Watch the House Subcommittee Hearing on Fintech and Online Small Business Lending

October 26, 2017AltFinanceDaily streamed the small business subcommitte hearing that took place at 10AM EST in Room 2360 of the Rayburn House Office Building on October 26th. If it’s not loading below, you can watch it at: House Small Committee website.

Kate Fisher, a partner at law firm Hudson Cook, testified on behalf of the Commercial Finance Coalition. As described in her prepared written testimony, “CFC member companies offer fair and innovative alternatives to bank term loans and have stepped in to provide capital to small businesses when larger, traditional banks stopped providing such financing. CFC member companies primarily offer Merchant Cash Advance (‘MCA’) factoring products. An MCA allows small businesses to access funds for, as an example, a seasonal inventory surge or to replace an unexpected major equipment failure. CFC members provide financing between $10,000 and $500,000 to qualified small businesses.”

Her written testimony can be accessed HERE.

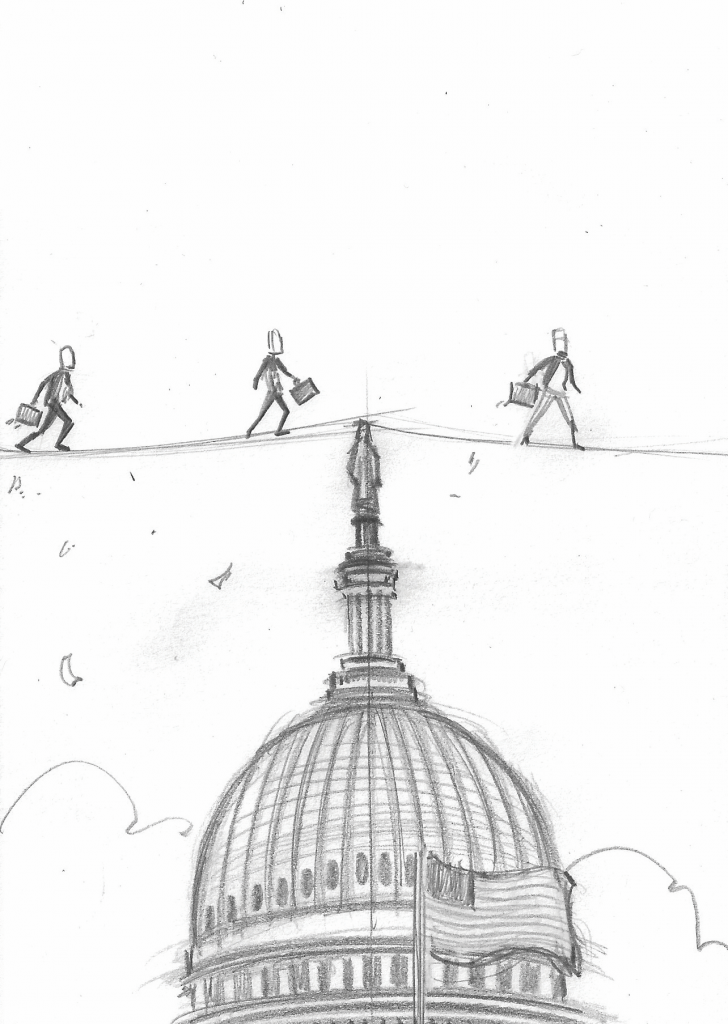

The CFC’s Spring Fly-in was covered back in June when the group met with 26 members of Congress and senior staff. The group was reportedly back in Washington again this week to educate members of the House Small Business Committee about MCAs and alternative finance. We will provide more information as it becomes available.

Lights Out for New York’s Attempt to Impose Stricter Lending Rules

April 5, 2017 In a late night session on Tuesday, and days past the budget deadline, the New York State Senate voted 58-2 in favor of a key budget bill. Noticeably gone from it was Part EE, which would’ve imposed stricter licensing requirements on not only just lending, but also other forms of finance. Part EE was originally put there by the Governor’s office as an amendment to Section 340 of the State’s banking law.

In a late night session on Tuesday, and days past the budget deadline, the New York State Senate voted 58-2 in favor of a key budget bill. Noticeably gone from it was Part EE, which would’ve imposed stricter licensing requirements on not only just lending, but also other forms of finance. Part EE was originally put there by the Governor’s office as an amendment to Section 340 of the State’s banking law.

Over the last two months, several trade groups used what little time they had to express concerns over the language. Their biggest frustration was that no one had consulted with them in advance. In February, Dan Gans, the executive director of the Commercial Finance Coalition (CFC) said, “They should allow all the stakeholders to have their voices heard.” The CFC, which represents many small business financing companies, did their best to do just that last month by actually making the trek to Albany.

