Confidence Down, But Not Out On Continued Success of Small Business Finance, Survey Reveals

July 19, 2016 A joint Bryant Park Capital/AltFinanceDaily survey of chief executives in the small business lending and merchant cash advance space showed a decline in confidence in the industry’s continued success, down from 91.7% in Q1 to 78.5% in Q2.

A joint Bryant Park Capital/AltFinanceDaily survey of chief executives in the small business lending and merchant cash advance space showed a decline in confidence in the industry’s continued success, down from 91.7% in Q1 to 78.5% in Q2.

Respondents were not asked to explain the reasons behind their confidence levels, but increased competition is likely one contributing factor. No doubt some of the creeping pessimism is also spillover from the adjustments occurring in consumer lending, namely declining loan volumes, layoffs and the events that took place at Lending Club.

Decreased confidence may have been the reason that attendance at AltLend last week was down compared to last year. AltLend is an alternative small business lending conference hosted each year at the Princeton Club in NYC. AltFinanceDaily has been a media partner of the event for the last two years.

On Forbes, Lendio CEO Brock Blake wrote that “2014 and 2015 brought an unhealthy amount of euphoria characterized by huge growth rates, hundreds of millions of dollars in venture capital, enormous valuations, high-flying IPOs, new lenders sprouting (almost) daily, and yield-hungry hedge funds chasing the newest, sexiest cash-producing asset.” But he added that “the industry is maturing and the future for online lending remains bright.”

Notably, 78.5% isn’t even bearish territory, but rather just a step down from the highs Blake described that have catapulted the industry for some time. Even as executives come to grips with the increasing regulatory scrutiny, non-bank small business financing companies have come to view themselves as in it for the long haul. That’s because growth in this sector has been less about refinancing credit cards to a lower interest rate for evermore narrow yields like on the consumer side, and more about fulfilling a role with small businesses that banks have been reluctant to take on for some time.

“Small business lending provides the fuel for small businesses across the country, and the fundamentals are still in place for this to be a formidable industry,” Blake wrote. “I am confident the supply of capital will continue to come from online lenders using technology to minimize risk and streamline processes.”

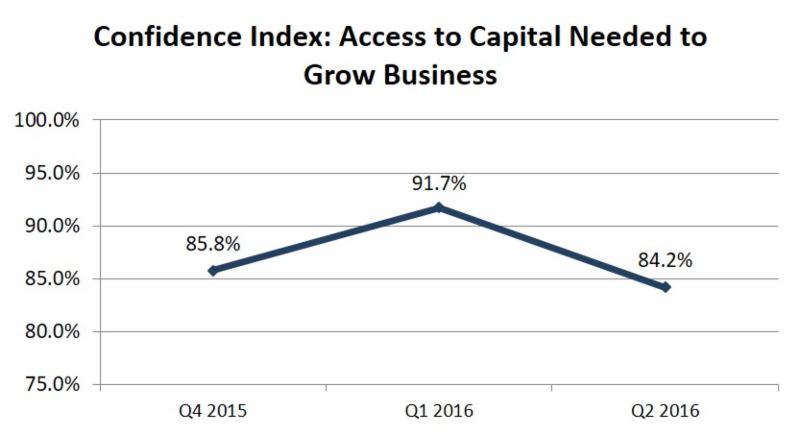

To his point, June and early July were a bright spot for companies raising capital. Fundry, Bizfi, Pearl Capital and Legend Funding all announced deals. The BPC/AltFinanceDaily survey showed that industry optimism in this endeavor hasn’t shrunk by much, decreasing only from 91.7% in Q1 to 84.2% in Q2.

Online Consumer Lenders Stumble, While Online Business Lenders Stay On Their Game

July 8, 2016

Something is happening in the land of marketplace lending, painful setbacks. And it’s mostly on the consumer side.

Avant, for example, plans to cut up to 40% of its staff, according to the Wall Street Journal. Prosper is cutting or has cut its workforce by 28%. For Lending Club it’s by 12% and for CommonBond by 10%. And then there’s Kabbage, whose consumer lending division playfully named Karrot, has been wound down altogether.

Kabbage/Karrot CEO Rob Frohwein told the WSJ that Karrot was put to sleep about three or four months ago, right around the time that it became obvious to industry insiders that the temperature had changed.

Ironically, the person who best summed up the problem is the chief executive of a lender that rivals the ones that are suffering, but has announced no such job cuts of his own. In March, SoFi CEO Mike Cagney told the WSJ “In normal environments, we wouldn’t have brought a deal into the market, but we have to lend. This is the problem with our space.” And that is a problem indeed because the success of these businesses becomes entirely dependent on making as many loans as possible so they can raise more capital to make as many more loans as possible so they can raise more capital. Perhaps the end game of that dangerous cycle is to go public, but the market has gotten a glimpse now of what that might look like, and they’re not very impressed with Lending Club.

