SBA ‘SmackDown’ In Linda McMahon, As Pick for Administrator Brings More WWE to Small Business Funding

December 8, 2016

President-Elect Trump’s pick to head the Small Business Administration is Linda McMahon, the former CEO of World Wrestling Entertainment (WWE). The publicly-traded company has produced many household names over the years, from The Undertaker to Bret “The Hitman” Hart to The Rock.

In a public announcement, Trump said “Linda has a tremendous background and is widely recognized as one of the country’s top female executives advising businesses around the globe. She helped grow WWE from a modest 13-person operation to a publicly traded global enterprise with more than 800 employees in offices worldwide.”

If confirmed by the Senate, McMahon will succeed Maria Contreras-Sweet, who has held the position since 2014 and has had a pretty open attitude about online lenders. The former WWE exec taking her place might find even more common ground with the non-bank finance community given that Bret the Hitman Hart is the official spokesperson for a merchant cash advance company.

Sharpshooter Funding in Canada, which heavily features Hart in their marketing campaigns, is affiliated with First Down Funding, a US-company that also does small business funding. A joint-company press release from earlier this year quotes Hart as saying, “When you sit down and listen to the whole format and how it provides money to much needed businesses and small business owners that need financial support and extra funding. It’s a worthwhile endeavor, and I’m actually very grateful that Paul Pitcher involved me with it so far.”

Meanwhile, McMahon says she is up to the task. “Our small businesses are the largest source of job creation in our country,” she said in an announcement. “I am honored to join the incredibly impressive economic team that President-elect Trump has assembled to ensure that we promote our country’s small businesses and help them grow and thrive.”

LendingMania might be just around the corner in 2017.

Fora Financial Crosses $500 Million in Small Business Funding

July 5, 2016Fora Financial crossed the $500 million mark in providing 10,000 small businesses with working capital since 2008.

The eight year old New York-based company that does merchant cash advances and business loans was started by college friends Dan Smith and Jared Feldman and finances a wide clientele of restaurants, retail stores, construction companies and more.

In May this year, the company closed a $52.5 million senior revolving credit facility with a group of financial institutions which will take care of Fora’s financing for the next three years and allow for expansion of the facility to $75 million.

“Providing half a billion dollars of capital to American small businesses is a tremendous accomplishment for Fora Financial and reflects the immense commitment, effort and support of our employees and stakeholders over the past eight years,” says Dan Smith, co-founder of Fora Financial. “Most of all, this achievement displays the faith our customers have in Fora Financial’s ability to provide them with the capital they need to drive their own business success. We are more committed than ever to providing our customers with the products and services that will help their businesses thrive.”