Ultimately, the legislature did not support the Governor’s plan. Both the Senate and the Assembly removed Part EE from their versions of the budget and on Tuesday night, the Senate passed it. The Assembly passed it the day after.

This is the first time the budget deadline has been missed under Governor Andrew Cuomo. The last miss was in 2010 under Governor Paterson, which came in 125 days late.

Brief: New York’s Attempt to Over-Regulate Lenders Downgraded to Doubtful

March 14, 2017 The Governor’s budget bill has encountered resistance up in Albany, sources say, specifically Part EE that aimed to amend New York’s banking law and impose sweeping licensing restrictions on all types of lending and finance. Analysts felt that the language could have vast unintended consequences beyond just online lenders, including factoring, commercial lenders and brokers, merchant cash advance and the securitization markets.

The Governor’s budget bill has encountered resistance up in Albany, sources say, specifically Part EE that aimed to amend New York’s banking law and impose sweeping licensing restrictions on all types of lending and finance. Analysts felt that the language could have vast unintended consequences beyond just online lenders, including factoring, commercial lenders and brokers, merchant cash advance and the securitization markets.

The passage of this proposal now looks doubtful. The Assembly, one of two branches of the State’s legislature, introduced their own version of the budget on March 13th and removed the language.

“The Assembly rejects the Executive proposal granting DFS regulatory authority over any online lenders doing business in New York State,” the bill says. Notably, they also rejected “the Executive proposal to authorize enforcement of Insurance, Banking, and Financial Services Law against unlicensed individual or businesses, including bringing a civil action.”

The Senate echoed same. “The Senate denies the Executive proposal to authorize the Superintendent of the Department of Financial Services to expand the regulation of small loan lenders,” their bill states.

Industry trade groups, namely the Commercial Finance Coalition (CFC), had mobilized quickly to tell their members’ stories up in Albany two weeks ago. One of the group’s concerns was that they had not been consulted in advance, nor given any time to engage in a discussion about the proposal.

“They should allow all the stakeholders to have their voices heard,” said Dan Gans, CFC’s executive director. With the proposal’s chances of making it through the final budget by the March 31st deadline waning, the group and others may finally get an opportunity to do just that at some point later in 2017. According to The CFC, they are looking for additional companies to support them in that endeavor. Anyone interested in finding out how they can help should contact Dan Gans at dgans@polariswdc.com.

As NY Lending License Proposal Looms, Industry Trade Groups Mobilize

February 13, 2017

The alternative small-business finance community plans to lobby hard against a far-reaching proposed expansion of the New York state lending license. The proposal calls for any person or company that solicits, arranges or facilitates business and consumer loans – or other types of financing – to obtain a license. That could include MCA companies, business loan brokers and ISOs.

Critics claim the expansion, which Governor Andrew M. Cuomo included in his proposed state budget, could trigger a series of ominous and possibly unintended events in the courts and on Wall Street. “It could destroy the industry if the worst comes to fruition,” declared Robert Cook, a partner at Hudson Cook LLP.

Some opponents also contend that the public hasn’t had a reasonable opportunity to respond. “Sneaking a provision with significant impact like this into the budget and not going through regular order is really disturbing,” said Dan Gans, a Washington lobbyist who also serves as executive director of the the Commercial Finance Coalition. “They should allow all the stakeholders to have their voices heard.”

The industry’s trade groups have been quick to react. The Small Business Finance Association has been in contact with New York state legislators to help them understand the ramifications of the proposal, according to Stephen Denis, the trade group’s executive director. Meanwhile, Gans is recommending that the CFC’s board hire an Albany lobbying firm to help advance the industry’s interests.

New York’s current consumer licensing law is written broadly enough to cover any loan to an individual for less than $25,000, even if it’s made for commercial purposes, said Cook. That means the current law could cover loans to sole proprietorships but would not affect loans to corporations, limited liability companies, partnerships or limited liability partnerships, he noted.

Under the proposal in Governor Cuomo’s budget, any type of commercial loan of up to $50,000 would require a license, Cook said. Today, the state requires a license only if a loan carries a simple interest rate of more than 16 percent. Under the budget proposal, all lending would require a license, even if the interest rate is less than 16 percent. Loans made by alternative funders typically carry interest rates of 36 percent to 100 percent, he said.

Under the proposal in Governor Cuomo’s budget, any type of commercial loan of up to $50,000 would require a license, Cook said. Today, the state requires a license only if a loan carries a simple interest rate of more than 16 percent. Under the budget proposal, all lending would require a license, even if the interest rate is less than 16 percent. Loans made by alternative funders typically carry interest rates of 36 percent to 100 percent, he said.

