Lendio Surpasses $1 Billion in Originations

October 16, 2018 Lendio announced today that it has facilitated $1 billion in financing to more than 51,000 small businesses across the U.S. since it was founded 2011. It reached the $500 million mark just a little over a year ago in July 2017.

Lendio announced today that it has facilitated $1 billion in financing to more than 51,000 small businesses across the U.S. since it was founded 2011. It reached the $500 million mark just a little over a year ago in July 2017.

“We are a marketplace, not a lender, which means we can help a lot more small business owners,” Lendio co-founder and CEO Brock Blake told AltFinanceDaily. “We can say ‘Yes’ more often because we have more options.”

Brock attributes the company’s recent growth to its marketplace business model, its team and all of its business partners. Lendio works with over 75 lenders on its platform and it also operates a turndown program where participating lenders refer to applications to Lendio that they have declined, but which might be funded by a different lender that Lendio works with.

Lendio also has about 30 franchisees that operate in 50 markers in the U.S. A market could be a single city or a handful of counties, and some franchisees cover multiple markets, according to Blake. Franchisees work with accountants, attorneys and chambers of commerce to inform local business owners about Lendio and ultimately get them to use the Lendio platform when looking for a small business loan.

Lendio has over 150 employees split between its headquarters in the Salt Lake City, Utah area and an office on Long Island.

Prior to co-founding Lendio, Blake created a company called Funding Universe, which connected entrepreneurs to venture capitalists in what he described was like speed dating. But he said that he soon realized that most American businesses need smaller amounts of capital, so he pivoted into small business lending.

“Across 75 lenders and 15 different loan products, it [can be] a challenge to really figure out which business owner fits with which loan product and to help that deal get funded,” Blake said. “But feel like over the last 18 months to 2 years we really have that process down. And now we’re gaining that flywheel effect. We’re continuing to gain more and more momentum. The ceiling is much higher and I’m really excited about the future in front of us.”

CA Bill to Revise Definition of Broker: 6/27/18 Hearing Transcript & Video (AB 3207)

July 29, 2018AB 3207 – CA Bill to Revise the definition of broker (6/27/18)

[0:00:02]

Bradford: We started as a subcommittee. We've already heard Assembly Member Arambula’s Bill AB 1289. Do we have a quorum? We’re gonna ask the secretary to call the roll and establish the quorum.

Speaker: Senator Bradford.

Bradford: Here.

Speaker: Bradford here. Vidak.

Vidak: Present.

Speaker: Vidak here. Gaines. Galgiani.

Galgiani: Here.

Speaker: Galgiani here. Hueso.

Hueso: Here.

Speaker: Hueso here. Lara.

Lara: Here.

Speaker: Lara here. Portantino.

Bradford: Quorum is established. So, we have only one other vehicle that will be heard today. That’s AB 3207 by Assembly Woman Limon and she is here present. And when you’re ready, Ms. Limon, you can make your presentation.

Limon: Great. Thank you, Chair. I wanna start off by taking the committee amendments and committing to work on any concerns addressed in the committee analysis. AB 3207 will provide important consumer protections for the thousands of consumers and small business owners who are served by finance lenders and brokers licensed under the California Financing Law. Under existing law, the definition of broker is vague and circular, leading to the confusion from lenders about which entities they can partner with when arranging loans. Further, the definition of broker in existing law was formulated long before the rise of the internet and the evolution of online lead generation. So, our laws need to be updated with this online activity in mind. Lead generators provide valuable marketing services to a wide range of industries and this bill contains a specific exemption clarifying that distribution of marketing materials or factual information about a lender is not a broker brokering activity. However, many online lender generators that serve the lending industry provide more than just marketing services. These entities act as brokers when they bring borrowers and lenders together to arrange a loan based on confidential data provided by a consumer or small business owner. This bill will allow online lead generators to continue to operate in California. Simply, this bill requires 3 basic things from these companies. One, get a business license from the State Department of Business Oversight; two, provide transparent disclosures to the customers; and three, obtain your customer’s consent before selling and transmitting their confidential data. Arguments from the opposition that this bill will cause lead generators to leave the state raise an important question. Why would a bill focused on licensure and transparency cause a small business to leave a very lucrative California market? Over the past 5 months, I have worked extensively with lenders and lead generators to ensure that this bill appropriately addresses the consumer protection concerns in our lending markets without placing unnecessary burdens on the businesses that work in this area. None of these companies have threatened to leave the state. In fact, many of them have applauded the efforts to bring clarity to existing law and bring bad actors out of the shadows and into the light. This bill has the support of consumer and commercial lenders, the Department of Business Oversight, and a coalition of consumer advocates who are here today to voice their support. With me, I have Adam Wright, senior counsel in the enforcement division in the Department of Business Oversight, to answer any questions from the committee.

Bradford: Witnesses and support, please come forward. State your name, organization.

Martindale: Chair Member, Suzanne Martindale with Consumers Union. We do support this measure and really appreciate the author's leadership in seeking to ensure that our laws stay up to date in terms of evolving technologies. Of course, a lot of lending now happens online and the business models have shifted, but that does not mean that consumers are not, you know, any less entitled to receiving protections when third parties acting on behalf of lenders are marketing to them and helping facilitate the origination of loans and also in particular handling sensitive information and the kinds of things that we wanna always ensure are protected. So, we understand that there’s potentially more discussion to be had about finding the sweet spot here, but I really, really think that the time is now to move forward and ensure that the DBO has the enforcement tools that it needs to properly regulate the space so that consumers who receive online loans are no less protected than those who get them in brick and mortar stores. So, for these reasons, we support and request an aye vote.

Bradford: Thank you. Additional witnesses and support.

Coleman: Good afternoon. Ronald Coleman here on behalf of the California Low Income Consumer Coalition (CLICC). Also here in strong support.

Bradford: Thank you.

Aponte-Diaz: Hi. Graciela Aponte-Diaz, Center for Responsible Lending. Also in strong support.

Bradford: Thank you.

Joyce: Hello. Pat Joyce on behalf of Credit Karma. Credit Karma actually has a neutral position on the bill and wanted the opportunity to thank the author and sponsors of the bill for working with us to address our concerns and allow us to remove our opposition. So, thank you.

