The Secret to Reviving Your Alternative Lending Business

April 14, 2017 It’s no secret times are changing for Small and Medium Enterprise (SME) lending. I think we can all agree the easy return on investment has given way to rising defaults and an origination engine that sounds like it’s barely chugging along. We all know the basic math in this business. Put lots of money on the street and hope the factor rates cover the losses while managing operating expenses to achieve a rate of return acceptable to private equity investors. So, when originations stall and defaults increase, the math becomes scary.

It’s no secret times are changing for Small and Medium Enterprise (SME) lending. I think we can all agree the easy return on investment has given way to rising defaults and an origination engine that sounds like it’s barely chugging along. We all know the basic math in this business. Put lots of money on the street and hope the factor rates cover the losses while managing operating expenses to achieve a rate of return acceptable to private equity investors. So, when originations stall and defaults increase, the math becomes scary.

As the fintech business leader for DataRobot, the leader in automated machine learning, I’ve had the opportunity to meet many SME business owners at LendIt in New York, and more recently at the Innovate Finance Global Summit in London. It’s very clear interest in machine learning (a branch of artificial intelligence used by many lenders to build risk-based pricing models) is at an all-time high. We’re grateful for the support of our customers, and we take our leadership role in predictive analytics and automated machine learning very seriously. We don’t just see ourselves as a software vendor. We’re innovators that listen intently to our customers (and potential customers), and build solutions that help them achieve their goals. So, when I see this critical juncture in the SME lending industry, I feel compelled to comment.

I believe the response in the industry to the current problem of growing defaults and dwindling originations is the wrong approach. Lenders seem to be doing one of three things (and potentially all of them): lowering underwriting standards, raising factor rates, or pushing independent sales organizations (ISOs) to bring in more applications by handing out one-time commission bumps or in-kind resources such as marketing support. I believe these actions are indicative of lenders who don’t fully realize the wealth of data they have in their companies. Let’s review what I would call a “prototypical” merchant cash advance or business loan lender. First, as Sean Murray, publisher of AltFinanceDaily, recently pointed out in a LinkedIn post (see, https://www.linkedin.com/feed/update/urn:li:activity:6253411111144685568/), most of the applications lenders receive are of very low quality, and in some cases are fraudulent. This will never be an industry where 50 percent of the applications will result in an offer. From the perspective of someone who talks to lenders almost every day, a company is lucky if 25 percent of its applicant pool can justify an offer. The fact is there just aren’t enough applicants in the industry to force that percentage to go much higher while still maintaining an acceptable default rate. And in terms of default rate, I’d question any lender who says their default rate is single digits. What that leaves us with is the number of applications which are approved and result in a closed deal (i.e., the “win-rate”). And this is where lenders are missing opportunities.

If lenders want to win in this industry, they need to win the right kind of deals that work for their individual business. If all lenders pursue the same strategy of pushing originations and taking on more risks, then many lenders are going to fail because a one-size fits all response to the current funding environment doesn’t work because there is no such thing as a one-size fits all portfolio. For example, if you specialize in “C” and “D” paper in the 3rd or 4th lien position, you want to win deals that look much different than lenders who want “A” paper in the 1st or 2nd lien position. Knowing how to increase your “win-rate” for YOUR type of deals is the key to success. And the key to the lender winning more of their type of deals is being able to understand their underwriting history and immediately spot deals that fit their framework, price them accordingly, and aggressively secure them before the competition. And that only happens if lenders understand their own data and have a risk-based pricing system which is lightning fast and makes the right decisions.

I’m not going to tell every lender to pursue automated machine learning. If a lender is brand-new to the market and isn’t keeping their data for analytical purposes, then deploying advanced machine learning algorithms is an inferior solution to good old-fashioned rules-based underwriting. But for everyone else, here is something you need to know. Many private equity funds are using machine learning algorithms to allocate their investments. It doesn’t take much imagination to consider those funds may start asking themselves why they are using machine learning to allocate their investments to companies not using machine learning to manage their risk exposure. The key to achieving success in a tightening market such as SME lending is to intimately understand your business. There is no more room for one-size fits all strategies. Consider what would happen if you simply doubled your “win-rate” for the deals that fit your business without looking at more applications? You would start spending a lot less time beating the originations drum and have more time to deliver superior customer service to increase your renewal rate. Automated machine learning can make that happen.

