Canada’s Alternative Financing Market Is Taking Off

May 20, 2019

Canadians have been slow out of the gate when it comes to mass adoption of alternative financing, but times are changing, presenting opportunities and challenges for those who focus on this growing market.

Historically, the Canadian credit market has traditionally been dominated by a few main banks; consumers or businesses that weren’t approved for funding through them didn’t have a multitude of options. The door, however, is starting to unlock, as awareness increases about financing alternatives and speed and convenience become more important, especially to younger Canadians.

Indeed, the Canada alternative finance market experienced considerable growth in 2017—the latest period for which data is available. Market volume reached $867.6 million, up 159 percent from $334.5 million in 2016, according to a report by the Cambridge Centre for Alternative Finance and the Ivey Business School at Western University. Balance sheet business lending makes up the largest proportion of Canadian alternative finance, accounting for 57 percent of the market; overall, this model grew 378 percent to $494 million in 2017, according to the report.

Industry participants say the growth trajectory in Canada is continuing. It’s being driven by a number of factors, including tightening credit standards by banks, growing market demand for quick and easy funding and broader awareness of alternative financing products.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To be sure, the Canadian market is much smaller than the U.S. and alternative finance isn’t ever expected to overtake it in size or scope. That’s because while the country is huge from a geographic standpoint, it’s not as densely populated as the U.S., and businesses are clustered primarily in a few key regions.

To put things in perspective, Canada has an estimated population of around 37 million compared with the U.S.’s roughly 327 million. On the business front, Canada is similar to California in terms of the size and scope of its small business market, estimates Paul Pitcher, managing partner at SharpShooter, a Toronto-based funder, who also operates First Down Funding in Annapolis, Md.

Nonetheless, alternative lenders and funders in Canada are becoming more of a force to be reckoned with by a number of measures. Indeed, a majority of Canadians now look to online lenders as a viable alternative to traditional financial institutions, according to the 2018 State of Alternative Lending in Canada, a study conducted by online comparison service Smarter Loans.

Of the 1,160 Canadians surveyed about the loan products they have recently received, only 29 percent sought funding from a traditional financial institution, such as a bank, the study found. At the same time, interest in alternative loans has been on an upward trajectory since 2013. Twenty-four percent of respondents indicated they sought their first loan with an alternative lender in 2018. Overall, nearly 54 percent of respondents submitted their first application with a non-traditional lender within the past three years, according to the report.

Like in the U.S., there’s a mix of alternative financing companies in Canada. A number of companies offer factoring and invoicing and payday loans. But there’s a growing number focused on consumer and business lending as well as merchant cash advance.

Some major players in the Canadian alternative lending or funding landscape include Fairstone Financial (formerly CitiFinancial Canada), an established non-bank lender that recently began offering online personal loans in select provinces; Lendified, an online small business lender; Thinking Capital, an online small business lender and funder; easyfinancial, the business arm of alternative financial company goeasy Ltd. that focuses on lending to non-prime consumers; OnDeck, which offers small business financing loans and lines of credit; and Progressa, which provides consolidation loans to consumers.

By comparison, the merchant cash advance space has fewer players; it is primarily dominated by Thinking Capital and less than a dozen smaller companies, although momentum in the space is increasing, industry participants say.

“The U.S. got there 10 years ago, we’re still catching up,” says Avi Bernstein, chief executive and co-founder of 2M7 Financial Solutions, a Toronto-based merchant cash advance company.

OPPORTUNITIES ABOUND

In terms of opportunities, Canada has a population that is very used to dealing with major banks and who are actively looking for alternative solutions that are faster and more convenient, says Sherbatov of Smarter Loans. This is especially true for the younger population, which is more tech-savvy and prefers to deal with finances on the go, he says.

Because the alternative financing landscape is not as developed in Canada, new and innovative products can really make a significant impact and capture market share. “We think this is one of the key reasons why there’s been such an influx of international companies, from the U.S. and U.K. for example, that are looking to enter the Canadian market,” he says.

Just recently, for example, Funding Circle announced it would establish operations in Canada during the second half of 2019. “Canada’s stable, growing economy coupled with good access to credit data and progressive regulatory environment made it the obvious choice,” said Tom Eilon, managing director of Funding Circle Canada, in a March press release announcing the expansion. “The most important factor [in coming to Canada] though was the clear need for additional funding options among Canadian SMEs,” he said.

OnDeck, meanwhile, recently solidified its existing business in Canada through the purchase of Evolocity Financial Group, a Montreal-based small business funder. The combined firm represents a significantly expanded Canadian footprint for both companies. OnDeck began doing business in Canada in 2014 and has originated more than CAD$200 million in online small business loans there since entering the market. For its part, Evolocity has provided over CAD$240 million of financing to Canadian small businesses since 2010.

“There is an enormous need among underserved Canadian small businesses to access capital quickly and easily online, supported by trusted and knowledgeable customer service experts,” Noah Breslow, OnDeck’s chairman and chief executive, said in a December 2018 press release announcing the firms’ nuptials.

There are also a number of home grown Canadian companies that are benefiting from the growth in the alternative financing market.

2M7 Financial Solutions, which focuses on merchant cash advances, is one of these companies. It was founded in 2008 to meet the growing credit needs within the small and medium-sized business market at a time when businesses were having trouble in this regard.

But only in the past few years has MCA in Canada really started picking up to the point where Bernstein, the chief executive, says the company now receives applications from about 200 to 300 companies a month, which represents more than 50 percent growth from last year.

“We’re seeing more quality businesses, more quality merchants applying and the average funding size has gone up as well,” he says.

NAVIGATING THROUGH CHALLENGES

Despite heightened growth possibilities, there are also significant headwinds facing companies that are seeking to crack the Canadian alternative financing market. For various reasons, some companies have even chosen to pull back or out of Canada and focus their efforts elsewhere. Avant, for example, which offers personal loans in the U.S., is no longer accepting new loan applications in Canada at this time, according to its website. Capify also recently exited the Canadian business it entered in 2007, even as it continues to bulk up in the U.K. and Australia.

