SBFA Announces Support for The Small Business Fairness Act

December 7, 2018The Small Business Finance Association (SBFA) today announced support for S.3717, The Small Business Fairness Act introduced by Senator Sherrod Brown (D-OH) and Senator Marco Rubio (R-FL). The bill would provide the Federal Trade Commission more clarity to protect small business owners from being forced to sign a “confession of judgment” before obtaining financing. A “confession of judgment” requires a small business owner to waive certain rights in court before obtaining financing and, in some cases, allows the lender to seize the owner’s assets if there is a default.

“This is a bad practice that must be eliminated,” said Jeremy Brown, chairman of RapidAdvance and SBFA. “Unfortunately, certain small business financing providers are misusing “confessions of judgment.” We firmly support any legislation that will provide small businesses protection from the misuse of this practice. If a small business we fund runs into trouble, we believe they should be treated fairly and deserve our commitment to help resolve the issue in a manner that is professional and respectful.”

SBFA is a non-profit advocacy organization dedicated to ensuring Main Street small businesses have access to the capital they need to grow and strengthen the economy. SBFA’s mission is to educate policymakers and regulators about the technology-driven platforms emerging in the small business lending market and how our member companies bridge the small business capital gap using innovative financing solutions. The organization is supported by companies committed to promoting small business owners’ access to fair and responsible capital.

“Our core values are centered on providing fair and responsible financing for small businesses,” said Steve Denis, executive director of SBFA. “Small business owners are the backbone of the American economy and we should empower them with as many tools as possible to grow and create jobs. We look forward to working with Senator Brown and Rubio to eliminate the abuse of the “confession of judgment” and expand the role of responsible lenders nationally.”

In 2016, SBFA released best practices for the alternative finance industry to help better protect small businesses as they seek funding online. SBFA’s best practices are centered on four principles—transparency, responsibility, fairness, and security. As the industry’s leading trade association, the best practices have been agreed to by every member company and exist to give small business owners confidence in their financing decisions. These principles provide them a better understanding of what to expect from responsible alternative finance companies, which includes fully disclosing all terms and costs and ensuring the products SBFA companies offer are in the best interest of the small business customer.

The Small Business Finance Association (SBFA) is a not-for-profit 501(c)6 trade association representing organizations that provide alternative financing solutions to small businesses.

Elevate Funding Strengthens Compliance and Monitor Abilities

November 21, 2018Yesterday, Elevate Funding announced that it would be using the PerformLine Platform to enhance its compliance and email monitoring abilities.

“Terminology is very important in this industry,” said Elevate Funding CEO Heather Francis.

Francis said that much of Elevate’s decision to use PerformLine is to make sure that the correct terms are being used so that the company is consistent in how it presents its MCA product, both to merchants and to referral partners.

“We’ve always been very in tuned to our image, both with our referral partners and with our merchants, and we like to make sure it’s a consistent image,” Francis said.

Together with PerformLine, Elevate Funding created a list of 500 problematic words or phrases. If these terms are used in an email – written by an Elevate Funding employee, a merchant or a referral partner – the email will get flagged and brought to the attention of Francis. Some red flag key terms include “loan,” “term,” “payback” and “free.” Regardless of who wrote the word, the Elevate Funding employee will be asked to send a clarifying follow-up email.

For example, Francis said that if a merchant sends an email that reads “What is my loan balance?” this email would be flagged and the company employee would respond, clarifying that the MCA deal is not a loan. In addition to being clear with customers and referral partners, the PerformLine service is beneficial for compliance reasons.

“In today’s regulatory environment, Elevate must stay on top of its compliance procedures not only to satisfy industry requirements but to ensure the security of sensitive data,” Francis said. “This includes all levels of interactions with our referral partners and the small business owners we service. PerformLine has provided the opportunity to review this information with speed and accuracy, so our compliance team can address any issues as they occur.”

Other funders, like GreenBox Capital, have employed monitoring capabilities not just to protect themselves from legal liability, but to protect merchant data.

Based in Gainesville, FL, Elevate Funding employs about 20 people.

Newtek Announces Growth in SBA Funding

November 8, 2018In its third quarter financial statements released yesterday, Newtek Small Business Finance, LLC (NSBF) announced that it had funded $122.4 million of SBA 7(a) loans during the three months ended September 30, 2018. This is an increase of about 18% year over year compared to $103.6 million in Q3 2017. The company forecasts full year 2018 SBA 7(a) loan funding of between $465 million and $485 million.

“We are extremely pleased to report yet another strong quarter, with double-digit year-over-year percentage growth,” said NSBF Chairman, President and CEO Barry Sloane.

National Funding Announces New President

November 5, 2018 Today National Funding announced that Joseph Gaudio has been promoted to President of the company, reporting directly to founder and CEO Dave Gilbert. Previously, Gaudio was Chief Operating Officer.

Today National Funding announced that Joseph Gaudio has been promoted to President of the company, reporting directly to founder and CEO Dave Gilbert. Previously, Gaudio was Chief Operating Officer.

“I can’t think of a more exciting time to be a part of the business and the SMB lending industry,” Gaudio said. “I look forward to working closely with our talented senior leadership team to further our mission of helping small businesses across the U.S. secure the critical capital they need to grow their businesses.”

This announcement comes just weeks after National Funding acquired QuickBridge, another alternative lender based in California.

Prior to joining National Funding, Gaudio was the CEO of Superior Mobile Medics for five years. He led the sale of the company to Quest Diagnostics and then served as part of the integration of the acquisition for Quest.

“Since joining National Funding in 2017, Joseph has helped propel the company to one of the top 10 alternative SMB lenders in the nation, and has been a driving force during our rapid growth,” Gilbert said. “Joseph’s strategic thinking capabilities, strong business acumen and his more than a decade of industry experience geared towards the small to medium business market provides critical firepower as we build National Funding into the leading brand serving the financial needs of Main Street America.”

