Double Factoring Puts Business Owners in Jail

July 29, 2015 It’s a case of receivables being sold to two parties at the same time. According to the FBI, Brian Newton and Victoria Snow were convicted last week on 1 count of conspiracy, 13 counts of mail fraud, and 11 counts of wire fraud. They face a combined 40 years in prison.

It’s a case of receivables being sold to two parties at the same time. According to the FBI, Brian Newton and Victoria Snow were convicted last week on 1 count of conspiracy, 13 counts of mail fraud, and 11 counts of wire fraud. They face a combined 40 years in prison.

The pair owned a company called Dataforce International in Clearwater, FL and began factoring their invoices in 2003 through a firm called Amerifactors. “As part of their scheme, Newton and Snow submitted a series of invoices for factoring to Amerifactors that were inflated and that did not reflect work that had been performed by Dataforce,” the report says. “In addition, the two engaged in ‘double factoring,’ which involved submitting the same Dataforce invoices for factoring to both Amerifactors and Prestige Funding.”

That aspect of the crime is significant because of how closely it relates to a questionable practice in the merchant cash advance industry known as stacking. Traditional merchant cash advances are purchases of future receivables and stacking is the instance of when a merchant allegedly sells those receivables to more than one party.

The practice is part of the reason the International Factoring Association actually voted to ban merchant cash advance companies from their trade association last year. “The merchant cash advance financing arrangement often leads to breaches of factoring agreements, because the factor client granted junior liens against the factor’s collateral or took on additional debt without the factor’s consent and knowledge,” wrote Steven N. Kurtz, Esq. last year in The Commercial Factor.”

Notably, Newton and Snow did more than just double factor invoices. Newton was secretly a partner in Prestige Funding, one of the factoring companies. Prestige Funding had raised more than $8 million from over 50 investors according to the FBI’s report and the scheme allowed Newton to divert more than $3 million into his personal bank account.

Sentencing has been set for October 9, 2015.

Business Financial Services Joins The Billion Dollar Club

July 29, 2015 Yet another small business financing company has surpassed a historic milestone. Representatives for Coral Springs, FL-based Business Financial Services, Inc. confirmed that they have funded $1 Billion since inception. BFS, as they’re known in the industry, was founded in 2002, though nearly half of their volume was funded in just the past two years.

Yet another small business financing company has surpassed a historic milestone. Representatives for Coral Springs, FL-based Business Financial Services, Inc. confirmed that they have funded $1 Billion since inception. BFS, as they’re known in the industry, was founded in 2002, though nearly half of their volume was funded in just the past two years.

AltFinanceDaily had recently speculated that BFS had funded somewhere between $700 million and $1.2 billion in their lifetime. They are now one of seven companies confirmed to have reached the billion dollar threshold.

New York City-based Merchant Cash and Capital announced hitting the billion dollar mark only four months ago.

“This milestone is indicative of how much demand there is for working capital among small businesses, the backbone of the U.S. economy,” said Marc Glazer, CEO and co-founder of BFS.

BFS/Boost Capital CEO Marc Glazer on Bloomberg London in 2013Much like Capify, a newly-formed lending conglomerate with operations in multiple countries, BFS has a presence in Canada and the United Kingdom. In the U.K., where they operate as Boost Capital, they’ve got an active relationship with the press.

Norman Carson, director of business development for Boost Capital, recently told The Telegraph, “Smaller companies in Britain have been told for too long that they’re inadequate in some way, operating in too risky a field, lacking in assets, or trading in the wrong way.”

Several commercial finance brokers put BFS in the same league as OnDeck and CAN Capital competitively. Referring to BFS, Arty Bujan of New York City-based Cardinal Equity told AltFinanceDaily, “I think they’re great and serve a specific sector of our industry for merchants that need more money and are willing to prove they’re worthy of it.” He added that the documentation requirements at least in his experience can be a little bit more stringent than for competing companies that promise to fund almost immediately.

And Chad Otar, a Managing Partner of Excel Capital Management, also of New York City, said, “Business Financial Services is a great addition to have in your pocket for the longer deals.”

In April of this year, BFS extended its credit line with its bank group led by Wells Fargo Bank, N.A. “We are excited to reach this milestone, as it is fueled by our ability to meet the financing needs of so many businesses of different sizes across more than 400 industries,” said Glazer.

In April of this year, BFS extended its credit line with its bank group led by Wells Fargo Bank, N.A. “We are excited to reach this milestone, as it is fueled by our ability to meet the financing needs of so many businesses of different sizes across more than 400 industries,” said Glazer.

BFS is the only billion-dollar-plus funder on the AltFinanceDaily leaderboard to be based outside of New York City or Silicon Valley. South Florida is widely considered to be one of the top three hubs for tech-based lending. This milestone for BFS is a validation of that.

“With a high percentage of our customers renewing with us, and doing so at higher amounts, we are well-positioned for continued growth,” Glazer said.

Generating Leads and Acquiring Borrowers Not Easy in Business Lending

July 21, 2015 “Banks are almost always losing money on small business lending,” said Manish Mohnot, TD Bank’s Head of Small Business Lending, on a panel at the AltLend conference in New York City. It’s a loss leader within the small business segment, he explained, because banks want to bring in deposits.

“Banks are almost always losing money on small business lending,” said Manish Mohnot, TD Bank’s Head of Small Business Lending, on a panel at the AltLend conference in New York City. It’s a loss leader within the small business segment, he explained, because banks want to bring in deposits.

Funding Circle’s Rana Mookherje concurred. “Banks just can’t make a loan under $500,000 profitably,” he said.