New York already has a criminal usury rate of 25 percent, but lenders have two methods of avoiding that cap, according to Cook. Under one method, the parties to the loan can use a provision called the “choice of law clause” and thus agree that the contract is subject to the laws of a state that does not limit commercial usury rates, he said. Or, using the second method, the small-business finance company can solicit the loan and refer it to a bank in a state without a cap. The bank makes the loan but then sells the loan back to the small-business finance company or an affiliate, he noted.

But adopting the changes proposed in the New York budget could possibly stymie both methods of circumventing the state’s usury laws. Consider the choice of law clause, Cook suggested. The courts could interpret the proposed expansion as an effort by the state to gain more control of commercial lending. That could prompt the courts to refuse to enforce choice of law clauses involving New York state because doing so would violate a significant policy in New York, he maintained. The proposal could also gut the second way around the usury law – the bank model – by requiring employees of out-of-state banks to have a license in order to originate loans or by prohibiting rates in excess of New York’s cap, he said. Both outcomes are speculative but constitute distinct possibilities, he added.

Expanding the license would also grant additional regulatory authority to the New York State Department of Financial Services, Cook maintained. Besides requiring the license, the DFS would have the ability to regulate, supervise and examine commercial lenders, he said. In the past the department has imposed some significant regulations on licensees, including fair lending requirements and cyber security requirements, he said. “They’re a very active regulator,” he contended. “They could require commercial lenders to jump through a lot of hoops that aren’t there today.”

Expanding the license would also grant additional regulatory authority to the New York State Department of Financial Services, Cook maintained. Besides requiring the license, the DFS would have the ability to regulate, supervise and examine commercial lenders, he said. In the past the department has imposed some significant regulations on licensees, including fair lending requirements and cyber security requirements, he said. “They’re a very active regulator,” he contended. “They could require commercial lenders to jump through a lot of hoops that aren’t there today.”

What’s more, time would pass while a company negotiates the initial hoops simply to obtain a license. Qualifying for the current New York license, for example, can take up to nine months, Cook said. “It’s a fairly intensive licensing process that requires a lot of information about the company, the officers and directors of the company,” he noted. “The licensing process is tough in New York.”

The expansion could also limit the industry’s access to capital, Cook warned. Some alternative funders raise money by selling loans or interests in loans on the secondary market. Requiring a license to buy those products could prompt Wall Street to look elsewhere for less-burdensome investment opportunities, he said.

The laundry list of potential bad effects has many in the industry wondering about the state’s intentions toward the industry. “It’s not clear whether the people up in Albany understand the potential effect this has,” Cook said.

To help bring about that understanding, the CFC intends to call upon its members and merchants who have benefitted from alternative finance to visit officials in the state capital, Gans said.

Gans finds reason for optimism as the associations coalesce around the issue. The state Senate in Albany tends to be pro-business, and I am confident we will find allies that will stand up to this, he said.

Denis also seems upbeat about the industry’s efforts to make itself heard in Albany. In Illinois, some legislators failed to differentiate between consumer loans and commercial loans when considering legislation last year, he noted. That might be the case in New York, too, and the SBFA might help them make the distinction, he said. As an example of the differences, he pointed out that business loans often carry high interest rates because of high risk. “We have talked to some folks in Albany, and everyone is receptive to the industry,” he said. Small business is a powerful constituency, he maintains.

Gans, Denis and Cook all said they’re not opposed to legislation or regulation that addresses problems caused by bad actors in the industry, but all three oppose government action that they believe unnecessarily limits members of the industry who are operating in good faith.

The proposed license in New York differs in at least one significant way from the California lending license that many alternative funders have obtained, Cook noted. The California license doesn’t impose a cap on interest rates, he said. If the New York proposal imposed licensing requirements but did not limit interest rates, the industry probably would reluctantly accept it, he suggested.

—-

Dan Gans at the CFC can be contacted at dgans@polariswdc.com

Stephen Denis at the SBFA can be contacted at sdenis@sbfassociation.org

Robert Cook at Hudson Cook can be contacted at rcook@hudco.com

FIRE DRILL IN ILLINOIS: BUSINESS FUNDING COMPANIES TARGETED IN REPRESSIVE BILL

June 30, 2016* Update 6/30 AM: Sen. Jacqueline Collins, D-Chicago is expected to introduce a revised bill today.

** Update 6/30 PM: Reintroduction of the bill has been delayed while they wait for comments from additional parties

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Foes say the measure was created to promote disclosure and regulate underwriting. They don’t argue with the need for transparency when it comes to stating loan terms, but they maintain that a provision of the bill that would cap loan payments at 50 percent of net profits would disrupt the market needlessly.

