Who’s On Your Fantasy Funding Team?

September 14, 2015 A few years ago, a friend of mine was dropped by the funding brokerage he worked for and put on the waiver wire. He was promptly picked up by a competitor and today ranks among one of the top closers in the industry. It was one of the strangest moves of the season because his numbers had been really good month after month. It turned out that he was turned loose for earning too much money, something the firm wasn’t content with.

A few years ago, a friend of mine was dropped by the funding brokerage he worked for and put on the waiver wire. He was promptly picked up by a competitor and today ranks among one of the top closers in the industry. It was one of the strangest moves of the season because his numbers had been really good month after month. It turned out that he was turned loose for earning too much money, something the firm wasn’t content with.

Even though he was compensated on a commission-only basis, he was apparently putting the company over their salary cap. That of course begged the question, why was there a compensation cap for a top performer, somebody who was directly leading to the firm’s growth? For what it’s worth, he was entitled to approximately 20% of the company’s gross commission revenue. So on every deal funded the company took home the other 80% of the commission. This worked for both parties until the closer started earning well into the six figures, at which point they told him he wasn’t allowed to earn more than a certain amount.

Although discouraged by the sudden limitation, he continued to work hard to prove why the cap should be removed. It wasn’t. Soon afterward he found himself on the waiver wire.

He was replaced by two rookies fresh out of college who were willing to do the same job for a lot less, but neither had any experience in the field.

As someone who has been active in this industry for nearly a decade, I’ve watched this scenario play out dozens of times.

- Firm needs top talent to grow

- Firm hires Talent

- Talent produces

- Firm grows

- Firm doesn’t like that Talent is making so much

- Firm fires Talent or Talent quits

As the firms gallop off to the next scouting combine to find somebody younger and more malleable, the pool of experienced talent is dispersed across a sea of competitors. A consequence of this is that each of those companies become more evenly matched and it becomes increasingly difficult to stand apart from the crowd.

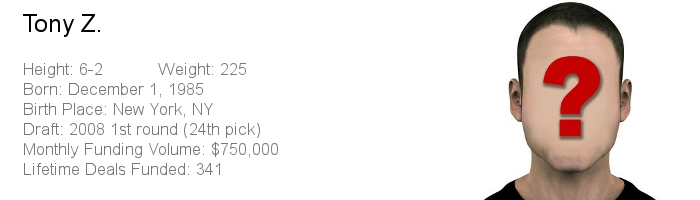

At trade shows and happy hours, it’s not uncommon for top players to openly question what would happen if they all joined forces to create a funding dream team of sorts. And while such cohesion rarely actually happens, I can’t help but imagine if given the opportunity to build the best team to win, who I would pick.

Top talent is expensive. I know this because I recently spent 89% of my budget in a fantasy football auction draft to acquire just three players. And last year I spent a similar percentage on only four players and won the entire league. My thought process was to build a team that was centered around the best of the best. Previous years of conservative play led to mediocre results and I wanted to change that.

Today, there are hundreds of alternative business financing companies and thousands that can be considered brokers. There’s a lot of decent teams out there but few that are built around a group of all stars. And oddly, some companies seem to be dumping their best and brightest on purpose, just like I described previously. That might lead to improved margins for the firm, but probably won’t help them win in the long run.

Here’s something to think about while you’re watching Monday Night Football. If you had to build your company around a core group of talented people, who would you pick? Don’t worry about whether or not they’re available or if they fit into your budget. Those are obstacles that can be overcome.

Here’s a list of positions to help you imagine your fantasy funder:

- 1 Senior Manager

- 2 Underwriters

- 2 Closers

- 1 Flex Spot

- 1 Admin

- 1 Collector

- 1 Tech Person

Good luck!

Revenue Advance Searches Up, Small Business Loan Searches Down

September 8, 2015Back in early 2013, I explored the popularity of Google search phrases related to the industry. At the time, keyword phrases such as merchant cash advance were on a downswing after reaching their peak back in September 2008. Oddly, the keyword hasn’t been able to match the popularity it had seven years ago, but it is on the way back up.

Other keywords are just about dead, but perhaps most interesting of all is that small business loans has been declining consistently for about ten years straight, though it appears to have tapered off a bit.