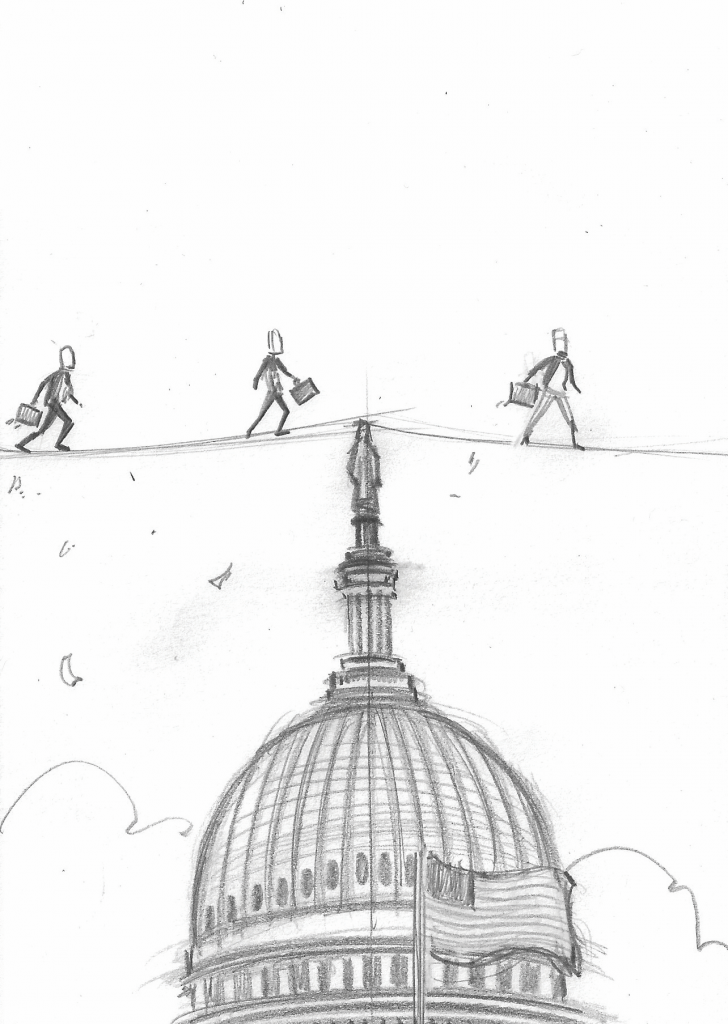

FIRE DRILL IN ILLINOIS: BUSINESS FUNDING COMPANIES TARGETED IN REPRESSIVE BILL

June 30, 2016* Update 6/30 AM: Sen. Jacqueline Collins, D-Chicago is expected to introduce a revised bill today.

** Update 6/30 PM: Reintroduction of the bill has been delayed while they wait for comments from additional parties

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Foes say the measure was created to promote disclosure and regulate underwriting. They don’t argue with the need for transparency when it comes to stating loan terms, but they maintain that a provision of the bill that would cap loan payments at 50 percent of net profits would disrupt the market needlessly.

Opponents also regard the bill as an encroachment on free trade. “The government shouldn’t be picking winners or losers – the market should be,” said Steve Denis, executive director of the Small Business Finance Association, a trade group for alternative funders.

The states or the federal government may need to protect merchants from a few predatory lenders, but most lenders operate reputably and have a vested interest in helping clients succeed so they can pay back their obligations and become repeat customers, several members of the industry maintained.

“The ability to pay is really a non-issue,” noted Matt Patterson, CEO of Expansion Capital Group and an organizer of the Commercial Finance Coalition, another industry trade group. “I don’t make any money if a borrower doesn’t pay me back, so I don’t make loans where I think there is an inability to pay.”

Outsiders may find interest rates high for alternative loans, but companies providing the capital face high risk and have a short risk horizon, said Scott Talbott, senior vice president of government affairs for the Electronic Transactions Association, whose members include purveyors and recipients of alternative financing. Several other sources said the risks justify the rates.

Besides, a consensus seems to exist among industry leaders that most merchants – unlike many consumers – have the sophistication to make their own decisions on borrowing. Business owners are accustomed to dealing with large amounts of money, and they understand the need to keep investing in their enterprises, sources agreed.

In fact, no one has complained of any small-business lending problems in Illinois to state regulators, said Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation and a member of Gov. Bruce Rauner’s cabinet.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

But the proposed legislation could itself cause problems by placing entrepreneurs at risk, according to Rob Karr, president and CEO of the Illinois Retail Merchants Association, which has 400 members operating 20,000 stores. “It would stifle potential access to capital for small businesses,” he warned.

Quantifying the resulting damage would present a monumental task, but a shortage of capital would clearly burden merchants who need to bridge cash-flow problems, Karr said. Shortfalls can result, for example, when clothing stores need to buy apparel for the coming season or hardware stores place orders in the summer for snow blowers they’ll need in six to eight months, he said.

Restaurant owners and other merchants who rely on expensive equipment also need access to capital when there’s a breakdown or a need to expand to meet competition or take advantage of a market opportunity, Karr observed.

Capital for those purposes could dry up because just about anyone providing non-bank loans to small merchants could find themselves subject to the proposed legislation, including factoring companies, merchant cash advance companies, alternative lenders and non-bank commercial lenders, said the CFC’s Patterson.

Banks and credit unions are exempt, the bill says, but a page or two later it includes provisions written so broadly that it actually includes those institutions, said Ben Jackson, vice president of government relations at the Illinois Bankers Association.

Trade groups representing all of those financial institutions – including banks and non-banks – have joined small-business associations in working against passage SB 2865. “The most important thing is to make sure we’re coordinating with the other groups out there,” the SBFA’s Denis contended. “Actually, Illinois was good practice for the industry in how we’re going to go about dealing with attempts at regulation.”

Patterson of the CFC agreed that associations should coordinate their responses to proposed legislation. “We’ve tried to gather all the affected players in the space and have dialogue with them,” he maintained.