Founded in 1999, National Funding is based in San Diego and employs roughly 230 people. It now also owns QuickBridge, with headquarters in Irvine, CA and a small satellite office in New York. The QuickBridge name and most all of its 100 employees remained in the recent acquisition. National Funding has provided more than $3 billion in capital to over 40,000 businesses nationwide with loan volume expected to exceed $500 million this year.

Is Small Business Lending Stuck in the Friend Zone?

October 23, 2018 Small-business owners have lots of places to go for capital, and the alternative small-business funding industry doesn’t exactly top the list, recent research shows. In fact, entrepreneurs claim they’re more than four times as likely to receive funding from a friend or family member than from an online or non-bank source.

Small-business owners have lots of places to go for capital, and the alternative small-business funding industry doesn’t exactly top the list, recent research shows. In fact, entrepreneurs claim they’re more than four times as likely to receive funding from a friend or family member than from an online or non-bank source.

That bit of intelligence comes from the National Small Business Association‘s 2017 Year End Economic Report, the most recent from the Washington-based trade group. Thirteen percent of the entrepreneurs who responded to the survey received loans from family or friends in the preceding 12 months, while 3 percent obtained funding from online or non-bank lenders, the report says.

But some variables come into play. Shopkeepers and restaurateurs are more likely to rely on friends and family for financing during their first five years in business, says Molly Brogan Day, the NSBA’s vice president of public affairs and a 15-year veteran of the survey. The association’s members, who account for many – but not all – of the respondents tend to have been in business longer than non-members so the actual percentage of all owners receiving funds from family or friends could well be higher than the survey indicates, she notes.

In fact, the average NSBA member started his or her business 11 years ago – a fairly long time for the sector, Day says. The association attracts well-established merchants partly because the trade group concentrates on advocacy and lobbying in the nation’s capital, Day notes. “There’s not a lot of networking, there’s not a ton of resources or educational offerings,” she says of the association. In other words, the organization’s emphasis tends to attract prospective members who have been in business long enough to see the results of laws and regulation instead of newcomers still struggling daily to establish themselves, she observes.

Anyway, it’s also worth noting that small-business owners appear nearly as likely to approach family or friends for cash as to petition large banks for funding, Day says, noting that 13 percent turn to friends and family, while 15 percent manage to obtain loans from large banks. To her, that indicates that banks just aren’t lending to small businesses as frequently as they should – a notion that should sound familiar to anyone in the alternative small-business funding industry.

Unsurprisingly, the association’s research indicates bank lending declined as the Great Recession made itself felt in 2007 and 2008. Before that, nearly 50 percent of merchants responding to the survey reported they had recently qualified for loans from big banks, small banks or credit unions, the research shows. “Now it’s pretty consistently a percentage in the low 30’s,” Day says. “People really need these loans.”

Lending by banks hit another snag in 2012 when new regulation and legislation, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, made itself felt. “There was such a massive overcorrection in the banking industry that it’s still really difficult for small businesses to get loans,” Day says.

Moreover, banks were granting fewer “character-based” loans even before the double whammy or recession and regulation, Day observes. Instead of employing the older practice of assessing the intangible virtues of a business owner well-known in the community, bankers began applying a more formulaic approach to evaluating loan applications based on credit scores and other quantifiable variables, she says.

That switch to numbers-oriented decisions proved detrimental for many entrepreneurs. “A lot of small business owners don’t look great on paper,” Day admits. Even a great business plan might not convince bankers to loosen their purse strings these days, she notes.

That’s where the alternative small-business funding industry comes into the picture. NSBA researchers began including the category of online and non-bank lenders in their surveys in 2013 and have seen the percentage of respondents using them grow each year to its current level of 3 percent.

“It’s not huge growth, but it’s notable,” Day says. Notable enough to achieve importance, she continues. “It’s an important opportunity for your readers to fill that void,” she says of the shortfall of adequate small business funding. “They’ve been doing a pretty good job of doing it.”

In fact, the NSBA research indicates that alternative funding and other sources have tended to take up the slack created by the banking industry’s decision to exercise extreme caution when evaluating small business loans. Some 73 percent of small business owners are obtaining enough financing these days, according to the survey.

Yet hiccups have occurred, like the decline to only 59 percent finding adequate funding in 2010, Day points out. And the fact that two-thirds to three fourths are generally securing adequate funding means that a fourth to a third aren’t, she notes, adding that she urges focusing on the latter group. “It’s concerning,” she says.

Inadequate funding can prove especially challenging for newer businesses that don’t have a track record, haven’t stockpiled proceeds from past operations, don’t own stock to leverage and aren’t savvy enough to finesse placement of debt, Day maintains. More-established businesses have greater access to those resources or have honed those skills, she notes.

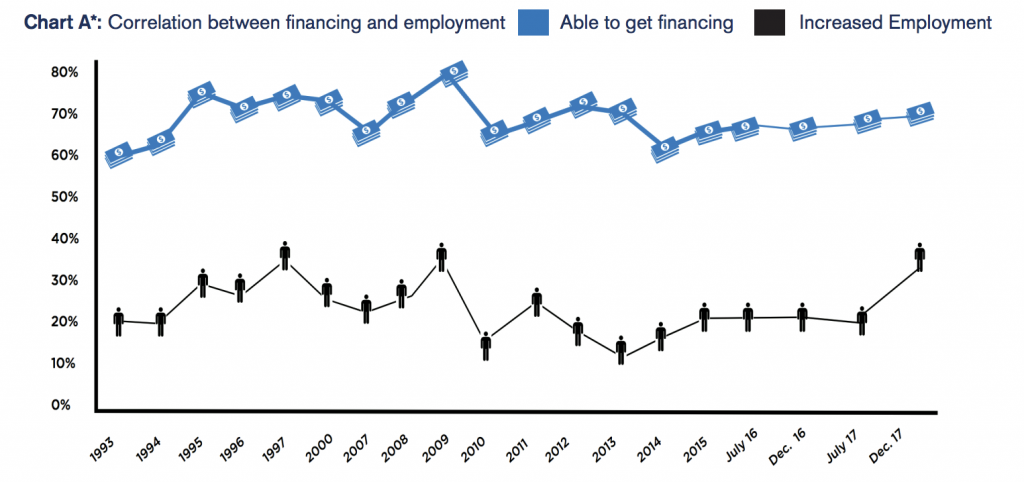

And much is at stake. Lack of funds not only hurts that significant portion of small-business owner but also prevents hiring workers, stymies economic growth and hinders community development, Day maintains. She points to research that shows the nearly direct correlation between availability of capital and increases in hiring. (See Chart A.)