Take a look:

three additional terms: merchant loans, ach loan, merchant financing

Hanna Kassis of Oarex Capital Markets noticed that the term Revenue Advance is at an all-time high. You can read his thoughts about that here:

Alternative Funding: Over The Top Down Under

September 2, 2015 San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

As many as 20 new alt-funders are doing business in Australia, but that number could swell to a hundred, said Beau Bertoli, joint CEO of Prospa, a Sydney-based alternative funder. “The market in Australia has been very ripe for alternative finance,” Bertoli, said. “We see an opportunity for the alternative finance segment to be more dominant in Australia than it is in America.”

Recent entrants to the embryotic Australian market include Spotcap, a Berlin-based company partly funded by Germany’s Rocket Internet; Australia’s Kikka Capital, which gets tech backing from U.S.-based Kabbage; America’s Ondeck, which is working with MYOB, a software company; Moula, which began offering funding this year but considers itself ahead of the curve because it formed two years ago; and PayPal, the giant American payments company.

The new entrants are joining ‘pioneers’ that have been around a few years, like Prospa, which has been working for three years with New York-based Strategic Funding Source, and Capify (formerly AUSvance until it was consolidated into the international brand Capify), which came to market in 2008 with merchant cash advances and started offering small-business loans in 2012.

Some don’t take the newcomers that seriously. “There are small players I’ve never heard of,” said John de Bree, managing director of Capify’s Sydney-based office, in a reference to local Australian funders. “The big ones like OnDeck and Kabbage don’t have the local experience.”

But many players view the influx as a good sign. “I think it’s an endorsement of the market,” Bertoli said. “There’s more publicity and more credibility for what we’re doing here in terms of alternative finance.” It’s like the merchant who gets more business when a competing store opens across the street.

Besides, the market remains far from crowded. “I’m not concerned about the arrival of OnDeck and Kabbage because it really does validate our model,” maintained Aris Allegos, who serves as Moula CEO and cofounded the company with Andrew Watt.

The market’s relatively small size – at least compared to the U.S. – doesn’t seem to bother players accustomed to the heavily populated U.S., a development some observers didn’t expect. “I’m very surprised,” de Bree said of the American interest in Australia. “The American market’s 15 times the size of ours.”

Others see nothing but potential in Australia. “This is a market that will evolve over time, and we think the opportunity is enormous,” said Lachlan Heussler, managing director of Spotcap Australia.

Some view the Australian rush to alternative finance not so much as a solitary phenomenon but instead as part of a worldwide explosion of interest in the segment, driven by banks’ reluctance to provide loans since the financial crisis, de Bree said.

Viewed independently or in a larger context, the flurry of activity in Australia is new. “The boom is probably only getting started,” Bertoli maintained in a reference to the Australian market. “Right now, it’s about getting the foundation of the market established.”

To get the business underway in Australia, alternative funders are alerting small-business owners and the media to the fact that alternative funding is becoming available and teaching them how it works, de Bree said. “Half of our job is educating the market,” noted Heussler.

New players are building the track record they need to bring down the cost of funds, according to Allegos. “Our base rate is 2 percent or 3 percent higher than yours,” he said, adding that the cost of funds is more challenging than gearing up the tech side of the business.

Although the alternative-lending business started later in Australia than in the United States and lags behind America in in exposure, it’s maturing rapidly, said de Bree. Aussie funders are benefitting from the lessons their counterparts have learned in the U.S., he said.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

Such differences mean that risk-assessment platforms that work in the United States or Europe require localization before they can perform effectively in Australia, sources said.

Sydney-based Prospa, for example, got its start three years ago and has been working ever since with New York-based Strategic Funding Source to localize the SFS American risk-assessment platform for Australia, said Bertoli, who shares the company CEO title with Greg Moshal.

Moula, which has headquarters in Melbourne, sees so many differences among markets that it decided to build its own local platform from scratch, according to Allegos.

One key difference between the two markets is that Australia does not have positive credit reporting. “We have nothing that even comes close to a FICO score,” said Allegos. The only credit reporting centers on negative events, he said.

Without credit scores from credit bureaus, funders base their assessments of credit worthiness largely on transaction history. “It’s cash-flow analytics,” said Allegos. “It’s no different from the analysis you’re doing in your part of the world, but it becomes more significant” in the absence of positive credit reporting, he said.