One of the challenges alternative lenders face in Canada is distrust of change. Since Canadians are so used to dealing with only a few major financial institutions to handle all their finances, they are skeptical to change this behavior, especially when the customer experience shifts from physical branches to online apps and mobile devices, says Sherbatov of Smarter Loans. He notes that adoption of fintech products in Canada has lagged in recent years, partially because there has been a lack of awareness and trust in new financial products available.

One way Smarter Loans has been working to strengthen this trust is by launching a “Smarter Loans Quality Badge,” which acts as a certification for alternative financing companies on its platform. It is issued to select companies that meet specified quality standards, including transparency in fees, responsible lending practices, customer support and more, he says.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

Another challenge that impacts alternative lenders in the consumer space is having restricted access to alternative data sources. Because of especially strict consumer privacy laws, access is “substantially more limited” than it is in any other geography,” says Jason Mullins, president and chief executive of goeasy, a lending company based in Mississauga, Ontario, that provides consumer leasing, unsecured and secured personal loans and merchant point-of-sale financing.

From a lending perspective, goeasy focuses on the non-prime consumer—generally those with credit scores of under 700. Mullins says the market consists of roughly 7 million Canadians, about a quarter of the population of Canadians with credit scores. The non-prime consumer market is huge and has tremendous potential, he says, but it’s not for the faint of heart.

Another issue facing alternative lenders is the relative difficulty of raising loan capital from institutional lenders, says Ali Pourdad, co-founder and chief executive of Progressa, which recently reached the $100 million milestone in funded loans for underserved Canadian consumers. “The onus is on the alternative lenders to ensure they have good lending practices and are underwriting responsibly,” he says.

What’s more, household debt to income ratios in Canada are getting progressively worse, with Canadians taking on too much debt relative to what they can afford, Pourdad says. As the situation has been deteriorating over time, there is inherently more risk to originators as well as the capital that backs them. “Originators, now more than ever, have to be cautious about their lending practices and ensure their underwriting is sound and that they are being responsible,” he says.

On the small business side of alternative lending, getting the message out to would-be customers can be a challenge in Canada. In U.S. there are thousands of ISOs reaching out to businesses, whereas in Canada, most funders have a direct sales force, with a much smaller portion of their revenue coming from referral partners, says Adam Benaroch, president of CanaCap, a small business funder based in Montreal.

He predicts this will change over time as the business matures and more funders enter the space, giving ISOs the ability to offer a broader array of financing products at competitive rates. “I think we’re going to see pricing go down and more opportunities develop, and as this happens, the business is going to grow, which is exactly what has happened in the U.S,” he says.

Generally speaking, Canadian businesses are still somewhat skeptical of merchant cash advance and require considerable hand-holding to become comfortable with the idea.

“You can’t wait for them to come to you, you have to go to them and explain what the products are,” says Pitcher of SharpShooter, the MCA funding company.

While Pitcher predicts more companies will continue to enter the Canadian alternative financing market, he doesn’t think it will be completely overrun by new entrants—the market simply isn’t big enough, he says. “It’s not for everyone,” he says.

OnDeck Slips To #3 in Tight Pack of Top Small Business Lenders

May 3, 2019 With most 2019 Q1 earnings in for public companies, the industry’s biggest lenders are off to the races. Square reported on Wednesday that Square Capital, its business lending arm, originated $508 million in loans in the first quarter of the year. Meanwhile, OnDeck originated $636 million this quarter, according to its earnings report released yesterday. Kabbage, which is not a public company, has been trailing very closely behind OnDeck for the last few years but someone familiar with the company said that Kabbage’s originations in the first quarter of this year surpassed OnDeck’s.

With most 2019 Q1 earnings in for public companies, the industry’s biggest lenders are off to the races. Square reported on Wednesday that Square Capital, its business lending arm, originated $508 million in loans in the first quarter of the year. Meanwhile, OnDeck originated $636 million this quarter, according to its earnings report released yesterday. Kabbage, which is not a public company, has been trailing very closely behind OnDeck for the last few years but someone familiar with the company said that Kabbage’s originations in the first quarter of this year surpassed OnDeck’s.

Then there is PayPal, which has not released official origination numbers for 2019 Q1. But earlier statements from PayPal that they had surpassed a billion dollars in quarterly small business funding in 2018 (already more than OnDeck), would put it in the #1 slot for originations. Additionally, a comment made by PayPal CEO Dan Schulman during the company’s earnings call last week implied that its Q1 2019 earnings are again over a billion dollars.

PayPal’s estimated originations number represents its US and international originations, including their business financing products available in the UK, Australia, Germany and Mexico. Likewise, OnDeck’s number represents originations from the US along with its smaller markets in Australia and Canada.

Square Capital operates exclusively in the US, so its originations number is US-only. And Kabbage’s undisclosed estimated originations number represents purely US originations.

| Company Name | 2019 Q1 Funding Volume |

| PayPal | $1,000,000,000+ |

| Kabbage | $650,000,000* |

| OnDeck | $636,000,000 |

| Square | $508,000,000 |

Online Loans You Can Take To The Bank

April 16, 2019

OnDeck, the reigning king of small business lending among U.S. financial technology companies, is sharpening its business strategies. Among its new initiatives: the company is launching an equipment-finance product this year, targeting loans of $5,000 to $100,000 with two-to-five year maturities secured by “essential-use equipment.”

In touting the program to Wall Street analysts in February, OnDeck’s chief executive, Noah Breslow, declared that the $35 billion, equipment-finance market is “cumbersome” and he pronounced the sector “ripe for disruption.”