And much is at stake. Lack of funds not only hurts that significant portion of small-business owner but also prevents hiring workers, stymies economic growth and hinders community development, Day maintains. She points to research that shows the nearly direct correlation between availability of capital and increases in hiring. (See Chart A.)

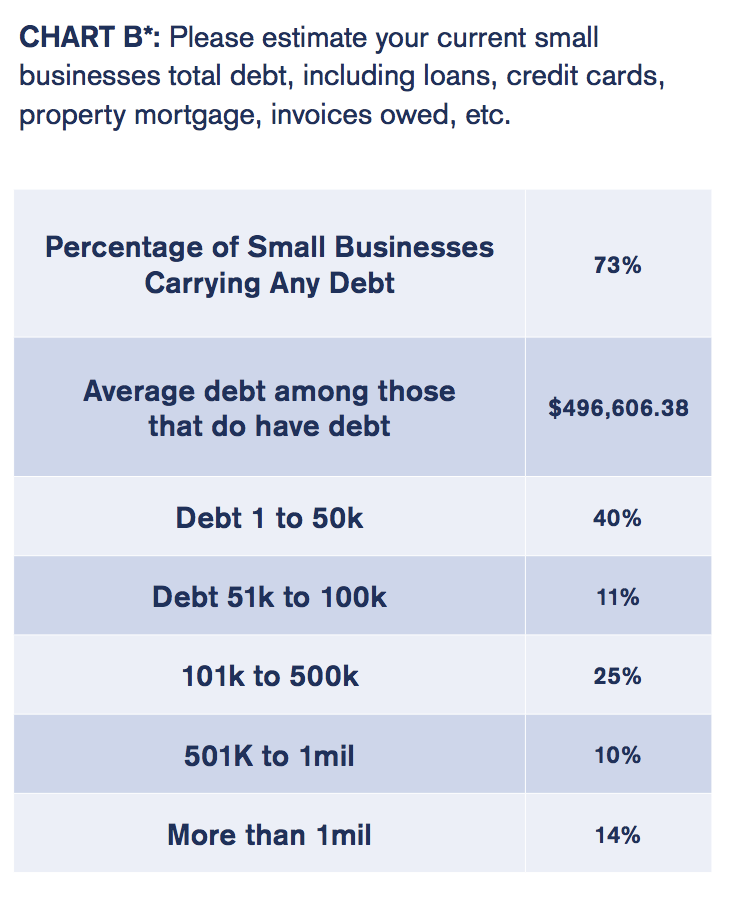

Other NSBA findings include the fact that in July of 2017 merchants reported having debt that averaged $496,000. Some 73 percent of those reported had at least some debt. Some 40 percent of survey respondents, the largest category have debt of $50,000 or less. (See Chart B.)

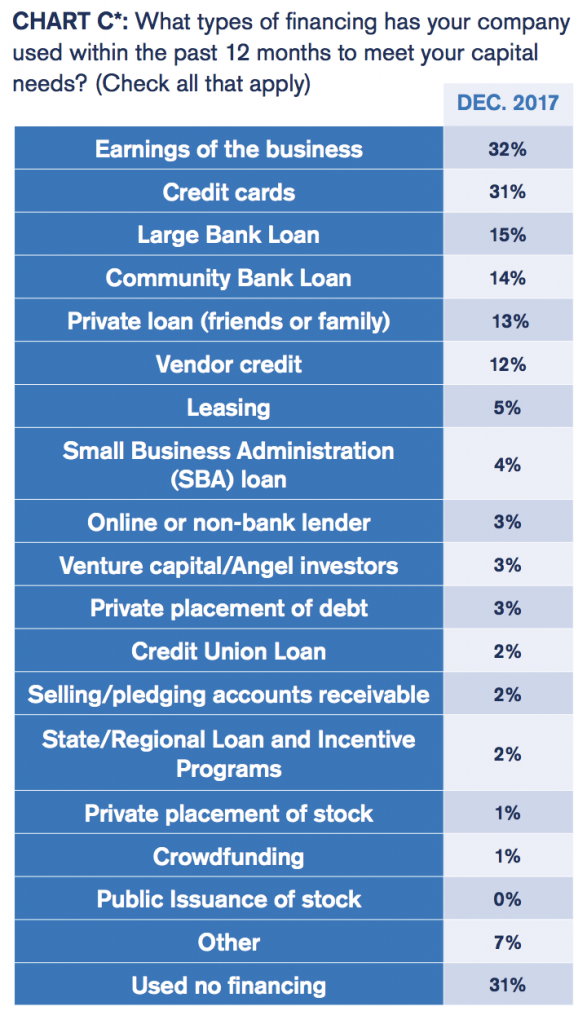

Financing most often comes from funds the business has earned, the trade group says. Some 32 percent of merchants cite that source. Yet simply pulling out a credit card remains a common way to make ends meet, with 31 percent saying they did that to meet capital needs in the last 12 months. (See Chart C.)