It’s a conundrum few outside banking think about. When consumers and businesses picture banks, they might think of loans, but when banks think of consumers and businesses, they think of deposits. The sentiment amongst the experts at AltLend was that traditional banks and alternative business lenders were not competing with each other for the same customers because each party was after a different objective.

And even when banks think about loans, because obviously they do, they just don’t approach them the way that alternative business lenders do. To that end, ApplePie Capital CEO Denise Thomas said, “Most community banks are looking to make loans backed by an asset. They just don’t want to underwrite [loans] one by one under a million dollars.”

Bankers are genuinely surprised by how alternative lenders subjectively or manually approach business loans, a subject covered just yesterday here on AltFinanceDaily. Charles Green, the Managing Director of the Small Business Finance Institute and moderator of the New Pioneers panel said he never saw banks use bank transaction history to make underwriting decisions in his 35 years of banking.

The factors paraded as being more important above everything else in alternative lending today have apparently been non-factors in traditional lending for years. “There is no substitute for banking information when reviewing a client for approval,” said Andrew Hernandez, a co-founder of Central Diligence Group, in Do Bank Statements Matter in Lending? Business Lenders and Consumer Lenders Disagree. These kind of statements are mind-blowing in traditional lending circles.

Nevertheless, banks watch in awe as alternative lenders not only make small commercial loans, but do it profitably. But how they source borrowers isn’t rocket science. Jim Salters, the CEO of The Business Backer pointed out that some alternative lenders are marketing on a large scale by running TV or radio commercials. But that level of investment isn’t for everyone, especially younger companies.

“Direct mail isn’t sexy, but it converts,” said Candace Klein, the Chief Strategy Officer of Dealstruck. She also said that her company is doing radio advertising.

Matt Patterson of Expansion Capital Group is well versed in digital marketing and incorporates SEO and online paid advertising such as Facebook in his strategy. There’s a difference in the conversion rate in advertising on Facebook versus something like Google, he explained. On Google, business owners are looking for something whereas on Facebook they stumble across it.

Everyone agreed that Pay-Per-Click marketing such as Google Adwords was very expensive in this competitive landscape.

Jim Salters, CEO of The Business BackerBut where can funders and lenders reliably turn to acquire deal flow cost effectively? Salters revealed the industry’s worst kept secret, brokers. The Business Backer acquires about half of its volume from brokers and the other half directly, according to Salters.

“The broker channel is one of the most cost effective channels for us,” said Klein, who would not say on the record exactly how much of Dealstruck’s total business was from brokers.

Patterson agreed with the favorable ROI of using brokers, but saw benefits to communicating with small businesses directly. “Everything about that relationship is better when you’re talking directly to that merchant,” he said. And yet, “our direct leads convert much lower than our broker leads will,” he added.

The panelists generally agreed that this was because brokers have essentially already gathered the documents and closed the deal by the time the lender or funder is finally seeing it.

But aren’t brokers and humans the antithesis of tech-based lending?

Brett Baris, the CEO of up-and-coming lender Credibility Capital said, “We were actually a little surprised by how much a human is needed.” Baris’ company acquires most of its leads through a partnership it has with Dun & Bradstreet. Most of their borrowers are prime credit quality.

“The human element is very important to get the higher quality borrowers to the finish line,” Baris noted. TD’s Mohnot was not surprised. For applicants doing $5 million to $6 million a year in revenue, they want somebody to walk them through the loan process, he opined.

“Merchants love talking to people,” Patterson said. “Some of that comes from the frustration of calling their bank and not being able to talk to people.”

But would that mean the assumptions about automation are wrong? Not quite, explained Mohnot. It’s the younger business owners who have the impulse desire to do things fast or online, he said.

And Klein said that observing merchant behavior at least at her company has shown that those all too eager to apply for a loan in an automated online fashion are typically looking for smaller amounts like $20,000 to $40,000. Meanwhile Dealstruck’s loan minimum is $50,000.

Not everyone is as fortunate as Baris, who is able to generate leads through the trust inherent in a conversation that originated with a D&B rep, but real actual bank declines are making their way to alternative lenders. They’re not the holy grail that everyone thinks they would be though.

“Conversions tend to be lower from bank leads because they’re expecting 6% and are insulted when they hear [a higher %],” said Klein. And Salters who refers to his company as a “turndown partner of choice for upstream lenders,” shared how hard it is for a bank to partner with an alternative lender in the first place. Years ago, banks were aghast by his hands-on, manual underwriting approach that he felt was his company’s core competency. The banks were afraid their regulators would freak out over something so subjective.

And yet Merchant Cash and Capital’s founder, Stephen Sheinbaum and Credit Junction’s CEO Michael Finkelstein both told an audience that they saw banks as collaborative partners.

Meanwhile, Dealstruck actually has a graduation system where merchants graduate out of their loan program and become eligible for a real bank loan. Klein explained that a small business could be referred to them by the bank and then after a couple of years of good history, they’ll refer it back to them.

The acquisition secret however seems to be in finding your strength. ApplePie is focused exclusively on franchises. Expansion Capital Group has formed relationships with several trade organizations. Credibility Capital goes hand-in-hand with D&B.

Still, there is no doubt that the broker channel is alluring, but it can be a slippery slope. Raiseworks CEO Gary Chodes cautioned that “brokers are incentivized to follow the money.” Klein also expressed concern. She knows firsthand how challenging brokers can be since she’s had to terminate some in the past for bad behavior.

“Transparency is extremely important,” Finkelstein proclaimed in regards to the customer experience. This means that lenders can’t simply work off the ROI metric alone. But that ROI is the envy of banks nationwide.

Banks want to refer their clients to alternative lenders because if they get approved, then the lender is going to deposit those funds at their bank, Mohnot alluded.