Opponents also regard the bill as an encroachment on free trade. “The government shouldn’t be picking winners or losers – the market should be,” said Steve Denis, executive director of the Small Business Finance Association, a trade group for alternative funders.

The states or the federal government may need to protect merchants from a few predatory lenders, but most lenders operate reputably and have a vested interest in helping clients succeed so they can pay back their obligations and become repeat customers, several members of the industry maintained.

“The ability to pay is really a non-issue,” noted Matt Patterson, CEO of Expansion Capital Group and an organizer of the Commercial Finance Coalition, another industry trade group. “I don’t make any money if a borrower doesn’t pay me back, so I don’t make loans where I think there is an inability to pay.”

Outsiders may find interest rates high for alternative loans, but companies providing the capital face high risk and have a short risk horizon, said Scott Talbott, senior vice president of government affairs for the Electronic Transactions Association, whose members include purveyors and recipients of alternative financing. Several other sources said the risks justify the rates.

Besides, a consensus seems to exist among industry leaders that most merchants – unlike many consumers – have the sophistication to make their own decisions on borrowing. Business owners are accustomed to dealing with large amounts of money, and they understand the need to keep investing in their enterprises, sources agreed.

In fact, no one has complained of any small-business lending problems in Illinois to state regulators, said Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation and a member of Gov. Bruce Rauner’s cabinet.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

But the proposed legislation could itself cause problems by placing entrepreneurs at risk, according to Rob Karr, president and CEO of the Illinois Retail Merchants Association, which has 400 members operating 20,000 stores. “It would stifle potential access to capital for small businesses,” he warned.

Quantifying the resulting damage would present a monumental task, but a shortage of capital would clearly burden merchants who need to bridge cash-flow problems, Karr said. Shortfalls can result, for example, when clothing stores need to buy apparel for the coming season or hardware stores place orders in the summer for snow blowers they’ll need in six to eight months, he said.

Restaurant owners and other merchants who rely on expensive equipment also need access to capital when there’s a breakdown or a need to expand to meet competition or take advantage of a market opportunity, Karr observed.

Capital for those purposes could dry up because just about anyone providing non-bank loans to small merchants could find themselves subject to the proposed legislation, including factoring companies, merchant cash advance companies, alternative lenders and non-bank commercial lenders, said the CFC’s Patterson.

Banks and credit unions are exempt, the bill says, but a page or two later it includes provisions written so broadly that it actually includes those institutions, said Ben Jackson, vice president of government relations at the Illinois Bankers Association.

Trade groups representing all of those financial institutions – including banks and non-banks – have joined small-business associations in working against passage SB 2865. “The most important thing is to make sure we’re coordinating with the other groups out there,” the SBFA’s Denis contended. “Actually, Illinois was good practice for the industry in how we’re going to go about dealing with attempts at regulation.”

Patterson of the CFC agreed that associations should coordinate their responses to proposed legislation. “We’ve tried to gather all the affected players in the space and have dialogue with them,” he maintained.

Even though that various associations reacting to the bill generally agreed on principles, their competing messages at first created a cacophony of proposals, according to some. “There was a lot of noise, and I think we’ll all learn from that,” Denis said. “The industry has to learn to speak with one voice to legislators.”

Citing the complexity of dealing with 50 states, 435 members of Congress and 100 senators, Denis said everyone with an interest in small-business lending must work together. “If we don’t, we lose,” he warned.

Many of the groups came together for the first time as they converged upon the Illinois capital of Springfield last month when the state’s Senate Committee on Financial Institutions convened a hearing on the bill. The committee allowed testimony at the hearing from three groups representing opponents. The groups huddled and chose Denis, Jackson and Martha Dreiling, OnDeck Capital Inc. vice president and head of operations.

City of Chicago Treasurer Kurt Summers was the only witness who testified in favor of the bill, according to Jackson. The idea of regulating non-bank commercial lenders in much the same way Illinois oversees lending to individuals arose in Summers’ office, said an aide to Illinois Sen. Jacqueline Collins, D-Chicago. Sen. Collins serves as chairperson of the Financial Institutions Committee and introduced to the bill in the senate.

Sen. Collins declined to be interviewed for this article, and Treasurer Summers and other officials in his of office did not respond to interview requests. However, published reports said Drew Beres, general counsel for Summers, has maintained that transparency, not underwriting, is the main goal. Talbott has met with Sen. Collins and said she’s interested primarily in transparency.

Support for the bill isn’t limited to the Chicago treasurer’s office. Some non-profit lending groups and think tanks back the proposed legislation, opponents agreed. The bill appeals to progressives attempting to shield the public from unsavory lending practices, they maintained.

