The Official Business Financing Leaderboard

June 20, 2015A handful of funders that were large enough to make this list preferred to keep their numbers private and thus were omitted.

| Funder | 2014 |

| SBA-guaranteed 7(a) loans < $150,000 | $1,860,000,000 |

| OnDeck* | $1,200,000,000 |

| CAN Capital | $1,000,000,000 |

| AMEX Merchant Financing | $1,000,000,000 |

| Funding Circle (including UK) | $600,000,000 |

| Kabbage | $400,000,000 |

| Yellowstone Capital | $290,000,000 |

| Strategic Funding Source | $280,000,000 |

| Merchant Cash and Capital | $277,000,000 |

| Square Capital | $100,000,000 |

| IOU Central | $100,000,000 |

*According to a recent Earnings Report, OnDeck had already funded $416 million in Q1 of 2015

| Funder | Lifetime |

| CAN Capital | $5,000,000,000 |

| OnDeck | $2,000,000,000 |

| Yellowstone Capital | $1,100,000,000 |

| Funding Circle (including UK) | $1,000,000,000 |

| Merchant Cash and Capital | $1,000,000,000 |

| Business Financial Services | $1,000,000,000 |

| RapidAdvance | $700,000,000 |

| Kabbage | $500,000,000 |

| PayPal Working Capital* | $500,000,000 |

| The Business Backer | $300,000,000 |

| Fora Financial | $300,000,000 |

| Capital For Merchants | $220,000,000 |

| IOU Central | $163,000,000 |

| Credibly | $140,000,000 |

| Expansion Capital Group | $50,000,000 |

*Many reputable sources had published PayPal’s Working Capital lifetime loan figures to be approximately $200 million in early 2015, but just a couple months later PayPal blogged that the number was more than twice that amount at $500 million since inception. The print version of AltFinanceDaily’s May/June magazine issue stated the smaller amount since it had already gone to print before PayPal’s announcement was made.

Mapping the Business Financing Industry (Sneak Peek)

May 27, 2015People often ask what the real presence of the merchant cash advance & business lending industry is like in New York City. Below is a map of Midtown Manhattan.

We apologize if we didn’t plot your company on here. Let us know you exist by signing up for our magazine.

In the May/June issue that’s being sent off to the printers at this very moment, we explore the industry scene in lower Manhattan. Midtown may have been a birthing place and permanent home for industry titans, but Wall Street, long believed to be a haven for stock brokers has been overrun by a new kind of broker.

You’ll just have to stay tuned to read more. If you’re not signed up to get our free print magazine, register now.

Also in the May/June issue:

- An examination of a new trend, consolidating loans and advances.

- Watching everyone else get rich off alternative lending? Whether you’re in underwriting, administration, operations, or sales and whether you have a lot of money to invest or just a little, there are opportunities available to “get in”. You might be in this industry but are you in this industry? We’ll run through the basics of what’s available out there. Become a player or just educate yourself.

- And more!

The Co-brokering Phenomenon: In Business Loans & Merchant Cash Advance

May 25, 2015 Meet the broker’s broker, the middleman serving the middleman. Some call this co-brokering since both parties will typically share in the commission.

Meet the broker’s broker, the middleman serving the middleman. Some call this co-brokering since both parties will typically share in the commission.

Wait, what?

The broker’s broker might have relationships that the little broker does not. They could have leverage over their funding partners because of the amount of volume they can produce or the amount of professionalism they bring to the table. And they likely have a canny ability to close deals that otherwise would get tossed by the wayside.

Disintermediation is the war cry of today’s famous tech-based lenders but in the Year of the Broker, reintermediation has been the unforeseen byproduct. Big lenders such as OnDeck are shedding third party funding advisors but those advisors aren’t magically going away.

A number of them are still getting their deals funded at OnDeck, just indirectly. They have to go through a broker whom OnDeck has not cut off, a handful of salespeople have told me. Many brokers acknowledge that OnDeck’s rates and terms are not easily attainable elsewhere so they’d rather share a commission with an OnDeck approved broker than risk a dead deal with no commission.

And CAN Capital is known to offer comparable pricing to OnDeck but it’s been reported that new brokers must go through a rigorous audit before CAN will accept their business. It’s not something everybody wants to go through.

With the two largest funders in the industry imposing real barriers to doing business with them, sanctioned brokers play toll booth operator for the swarm of shops that can’t get their deals submitted without them.

Perhaps as a direct result of that, there is now an entire niche of brokers whose only business is brokering deals for other brokers. They have little to no interaction with merchants. They have no marketing budget. They might not even have a website. And they play an almost mystical role of gatekeeper and power broker.