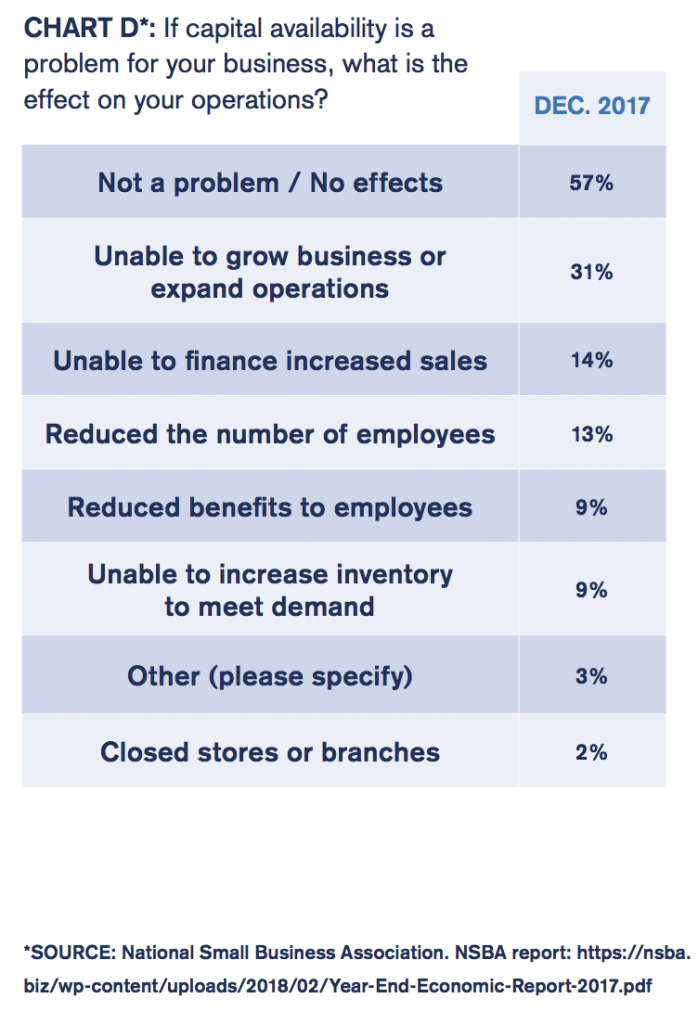

While most (57 percent) say that lack of capital hasn’t hurt their enterprises recently, 31 percent say a dearth of capital prevented them from expanding their operations, 14 percent report they weren’t able to expand their sales because they lacked funding, and 13 percent admit they laid off employees because it was difficult to find the cash to meet the payroll. (See Chart. D)

While most (57 percent) say that lack of capital hasn’t hurt their enterprises recently, 31 percent say a dearth of capital prevented them from expanding their operations, 14 percent report they weren’t able to expand their sales because they lacked funding, and 13 percent admit they laid off employees because it was difficult to find the cash to meet the payroll. (See Chart. D)

The availability of credit hadn’t changed much in the year leading up to the survey, the association says. About 77 percent reported no change in their lines of credit or credit cards, while 18 percent saw their perceived creditworthiness increase and 5 percent saw it decline.

Those results come with a bit of history. The NSBA has been surveying small-business owners since 1993. At first, the trade group hired polling companies to perform the task and cooperated on the report with the Arthur Andersen accounting firm. Computerization enabled the association to take the project in house beginning in 2007. It works on the survey with ZipRecruiter, an online employment marketplace.

Some 1,633 small-business owners participated in the research for the 2017 Year End Economic Report by answering 42 questions online in December 2017 and January 2018. Many of the survey questions have remained the same over the years to facilitate comparisons and tracking.

Some 1,633 small-business owners participated in the research for the 2017 Year End Economic Report by answering 42 questions online in December 2017 and January 2018. Many of the survey questions have remained the same over the years to facilitate comparisons and tracking.

Small businesses on the list of members and the list of non-members receive two email messages alerting them to the survey and providing an online link to the questions. The surveys take place twice a year.

As mentioned earlier, some survey respondents belong to the association and some don’t, but Day was unable to pinpoint the percentages. In response to a question from AltFinanceDaily, she said she may begin tallying how many respondents are members and non-members because non-members tend to have been in business for a shorter time than members. Non-members also tend to differ from members because political engagement often brings the former to the association’s attention.

Participating merchants come from every industry and every state, Day says. Manufacturing and professional services are very slightly overrepresented, while mining is the only category that’s scarcely represented, she admits. Not many small businesses operate in the mining sector, she adds.

GOING NATIONAL: How David Gilbert Built One of the Largest Small Business Lenders in the Country

October 17, 2018 When Ty Austin, who owns a florist shop in West Palm Beach, secured a $5,000 loan from National Funding last year, he was happy to have working capital and could build inventory for mini-gardens and landscaping,

When Ty Austin, who owns a florist shop in West Palm Beach, secured a $5,000 loan from National Funding last year, he was happy to have working capital and could build inventory for mini-gardens and landscaping,

The experience, moreover, was surprisingly pleasant. “The guy I worked with was really cool,” Austin says, referring to the sales representative at the San Diego-based financial technology firm. “It turned out that he was getting married and I ended up giving him and his fiancé advice on floral arrangements.”

The borrowing worked out so well that the Floridian, who is 46 and the sole proprietor of Austintatious Designs, re-upped for a second loan of $12,000 to help purchase a commercial van. The van will be used to transport flowers, plants and tools while doubling as a billboard-on-wheels. “It gives me more ‘street cred,’” he jokes.

To register his approval with National Funding, Austin went online to TrustPilot and posted a rave review of the sales rep: “James Johnson Rocks!”

Pam, a Texas wellness coach who provides clients with an array of holistic health therapies, needed extra money to buy an infrared sauna to add to her portfolio of services. But her credit rating was “poor,” she told AltFinanceDaily in an e-mail interview, “from when I changed careers and lost my health and struggled to make my credit card and student loan payments on time.”