Even though that various associations reacting to the bill generally agreed on principles, their competing messages at first created a cacophony of proposals, according to some. “There was a lot of noise, and I think we’ll all learn from that,” Denis said. “The industry has to learn to speak with one voice to legislators.”

Citing the complexity of dealing with 50 states, 435 members of Congress and 100 senators, Denis said everyone with an interest in small-business lending must work together. “If we don’t, we lose,” he warned.

Many of the groups came together for the first time as they converged upon the Illinois capital of Springfield last month when the state’s Senate Committee on Financial Institutions convened a hearing on the bill. The committee allowed testimony at the hearing from three groups representing opponents. The groups huddled and chose Denis, Jackson and Martha Dreiling, OnDeck Capital Inc. vice president and head of operations.

City of Chicago Treasurer Kurt Summers was the only witness who testified in favor of the bill, according to Jackson. The idea of regulating non-bank commercial lenders in much the same way Illinois oversees lending to individuals arose in Summers’ office, said an aide to Illinois Sen. Jacqueline Collins, D-Chicago. Sen. Collins serves as chairperson of the Financial Institutions Committee and introduced to the bill in the senate.

Sen. Collins declined to be interviewed for this article, and Treasurer Summers and other officials in his of office did not respond to interview requests. However, published reports said Drew Beres, general counsel for Summers, has maintained that transparency, not underwriting, is the main goal. Talbott has met with Sen. Collins and said she’s interested primarily in transparency.

Support for the bill isn’t limited to the Chicago treasurer’s office. Some non-profit lending groups and think tanks back the proposed legislation, opponents agreed. The bill appeals to progressives attempting to shield the public from unsavory lending practices, they maintained.

Politicians may view their support of the bill as a way of burnishing their progressive credentials and establishing themselves as consumer advocates, said opponents of the legislation who requested anonymity. “It’s an important constituency,” one noted. “No one is against small business.”

After listening to testimony at the hearing, committee members voted to move the bill out of committee for further progress through the senate, Jackson said. Eight on the committee voted to move the bill forward, while two voted “present” and one was absent. But most of the senators on the committee said the legislation needs revision through amendments before it could become law, according to Jackson.

The legislative session was scheduled to end May 31. If the bill didn’t pass by then it could come up for consideration in a summer session if the General Assembly chooses to have one, Jackson said. If it does not pass during the summer, it could come to a vote during a two-week “veto session” in the fall or in an early January 2017 “lame duck session.” Unpassed legislation dies at that point and would have to be reintroduced in the regular session that begins later in January 2017, he noted.

Although time is becoming short for the proposed legislation, it’s a high-profile measure that could prompt action, particularly if amendments weaken the rule for underwriting, Jackson said. The Illinois General Assembly sometimes passes important legislation during lame duck sessions, he said, noting that a temporary increase in the state sales tax was enacted that way.

Whatever fate awaits SB 2865, some in the alternative funding business have suspected that the bill came about through an effort by banks to push non-banks out of the market. But cooperation among groups opposed to the proposed legislation appears to lay that notion to rest, according to several sources.

“I don’t get that impression,” Denis said of the allegation that bankers are colluding against alternative commercial lenders. “I think this shows banks and our industry can get together and share the same mission.”

Talbott of the ETA also counted himself among the disbelievers when it comes to conspiracy theories against alternative lenders. “I’d say that’s a misreading of the law and not the case,” he said. “Traditional banks oppose this because it would effectively reduce their options in the same space.”

The interests of banks and non-banks are beginning to coincide as the two sectors intertwine by forming coalitions, noted Jackson of the state bankers’ association. A number of sources cited mergers and partnerships that are occurring among the two types of institutions.

In one example, J.P. Morgan Chase & Co. is using OnDeck’s online technology to help make loans to small businesses. Meanwhile, in another example, SunTrust Banks Inc. has established an online lending division called LightStream.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

And however the industries structure themselves, the need for small-business funding remains acute. Banks, non-banks and merchants agree that the Great Recession that began in 2007 and the regulation it spawned have discouraged banks from lending to small-businesses. The alternative small-business finance industry arose to fill the vacuum, sources said.

That demand draws attention and could lead to bouts of regulation. Although industry leaders say they’re not aware of legislation similar to Illinois SB 2865 pending in other states, they note that New York state legislators discussed small-business lending in April during a subject matter hearing. They also point out that California regulates commercial lending.