StreetShares Reports $2.8M Loss on Just $277,000 in Revenue For Last Six-Month Period

March 30, 2017 StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares has so far charged off 23 loans for a combined principal balance of $380,804. Charge-off determinations are made after 150 days of delinquency.

The company made history last year by becoming the first lender in the US to be approved by the SEC to use funds from public investors to back loans to small businesses. This was done through Regulation A+ of the Jumpstart Our Business Startups (JOBS) Act. Reg A+ investors make up $656,675 of StreetShares’ liabilities on the balance sheet.

StreetShares currently makes loans to small businesses between $2,000 to $500,000 for terms of three months to three years.

The company also spent more than 5x their revenue on payroll and payroll tax for the six-month period and more than 3x their revenue on marketing expenses.

Earlier this month, StreetShares announced a partnership with Nor-Cal FDC “to assist small business and veteran business owners in obtaining funding needed to win new opportunities.”

In the release, StreetShares CEO Mark Rockefeller said, “we’re eager to provide veteran-owned small businesses with the funding solutions they need to grow.”

Managing Risk in Small Business Lending

March 16, 2017 Two years ago, I left a promising career at PayPal, a major technology giant, for what some considered a risky move: I joined BlueVine, a young fintech startup. My title: vice president of risk.

Two years ago, I left a promising career at PayPal, a major technology giant, for what some considered a risky move: I joined BlueVine, a young fintech startup. My title: vice president of risk.

This year, I took on an even bigger role when I was named chief risk officer of the Silicon Valley company, which offers working capital financing to small and medium-sized businesses.

My promotion comes at a time when risk is becoming a bigger concern in fintech, which is ushering in big changes in banking and financial services.

Fintech revolutionizes financial services

Data science technology has dramatically improved access to financing and the way we manage our money. The fintech wave that began with my former company, PayPal, and the world of payments, has spread to other aspects of personal finance, from mortgages to student and auto loans to investing.

This expansion was accompanied by growing concern that the fintech boom is fraught with risks that, if left unchecked, could lead to a major bust in the financial services industry that could in turn cause harm to the broader economy.

In a speech in January, Mark Carney, the governor of the Bank of England, cited the need to “ensure that fintech develops in a way that maximises the opportunities and minimises the risks for society.” “After all, the history of financial innovation is littered with examples that led to early booms, growing unintended consequences, and eventual busts,” he said.

Risk management as key to success

Risk management certainly has been a focus area for BlueVine from the beginning.

BlueVine joined the revolution in small business financing in 2014 when it rolled out an innovative online invoice factoring platform.

Factoring is a 4,000-year old financing system that allows small businesses to get advances on their unpaid invoices by providing easy, convenient access to working capital. BlueVine transformed what had been a slow, clunky, paper-based solution into a flexible and convenient online financing system that enables entrepreneurs to plug cash flow gaps that often hamper business growth.

Because the BlueVine platform is based on cutting-edge data science technology that can process and analyze information to make quick funding decisions, managing risk inevitably became a major challenge in building our business. As Eyal Lifshiftz, our founder and CEO, recalled in a recent column, in BlueVine’s first month of operation, almost every other borrower defaulted.

In fact, that was partly the reason Eyal invited me to join his team. BlueVine serves small and medium-sized businesses seeking substantial working capital financing of up to $2 million. To succeed, we needed to build a robust data and risk infrastructure.

Small startup with big data needs

Joining BlueVine also posed a personal challenge.

At PayPal, where I started as a fraud analyst and then moved into the company’s data science division where I helped develop behavior-based risk models, I had enormous amounts of data to work with to do my job. Now, I was joining a young startup with very limited data history, but with big data needs.