Bradford: Thank you very much. Next witness.

Preity: Sumanta Preity on behalf of OnDeck Capital. In support of the bill.

Bradford: Thank you.

Glad: Margaret Glad on behalf of NerdWallet.

[0:05:01]

We’re also in that tweener category. We’d been working very productively with the author's office and particularly Mr. Burdock. We appreciate their amendments that they’ve made to date to address NerdWallet’s concerns. We have a couple of more issues related to disclosures as the bill currently stands. They are mandated disclosures that don't represent our business model. We’d have to tell consumers we’re doing things we aren't doing. So, we're continuing to work with the author and his and her staff to resolve those issues. We appreciate the committee's thorough analysis and all the work and hope to come to resolution of our remaining issues.

Bradford: Great. Thank you.

Pappas: Emily Pappas on behalf of Lending Tree. Similar position to what Margaret just said. Our client has generally supported the framework on this bill. We virtually had an opposed and less amended position due to some of the disclosure requirements. However, we learn from the author's office today that they'd be willing to take the amendments that relieve us of our concerns. Therefore, we’ll switch to a neutral position.

Bradford: Thank you. Any additional witnesses in support? Witnesses in opposition.

Quinton: Hi. David Quinton on behalf of the Online Lenders Alliance. I do have a clarifying question. We are in strong opposition as the bill was in print. We've heard discussion about amendments. If all of the amendments that were in the analysis were accepted, I think that moves us to neutral, but we're not clear on that at this point. So, I’m not sure how to proceed.

Bradford: Those are the amendments that we’re referring to that weren’t announced as well as we’re addressing the concerns that we’re raised as well in the bill.

Quinton: Would that be possible so we can—

Bradford: I’m sorry?

Quinton: Oh, she was— I’m sorry. I was listening.

Bradford: Ms. Galgiani.

Bradford: Yeah. Yeah. If you want to, Ms.—

Quinton: Okay. Thank you.

Galgiani: I would just like to clarify with the author the amendments that have been agreed to and looking through the analysis and then trying to complete which all of those are. I wanna make sure that we're on the same page; the author, the members, the opposition. And there are two concerns that I’ll start with that we don't have expressed amendments for, but we're hoping that you'll work with the opposition and your stakeholders over the July break and we can come back and address those. And one is dealing with lead generators being designated assets as opposed to being referred to as brokers and that those lead generators hold the generator licenses. That's a concern. And the other concern is imposing the same standard of liability on lead generators for the acts of those from whom they buy leads as the bill imposes on lenders for the acts of lead generators from whom they buy leads.

Limon: So, I can say that we continue the conversations. it's definitely not a problem. I think that, you know, this bill has gone through 6 rounds of amendments. And so, I think that's reflective of the fact that we continue to have the conversation. On the two separate license definitions, what we know is that creating two separate license licenses for brokers and lead generators would require many companies to attain two separate licenses from the DBO. Additionally, drafting a separate regulatory framework for lead generators would also add confusion for the businesses that would need to decide whether they need a lead generator or a broker license. The bill does require to have one license right now. And the bill provides specific disclosure requirements that makes sense in terms of the online generation world. So, that's kind of where we've been thinking about it in terms of that. In terms of the lender liability, the bill and existing law hold licensees accountable for their own actions. So, both the lenders and the brokers are liable for violations of the law that occur within their companies. For licensed brokers who choose to obtain referrals from unlicensed third party, the bill requires those brokers to establish policies and procedures intended to ensure that those unlicensed parties uphold the consumer protections provided by the law. The issue of the lender liability raised in the analysis is a red herring. Just as existing current law, the bill would continue to practice the practice of holding licensees accountable for their own violations. And I just wanna again say that that's current law.

Galgiani: Okay. So, am I hearing—

Limon: You are hearing that we are happy to continue those conversations. You brought up the two concerns and I wanted to share the feedback on those two concerns.

Bradford: But we're still open to move forward in having— resolve our differences as it relates to the two— those two concerns. We’re not gonna split the baby here today, but we’re gonna try to figure out how to move forward on those concerns.

[0:10:03]

So, we have that commitment as we move forward to address it in a way that we all come together. Am I correct?

Limon: You have the commitment to continue the conversation to try to figure out a way to address it.

Bradford: Yes, sir.

Quinton: So, on the issue of the two remaining issues, so we thank the author for taking the amendments as presented by your consultant in the analysis. But of the two remaining issues, I believe the broker issue is one that we can work with. That's fine. The devil is in the details. The problem is with this issue, as you know, the details have details. It’s a very, very complex issue. So, that’s our one concern, but we can work with the broker issue. I think we’re okay with that. That's fine as it is. However, being held for strict liability for the actions of a third party affiliate is a very far reaching legal standard and we have really serious concerns with that. So, we just wanna clarify if it is still that we are held with strict liability for the actions of a third party affiliate like we would still have to oppose the bill with that. So, I just want clarification on that, Mr. Chairman.

Bradford: Well, as far as that concern, I'm hoping we're gonna sit down at the table again during the break and whittle that out and figure out how we come to consensus. And I understand your concerns and that's why they're still listed as concerns. They haven't been amended in the bill. But hopefully, going forward, we will find some solution or amendment to address that for you.

Quinton: So, I think at this point— to finish my statement and I’ll hand it over very briefly to Jason— at this point, I would say that we would still be opposed until we can see that amendment because that is a very, very serious issue that could hold us liable over issues we have no authority over. And I’d like to introduce Mr. Jason Romrell who is with Lead Smart, one of the leading lead generators in the State of California.