Many dread the potential for unintended results as a crazy quilt of regulation spreads across the nation with each state devising its own inconsistent or even conflicting standards. Keeping up with activity in 50 states – not to mention a few territories or protectorates – seems likely to prove daunting.

But mechanisms have been developed to ease the burden of tracking so many legislative and regulatory bodies. The CFC, for instance, employs a government relations team to monitor the states, Patterson said. The ETA combines software and people in the field to deal with the monitoring challenge.

And regulation at the state level can make sense because officials there live “close to the ground,” and thus have a better feel for how rules affect state residents than federal regulators could develop, Sec. Schneider said.

Easier accessibility can also keep make regulators more responsive than federal regulators, according to Sec. Schneider. “It’s easier to get ahold of me than (Director) Richard Cordray at the Consumer Financial Protection Bureau,” he said.

Also, state regulators don’t want to take a provincial view of commerce, Sec. Schneider noted. “As wonderful as Illinois is, we want to do business nationwide,” he joked.

State regulators should do a better job of coordinating among themselves, Sec. Schneider conceded, adding that they are making the attempt. Efforts are underway through the Conference of State Bank Supervisors, a trade association for officials, he said.

At the moment, state legislatures and federal regulators have small-business lending “squarely on their agenda,” the ETA’s Talbott observed. The U.S. Congress isn’t paying close attention to the industry right now because they’re preoccupied with the elections and the presidential nominating conventions, he said.

The goal in Illinois and elsewhere remains to encourage legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that, said Talbott.

At any rate, the industry should unite in a proactive effort to explain the business to legislators, according to Denis. “We need to work with them so that they understand how we fund small businesses,” he said. “That’s the way we can all win.”

Funding Circle Still Focused on “Marketplace” and Small Business

April 13, 2016

At Lendit, AltFinanceDaily asked Funding Circle co-founder and US market head Sam Hodges if the company’s domestic loan volume would eventually outpace originations in the UK. Hodges expressed optimism that it would and explained that the company’s UK origins had simply given that operation a 12-24 month head start.

The company has originated more than $2 billion in loans since inception. A page on their UK site specifies that 1,212,223,380 pounds have gone to british businesses, the equivalent of about $1.7 billion.

Asked if the company would branch out into other types of lending such as consumer, Hodges responded that the company remains dedicated to two principles, “marketplace and small business.” On that note however, he said their UK branch already engages in commercial property loans and didn’t rule out that such a product could eventually be made available in the US.

CAN Capital Crosses $6 Billion in Small Business Funding

April 7, 2016

CAN Capital has surpassed the milestone of providing more than $6 billion in working capital to over 70,000 small businesses over 18 years.

Since they have a strong track record of repeat business, the company has actually made over 170,000 individual fundings across restaurants, medical offices, beauty salons and more. Last year, the company introduced two new special small business loans – TrakLoan, which adjusts daily payments with daily card sales and a monthly installment loan product offering a customer longer terms with higher transaction sizes.

The New York-based company was founded in 1998 and uses propriety data-driven models to underwrite loans and advances. CAN Capital is one of the early companies in the space that has seen much overhaul over the past few years with a slew of new companies offering a variety of working capital products distributed through a number of channels. “There has been an evolution both in product and distribution over the years,” said Daniel DeMeo, CEO of CAN Capital. “From a single type of loan and monolithic distribution, we have come to work with big changes in underwriting and decision making,” he said.

It helps to have a favorable economic environment for small businesses to thrive in. The Federal Reserve, in its part has kept borrowing rates unchanged in a decade with only a marginal hike. Small business borrowing also peaked in February touching 17 percent after hitting a two-year low the previous month.

Alternative Business Funding’s Decade Club

October 22, 2015 The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

“At that time, the industry was a bunch of cowboys. It was an opportunistic industry of very small players,” says Andy Reiser, chairman and chief executive of Strategic Funding Source Inc., a New York-based alternative funder that’s been in business since 2006. “The industry has gone from this cottage industry to a professionally managed industry.”

Indeed, the alternative funding industry for small businesses has grown by leaps and bounds over the past decade. To put it in perspective, more than $11 billion out of a total $150 billion in profits is at risk to leave the banking system over the next five plus years to marketplace lenders, according to a March research report by Goldman Sachs. The proliferation of non-bank funders has taken such a huge toll on traditional lenders that in his annual letter to shareholders, J.P. Morgan Chase & Co. chief executive officer Jamie Dimon warned that “Silicon Valley is coming” and that online lenders in particular “are very good at reducing the ‘pain points’ in that they can make loans in minutes, which might take banks weeks.”

