For Factoring, Different Spin, Same Issues as MCA

April 10, 2017

They called it the 2017 Factoring Conference, but an MCA professional would’ve hardly noticed. On the agenda was news about Dodd-Frank’s Section 1071, the now-dead NY lending legislation, usury litigation, confessions of judgment, stacking, fintech and gripes about brokers. And yet factors and MCA companies still largely live separate lives.

The underlying differences between the two industries are as much cultural as they are contractual. The International Factoring Association’s directory reports having nearly twice as many members from Texas as they do from New York. They also list having more members from Utah than they do New Jersey. Compare that to our own readership at AltFinanceDaily in which website visitors and magazine subscribers are most heavily concentrated in New York, California, Florida and New Jersey. Texas ranks 8th for subscribers and Utah is much, much farther down. And while purely based on my unscientific observation, I’d wager a bet that the average age of a factoring company owner is at least a decade older (probably much more) than the average age of an MCA company owner.

Differing philosophies between the two industries are perhaps exacerbated by this generational and demographic gap.

On a fintech disruption panel at the factoring conference last week, Pearl Capital CEO Sol Lax told attendees that the MCA industry was not only innovative but ultra competitive. “You either need to evolve or become a phone booth,” he said. Other panelists explained that today’s average small business is focused on speed and simplicity and that they’ve built their models around that.

But factoring has survived the test of time. In the latest issue of The Commercial Factor, Jeremy B. Tatge traces the first factoring agreement in America to 1628. “This spirit has endured and survived wars of independence, such as the American Revolution, two World Wars in the Twentieth Century, and even down to the present day (NATO being but one of many examples),” he writes.

Will technology finally break that spirit or will today’s stereotypical young MCA company owner from New York and Florida eventually find themselves becoming older, wiser, and ready to lay down roots in the midwest? Will they trade the Las Vegas conferences for honky tonks in Cowtown?

I don’t believe that such a transition even has to happen. Whatever differences the two industries have, they are united by common causes and issues and can evolve together.

NYC Taxi Drivers Protest, AltFinanceDaily Reporter Goes For a Ride

September 17, 2020 On Thursday, NYC taxi drivers shut down the Brooklyn Bridge to formally protest the financing costs tied to their taxi medallions, the certificate that allows them to operate in the five boroughs. Tensions over “Medallion loans” have been bubbling over since last year when it was revealed that many borrowers had signed a Confession of Judgment to obtain their loan, which basically waived their right to settle any disputes with their lender in court should they be unable to make the payments. Since then, COVID has completely devastated an already suffering industry…

On Thursday, NYC taxi drivers shut down the Brooklyn Bridge to formally protest the financing costs tied to their taxi medallions, the certificate that allows them to operate in the five boroughs. Tensions over “Medallion loans” have been bubbling over since last year when it was revealed that many borrowers had signed a Confession of Judgment to obtain their loan, which basically waived their right to settle any disputes with their lender in court should they be unable to make the payments. Since then, COVID has completely devastated an already suffering industry…

“Before it was good, we could make $100-$150 a day,” said Mohammad Ashref, a local Brooklyn taxi driver in a video interview with AltFinanceDaily reporter Johny Fernandez. “Now it’s very hard to survive, we work very hard to make 60, 70, or $80 a day, but what can I do? I have to make a living. We have no other choice.”

Ashref technically drives a green cab, different from the yellow cabs that were protesting on the bridge in that they’re not permitted to accept street-hails throughout most of Manhattan. Green taxis also operate through a permit rather than a medallion, a still relatively new concept that was first rolled out in 2013 to facilitate ride-hailing in the outer boroughs where yellow cabs did not spend much time.

Ashref technically drives a green cab, different from the yellow cabs that were protesting on the bridge in that they’re not permitted to accept street-hails throughout most of Manhattan. Green taxis also operate through a permit rather than a medallion, a still relatively new concept that was first rolled out in 2013 to facilitate ride-hailing in the outer boroughs where yellow cabs did not spend much time.

In the interview with Fernandez, Ashref pointed out that the success of the taxi business is intertwined with the restaurant industry. Many riders in the boroughs depend on cabs to take them to restaurants or night clubs, but with the complete ban on indoor dining still in effect within city limits, that need has mostly dried up.