Romrell: Thank you. Chairman and committee members, thank you for allowing me to speak on AB 3207. The thing that I want to make clear, we’re a California-based lead generator. We have a sister company that has a DTL and CFL license. We’ve had those for the last 5 years. Our interest in this bill is not to oppose to bill. It’s to make sure that the good lead generators, the lead generators who function ethically are still allowed to function in fintech environment that is becoming the movement. If we don't do that, we are putting consumers at a huge disadvantage. In fact, we’re putting them at more risk than they’re at now. We have been involved in this discussion with the DBO, with members of the legislature, and even on the federal level for many years. So, the role that we play as a good ethical lead generator is a very important consumer protection role. We have the same objective as Assembly Member Limon. We have the same objective as the DBO. It's to protect consumers. So, the issues that we were facing prior to the amendments being put forward were in the details. There is no opposition to the concept. We want to be here to protect consumers, but it is the details. So, the one thing I do want to mention is lead generation is complex. There a lot of layers to it. It is not a one size fits all activity. And that is one of the challenges in crafting good legislation. So, I'm not going to go into the details that we had issues with because I think, in light of these potential amendments, everything has changed. But what I do wanna point out is the distinction between the good lead generators and the bad lead generators. The good lead generators already do a lot of what is in AB 3207. We get consent. We vet our lenders. We make sure the marketing message that goes to the consumer is accurate, truthful, and proper. We do a lot of that work, and it's time consuming, and it takes a lot of money and energy. The bad lead generators do not care. So, the risk we run with legislation is if we over legislate the good guys. We will. And Assembly Members Limon asked the question “Why would a small business leave California?” If we can't function without the threat of class action lawsuits, if we literally cannot comply with the details of a bill, we’ll move to other markets. If we do that, consumers are injured severely. So, my plea to this committee and to Assembly Member Limon is we are here. We are invested in the process. We want to get it right. We don't want to oppose the bill. We want to make it work for us and for California consumers.

[0:15:02]

And that is our position, is to protect the people that we live and work with everyday.

Bradford: Thank you. Any additional witnesses in opposition?

Bauer: Paul Bauer on behalf of Elevate. I’m kind of in that tweener category that other people have step forward in. I just wanted to lend our voice to those of Mr. Quinton and Mr. Romrell who presented. And we also wanna see the bill be perfected as we move forward. So, I look forward to that work.

Bradford: Thank you. I appreciate it.

Sunley: Alex Sunley on behalf of the Small Business Finance Association. In opposition.

Bradford: Thank you.

Damar: Hi, Dominic Damar here on behalf of Innova. I share Mr. Bauer’s and [0:15:49][Inaudible] position relative to the amendments and look forward to working and hearing from the author on changes to be made. Thank you.

Bradford: Thank you.

Conaway: Good afternoon. This is Jerry Conaway on behalf of Lead Flash. And we're currently in opposition, but looking forward to seeing the amendments. And I'm working with the bill's author to make a great bill. Thank you.

Bradford: Thank you.

Smeltzer: Thank you, Mister Chair and members. Jason Smeltzer here on behalf of the California Financial Service Providers. Also the same position as Mr. Quinton. I would love to see the assembly member and work this out and remove our opposition then.

Bradford: Thank you.

Schriver: Rachel Schriver with the TMX Finance Family of Companies. We’re opposed to the bill in print, but certainly optimistic about finding a path forward.

Bradford: I appreciate it. Any additional witnesses? Any tweeners? All right. We’ll bring it back to the committee. Any questions by the committee members? Mr. Ric Lara. No. Oh. Oh okay. Ms.—

Lara: I just wanna move the bill, but I know Ms. Galgiani—

Galgiani: I wanted to finish and—

Bradford: Yes. Oh, go ahead, Ms. Galgiani.

Galgiani: We’ve done a lot of work on this bill—

Bradford: Yes, we have.

Galgiani: …today and I’ve been in two other committees today since 9 o’clock this morning. So, I wanna make sure we’re on the same page. So, the second item amendment that would provide exemptions from lead generator definition for administrative and clerical tasks, credit bureaus, internet search engines, and social media platforms, has that amendment been agreed to? That's on Page 14B in the analysis. Page 14B addresses the concern. And so, the amendment would be to provide an exemption for those clerical staff, etc.

Wright: And this is Adam Wright on behalf of the DBO. When it comes to that request, we do not believe it's necessary because of the way that the activities are already drafted. We do not believe that it covers search engines or social media advertisements because those two mediums of advertisements do not send actual consumer data to lenders and they are not paid on a per successful loan basis. Thus, they would not be caught up on the activities under a broker.

Galgiani: Okay. Okay. So, what is the amendment that you're taking then because it sounds like no? Am I right or— Maybe we should start with the author sharing with us the amendments that she’s taking because—

Bradford: You know, we’ve spent a whole lot of time in all due respect to the author and to those who are opposing this bill, but a lot of time have been invested here. And we wanna have a vehicle that first protects consumers, but also allows the industry to thrive and survive here in California. And I think the amendments that we've put forth I thought we had understanding and a commitment that we're gonna continue to move forward and keep this vehicle alive and understanding that we have some kind of agreement, but—

Limon: So, here's the deal, right? So, if you look on Page 13 and it says amendments and it describes some of the issues, but there's not specific amendments. So, according to the author’s office, the use of the word “expresses” intends to [0:18:54][Inaudible] consent. Right? We can go on. And so, I think that that’s what we have to continue talking about. Because in the areas where there is very specific things, it’s easier to say yes or no. In the areas where it talks about a concern, but it doesn't give you actual language, that's where we're trying to figure out how.

Bradford: And we’re not gonna find that extra language here today. What we're trying to get clarity on is what has been put forth in analysis those concerns that were raised as well as those amendments that we suggested that we get agreement on that today and we’ll work out the details moving forward with the understanding that we come to agreement, we’ll pull this bill back to the committee.

Limon: Yes. We can provide clarity for all of these amendments. We are just looking for actual language.

Galgiani: Are we drafting those amendments in committee? Committee staff will draft those amendments.

Bradford: Yes.

Limon: Can we draft the amendments and provide them to you?

Bradford: No. I think this committee will work in concert with you in drafting those amendments. That's our understanding of finding common ground on what we have already in analysis.

[0:20:01]

Limon: As long as our office and as the author I’m able to also be part of that, I—

Bradford: That’s our understanding that we’re gonna work in collaboration as we move forward on this thing.

Galgiani: Okay.

Bradford: Galgiani.