Politicians may view their support of the bill as a way of burnishing their progressive credentials and establishing themselves as consumer advocates, said opponents of the legislation who requested anonymity. “It’s an important constituency,” one noted. “No one is against small business.”

After listening to testimony at the hearing, committee members voted to move the bill out of committee for further progress through the senate, Jackson said. Eight on the committee voted to move the bill forward, while two voted “present” and one was absent. But most of the senators on the committee said the legislation needs revision through amendments before it could become law, according to Jackson.

The legislative session was scheduled to end May 31. If the bill didn’t pass by then it could come up for consideration in a summer session if the General Assembly chooses to have one, Jackson said. If it does not pass during the summer, it could come to a vote during a two-week “veto session” in the fall or in an early January 2017 “lame duck session.” Unpassed legislation dies at that point and would have to be reintroduced in the regular session that begins later in January 2017, he noted.

Although time is becoming short for the proposed legislation, it’s a high-profile measure that could prompt action, particularly if amendments weaken the rule for underwriting, Jackson said. The Illinois General Assembly sometimes passes important legislation during lame duck sessions, he said, noting that a temporary increase in the state sales tax was enacted that way.

Whatever fate awaits SB 2865, some in the alternative funding business have suspected that the bill came about through an effort by banks to push non-banks out of the market. But cooperation among groups opposed to the proposed legislation appears to lay that notion to rest, according to several sources.

“I don’t get that impression,” Denis said of the allegation that bankers are colluding against alternative commercial lenders. “I think this shows banks and our industry can get together and share the same mission.”

Talbott of the ETA also counted himself among the disbelievers when it comes to conspiracy theories against alternative lenders. “I’d say that’s a misreading of the law and not the case,” he said. “Traditional banks oppose this because it would effectively reduce their options in the same space.”

The interests of banks and non-banks are beginning to coincide as the two sectors intertwine by forming coalitions, noted Jackson of the state bankers’ association. A number of sources cited mergers and partnerships that are occurring among the two types of institutions.

In one example, J.P. Morgan Chase & Co. is using OnDeck’s online technology to help make loans to small businesses. Meanwhile, in another example, SunTrust Banks Inc. has established an online lending division called LightStream.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

And however the industries structure themselves, the need for small-business funding remains acute. Banks, non-banks and merchants agree that the Great Recession that began in 2007 and the regulation it spawned have discouraged banks from lending to small-businesses. The alternative small-business finance industry arose to fill the vacuum, sources said.

That demand draws attention and could lead to bouts of regulation. Although industry leaders say they’re not aware of legislation similar to Illinois SB 2865 pending in other states, they note that New York state legislators discussed small-business lending in April during a subject matter hearing. They also point out that California regulates commercial lending.

Many dread the potential for unintended results as a crazy quilt of regulation spreads across the nation with each state devising its own inconsistent or even conflicting standards. Keeping up with activity in 50 states – not to mention a few territories or protectorates – seems likely to prove daunting.

But mechanisms have been developed to ease the burden of tracking so many legislative and regulatory bodies. The CFC, for instance, employs a government relations team to monitor the states, Patterson said. The ETA combines software and people in the field to deal with the monitoring challenge.

And regulation at the state level can make sense because officials there live “close to the ground,” and thus have a better feel for how rules affect state residents than federal regulators could develop, Sec. Schneider said.

Easier accessibility can also keep make regulators more responsive than federal regulators, according to Sec. Schneider. “It’s easier to get ahold of me than (Director) Richard Cordray at the Consumer Financial Protection Bureau,” he said.

Also, state regulators don’t want to take a provincial view of commerce, Sec. Schneider noted. “As wonderful as Illinois is, we want to do business nationwide,” he joked.

State regulators should do a better job of coordinating among themselves, Sec. Schneider conceded, adding that they are making the attempt. Efforts are underway through the Conference of State Bank Supervisors, a trade association for officials, he said.

At the moment, state legislatures and federal regulators have small-business lending “squarely on their agenda,” the ETA’s Talbott observed. The U.S. Congress isn’t paying close attention to the industry right now because they’re preoccupied with the elections and the presidential nominating conventions, he said.

The goal in Illinois and elsewhere remains to encourage legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that, said Talbott.

At any rate, the industry should unite in a proactive effort to explain the business to legislators, according to Denis. “We need to work with them so that they understand how we fund small businesses,” he said. “That’s the way we can all win.”

Online Small Business Lending Task Force Initiated by the ETA

April 30, 2016 The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

Though you might not have suspected it last week at Transact16, the ETA very much plans to involve themselves in the affairs of marketplace lending. That might not have been obvious from a Bloomberg article that reported that OnDeck, Kabbage and PayPal were forming a splinter organization as an “extension” of the ETA known as the Online Small Business Lending Task Force. Referred to as a new initiative in the announcement, the group’s mission is described as striving to “prevent hasty or overly restrictive regulations.”

