Thinking Capital, Equifax Create Canadian Small Business Credit Grades

July 10, 2018

Equifax and Thinking Capital today announced the launch of BillMarket, a service that will now provide Canadian small businesses with a credit grade, A through E. CEO and cofounder of Thinking Capital Jeff Mitelman told AltFinanceDaily this is revolutionary because, up until now, a Canadian small business’ creditworthiness has usually been based on the personal credit score of the small business owner.

“BillMarket creates a new language of credit for small business in Canada,” Mitelman said. “For the first time, there is a practical way to talk about and put a dollar value on small business credit in Canada. BillMarket expands the purchasing power for Canadian SMBs and eliminates friction in the supply chain.”

Equifax offers this new credit grade for free, and simultaneously, a small business owner is offered a supply chain financing deal by Thinking Capital. Specifically, if a small business owes money to a vendor in 30 days, Thinking Capital can turn that 30 day invoice into a 120 day invoice. Thinking Capital pays the small business’ vendor and the small business has 120 days to pay Thinking Capital. There are fees associated with this, which are based on the small business’ credit grade, but a small business can simply use Equifax’s credit grade and seek funding elsewhere.

“BillMarket represents a cash flow revolution for the Canadian small business market,” he said.

Traditionally, Thinking Capital provides an MCA product, which it calls Flexible, as well as a term product, which it calls Fixed. The company provides funding up to $300,000 to small to medium sized Canadian businesses. Clients must be in business for at least six months and have average monthly sales of at least $7,000. The funder was acquired in March by Toronto-based Purpose Financial, but it still uses the Thinking Capital name.

Founded in 2006, Thinking Capital employees roughly 200 people and has offices in Montreal and Toronto.

Funding Circle Report Shows Demand for Alternative Financing

June 14, 2018Funding Circle, together with Oxford Economics, released a report this week using data from its customers last year. Funding Circle is a business loan platform that matches small business borrowers with investors that want to lend. Some of these findings may be reflective of the broader alternative finance market.

Data from the report conveys that there is an increased appetite among small business merchants for online lending products. Of the small business customers surveyed, 70 percent did not attempt to get a bank loan before applying for an alternative loan from the Funding Circle platform. The main reason for this, cited by more than three-quarters of these customers, was a perception that the bank loan process would be too burdensome. Another nine percent skipped banks because they said they thought they would be rejected.

Of the businesses that had first approached a bank before seeking funding from Funding Circle, 50 percent said they didn’t obtain a bank loan because their application was rejected. Another 36 percent responded that the bank loan process took too long, and seven percent felt that the bank’s rates and fees were too high.

When asked about the impact of not receiving funding through Funding Circle (or we can imagine a different online funder), the most common response, given by 27 percent of respondents, was that they would have missed an opportunity. After this, 22 percent believed they would not be able to consolidate their debt and 16 percent thought that they would not have been able to achieve profit growth.

Loan volume in the U.S. rose significantly for Funding Circle last year. A total of $509 million in new loans were issued in the U.S. in 2017, an increase of 80 percent from $281 million issued the previous year.

“It has become evident that small businesses are underserved in every country we operate,” said Funding Circle co-founder and CEO Samir Desai. “From butchers and bakers, to IT consultants and accountants, these are the businesses that are creating jobs, boosting productivity and driving our economies forward. The economic impact that these businesses have had as a result of accessing finance through Funding Circle is hugely rewarding to see.”

Founded in 2010, Funding Circle has helped 40,000 small businesses find financing. The company operates in the U.S., U.K., Germany and the Netherlands.