The burgeoning growth of alternative providers is certainly driving banks to rethink how they do business. But increased competition is also having a profound effect on more seasoned alternative funders as well. One of the latest threats to their livelihood is from fintech companies, like Lendio and Fundera,for example, that are using technology to drive efficiency and gaining market share with small businesses in the process.

“Established lenders who want to effectively compete against the new entrants will need to automate as much decisioning as possible, diversify acquisition sources and ensure sufficient growth capital as a means to capture as much market share as possible over the next 12 to 18 months,” says Kim Anderson, chief executive of Longitude Partners, a Tampa-based strategy consulting firm for specialty finance firms.

Of course, there is truth to the adage that age breeds wisdom. Established players understand the market, have a proven track record and have years of data to back up their underwriting decisions. At the same time, however, experience isn’t the only factor that can ensure a company will continue to thrive over the long haul.

WORKING TOWARD THE FUTURE

Indeed, established players have a strong understanding of what they are up against—that they can’t afford to live in the glory of the past if they want to survive far into the future.

“With every business you have to reinvent yourself all the time. That’s what a successful business is about,” says Reiser of Strategic Funding. “You see so many businesses over the years that didn’t reinvent themselves, and that’s why they’re not around.”

Strategic Funding has gone through a number of changes since Reiser, a former investment banker, founded it with six employees. The company, which has grown to around 165 employees, now has regional offices in Virginia, Washington and Florida and has funded roughly $1 billion in loans and cash advances for small to mid-sized businesses since its inception.

One of the ways Strategic Funding has tried to distinguish itself is through its Colonial Funding Network, which was launched in early 2009. CFN is Strategic Funding’s secure servicing platform which enables other companies who provide merchant cash advances, business loans and factoring to “white label” Strategic Funding’s technology and reporting systems to operate their businesses.

“When you’re in a commodity-driven business, you have to find something to differentiate yourself,” Reiser says.

FINDING WAYS TO BE DIFFERENT

That’s exactly what Stephen Sheinbaum, founder of Bizfi (formerly Merchant Cash and Capital) in New York, has tried to do over the years. When the company was founded in 2005, it was solely a funding business. But over the years, it has grown to around 170 employees and has become multi-faceted, adding a greater amount of technology and a direct sales force. Since inception, the Bizfi family of companies has originated more than $1.2 billion in funding to about 24,000 business owners.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Sheinbaum credits newer entrants for continually coming up with new technology that’s better and faster and keeping more established funders on their toes.

“If you don’t adapt, you die,” he says. “Change is the one constant that you face as a business owner.”

David Goldin, chief executive of Capify, a New York-based funder, has a similar outlook, noting that the moment his company comes out with a new idea, it has to come up with another one. “If you’re not constantly innovating you’re in trouble,” he says. “It’s a 24/7 global job.”

Capify, which was known as AmeriMerchant until July, was founded by Goldin in 2002 as a credit card processing ISO. In 2003, the company began focusing all of its efforts on merchant cash advances. Four years later, the company made its first international foray by opening an office in Toronto. The company continued to expand its international presence by opening up offices in the United Kingdom and Australia in 2008. The company now has more than 200 employees globally and hopes to be around 300 or more in the next 12 months, Goldin says. The company has funded about $500 million in business loans and MCAs to date, adjusted for currency rates.

THE CULTURE OF CHANGE

Five or six years ago, Capify’s main competitors were other MCA companies. Now the competition primarily comes from fintech players, and to keep pace Capify has made certain changes in the way it operates. From a human resources standpoint, for instance, Capify switched from business casual attire to casual dress in the office. The company has also been doing more employee-bonding events to make sure morale remains high as new people join the ranks. “We’ve been in hyper-growth mode,” he says.

CAN Capital in New York, another player in the alternative small business finance space with many years of experience under its belt, has also grown significantly (and changed its name several times) since its inception in 1998. The company which began with a handful of employees now has about 450 and has offices in NYC, Georgia, Salt Lake City and Costa Rica. For the first 13 years, the company focused mostly on MCA. Now its business loan product accounts for a larger chunk of its origination dollars.