Galgiani: Okay. Next, item #4 on my list of concerns in amendments, define term “express consent” and provide the express consent provided by a prospective borrower to one entity satisfies the requirement for all other entities that purchase a consumer's confidential data to obtain express consent and that is addressing the concern outlined on Page 13A of the analysis.

Limon: So, back to the concerns, we’re happy to have a conversation. I’m trying to go to the amendments. So, we are happy to clarify it. So, here’s the confusion, right, that you have some amendments and we've agreed to take those and to work together and then you have the concerns. And the concerns I think need a discussion. We weren't prepared to go back and forth on the concerns here.

Bradford: We’re not trying to do that. So, we're trying to get clarity on those amendments that have been identified, but also address those concerns moving forward as well the two areas of concerns that are being raised so we can keep this vehicle alive and continue our discussion. So, we're—

Limon: We’re I think on the same page that the concerns we need to keep talking about the amendments, we are agreeing to work together on language.

Bradford: I understand that. We have specific amendments that we’re trying to get agreement on today. The concerns, we can work out. You know, that's going forward, but the amendments that we have before, today, we’re trying to get clarity on it. Senator Lara.

Lara: Without skipping over Senator Galgiani, my understanding is that she's already agreed to the amendments.

Galgiani: And we're trying to clarify what those amendments are—

Lara: Okay.

Galgiani: …specifically so that we don't just leave it to the fact that there's going to be a discussion—

Lara: Understood. Understood.

Galgiani: …in July. We want clarity on very specific amendments.

Limon: I started by saying I agree to the amendments. And so, if there are, you know, clear amendments, that's easy because there's language. If there's not language, we have to have a discussion. And what I heard was that we were simultaneously gonna draft those, that language.

Galgiani: And I'm trying to go through those amendments item by item so that we're on the same page and the two that I outlined—

Bradford: Ms. Galgiani, I think what we’re gonna have discussion on and negotiations is on the concerns, but the amendments or the amendments that we’re trying to get commitment on today, the amendments that we have that we're in an analysis that were clearly spelled out in analysis, you're taking those.

Limon: Yes.

Bradford: Great.

Galgiani: And the committee staff is drafting this.

Bradford: Yes. Yes.

Limon: With collaboration from our office so we—

Bradford: That’s right.

Limon: …can draft them together.

Galgiani: Okay. Okay. So, I’ll continue to the fifth one. Requiring that the entity that collects a prospective borrower’s confidential data to provide that borrower with the disclosure described in section 22348. So, in essence, the original point person who collected the personal information is the person who is required to provide the disclosure.

Limon: Uh-huh.

Galgiani: Okay. Number 6, add two additional statements to the disclosure described in section 22348 (A) lenders to whom the prospective borrower is referred may separately contact the prospective borrower and (B) lenders to whom the prospective borrower is referred may separately contact the prospective borrower.

Limon: Yup.

Galgiani: Okay. Number 7, delete the disclosure required under Section 22338.5.

Limon: So, wait—

Galgiani: Okay. And that’s on Page 23—

Limon: You know, I have agreed to the amendments whether it’s clear language. And so, yeah.

Bradford: Okay.

Limon: I think that this feels like it’s leading into a conversation and I just— We wanna have that conversation.

Bradford: Well, I’m gonna go on record right now. The amendments that we have before that was in analysis, I wanna be clear those are the ones you’re agreeing to and we’ll continue to work out the concerns. Am I correct?

Limon: Yes.

Bradford: And if we deviate from that, we will pull the bill back to this committee.

Limon: Right. And we will work together on drafting the language so that it's not just— Right?

Bradford: Drafting the language as it relates to the concerns. Yes. If we all have agreement on that—

Lara: [0:24:51][Inaudible]

Bradford: Exactly. So, we’re taking the amendments that are in the committee’s analysis.

[0:25:00]

That’s the motion you're putting forth, Ms. Galgiani.

Galgiani: Yes.

Bradford: Yes. Yes. Okay. Great. Any additional questions or comments by committee?

Speaker: As amended.

Bradford: As amended. Ms. Limon, would you like to close?

Limon: Unlicensed brokering activity poses a risk to consumer’s financial well-being and this bill will ensure that California's financial regulator can enforce the consumer protections under the California Financing Law. For this reason, today, I ask you for an aye vote.

Bradford: So, we have a motion and it’s do pass as amended to appropriations based on committee analysis. And we will move forward in addressing the concerns as we move forward. Am I correct? So, that’s the understanding then, Secretary, of our amendment. Madam chief consultant, that’s our understanding? Great. All right. Do pass as amended and committee analysis. Madam Secretary, please call the roll.

Speaker: Assembly Bill 3207, motion is do pass as amended to appropriation. Senator Bradford.

Bradford: Aye.

Speaker: Bradford Aye. Vidak.

Vidak: No.

Speaker: Vidak no. Gaines. Galgiani.

Galgiani: Aye.

Speaker: Galgiani aye. Hueso.

Hueso: Aye.

Speaker: Hueso aye. Lara.

Lara: Aye.

Speaker: Lara aye. Portantino.

Portantino: Aye.

Speaker: Portantino aye. We have 5 to 1.

Bradford: All right. Your bill is out.

Limon: Thank you.

Bradford: Thank you. And we look forward to our continued discussion and work on this issue.

[0:26:28] End of Audio

Lawyers Weigh in on Federal Decision That CFPB is Unconstitutional

June 22, 2018In light of a federal court ruling yesterday that the structure of the Consumer Financial Protection Bureau (CFPB) is unconstitutional, AltFinanceDaily spoke with some lawyers to get their perspective on what this decision could mean.

Alan Kaplinsky, Partner, Ballard Spahr

“I think it will sow more confusion related to the CFPB. I think it’s important to note that this opinion – while it is precedent that could be cited in other cases…it’s not binding on any other court anywhere in the country, including in the Southern District of New York. That being said, I anticipate that the CFPB will appeal [the decision] if for no other reason than because they have other cases. Ultimately, I would anticipate that the case will end up in the U.S. Supreme Court.”