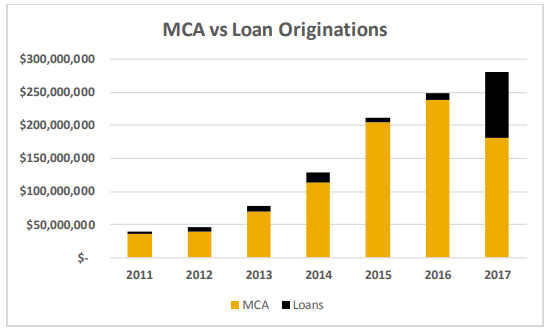

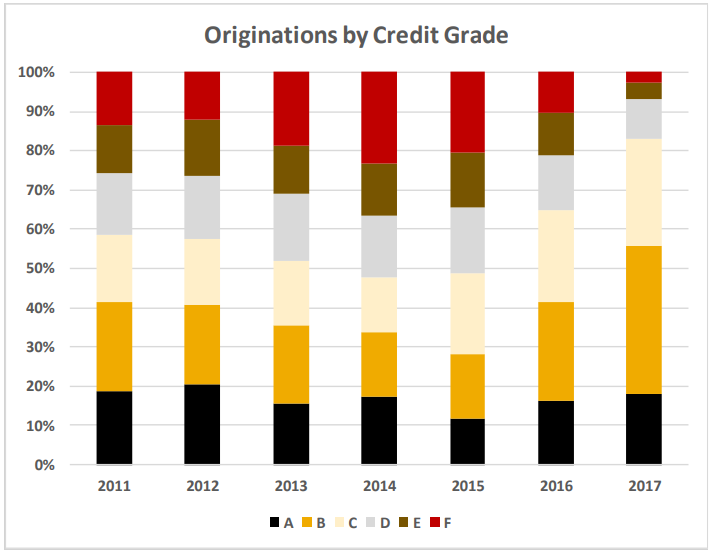

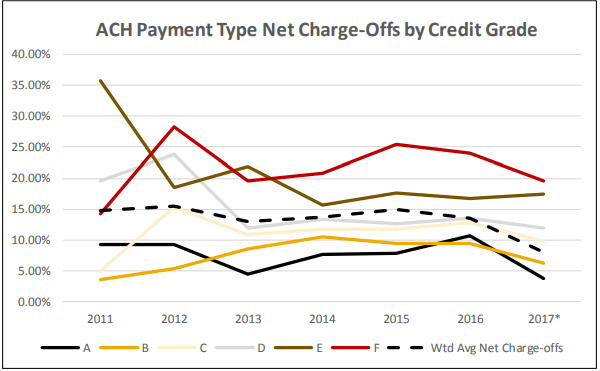

An Inside Look at Strategic Funding’s Portfolio

June 10, 2018A Kroll Bond Rating Agency report reveals interesting details about Strategic Funding Source’s $105 million securitization and also their business. Here are a few main takeaways:

Pool breakdown

60% MCA

40% Loans

Average original receivable balance per merchant: $40,705

Weighted Average FICO Score: 649

Weighted Average RTR Multiple: 1.35

Weighted Average Time in Business: 12.5 years

Weighted Average Gross Revenue: $1,729,709

Number of ISOs/referral partners: 1,300

In an earlier interview, Strategic Funding CEO Andrew Reiser said, “It’s certainly exciting to be able to meet the requirements of a securitization. Kroll is a very responsible agency and they put you through a lot of rigor to be able to meet [their] requirements and have a rated bond.”

Uplyft Capital Launches New Brand Identity, Putting its Business Friendly Technology Capabilities at the Forefront

May 29, 2018

Uplyft Capital, a technology-focused cash advance company today announced the launch of its new brand identity. The redesign emphasizes the company’s utilization of business-friendly technology solutions to improve communication, underwriting and servicing for its clients.

“Cash Advance companies in the US are broken and inefficient. We launched Uplyft in 2012 with one simple strategy in mind – to actually make receiving working capital simple, intuitive and human. We stand with our small business clients and we believe that technology can significantly improve the funding process. As we transition from a strictly human-based approach to a hybrid AI-driven model we believe we can service both Clients and Sales Partners more efficiently. Uplyft Capital is now better positioned to serve our growing and diverse client base,” said Michael Massa, Uplyft Capital CEO and Founder.

“The small business funding marketplace is changing quickly and we knew that we needed to transform with it. As we continue to grow, we want to provide improved capabilities for our trusted consumers, sales partners, and investors.