Onesy-twosy woes

A strong focus within the industry has been growth. There’s a lot of time, resources, and salesmanship that goes into courting the lucrative partnerships. Large funders, especially those with VC backing, are typically not interested in mom and pop broker shops. “If they’re only going to send one or two deals per month, we don’t want them,” I’ve heard time and time again.

Even five to ten deals a month can draw yawns. It’s nothing particularly against the mom and pop brokers, but experience has apparently shown them that the same amount of resources are spent on the onesy-twosy brokers as the ones doing a hundred deals a month. The cost benefit analysis has to make sense, they say.

That’s left hundreds or perhaps even thousands of mom and pop brokers to fend for themselves. What outsiders might not seem to realize is that the commission on a $50,000 loan or advance can be $5,000. That’s potentially enough for a stay-at-home parent to pay for the rent, groceries, and all the other bills. A onesy-twosy broker might be completely insignificant to a funder doing a billion dollars worth of deals a year, but to a mom and pop broker, it only takes one deal to pay their bills and only a handful to make them rich, especially if they live in middle America where the cost of living is cheaper.

In From Lowes to Loans, superstar broker William Ramos said he made $66,000 on just one deal alone. While his shop produces more than a million dollars in deal flow a month, it’s easy to see what’s drawing the hoards of newbies in. A $66,000 commission might be the only commission someone needs for an entire year.

There is no licensing required so becoming a broker is as easy as imagining that you are one. And as the space invites the less knowledgeable, a more sinister element has found opportunity as well.

Shady

“There is no president/ruler of the MCA world that can help you with your commission debacles,” wrote PSC’s Amanda Kingsley on an industry forum. That was part of her reply to a thread titled, co-brokering scumbags. The thread might be new, but the circumstances aren’t. A broker sent their deal to another broker who got the deal closed with a funder. The original broker supposedly got screwed out of the commission.

“There is no president/ruler of the MCA world that can help you with your commission debacles,” wrote PSC’s Amanda Kingsley on an industry forum. That was part of her reply to a thread titled, co-brokering scumbags. The thread might be new, but the circumstances aren’t. A broker sent their deal to another broker who got the deal closed with a funder. The original broker supposedly got screwed out of the commission.

It’s a case of stolen deals. “You just have to find the right people to work with. There are a lot of shady characters in this industry,” wrote another user.

1st Capital Loans Managing Member John Tucker, who recently authored, Broker Business Planning, wrote in reply to the thread, “Get everything in writing and research your lender/partner heavily before contracting with them. Talk to other brokers and ask them about their experience with said lender/partner in terms of paying on new deals, renewals and residuals. Get a ‘feel’ for them.”

Several faulted the aggrieved party for not taking the time to hammer out a contract that would allow them to rectify the situation easily through a lawsuit. But even with a contract, pursuing the offender legally could cost more than the commission lost. A stolen deal might cost a broker a few hundred or a few thousand dollars, figures worthy of small claims court.

“Under no circumstances would I ever co-broker a deal,” wrote Tucker. “There’s just no reason to unless you are a newbie and getting trained by said broker.”

But another user wrote, “Sometimes you don’t even know you are co-brokering until after the fact.”

Unscrupulous brokers will be purposely deceitful but for others walking the thin line between broker and funder, it’s difficult to judge what constitutes direct. There are brokers that wholeheartedly believe that if any portion of their own funds are invested in a deal, then they too are a direct funder. That means a broker that syndicates with a variety of funders could be so inclined to identify themselves as a direct funder by extension.

Kingsley wrote, “You have to understand what a ‘broker’ is in this space and understand that it is A LOT different than brokering in another industry.”

She also pointed out that it’s not always the little guy that’s susceptible to becoming a victim, as could be the case if an early deal default leads to a commission chargeback. When that happens, the funder will take back the full commission on the deal from the broker of record. It’s the responsibility of that broker to claw back whatever split of the commission they shared with the sub-broker.

“The broker you sub-brokered for, can vanish,” Kingsley wrote.

Ban the bad guys?

Several industry veterans have suggested creating an ISO/funder blacklist for those that steal commissions or deals. The challenge is that a stolen deal is not always a black and white situation. Often times there are expiration dates built into contracts that allow funders to claim deals if they have not been closed by the submitting broker within a specified period of time. Other times it’s a case of miscommunication, or the victim conveniently left out key details that would certainly add a degree of color to the situation.

Calling out an offender online can quickly devolve into a he said/she said schoolyard brawl. Unfortunately, this might be the only remedy a victim has, especially if they have limited financial resources to pursue legally, or the only evidence of their deal is a handshake or an email.