Australia lacks credit scores at least partly because the country’s four main banks control most of the financial sector and choose not to release credit information, sources said. The banks have warded off attacks from all over the world because the regulatory environment supports them and because their management understands how to communicate with and sell to Australian customers, sources said.

The big banks – Commonwealth Bank, Westpac, Australia and New Zealand Banking Group, and National Australia Bank – set their own rules and have kept money tight by requiring secured loans and long waiting periods, Bertoli said. It’s difficult for merchants who don’t fit into a “particular box” to procure funding, he maintained. “It’s almost like an oligarchy,” Allegos said of the banks’ grip on the financial system.

Eventually, the banks may form partnerships with alternative lenders, but that day won’t come soon, in Allegos’ estimation. It could be 12 months or more away, he said.

Even as the financial system evolves, deep-seated differences will remain between Australia and the U.S. Most Americans and Australians speak English and share many views and values, but the cultures of the two countries differ greatly in ways that affect marketing, Bertoli said. “In your face” advertising that can work well with “loud, confident” Americans can offend the more “laid-back” Australian consumers and business owners, he said.

Australians have become tech-savvy and comfortable with online banking, but they guard their privacy and often hesitate to reveal their banking information to a funding company, Allegos said. The entrance of OnDeck and Kabbage should help familiarize potential customers with the practice of sharing data, he predicted.

Cost structures for businesses differ in Australia from the U.S., Bertoli noted. Australian companies pay higher rent and have to pay minimum wages set much higher than in the United States, he said. Published reports set the Australian minimum wage at $13.66 U.S. dollars. The higher costs down under can take a toll on cash flow. “Take an American scorecard and apply it to Australia?” Bertoli asked rhetorically. “You just can’t.”

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

No matter how many people are involved, changing their habits takes time. Australian merchants prefer fixed-term loans or lines of credits instead of merchant cash advances, Bertoli said. In many cases Australian merchants simply aren’t as familiar as Americans are with advances, Allegos said.

Besides, the four big banks in Australia tend to solicit merchants for credit and debit card transactions without the help of the independent sales organizations and sales agents. In the U.S., ISOs and agents play an important role in explaining and promoting advances to merchants, Bertoli said. Advances make sense for merchants because advances adjust to cash flow, and they help funders control risk, but just haven’t caught on in Australia, Bertoli said. Australians resist advances if too many fees are attached, said Allegos.

Pledging a portion of daily card receipts might seem too frequent, too, he said. Besides, advances are limited to merchants who accept debit and credit cards, while any business could conceivably choose to take out a loan, said de Bree.

Advances have to compete with inventory factoring, which has become a massive business in Australia, according to Heussler. The business can become intrusive because funders may have to examine balance sheets and talk to customers, he said.

Australia’s reluctance to turn to advances, leaves most alternative funders promoting loans and lines of credit. Prospa, for example, uses some brokers to that end but also relies on online connections, direct contact with customers, and referrals from companies that buy and sell with small and medium-sized businesses.

“Anyone that touches a small business is a potential partner,” said Heussler, including finance brokers, accountants, lawyers and even credit unions, which have the distribution but not the product.

Moula finds that most of its business comes from well-established companies and that loans average just over $27,000 in U.S. currency and they offer loans of up to more than $77,000 U.S. The company offers straight-line, six- to 12-month amortizing loans.

Using a model that differs from what’s common in the U.S., Moula charges 1 percent every two weeks, collects payments every two weeks and charges no additional fees, Allegos said. A $10,000 (Australian) loan for six months would accrue $714 (Australian) in interest, he noted.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

If companies have all of the necessary information at hand, they can complete an application in 10 minutes, Allegos said. Moula has to research some applications offline if the company’s structure deviates too greatly from the usual examples – much the same as in the U.S., he maintained. The latter requires strong customer-service departments, he said.

Kikka uses a platform based on the Kabbage model, which gives 95 percent of customers a 100-percent automated experience, Steger said. “It goes to show the power of our automation, our algorithms and our platform,” he maintained.

Spotcap prefers to deal with businesses that have been operating for at least six months, Heusler said. The funder examines records for Australia’s value-added tax and other financials, and it likes to connect with the merchant’s bank account. Spotcap can usually gain access to the account information through cloud-based accounting systems and thus doesn’t require most companies to download a lot of financial documents, he noted.