This year, the company reached the significant milestone of providing small businesses with access to more than $5 billion of working capital, more than any other company in the space. To date, CAN Capital has facilitated the funding of more than 160,000 small businesses in more than 540 unique industries.

Throughout its metamorphosis to what it is today, the company has put into place more formalized processes and procedures. At the same time, the company has tried very hard to maintain its entrepreneurial spirit, says Daniel DeMeo, chief executive of CAN Capital.

One of the challenges established companies face as they grow is to not become so rule-driven that they lose their ability to be flexible. After all, you still need to take calculated risk in order to realize your full potential, he explains. “It’s about accepting failure and stretching and testing enough that there are more wins than there are losses,” says DeMeo who joined the company in March 2010.

ADVICE FOR NEWCOMERS

As the industry continues to grow and new alternative funders enter the marketplace, experience provides a comfort level for many established players.

“The benefit we have that newcomers don’t have is 10 years of data and an understanding of what works and what doesn’t work,” says Reiser of Strategic Funding. With the benefit of experience, Reiser says his company is in a better position to make smarter underwriting decisions. “There are many industries we funded years back that we wouldn’t touch today for a variety of reasons,” he says.

Experienced players like to see themselves as role models for new entrants and say newcomers can learn a lot from their collective experiences, both good and bad. Noting the power of hindsight, Reiser of Strategic Funding strongly advises newcomers to look at what made others in the business successful and internalize these best practices.

One of the dangers he sees is with new companies who think their technology is the key to long-term survival. “Technology alone won’t do it because that too will become a commodity in time,” he says.

Over the years Strategic Funding has learned that as important as technology is, the human touch is also a crucial element in the underwriting process. For example, the last but critical step of the underwriting process at Strategic Funding is a recorded funding call. All of the data may point to the idea that a particular would-be borrower should be financed. But on the call, Strategic Funding’s underwriting team may get a bad vibe and therefore decide not to go forward.

“We look at the data as a tool to help us make decisions. But it’s not the absolute answer,” Reiser says. “We are a combination of human insight and technology. I think in business you need human insight.”

Seasoned alternative funding companies also say that newbies need to implement strong underwritingcontrols that will enable them to weather both up and down markets.

The vast majority of newcomers have never experienced a downturn like the 2008 Financial Crisis, which is where seasoned alternative financing companies say they have a leg up. Until you’ve lived through down cycles, you’re not as focused as protecting against the next one, notes Sheinbaum of Bizfi. “Every 10 years or 15 years or so, there seems to be a systemic crisis. It passes. You just have to be ready for it,” he says.

Goldin of Capify believes that many of today’s start-ups don’t understand underwriting and are throwing money at every business that comes their way instead of taking a more cautious approach. As a funder that has lived through a down market cycle, he’s more circumspect about long-term risk.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

Having a solid capital base is also a key to long-term success, according to veteran funders. Many of the upstarts don’t have an established track record and need to raise equity capital just to stay afloat—an obstacle many long-time funders have already overcome.

Goldin of Capify believes that over time consolidation will swallow up many of the newbies who don’t have a good handle on their business. Hethinks these companies will eventually be shuttered by margin compression and defaults. “It can’t last like this forever,” he says.

In the meantime, competition for small business customers continues to be fierce, which in turn helps keep seasoned players focused on being at the top of their game. Getting too comfortable or complacent isn’t the answer, notes DeMeo of CAN Capital. Instead, established funders should seek to better understand the competition and hopefully surpass it. “Competition should make you stronger if you react to it properly,” he says.

Madden vs. Midland Funding, LLC: What does it mean for Alternative Small Business Lending?

August 13, 2015 On Friday, May 22, 2015, while the rest of us were gearing up for the long Memorial Day weekend, three judges of the United States Court of Appeals for the Second Circuit quietly issued their decision in Madden v. Midland Funding, LLC. Though issued to little fanfare, the decision, if upheld on appeal—may lead to significant changes in consumer and commercial lending by non-bank entities.

On Friday, May 22, 2015, while the rest of us were gearing up for the long Memorial Day weekend, three judges of the United States Court of Appeals for the Second Circuit quietly issued their decision in Madden v. Midland Funding, LLC. Though issued to little fanfare, the decision, if upheld on appeal—may lead to significant changes in consumer and commercial lending by non-bank entities.

