefits, and vacation time. Somewhere out there in another universe, Ben Affleck’s younger self is crying at the thought of this. “Vacation time?”

So when you put up an ad on LinkedIn or Craigslist and say you’re looking for 10 guys with MCA experience, just know that breed is in short supply and high demand. If you’re heavy on ACH, you can train new guys quick but they’re not going be equipped to take on the multi-layered sale if the tide turns back towards split-funding. There are tons of job openings out there for sales reps but those spots aren’t as easy to fill as they used to be.

“You become an employee of this firm, you will make your first million within three years. I’m gonna repeat that – you will make a million dollars.”

Happy hiring.

– Merchant Processing Resource.com

../../

MPR.mobi on iPhone, iPad, and Android

Alternative Business Lending With Steve Sheinbaum on #BusinessFuel

May 27, 2013This past friday, I joined in on Lendio’s #BusinessFuel on twitter, a twitter chat that is held weekly. There were many alternative business lending experts in attendance including Steve Sheinbaum, the CEO of Merchant Cash and Capital. He was the featured guest and the questions were directed at him for the last half hour. I’ve created a storify summary below with all of the important pieces:

Alternative Business Financing

A small group of experts got together on Lendio’s #BusinessFuel twitter chat to discuss alternatives to banking with Merchant Cash & Capital’s CEO, Steve Sheinbaum

Storified by Sean M· Mon, May 27 2013 10:13:11

QUESTION 1 ———–>

QUESTION 1 ———–>

QUESTION 2 ———–>

QUESTION 2 ———–>

QUESTION 3 ———–>

QUESTION 3 ———–>

QUESTION 4 ———–>

QUESTION 4 ———–>

The CEO of Merchant Cash and Capital, Steve Sheinbaum Joined the Chat

MCC’S ANSWERS BELOW

Merchant Cash Advance Industry is Busy at Work

May 16, 2013 After what was one of the wildest two weeks in Merchant (MCA) history, the game-changing news finally subsided, but no one is taking a deep breath. Instead, everyone is busy working their butts off trying to help small businesses grow.

After what was one of the wildest two weeks in Merchant (MCA) history, the game-changing news finally subsided, but no one is taking a deep breath. Instead, everyone is busy working their butts off trying to help small businesses grow.

UPDATE 5/16: RapidAdvance has acquired the operating assets of ProMAC. First Instance of consolidation that we’ve been predicting would happen this year. See news release detailing the acquisition HERE.

There is just loads of capital available right now and the technology is catching up quick to support the mass deployment of it. A writer for the American Banker believes that the MCA industry is even beginning to threaten community banks.

Many community bankers would be open to using online applications and other technological tools to make faster loan decisions, says Trey Maust, co-president and chief executive at the $121 million-asset Lewis & Clark Bank in Oregon City, Ore. But most community banks use a business model that requires more hands-on interaction with borrowers, he says.

Hands-on is another term for driving back and forth to the bank for appointments, having the bankers visit your business, all the while they try to sign you up for other bank products, like checking accounts that incur a monthly fee.

Who’s at Work

We know some of the major industry players but it’s interesting to see who else is doing significantly large volume. Pearl Capital recently reported funding $7 million in a single month and United Capital source came in at a tad shy of $4 million in just this past April. These are firms you may have heard of already, but they’re now sitting at the big kids table.

What the Generals are Saying

If you haven’t been paying attention to the DailyFunder.com forum, 4 Chief Executives have contributed to the site in a very meaningful way by sharing their thoughts on the MCA industry at large. This is the kind of wisdom you would normally get in bits and pieces through occasional citation in the Green Sheet or other publications, but the full monty has materialized in the very exclusive CEO Corner. Some key highlights from what they’ve shared so far:

Excerpts from Jeremy Brown, CEO of RapidAdvance:

Those of us that have been in this business for 5 years or more – Rapid started in 2005 – are excited at the positive press we get today vs. several years ago and how we are becoming embraced and accepted as a mainstream product. More PE firms, banks, and others want to invest in or lend to the industry. Those groups have always been intrigued by the returns in this industry but the conversations are different today.One thing I think will be different next year are fewer deals offered over 12 months in payback period. When you look at the data over an extended period of time, 18 month term loans don’t make sense for the merchants that are funded. It’s not the most efficient use of funds, limits the ability for the merchant to renew and the longer term deals are far riskier. (See: Year in Review and What Next Year May Bring)