The pressure of living up to the expectation of eternal loan growth manifested itself when Lending Club manipulated loan data in a $22 million loan sale to an investor, but it was a problem all the way back to their inception. In 2009, the company founder made $722,800 worth of loans to himself and to family members, allegedly to keep up the appearances of continuous loan growth. It was never found out until last month, seven years later.

That is a perfect example of the vulnerability that SoFi’s CEO spoke of months ago when he said, “we have to lend.” Because if they don’t lend or investors won’t give them money to lend, well then we’d probably see things like massive job cuts, falling stocking prices, and a loss of investor confidence. And that’s what we’re seeing now.

This wave of cuts is not affecting much of the business lending side

Despite the rush to the exits on consumer lending, Kabbage’s CEO is still very bullish on their business lending practice, so much so that they intend to increase their staff by more than 25%.

And in the last month alone, four companies that primarily offer merchant cash advances, have announced new credit facilities to the aggregate tune of $118 Million, one of whom is Fundry which landed $75 Million. Meanwhile, Fora Financial secured a $52.5 Million credit facility in May. Fora offers both business loans and MCAs.

And here’s one big difference between the consumer side and the business side. While online consumers lenders have found themselves trapped on the hamster wheel of having to lend, there is very little such pressure on those engaged in business-to-business transactions. Sure, their investors and prospective investors want to see growth, but only a handful are following the Silicon Valley playbook of always trying to get to the next venture round fast enough, lest they self destruct.

Avant’s latest equity investment, for example, was a Series E round. Prosper and Lending Club also hopped from equity round to equity round, progressing on a track with evermore venture capitalists that were likely betting on the companies going public.

But over on the business side, they’re much less likely to involve venture capitalists. Equity deals tend to be one-offs, major stakes acquired by private equity firms or private family offices, sometimes for as much as a majority share. These deals tend to be substantially bigger, are harder to land, and are less likely to be driven by long-shot gambles. In other words, the motivation is less likely to be driven by the hope that the company can simply lend just enough in a short amount of time to land another round of capital from another investor.

Examples:

- RapidAdvance was acquired by Rockbridge Growth Equity

- Fora Financial sold an undisclosed but “significant” stake to Palladium Equity Partners

- Strategic Funding Source sold a large stake to Pine Brook Partners

- Fundry sold a large stake to a private family office

Business lending behemoth CAN Capital has raised all the way up to a Series C round but they’ve been in existence for 18 years, way longer than any of their online lending peers. Several other of the top companies in the business-to-business space have relied only on wealthy investors that did not even warrant the need for press.

The upside is that these companies are less vulnerable to the whims of market interest and confidence. Having a down month would not trigger an immediate death spiral, where a downtick in loans means less investor interest which means a further downtick in loans, etc.

The margins in the business-to-business side tend to be bigger too, which means it’s the profitability that often motivates investments, rather than pure origination growth potential.

There are outliers, of course. Kabbage, which has raised Series A through E rounds already, admitted to the WSJ that they still aren’t profitable. Funding Circle, which also raised several rounds, disclosed that at the end of 2014, they had lost £19.4 Million for the year, about the equivalent of $30 Million US at the time.

These facts do not mean that either company is in trouble. Kabbage is not limiting themselves to just making loans for instance, since they also have a software strategy to license their underwriting technology to banks like they have already with Spain’s Banco Santander SA and Canada’s Scotiabank. And Funding Circle enjoys government support at least in the UK where they primarily operate. There, the UK government is investing millions of dollars towards loans on their platform as part of an initiative to support small businesses.

Business lenders and merchant cash advance companies may not necessarily be on the same venture capital track as many of their consumer lending peers because it is a lot more difficult to perfect and scale small business loan underwriting. Even the most tech savvy of the bunch are examining tax returns, verifying property leases, reviewing corporate ownership documents, and scrutinizing applicants through phone interviews. While this process can be done much faster than a bank, there’s still a very old-world commercial finance feel to it that lacks a certain sex appeal to a Silicon Valley venture capitalist who may be expecting a standalone world-altering algorithm to do all the risk related work so that marketing and volume becomes all that matters. Maybe on the consumer side something close to that exists.

Instead, a commercial underwriting model steeped in a profitability-first mindset makes online business lenders better suited to be acquired by a traditional finance firm, rather than a venture capitalist that is probably hoping to hitch a ride on the join-the-fintech-frenzy-and-go-public-quickly-so-I-can-make-it-rain express train.