It would seem that there is not one particular methodology that works better than all the others to acquire a borrower and that’s okay. Alternative lenders struggling to maximize their ROI can take comfort in the fact that banks, with all the resources they have at their disposal, accepted a long time ago that it was impossible to even make money at all in small business lending.

If you’re at least in the black, you’re probably doing just fine…

Do Bank Statements Matter in Lending? Business Lenders and Consumer Lenders Disagree

July 16, 2015Bank statements. Those in consumer lending argue they’re all but irrelevant because FICO and credit reports do the job of predicting risk just fine, but over in today’s small business lending environment, there’s an entirely different sentiment; Reveal your recent banking history or be declined.

After having bought nearly $60,000 worth of consumer notes on Lending Club and Prosper combined, there’s something I’ve seen a lot of, bounced ACHs.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

For all the fanfare surrounding online marketplace consumer lending, access to borrower banking history is oddly absent.

“Welcome to consumer lending, where the rules are different because the game is too,” replied a user to my comment on a peer-to-peer lending forum.

Veteran consumer lenders assumed I was a lost newbie who knew nothing about lending. “I have a feeling if you ask to crawl someone’s bank account, they’ll just go elsewhere,” one user said. “Seems that’d only work on subprime borrowers who have limited bargaining power.”

“I’m assuming you may be new to lending,” he continued. “Making a loan based on deposit balances is rarely a good idea.”

My initial question to them was that without bank statements, how could they ascertain if a borrower’s finances were actually in order at least at the time the loan was issued? It’s really easy to access someone’s banking history for the last 90 days by using common tools like Yodlee or Microbilt, I argued.

Some people sympathized with my logic but others believed requesting bank data would be suicide in today’s competitive environment. And still more wondered if there might be consumer protection laws that prevented lenders from seeing a loan applicant’s banking records (which sounded ridiculous).

A Credit Card Issuer’s Take

Those questions led me to interview an underwriting manager at one of the nation’s largest credit card issuers who would only speak on the condition of total anonymity, including the bank’s name. There, he oversees a department of people that manually assess credit card applicants. There is no algorithmic approval process. In his department, humans underwrite each application, conduct phone interviews with the prospective borrowers, and request additional documents if they feel it’s warranted.

Requesting bank statements is a regular part of the job, explained the manager. “We require proof of income for any line over 25k,” he added. “It’s the main thing we ask for along with proof of address.”

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

“The Adverse Action reason [for that] would be ‘sufficiently obligated’,” he stated. “That’s when their bank account shows they can not take on any additional financial obligations.”

The manager shared however that he believed there is a very strong correlation between what’s on the credit report and what to expect in the bank statements. Generally speaking, good credit will show a healthy banking situation, he explained. They’re rarely taken by surprise. Overall, the credit reports and phone interviews are enough for them to feel comfortable and the bank statements are really just there to check off a compliance box.

Meanwhile, those that speculated requesting bank data would be a death knell competitively might want to talk to Kabbage’s sister company, Karrot. Karrot already crawls bank accounts as part of their consumer loan application program and competes with Lending Club, Prosper, and Avant. Considering Kabbage has funded more than half a billion dollars worth of business loans using this very methodology, it’s safe to say that applicants aren’t flocking to competitors in droves over the perceived injustice or inconvenience of filling out three additional fields on a web application to share their transaction history.

Bounced Payments

Kabbage CEO Rob Frohwein offered these comments last year about their underwriting, “A critical aspect of consumer lending is determining the appropriate amount of a payment to collect so that an account doesn’t become overdrawn. Our intelligence accurately predicts how much of a payment to request via ACH so consumers avoid the cost and headache associated with non-sufficient funds.”

I thought about those statements when I noticed that thirty-six of my Lending Club notes carried a Grace Period status the other day. These are borrowers whose payments just recently bounced. Some are only three or four months into a five-year loan. Worse, there are those that are saying they have no money whatsoever to make a payment. How can this be when they just practically got approved?

To the consumer crowd it’s business as usual. “If you got their bank account, you still wouldn’t be able to predict who will default. You can’t predict defaults on any individual borrower,” argued one veteran on a forum.

But it’s not all about the lender’s tolerance for risk. ACH rejects can have consequences that affect a lender’s ability to debit accounts in the future.

“Ultimately, regulatory thresholds set by NACHA will continue to become more and more critical of returns,” said Moe Abusaad of ACH Processing Co, an ACH processor based in Plano, TX. “I think it’s safe to say that there is a positive correlation in considering statements as a component of the underwriting process to the rate of returns incurred,” he added.

And while it’s true that bank data can’t make predictions perfectly on its own, nobody in small business lending or merchant cash advance would consider an approval without it.

Bank Statements or Bust

“There is no substitute for banking information when reviewing a client for approval,” said Andrew Hernandez, a co-founder of Central Diligence Group, a risk management firm that allows business lenders and merchant cash advance companies to outsource their underwriting.

“Money moves fast through these businesses and every business is unique, so a lot more variables come into play than just having to account for the timely monthly payments of credit cards, cars, and mortgages as you find in the consumer world,” he added. “A FICO score along with other information presented in a credit report provide a detailed, historical snapshot of a client’s creditworthiness in consumer lending, and while these are great complementary tools for us to use in our underwriting process, I believe that banking data paints us a picture of its own which is absolutely essential in assessing the risk of a B2B transaction in our space.”

Those underwriting business loan deals have reported seeing applicants with open personal loans from Lending Club, which shows that the exact same borrowers are being underwritten in two different ways.

But Julio Izaguirre, another co-founder of Central Diligence Group added that, “banking transactions are essential in gauging the cash flow of the business by looking at recent and up-to-date bank volume, but it is even more important with businesses that lack historical data and cannot provide financials or other documentation to show and prove their track record.”