This meant putting together exceptional and experienced teams of data scientists and underwriters and developing a technology that becomes progressively more precise and accurate as it draw lessons from our steadily expanding data and underwriting decisions. It was important for us to have a group of super smart, highly-motivated and technologically-strong people working closely with a team of experienced and sharp underwriters.

Here’s how the process works: Our underwriters develop a robust methodology which is then translated into detailed logic decision trees.

Each decision tree includes dozens, even hundreds of branches, made up of question sets on different underwriting situations.

For example, a decision tree could focus on approving new clients coming from a specific industry, such as transportation or construction, or on increasing the credit line for a client with a specific financial profile.

A typical decision tree would drill down on further financial questions: What’s the expected cash-flow of the business in three to six months? What’s the pace at which it has accumulated debt over the past year? Are the business sales seasonal in a material way?

The questions could also focus on non-financial areas: Does the company’s website look professional? How does it compare with major companies in its industry? Does the business actively maintain its Facebook and Twitter accounts?

The goal is to build a risk infrastructure that steadily becomes more efficient in answering questions in an automated, large-scale and highly accurate manner. Our data scientists leverage multiple external data sources and use dynamic advanced machine learning models to answer these questions pretty much in real-time and with a high degree of accuracy.

So it’s a combination of technology and human input. There will always be gray areas, questions and situations that cannot immediately be addressed by our computer models.

But as the models get better and more robust, the gray areas will shrink. Our models are constantly and automatically enhanced, re-trained and expanded by the most recent data and input from our underwriters.

Think of it as the fintech version of Deep Blue and AlphaGo, the powerful computer programs that famously outplayed topnotch chess grandmasters. Both programs were based on similar principles: the more they played, the more knowledge they absorbed and the more formidable they became at chess.

Technology and teamwork

An even better example is the self-driving car powered by Google’s artificial intelligence technology. Human input is still required, but the more driving the car does, the smarter and more autonomous it becomes.

Building our risk infrastructure is an ongoing process for BlueVine. But it already has helped us steadily expand our reach, making us stronger, smarter and even faster in financing small and medium-sized businesses.

In just a couple of years, the strides we’ve made in managing risk more effectively enabled us to increase our credit lines to $2 million for invoice factoring and $100,000 for business lines of credit, which means we’ve been able to serve bigger businesses with bigger financing needs.

While we initially focused mainly on small businesses with annual revenue of under $250,000, today we have an increasing number of clients with annual sales of more than $1 million and increasingly, we’ve been able to serve clients with revenue of more than $10 million a year.

By the end of 2016, BlueVine had funded roughly $200 million. We’re on track to fund half a billion dollars by the end of this year.

We’ve accomplished this in a time of heightened skepticism about fintech in general and alternative business lending in particular. But rather than scoff at this skepticism, I’d point out two things.

First, fear often accompanies the rise of a new technology. Second, in the wake of the 2009 financial crisis, it’s prudent to raise hard questions about the rapid emergence of new financial technologies.

While building technologies and companies that can provide financial services faster and easier is a laudable goal, It’s wise to move cautiously and with humility.

The BlueVine experience underscores this.

Risk is still a challenge we take on every day. But we have found ways to take it on confidently and effectively with a vigorous combination of technology and teamwork.

Ido Lustig is Chief Risk Officer of BlueVine.

Stolen Deals? How One Funder Used Technology to Say ‘No More’

March 14, 2017 It’s another chapter in the saga of stolen deals, a problem that shops all over the country seem to be grappling with. For Miami-based Greenbox Capital, company CEO Jordan Fein hoped it was something that they didn’t have to worry about. But believing it was better to be safe than sorry, Greenbox launched a 90-day probe to review all controls and personnel to see if theft existed in their organization and how it was being done. They weren’t too happy with the results, which determined that there was indeed employee theft taking place.

It’s another chapter in the saga of stolen deals, a problem that shops all over the country seem to be grappling with. For Miami-based Greenbox Capital, company CEO Jordan Fein hoped it was something that they didn’t have to worry about. But believing it was better to be safe than sorry, Greenbox launched a 90-day probe to review all controls and personnel to see if theft existed in their organization and how it was being done. They weren’t too happy with the results, which determined that there was indeed employee theft taking place.