While those performance expectations may prove true – the first results of OnDeck’s product launch won’t be seen until 2020 – Breslow’s message seemed to conflict with OnDeck’s image as a public company. Rather than casting itself as a disruptor these days, OnDeck emphasizes the ways that its business is melding with mainstream commerce and finance.

Consider that the New York-based company, which saw its year-over-year revenues rise 14% to $398.4 million in 2018, is collaborating with Visa and Ingo Money to launch an “Instant Funding” line-of-credit that funnels cash “in seconds” to business customers via their debit cards. With the acquisition of Evolocity Financial Group, it is also expanding its commercial lending business in Canada, a move that follows its foray into Australia where, the company reports, loan-origination grew by 80% in 2018.

Consider that the New York-based company, which saw its year-over-year revenues rise 14% to $398.4 million in 2018, is collaborating with Visa and Ingo Money to launch an “Instant Funding” line-of-credit that funnels cash “in seconds” to business customers via their debit cards. With the acquisition of Evolocity Financial Group, it is also expanding its commercial lending business in Canada, a move that follows its foray into Australia where, the company reports, loan-origination grew by 80% in 2018.

Perhaps most significant was the 2018 deal that OnDeck inked with PNC Bank, the sixth-largest financial institution in the U.S. with $370.5 billion in assets. Under the agreement, the Pittsburgh-based bank will utilize OnDeck’s digital platform for its small business lending programs. Coming on top of a similar arrangement with megabank J.P. Morgan Chase, the country’s largest with $2.2 trillion in assets, the PNC deal “suggests a further validation of OnDeck’s underlying technology and innovation,” asserts Wall Street analyst Eric Wasserstrom, who follows specialty finance for investment bank UBS.

“It also reflects the fact that doing a partnership is a better business model for the big banks than building out their own platforms,” he says. “Both banks (PNC and J.P. Morgan) have chosen the middle ground: instead of building out their own technology or buying a fintech company, they’ll rent.

“J.P. Morgan has a loan portfolio of $1 trillion,” Wasserstrom explains. “It can’t earn any money making loans of $15,000 or $20,000. Even if it charged 1,000 percent interest for those loans,” he went on, “do you know how much that will influence their balance sheet? How many dollars do think they are going to earn? A giant zero!”

“J.P. Morgan has a loan portfolio of $1 trillion,” Wasserstrom explains. “It can’t earn any money making loans of $15,000 or $20,000. Even if it charged 1,000 percent interest for those loans,” he went on, “do you know how much that will influence their balance sheet? How many dollars do think they are going to earn? A giant zero!”

Similarly, Wasserstrom says, spending the tens of millions of dollars required to develop the state-of-the art technology and expertise that would enable a behemoth like J.P. Morgan or a super-regional like PNC to match a fintech’s capability “would still not be a big needle-mover. You’d never earn that money back. But by partnering with a fintech like OnDeck,” he adds, “banks like J.P Morgan and PNC get incremental dollars they wouldn’t otherwise have.”

The alliance between OnDeck and old-line financial institutions is one more sign, if one more sign were needed, that commercial fintech lenders are increasingly blending into the established financial ecosystem.

Not so long ago companies like OnDeck, Kabbage, PayPal, Square, Fundation, Lending Club, and Credibly were viewed by traditional commercial banks and Wall Street as upstart arrivistes. Some may still bear the reputation as disruptors as they continue using their technological prowess to carve out niche funding areas that banks often neglect or disdain.

Yet many fintechs are forming alliances with the same financial institutions they once challenged, helping revitalize them with new product offerings. Other financial technology companies have bulked up in size and are becoming indistinguishable from any major corporation.

Big Fintechs are securitizing their loans with global investment banks, accessing capital from mainline financial institutions like J.P. Morgan, Goldman Sachs and Wells Fargo, and finding additional ways — including becoming publicly listed on the stock exchanges – to tap into the equity and debt markets.

One example of the maturation process: through mid-2018, Atlanta-based Kabbage has securitized $1.5 billion in two bond issuances, 30% of its $5 billion in small business loan originations since 2008.

One example of the maturation process: through mid-2018, Atlanta-based Kabbage has securitized $1.5 billion in two bond issuances, 30% of its $5 billion in small business loan originations since 2008.

In addition, fintechs have been raising their industry’s profile with legislators and regulators in both state and federal government, as well as with customers and the public through such trade associations as the Internet Lending Platform Association and the U.S. Chamber of Commerce. Both individually and through the trade groups, these companies are building goodwill by supporting truth-in-lending laws in California and elsewhere, promoting best practices and codes of conduct, and engaging in corporate philanthropy.

Rather than challenging the established order, S&P Global Market Intelligence recently noted in a 2018 report, this cohort of Big Fintech is increasingly burrowing into it. This can especially be seen in the alliances between fintech commercial lenders and banks.

“Bank channel lenders arguably have the best of both worlds,” Nimayi Dixit, a research analyst at S&P Global Market Intelligence wrote approvingly in a 2018 report. “They can export credit risk to bank partners while avoiding the liquidity risks of most marketplace lending platforms. Instead of disrupting banks, bank channel lenders help (existing banks) compete with other digital lenders by providing a similar customer experience.”

It’s a trend that will only accelerate. “We expect more digital lenders to incorporate this funding model into their businesses via white-label or branded services to banking institutions,” the S&P report adds.

Forming partnerships with banks and diversifying into new product areas is not a luxury but a necessity for Fundation, says Sam Graziano, chief executive at the Reston (Va.)-based platform. “You can’t be a one-trick pony,” he says, promising more product launches this year.

Fundation has been steadily making a name for itself by collaborating with independent and regional banks that utilize its platform to make small business loans under $150,000. In January, the company announced formation of a partnership with Bank of California in which the West Coast bank will use Fundation’s platform to offer a digital line of credit for small businesses on its website.