Uplyft Capital’s new logo visually exhibits the changed brand. Using a soft purple as its base for the icon, the lowercase “uplyft capital” wordmark is a more minimal and modern than the previous design. Uplyft Capital’s new icon plays with the “arrow in upwards growth” for small businesses, looking to get out of the current box they are in, a playful hearkening to Uplyft Capital’s mission to help the growth potential of each client.

“Uplyft Capital’s remarkable new identity is a product of focused research, strategy, and execution. We believe it perfectly conveys the foundational brand values of a modern, technologically-focused company adept and capable of tackling the future of small business funding, ” said Mr. Massa.

With the announcement of the rebrand, Uplyft Capital’s has also redesigned its consumer-facing user experience to better help customers and partners stay organized and efficient. With this redesign, users will find an improved user experience, particularly on mobile, with more natural and easy-to-use features with overall better reporting and tracking tools.

Why Small Businesses Sought Financing in 2017, and Why They Were Denied

May 24, 2018 Nearly 60 percent of small businesses applied for financing in 2017 because they wanted to expand their business or pursue new opportunities, according to the latest report by the Federal Reserve. Forty-three percent of small businesses sought financing for operating expenses while 26 percent sought capital for refinancing. Nine percent had a different reason.

Nearly 60 percent of small businesses applied for financing in 2017 because they wanted to expand their business or pursue new opportunities, according to the latest report by the Federal Reserve. Forty-three percent of small businesses sought financing for operating expenses while 26 percent sought capital for refinancing. Nine percent had a different reason.

Of course, not all applications are funded. Forty-six percent of small businesses received all the financing they sought, 12 percent received most (more than 50 percent) of it, 20 percent received some (less than 50 percent) of the financing they desired and 23 percent were denied financing altogether.

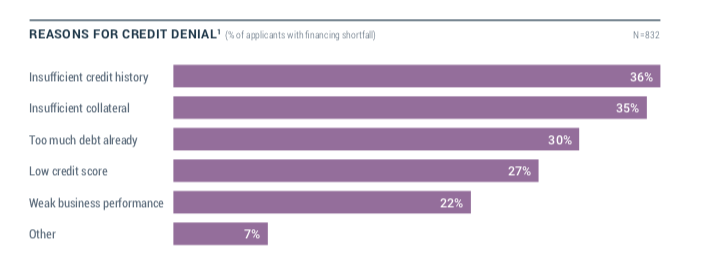

Of the reasons why merchants were denied funding, “Having insufficient credit history” ranked number one, according to the report. A very close second was “Having insufficient collateral,” followed by “Having too much debt already.” After that, in descending order, came “Low credit score,” “Weak business performance” and “Other.”

The “Having insufficient collateral” category does not apply for MCA financing, but the other categories do. According to Nick Gregory, founding partner at Central Diligence Group, which provides MCA underwriting services, “Having too much debt already” is perhaps the main reason why merchants seeking cash advances get declined.

“A lot of times the merchants are overleveraged,” Gregory said.

He explained that if a merchant also has something like two MCA arrangements (or positions) already, that merchant likely has taken on too many contractual obligations which will often be a reason to decline the application. In Gregory’s experience, another common reason for declining an MCA financing application is “Weak business performance.”

Contradictory to the Federal Reserve report’s top reason for denying financing to a small business borrower, Gregory said that “Having insufficient credit history” is seldom a reason to deny MCA financing. This disconnect likely comes from the fact that the report includes all types of small business financing, with MCA accounting for just seven percent. The number maybe seem small, but it continues to increase while small business applications for factoring have decreased.

World Business Lenders Secures Credit Facility

May 16, 2018 World Business Lenders announced yesterday that it obtained a $30 million credit facility from a Cayman Islands fund created by a group of Asian banks and investors.

World Business Lenders announced yesterday that it obtained a $30 million credit facility from a Cayman Islands fund created by a group of Asian banks and investors.

“The terms [of the facility] are very attractive,” said World Business Lenders CFO Tom Wills. “Single digit fixed interest rate and high advance rates.”

The new facility will be used to continue funding a loan product that is a hybrid of a business loan and a mortgage, Wills told AltFinanceDaily. He said that World Business Lenders invented this product three years ago.