Sources across the industry have told AltFinanceDaily that some employees will do things that make it easy to catch them, while others say that their tactics are constantly evolving. Disabling the USB ports isn’t enough, they say, since personal smart phones can be used to covertly steal data by simply taking pictures of a computer screen. Some say that apps like Snapchat are even making it increasingly easy for them to erase the evidence trail.

For Greenbox Capital, the probe convinced them that being a funding company meant they also needed to become a top-notch security company, especially since they are being entrusted with sensitive information. It’s their ISOs’ deals they have to protect, they say. Understanding how important that is, the company designed proprietary software to monitor the actions of all users on their system, which allows them to know who clicked on what when, and for how long. But that wasn’t enough, they insist. They also developed algorithms to detect suspicious behavior and their security team receives an alert whenever it gets triggered.

And it’s not just what someone clicked on or downloaded, they say, since their system also analyzes phone call activity, texting activity, wifi activity and the number of absences from one’s desk. The implication from that, of course, is that they must be incorporating video surveillance, which they confirmed they are.

They’re not alone. Chad Otar, CEO of Excel Capital Management, an ISO based in New York City, says that when it comes to their office, they have “eyes and ears everywhere.” Otar explains that because commission payouts can be so high, even experienced salespeople can feel tempted to risk their jobs to get their hands on good leads. Some will try to use different emails accounts on the office computer, using their private ones to transact information they’re not supposed to. To prevent that, they’re using Google Vault. “It allows us to monitor all emails going out and coming in from everyone’s account that is linked to the server,” he explains. “And if they try to access another email account, it blocks them.”

But even while threats like Snapchat exist, Otar says some employees will take a low-tech approach and hide valuable information in the trash bin and then offer or attempt to “take out the trash.”

For Greenbox, thanks to their new platform, they were actually able to catch two employees who were stealing data and actually selling deals on the black market.

A black market?

A black market?

To put such behavior in perspective, 3 years ago, the name and phone number for someone qualified and interested in working capital could fetch $200 through normal lead channels. These days, sources say it can cost several thousand dollars in marketing just to fund a single deal and that a good lead is worth more than gold.

Greenbox believes that all companies should stop and take a close look at the controls they have in place to catch internal theft. Determined to prevent what they found from ever happening again, they say they now have the tightest internal controls in the industry and advise all businesses to rethink their approach to data security. “As it stands today there is no safer place to send your deals,” company CEO Jordan Fein says.

Of note, readers should stand to realize that getting caught might not just mean embarrassment or termination. Last year, a former MCA sales rep pled guilty to attempted criminal possession of computer related material for being on the receiving end of stolen deal information and using it. Since then, other companies have privately suggested that this was not the only deal-stealing situation that has involved law enforcement and that data theft is a serious offense.

Excel Capital Management‘s Otar says that if you create a sense of pride and loyalty in your workplace, your own employees will report any bad behavior they witness to you.

For Greenbox Capital, they believe their cloud-based system and advanced algorithm is not just about funding more deals, it’s about protecting the integrity of the entire process and maintaining trust.

Stealing deals? it’s not worth the risk.

In Canada, Alternative Business Finance Industry Similar, Yet Different

March 8, 2017 David Gens believes the top 3 alternative small business finance players in Canada are funding between $15 million and $20 million to small businesses a month combined. That’s a small market compared to the US, where the top 3 companies are funding close to a half billion dollars per month. Gens, who has a background in private equity, is the founder, president and CEO of Merchant Advance Capital, a company with around 40 employees in offices in Toronto and Vancouver.

David Gens believes the top 3 alternative small business finance players in Canada are funding between $15 million and $20 million to small businesses a month combined. That’s a small market compared to the US, where the top 3 companies are funding close to a half billion dollars per month. Gens, who has a background in private equity, is the founder, president and CEO of Merchant Advance Capital, a company with around 40 employees in offices in Toronto and Vancouver.