Translation: A lack of credit history and formal financial statements can be overcome thanks to in-depth analysis of bank account data.

“When our underwriters look at a bank statement you can get a better understanding of the business cash flow, operational cost and how the owner manages his business,” said Heather Francis, CEO of Gainesville, FL-based Elevate Funding. “The credit score is like a person’s blood pressure reading,” she continued. “It indicates there may be an issue but until lab work is pulled and analyzed you don’t know what that issue is. The bank statement is that lab work and it can tell you more about the issues behind the scenes than a credit score can.”

Greg DeMinco, a Managing Partner of Americas Business Capital based in Cherry Hill, NJ would probably agree. “FICO isn’t everything,” he shared. “Bank statements can tell a great story especially if there is upward momentum month after month, and more importantly a high ratio of deposits to requests for the advance.”

Meanwhile, the manager of the credit card issuer was surprised to hear about the high value placed on bank statements in business lending. I offered him the example of an applicant with good credit that was consistently negative in the bank because of a reliance on overdraft protection as a way to make sure all the bills were being paid. “That’s the craziest thing I ever heard,” he commented.

But over in the peer-to-peer lending forum it didn’t sound so crazy at all. “Plenty of Americans are ‘broke’, in the sense that they have negative net worth, yet they’ll continue servicing their debts for… a long time… no matter what it takes,” shared one user.

The argument seems to come full circle, that business lending and consumer lending are just different.

But to Isaac Stern, the CEO of New York-based Yellowstone Capital, the bank statements are not just about financial health. “We are literally underwriting against fraud,” said Stern, who said his office regularly receives applications with doctored statements. “Logging in [to the banks] and verifying those statements are probably the most important part of the process,” he noted.

His logic goes that a consumer that is paid a salary has a predictable stream of income and so that information along with a credit report might be enough for a consumer lender, but business revenue is less predictable and can vary practically day-to-day.

“You can’t just look at a FICO score and say, ‘this is a good a business’,” Stern explained. “The story is in the bank statements.”

Strategic Funding Source Increases Borrowing Capacity to $90 Million with New Revolving Credit Facility Led by CapitalSource

July 15, 2015 Strategic Funding Source, Inc., a leading provider of direct financing to small and midsize businesses, today announced that it has closed on a $90 million revolving credit facility. Led by CapitalSource, a division of Pacific Western Bank, the loan agreement includes continued participation from East West Bank and the addition of BankUnited to the lending group.

Strategic Funding Source, Inc., a leading provider of direct financing to small and midsize businesses, today announced that it has closed on a $90 million revolving credit facility. Led by CapitalSource, a division of Pacific Western Bank, the loan agreement includes continued participation from East West Bank and the addition of BankUnited to the lending group.

“Gaining access to the capital needed to grow continues to be an issue for many of America’s hard working small business owners and our industry plays a crucial role in addressing that need,” said Andrew Reiser, Chairman and Chief Executive Officer, Strategic Funding Source. “With the support of our outstanding bank partners we have now more than doubled our borrowing capacity. Coupled with the $110 million line of equity financing we secured from Pine Brook in August 2014, we are poised to significantly expand our footprint in the robust and evolving small business lending space.”

Strategic Funding Source provides loans and cash advances to small businesses by combining advanced technology and insight based on years of experience as small business owners and financial industry experts. The company works directly with small business owners to identify their capital requirements and creates flexible, tailored financing options that suit their individual business models.

About Strategic Funding Source, Inc.

Strategic Funding Source finances the future of small businesses utilizing advanced technology and human insight. Established in 2006, the Company is headquartered in New York City and maintains regional offices in Virginia, Washington state, and Florida. Strategic Funding Source has served thousands of small business clients across the U.S. and Australia. Visit www.sfscapital.com to learn more about the Company, its financing products and partnership opportunities.

A Decade of Funding

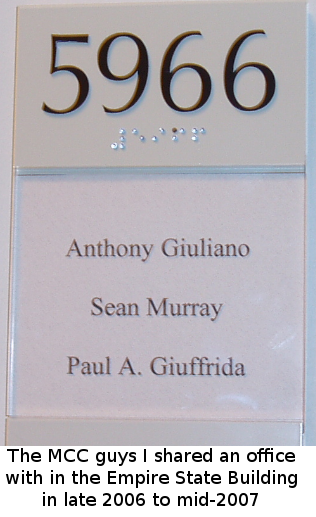

July 7, 2015Next month is my 9 year anniversary in the merchant cash advance industry, which means I’ll be starting my 10th year. A decade of merchant cash advance… holy shit. I’ve had the opportunity to view it from many different angles and have accrued my fair share of adventures, plenty of which I’ve written about and others I’ll have to take to my grave.

I also launched this very website exactly 5-years ago under its original name MerchantProcessingResource.com. Not many people can say they’ve authored more than 600 stories (yes, seriously) on merchant cash advance, but I can. I’m fortunate to have turned something I merely enjoyed in the beginning into a business of its own.

I also launched this very website exactly 5-years ago under its original name MerchantProcessingResource.com. Not many people can say they’ve authored more than 600 stories (yes, seriously) on merchant cash advance, but I can. I’m fortunate to have turned something I merely enjoyed in the beginning into a business of its own.

Looking back now, there weren’t many people keeping a live diary of events as the industry dove headfirst into the financial crisis. Who would’ve bothered to report on an industry that was arguably made up of only a thousand people?