Despite the differences between the two countries, banking regulations bear similarities in Australia and the United States, sources said. In both nations the government tries harder to protect consumers than businesses because they assume business owners are more financially savvy. For consumers, regulators scrutinize length of term and pricing, sources said, and on the commercial side the government is concerned about money laundering and privacy.

Regulation of commercial funding will probably intensify, however, to ward off predatory lending, Bertoli said. Government will consult with businesses before imposing rules, he said. A couple of alternative business funders aren’t transparent with their pricing and they charge several fees – that sort of behavior will encourage regulation, Allegos said.

“I know they’re watching us – and watching us very closely,” he added.

In general, however, the Australian government supports alternative finance, Bertoli said, because they want there to be options other than the four big banks and wants small business to have access to capital. Small businesses account for 46 percent of economic activity in Australia and employ 70 percent of the workforce, he noted, saying that “if small businesses are doing badly, the economy is doing badly.”

Hence the need, many in the industry would say, for more alternative funding options in Australia.

Business Financial Services Acquires Entrust Merchant Solutions

August 26, 2015 A representative for Coral Springs, FL-based Business Financial Services (BFS) has confirmed that the company has acquired Entrust Merchant Solutions. Entrust is a well established and widely known NY-based ISO/broker shop that was founded in 2007. As part of the deal, Entrust CEO Ilya Fridman will remain with the company and for the time being, the Entrust name will not change. They are now a part of the BFS family of companies however.

A representative for Coral Springs, FL-based Business Financial Services (BFS) has confirmed that the company has acquired Entrust Merchant Solutions. Entrust is a well established and widely known NY-based ISO/broker shop that was founded in 2007. As part of the deal, Entrust CEO Ilya Fridman will remain with the company and for the time being, the Entrust name will not change. They are now a part of the BFS family of companies however.

The news comes on the heels of a major milestone. Just a month ago, BFS announced that they had funded more than $1 Billion since inception, earning them a spot as one of the industry’s largest players.

The Entrust acquisition is representative of an M&A trend taking place in the industry. Below is a list of some of the more recent ones:

- Enova International acquired The Business Backer (for $27 million)

- Merchants Capital Access acquired Reliant Funding

- Capital Z Partners acquired Pearl Capital

- World Business Lenders acquired the business loan operations of Plan B Growth (and has made 11 acquisitions total over the past 12 months)

Prior to the deal, Entrust was an ISO for BFS. Over the last few days though, some insiders speculated that the relationship had suddenly grown even tighter. It turns out they were right.

Reactions to the Treasury RFI: Business Lenders and Merchant Cash Advance Companies Share Their Thoughts

August 13, 2015 The Treasury Department could get an earful from the alternative funding industry during a 45-day public comment period on online marketplace lending that began July 17.

The Treasury Department could get an earful from the alternative funding industry during a 45-day public comment period on online marketplace lending that began July 17.

Treasury emphasizes that it isn’t a regulator and its Request for Information, or RFI, isn’t a regulatory action. The department just wants to hear success stories and opinions on potential public policy issues, a Treasury spokesman said.

“There isn’t a lot of data available on this industry,” the spokesman noted. “The RFI allows us to gather information from the public.”

One portion of the public – alternative funding executives – may have a lot to say on the subject. At least some of the industry’s top players favor regulation or legislation that could clean up the industry and clarify conflicting directives.

“Personally, I’d be glad to see it on the federal level,” Stephen Sheinbaum, president and CEO of Merchant Cash and Capital, said of regulation. “We won’t have to deal with 50 individual states, which is more unruly.”

Others would prefer to see the industry regulate itself instead of having federal agencies issue dictates or having Congress pass laws.

“I would like to put in my two cents,” said Asaf Mengelgrein, owner and president of Fusion Capital, indicating he intended to respond to the RFI. “I see a need for better practices, but regulation should come internally.”

Whoever makes the rules, restrictions seem inevitable because of alternative funding’s prodigious growth, executives agreed. “Regulatory attention is a sign of an emerging industry,” said Marc Glazer, president and CEO of Business Financial Services.