Isn’t that the point of a 6 month MCA – to meet a current need and have the merchant be able to draw again in 4-6 months for the next capital need? That is the problem with the 15 – 24 month deals that are being offered to merchants today. Our industry is based on providing working capital to merchants. By its very definition, working capital is less than 12 months. Longer term deals are permanent capital, even when they are repaid over 15-24 months.it was no surprise when the economy tanked in late 2008 that the merchants in our portfolios at that time took a major hit to sales and therefore the funding companies losses increased by 50% or more on their outstanding portfolios. So what happens when the next recession – big or small – hits and funders have portfolios out to 24 months? It doesn’t take an MBA from Harvard to figure out that answer. (See: Working Capital or Permanent Capital

Haven’t gotten into the industry myself in 2006, I can totally validate the complete 180 in press coverage. I’ve put all my energy into MCA and it’s gratifying to finally hear the praises so many years later.

Excerpts from Steve Sheinbaum, CEO of Merchant Cash and Capital:

The industry already services hundreds of thousands of small business merchants with cash advances for growth and other purposes based upon monthly credit card receipts. For years this has been the basic model of operation. But, what about the substantial number of businesses that require quick and easy access to capital who don’t accept credit cards or don’t produce enough in monthly credit card receipts to qualify under the normal MCA guidelines? Tens of thousands of businesses could use the capital infusions the industry provides daily but either don’t think they’ll qualify or, because of our lack of creativity, the industry hasn’t produced a means of addressing their needs. These businesses would make great customers but because of the rigid requirements we have in place to protect our livelihoods we’ve left money on the proverbial table.That’s not the case anymore. (See: Creativity in the C-Suite…Another way to Fund!)

In regards to advances on gross revenue instead of just credit card payments, he’s absolutely right.

Excerpts from Andy Reiser, CEO of Strategic Funding Source:

the most important part of any deal is the people. We rely heavily on the relationships we have with the client and most importantly with our ISO partners and ISO syndicate partners who invest side by side with us. Valuing these relationships is far more important than relying solely on the numbers and how sophisticated our technology is.Over our 8 year history, we have noticed that the performance of a deal has more to do with the relationship we have with our ISO partner and ISO syndicate partner, then with the deal itself. We have all kinds of tools available to help us analyze the potential success of a deal – FICO scores, due diligence checklists, signed affidavits, warranties and representations, scoring models, algorithms, etc. And yet, some of the ugliest deals on paper have been some of our best performers, while some of the most attractive deals on paper have been nothing but trouble. (See: Business and Baseball Fantasies)

During my time as a head underwriter, I witnessed the exact same thing. Solid referral partners had solid performing clients even if they didn’t look so good on paper. Likewise, the shakier resellers had clients that underperformed across the board, including the deals that looked cleanest.

Excerpts from Craig Hecker, CEO of Rapid Capital Funding

As each MCA company grows and creates a positive reputation, we all grow as an industry…together. But as our popularity grows, however, so does our competition. We already know that Amazon, eBay, and Google are stepping into the market, and AMEX is looking to expand their short term financing portfolio. These big business industry leaders will help build our brand of finance and benefit our portfolios, but I also think it is fundamental that we market ourselves as the alternative to big business finance and identify ourselves with the small business owner. (See: Small Business and How MCA Can Bridge the Gap to Success

We’ve got some big names in the industry now, whether they are financing the merchants directly or backing the funders that do the financing. I agree that you need not be intimidated by competing against these established brand names. Positioning yourself as the funder next door, people that have walked a mile in the merchant’s shoes (literally) can actually be a strong advantage.

What’s Next?

We’re pretty confident there will be more big headlines in the near future but for now we can’t confirm or say anything. DailyFunder.com is also lining up additional industry captains to participate in the CEO Corner and I’m sure there will be plenty of nuggets for us all to dissect. They’re probably the best source of MCA information that you can possibly get.

Stay tuned.

– Merchant Processing Resource

../../

MPR.mobi on iPhone, iPad, and Android