“We don’t view ourselves as directly competing with banks,” Gens says, suggesting that his target market is less than prime. It’s a point that his counterparts in the US have made often. But there’s a slight difference with that approach in their market, he adds. “Most Canadian consumers are prime.” And unlike the US, the banks are not necessarily portrayed as the enemy in Canada where five major ones dominate the market.

“It’s exceptionally difficult for an alternative small business lender to build a brand,” said Jeff Mitelman, CEO of Montreal-based Thinking Capital, on a panel at the LendIt Conference. Despite that, his company has funded half a billion dollars to 15,000 unique businesses over the last 10 years. A panelist besides him half-joked however, that there is such an inherent conservatism with Canadian small business owners that some don’t even want to grow and are content with running lifestyle businesses.

But of the deals that are getting done, they’re often acquired through direct marketing. “The ISO market is not like it is in the US,” Gens says. “There’s just a handful of them.” Where there are ISOs though, competitive pressures usually follow. He says that they’re competing on at least 50% of the deals they work on, in part because of these ISOs. Stacking is happening in Canada too, he admits. “It’s not as crazy as it is in the states,” he contends. “Philosophically, it doesn’t align with our business.”

Some deals in Canada are actually being facilitated by US ISOs, he acknowledges, before clarifying that they should be aware that they will get paid in Canadian dollars, which at present are worth about a three quarters of an American dollar. They are in a different country after all.

Gens and others like Bruce Marshall, vice president of British Columbia-based Company Capital, agree that OnDeck’s push into Canada has been good for the entire industry. Six months ago, Marshall said, “We are happy that some of the bigger US players are coming up here and they are spending millions of dollars on advertising. These companies raise awareness of the industry to a higher level and with us being a smaller company, we can ride on their coattails.”

Over time, they believe alternatives will become more mainstream. For Gens, part of that is about doing right by the customer. “We pride ourselves on being very transparent,” he says. There are no hidden fees with their products and they can make things easy like use APIs to access a merchant’s bank statement history, provided an applicant wants to do it that way. “More than 50% of merchants are still submitting bank statements,” he says. That trend is still pretty much true in the US as well. “There’s a much lower incidence of fraud in Canada,” he asserts. It’s a nation of small businesses he’s content to serve.

The Top Small Business Funders of 2016

March 6, 2017The MCA and small business lending origination numbers for 2016 are in. In some cases, a company may have merely placed or facilitated an acquired customer with a partner or competitor (but still counted them in their annual volume) and thus the figures do not necessarily represent what actually went on balance sheet. The rankings omit some larger players for which no data could be confirmed and when a reasonable estimate could not be made.

| Company Name | 2016 Origination Volume | 2015 | 2014 |

| OnDeck | $2,400,000,000 | $1,900,000,000 | $1,200,000,000 |

| PayPal Working Capital | $1,500,000,000* | $900,000,000* | $250,000,000* |

| Kabbage | $1,250,000,000 | $1,000,000,000 | $400,000,000 |

| CAN Capital | $1,100,000,000* | $1,500,000,000* | $1,000,000,000* |

| Square Capital | $798,000,000 | $400,000,000 | $100,000,000 |

| Bizfi | $550,000,000 | $480,000,000 | $277,000,000 |

| Yellowstone Capital | $460,000,000 | $422,000,000 | $290,000,000 |

| Strategic Funding | $375,000,000 | $375,000,000 | $280,000,000 |

| National Funding | $350,000,000 | $293,000,000 | |

| BFS Capital | $300,000,000 | ||

| BlueVine | $200,000,000* | ||

| Platinum Rapid Funding Group | $180,000,000 | $100,000,000 | |

| IOU Financial | $107,600,000* | $146,400,000 | $100,000,000 |

*Asterisks signify that the figure is an estimate

Innovative Lending Platform Association and Coalition for Responsible Business Finance Join Forces

March 5, 2017NEW YORK, Early Release — The Innovative Lending Platform Association (ILPA) and the Coalition for Responsible Business Finance (CRBF) today announced they are joining forces and will now operate as the ILPA – the leading trade organization representing a diverse group of online lending and service companies serving small businesses. Joining ILPA’s existing members, OnDeck® (NYSE: ONDK), Kabbage® and CAN Capital, are CRBF member companies Breakout Capital, Enova International’s (NYSE: ENVA) The Business Backer™, PayNet and Orion First Financial. United by a shared commitment to the health and success of small businesses in America, the newly expanded ILPA is dedicated to advancing best practices and standards that support responsible innovation and access to capital for small businesses.