In April 2009, even before AltFinanceDaily launched, I submitted a story to the only merchant cash advance magazine of its kind. It didn’t have a very clever name, just Merchant Cash Advance Publication. My story, titled, An Underwriter in Salesman’s Clothing, rambled on about the end of the industry’s glory days, the wave of declined deals in the recession, and how funders should be more appreciative of ISOs.

Here’s a summary of what I wrote more than six years ago:

Here’s a summary of what I wrote more than six years ago:

I was complaining about stacking as far back as 2007 apparently. I addressed it as a merchant problem. Merchants were taking advantage of funders, not the other way around like some frame the argument in 2015.

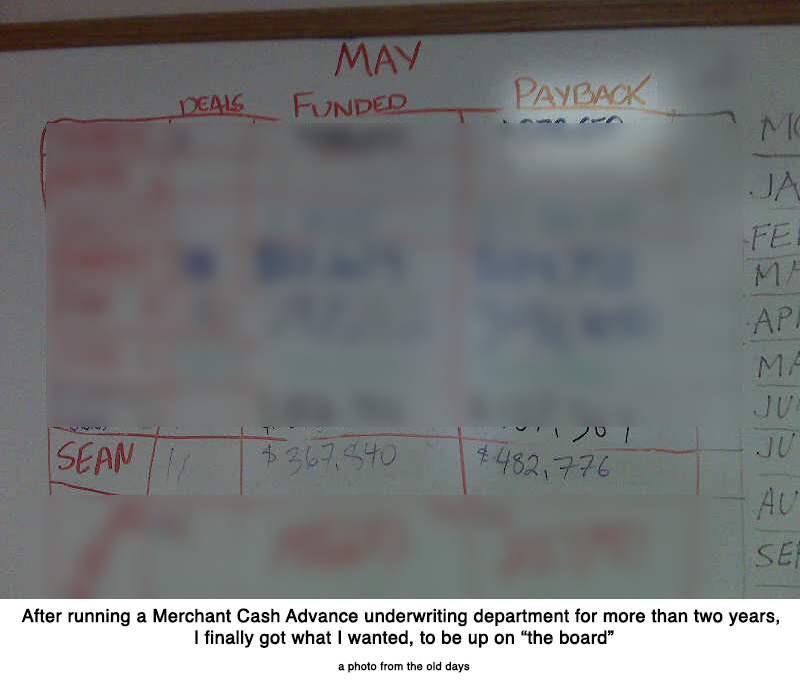

I left my post as Director of Underwriting in late 2008 because “I wanted the ringing phones, the commotion, the markerboards with stats, the glory, the $20,000 [monthly] checks.”

Funding companies became super conservative during the financial crisis and all my deals were being killed (25 deals declined in a row at one point.)

I had recently charged my first closing fee, felt bad about it, and got in trouble for it.

I said 1.40 factor rates wouldn’t last (I was wrong about this!)

I bitched about algorithmic declines (I apparently thought computers underwriting files was a good way to upset ISOs.)

I acknowledged my own hypocrisy when I realized how hard it was to be a sales rep after thinking sales reps were overpaid and overrated in my previous years as an underwriter.

I continued on as a sales rep for another two and a half years after I wrote that. That means that in 2010 when I started AltFinanceDaily, I was still calling UCCs, closing deals and boarding merchant accounts while sitting in a windowless room rented by a startup ISO.

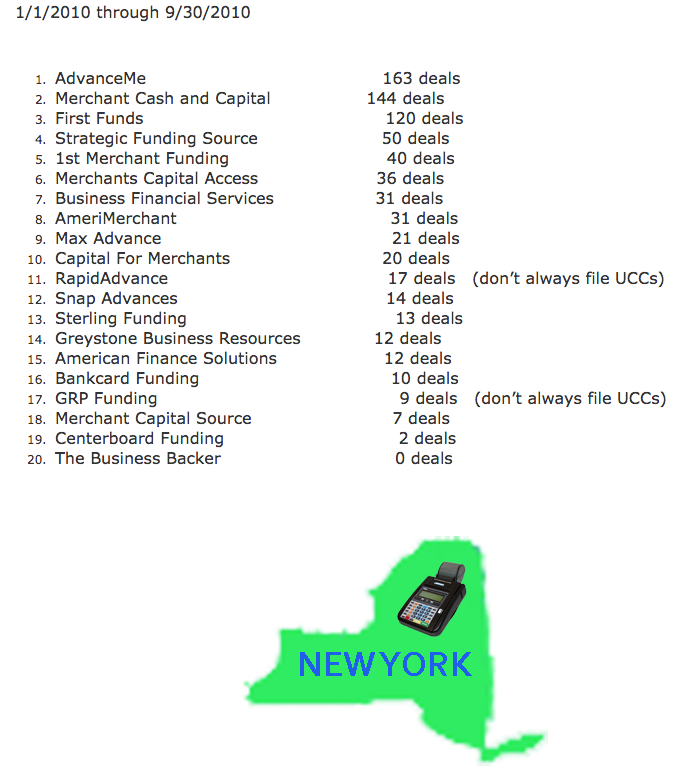

But what was there to blog about in 2010? Oh little stuff like who the biggest funding companies were at the time by checking UCC filings since almost everyone filed UCCs back then. Notably, the third largest merchant cash advance company of 2010, First Funds, is no longer in business.

I also wrote about shopping deals around and the impact that might have on a merchant’s credit report. That was the day-to-day stuff though, information I was just putting out there hoping someone on the Internet might see it. What got everyone excited was the 2010 New York State leaderboard which eventually prompted me to spend my nights and weekends investigating the industry on a wider level.