Fundation lists as many as 20 banks as partners, including most prominently a pair of tech-savvy financial institutions — Citizens Bank in Providence, R.I. and Provident Bank in Iselin, N.J. — which have been featured in the trade press for their enthusiastic embrace of Fundation.

Fundation lists as many as 20 banks as partners, including most prominently a pair of tech-savvy financial institutions — Citizens Bank in Providence, R.I. and Provident Bank in Iselin, N.J. — which have been featured in the trade press for their enthusiastic embrace of Fundation.

John Kamin, executive vice president at $9.8 billion Provident reports that the bank’s “competency” is making commercial loans in the “millions of dollars” and that it had generally shunned making loans as meager as $150,000, never mind smaller ones. But using Fundation’s platform, which automates and streamlines the loan-approval process, the bank can lend cheaply and quickly to entrepreneurs. “We’re able to do it in a matter of days, not weeks,” he marvels.

Not only can a prospective commercial borrower upload tax returns, bank statements and other paperwork, Kamin says, “but with the advanced technology that’s built in, customers can provide a link to their bank account and we can look at cash flows and do other innovative things so you don’t have to wait around for the mail.”

Provident reserves the right to be selective about which loans it wants to maintain on its books. “We can take the cream of the crop” and leave the remainder with Fundation, the banker explains. “We have the ability to turn that dial.”

The partnership offers additional side benefits. “A lot of folks who have signed up (for loans) are non-customers and now we have the ability to market to them,” he says. “After we get a small business to take out a loan, we hope that we can get deposits and even personal accounts. It gives us someone else to market to.”

As a digital lender, Provident can now contend mano a mano with another well-known competitor: J.P. Morgan Chase. “This is the perfect model for us,” says Kamin, “it gives us scale. You can’t build a program like this from scratch. Now we can compete with the big guys. We can compete with J.P. Morgan.”

For Fundation, which booked a half-billion dollars in small business loans last year, doing business with heavily regulated banks puts its stamp on the company. It means, for example, that Fundation must take pains to conform to the industry’s rigid norms governing compliance and information security. But that also builds trust and can result in client referrals for loans that don’t fit a bank’s profile. “For a bank to outsource operations to us,” Graziano says, “we have to operate like a bank.”

Bankrolled with a $100 million line of credit from Goldman Sachs, Fundation’s interest rate charges are not as steep as many competitors’. “The average cost of our loans is in the mid-to-high teens and that’s one reason why banks are willing to work with us,” Graziano says. “Our loans,” he adds, “are attractively structured with low fees and coupon rates that are not too dramatically different from where banks are. We also don’t take as much risk as many in the (alternative funding) industry.”

Despite its establishment ties, Graziano says, Fundation will not become a public company anytime soon. “Going public is not in our near-term plans,” he told AltFinanceDaily. Doing business as a public company “provides liquidity to shareholders and the ability to use stock as an acquisition tool and for employees’ compensation,” he concedes. “But you’re subject to the relentlessly short-term focus of the market and you’re in the public eye, which can hurt long-term value creation.”

Graziano reports, however, that Fundation will be securitizing portions of its loan portfolio by yearend 2020.

PayPal Working Capital, a division of PayPal Holdings based in San Jose, and Square Inc. of San Francisco, are two Big Fintechs that branched into commercial lending from the payments side of fintech. PayPal began making small business loans in 2013 while Square got into the game in 2014. In just the last half-decade, both companies have leveraged their technological expertise, massive data collections, data-mining skills, and catbird-seat positions in the marketplace to burst on the scene as powerhouse small business lenders.

PayPal Working Capital, a division of PayPal Holdings based in San Jose, and Square Inc. of San Francisco, are two Big Fintechs that branched into commercial lending from the payments side of fintech. PayPal began making small business loans in 2013 while Square got into the game in 2014. In just the last half-decade, both companies have leveraged their technological expertise, massive data collections, data-mining skills, and catbird-seat positions in the marketplace to burst on the scene as powerhouse small business lenders.

With somewhat similar business models, the pair have also surfaced as head-to-head competitors, their stock prices and rivalry drawing regular commentary from investors, analysts and journalists. Both have direct access to millions of potential customers. Both have the ability to use “machine learning” to reckon the creditworthiness of business borrowers. Both use algorithms to decide the size and terms of a loan.

Loan approval — or denials — are largely based on a customer’s sales and payments history. Money can appear, sometimes almost magically in minutes, in a borrower’s bank account, debit card or e-wallet. PayPal and Square Capital also deduct repayments directly from a borrower’s credit or debit card sales in “financing structures similar to merchant cash advances,” notes S&P.

At its website, here is how PayPal explains its loan-making process. “The lender reviews your PayPal account history to determine your loan amount. If approved, your maximum loan amount can be up to 35% of the sales your business processed through PayPal in the past 12 months, and no more than $125,000 for your first two loans. After you’ve completed your first two loans, the maximum loan amount increases to $200,000.”

PayPal, which reports having 267 million global accounts, was adroitly positioned when it commenced making small business loans in 2013. But what has really given the Big Fintech a boost, notes Levi King, chief executive and co-founder at Utah-based Nav — an online, credit-data aggregator and financial matchmaker for small businesses – was PayPal’s 2017 acquisition of Swift Financial. The deal not only added 20,000 new business borrowers to its 120,000, reported TechCrunch, but provided PayPal with more sophisticated tools to evaluate borrowers and refine the size and terms of its loans.

“PayPal had already been incredibly successful using transactional data obtained through PayPal accounts,” King told AltFinanceDaily, “but they were limited by not having a broad view of risk.” It was upon the acquisition of Swift, however, that PayPal gained access to a “bigger financial envelope including personal credit, business credit, and checking account information,” King says, adding: “The additional data makes it way easier for PayPal to assess risk and offer not just bigger loans, but multiple types of loans with various payback terms.”