Lucy Morris, Partner, Hudson Cook (previously a Deputy Enforcement Director at the CFPB)

“The bottom line is that it creates yet more uncertainty for the bureau, for industry and for consumers. Is this bureau legitimate or not? And if not, what does that mean for all of the many decisions and actions taken by the former [CFPB] director Cordray and the current acting director, Mulvaney.

Maybe this can add to a momentum to create a bipartisan commission to finally resolve this, and to give everyone a commission that…avoids the wide pendulum swings that have been happening. This requires a legislative fix, which is challenging of course.”

Lawrence Kaplan, Of Counsel, Paul Hastings

“Typically, in a case like this, you would have a circuit split, where now you have one circuit saying yes and one circuit saying no. And ultimately that would go up to the supreme court. But you could have the administration saying ‘We’re not going to defend this.’ [Given the administration’s unfavorable attitude toward the CFPB], it’s likely that you’re not going to see anyone vigorously defend the agency.

As for alternative lenders, [these] are state issues. And as a result, [lenders] are not off the hook…At the end of the day, everyone will still have to comply with a patchwork of state laws. You’re really taking away the federal hammer. So, [certain cases] may no longer be a federal case. Now, in some ways, be careful what you wish for, because now you have to face 50 executioners [because] a lot of the states would defer to and join with the feds.”

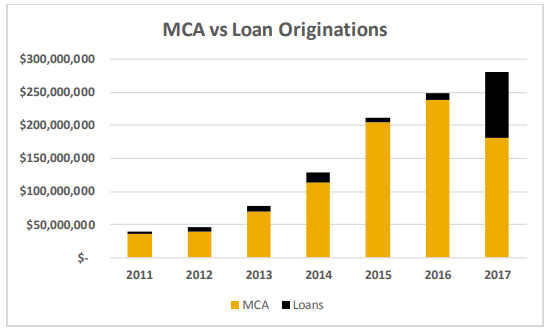

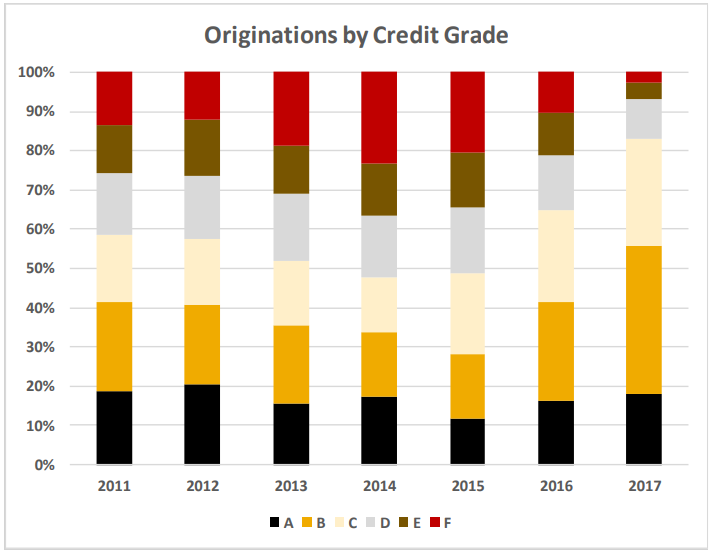

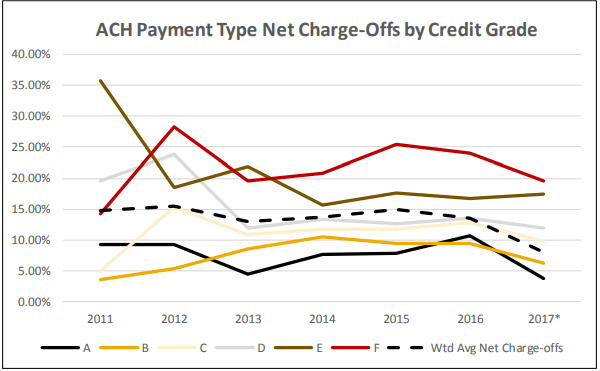

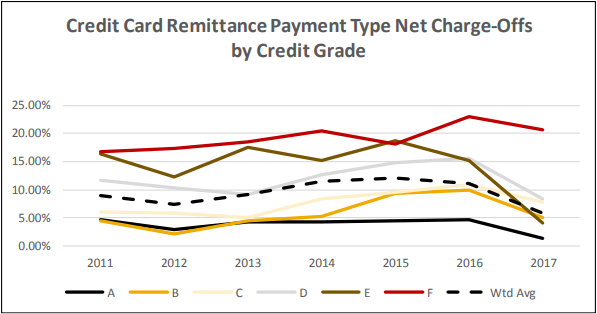

An Inside Look at Strategic Funding’s Portfolio

June 10, 2018A Kroll Bond Rating Agency report reveals interesting details about Strategic Funding Source’s $105 million securitization and also their business. Here are a few main takeaways:

Pool breakdown

60% MCA

40% Loans

Average original receivable balance per merchant: $40,705

Weighted Average FICO Score: 649

Weighted Average RTR Multiple: 1.35

Weighted Average Time in Business: 12.5 years

Weighted Average Gross Revenue: $1,729,709

Number of ISOs/referral partners: 1,300

In an earlier interview, Strategic Funding CEO Andrew Reiser said, “It’s certainly exciting to be able to meet the requirements of a securitization. Kroll is a very responsible agency and they put you through a lot of rigor to be able to meet [their] requirements and have a rated bond.”

FinMkt Launches ISO Business

May 10, 2018

FinMkt has launched a broad ISO, working with referral partners from brokers to accountants to small business advisors. With two years of experience facilitating consumer lending, the company has just entered the small business lending market.

“We took the same engine that we used on the consumer side and we rolled it over to the small business side,” said FinMkt’s VP of Business Development who is overseeing this new division, called Bizloans.

The Bizloans brand within FinMkt started at the end of last year, but has been in stealth mode for the last three to six months, Sklar told AltFinanceDaily. So far, Bizloans has facilitated $15 million in loan application requests over the last 60 days. Of this, roughly $5 million has been funded.

The new division can present small businesses with a variety of financing, from merchant cash advance to factoring and lines of credit. In the few months that FinMkt’s Bizloans has been in operation, Sklar said that real estate asset-backed loans, equipment leasing and merchant cash advance has made up the bulk of the funding products facilitated.