The bad guys, if they’re engaged in trickery on a large scale, tend to get identified rather quickly. There’s always a few that come in, burn a lot of bridges, and then find themselves completely ostracized from the industry. When the damage is done, they might never be heard from again or they might try to repeat the process by using a different name. Blacklisting a broker or funder wouldn’t be foolproof, especially if the company owner legally changes their name, which has actually happened before.

Trust

Through it all, Tucker offered this advice, “In a nutshell, the only true thing protecting your compensation is a very good relationship with an honest, credible and ethical lender.”

And if you have to go through a broker, make sure you choose the right one. Don’t blindly send your deal to somebody you met on a message board. An unscrupulous player will tell you exactly what you want to hear. Ask around for references. If nobody’s ever heard of them, chances are you’re talking to the wrong shop.

Even the author of that thread conceded that co-brokering offers benefits. “I’m all for co-brokering deals, especially if someone has a solution that may suit the client better than a traditional MCA or when an MCA wont work,” he wrote.

So there just may be a place for the broker’s broker, whether as a gatekeeper, power broker, or toll booth operator. And like it or not, reintermediation has ironically become a byproduct of disintermediation. There are sadly no algorithms that exist to vet how a broker might treat another broker. Co-brokering is a trade that relies on the most basic of basics, trust.

Nothing’s more valuable.

The Myth of the Exclusive Lead

May 14, 2015 The Small Business financing space is getting crowded. There’s no disputing that. With new ISOs and Direct Funders appearing each day, this space is getting tighter and tighter. With a finite number of small businesses that are receptive to a certain type of loan instrument, competition can be fierce. Both existing and new funders are looking for ways to gain new business to ensure a stream of income. Many turn to lead providers like myself, but many ask the same question “Do you do exclusive leads?”

The Small Business financing space is getting crowded. There’s no disputing that. With new ISOs and Direct Funders appearing each day, this space is getting tighter and tighter. With a finite number of small businesses that are receptive to a certain type of loan instrument, competition can be fierce. Both existing and new funders are looking for ways to gain new business to ensure a stream of income. Many turn to lead providers like myself, but many ask the same question “Do you do exclusive leads?”

When theLendster was first starting out and getting its sea legs, a meeting was held with the management team and the idea of selling exclusivity to our clients was raised. This idea was warmly received all around the table. After all, the price would be higher. However, this became more troublesome than it was worth as we soon found out exclusivity was a myth and made us look not forthcoming with our clients.

The number of small businesses is finite but measurable. There are 319 million people in the United States today. Broadly speaking, small businesses are about 10% of this number. Therefore, we are looking at more or less 32 million businesses across the nation. Now, how many are looking for what we’re offering? 10%? 25%? 50%? Using these percentages, the “goldilocks” businesses (not able to get a bank loan but at the same time able to pay back an MCA or small business loan) number anywhere from 3 million to 16 million.

While this is a wide margin, it demonstrates something regardless: the number isn’t that large. So when adding in lead generators and funders/ISOs who do their own direct marketing, the competition to get a lead’s attention is fierce. The problem is everyone is reaching out to the same businesses. These prospective customers are being bombarded from all angles: telemarketing, email and direct mail. Each of these all sound like there could be some exclusivity and while a salesperson may have a small window of opportunity to grab the attention of the decision maker, it doesn’t last forever.

So when a business is identified, the whole industry zeroes in on them. Let’s give a hypothetical example: A salesperson is connected directly to the business’s decision maker via a live transfer telemarketing campaign and is able to talk to them about the product. This can lead to an application sent out. However the second the business owner hangs up the phone, they’ll go to their mailbox and get a letter from another funder or ISO. Now their attention is shifted to the letter. Then while reading the letter, in between serving customers, the phone rings again. It’s another funder. They listen and perhaps send an application. And then, When going to read their email, they are part of drip marketing campaigns from still other funders or lead generators. So right then and there, the attention that the original salesperson was fortunate enough to grasp has quickly faded away.

So how can a lead generator guarantee exclusivity? The answer is this: beyond promising not to sell the lead multiple times, there’s not much they can do. Going back to when theLendster was in the middle the exclusivity experiment, our clients would come back day after day saying that we were misleading them. Business owners would answer their phone and say, “I’ve been contacted by you dozens of times.” While this was true, it wasn’t an entirely accurate statement though. The leads that were sent were only delivered to one client. However, anything that was occurring outside the confines of theLendster was beyond our control. So clients believed that multiple competitors were contacting the leads from theLendster’s list, which was not the case.