Regulation should curb the practice of stacking loans or advances, which can burden merchants with more financial obligations than they can meet, Sheinbaum said. Stacking has proliferated even though ethical members of the industry avoid it, he said.

At the same time, disclosure statements should become more transparent so that merchants can easily identify how much they’re paying in fees and expenses, Sheinbaum maintained. Merchants should also be able to see how much they’re paying the different entities involved in the deal, he said.

“I’m not suggesting someone should make more or less, but transparency is a healthy thing and this industry could use a little more of it,” Sheinbaum said.

The alternative-funding industry could follow the example of the mortgage business, where more-standardized forms help consumers compare competing offers, Sheinbaum said. “That’s not the case in this industry, so that might help,” he maintained.

The alternative-funding industry could follow the example of the mortgage business, where more-standardized forms help consumers compare competing offers, Sheinbaum said. “That’s not the case in this industry, so that might help,” he maintained.

The industry should not emulate the credit card processing business, which uses complicated and dissimilar contracts to keep customers uniformed, Sheinbaum said. “It’s not so easy for a merchant to understand the effective cost of a transaction – and that’s by design,” he said.

Reviewing those issues could confuse among regulators who don’t understand the industry, Mengelgrein warned. Someone “on the outside looking in” might consider the industry’s fees and factor rates outrageously high, but that’s because they fail to understand the financial risk involved with lending to small businesses, he said.

Before imposing rules, regulators should also bear in mind that many small businesses could not survive without alternative funding, Mengelgrein continued. In recent years banks have failed to step up and help merchants in need of cash, and the alternative lending community has filled the gap.

Sheinbaum agreed. “I hope the regulators and legislators will make an earnest effort to understand all the good that folks in the alternative finance space provide for people,” he maintained. “It’s a critical role we play in keeping small businesses going, and small business is important to this country.”

The Small Business Finance Association could play a critical role in helping government understand the industry, Sheinbaum suggested. He noted that the trade group changed its name from the North American Merchant Advance Association because the industry is adding loans to its initial offering of merchant cash advances.

Whatever shape regulation takes, the industry should keep up with the new rules, Glazer cautioned. “As this industry evolves, we will work closely with our partners and our customers to ensure that everyone is informed about any new regulations and the potential impact that they may have on our business,” he said.

Meanwhile, Treasury’s efforts to comprehend the business are continuing. Its RFI contains 14 detailed questions that respondents could address.

The department held a forum on Aug. 5 called “Expanding Access to Credit through Online Marketplace Lenders.” The event included two panel discussions and roundtable discussions with Treasury staff.

Attendees numbered about 80 and included consumer advocates, representatives of nonprofit public policy organizations and members of the financial services industry, the department said.

The Importance Of A Profitable Business Model And Creative Financing For Your Broker Office

August 10, 2015 Continuing The Year Of The Broker Discussion, I wanted to touch on another aspect that isn’t discussed too often in our space (Independent Broker or Independent Agent space), and that’s the importance of creating a profitable business model and rounding up creative debt financing for our Office.

Continuing The Year Of The Broker Discussion, I wanted to touch on another aspect that isn’t discussed too often in our space (Independent Broker or Independent Agent space), and that’s the importance of creating a profitable business model and rounding up creative debt financing for our Office.

I believe it was the Roman Playwright, Plautus, that said, You must spend money to make money. This is certainly true for Independent Brokers and Agents, as we are entrepreneurs in every sense of the word, or if you operate a one man show like I do, then you would be more along the lines of a solopreneur which is new terminology floating around that refers to certain special entrepreneurs who run their business solo with full responsibility over the day-to-day operations.

However, despite the fact that one must spend money in order to make it, it begs the question as to why many new Brokers have very little networks, resources and other sources for financing?

Not only do they lack these resources, but many new Brokers also have not truly developed a scientific business model for their office based on: If I invest XYZ in data, marketing and all other aspects in association of producing 1 new closed deal, I would receive XYZ back into terms of the revenue off the initial closed deal as well as XYZ back in terms of recurring revenues on the renewals of said merchant.

Many new brokers lack both a scientific and profitable business model, along with efficient financing for said business model, which threatens their survival going forward.