For MCA products, $35,000 has been the average request and $150,000 has been the average for equipment leasing. According to Sklar, some of the funding companies that Bizloans has already worked with include OnDeck, Gibraltar, SOS Capital, 6th Avenue Capital and the San Diego-based bank holding company, BofI.

For successfully funded deals, Sklar said that they will get paid a commission and then pay the broker, depending on how involved they were in the deal.

“The commission splits vary depending on the amount of legwork and the amount of sophistication [the broker has] in the industry,” Sklar said.

For deals where the broker did most all of the work and simply used Bizloans as a platform, those brokers will generally get 80% of the commission, Sklar said. If the broker only supplied the lead, then they may only get 40%. Bizloans offers training to brokers less familiar with the industry.

Founded in 2011 by CEO Luan Cox and CTO Sri Goteti, FinMkt initially operated in the crowdfunded securities space. The company of 15 people is headquartered in New York City and has an office in Hyderabad, India.

Wayward Merchants

April 19, 2018

Wayward merchants and outright criminals are continuing to bilk the alternative small-business funding industry out of cash at a dizzying pace. In fact, an estimated 23 percent of the problematic clients that funders reported to an industry database in 2017 appeared to have committed fraud, up from approximately 17 percent in the previous year. That’s according to Scott Williams, managing member of Florida-based Financial Advantage Group LLC, who along with Cody Burgess founded the DataMerch database in 2015. Some 11,000 small businesses now appear in the database because they’ve allegedly failed to honor their commitments to funders, Williams says.

Whether fraudulent or not, defaults remain plentiful enough to keep attorneys busy in funders’ legal departments and at outside law firms funders hire. “I do a lot of collections work on behalf of my cash-advance clients, sending out letters to try to get people to pay,” says Paul Rianda, a California-based attorney. When letters and phone calls don’t succeed, it’s time to file a lawsuit, he says.

Lawsuits become necessary more often than not by the time a funder hires an outside attorney, according to Jamie Polon, a partner at the Great Neck, N.Y.- based law firm of Mavrides Moyal Packman Sadkin LLP and manager of its Creditors’ Rights Group. “Typically, my clients have tried everything to resolve the situation amicably before coming to me,” he observes.

That pursuit of debtors isn’t getting any easier. These days, it’s not just the debtor and the debtor’s attorney that funders and their attorneys must confront. Collections have become more difficult with the recent rise of so-called debt settlement companies that promise to help merchants avoid satisfying their obligations in full, notes Katherine Fisher, who’s a partner in the Maryland office of the law firm of Hudson Cook LLP.

Meanwhile, a consensus among attorneys, consultants and the funders themselves holds that the nature of the fraudulent attacks is changing. On one side of the equation, crooks are hatching increasingly sophisticated schemes to defraud funders, notes Catherine Brennan, who’s also a partner in the Maryland office of Hudson Cook LLP. On the other side, underwriters and software developers are becoming more skilled at detecting and thwarting fraud, she maintains.

Meanwhile, a consensus among attorneys, consultants and the funders themselves holds that the nature of the fraudulent attacks is changing. On one side of the equation, crooks are hatching increasingly sophisticated schemes to defraud funders, notes Catherine Brennan, who’s also a partner in the Maryland office of Hudson Cook LLP. On the other side, underwriters and software developers are becoming more skilled at detecting and thwarting fraud, she maintains.

Digitalization is fueling those changes, says Jeremy Brown, chairman of Bethesda, Md.-based RapidAdvance. “As the business overall becomes more and more automated and moves more online – with less personal contact with merchants – you have to develop different tools to deal with fraud,” he says.

A few years ago, the industry was buzzing about fake bank statements available on craigslist, Brown recalls. Criminals who didn’t even own businesses used the phony statements to borrow against nonexistent bank accounts, and merchants used the fake documents to inflate their numbers.

Altered or invented bank statements remain one of the industry’s biggest challenges, but now they’ve gone digital. About 85 percent of the cases of fraud submitted to the DataMerch database involve falsified bank documents, nearly all of them manipulated digitally, Williams notes.

Merchants alter their statements to overstate their balances, increase the amount of their monthly deposits, erase overdrafts, or hide automatic payments they’re already making on loans or advances, Williams says. Most use software that helps them reformat and tamper with PDF files that begin as legitimate bank statements, he observes.

To combat false statements, alt funders are demanding online access to applicants’ actual bank accounts. Some funders ask for prospective clients’ usernames and passwords to examine bank records, but applicants often consider such requests an invasion of their privacy, sources agree.

That’s why RapidAdvance has joined the ranks of companies that use electronic tools like DecisionLogic, GIACT or Yodlee to verify a bank balance or the owner of the account and perform test ACH transfers – all without needing to persuade anyone to surrender personally identifiable information, Brown says.

Other third-party systems can use an IP address to view the computing device and computer network that a prospective customer is using to apply for credit, Brown says. RapidAdvance has received applications that those tools have traced to known criminal networks. The systems even know when crooks are masking the identity of the networks they’re using to attempt fraud, he observes.

RapidAdvance has also developed its own software to head off fraud. One program developed in-house cross references every customer who’s contacted the company, even those who haven’t taken out a loan or merchant cash advance. “People who want to defraud you will come back with a different business name on the same bank account,” Brown says. “It’s a quick way to see if this is somebody we don’t want to do business with.”

Sometimes businesses use differing federal tax ID numbers to pull off a hoax, according to Williams at DataMerch. That’s why his company’s database lists all of the ID numbers for a business.

All of those electronic safeguards have come into play only recently, Brown maintains. “We didn’t think about any of this five years ago – certainly not 10 years ago,” he says. In those days, funders were satisfied with just an application and a copy of a driver’s license, he remembers.

Since then, some sage advice has been proven true. When RapidAdvance was founded in 2005, the company had a mentor with experience at Capital One, Brown says. One piece of wisdom the company guru imparted was this: “Watch out when the criminals figure out your business model.” That’s when an industry becomes a target of organized fraud.