So how can a lead generator guarantee exclusivity? The answer is this: beyond promising not to sell the lead multiple times, there’s not much they can do. Going back to when theLendster was in the middle the exclusivity experiment, our clients would come back day after day saying that we were misleading them. Business owners would answer their phone and say, “I’ve been contacted by you dozens of times.” While this was true, it wasn’t an entirely accurate statement though. The leads that were sent were only delivered to one client. However, anything that was occurring outside the confines of theLendster was beyond our control. So clients believed that multiple competitors were contacting the leads from theLendster’s list, which was not the case.

In the end, theLendster decided to move to a shared lead model to ensure that clients who signed on were aware that not only would they be competing against others for the lead that was delivered, but also against others who reached that lead through other lead generators or marketing initiatives. Since then, clients have been satisfied and were able to adjust their sales tactics to make sure that they have a fighting chance on closing the business. In fact, many of the clients we have expressed that they are more successful using this approach.

But why are funders drawn to the exclusive lead? It’s simple. They believe that they are the only ones that will touch this potential customer. This gives their sales team a competitive edge. However, with the funding space as crowded as ever, it would be a success if the day the lead comes in that it was only touched by 3 or 4 other companies. This is why the exclusive lead is a myth. With hundreds of marketers dipping their hand in this well, nothing like exclusivity can be guaranteed.

All is not lost though, as leads themselves provide an invaluable service to ISOs and Direct Funders. Without this necessary marketing tool in the hands of sales teams, there would be no selling. Simply put: leads are the lifeblood of this industry. It’s what powers the sales engine and connects funder and funded.

From a funder and ISO viewpoint, exclusive leads should not, and from now on cannot be viewed as a siloed item. Business owners are not sitting by the phone, the mailbox, or the computer waiting for a funding opportunity to arise. They are out there running their businesses and trying to make their living. However, in between the day-to-day running of their business, they are being exposed to multiple solicitations from a wide range of funders. These prospective customers live in a world where they are constantly being exposed to your competition. Exclusivity is not the “golden gun” that can change a funder’s narrative. Because it was never existed in the first place.

Broker Business Planning – Selecting the Right Lenders

May 10, 2015Continuing The “Year of the Broker” Discussion

2015 is certainly the “Year of the Broker,” as the low barrier to entry into our space, in conjunction with various recruiting advertisements promising lucrative pastures, is attracting a variety of individuals with various levels of professional backgrounds. Some entrants have prior experience as a mortgage broker, insurance agent or banking specialist, while others are less familiar with professional sales and are under the belief that our space welcomes a lucrative introduction. Nevertheless, I believe that new broker entrants must be reminded that this is an entrepreneurial pursuit, rather than a get rich quick procedure, and efficient business planning will play a major part in the success or failure of your venture. A part of this efficient business planning, other than the basics of good resources for accounting, legal, marketing, market research, and financing, is the strategic selection of your lender partnerships. The right partnerships will grow, develop and sustain your business, but the wrong partnerships could add your entrepreneurial pursuit to the list of business startup failures.

2015 is certainly the “Year of the Broker,” as the low barrier to entry into our space, in conjunction with various recruiting advertisements promising lucrative pastures, is attracting a variety of individuals with various levels of professional backgrounds. Some entrants have prior experience as a mortgage broker, insurance agent or banking specialist, while others are less familiar with professional sales and are under the belief that our space welcomes a lucrative introduction. Nevertheless, I believe that new broker entrants must be reminded that this is an entrepreneurial pursuit, rather than a get rich quick procedure, and efficient business planning will play a major part in the success or failure of your venture. A part of this efficient business planning, other than the basics of good resources for accounting, legal, marketing, market research, and financing, is the strategic selection of your lender partnerships. The right partnerships will grow, develop and sustain your business, but the wrong partnerships could add your entrepreneurial pursuit to the list of business startup failures.

The selection of your lender partnerships will depend on your unique value proposition (UVP). No entrepreneur should begin a pursuit without a well-defined UVP, for your UVP is the foundation of all of your business planning and return on investment forecasts. Your UVP should answer this question:

Understanding my market segment, what is it specifically that I will bring to the segment that isn’t already being provided by the current crop of solution providers?

The question includes three main components that must be addressed:

- The identification of a market segment

- The characteristics of all services within your industry, being sold to that market

- The services that you will uniquely provide to said market and their unique characteristics

Once your UVP is set, now it’s time to look into the selection of your Lender Partnerships.

Once your UVP is set, now it’s time to look into the selection of your Lender Partnerships.