Consumer lenders who had to lend and are faltering lately, will now have to figure out something more long term beyond just making as many loans as possible. It might not be something that excites their venture capitalist friends, but it is crucial to building a company that will last a long time.

Marketplace Lending Hearing To Be Held By House Subcommittee

July 7, 2016 On July 12th, the Subcommittee on Financial Institutions and Consumer Credit is scheduled to hold a hearing to examine the opportunities and challenges specifically in online marketplace lending. Among the witnesses offering testimony will be Parris Sanz, Chief Legal Officer of CAN Capital and Sachin Adarkar, General Counsel of Prosper Funding. Rob Nichols, the CEO of the American Bankers Association and Bimal Patel, a partner of O’Melveny & Myer will join them.

On July 12th, the Subcommittee on Financial Institutions and Consumer Credit is scheduled to hold a hearing to examine the opportunities and challenges specifically in online marketplace lending. Among the witnesses offering testimony will be Parris Sanz, Chief Legal Officer of CAN Capital and Sachin Adarkar, General Counsel of Prosper Funding. Rob Nichols, the CEO of the American Bankers Association and Bimal Patel, a partner of O’Melveny & Myer will join them.

The hearing will be held at 2PM in room 2128 of the Rayburn House Office Building and also streamed online.

A memorandum circulated by the House Financial Services Committee said that the “hearing will give Committee members the opportunity to assess the development of the FinTech market, including how online lenders and banks interact. Further, the hearing will evaluate the current regulatory structure and recent policy developments.”

American Express Expands Business Loan Options

July 5, 2016 American Express is expanding beyond their merchant financing program. The new Working Capital Terms program makes small business owners who are simply Amex cardholders, eligible for funding as well.

American Express is expanding beyond their merchant financing program. The new Working Capital Terms program makes small business owners who are simply Amex cardholders, eligible for funding as well.

There’s a catch however. The funds must be used to pay vendors, according to Bloomberg, a process which Amex controls by paying the vendors on the borrower’s behalf. The program is more a way to enable small businesses to pay vendors using their Amex card in situations where vendors don’t accept Amex, rather than providing businesses with capital to use on a discretionary basis like OnDeck and Square Capital offer.

The Bloomberg story headline, “AmEx Challenges Square, On Deck With Online Loan Marketplace” is pretty misleading. They actually quote Susan Sobbott, AmEx’s president of global commercial payments, as saying “It’s a big opportunity for us to go into an area where businesses want to pay vendors that don’t accept any credit cards.”

There does not appear to be any “marketplace.”

In April, AmEx made their merchant financing program available on the Lendio platform. That product, which is different than the new Working Capital Terms program, was called a hybrid between a merchant cash advance and a bank loan, according to Lendio CEO Brock Blake. Merchants with a minimum revenue of $50,000 and two years of operating history can apply for that loan based on cash flow and historical credit card sales activity.

Split-Funding MCA and Daily Debit Loans Are Spreading Across the World

July 4, 2016

When banks say no, merchants all over the world are getting funded via non-bank alternatives that resemble products here in the USA. In Hong Kong for example, a special administrative region of China, there are non-bank businesses that offer merchant cash advances and/or daily debit loans.

Having had the opportunity to visit with some of those funders there last week, I was surprised to learn that we spoke the same language. By that I mean that they price deals with factor rates, work with local finance brokers, underwrite files using recent bank statements, do site inspections and more. They even a have decision issued by the highest court in the land that declared merchant cash advances to be purchases, not loans.

Even the pitch is basically the same. “Banks aren’t lending to small businesses,” I heard time and time again in Hong Kong. And that’s probably not going to change any time soon. While the non-bank business financing scene is starting to take off, merchant cash advances in particular have been around there for about seven years already.

Hong Kong’s population is a little less than a third of the size of Australia, where many US-based funders have been expanding to over the last couple years.

Business Finance Companies Visit Capitol Hill

June 17, 2016 Scores of companies providing working capital to small businesses descended on Capitol Hill in early May to educate policymakers about the benefits they provide to the economy. Among them was the Coalition for Responsible Business Finance (CRBF), the Electronic Transactions Association (ETA) and the Commercial Finance Coalition (CFC).

Scores of companies providing working capital to small businesses descended on Capitol Hill in early May to educate policymakers about the benefits they provide to the economy. Among them was the Coalition for Responsible Business Finance (CRBF), the Electronic Transactions Association (ETA) and the Commercial Finance Coalition (CFC).

The inability of banks to satisfy the demands of small businesses is not new, nor is it a problem purely borne out of the recession, data indicates. That’s partially why the Small Business Administration (SBA) exists, according to a 2014 report co-authored by former SBA Administrator Karen Mills.