But the group’s named lobbyist, Scott Talbott, is also the ETA’s lobbyist. And the three lenders named, were already members of the ETA. When Talbott was asked by AltFinanceDaily to clarify the relationship between the “task force” and the ETA, he said that the two weren’t separate. The “ETA organized its members to lobby on the issue. It’s what we do every day,” he wrote.

The “task force” merely highlights members in the trade group that share a common interest.

Formed in 1990 and comprising of over 550 companies across 7 countries, the ETA has served the payments industry well. OnDeck, Kabbage and PayPal therefore find themselves in good company and led by advocates with well-established government relationships.

Along with the ETA, the online small business lending industry has found support from the Marketplace Lending Association, the Small Business Finance Association, the Commercial Finance Coalition and the Coalition for Responsible Business Finance.

Splits Glitz or Fritz? – Transact 16 highlighted strange chapter in merchant cash advance history

April 21, 2016

It’s Opposite Day in the alternative business funding industry. Lenders are splitting card payments and merchant cash advance companies are doing ACH debits.

Jacqueline Reses was not an odd choice for Transact 16’s Wednesday morning keynote. Square, the company she works for, has continued to be a hot topic in the payments world for years. But what was striking is that Reses heads the lending division, the group that allows merchants to pay back loans through their future card sales. If that sounds very merchant-cash-advance-like, it’s because that’s exactly the product they used to offer before changing the legal structure behind them.

Split-payments, not ACH payments, have literally propelled Square and PayPal to the top of the charts of the alternative business funding industry. One individual on the exhibit hall floor posited that Square’s ability to originate loans through their payments ecosystem was the company’s real value; Payments itself was secondary. It’s a testament to the opportunities that split-payments affords to (as I argued 3 years ago on the ETA’s blog) a company well positioned to benefit from it.

Meanwhile, the companies at Transact that one would have historically described as merchant cash advance companies have mostly transitioned away from split-payments to ACH. Essentially, Square and PayPal embraced splits as an incredible strength while yesterday’s merchant cash advance companies viewed splits as a handcuff that limited scalability. The payment companies became merchant cash advance companies and the merchant cash advance companies became something else entirely, a diverse breed of loan and future receivable originators operating under a label people are now calling “marketplace lenders.” But even Square and PayPal, arguably the two companies at Transact doing the most split-payment transactions, claim to make loans, not advances.

Merchant Cash Advance as anyone knew it previously is dead

Ten years. That’s the average age of the small business funding companies that exhibited at Transact this week. They are but the last remaining players that probably considered the debit card interchange cap imposed by the Durbin Amendment of Dodd-Frank as being among the most significant legislation that affected their businesses.

A senior representative for one credit card processor told me at the conference that their biggest gripe with new merchant cash advance ISOs today is that they know almost absolutely nothing about merchant accounts. It’s not that they know less, they know nothing, he said.

One company was notably absent from the floor this year, OnDeck. They’ve since embraced the marketplace lending community as their home, just as many others have.

Nine years ago, I overheard a very influential person say that the first company to be able to split payments across the Global, First Data and Paymentech platforms would be crowned the “winner” of the merchant cash advance industry and by extension the wider nonbank small business financing space.

If one were to define the winner as the first company from that era to go public, well then those 3 platforms played no role. OnDeck was the first and they relied on ACH payments the entire way. They also refer to themselves these days as a nonbank commercial lender. If that doesn’t sound very payments-like, it’s because it’s not.

What cause is being Advanced?

At least four coalitions are currently advocating on the marketplace lending industry’s behalf, the Coalition for Responsible Business Finance, the Marketplace Lending Association, the Small Business Finance Association, and the Commercial Finance Coalition. The Transact conference is put on by the Electronic Transactions Association whose tagline is “Advancing Payments Technology.” In an age where new merchant cash advance ISOs know nothing about payments, it’s no wonder there’s a growing disconnect.

Could Transact now be one of the best kept secrets?

A few people from companies exhibiting say that they believed they stood a better chance to land referral relationships from payment companies by being there and that there was still a lot of value in landing those deals. Partnerships like these may be why the average exhibitor has been in business for 10 years while today’s new companies relying solely on pay-per-click, cold calling, or handshakes are falling on hard times.