Loans that were previously only subject to the usury laws of a single state may now be subject to more restrictive usury laws of multiple jurisdictions. Commercial transactions that could be affected include short-term loans by a number of alternative small business lenders.

The Case

The plaintiff, Saliha Madden, opened a credit card account with a national bank in 2005. Three years later, Madden’s account was charged off with an outstanding balance. The account was later sold to Midland Funding, LLC, a debt purchaser.

In November 2010, Midland sent a collection letter to Madden’s New York residence informing her that interest was still accruing on her account at the rate of 27% per year. In response, Madden filed a class action lawsuit against Midland and its servicer. In her complaint, Madden alleged that Midland had violated state and federal laws by attempting to collect a rate of interest that exceeded the maximum rate set by New York State’s usury laws. Midland countered that as a national bank assignee, it was entitled to the preemption of state usury laws granted to national banks by the National Bank Act (the “NBA”). The district court agreed with Midland and entered judgment in its favor. Madden appealed to the Second Circuit.

After reviewing the record, the Court of Appeals reversed the district court’s decision. The appellate court found that the NBA’s preemption provision did not apply to Midland as a mere bank assignee. Instead, the court held that in order “[t]o apply NBA preemption to an action taken by a non-national bank entity, application of state law to that action must significantly interfere with a national bank’s ability to exercise its power under the NBA.”

The court explained that the NBA’s preemption protections only apply to non-bank entities performing tasks on a bank’s behalf (e.g. bank subsidiaries, third-party tax preparers). If a bank assignee is not performing a task on a national bank’s behalf, the NBA does not protect the assignee from otherwise applicable state usury laws. Therefore, as Midland’s collection efforts were performed on its own behalf and not on behalf of the national bank that originated Madden’s account, the appellate court found that New York’s usury laws were not preempted and that Midland could be subject to New York’s usury restrictions.

Usury Law Compliance

The Madden decision undermines a method of state usury law compliance that I’ll refer to as the “exportation model”. In a typical exportation arrangement, a non-bank lender contracts with a national bank to originate loans that the lender has previously underwritten and approved. After a deal has been funded, the bank sells the loan back to the lender for the principal amount of the loan, plus a fee for originating the deal.

1F.3d —, 2015 U.S. App. LEXIS 8483 (2d Cir. N.Y. May 22, 2015).

The exportation model allows non-bank lenders to benefit from the preemption protections granted to banks under the NBA. Specifically, the NBA provides that a national bank is only subject to the laws of its home state. This provision allows a bank to ‘export’ the generally less restrictive usury laws of its home state to other states where it does business. As bank assignees, lenders that have purchased loans from a bank are only subject to the laws of the originating bank’s home state. This exemption saves these non-bank lenders from having to engage in a state-by-state analysis of applicable usury laws.

The Madden decision, however, casts doubt on the ability of these non-bank assignees to benefit from the NBA’s preemption protections. The Second Circuit’s decision makes clear that non-bank assignees that are not performing essential acts on a bank’s behalf—which would seem to include alternative small business lenders—are not entitled to NBA preemption and are subject to the usury laws of the bank’s home state as well as any otherwise applicable state’s

usury laws.

Aftermath

While the Court of Appeals’ decision foreclosed Midland’s preemption argument, other issues remained unresolved. Specifically, the circuit court did not decide whether the choice-of-law provision in Madden’s cardholder agreement—which provided that any disputes relating to the agreement would be governed by the laws of Delaware—would prevent Madden from alleging violations of New York State usury law.

In the district court proceeding, both parties had agreed that if Delaware law was found to apply, the 27% interest rate would be permissible under that state’s usury laws. The district court, however, did not address the choice-of-law issue because the court had found that the NBA’s preemption protections were sufficient grounds upon which to resolve the case. As the issue had not been addressed, the circuit court remanded the case back to the district court to decide which state’s law controlled.

In the district court proceeding, both parties had agreed that if Delaware law was found to apply, the 27% interest rate would be permissible under that state’s usury laws. The district court, however, did not address the choice-of-law issue because the court had found that the NBA’s preemption protections were sufficient grounds upon which to resolve the case. As the issue had not been addressed, the circuit court remanded the case back to the district court to decide which state’s law controlled.