As that prediction of fraud has become reality, it hasn’t necessarily gotten any easier to pinpoint the percentage of deals proposed with bad intent. That’s because underwriters and electronic aids prevent most fraudulent potential deals from coming to fruition, Brown notes. The company looks at the loss rates for the deals that it funds, not the deals it turns down.

Brown guesses that as many as 10 percent of applications are tainted by fraudulent intention. “It’s meaningful enough that if you miss a couple of accounts with significant dollar amounts,” he says, “then it can have a pretty negative impact on your bottom line.”

Some perpetrators of fraud merely pretend to operate a small business, and funders can discover their scams if there’s time to make site visits, Rianda notes. Other clients begin as genuine entrepreneurs who then run into hard times and want to keep their doors open at all costs, sources agree.

Applicants sometimes provide false landlord information, something that RapidAdvance checks out on larger loans, Brown notes. Underwriters who call to verify the tenant-landlord relationship have to rely upon common sense to ferret out anything “fishy,” he advises.

Applicants sometimes provide false landlord information, something that RapidAdvance checks out on larger loans, Brown notes. Underwriters who call to verify the tenant-landlord relationship have to rely upon common sense to ferret out anything “fishy,” he advises.

Underwriters should ask enough questions in those phone calls to determine whether the supposed landlord really knows the property and the tenant, which could include queries concerning rent per square foot, length of time in business and when the lease terminates, Brown suggests. All of that should match what the applicant has indicated previously.

Lack of a telephone landline may or may not provide a clue that an imposter is posing as a landlord, Brown continues. Be aware of a supposed landlord’s verbal stumbles, realize something’s possibly amiss if a dubious landlord lacks of an online presence, note whether too many calls to the alleged landlord go into voicemail and be suspicious if a phone exchange with a purported landlord simply “feels” residential instead of commercial, he cautions.

Reasonable explanations could exist for any of those concerns, but when in doubt about the validity of a tenant-landlord relationship it pays to request a copy of the lease or other type of verifications, according to Brown. Then there are the cases when the underwriter is talking to the actual landlord, but the applicant has convinced the landlord to lie. It could happen because the landlord might hope to recoup some back rent from a merchant who’s obviously on the verge of closing up shop.

Occasionally, formerly legitimate merchants turn rogue. They take out a loan, immediately withdraw the funds from the bank, stop repaying the loan, close the business and then walk or run away, notes Williams. “We view that as a fraudulent merchant because their mindset all along was qualifying for this loan and not paying it back,” he says.

Collecting on a delinquent account becomes problematic once a business closes its doors, Rianda notes. As long as the merchant remains in business, funders can still hope to collect reduced payments and thus eventually get back most or all of what’s owed, he maintains.

In another scam sometimes merchants whose bank accounts are set up to make automatic transfers to creditors simply change banks to halt the payments, Brown says. That move could either signal desperation or indicate the intent to defraud was there from the start, he says.

Merchants with cash advances that split card revenue could change transaction processors, install an additional card terminal that’s not programmed for the split or offer discounts for paying with cash, but those scams are becoming less prevalent as the industry shifts to ACH, Brown says. Industrywide, only 5 percent to 10 percent of payments are collected through card splits these days, but about 20 percent of RapidAdvance’s payments are made that way.

Merchants occasionally blame their refusal to pay on partners who have absconded with the funds or on spouses who weren’t authorized to apply for a loan or advance, Brown reports. Although that claim might be bogus, such cases do occur, notes Williams of DataMerch. People who own a minority share of a business sometimes manipulate K-1 records to present themselves as majority owners who are empowered to take out a loan, Williams says.

In a phenomenon called “stacking,” merchants take out multiple loans or advances and thus burden themselves with more obligations than they can meet. Whether or not that constitutes fraud remains debatable, Rianda observes. Stacking has increased with greater availability of capital and because some funders purposely pursue such deals, he contends.

Some contracts now contain covenants that bar stacking, notes Brennan of Hudson Cook. As companies come of age in the alt-funding business, they are beginning to employ staff members to detect and guard against practices like stacking, she says.

Moreover, underwriting is improving in general, according to Polon “The vetting is getting better because the industry is getting more mature,” he says. “The underwriting teams have gotten very good at looking at certain data points to see something is wrong with the application – they know when something doesn’t smell right.” They’re better at checking with references, investigating landlords, examining financials and requesting backup documentation, he contends.

Despite more-systematic approaches to foiling the criminal element and protecting against misfortunate merchants, one-of-a-kind attempts at fraud also still drive funders crazy, Brown says. His company found that a merchant once conspired with the broker who brought RapidAdvance the deal. The merchant and the broker set up a dummy business, transferred the funds to it and then withdrew the cash. “The guy came back to us and said, ‘I lost all the money because the broker took it,’” he recounts. “Why is that our problem?” was the RapidAdvance response.

Although such schemes appear rare, some funders are developing methods of auditing their ISOs to prevent problems, notes Brennan. They can search for patterns of irregularities as an early-warning system, she says. It’s also important to terminate relationships with errant brokers and share information about them, she advises, adding that competition has sometimes made funders reluctant to sever ties with brokers.

Although fraud’s clearly a crime, the police rarely choose to involve themselves with it, Brown says. His company has had cases where it lost what it considered large dollar amounts – say $50,000 – and had evidence he felt clearly indicated fraud but the company couldn’t attract the attention of law enforcement, he notes.

Although fraud’s clearly a crime, the police rarely choose to involve themselves with it, Brown says. His company has had cases where it lost what it considered large dollar amounts – say $50,000 – and had evidence he felt clearly indicated fraud but the company couldn’t attract the attention of law enforcement, he notes.

Rianda finds working with law enforcement “hit or miss,” whether it’s a matter of defaulting on loans or committing other crimes. In one of his cases an employee forged invoices to steal $100,000 and the police didn’t care. In another, someone collected $3,000 in credit card refunds and went to jail. If the authorities do intervene, they may seek jail time and sometimes compel crooks to make restitution, he notes.

“Engaging law enforcement is generally not appropriate for collections,” according to Fisher from Hudson Cook. However, notifying police agencies of fraud that occurs at the inception of a deal can sometimes be appropriate, says Fisher’s colleague Brennan, particularly when organized gangs of fraudsters are at work.