In addition, leading national small business organizations that formerly served as the CRBF Advisory Board will now represent small business customers as formal advisors to the ILPA. The Advisory Board includes individuals from the National Federation of Independent Business (NFIB), the National Small Business Association (NSBA), the Small Business & Entrepreneurship Council (SBE Council), the U.S. Chamber of Commerce, and new representatives from the Association for Enterprise Opportunity (AEO). These small business organizations have provided key input into the collective group’s best practices and standards initiatives over the past year, ensuring that the needs of their small business constituents are addressed.

The expanded ILPA remains committed to advancing online small business lending education, advocacy and best practices. In October, the ILPA introduced the SMART Box™ (Straightforward Metrics Around Rate and Total cost), a first-of-its-kind model pricing disclosure and comparison tool launched in partnership with the AEO. The SMART Box is focused on empowering small businesses to better assess and compare finance options and is now available for broader adoption by lending platforms. More details can be found at: http://innovativelending.org/smart-box/

As a leading voice for responsible business funding, CRBF launched in January 2016 with the mission to create a concrete code of ethics for the industry and to educate policymakers on the value of non-bank small business financing. The organization outlined responsible and transparent business practices for both providers as well as customers, and the expanded ILPA has leveraged that work to formulate an updated industry Code of Ethics that will guide the ILPA moving forward.

The expansion of the ILPA follows a period of broad stakeholder engagement and a demonstrated shared commitment to serving small businesses. With this unification, the cross-industry effort to bring innovative and responsible solutions to improve access to capital for Main Street small businesses continues to gain momentum.

“Fostering responsible innovation and empowering small businesses to better assess and compare finance options are priorities for the ILPA. We are delighted to join forces with the CRBF as we work together to advance small business online lending education, advocacy and best practices,” said Noah Breslow, Chief Executive Officer, OnDeck. “We are proud to be part of this growing cross-sector effort to help improve capital access on behalf of small businesses across the United States.”

“The combination of these leading organizations represents a landmark moment in the industry, signifying how major players in the small business lending space are increasingly aligned on values and best practices that benefit small businesses,” said Carl Fairbank, founder and chief executive officer, Breakout Capital. “Founded on the fundamental principles of responsible lending, education and transparency, Breakout Capital is thrilled to partner with other premier players in the industry who share our vision and believe that a unified industry voice can promote small business success more effectively. “As a founding member company of CRBF, The Business Backer is thrilled with the merger between the CRBF and the ILPA,” said Jim Salters, president of The Business Backer and CRBF Advisory Board member. “The move creates an even larger platform of industry leaders with a common voice to help ensure small businesses have access to honest and transparent funding sources.”

“The ILPA was launched as a self-regulatory exercise and is focused on empowering small businesses with clear and transparent ways to compare financing options,” said Rob Frohwein, co-founder and chief executive officer of Kabbage. “Kabbage and the ILPA are excited to join with the CRBF in order to advance ubiquitous industry standards. Together, we are eager to continue working with regulators and policymakers to expand small businesses’ ability to easily access technology-driven financing products.”

“Access to capital is a high priority for America’s small businesses. As our economy grows, small business owners need diverse sources of capital to hire new employees and expand their businesses. The U.S. Chamber of Commerce applauds the innovative capital providers in the ILPA for their dedication to fueling growth on Main Street,” said Tom Sullivan, vice president, small business, U.S. Chamber of Commerce.