To begin, let’s say that you decide to come into the industry and target start-up retail/restaurant businesses, that is, those with less than 1 year in operation. Because you are selling working capital solutions, you would research all available working capital options to this market segment which include sources such as nonprofit loans, business credit cards, personal savings, loans from retirement accounts, friends and family, equipment leasing, and merchant cash advances. To serve this market segment efficiently, you would choose to offer merchant cash advances and equipment leasing.

Next, you would scroll through all of the direct lending sources in the country that provide the working capital solution you have decided to lead with, but who also specialize or at least “serve” the target market you are seeking. Many equipment leasing companies do not fund businesses with less than 2 years in business, and many cash advance companies do not fund companies with less than 1 year in business. Your goal would be to find these lenders and create that network, negotiate pricing, workout your commission schedules, and verify all aspects of said partnership to make sure that it’s beneficial for your clients and your office. It should be a win-win-win partnership, a win for your clients as they find a source for working capital that they didn’t know existed, a win for your partner as they obtain “feet on the street (or telephone)” reps without having to pay their overhead, and a win for your office as you are allowed to serve your market and be paid well in doing so.

Due Diligence Is Key

When finalizing your lender selections, make sure all forms of due diligence are completed on the lender(s) to verify their credibility and competency. These forms of research include all of the following:

(( Structure and Legality ))

- The lender should be a licensed direct lender (in states where necessary).

- The lender shouldn’t be a start-up, but instead a proven entity with at least 2 years of operation.

- The lender should have at least directly funded volume in the eight digits (over $10,000,000).

- The lender should have a full staff of employees rather than just one person.

- The lender’s customer service and support departments should be easy to reach.

- The lender should have some sort of press or news media releases on its establishment.

- The lender should specify if they are going to do advances or loans or both.

- The lender’s funding agreements should specify if the transaction will be an advance or loan.

(( Online Presence ))

- The lender should have a fully functional business website, registered for at least two years.

- The lender should have a business email from their business website domain.

- The lender should be BBB Accredited (www.BBB.org) with at least an A rating.

- The lender should be a part of business associations with logo(s) displayed on their website.

- The lender should be included on basic online business directory listings.

(( Broker Respect ))

- The lender should provide a comprehensive Broker Agreement full of legal provisions.

- The lender’s Broker Agreement should spell out all provisions of the relationship.

- The lender’s Broker Agreement should spell out any quotas.

- The lender’s Broker Agreement should spell out new/renewal deal commission structure.

This is a rough introduction and surely there are other criterion that are important in selecting your lender partnerships. However, these recommendations will surely give you a head start as you head into one of the most competitive industries in financial services.

Get Paid More in Alternative Business Financing

May 5, 2015Maybe you’re happy with your current job now.

Maybe you’re making a lot of money.

Maybe you’re not.

Or maybe you’re at least curious to see what’s out there?

This is an exciting time to be in the alternative business financing industry. The OnDeck IPO made several senior-level people in the company instant multi-millionaires, many of whom are only in their 30s.

Now is the time

Now is the time

Back in 2007, payment processing professionals thought that the age of merchant cash advance was over. A Green Sheet writer in August of that year actually wrote a story about cash advance and said, “I think that boat has come and gone, and I missed it.”

And yet there were 20-somethings making between $200,000 to $1 Million a year. I knew a few of them and for their sakes, I won’t name names. The industry has treated those who are good at it very well.

Not everybody got rich though.

The industry got corporate really fast in 2008 and 2009 when it became apparent you couldn’t run a funding company like it was Delta Tau Chi in the movie Animal House. Commissions and salaries shrank and then leveled off for a time. But then the ACH payment methodology renewed the industry’s wild growth and made every business owner in the country a potential candidate for funding, rather than just those processing more than $5,000 a month in Visa/Mastercard sales.

Commissions shot up, way up. Opportunities exploded.

Today, having experience in the merchant cash advance or alternative business lending space is extremely valuable. It’s a buyer’s market. Demand for qualified and experienced professionals by funding companies and brokers far outpaces those looking for work. There are 20-somethings making well into the six figures again, particularly if they’re good at sales.

Other positions are in demand too: Operations, Underwriting, Administrative, Collections and more. If you have experience in these areas, there are employers very eager to talk to you.

But maybe you’re 100% happy.

Or maybe you’re not.