While PayPal used the Swift acquisition to spur growth and build market share, its rival Square — which is best known for its point-of-sale terminals, its smartphone “Cash App,” and its Square Card — has employed a different strategy.

OF A FREIGHT TRAIN

By selling off loans to third-party institutional investors, who snap them up on what Square calls a “forward-flow basis,” the Big Fintech barged into small business lending with the subtlety of a freight train. In just four years, Square originated 650,000 loans worth $4.0 billion, a stunning rise from the modest base of $13.6 million in 2014.

Square’s third-party funding model, moreover, demonstrates the benefits afforded from being deeply immersed in the financial ecosystem. Off-loading the loans “significantly increases the speed with which we can scale services and allows us to mitigate our balance sheet and liquidity risk,” the company reported in its most recent 10K filing.

Square’s third-party funding model, moreover, demonstrates the benefits afforded from being deeply immersed in the financial ecosystem. Off-loading the loans “significantly increases the speed with which we can scale services and allows us to mitigate our balance sheet and liquidity risk,” the company reported in its most recent 10K filing.

Square does not publicly disclose the entire roster of its third-party investors. But Kim Sampson, a media relations manager at Square, told AltFinanceDaily that the Canada Pension Plan Investment Board — “a global investment manager with more than CA$300 billion in assets under management and a focus on sustained, long term returns” – is one important loan-purchaser.

Square also offers loans on its “partnership platform” to businesses for whom it does not process payments. And late last year the company introduced an updated version of an old-fashioned department store loan. Known as “Square Installments,” the program allows a merchant to offer customers a monthly payment plan for big-ticket purchases costing between $250 and $10,000.

Which model is superior? PayPal’s — which retains small business loans on its balance sheet — or Square’s third-party investor program? “The short answer,” says UBS analyst Wasserstrom, “is that PayPal retains small business loans on its balance sheet, and therefore benefits from the interest income, but takes the associated credit and funding risk.”

Meanwhile, as PayPal and Square stake out territory in the marketplace, their rivalry poses a formidable challenge to other competitors.

Both are well capitalized and risk-averse. PayPal, which reported $4.23 billion in revenues in 2018, a 13% increase over the previous year, reports sitting on $3.8 billion in retained earnings. Square, whose 2018 revenues were up 51 percent to $3.3 billion, reported that — despite losses — it held cash and liquid investments of $1.638 billion at the end of December.

King, the Nav executive, observes that Able, Dealstruck, and Bond Street – three once-promising and innovative fintechs that focused on small business lending – were derailed when they could not overcome the double-whammy of high acquisition costs and pricey capital.

“None of them were able to scale up fast enough in the marketplace,” notes King. “The process of institutionalization is pushing out smaller players.”

Capify Secures Massive Credit Facility from Goldman Sachs

January 16, 2019 Capify, which serves the UK and Australia markets, announced this morning that it has secured a £75 million (roughly $95 million) credit facility from Goldman Sachs.

Capify, which serves the UK and Australia markets, announced this morning that it has secured a £75 million (roughly $95 million) credit facility from Goldman Sachs.

“This credit facility validates our company as a leader in the marketplace and underlines the strength of our business model to provide simple, affordable and smart financial options to UK and Australian small businesses,” Capify founder and CEO David Goldin said.

The achievement is notable for a company that is not venture capital or private equity based.

“Capify is one of the leading small business providers in the UK and Australia,” said Pankaj Soni, Executive Director at Goldman Sachs Private Capital. “We have been impressed with the management team, business model and innovative finance solutions for small businesses [and] we look forward to supporting their growth in the years ahead.”

Capify provides MCA deals and business loans to small business merchants. Goldin told AltFinanceDaily that MCA deals make up about 75% of Capify’s business in the UK, with about 25% in business loans. The ratio in Australia is the inverse, he said.

Goldin entered the UK and Australian markets in 2008 and said that they have become hyper competitive over the last three to four years. He acknowledged that both markets are still far smaller than the U.S. though.

“You don’t see these big crazy origination volumes [that you do in the U.S.]…[for us,] it’s about building a profitable, growing company.”

According to Goldin, another difference between the U.S. market and the UK and Australian markets is that the latter has embraced self-regulation much faster than the U.S. For instance, in Australia, there have been recommendations from semi-governmental organizations on how funders should perform, including the publishing of APR in contracts for business loans.

“These markets have moved quicker for self-regulation in the last two or three years than the U.S. market has moved in 10 years.”

This may be a matter of other countries learning from the experiences of the U.S., he said.

Goldin said that in addition to scaling Capify, the money from the facility will also be used to launch partner/broker programs in the UK and Australia. So far, the majority of Capify’s leads come from internal direct marketing efforts.

Capify employs more than 120 people divided between two offices, one in Manchester, England and the other in Sydney, Australia.

Goldin integrated the U.S. operations of Capify to Strategic Funding (now Kapitus) in 2017.

How a Computer Game Master Applied His Talents to Online Lending

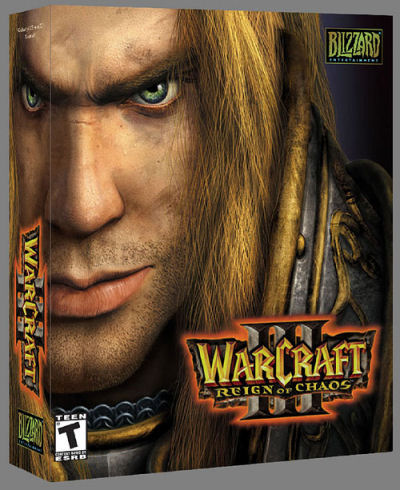

December 28, 2018Eden Amirav is co-founder and CEO of Lending Express. The 29 year old spends his days trying to grow his company, an online lending platform for small businesses. But about 15 years ago, as a teenager in Israel, he spent his evenings and school breaks fighting orcs, defending construct units and mostly defeating enemies in a fictional world called Azeroth. He was a master player of the computer game, Warcraft III, released in 2002. But calling Amirav “a master player” is even an understatement since Amirav was the master player in his country. He was Israel’s #1 champion in Warcraft III for four consecutive years from 2003 to 2006.