Some payment processors acknowledged that merchant cash advance companies were still a good source to acquire merchant accounts, though the process by which that happens is not the same as it used to be. A lot of it is referral based now, according to one senior respresentative for a card processor. The funding company funds a deal via ACH and then refers them to the payment guy to try and convert that as an add-on. The residual earnings may not be as good as they used to be but that’s because they don’t have to do any work in this circumstance. In a sense, funders are still leading with cash but instead of the boarding process being mandatory, it’s an entirely separate sale that sometimes works and sometimes doesn’t. In that way, small business funding companies can be a good lead source for payments companies.

When I asked the senior representative if they really had success closing merchant accounts just off of a referral from a funding company, he looked at me incredulously, and said, “you used to do this, of course we do. that’s how this whole industry started.”

“What industry?” I asked.

What industry indeed…

SCORCHED EARTH – Controversial Bill Could Eliminate Marketplace Lending, Merchant Cash Advance and Nonbank Business Loans in Illinois (and starve small businesses in the process)

April 9, 2016

The State of Illinois wants to make it a Class A misdemeanor for providing small businesses with quick, easy working capital.

The world’s strangest bill, dubbed the Small Business Lending Act, could send marketplace lenders, nonbanks, and merchant cash advance companies to prison for up to 1 year if applicants don’t submit at the very least, their most recent six months bank statements, the previous year’s tax return, a current P&L, a current balance sheet, and an accounts receivable aging.

Loans in which the monthly payments exceed at least 50% of the business’s monthly net income would be illegal, which implies that any business that is either breaking even or running at a loss would be banned from obtaining a loan from alternative sources.

This is not an April Fools’ prank. Not even preemption granted under the National Bank Act or Federal Deposit Insurance Act is safe.

Introduced into the State Senate under the pretense that it would squash predatory lenders, the bill’s licensing and compliance proposal would also effectively outlaw marketplace lending and securitizations by making the sale of loans illegal unless it’s to a bank or another state-licensed party. Even merchant cash advances are referenced specifically but almost as an afterthought and defined in such a way that even traditional factoring companies may be in jeopardy.

No licensee or other person shall pledge, assign, hypothecate, or sell a small business loan entered into under this Act by a borrower except to another licensee under this Act, a licensee under the Sales Finance Agency Act, a bank, savings bank, community development financial institution, savings and loan association, or credit union created under the laws of this State or the United States, or to other persons or entities authorized by the Secretary in writing. Sales of such small business loans by licensees under this Act or other persons shall be made by agreement in writing and shall authorize the Secretary to examine the loan documents so hypothecated, pledged, or sold.

At a time when most fintech lenders are advocating for smart regulation, the State of Illinois apparently wants to end all nonbank commercial finance under $250,000 completely, with the exception of one organization (which we’ll get to shortly).

At a time when most fintech lenders are advocating for smart regulation, the State of Illinois apparently wants to end all nonbank commercial finance under $250,000 completely, with the exception of one organization (which we’ll get to shortly).

There are some exemptions granted under this proposal of course. Loans over $250,000 aren’t subject to it, nor are any loans made by Illinois-based banks or credit unions, that is unless they are acting as the agent for another party like say perhaps a marketplace lender.

Hidden inside is also an exemption for nonprofit lenders, a loophole left open for Accion Chicago, the nonprofit masterminds behind the bill who seem to want the entire state’s lending market all for themselves.

Illinois State Senator Jacqueline Collins Introduced This Bill

Senator Collins introduced the legislation as an amendment to Senate Bill 2865 on April 6th. A former journalist, she’s now the chairwoman of the Illinois Senate Financial Institutions Committee. Among her self-professed accolades is that she “has played a key role in addressing predatory lending and high foreclosure rates in Chicago through legislation that protects homebuyers and homeowners with subprime mortgages.” She lists the Mortgage Rescue Fraud Act, the landmark Sudan Divestment Act and the Payday Loan Reform Act among her major legislative accomplishments.

It’s no surprise then that sections of the bill are borrowed straight out of the Payday Loan Reform Act. Collins isn’t acting on her own however…

Chicago City Treasurer Kurt Summers

In January, Senator Collins joined Chicago City Treasurer Kurt Summers in a call for “new legislation to protect small business owners from misleading and dishonest predatory lenders.” In a closed-door hearing, the committee supposedly heard from business owners, advocates and elected officials on predatory lending.

“Chicago’s small business community deserves protection from the unchecked greed of predatory lenders,” Treasurer Summers said. “While access to capital is the number one concern of small business owners across the state, bank and commercial loans continue to decline, steering them to underhanded lenders. As we continue to urge banking partners to increase their local investment, this new, common-sense legislation would ensure transparency in lending that so often puts our entrepreneurs at risk.”

Of note is his use of the phrase “banking partners” since this bill has bankers all over it, as we’ll get into shortly. Summers represents the Chicago Mayor’s office and the Mayor’s office says they’ve launched this campaign thanks to partners like Accion Chicago.