Your Profitable Business Model

I argue with investors across the Investment Community all of the time in relation to which is better in terms of building the most Wealth, is it investing in Stocks or operating your own Profitable Business Model? I have always believed creating your own Profitable Business Model was the fastest way to Wealth due to the lack of control one has over the returns you can generate through the Stock Market. Commentators like James Altucher tend to agree with my mentality as he says: The best way to take advantage of a booming stock market is to invest in your own ideas. If you have an extra $50,000 don’t put it into stocks. Put it into yourself. You’ll make 10,000% on that instead of 5% per year.

I’ve always used a model of at least a 400% return within 24 months for operating my office because, not only did I have to cover business expenses and taxes, but I also had to cover my personal expenses, the funding of my emergency funds/savings, and the funding of my retirement accounts which includes SEP IRAs, Social Security, and Health Saving Accounts.

So for example, my model might have it to where if I invest $30,000 into my office, that should produce revenues of around $180,000 within 24 months, revenues include commissions from new deals, renewal deals, side processing residuals and other valued added products. This would leave a profit before taxes of $150,000 or a 500% return. Now the 500% range is just the benchmark used, in terms of actual returns, they have been at least double this amount due to my focus on maintaining clients for the long term as with recurring clients, there are no investment dollars spent on the acquisition of those additional revenues but they do continue to add to the overall “profitability” measurement of the original investment.

Utilizing this predictable model allows for the use of creative financing for leverage, cashflow management, along with the preservation of savings, and other investment portfolios. One of the tools I have been using for creative financing have been Credit Card No Interest Promotional Offers.

Using Credit Card Promotional Offers To Finance Your Office

I’m a Dave Ramsey fan like many Americans, but I’m totally against Mr. Ramsey’s consistent hammering of the use of “debt,” specifically the use of Credit Cards. Credit Cards are just like hand guns, if you put the gun in the hands of a solider, police officer, hunter, or a responsible home owner, then you protect human life, build nations and protect communities. If you put the gun in the hands of the common Chicago inner city street thug, then you get crime and homicide. If you put a Credit Card in the hands of a responsible person, the Credit Card is used to bring a variety of additional benefits to said user. But in the hands of an irresponsible person, the Credit Card just adds to their financial woes.

If you strive to keep your personal credit profile clean and with high efficiency, you should qualify for a number of Credit Cards that not just provide cashback rewards, but they provide short term financing in the form of 0% interest for 12 – 18 months, with a 1% – 3% upfront fee. This means you can receive an up to 18 month loan for only 1% – 3% in borrowing costs. These offers are not presented just when the card is opened, but they are generated usually on a monthly or quarterly basis.

So coming back to my business model, I might put that entire $30,000 on a credit card promo deal for 18 months with an upfront fee of 3%, which means the borrowing costs are $900. I would continue paying the minimum payment every month which is usually calculated as no more than 0.5% – 1% of the outstanding balance. I would invest the $30,000 into my business model and would have obtained the break-even return and profit measurement in a relatively short period of time (usually 3 – 5 months) and then be profitable on the investment. I would eventually end up paying off the outstanding balance on the Credit Card well before the promo period ends, which further increases my positive credit history allowing for larger credit limits to be requested.

Other Benefits Of Credit Cards Over Other Payment Options

Credit Cards also provide a host of other benefits including cashback rewards of anywhere from 1% – 45% depending on the reward category, these rewards and savings are not available through any other form of payment option. If you seek out cards with no monthly fees, setup fees or annual fees, you could run up balances, pay them off before the grace period ends, and obtain a stream of free income.

Credit Cards also include Chargeback Protection that can save you a significant amount of headaches down the line should you run into an unscrupulous vendor, or if you are the unfortunate victim of theft such as a robbery, identity theft, strong-arm theft, etc. For example:

- If someone steals your wallet and goes on a “card swiping spree”, once you report your Credit Card stolen then you aren’t responsible for any of those transactions. This isn’t as efficient if you carried a Debit Card, as the money would be gone from your Checking Account until the Bank recovers the funds in 30 – 90 days, which might cause you some cashflow issues. If you carried Cash, the money might never be recovered.

- If you ordered something from a vendor and didn’t receive it, you are protected with the use of Credit Cards. With a Debit Card or Check, it will again take 30 – 90 days for the dispute to complete with the Bank, however, throughout this period of time the money is still gone from your account until the dispute is over, which might cause some cashflow issues. If you used Cash for the order, the money might never be recovered in this case as even though you are likely to obtain a judgment by suing the vendor, the Courts do not assist you with collections.