Like Austin, Pam — who asks to be identified by her first name —found National Funding through an online search. And she too secured $5,000, although her transaction was structured as a merchant cash advance, rather than a loan. The terms of the MCA require a daily debit from her bank account. She reckons that the total cost of the MCA to be roughly $1,500.

Pam pronounces herself satisfied with the deal and mightily impressed with the way National Funding treated her. The process took about three days — and would have gone even quicker if she’d located her professional licenses sooner. Best of all, she says, the agent at the company tailored the financing to suit her circumstances. “They were great as far as getting my questions answered, even listening to my past situation, which others may not have cared about,” she says.

Pam pronounces herself satisfied with the deal and mightily impressed with the way National Funding treated her. The process took about three days — and would have gone even quicker if she’d located her professional licenses sooner. Best of all, she says, the agent at the company tailored the financing to suit her circumstances. “They were great as far as getting my questions answered, even listening to my past situation, which others may not have cared about,” she says.

“They really wanted to get me an option that they knew I’d be able to repay,” Pam adds. “They said they were in the business of helping small businesses grow rather than putting them in a hard financial situation.”

The positive experiences that Austin and Pam had with National Funding are not isolated instances. Rather, they are representative of clients’ dealings with the company. Witness its online reviews from business borrowers at TrustPilot which go back three years, run for 36 pages, and merit National Funding a 9.4 rating on a scale of 10. That’s a straight-A grade on any report card. Although there’s the occasional naysayer — four percent assert that their experience was “poor” or “bad” (and some negative comments can be blistering) — the weight of the reviews is almost embarrassingly positive.

Typical postings find that National Funding and its agents win kudos for, among other things, being “prompt and professional,” providing service that is “hassle free and about as friendly as you can be,” and even being “accommodating and gracious.” A man named Al McCullough spoke for many when he declared: “My experience was great. Professional and on time. Couldn’t ask for more.”

All of which helps account for why National Funding — its 230 employees working out of a sleek suburban office building guarded by a tall stand of palm trees in San Diego — is a rising star in the world of alternative business lending and financial technology. In 2017, the company raked in $94.5 million in revenues, a 24.8 percent bounce over the $75.7 million recorded a year earlier and nearly fourfold the $26.7 million posted in 2013.

All of which helps account for why National Funding — its 230 employees working out of a sleek suburban office building guarded by a tall stand of palm trees in San Diego — is a rising star in the world of alternative business lending and financial technology. In 2017, the company raked in $94.5 million in revenues, a 24.8 percent bounce over the $75.7 million recorded a year earlier and nearly fourfold the $26.7 million posted in 2013.

In recognition of the company’s three-year growth rate of 142%, Inc. magazine included National Funding in its current list of the country’s 5,000 fastest-growing companies, the lender’s sixth straight appearance on the coveted roster. Since its inception in 1999, National Funding reports that it has originated more than $2 billion in loans to some 35,000 borrowers.

The company’s impressive performance has similarly merited accolades for David Gilbert, the 43-year-old chief executive who started the company on little more than a shoestring and whom employees regularly describe as “visionary.” Among Gilbert’s trophies: Accounting firm Ernst & Young recently presented him with its “Entrepreneur of the Year 2017 Award” for San Diego finance.

At first glance, the San Diego financier doesn’t look too much different from its cohorts. The company proffers unsecured loans of $5,000 to $500,000 to a mélange of small businesses in all 50 states and across multiple industries, including retail stores, auto repair shops, truckers, construction companies, heating-and plumbing contractors, spas and beauty salons, cafes and restaurants, waste management, medical and dental clinics, and insurance agencies.

To qualify for financing, a prospective borrower should have been in business for a year, have at least $100,000 in revenues, and boast a personal credit score of at least 500. While there’s no collateral required for loans, National Funding insists on a personal guarantee. The website reviewer NerdWallet cautions borrowers that this “puts your personal assets and credit at risk if you fail to repay the loan.”

Along with unsecured loans, National Funding offers equipment leasing – usually for heavy trucks and construction equipment – as well as merchant cash advances. The equipment lease is secured by the machinery. As in the case of Pam, the wellness coach cited above, MCAs are debited daily, the money automatically withdrawn from bank accounts.

There are a number of businesses that National Funding disdains, no matter how stellar their credit. “We won’t finance casinos, strip bars, tobacco, or firearms,” Gilbert says. “We’re not going to support industries like that.”

For CEO Gilbert, doing business ethically is a signature feature of the company. Among other things, National Funding presses its salespeople to steer clear of putting people into dodgy loans that are likely to default. “We’re lending capital,” Gilbert says, “and one of our core values is the way we support our customers. Are we placing people with the right product to meet their needs or are we being selfish? The best way to be customer oriented is to get a better understanding of what capital will do for them.”

That corporate ethos, coupled with the company’s remarkable performance, has raised its profile while earning it a measure of esteem among industry peers. “What I do know about National Funding,” says Douglas Rovello, senior managing partner at Fund Simple, a lender and broker in the Tampa area, “is that they have five or six different programs and set their rates high but competitively. They’re known for fitting their products to a client’s needs,” he adds. “And in a business that has its share of bad actors, they have a reputation as a company with a conscience.”

A company with a conscience. Customers come first. And yet National Funding turns heads with its sales production of roughly 1,000 financings a month and triple-digit growth rate. So how do they it? A good place to start is with Gilbert, whose leadership skills, business acumen, and second-to-none work ethic “set the tone,” says Kevin Bryla, the company’s 52-year-old chief marketing officer.

For his part, Gilbert credits his family background and an upbringing in which education and academic achievement were strongly encouraged. The fifth of six children, he’s the only one who opted for a business career. “There are three doctors, two lawyers – and me,” Gilbert says.

The son of a prominent physician, his mother a homemaker and volunteer docent at the nearby Nixon Library for the past 25 years, Gilbert grew up in Yorba Linda. He attributes his keen interest in business to observing how his father, a pathologist, operated his own laboratory, which employed 60 people. “It was the business side of medicine that fascinated me,” he asserts.