It’s a buyer’s market

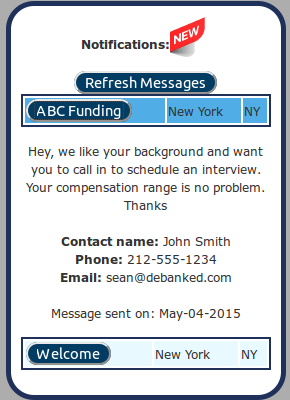

Because the demand for experienced individuals is so overwhelmingly high, we’ve created the AltFinanceDaily Jobs network and put the ball fully in the court of the job candidates. That means you can fill out a blind profile that details your background, but keeps your identifying information away from employers. Employers can view the background but they won’t be able to see your name, email address, or username. If they like your profile, they can contact you through the site.

You’ll be able to see who the employer is and their message when you log on. Only if you choose to email them or call them to schedule an interview will they ever know who you are. If you don’t do either, they’ll never know who you were. Like I said, the ball is in your court. Why not see who comes knocking once they’ve seen a little bit about you?

Initially, we’re only allowing a handful of vetted employers on the network to prevent abuse and solicit feedback. As of now an employer can only send you one message.

We’re also not sending email notifications so if you’ve registered with your work email address, job notifications will not be sent there. They can only be viewed by logging on.

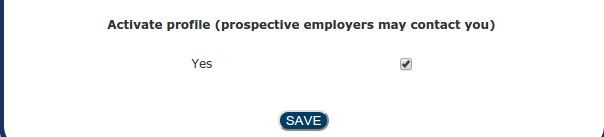

If you no longer want your profile to be discoverable by employers, just untick this checkbox and click save. It’s unticked by default so if you’ve already set up a profile but forgot to tick the box, you won’t be receiving any messages anytime soon.

Anyone can create a jobs profile so long as they have a AltFinanceDaily forum account. If you don’t have one, register here. Then just log on to create a profile on the network at ../../jobs/.

Have feedback? Notice a bug? Are you an employer looking to hire that wants access to this? Email sean@debanked.com.

The industry’s growth is on fire. Are you happy with your place in it???

The Business Backer Appoints Simcha Kackley as VP of Marketing

April 21, 2015CINCINNATI, April 21, 2015 — The Business Backer, a leading provider of small business financing solutions, today announced the appointment of Simcha Kackley as the company’s Vice President of Marketing. In her new role, Kackley will be responsible for leading the firm’s marketing and growth strategy. Additionally she will support the execution of all marketing activities including lead generation and penetration of the direct and partnership channels. She will report to Jim Salters, The Business Backer’s CEO and will be based in the firm’s headquarters in Blue Ash.

“As the company continues to experience tremendous growth, Simcha will play an integral role in further defining our brand both internally and externally,” said Salters. “She is a strategic, data-driven and digitally-focused marketer and we’re thrilled to add her expertise to our ever-growing team.”

Kackley has over a decade of diverse marketing experience, most recently serving as Director of Marketing at iSqFt, an online platform that connected contractors with construction jobs across the U.S. Prior to that, she served as the Director of Marketing for the Jewish Federation of Cincinnati. In both roles she demonstrated measurable results in cross-functional strategic planning, branding and lead generation, among others.

“I’m thrilled to be joining a company that is so deeply committed to the success of the small business owner,” said Kackley. “Our focus on True Relationship Financing ensures that the needs of our customers are the driving force for everything we do and I look forward to enhancing our effort to help small businesses get the capital they need to survive and thrive.”

Kackley holds an MBA from the University of Cincinnati and a Bachelor’s degree in marketing from Xavier University. She is active in the local community through philanthropic work with the National MS Society. She founded and hosted Rock ‘n Aspire, an annualCincinnati-based fundraiser created to inspire music lovers to unify in support of the National MS Society, whose mission is to find a cure and address the challenges of everyone affected by MS. She is also the incoming President of the local chapter of the American Marketing Association.

About The Business Backer

The Business Backer, headquartered in Blue Ash, Ohio, provides customized funding solutions and advice for small and medium-sized businesses. The Business Backer’s revolutionary approach to underwriting, combined with a team of expert advisors, has allowed the company to provide more than $250 million in funding for thousands of small businesses across the United States. The Business Backer has received numerous local and national awards for growth, ethics and leadership. Learn more at www.businessbacker.com.

Good Recordkeeping Plays Important Role in Funding Success

April 17, 2015CPA Yoel Wagschal recently started working with a syndicator who relied on Excel spreadsheets to track all his deals. The syndicator thought he had everything in tip-top shape, but it turns out that his system was hard for an outsider to understand and the data didn’t reconcile with his bank statements.