Hon. Kurt Summers, Treasurer, City of Chicago from City Club of Chicago on Vimeo.

Accion Chicago and the Mayor’s Office

Last year, Mayor Rahm Emanuel announced a joint campaign with Accion Chicago to help small businesses avoid predatory lending.

Accion Chicago, ironically makes business loans themselves, having originated 535 loans totaling $4.8 million in 2014 with a maximum loan size of $100,000.

Who is Accion Chicago really?

The Small Business Lending Act virtually ensures that small business loans under $250,000 only be facilitated by banks and nonprofits. Isn’t it convenient then that Accion Chicago is not only a nonprofit, but also funded and staffed by banks?

According to their 2014 annual report, Citibank and JPMorgan Chase were two of their three largest supporters (the third was the US Treasury!). Below are some of the figures:

$100,000+

- Citibank

- JPMorgan Chase

$50,000 – $99,999

- Bank of America

$20,000 – $49,999

- Fifth Third Bank

- PNC Bank

- U.S. Bank

$5,000 – $19,999

- American Chartered Bank

- Alliant Credit Union

- BMO Harris Bank

- First Bank of Highland Park

- First Eagle Bank

- First Midwest Bank

- Ridgestone Bank

- State Bank of India

- The PrivateBank

- Wells Fargo Bank

About a dozen more banks gave less than $5,000.

JPMorgan Chase has also been a partner of the annual Taste of Accion fundraising event, and was the lead sponsor in 2014, a spot that costs $30,000. Benefactor sponsorships which cost $20,000 each were comprised of American Chartered Bank, Capital One, Northern Trust Company, and Wintrust Bank. And the lesser sponsorships? Again, mostly banks.

JPMorgan Chase has also been a partner of the annual Taste of Accion fundraising event, and was the lead sponsor in 2014, a spot that costs $30,000. Benefactor sponsorships which cost $20,000 each were comprised of American Chartered Bank, Capital One, Northern Trust Company, and Wintrust Bank. And the lesser sponsorships? Again, mostly banks.

You know who hasn’t donated to Accion Chicago? Marketplace lenders and merchant cash advance companies.

Accion Chicago raised only $1.4 million in 2014 from public support, the bulk of which came from banks or related traditional financial institutions. So is it just a coincidence that this predatory lending bill they’re supporting grants exemptions to all the banks from compliance?

Accion Chicago’s 2014 Board of Directors includes executives from:

- American Chartered Bank (chairman)

- First Eagle Bank

- JPMorgan Chase

- Ridgestone Bank

- MB Financial Bank

- Talmer Bank & trust

- Citibank

- First Midwest Bank

The 2014 committees were made up almost entirely of bank executives from:

- First Eagle Bank

- The PrivateBank

- Ridgestone Bank

- U.S. Bank

- JPMorgan Chase

- Forest Park National Bank & Trust Co.

- MB Financial Bank

- FirstMerit Bank

- Wintrust Bank

- Standard Bank & Trust Co.

- First Midwest Bank

- Wells Fargo Bank

- Seaway Bank & Trust Co.

- Metropolitan Capital Bank

- Evergreen Bank Group

- First Financial Bank

- PNC Bank

Thanks to the impartial work of these good citizens, they have discovered that small businesses should only be working with banks or nonprofits funded and staffed by banks and have craftily devised a bill to legislate all the alternatives out of existence.

If this was really about predatory lending, then they screwed up big time

All coincidences aside, some of the bill’s rules have nothing to do with protecting borrowers, like the required $500,000 surety bond to become licensed for example. Compare that to California’s $25,000 licensed lender surety bond. And the restriction on being able to sell or securitize a loan, how does that help small businesses?

These requirements and others suggest that it’s about preventing all alternatives from existing in the marketplace, rather than predatory alternatives. The losers would undoubtedly be small businesses and the Illinois job market. Senator Collins and Treasurer Summers, both of whom have a strong track record of empowering their constituents financially, may have underestimated or overlooked the likely negative consequences of this bill.

The nonbanks

Several nonbank trade groups are reportedly in the process of formulating a response.

The Commercial Finance Coalition for example, a nonprofit coalition of financial technology companies, told AltFinanceDaily that they are concerned about the impact this will have on the Illinois job market and will indeed have representatives on the ground in Illinois.

They also wanted to make known that they welcome support from marketplace lenders, nonbanks and merchant cash advance companies in these efforts and that interested parties should email Mary Donahue at mdonohue@commercialfinancecoalition.com

To contact Senator Jacqueline Collins who introduced the bill, call her at 217-782-1607.