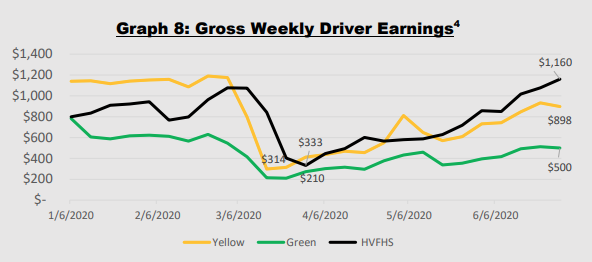

According to the NYC Taxi & Limousine Commission, yellow and green cabs were making as little as $314 and $210 a week respectively during the peak period of the shutdowns. In a 40 hour week, these amount to a fraction of the $15/hour local minimum wage and that’s even before factoring in driver costs like a vehicle lease, loan payments, insurance, and more.

AltFinanceDaily has been exploring several areas of the New York City economy over the last few months. For instance in July, reporter Johny Fernandez looked into how the pandemic was affecting a street performer in Times Square that was dressed as Batman.

“The business now is slow,” Batman said. “There’s so few people at this moment […] At this moment I see people scared, they don’t want pictures…”

Batman, like others in New York City, was hopeful that a return to normalcy was just around the corner.

AltFinanceDaily’s Most Popular Stories of 2018

December 22, 2018

Five of the top 10 most read stories of 2018 were related to the saga of 1st Global Capital; The bankruptcy, SEC charges, the revelation that they had made a $40 million merchant cash advance, and finally the devastating news of that deal falling apart. We decided to lump all of them together in our #1 slot, but first, the following story was the most independently read of 2018:

The Saga of 1st Global Capital

1. Largest MCA Deal in History Suffers Multiple Closures was picked up by ABC News in California, placing AltFinanceDaily’s website on TV for the first time.

These were the other most read stories related to 1st Global Capital

- 1 Global Capital Files Chapter 11

- Syndication at Heart of SEC and Criminal Investigation into 1st Global Capital

- 1st Global Capital Charged With Fraud by SEC

- The Largest Merchant Cash Advance in History

Bloomberg Businessweek began publishing a series in November about the allegedly scandalous merchant cash advance industry. An initial review by AltFinanceDaily uncovered questionable holes in their reporting, but when the series’ senior editor thanked a state senator for proposing legislation in response, suspicious ties were uncovered, followed by one Bloomberg reporter wiping his twitter account clean. Bloomberg’s exaggerated series dubbed #signhereloseeverything has spawned a highly popular counterseries that has challenged Bloomberg’s reporting. We call it #tweetherewipeeverything. The following stories were all in the year’s top 12 most read, but we’ve lumped them together here at #2.

The Bloomberg Blitz

2. Multimillionaire CEO Claims Predatory Lenders are Causing Him to Sell His Furniture for Food

The other two were:

Arrested for Data Theft

3. CAUGHT: Backdoored Deals Leads to Handcuffs was the year’s third most read story.

MCAs are Not Usurious

4. It’s Settled: Merchant Cash Advances Not Usurious came in at #4 this year, ending the debate that has persisted in hundreds of cases at the trial court level in New York State.

In October 2016, the plaintiffs sued defendant Pearl in the New York Supreme Court alleging that the Confession of Judgment filed against them should be vacated because the underlying agreement was criminally usurious. As support, plaintiffs argued that the interest rate of the transaction was 43%, far above New York State’s legal limit of 25%. The defendant denied it and moved to dismiss, wherein the judge concurred that the documentary evidence utterly refuted plaintiffs’ allegations. Plaintiffs appealed and lost, wherein The Appellate Division of The First Department published their unanimous decision that the underlying Purchase And Sale of Future Receivables agreement between the parties was not usurious.

Debt Settlement Company Sued

5. ISOs Alleged to Be Partners in Debt Settlement “Scam” in Explosive Lawsuit was #5 in 2018. The lawsuit ultimately settled and resulted in a big payout to the MCA companies.

A Broker’s Bio

6. The Broker: How Zach Ramirez Makes Deals Happen was #6. AltFinanceDaily interviewed Zachary Ramirez to find out what makes a successful broker like him tick, how he does it, and what kinds of things he’s encountered along the way.

Ban COJs?

7. Senate Bill Introduced to Ban Confession of Judgments Nationwide was #7. Although this is related to the Bloomberg Blitz, the introduction of this bill fits more neatly into a category of its own.

Who’s Funding How Much?

8. A Preliminary Small Business Financing Leaderboard was #8. Despite this being published early in the year and offering detailed origination volumes for several companies all in one place, it wasn’t as well-read as all the drama that unfolded later in the year. Unsurprisingly, a chart of The Top 2018 Small Business Funders by Revenue ranked right behind this one, but we’ve lumped it in with #8 since it’s related.