Amirav started when he was about 12 and by the time he was 14, he became his country’s best competitive player. “I was very nervous,” Amirav said about the final game of his first national tournament. He was 14 and his opponent was 18.

“I saw him as a real adult,” Amirav said.

His family and friends were among more than one thousand people watching the final game in an auditorium – rooting him on as they observed the virtual duel projected on a big screen above the stage.

“I was an underdog and my winning was a big surprise,” Amirav said. “It was a shock when I won the tournament because I was very young.”

Amirav played the game as the humans (as a opposed to the race called the “orcs”) and his chosen hero was Archmage, known for its ability to “regenerate sorceresses,” among other things. If this makes absolutely no sense, you’re not alone.

What is clear, though, is that Amirav said that his mastery of Warcraft III helped him years later when he started creating companies.

What is clear, though, is that Amirav said that his mastery of Warcraft III helped him years later when he started creating companies.

“I think the most direct connection between gaming and becoming an entrepreneur is speed,” Amirav said. “To play [the game] on a professional level you have to be very quick with computers. Having those skills led me to programming…and when you’re working on a startup and developing code, if you do this stuff very quickly, you can accomplish a lot in a shorter time than your competition, [which] really gives you an advantage.”

Amirav said that in his heyday as a computer gamer, he performed more than 200 actions per minute. (That means either clicks on the mouse or taps on the keyboard.) Amirav has used his ability to move fast to expand Lending Express rather quickly in the U.S. The platform, which connects small business owners to funders, launched first in Australia in October 2016. In June of this year, the company announced its official entrance into the U.S. market, and Amirav said that Lending Express has assisted in funding almost as much volume in the U.S. in a little over six months as it has in Australia in over two years.

He said he expects the U.S. to surpass Australia in funding volume in 2019 and he plans to grow its U.S. office, which is now a one-person operation in San Matteo, CA.

Also, Amirav said that they should be announcing shortly $100 million in funding facilitated by Lending Express. He said their total volume is about $98 million right now.

Even though Amirav competed one-on-one, he did not practice alone. In fact, he said he was always part of what he called a “clan,” where gamers would practice together. Now, instead of practicing with a clan, Amirav works with and leads a team of more than 30 employees at the Lending Express headquarters in Tel Aviv.

“You get to know these people and it’s like a band,” Amirav said of the his gaming clan. “You need everyone to be playing at the right tempo.”

Editor’s note: A profile on Amirav in Forbes incorrectly attributed his gaming background to World of Warcraft. That is another game with an entirely different style of play and objectives. Amirav was a champion of Warcraft 3, a Player vs. Player (PvP) game format. World of Warcraft is a Massive Multiplayer Online Role Playing Game (MMORPG).

Open Banking — A U.S. Pipe Dream or Near-Term Reality?

December 18, 2018 Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. It’s a movement that’s been gaining ground globally in recent years. Regulations in the U.K., a forerunner in open banking, went into effect in January, while several other countries including Australia and Canada are at varying stages of implementation or exploration.

For the U.S., however, the time frame for comprehensive adoption of open banking is murkier. Industry participants say the prospects are good, but the sheer number of banks and the fragmented regulatory regime makes wholesale implementation immensely more complicated. Nonetheless, industry watchers see promise in the budding grass-roots initiative among banks and technology companies to develop data-sharing solutions. Regulators, too, have started to weigh in on the topic, showing a willingness to further explore how open banking could be applied in U.S. markets.

Open banking “is a global phenomenon that has great traction,” says Richard Prior, who leads open banking policy at Kabbage, an alternative lender that has been active in encouraging the industry to develop open banking standards in the U.S. “It’s incumbent upon the U.S. to be a driver of this trend,” he says.

The stakes are particularly high for alternative lenders since they rely so heavily on data to make informed underwriting decisions. Open banking has the potential to open up scores of customer data and significantly improve the underwriting process, according to industry participants.

“Open banking massively enables alternative lending,” says Mark Atherton, group vice president for Oracle’s financial services global business unit. What’s missing at the moment is the regulatory stick to ensure uniformity. Certainly, data sharing is gradually becoming more commonplace in the U.S. as banks and fintech companies increasingly explore ways to collaborate. But even so, banks in the U.S. are currently all over the map when it comes to their approach to open banking, posing a challenge for many alternative lenders. Many alternative lenders would like to see regulators step in with prescriptive requirements so that open banking becomes an obligation for all banks, as opposed to these decisions being made on a bank-by-bank basis. Especially since many consumers want to be able to more readily share their financial information, they say.

“It will create huge value to everyone if that data is more accessible,” says Eden Amirav, co-founder and chief executive of Lending Express, an AI-powered marketplace for business loans.

Some global-minded banks like Citibank have been on the forefront of open banking initiatives. Spanish banking giant BBVA is also taking a proactive approach. In October, the bank went live in the U.S. with its Banking-as-a-Service platform, after a multi-month beta period. Also in October, JPMorgan Chase announced a data sharing agreement with financial technology company Plaid that will allow customers to more easily push banking data to outside financial apps like Robinhood, Venmo and Acorns.

There are several other examples of open banking in action. Kabbage customers, for instance, authorize read-only access to their banking information to expedite the lending process through the company’s aggregator partners, says Sam Taussig, head of global policy at Kabbage.

Also, companies such as Xero and Mint routinely interface with banks to put customers in control of their financial planning. And companies like Plaid and Yodlee connect lenders and banks to help with processes such as asset and income verification.