Wagschal, who heads an accounting firm in Monroe, New York, comes across this problem frequently these days. It’s been exacerbated by the exponential growth of the alternative funding industry in recent years. There are a sizeable number of alternative funders that started out small and have grown by leaps and bounds, yet they are still using rudimentary systems to keep track of their business dealings. In most cases, funders want to do the right thing, but they don’t always know how or the extent of what’s involved. Unknowingly these funders may be setting themselves up for financial or legal troubles.

“Sooner rather than later you are going to find yourself swimming in the Atlantic Ocean without any plan on how to get out of there,” Wagschal says.

“Sooner rather than later you are going to find yourself swimming in the Atlantic Ocean without any plan on how to get out of there,” Wagschal says.

Although newbie funders may be able to get by with simple tools and minimal staff, more sophisticated efforts are required once they are doing multiple transactions a month. It’s one thing when you are tracking a few daily deals on a spreadsheet. It’s quite another when you’re trying to keep track of all the moving parts for hundreds of deals.

What’s more, there’s a lot of slicing and dicing of data that goes into properly understanding your existing business and growth possibilities. If you don’t use the right tools to help you keep precise records, it’s nearly impossible to understand the fundamentals of your business in order to grow. Excel, while a useful tool, has its limits, and funders who rely exclusively on spreadsheets don’t get the benefits of other more sophisticated options that have become available to them in the past few years. Manually entering data also increases the possibility of human error, which can lead to thousands upon thousands of lost revenue for a funder’s business.

The Pitfalls of Not Keeping Good Data

Keeping good data is especially important to funders who want to take on additional investors or who are considering a sale at some point. Kim Anderson, chief executive of Longitude Partners Inc., a strategic advisory firm in Tampa, Florida, works with a number of funders that are looking to facilitate additional growth by bringing on outside investors. Many of these companies find themselves scrambling because they don’t readily have access to the kind of information potential investors want.

Not keeping good books can also inhibit a funder’s ability to expand into additional markets. Say a funder wants to introduce a new product or migrate a product offering to a different vertical. Companies that don’t analyze their data effectively may have a hard time understanding what part of their existing portfolio would be the most appropriate or profitable segment to introduce the product to, Anderson says.

Potentially impeding growth is bad enough, but funders that don’t keep proper books can also find themselves embroiled in legal or tax troubles. Some MCA providers, for instance, have faced stiff penalties for treating transactions as loans on their books instead of the purchase and sale of future income.

“If they are showing the revenue recognition in the exact same way that loan industry companies are doing, then they are setting themselves up to be judged in the same way that a loan company would,” says Christina Joy Tharp, a staff accountant in Wagschal’s office. If you’re using the same accounting methods as lenders, you could be deemed a predatory lender by multiple enforcement agencies, even if that’s not your intent, she says.

The strength of your business can also be significantly impacted by how you classify performing and nonperforming loans or receivables. “There are thousands of pages of rules on how banks have to classify performing and non-performing loans. None of that exists for this industry, which is completely unregulated,” says Alex Gemici, managing director and head of M&A at World Business Lenders, an alternative lending company in Manhattan.

As a result, funders don’t have a universal way of keeping their books. Many funders believe that as long as they are collecting sporadic payments, a loan or receivable should be classified as performing. Gemici strongly disagrees, saying this approach sets up a funder for potential failure given that the default rate for loans/receivables is about one in five. “It’s one thing to show on your books that loans or receivables are performing, it’s another when you run out of cash,” Gemici says.

Choosing an Outside Provider

Recognizing that Excel spreadsheets can only carry a funder so far and that out-of-the-box software probably won’t be a complete solution for alternative funders, a small number of companies have stepped up to provide customized solutions for the industry. MCA funders—where the perceived need is greatest—are a particular focus for these providers.

Benchmark Merchant Solutions, a processor in Amherst, New York, is one such company honing in on the MCA funder space. In 2014 the company launched MCA Track, software that’s designed to help MCA funders with their recordkeeping needs. It also helps them keep track of their income for tax purposes.

Benchmark Merchant Solutions, a processor in Amherst, New York, is one such company honing in on the MCA funder space. In 2014 the company launched MCA Track, software that’s designed to help MCA funders with their recordkeeping needs. It also helps them keep track of their income for tax purposes.

Among other things, MCA Track allows funders to view their performance at a glance. It shows them, for example, how merchants are performing, how the funds are allocated according to syndicator, the status of a deal, open cash advances, closed cash advances and defaulted cash advances. Funders can also get profitability data and other types of big picture information about their business as well. The software costs about $2,000 a month depending on the user’s size.