“If the market will give a small business a loan, there is no need for taxpayer support,” the report states. “However, there are small businesses for which the bank would like to make a loan but that business may not meet the bank’s standard credit criteria.” That occurs so often that the SBA actually had to temporarily suspend guarantees last year because they had reached their limit.

“The SBA has a portfolio of over $100 billion of loans that lenders would not make without credit support,” according to Mills’ report. If that number looks big, it’s because it’s comprised mainly of loans to the larger end of the small business spectrum. Smaller businesses or businesses with smaller needs anyway, continue to be underserved. The average 7(a) loan guaranteed by the SBA in fiscal year 2015 for example was $371,628. Compare that to the $20,000 – $35,000 average deal size reported by some members of the CFC.

“Small firms were hit harder than large firms during the crisis, with the smallest firms hit the hardest,” Mills’ report states, but it adds that small businesses have been responsible for adding two out of every three net new jobs since 2010.

Tom Sullivan, who leads the CRBF, emphasized to AltFinanceDaily that job creation plays a crucial role in what their organization represents and stressed that it was very important to get the input of small business owners when policymakers consider new regulations.

The CFC meanwhile, estimates that aggregate funding between its members have preserved at least 1 million jobs. And OnDeck, who was on the Hill with the ETA, announced late last year that their first $3 billion in loans have generated an estimated $11 billion in US economic impact and actually created 74,000 jobs.

While the schedules and agendas of each group were different, the CFC reportedly met with nearly two-dozen House and Senate members or their staff in a single day.

BRIEF: Legend Funding Secures $3 million Debt Facility

June 14, 2016New York City-based merchant cash advance company Legend Funding secured a $3 million debt facility from Houston-based investment investment banking firm Ango Worldwide.

Legend provides working capital financing to businesses in the USA and Canada and the company plans to use the funds for expansion. The deal gets Ango some equity and a seat on the board.

“The merchant cash advance industry is experiencing exciting growth and we felt that the legend management team are strongly positioned to take advance of this opportunity,” said Ango CEO John Carson in a news release.

Second Circuit Incorrect on Madden Case, US Solicitor General Opines

May 25, 2016

Given the Madden v Midland decision, does the National Bank Act continue to have preemptive effect after the national bank has sold or otherwise assigned the loan to another entity?

This question was presented to the US Solicitor General, the person appointed to represent the federal government of the United States of America in Supreme Court cases. The US Supreme court had asked the Solicitor General to weigh in before deciding to take on the case. And the answer is in:

The US Court of Appeals for the Second Circuit was incorrect in its ruling, the federal government believes.

Nevertheless, the US Supreme Court should not even hear the case, they say, because there is “no circuit split on the question presented” and “the parties did not present key aspects of the preemption analysis” to the lower courts. Put simply, “The court of appeals’ decision is incorrect,” they explain, and the heart and soul of preemption itself has never been in question.

The message from the US Solicitor General is clear, carry on friends, nothing to see here with Madden v Midland.

The US Supreme Court could still opt to hear the case but that is very unlikely at this point. Lawsuits filed against alternative lenders such as Lending Club in recent months had used the Madden ruling as evidence to support usury complaints. The connection between a case where a debt collector bought a charged off credit card debt from a bank (which is what Madden was about) and the business model of Lending Club was already weak, but several plaintiffs hoped to use it as a stepping stone. The Solicitor General’s opinion could likely derail attempts by other plaintiffs to cite Madden.

Of notable mention is that many of today’s alternative lenders have relationships with state chartered banks that are covered under the Federal Deposit Insurance Act, not the National Bank Act which the US Supreme Court was asked about. While the two laws are very similar, it did put alternative lenders at an additional arm’s length from Madden.

You can read the Solicitor General’s full brief here.

Read revious posts about this case:

3/22/16 Plot Twist: Obama Administration to Comment on Madden v Midland

3/2/16 Lending Club Class Action Lawsuit Predicated on Madden v Midland Risk

2/26/16 Lending Club Shifts Fee Arrangement With WebBank

2/18/16 Without Scalia, Media Outlets Reporting Marketplace Lenders Supposedly Doomed With Supreme Court Case (They’re Wrong)

11/15/15 Madden v. Midland Appealed to the US Supreme Court

8/13/15 Madden vs. Midland Funding, LLC: What does it mean for Alternative Small Business Lending?

8/13/15 Madden v. Midland Appeal Rejected

8/8/15 Renaud Laplanche on Madden v. Midland

7/28/15 Blyden v. Navient Corp: A Glimpse of a Post-Madden Future?

6/11/15 Legal Brief: Madden v. Midland Funding