Some banks, however, are more reticent than others when it comes to data sharing. And with no regulatory requirements in place, it’s up to individual banks how to proceed. This can be nettlesome for alternative lenders trying to get access to data, since there’s no guarantee they will be able to access the breadth of customer data that’s available. “As an underwriter, you want the whole financial picture, and if data points are missing, it’s hard to make appropriate lending decisions,” Taussig says.

The problem can be particularly acute among smaller banks, industry participants say. While the quality of data you can get from one of the money-center banks is quite good, “as you go down the line, it becomes a little less consistent,” says James Mendelsohn, chief operating officer of Breakout Capital Finance. For these smaller banks, the issue is sometimes one of control. There’s a feeling among some community banks, that “if I make it easier for my small business customers to get loans elsewhere, I’m done,” says Atherton of Oracle.

Absent regulatory requirements, alternative lenders are hoping that this initial hesitation among some banks changes over time as they continue to gain a better understanding of the market opportunity and as more of their counterparts become open to data sharing through APIs.

Open banking could be a boon for banks in that it would enable them to service customers they probably couldn’t before, says Jeffrey Bumbales, marketing director at Credibly, which helps small and mid-size businesses obtain financing. Open banking makes for a “better customer experience,” he says.

One challenge for the U.S. market is the hodgepodge of federal and state regulators that makes reaching a consensus a more arduous task. It’s not as simple here as it may be in other markets that are less fragmented, observers say.

Major rule-making would be involved, and there are many issues that would need attention. One pressing area of regulatory uncertainty today is who bears the liability in the event of a breach—the bank or the fintech, says Steve Boms, executive director of the Northern American chapter of the Financial Data and Technology Association. Existing regulations simply don’t speak to data connectivity issues, he says.

To be sure, policymakers have started to give these matters more serious attention, with various regulators weighing in, though no regulator has issued definitive requirements. Still, some industry participants are encouraged to see regulators and policymakers taking more of an interest in open banking.

A recent Treasury Report, for example, notes that as open banking matures in the United Kingdom, “U.S. financial regulators should observe developments and learn from the British experience.” And, The Senate Banking Committee recently touched on the issue at a Sept. 18 hearing. Industry watchers say these developments are a step in the right direction, though there’s significant work needed, they say, in order to make open banking a pervasive reality.

“We’re seeing the pace and interest around these things picking up pretty significantly,” Boms says. Even so, it can take several years to implement a formal process. “The hope is obviously as soon as possible, but the financial services sector is a very fragmented market in terms of regulation. There’s going to have to be a lot of coordination,” Boms says.

Another challenge to overcome is customers’ willingness to use open banking. Many small business owners are more comfortable sending a PDF bank statement versus granting complete access to their online banking credentials, says Mendelsohn of Breakout Capital Finance. “There’s a lot more comfort on the consumer side than there is on the small business side. Some of that is just time,” he adds.

Certainly sharing financial data is a concern—even in the U.K. where open banking efforts are well underway. More than three quarters of U.K. respondents expressed concern about sharing financial data with organizations other than their bank, according to a recent poll by market research body, YouGov. This suggests that more needs to be done to ease consumers into an open banking ecosystem.

The topic of data security came up repeatedly at this year’s Money20/20 USA conference in Las Vegas. How to make people feel comfortable that their data is safe is a pressing concern, says Tim Donovan, a spokesman for Fundbox, which provides revolving lines of credit for small businesses. Clearly, it’s something the industry will have to address before open banking can really become a reality in the U.S., he says.

Despite these challenges, many market watchers feel open banking in the U.S. is inevitable, given the momentum that’s driving adoption worldwide. Several countries have taken on open banking initiatives and are at varying states of implementation—some driven by industry, others by regulation. Here is a sampling of what’s happening in other regions of the world:

In the U.K., for example, the implementation process is ongoing and is expected to continually enhance and add functionality through September 2019, according to The Open Banking Implementation Entity, the designated entity for creating standards and overseeing the U.K’s open banking initiative.

At the moment, only the U.K.’s nine largest banks and building societies must make customer data available through open banking though other institutions have and continue to opt in to take part in open banking. As of September, there were 77 regulated providers, consisting of third parties and account providers and six of those providers were live with customers, according to the U.K. open banking entity.

In Europe, the second Payment Services Directive (PSD2) requires banks to open up their data to third parties. But implementation is taking longer than expected—given the large number of banks involved. By some opinions, open banking won’t really be in force in Europe until September 2019, when the Regulatory Technical Standards for open and secure electronic payments under the PSD2 are supposed to be in place.

In Australia, meanwhile, the country has adopted a phase-in process to take place over a period of several years through 2021. Starting in July 2019, all major banks will be required to make available data on credit and debit card, deposit and transaction accounts. Data requirements for mortgage accounts at major banks will follow by February 1, 2020. Then, by July 1 of 2020, all major banks will need to make available data on all applicable products; the remaining banks will have another 12 months to make all the applicable data available.

For its part, Hong Kong is also pushing ahead with plans for open banking. In July, the Hong Kong Monetary Authority published its open API framework for the local banking sector. There’s a multi-prong implementation strategy with the final phase expected to be complete by mid-2019.

Singapore, by contrast, is taking a different approach than some other countries by not enforcing rules for banks to open access to data. The Monetary Authority of Singapore has endorsed guidelines for Open Banking, but has expressed its preference to pursue an industry-driven approach as opposed to regulatory mandates.

Other countries, meanwhile, are more in the exploratory phases. In Canada, the government announced in September a new advisory committee for Open Banking, a first step in a review of its potential merits. And in Mexico, the county’s new Fintech Law requires providers to provide fair access to data, and regulators there are reportedly gung-ho to get appropriate regulations into place. Still other countries are also exploring how to bring open banking to their markets.

The U.S. meanwhile, is on a slower course—at least for now. More banks are using APIs internally and have been exploring how they can work with third-party technology companies. Meanwhile, companies like IBM have been coming to market with solutions to help banks open up their legacy systems and tap into APIs. Other industry players are also actively pursuing ways to bring open banking to the market.