I began talking to people at other funding companies about their monthly numbers. It wasn’t that hard to get information as an industry insider, especially if you had deals to send somebody’s way. I also spent money to acquire secured party lists to count the number of UCC filings by funders in all 50 states rather than just look at one free state like I did with New York originally. I think I was the only person in the industry at the time running up their personal credit card bill to conduct such research. I had also been in the industry for four years at that point and had a great network of contacts who could clue me in on their volume.

While I said that I also looked at census records and department of labor records, I’ll admit that data wasn’t extremely useful. The end result was a best guess estimate that in 2010, there were approximately 21,000 merchant cash advances transacted for $524 million.

My data would go on to be republished in ISO&Agent Magazine, The Scotsman Guide, and Leasing News, and also end up in many other places I didn’t expect, like in the business plans of merchant cash advance companies that were looking to raise capital. In fact, in a private meeting I had with an MCA company months later in South Florida, the CEO let me take a peek at the docs they had just submitted to a bank for a credit facility. Included was a printout of these numbers with my name on it and all. Apparently there was something to this writing thing…

My last day as a sales rep was in the Fall of 2011. I left the commission-only life (oh what, you 2015 pansy closers actually get a base salary?) for something even more risky, an entrepreneurial life. For a couple years, I played underwriting consultant to a handful of merchant cash advance companies and industry expert to institutional investors interested in the space. I learned how to code in my spare time and spent more than a year in online lead generation.

I never stopped writing.

Along the way I’ve visited the offices of dozens of ISOs and funders, syndicated in deals, and test-drove new technology.

None of this makes me particularly special, especially when I hear about how much some of my old sales buddies are making these days on deals. “Are you SURE you don’t want to come back?” they ask. It’s enticing no doubt. A part of me wants to grab the phone out of their hand and attempt to shatter their record on the markerboard this month even though I’m pretty sure I’m rusty as hell.

One thing noticeable between now and 9-years ago is that my hair turned grey. This industry will do that to you (or at least it did to me.) And I still get a kick out of meeting folks who got into the industry years before I did. The 90s/early 2000s AdvanceMe crowd likes to tell me that they were funding merchants while I was still in diapers. They are practically right.

As I enter my own tenth year in the biz however, it’s exciting to think that the industry is just now getting started. OnDeck was the first IPO in the space and the general public is learning about short term business funding for the first time. There’s no shortage of news to report and that keeps me plenty busy these days.

And so even after a decade of MCA, it’s never too late to put on your Funded pants. Opportunity awaits and I hope you’ll continue to ride the wave with me. Thanks for reading since 2010!

The Rest of the Alternative Lending Industry’s Funding Numbers

July 1, 2015 Let’s be serious, the industry’s much bigger than we may have let on when we published the industry leaderboard (some mods have been made) in the May/June issue.

Let’s be serious, the industry’s much bigger than we may have let on when we published the industry leaderboard (some mods have been made) in the May/June issue.

Right after AltFinanceDaily sent the final file off to the printers in May, PayPal announced that the widely circulated $200 million lifetime funding figures were slightly outdated.

How off were they?

Oh, just by about $300 million or so. By May 7th, PayPal’s Working Capital program for small businesses had already exceeded $500 million. The industry leaderboard has been revised to reflect the news. PayPal says they are funding loans at the rate of $2 million per day, which puts them on pace for more than $700 million a year. Um, wow?

One name that’s missing from that list is Amazon, whose secretive short term business loan program is reported to have already generated hundreds of millions of dollars in loans. Given the $300 million discrepancy that PayPal let ruminate for months, we’re in no position to speculate on Amazon. Anyone could try to assess what they’ve been up to however, since they file UCCs on their clients under the secured party name “AMAZON CAPITAL SERVICES, INC.”

Of course if you’re craving specific numbers, an anonymous source inside Yellowstone Capital revealed that Yellowstone produced $35.5 Million worth of deals in the month of June alone. Yellowstone has a strategically diverse business model that allows them to either fund small businesses in-house (essentially on their own balance sheet) or broker them out to other funders. Yellowstone was listed on AltFinanceDaily’s May/June industry leaderboard at $1.1 Billion in lifetime deals and $290 Million in 2014. June’s figures indicate that they are probably well on their way to surpassing last year’s numbers.

Curiously, platform/lender/broker/marketplace company Biz2Credit has been hanging on to the same stodgy old number for more than a year.

Funded over $1.2 billion. 200,000+ happy customers.http://t.co/3h64lI4cgG #smallbusiness #Funding

— Biz2Credit (@biz2credit) June 19, 2015

They were touting that same $1.2 Billion number exactly 1 year ago. Surely they have done more since then? Biz2Credit’s service covers a much wider scope however so a direct comparison with their peers may not be appropriate. A lot of their loans are arranged through traditional banks which are typically transacted in amounts larger than the average $25,000 deal alternative lenders do.

A source familiar with Biz2Credit’s breadth said he observed a deal where the company helped a businessman in Mexico obtain financing to purchase a new helicopter, a transaction which apparently necessitated a team to fly down there to sign paperwork. Definitely not a standard transaction!

When we published the industry leaderboard initially, it admittedly omitted some of the industry’s largest players. Many firms are fairly secretive about the numbers they release and we’re in no position to disclose numbers that aren’t supposed to be public. Below is data that we hadn’t published previously.

The industry’s unsung behemoths

The industry’s unsung behemoths

The $300 million lifetime funding figure publicized by NYC-based Fora Financial can’t be that stale. It’s the number currently stated on their website and a late February 2015 company announcement revealed they were only at $295 million at the time. We feel comfortable enough to now have Fora Financial on the leaderboard.

In 2014, Delaware-based Swift Capital revealed that they had funded more than $500 million. It’s unclear how much that’s increased since then.