Benny Silberstein, chief operating officer of Benchmark, says the software was created because the processing company found that funders were often asking Benchmark to get data for them, especially when there were discrepancies. It can be real headache for funders to wade through inconsistencies with merchants, syndicators and ISOs, Silberstein says. “I can’t begin to tell you how many times funders asked us for a list of all the payments they’d received.”

PSC of Port Washington, New York, is another company trying to help MCA funders keep better records and manage their business more effectively. For a monthly membership fee, the company offers a front-end to back-end relationship management solution that allows funders to track all their contacts, documents, deals and commissions. Daily reports provide detailed data and summary information about an MCA’s funding business. The data includes the actual advance amount, the right to receive amount, the factor rate, processing fees, daily debits and credits, commissions paid to outside brokers or their own people, other management fees, ACH fees, wiring fees, payments, missing payments, collections information and participation with other syndicates.

The product has been on the market for about two years and the monthly fee varies according to a funder’s size, says Tom Nix, director of sales for PSC. He declined to be more specific about cost.

“The companies that are small and just starting out—if they are just doing a few transactions a month—they could probably get by using a spreadsheet. But that’s only feasible if you have a few transactions that you’re doing per month. Once you’re growing, when you get up to 10, 20, 30, 100 deals, the management of data becomes truly uncontrollable,” says Nix, who has seen a number of funders struggling to stay afloat or exit the business entirely because of their inability to keep good records.

“If you don’t have the right information and understand it, you’re going to give money to someone and you won’t [necessarily] get it back,” Nix says.

It’s possible for funders to set up their own infrastructure, but it can be costly and some feel it detracts from their ability to generate new business. That’s why Anthony Mannino, president of Nulook Capital in Massapequa, New York, chose to work with PSC. He researched the idea of doing all the back office and data collection on his own, but he decided not to reinvent the wheel since it would have meant hiring additional staff and would divert the company’s attention away from its primary focus—bringing in new business.

“A service provider like PSC gives us the ability to grow our company controlled and in a much quicker manner than we ever could than if we had to build our back end on our own,” Mannino says. “It takes most of the responsibility off of my company so we are able to focus on just growing the business and growing the sales.”

CloudMyBiz Inc. in Los Angeles is another company trying to service the alternative funder market, providing customized CRM systems for both lenders and MCA providers.

The CloudMyBiz system relies on a platform called Salesforce and is customized to the funding industry. It helps funders with the various facets of origination, underwriting and loan servicing. It helps them generate and track leads, automate funding workflow, understand and manage their deal pipeline and daily funding activities, collect and schedule recurring ACH payments and track syndication partners.

You could buy the Salesforce software and use it out of the box, but it provides only the basic functionality that funders need to run their business properly, says Henry Abenaim, principal consultant at CloudMyBiz. That’s where CloudMyBiz comes in by customizing the software for a funder’s specific business requirements. The fee varies widely, depending on the funder’s specifications, he says, declining to be more specific.

About two and a half years ago, Creative Vision Studio LLC in Long Beach, Calif., which had focused on the merchant credit card processing industry for more than a decade, also started offering a CRM system to MCA providers. The software is called Bankcard Pros CRM and customers can use it for merchant credit card processing, MCA or both. The software automates the data entry, underwriting, approval, funding and payback process from start to finish, says Robert Hendrix, the company’s chief executive. Funders also have access to 17 different management reports so they can track the performance and profitability of their entire portfolio per month.

The company charges an upfront fee of $4,000 to $5,000 to use the software, which is customized to a particular client’s business. There’s a $399 monthly fee after that. While it may seem costly to some funders, Hendrix says the software pays for itself within a month because of the efficiencies created. Importantly, the software eliminates the possibility of costly human mistakes that can occur in manually updating daily payments on a spreadsheet. “One little mistake can cost funders $2,000 to $3,000, even up to $10,000. They can be very costly mistakes,” he says.

It is, of course, possible for funders to keep good books and records using homegrown systems and personnel, and funders need to carefully weigh their options, taking into account that doing it right will probably require a meaningful investment in infrastructure and personnel. Whether they do it alone or hire an outside vendor, the important thing for funders is to collect the data and be able to evaluate it and display it in a way that makes sense to them, their customers, tax preparers, potential investors and others who need access.

Funders also need to remember that being successful in the business over the long term requires them to do more than simply capture accurate data. Beyond that, funders need to be able to manipulate the information in a way that helps them understand the nuts and bolts of their specific business, says Anderson of Longitude Partners.

“They may be able to produce enough financial information to complete an accurate tax return, but when it comes to understanding their operating metrics, they may not have collected or evaluated all of the right information to answer questions about what really drives the growth or sustainable profitability of the business,” he says.