As for when and if open banking will become pervasive in the U.S., it’s anyone’s guess, but industry participants have high hopes that it’s an achievable target in the not-too-distant future.

Thus far, there has been little pressure for banks to adopt open banking policies, says Taussig of Kabbage. But this is changing, and things will continue to evolve as other countries adopt open banking and as pressure builds from small businesses and consumers in an effort to ensure the U.S. market stays competitive, he says. Open banking “is going to happen in the near future,” Taussig predicts.

Breslow Shows What a Fintech/Bank Partnership Looks Like

October 24, 2018 In the wake of OnDeck’s announcement of ODX, a new subsidiary that will service banks, OnDeck CEO and Money 20/20 veteran Noah Breslow took to the stage for a discussion with his new business partner, Lakhbir Lamba, Head of Retail Lending at PNC Bank. PNC will now be using ODX to originate lines of credit for the bank’s small business customers, while everything will stay on PNC’s balance sheet.

In the wake of OnDeck’s announcement of ODX, a new subsidiary that will service banks, OnDeck CEO and Money 20/20 veteran Noah Breslow took to the stage for a discussion with his new business partner, Lakhbir Lamba, Head of Retail Lending at PNC Bank. PNC will now be using ODX to originate lines of credit for the bank’s small business customers, while everything will stay on PNC’s balance sheet.

“We’re keeping a laser focus on small business lending,” Breslow said, when asked if OnDeck would begin to serve other segments of the market, like student or auto loans.

“The problems that small businesses face are worldwide,” Breslow said, indicating that the company has interest in expanding service to small businesses internationally. Already, OnDeck operates in Canada and Australia.

The moderator asked if an application that is rejected by PNC would become a lead for OnDeck. Breslow and Lamba said that is not currently the arrangement, but that it may be a possibility.

“Our goal [with ODX] is to service banks,” Breslow said, while acknowledging that banks serve a different kind of small business customer than OnDeck.

“We will make sure that we underwrite based on PNC’s risk appetite,” Breslow said.

OnDeck Small Business Online Lending Tops $10 Billion

September 12, 2018OnDeck is the world’s largest non-bank online small business lending platform.

Federal Reserve says small businesses are turning to online lenders in record numbers

NEW YORK, N.Y., September 12, 2018 – – OnDeck® (NYSE: ONDK), today announced it has achieved a milestone in the Financial Technology (FinTech) industry, becoming the first non-bank online lender to surpass $10 billion in total loans originated to small businesses. OnDeck, with operations in the United States, Canada and Australia, is now the world’s largest non-bank online lender to small business by total loan volume.

The achievement by OnDeck, a pioneer of the FinTech lending industry, is the latest indication that small businesses increasingly prefer to seek financing online. According to the recent Small Business Credit Survey from the Federal Reserve, small business owners are turning to online lenders in record numbers. In 2017, 24 percent of small businesses seeking credit applied online, up from 21 percent the previous year. Not only did the total number of loan applications to online lenders increase in 2017, but satisfaction rates of small businesses soared almost 50 percent year-over-year.1

OnDeck provided its first small business loan online in 2007, taking just 11 years to pass $10 billion in total loan volume in a digital lending market it helped create. The majority of OnDeck’s lending occurred in the last few years as it gained scale, with the company originating $2.1 billion in loans in 2017 alone.

“If reaching $10 billion dollars in total loan volume online tells us anything, it’s that the days of old-fashioned lending to small businesses are numbered,” said Noah Breslow, Chairman and Chief Executive Officer, OnDeck. “We created OnDeck because we believed the Internet could revolutionize and speed up the way underserved small businesses access capital. Today, we are helping to fill a credit gap across hundreds of industries by providing fast, secure and transparent loans that enable small businesses to grow, generate economic activity and create jobs. We look forward to providing billions more in financing and powering the small business lending migration to the online model via our OnDeck-as-a-Service platform.”

Small businesses are the economic backbone of America, accounting for more than 99% of all U.S. companies1 and employing over half of all private sector workers2. However, they still face a growing credit gap. According to the Federal Reserve survey, 54% of small businesses report credit shortfalls3 and lower-income communities are disproportionately impacted. Traditional large banks deny 44% of all small business loan applications3 and many are steadily exiting the small business credit market. Since 2008, small business lending from traditional sources has fallen over 20%4.

Identifying the developing credit gap over a decade ago, OnDeck transformed the means by which small businesses access capital, using proprietary technology and a small business credit scoring system, the OnDeck Score®, to more efficiently evaluate a business’ creditworthiness and make lending decisions in real time. OnDeck provides term loans and lines of credit to small businesses and can supply customers with funding in as little as one business day. The economic impact of this online lending activity is substantial. Immediate infusions of capital enable small businesses to purchase inventory, cover operational costs, or expand without delay, which can stimulate economic growth and help create jobs in their communities.

OnDeck and the Impact of Online Lending on the Economy

An Analysis Group report commissioned by OnDeck in 2015 analyzed the economic impact from the first $3 billion OnDeck lent to small businesses. The report estimates that those loans powered $11 billion in business activity and created 74,000 jobs nationwide. In 2018, OnDeck announced it had provided small businesses more than $10 billion in capital.

In May of 2018, a report on small business online lending in the United States revealed that OnDeck and four other small business lending platforms funded nearly $10 billion in online loans from 2015 to 2017, generating $37.7 billion in gross output and creating 358,911 jobs and $12.6 billion in wages in U.S. communities. The upsurge in online lending is filling a critical financing gap for small businesses across industries, according to NDP Analytics, a Washington, D.C.-based economic research firm. See the NDP Report here: http://www.ndpanalytics.com/online-lending/

OnDeck Company Timeline

Download here: https://www.ondeck.com/wp-content/uploads/2018/09/10-year-timeline-02.pdf