The son of a prominent physician, his mother a homemaker and volunteer docent at the nearby Nixon Library for the past 25 years, Gilbert grew up in Yorba Linda. He attributes his keen interest in business to observing how his father, a pathologist, operated his own laboratory, which employed 60 people. “It was the business side of medicine that fascinated me,” he asserts.

Even so, his two closest friends at the University of Southern California — fraternity brothers Marc Newburger and Sean Swerdlow– tell a somewhat different story. They remember Gilbert as someone who found his true calling, his métier, during his college years. Enrolled initially in pre-med courses, he was a diligent student but, his friends assert, manifestly unsuited for a career in medicine.

“Formative,” says Swerdlow, the older of the two fraternity brothers and now a management consultant based in Southern California, “would be a very good word” to characterize that period during which Gilbert abandoned medicine in favor of the world of commerce. In 1997, he earned a bachelor’s degree in business administration “with an emphasis in entrepreneurship.”

But it was fraternity life just as much as the classroom, his friends agree, that shaped him and foreshadowed his future. “It wasn’t ‘Animal House,’” Swerdlow says of Alpha Epsilon Pi. “We boasted the highest GPA (grade point average) on fraternity row.”

Nonetheless, Gilbert took to the social life and camaraderie that the fraternity offered with gusto, and his friendship with the colorful Newburger was especially fateful. A freewheeling entrepreneur today, Newburger takes a measure of credit — Gilbert’s disapproving parents might have preferred the word “blame” — for contributing to his fraternity brother’s metamorphosis. “Dave hated all of his pre-med classes,” Newburger insists. “He had zero stomach for it. He was so much like I was: a natural people person and a born entrepreneur.”

Newburger is the quintessential soldier of fortune. After college, he tried his hand as an actor, supporting himself by playing poker and getting paid to be a contestant on TV game shows including “The Dating Game,” “Card Sharks,” and “3’s A Crowd.” He’s now the co-president and co-inventor of Drop Stop, a patented device that “minds the gap” between a car’s front seat and the console and prevents coins, keys, glasses, and mobile phones from disappearing down that rabbit hole. (Drop Stop really took off after Newburger and his business partner appeared on the television show “Shark Tank” and scored a $300,000 capital injection from celebrity-investor Lori Greiner who took a 30% stake in the company and slapped her name on the brand.)

Back at the frat house, Newburger and Gilbert collaborated on business ventures. The pair once sold T-shirts sporting an off-color message about USC’s archrival, the University of California at Los Angeles. “The (anti-UCLA) message was pure hatred,” Newburger recalls. “But it was just for the day of the football game and it was all in fun.”

At first, sales at the stadium were lackluster. USC students kept trying to bid down the price or importune them to throw in an extra tee. As for the game itself, USC’s chances for victory looked equally unpromising. As time ran out, however, the Trojan quarterback completed a Hail Mary pass and USC won. The two fraternity brothers grabbed the bundle of shirts and sprang into action. “We got to the exit just in time and sold out in a matter of seconds,” Newburger recalls.

Newburger takes credit too for introducing his friend to Las Vegas’ gaming tables. Gilbert, his friend says, immediately demonstrated a knack for counting cards, handling money, and taking risks. “It was typically blackjack,” recalls Swerdlow, who sometimes accompanied them. “We didn’t have much money then. But there were moments when Dave would bet a big pile of chips. He’s willing to make a bet and live with the consequences.”

Sports are another of Gilbert’s enthusiasms. His friends say that, whether he’s returning serve at ping pong or standing over a putt — he plays to an 11 handicap at golf – he wants to win. Remarks Newburger: “He’s competitive to the point that — when he beats you — he wants the Goodyear blimp flying overhead to announce his victory.”

Gilbert, who is married with two children, is legendarily loyal to friends and family. While most members of a college fraternity might keep up with old companions after graduation by exchanging greeting cards and attending college reunions, Gilbert goes the extra mile.

He once footed the bill for Swerdlow to travel with the USC football team to an away game, arranging it so that his fraternity brother could view the action from field-level. After Newburger had a recent health scare (no worries, he’s O.K.), Gilbert rounded up a couple of dozen fraternity brothers and their wives (or companions), and put together a four-day bash in his buddy’s honor. The event was held at Cabo, the Mexican beach resort in Baja California, and Gilbert underwrote a fair amount of the cost. “He shares his success with his friends,” Newburger says, adding: “I don’t know anybody who works harder on friendships.”

He once footed the bill for Swerdlow to travel with the USC football team to an away game, arranging it so that his fraternity brother could view the action from field-level. After Newburger had a recent health scare (no worries, he’s O.K.), Gilbert rounded up a couple of dozen fraternity brothers and their wives (or companions), and put together a four-day bash in his buddy’s honor. The event was held at Cabo, the Mexican beach resort in Baja California, and Gilbert underwrote a fair amount of the cost. “He shares his success with his friends,” Newburger says, adding: “I don’t know anybody who works harder on friendships.”

Many of the personality traits described by friends and colleagues — tenacity and competitiveness, self confidence and leadership — played a key role in the development and success of National Funding, which Gilbert founded just two years out of college with $10,000 borrowed from his uncle, Howard Kaiman, of Omaha.

He’d worked a couple of quick jobs right after college, including a stint at small-business lender Balboa Capital, but he was always destined to be his own boss. Gilbert’s start-up was called Five Point Capital and, at first, it was located in the affluent Chatsworth section of Los Angeles and concentrated on equipment leasing.

“The first two years we were a cold-calling company and then we got into direct mail and saw some success and then we moved to San Diego and started to scale up the company,” Gilbert says. The decampment, he explains, was “for the quality of life, but we also felt we could hire from a better talent pool than L.A. We wanted to set ourselves apart.”