At the same time, sheriffs and marshals can help collect judgments, Polon says. He works with attorneys, sheriffs and marshals all over the country to enforce judgments he has obtained in New York State, he says. That can include garnishing wages, levying a bank account or clearing a lien before a debtor can sell or refinance property, he notes.

When Rianda files a lawsuit against an individual or company in default, the defendant fails to appear in court about 90 percent of the time, he says. A court judgment against a delinquent debtor serves as a more effective tool for collections than does a letter an attorney sends before litigation begins, Rianda notes.

But even with a judgment in hand, attorneys and their clients have to pursue the debtor, often in another state and sometimes over a long period of time, Rianda continues. “The good news is that in California a judgment is good for 10 years and renewable for 10,” he adds.

So guarding against fraud comes down to matching wits with criminals across the country and around the world. “It makes it hard to do business, but that’s the reality,” Brown concludes. Still, there’s always hope. To combat fraud, funders should work together, Brennan advises. “It’s an industrywide problem … so the industry as a whole has a collective interest in rooting out fraud.”

Enova’s TBB Did $15M in Merchant Cash Advance Revenue in 2017

March 12, 2018International online lending conglomerate, Enova, generated $843.7 million in revenue last year, according to their recent annual report. More than $15 million came from merchant cash advances (MCAs) made through The Business Backer (TBB), a small business financing company they acquired in 2015. That’s down from $18.6 million in MCA revenue generated in 2016.

Though MCA revenue may be down, TBB began offering an installment small business loan product in 2017. They’re available in 10 states, according to the company.

Enova refers to MCAs as RPAs in their reports, short for Receivable Purchase Agreements. “Small businesses receive funds in exchange for a portion of the business’s future receivables at an agreed upon discount,” they state.”A small business customer who enters into a RPA commits to delivering a percentage of its receivables through ACH or wire debits or by splitting credit card receipts until all purchased receivables are delivered.” That is a textbook explanation of MCAs.

Their average “RPA” customer averages $1.5 million in annual sales and has 10 years of operating history.

I Got Funded, Again

March 1, 2018 One year after I received a 12-month loan from Square on fixed monthly ACH, I logged onto my dashboard to renew. I was pre-approved to do it all over again, the screen indicated, but the monthly ACH payment option had disappeared. In its place, Square offered to withhold a fixed percentage of my credit card sales going forward until the balance was paid in full.

One year after I received a 12-month loan from Square on fixed monthly ACH, I logged onto my dashboard to renew. I was pre-approved to do it all over again, the screen indicated, but the monthly ACH payment option had disappeared. In its place, Square offered to withhold a fixed percentage of my credit card sales going forward until the balance was paid in full.

Known as a “split,” diverting a percentage of the card payment proceeds to a financial company is straight out of the merchant cash advance playbook. Square, however, structures their transactions as loans. That means that regardless of how my sales ebb and flow, I must pay off my balance in full in 18 months.

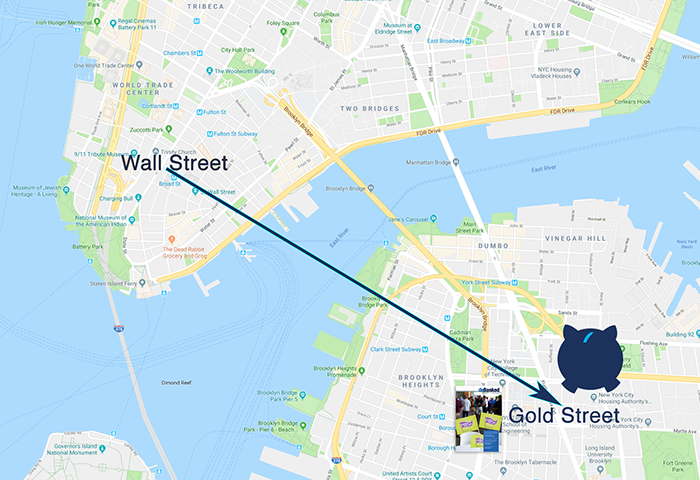

I was okay with that. I had to be. It was that time of year when working capital is very important, the holidays. Not to mention, AltFinanceDaily was in the process of moving, again. If you recall in December of 2016, we moved to a slightly larger office in the same building on Wall Street. In December of 2017, however, we moved from Manhattan to Brooklyn, a process that was a little more involved.

But this loan had no monthly payment, just a 15.75% split. Others may refer to this as the holdback, withhold, or specified percentage. Square’s application process this time around was slightly more rigorous than a year ago, a few more buttons, a couple more disclosures, and even a notice that a review could take between 1-3 days. I was still approved the same day, however, and had funds the next. There were no hidden fees or closing costs.

Six days after being funded, I ran a charge, Square took their split, and I netted the different minus the interchange fees. I noticed, but in a way I didn’t. I didn’t have to worry about how much the monthly payment would be and when. The loan was being repaid all by itself. That was how I processed it psychologically anyway, as I imagine many other small business owners have as well.

And the feeling of relief from impending monthly payments is not entirely mental. Seven weeks later, I was already 17% paid off. That’s real progress, especially with a 65-week window remaining to pay off in full.

Had the same transaction been structured as a merchant cash advance, the timeframe would’ve been unlimited. But hey, I guess sometimes you can’t have it all. It was a 1.10 factor rate, decent by industry standards, certainly not the most expensive, but not the least expensive either. It was fast, it was helpful, and best of all, it was free from the burden of fixed monthly payments.

I got funded again and loved it. What are you still waiting for?

Editors Note: AltFinanceDaily did not collaborate with Square in the writing of this editorial. Square did not even contact us after I published my first experience with their product one year ago. It is unclear if they are even aware that I wrote anything at all. Square is not an advertiser nor have they sponsored any of our events. I did not attempt to interview them for this write-up or tip them off that I would be writing anything. To my knowledge, we did not receive any special benefit or pricing. AltFinanceDaily chose Square for funding in part to avoid the conflict of writing a review about a paying advertiser or sponsor.