To Wrap

In order to survive going forward as an Independent Broker or Agent, remember the importance of developing a profitable business model as well as having low cost sources of financing for said model. Credit Cards are one of the ways you can creatively finance your business model.

I’m on track to end the year with near or over $200,000 in total credit limit availability. This credit limit availability is spread out over a number of different accounts, but some of my favorite Credit Card Accounts include: The Double Cash Card ™ from CitiBank, The Discover IT Card ™ from Discover Bank, The BankAmericard Cash Rewards Card ™ from Bank of America, The Chase Freedom Card ™ from Chase Bank, The Upromise Mastercard ™ from Barclay’s Bank, The QuickSilver Rewards Card ™ from Capital One Bank, and The Blue Cash Everyday Card ™ from American Express.

Funding Circle Breeds Bean Bags

August 7, 2015Yogibo CEO Eyal Levy saw a business loan ad for Funding Circle and applied. “The process was very smooth,” Levy said, who made a point to say that he was interviewed by an underwriter. Today, Yogibo has around 25 retail store locations and their bean bag business is booming.

Bloomberg’s Eric Schatzker expressed surprise that it wasn’t an instantaneous automated algorithmic approval that online lending has a reputation for these days. Video below:

Just like Lending Club, whose CEO appeared on Bloomberg earlier today, Funding Circle is one of the original founders of the Responsible Business Lending Coalition. They announced a “borrowers bill of rights” yesterday.

New Funding Brokers Struggle As Industry Grows

August 3, 2015 Here’s a few things that will have you scratching your head.

Here’s a few things that will have you scratching your head.

1. A new sales agent recently took to an industry forum to ask for help with ACH processing. According to him, he charged a closing fee on a loan that closed and then realized that he had no idea how to collect the fee. His problem was perplexing because he had the merchant sign an agreement that authorized him to debit the funds out despite not having an ACH processing account.

Some sympathetic veterans advised him to have the merchant write him a check, but others were too dumbfounded by his use of an ACH agreement when he did not know anything about ACH. The agreed fee was probably too large to write off as a mistake so hopefully the merchant will understand and write him a check for services rendered.

The lesson: If you don’t know how to do something, don’t guess. The agent would’ve been in a much better situation if he had asked how to collect fees prior to drawing up an agreement that referred to a methodology he had no familiarity with.

2. A semi-seasoned sales agent griped about a recent experience on an online message board about a business lender that stole his deals and turned out to be a repeat felon. The broker community was not sympathetic when they learned that the “lender” used a gmail address to communicate. What’s worse is that a perfunctory Google search revealed a record of violent crime.

The lesson: At the very least, do not send deals to anyone using a free email address. This was item #3 on my Advice to New Brokers list, published back in February. This also violated item #4 on my list, which says, don’t send your deal to some random company just because they went around posting on the web. A simple Google search for this broker would’ve showed that the “lender” was a serial criminal.

3. One broker e-mailed me to say that a lender had stolen his syndication money and disappeared. Another told me that they had stopped receiving their syndication deposits for their entire portfolio and wasn’t sure what was going on. This situation often doesn’t make the public forums because the aggrieved parties are sometimes too embarrassed to tell others that they got hustled. I recommended a lawyer to one of them.

The lesson: Refer to #4 on my Advice to New Brokers list. Even if others claim to be having a positive experience, there are a few red flags to look out for when it comes to syndication:

- Were they too eager to accept your money?

- Did they have an Anti-Money Laundering process in place?

- Would your funds be co-mingled with their operating funds or isolated in a separate account?

- How is their system structured? Will you get paid even if they declare bankruptcy?

- Was the owner of the company ever charged or convicted with fraud? This is probably the most important and for some reason the most overlooked. If the owner was previously charged with fraud and your money eventually gets stolen, you can only blame yourself. And if you don’t know if someone has a past criminal history, you should probably ask around in addition to conducting a formal background check.

Syndicating brings me to item #1 on my Advice list, hire a lawyer. If you can’t afford a lawyer, you definitely can’t afford to syndicate.