By 2007, Five Point was cranking up operations, revenues shot to $28 million and its headcount totaled 210 employees. “Then the Great Recession hit” in 2008-2009, Gilbert says. The company was forced to furlough 140 employees, two-thirds of its workforce. Yet even as it retrenched, the company managed to branch out. It began making merchant cash advances, Gilbert says, and, also in 2007, it linked up with CAN Capital to do broker financings. “We were pretty well known and they were looking for partners for factoring and leasing,” Gilbert explains.

It took time to recover after the financial crisis. But by 2013 – the year that Gilbert re-branded his company “National Funding” – the company was able to hire back as many as 15% of its laid-off employees (most had found other jobs, in many cases relocating to Silicon Valley, Gilbert reports). By then, the company had secured a $25 million credit facility from Wells Fargo Bank, which allowed it to move up the food chain to “become a balance-sheet lender,” Gilbert says, and offer a wider selection of financing options.

Key to driving the company’s phenomenal growth has been its flood-the-zone marketing and sales strategies. The company spends $16 million annually on marketing using a full panoply of channels and media, both online and offline. These include direct mail and targeted marketing, paid advertising, search-engine optimization or SEO, and sports sponsorships. “We try to build a whole range of marketing mechanisms,” explains marketing chief Bryla, “and when you get the mix right, they all help each other.”

Gilbert is a big believer in the benefits of sports marketing, the company’s website featuring the logos of the San Diego Padres (baseball), and Anaheim Ducks and Los Angeles Kings (hockey). Ever the faithful alumnus, Gilbert and his company back USC football as well. During the 2015 2016 college football season, the company paid for naming rights for what became, for one night, the “National Funding Holiday Bowl” at Qualcomm Stadium.

Gilbert is a big believer in the benefits of sports marketing, the company’s website featuring the logos of the San Diego Padres (baseball), and Anaheim Ducks and Los Angeles Kings (hockey). Ever the faithful alumnus, Gilbert and his company back USC football as well. During the 2015 2016 college football season, the company paid for naming rights for what became, for one night, the “National Funding Holiday Bowl” at Qualcomm Stadium.

Janet Fink, department chair at the McCormack School of Sports Management located at the University of Massachusetts-Amherst, told AltFinanceDaily that sponsorship programs can easily cost a million dollars or more. “It’s not cheap,” she says. “When a company sponsors a team, they get a number of benefits. One is that they get to put the team’s logo on their website. The idea is that fans are passionate or have an affinity for the team and that it will rub off on a sponsor.

“Sports enthusiasts,” Fink adds, “often make good customers. When you have enough disposable income to go to these sporting events, you’re probably a good prospect for a loan.”

The sponsorships — which include civic involvement such as offering Holiday Bowl tickets to members of San Diego’s large military contingent as well as to company employees — also build good will in the community and team spirit among the workforce. (National Funding also makes an effort to hire veterans, says Bryla.)

Gilbert believes in the old adage that you have to spend money to make money. The company spends $14 million rewarding its network of outside brokers. Inside the company, high-performing salespeople are compensated with commissions, bonuses and an assortment of rewards, including resort trips.

But sales representatives’ must conform to company guidelines. Justin Thompson, National Funding’s sales chief, explains that the “customer comes first” philosophy is not just a slogan but a core value. “We’re not a factory spitting out widgets,” Thompson says. “We’re here to build relationships and sell a repeatable product. We want that customer to come back to us. Every loan is customized. Six of ten customers who pay off their loans come back for a second financing. Whether your business is dog grooming or you’re an asphalt company,” he adds, “people will do business with people they like and trust.”

Using the software program “customer relationship management” (CRM), National Funding expends a lot of effort gathering data on its business customers and extrapolating the information for use in credit evaluations. But the use of technology only goes so far.

Gilbert reckons that the art of the deal involves about “70 percent algorithm and 30 percent people.” He adds, “You still need the people component to look at credit profiles. The algorithm spits out a recommendation but we still need the human element.”

Gilbert reckons that the art of the deal involves about “70 percent algorithm and 30 percent people.” He adds, “You still need the people component to look at credit profiles. The algorithm spits out a recommendation but we still need the human element.”

If there’s a fly in the National Funding ointment, it’s that the company’s fees can be more expensive than a bank loan.

But borrowers who have been denied loans at a bank or other lender are likely to overlook those costs. Austin, the florist in West Palm Beach, for example, came to National Funding when his bank, North Carolina-based BB&T Bank, gave him the cold shoulder despite the $15,000 in deposits that he averages each month. “I’ve been with them for six years,” he fretted, “and they treated me shabbily.”

Even more grateful was Jimmy Frisco, of Annapolis, who is co-owner with his wife of Lisa’s Luncheonette, a business that includes a food trailer and several cafeterias located in the city’s office buildings. They employ about a dozen people.

Frisco had taken a nasty spill and was laid up for seven months. Health insurance covered the $18,000 in medical costs but he and Lisa fell behind in their bills and needed working capital to pay for food purchases and other business expenses. By the time a flyer from National Funding popped up in his mailbox, he and his wife “had been turned down by several other lenders, including banks,” he says, adding: “Things happen in life and we don’t have the best of credit.”

Getting that loan for $25,000 from National Funding took just three days. Frisco’s health is much improved and business is back to normal. He won’t discuss the terms of the financing, other than to say “it was reasonable.”

He adds: “There were no problems with National Funding, no hassle with the paperwork. They’re great people to work with.”

Yoel Wagschal Becomes Last Chance Funding’s CFO

October 10, 2018

Yoel Wagschal, an accountant who specializes in servicing MCA funding companies, told AltFinanceDaily today that he will now be the CFO for Last Chance Funding (LCF), which has been one of his clients for about five years. Wagschal said he will maintain his private accounting practice, spending half the week working for LCF and the other half running his own business, serving other clients, mostly in the MCA space.