Thoughts by Ron

9. Ron Suber: ‘This Industry Will Look Very Different One Year From Now’ was #9. Known as the Magic Johnson of fintech, the 1-year prediction by former Prosper Marketplace president Ron Suber, originally captured in the LendAcademy Podcast, resonated all throughout the fintech world. Will he be proven correct?

A Rags to Riches Tale

10. How A New Hampshire Teen Launched A Lending Company And Climbed Into The Inc. 500 was #10.

Josh Feinberg was not a complete newbie when he started in the lending business in 2009, but he also had a long way to go to find success. His dad had been in the business for 15 years and shortly after graduating high school, Josh started to work in equipment financing and leasing at Direct Capital in New Hampshire, his home state. He then had a brief stint working remotely for Balboa Capital, but he wasn’t sure that finance was for him.

He was 19, with a three year old daughter, and he took a low paying job working at a New Hampshire pawn shop owned by his brother and a guy named Will Murphy.

“I was making $267 a week at the pawn shop and I was having to ask friends to help me pay my rent for a room,” Feinberg said. “So at that point, I realized that something needed to change.”

Multimillionaire CEO Claims Predatory Lenders are Causing Him to Sell His Furniture for Food

November 22, 2018 Two months ago, a billionaire hedge-fund manager named Philip Falcone, the 377th richest person in the United States who once “put the squeeze on Goldman Sachs,” led a Virginia-based investment group to make a strategic purchase of a local Telemundo TV station in Columbus, Ohio. The seller, a company led by local businessman Richard Schilg, pocketed a lavish sum of $850,000, according to the Columbus Dispatch.

Two months ago, a billionaire hedge-fund manager named Philip Falcone, the 377th richest person in the United States who once “put the squeeze on Goldman Sachs,” led a Virginia-based investment group to make a strategic purchase of a local Telemundo TV station in Columbus, Ohio. The seller, a company led by local businessman Richard Schilg, pocketed a lavish sum of $850,000, according to the Columbus Dispatch.

Two months later, Schilg, who is 61-years old, had become so poor and destitute that he would have to sell his furniture just to buy food. That’s what Bloomberg Businessweek says of Schilg in its purported tell-all piece about predatory lending. Though Schilg successfully negotiated a deal with a Wall Street billionaire, he apparently was outmatched and “unable to defend himself” when it came to much less sophisticated transactions at his other business, Pathmark HR, a human resources company located 15 miles outside of Columbus.

Pathmark HR is anything but small. At the end of 2017, Schilg’s company was on track to gross $20 million a year in sales. Along the way, he engaged in commercial finance transactions that required the sale of future receivables, non-loan arrangements that businesses use to fuel their growth.

They did not go as planned. Multiple financial companies obtained judgments to enforce the contracts that Pathmark HR had entered into, NY State court records confirm. Schilg told Bloomberg Businessweek that “your life is ruined by their contract.”

But if that’s the case, it stands to reason he wouldn’t enter into one again.

Pathmark HR kept applying for more of these things, industry insiders told AltFinanceDaily, though the stream of judgments filed against his business from competitors offering similar products have served as a veritable red flag for underwriting departments. That would’ve created a problem for Pathmark HR if it intended to rely on that type of capital going forward.

That’s when a straw man appeared.

According to a purported (and admittedly unauthenticated) corporate resolution reviewed by AltFinanceDaily, Schilg appears to have transferred his majority interest in Pathmark HR to an 82-year old minority shareholder named Robert Renzetti, who lists a small mobile home more than 1,000 miles away in Sarasota, FL as his residence.

There’s a catch. The corporate resolution (dated in 2017) says that Schilg can just buy the shares back from Renzetti in the future. Either way, several finance companies said they received applications for capital from Pathmark HR up through and including this year, with only Renzetti’s name and information included. Schilg’s is nowhere to be found.

Schilg, who Bloomberg Businessweek portrays as so poor that he’s more-or-less eating his household furniture to stay alive, is the former founder, chairman and CEO of Team America Corp, a staffing organization that grew to more than $350 million in annual sales by 1999. That’s more than $500 million at today’s value, larger than almost every single alternative funder that AltFinanceDaily ranked in 2018.

Meanwhile, the only thing that separates Schilg from the sale of his TV station to a billionaire is FCC approval. Hopefully the man has enough furniture to see it through.

This is the second in a series of articles relating to a fanciful tale in Bloomberg Businessweek