But before sending the case back down, the appellate court made two points worth noting. First, the court stated that “[w]e express no opinion as to whether Delaware law, which permits a ‘bank’ to charge any interest rate allowable by contract…would apply to the defendants, both of which are non-bank entities.” The court’s statement suggests that it may not have completely agreed with the parties that 27% would be a permissible interest rate under Delaware law.

Second, the court highlighted a split in New York case law on the enforceability of choice-of-law provisions where claims of usury are involved. Generally, courts will refuse to enforce a choice-of-law provision if the application of the chosen state’s law would violate a public policy of the forum state. As usury is sometimes considered an issue of public policy, the enforceability of such clauses is commonly a point of contention in usury actions. The cases cited by the Court of Appeals show that some courts in New York have enforced choice-of-law provisions—even where the interest rate permitted by the chosen state would violate New York’s usury laws—while other New York courts have refused to enforce such provisions in light of public policy concerns.

New York, however, is by no means the only state with usury laws that are less than straightforward. The general complexity of state usury laws is evidenced by the circuit court’s hesitation to agree with Madden’s concession that a 27% interest rate would be permissible under Delaware law. The court made clear that an argument could be made that the rate was usurious under both New York and Delaware law.

Madden’s Impact

An important legal principle that was not addressed in either the district or circuit court proceedings is the ‘valid when made’ doctrine of assignment law. The ‘valid when made’ doctrine provides that a loan that is valid at the time it is made will remain valid even if the loan is subsequently assigned. This doctrine may have led to a different outcome in the case had Midland argued it before the district or circuit court. Midland is now appealing the Second Circuit’s decisions and many expect a ‘valid when made’ argument to be a primary point of Midland’s appeal (SEE NOTE BELOW). If this argument is successful, the practical impact of Madden would be greatly diminished.

NOTE: The Second District Court rejected a request to rehear the case. Read that decision here.

In the meantime, the Madden decision will likely increase the importance of choice-of-law analysis in relation to usury law. Assignees that previously relied on the NBA’s preemption provision as a method of state usury law compliance will now need to address the enforceability of their contractual choice-of-law clauses where claims of usury may become an issue. This analysis is often a complex undertaking because states take varying views of what constitutes usury as well as whether or not usury is an issue of public policy.

While the Madden decision may have been published before the long Memorial Day weekend, analyzing its consequences will likely keep many non-bank lenders (and their attorneys) busy, even on their days off.

STRATEGIC FUNDING SOURCE NAMES ALAN NUSSBAUM VICE PRESIDENT OF BUSINESS DEVELOPMENT

April 20, 2015NEW YORK (April 20, 2015) – Strategic Funding Source, Inc., a leading provider of small business financing, today announced that Alan Nussbaum has joined the company as Vice President of Business Development.

In his role, Nussbaum will be responsible for developing untapped affinity relationships and other industry opportunities including the opening of new channels in emerging markets, which seek access to capital. He will report to David Sederholt, the Chief Operating Officer of Strategic Funding Source and will be based at the company’s New York City headquarters.

Nussbaum is one of the early entrants to the small business alternative financing industry and spent over 16 years leading sales initiatives with CAN Capital, the largest company in the industry. During his tenure at CAN Capital, he contributed to the growth of the company by developing diverse sales channels and will now bring his years of experience to Strategic Funding Source. As with several executives of Strategic Funding Source, Nussbaum started his career as the owner operator of small businesses, which included restaurants and a food service supply company.

“We’re pleased to welcome Alan to the management team at Strategic Funding Source,” said Sederholt. “I have known him for over 20 years as a respected member of the industry and look forward to him contributing his vast experience and insights to our company.”

“Over the course of my career, I have seen alternative finance products evolve into the mainstream direct solution for small businesses,” said Nussbaum. “I’m excited to join Strategic Funding Source, which has never forgotten the importance of people in their relationships. The company has a proven record as a leader and innovator that combines technology with a human touch. I look forward to helping both Strategic Funding Source and the small businesses we serve continue to grow.”

Nussbaum is a graduate of Pratt Institute in Brooklyn, N.Y.

About Strategic Funding Source, Inc.

Strategic Funding Source finances the future of small businesses utilizing advanced technology and human insight. Established in 2006, the company is headquartered in New York City and maintains regional offices in Virginia, Washington state, and Florida. The company has served thousands of small business clients across the U.S. and Australia, having financed over $800MM since inception. Visit www.sfscapital.com to learn more about Strategic Funding Source, its financing products and partnership opportunities.