“I always treated my clients like I was a part time CFO,” Wagschal said. “Yes, it’s a little different to be the officer of one particular company, and that’s why I feel it’s important to make this announcement so my clients or prospective clients know that I am an officer, officially, of Last Chance. You can either embrace it, or not.”

For those who might see this arrangement as a conflict of interest, he argued that this has essentially always been the case since he has two dozen MCA clients.

“If the accountant is honest and doesn’t exchange information from one client to another, his knowledge will only be better, and [the client] will gain from having an accountant with other clients in the same space.”

Wagschal said he believes that every company needs a CFO. And being a part-time, per diem CFO, largely in the MCA space, has been his niche for the past 15 to 20 years.

Already, Wagschal has eliminated some jobs in LCF’s accounting department by creating a more efficient system, he said. (No one was fired; a few employees were just moved elsewhere). Wagschal believes that many accounting departments are often too big and that great leadership actually frees up time for a company.

“If you have proper accounting procedures in your company, then the compliance and the reporting comes so easy, it’s a piece of cake,” Wagschal said.

LCF’s owner and CEO Andy Parker is very excited about Wagschal’s new role at the company.

“I have never come across a more talented accountant in the MCA space,” Parker said of Wagschal.

Parker said that since he co-founded the Long Island-based company in 2011, they have seen triple digit growth year after year.

“As we continue to grow, we really needed a serious level accountant and we’re glad Yoel accepted the position,” Parker said.

Wagschal’s introduction to the MCA industry was a dramatic one. As a forensic accountant, he had contacts with tax attorneys, one of whom introduced him to the owner of an MCA firm whose partner had made a really costly mistake. Instead of sending an agreed-upon $9,600 to a merchant, he accidentally added an extra zero to the end and $96,000 was sent to that merchant. In what Wagschal described as a “very intense” experience, Wagschal drove to the town where the merchant operated from and said he rescued the money within 48 hours of being contacted.

But beyond this initial Indiana Jones-esque introduction to the MCA industry, Wagschal said that he began to see a void.

“It was a very new industry. People were confused, and I saw an opening,” Wagschal said.

Fora Financial & Expansion Capital Group Partner with Ocrolus to Automate Underwriting Legwork

October 8, 2018

New York, NY — Ocrolus, the emerging leader in analyzing loan documents, today announced integrations with Fora Financial and Expansion Capital Group, two of the fastest-growing online small business lenders. Enabling quicker and more precise loan decisions, Ocrolus has seen rapid adoption since its debut in the small business lending world with flagship customer Strategic Funding Source in May 2017. Following its Series A round highlighted by QED Investors, Ocrolus is quickly growing its customer base and team with laser-focus on the lending space.

Ocrolus employs crowdsourcing and artificial intelligence to drive efficiencies in the origination process, from document collection to calculating credit model inputs. The Company’s simple API ingests and analyzes bank statements and other loan files, returning actionable data and risk analytics, with 99+% accuracy.

Fora Financial, one of the most prominent New York City-based online lenders, has partnered with Ocrolus to automate bank statement reviews, resulting in a faster, more accurate end-to-end underwriting workflow. The benefits of automation have become increasingly important as Fora Financial accelerated growth after its June 2018 acquisition of US Business Funding. Leveraging Ocrolus to parallelize underwriting tasks, Fora Financial is poised to eclipse $400 million in annual originations over the next year.

“We are excited to automate an additional step in our underwriting process that has historically been very laborious, requiring additional staffing as we grew originations,” said Dan Smith, Co-founder and President of Fora Financial. “As a tech-enabled SMB lender, we rely on our technology to achieve scale while delivering a frictionless process for small businesses to access capital.”

Expansion Capital Group (ECG), recently honored on the 2018 Inc. 5000 as one of the fastest-growing private companies in America, has also partnered with Ocrolus to enhance its underwriting process. ECG sought a loan automation partner to facilitate ambitious growth objectives while improving risk management capabilities. With Ocrolus now handling its document analysis work, ECG, who has grown 627% over the past three years, looks forward to scaling its operation to new heights, thanks to its leaner, technology-enabled infrastructure.

Herk Christie, Head of Operations at ECG says, “Using Ocrolus solutions, we have been able to create a lean, smart and tech-enabled underwriting infrastructure that focuses on quality without sacrificing speed. The level of data Ocrolus provides will continue to feed the growth of our statistical models, further benefiting our clients and partners alike.”

Growing beyond online small business lending, into online personal lending and traditional banking, Ocrolus has added a couple of prominent lending executives to its team. Matt Burton, former CEO of Orchard Platform has joined Ocrolus as a Board Advisor. Kevin Bailey, former Senior Advisor at the US Department of Treasury, has joined Ocrolus as Head of Growth.

As CEO of Orchard Platform (acquired by Kabbage), Matt Burton became a cornerstone of the online lending community. Orchard’s Online Lending Meetup events regularly brought together industry thought leaders from all over the world, helping to shape the next generation of financial services. As an Advisor to Ocrolus, Mr. Burton is continuing his mission to grow online lending into an efficient, transparent, and global financial market.

A former White House and Treasury official, Kevin Bailey brings more than fifteen years of experience as a financial services and public policy professional. Prior to joining Ocrolus, Kevin was the Director of Business Development & Capital Markets at CommonBond, a leading marketplace student lender. Mr. Bailey is a graduate of Rice University and the University of Chicago Booth School of Business. At Ocrolus, Mr. Bailey is leading growth efforts as the Company expands beyond its core online small business lending market, into online personal lending and traditional banking.

Visit www.ocrolus.com for more information.

About Ocrolus

Ocrolus is a RegTech company that automates data verification and analysis for bank statements and other loan documents. The Company analyzes e-statements, scans, and cell phone images of documents from any financial institution with over 99% accuracy, and rigorous process documentation. By replacing tedious, imperfect human audits with sharp, AI-driven analyses, Ocrolus modernizes financial review processes in lending with unprecedented speed and accuracy.

Media Inquiries:

media@ocrolus.com