Credibly (formerly RetailCapital), has publicized that they’ve funded more than $140 million in their lifetime. Founded in Michigan, the company has opened offices in New York, Arizona, and Massachusetts. They’ve been added to the lifetime leaderboard.

New York City-based AmeriMerchant has a claim on their website that they have funded more than $500 million since inception. How much more exactly? We’re not sure.

Coral Springs, FL-based Business Financial Services keeps their figures mostly under wraps but a good guess would place their lifetime figures at somewhere between $700 million and $1.2 billion.

Miami, FL-based 1st Merchant Funding had reportedly funded close to $100 million in the Spring of 2014. It’s uncertain as to where they might be now.

Woodland Hills, CA-based ForwardLine surpassed $250 million in funding as far back as 2013.

Orange, CA-based Quick Bridge Funding disclosed more than $200 million in funding in late 2014.

Troy, MI-based Capital For Merchants has funded $220 million since inception. But there’s more to the story. Capital For Merchants is owned by North American Bancard, a merchant processing firm that acquired another merchant cash advance company, Miami, FL-based Rapid Capital Funding in late 2014. And coincidentally, Rapid Capital Funding had just acquired American Finance Solutions months earlier, which is an Anaheim, CA-based merchant cash advance company that had funded more than $250 million since inception. All told, North American Bancard owns at least three merchant cash advance companies: Capital For Merchants ($220 million), American Finance Solutions ($250 million+), and Rapid Capital Funding (undisclosed). There are rumors that they’re in talks to acquire at least one more company in the space, which, if true, would make North American Bancard one of the industry’s most powerful players.

Don’t bother counting up the above totals

These figures all barely scratch the surface as AltFinanceDaily’s database indicates there are literally hundreds of genuine direct funders in the industry.

Thanks to the company representatives that took the time to confirm their funding numbers with us directly. Anyone interested in sharing their figures can email sean@debanked.com. If there is a gross inaccuracy somewhere as well, please report it to us.

This page might be updated in the future so check back!

Investing in the Industry: Break Out of Your Bubble

June 29, 2015 Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

“Most people don’t know everything that’s out there. There are huge opportunities,” says Peter Renton, an investor and analyst who founded Lend Academy LLC of Denver, Colorado, a popular resource for the online lending industry.

Indeed, there are a growing number of online alternative lending sites that theoretically allow a person to invest in all shapes and sizes of loans. There are sites like Lending Club and Prosper that allow smaller investors to tap into the burgeoning P2P market. There are also a plethora of platforms that cater only to wealthier, more sophisticated investors in a host of areas like small business, real estate, student loans and consumer loans.

Even though there is a surplus of options, prudent investing is not quite as simple as depositing ample funds in an account and clicking the “go” button. Before you get started, you need to carefully consider factors such as your own finances and risk tolerance. You should also have a good handle on the specifics about the online platform—how it works, its history and track record, the types of investments it offers, the platform’s management team, technology and your ability to diversify based on available investment opportunities.

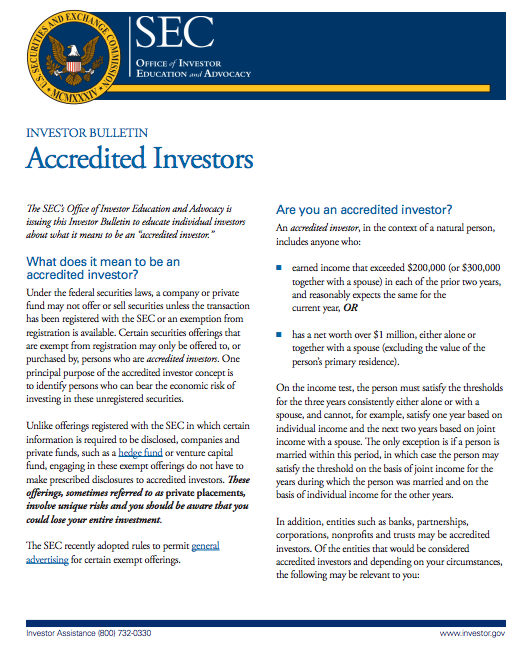

One of the first things you’ll have to think about as a potential investor is whether you have the financial wherewithal to be considered accredited by the SEC. If the answer’s yes, you’ll have a lot more choices of online marketplaces to choose from as well as types of investments. Basically, to meet the SEC’s threshold, you’ll need to have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect to earn the same for the current year. Alternatively, you need to have a net worth over $1 million, either alone or together with a spouse (excluding the value of your home). (Check out the SEC’s website for more detailed info.)

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

But smaller investors do have options. Two San Francisco-based online lending platforms, Lending Club and Prosper, cater to individual investors, and you can still make a pretty penny plunking down money with these venues. You’ll also find a wealth of information about investing with them by perusing their websites as well as by reading the blog posts of media-savvy financiers.

“Right now, Lending Club and Prosper provide a great entry point for people who want to get involved in investing in alternative lending,” says Renton of Lend Academy.

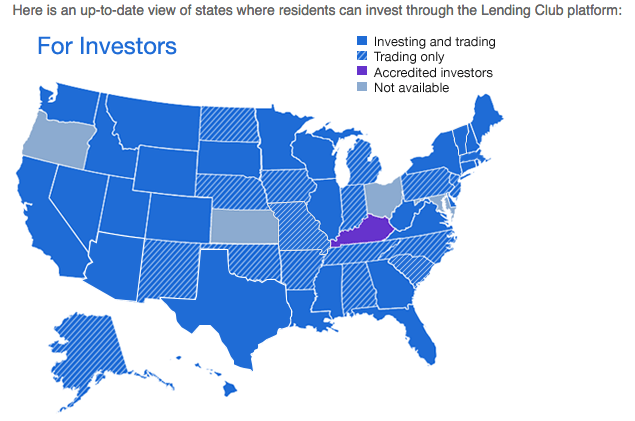

The caveat is that these platforms aren’t yet open to investors in every state, so if yours isn’t on the list you’re out of luck for now. However, with each marketplace you’ve got more than a 50 percent chance your state is on the approved list, so it’s worth digging deeper.