“Three years ago, we saw some credit weakness coming into the market and we decided to develop this real estate collateralized product,” Wills said.

World Business Lenders provides business loans that range from $5,000 to $2 million and are paid back between six and 36 months. Their average loan size is $150,000.

Wills said that the hybrid product is becoming more institutionally accepted and that they have been seeing more demand for it. Created in 2011, the company employs over 100 people at its office in Jersey City, NJ.

Strategic Funding Announces Securitization

May 12, 2018

Strategic Funding received preliminary ratings from Kroll Bond Rating Agency on four classes of Series 2018-notes that can be sold to investors. The notes are composed of Strategic Funding’s receivables, packaged together based on quality.

“It’s certainly exciting to be able to meet the requirements of a securitization,” said Strategic Funding CEO Andrew Reiser. “Kroll is a very responsible agency and they put you through a lot of rigor to be able to meet [their] requirements and have a rated bond.”

Reiser told AltFinanceDaily that although their securitization starts at $100 million, it gives the company the ability to ramp up to $500 million.

“A securitization allows you to continue to grow without having to constantly find who’s the next source of capital,” Reiser said.

He spoke of a securitization in contrast to a warehouse line of credit, which is a short-term revolving credit facility.

“A warehouse line requires banks to bring on more banks [which] is more tedious. With a securitization, it’s a very seamless process. It makes growth easier.”

Only Kabbage and OnDeck have a securitization in the alternative lending space, Reiser said.

The notes will be secured by a pool of the company’s receivables consisting of business loans and merchant cash advances. This securitization is particularly unique as it is uncommon to securitize merchant cash advances since the timing of a cash advance receivable is uncertain. (The securitizations for Kabbage and OnDeck are not backed by merchant cash advances as those companies don’t provide this product.)

The four classes of notes, valued at $100 million, received the following ratings by Kroll:

A- notes ($65,394,000), BBB- notes ($19,131,000) BB notes ($5,777,000) and B notes ($9,698,000).

Founded in 2006, Strategic Funding is headquartered in New York, with other offices in Boca Raton, FL, Arlington, VA, and Rockwell, TX, outside of Dallas.

FinMkt Launches ISO Business

May 10, 2018

FinMkt has launched a broad ISO, working with referral partners from brokers to accountants to small business advisors. With two years of experience facilitating consumer lending, the company has just entered the small business lending market.

“We took the same engine that we used on the consumer side and we rolled it over to the small business side,” said FinMkt’s VP of Business Development who is overseeing this new division, called Bizloans.

The Bizloans brand within FinMkt started at the end of last year, but has been in stealth mode for the last three to six months, Sklar told AltFinanceDaily. So far, Bizloans has facilitated $15 million in loan application requests over the last 60 days. Of this, roughly $5 million has been funded.

The new division can present small businesses with a variety of financing, from merchant cash advance to factoring and lines of credit. In the few months that FinMkt’s Bizloans has been in operation, Sklar said that real estate asset-backed loans, equipment leasing and merchant cash advance has made up the bulk of the funding products facilitated.

For MCA products, $35,000 has been the average request and $150,000 has been the average for equipment leasing. According to Sklar, some of the funding companies that Bizloans has already worked with include OnDeck, Gibraltar, SOS Capital, 6th Avenue Capital and the San Diego-based bank holding company, BofI.

For successfully funded deals, Sklar said that they will get paid a commission and then pay the broker, depending on how involved they were in the deal.

“The commission splits vary depending on the amount of legwork and the amount of sophistication [the broker has] in the industry,” Sklar said.

For deals where the broker did most all of the work and simply used Bizloans as a platform, those brokers will generally get 80% of the commission, Sklar said. If the broker only supplied the lead, then they may only get 40%. Bizloans offers training to brokers less familiar with the industry.

Founded in 2011 by CEO Luan Cox and CTO Sri Goteti, FinMkt initially operated in the crowdfunded securities space. The company of 15 people is headquartered in New York City and has an office in Hyderabad, India.