“CAN Capital has been a supporter of transparency throughout our 19 year history, and we are excited to see the ILPA expand as it continues to support small business owners,” said Parris Sanz, chief executive officer of CAN Capital.

“Small business lending continues to be stubbornly elusive for many small firms and what we need is not just more lending, but better lending options,” said Todd McCracken, National Small Business Association president and chief executive officer. “This merger will expand on efforts to connect small business with a variety of fair and responsible lending resources.”

“We are excited to be part of an organization whose purpose is to create a vibrant, healthy, small business lending marketplace that serves the engine of the U.S. economy – small businesses,” said David Schaefer, chief executive officer of Orion First Financial. “As a loan servicer to small business lenders, we are particularly enthusiastic that the ILPA is embracing a diverse membership and participation from small business associations through its Advisory Board.”

“SBE Council looks forward to partnering with the expanded ILPA to continue advocating for the innovative and responsible sources of funding to which entrepreneurs and small businesses need access,” said Karen Kerrigan, president and chief executive officer of the Small Business & Entrepreneurship Council.

“It is critical that these and other responsible lenders come together to advance initiatives like SMART Box,” said Connie Evans, president/chief executive officer of the Association for Enterprise Opportunity. “The time is ripe for united voices and action to give more people the opportunity and the tools to realize a brighter future for their businesses.”

Together, the members of the expanded ILPA have provided access to more than $14 billion dollars in capital to small businesses to help drive growth and hiring.

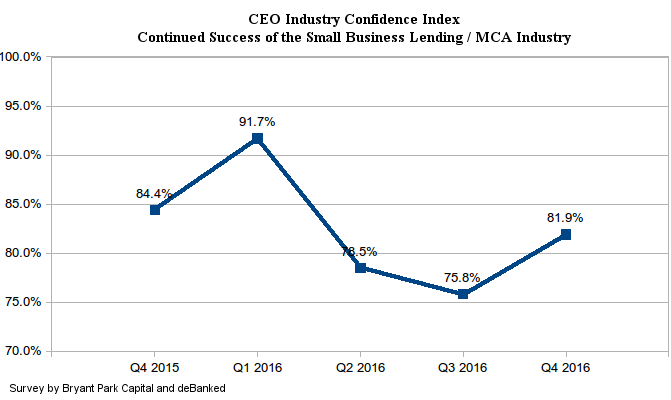

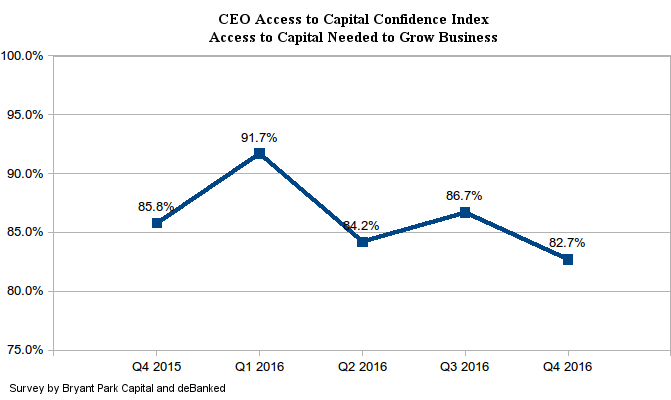

Confidence Stable For Small Business Lenders and MCA Companies

February 26, 2017Recent events may be putting a slight damper on the confidence of industry CEOs in being able to access capital needed to grow their businesses, but continued success of the industry in general is ticking back up. This data is according to the latest survey conducted by Bryant Park Capital and AltFinanceDaily of small business lending and merchant cash advance company CEOs.

Confidence in the industry’s continued success bumped back up to 81.9% in Q4, while confidence in being able to access capital reached its lowest level since the survey’s inception. Still, at 82.7%, it’s high.

In late November of 2016, CAN Capital, one of the industry’s largest companies, encountered problems that caused the company to suspend funding. Several of their competitors since then have reported a boost in submission volume, which they partially attributed to that event.

Pressure on companies to merge or exit the market may also be kindling optimism for larger players who stand to gain market share.