Assuming you meet their respective suitability requirements, you can choose to invest on one platform or both. To be sure, they are alike in many ways. Both allow you to invest with as little as $25 and fund one loan, however they recommend you buy at least 100 loans to be properly diversified, which you can do for as little as $2,500. You can manually choose which loans to buy, or enter your investment criteria so loan picking is automated. You can also invest retirement money in an IRA through Lending Club or Prosper.

There’s no fee to get started investing on either platform. For Lending Club, investors pay a service fee equal to 1 percent of the amount of payments received within 15 days of the payment due date. Prosper charges investors 1% per year on the outstanding balance of the loan. As the loan gets smaller, the servicing fee, which is charged monthly, gets smaller too.

To invest in Lending Club, in most cases you’ll need either $70,000 in income and a net worth of at least $70,000, or a net worth of at least $250,000. There may be other financial suitability requirements that vary slightly depending on the state you live in. For Prosper, individual investors must be United States residents who are 18 years of age or older and have a valid Social Security number.

At any given time, Lending Club has more than 1,000 loans visible on the platform and new ones get added every day, according to Scott Sanborn, chief operating officer and chief marketing officer. Prosper, meanwhile, on average has more than 200 loans for people to invest in, says Ron Suber, president.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

To encourage more people to start investing, some savvy investors have started to self-publish online the quarterly returns they accumulate through the Lending Club and Prosper platforms. Renton, of Lend Academy, reported a balance of $476,769 on Dec. 31, 2014 and a real-world return for the trailing 12 months of 11.11 percent. Another well-known P2P investor and blogger, Simon Cunningham—the founder of LendingMemo Media in Seattle—reported a 12-month trailing return of 12.0 percent over the same time period, with a published account value of $41,496. Both investors say they expect returns to drop back somewhat over time, however, as the online marketplaces continue to lower interest rates to attract more borrowers.

Of course, if you’re an accredited investor, you will have access to even more online marketplaces. For instance, there’s SoFi of San Francisco for student loans, Realty Mogul of Los Angeles for real estate loans and Upstart of Palo Alto, California, that focuses on loans to people with thin or no credit history. The list of possibilities goes on and on.

Generally speaking, the more money you have to invest, the more options you have. “In this country today, you’ve got well over a hundred options if you’re willing to put seven figures in,” Renton says.

The minimums at venues that focus on accredited investors tend to be more than you’d find at Lending Club or Prosper. At SoFi, accredited investors need at least $10,000 to begin investing in the company’s unsecured corporate debt. SoFi’s been in the lending business for several years now and currently focuses on student loans, mortgages, personal loans and MBA loans. Investors, however, can’t currently invest in these loans, says Christina Kramlich, co-head of marketplace investments and investor relations at SoFi. The company plans to eventually offer investment opportunities in the areas of mortgages and personal loans, she says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

Because it’s still so new, it can be hard for investors to know how to compare marketplaces. For starters, consider the platform’s historical performance. There are a lot of new marketplaces popping up, but it takes time to develop a proven track record. This isn’t to say you shouldn’t dabble with the newer platforms, but if you do, you’ll want above-average returns to balance out the higher risk, says Sanborn of Lending Club. “About three years in, we started to build a track record. At five years in, it was very solid,” he says. “You need time to see how a basic batch of loans is going to perform.”

Before investing, you’ll want to get a sense of how committed senior management is to the company and try and get a sense of whether the company seems to have enough capital for the business to run well. Try to find out about the cash position of the company, how the loans are going to be serviced, what entity is doing the underwriting and how and where your cash will be held.

“It’s not just assessing the risk of the asset and the investment, it’s assessing the risk of the enterprise that is making it available to you,” Sanborn says.

It’s also important to ask questions about the loans themselves. Where do they come from and is the volume sustainable? Ideally, a platform should offer a variety of loans so investors can properly diversify, or you might need to consider investing with multiple platforms to achieve your desired balance.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

When you’re asking all these questions, try to get a sense of how receptive the platform is to the feelers you’re putting out. Investors should only work with companies that are willing to be open about how they are investing your money, their historical returns and other important data. “I can’t stress transparency enough,” says Periu of Funding Circle.

The technology the platform uses is another key element. Is the technology easy to use, or does the platform create stumbling blocks for investors? Are there ways to automate lending, or do you have to log on every day and manually invest in loans?

Suber of Prosper says investors should also consider whether platforms work with a back-up servicer in case there’s a disruption and whether they run regular tests to make sure everything works as expected. “It’s just like a backup generator and you have to test it every once in a while and make sure it goes on.”

Certainly it pays to do your homework before you invest your hard-earned cash with an online platform. Ask around, attend industry conferences and absorb all you can from publicly available data. The good news is that there will probably be even more information for you to tap into as the industry continues to grow.

“Two years ago [marketplace lending] was very esoteric. A year ago it was still esoteric,” says Funding Circle’s Periu. Now, more and more investors are hearing about marketplace lending and want to make it part of their broader fixed income bucket. Even so, more has to happen for it to become a mainstream investment. “Awareness and education need to continue,” he says.

Once more people understand the extent of what’s out there, Suber of Prosper expects investing in online marketplaces will take off even more than it already has. “A lot of people still don’t know this as an investment opportunity,” he says.