Par Funding, Receiver Continue to Spar Over Its MCA Business

December 18, 2020 “From inception through 2019, [Par Funding] incurred a cash loss from operations of $136.2 million.”

“From inception through 2019, [Par Funding] incurred a cash loss from operations of $136.2 million.”

That’s the conclusion reached by Bradley D. Sharp, CEO of Development Specialists Inc (DSI), the financial advisor to the Receiver appointed in the Par SEC case.

Par has scoffed at the Receiver’s analysis of its business. “We do not necessarily begrudge attorneys, whose skill sets are often in other areas, a potential inability to understand the math that often makes for a strong and profitable financial model,” Par’s lawyers wrote in an October court filing. “There is a reason that smart, mathematically inclined people are typically hired by banks, hedge funds and financial services firms. But the Receiver and his counsel’s inability to understand Par’s business has led to all manner of baseless accusations that are easily answered in the very documents they possess but do not understand…”

Par says it was profitable and walks the Court throught its mathematical process. Sharp says Par’s assessment “is misleading and does not reflect actual operations at the company.”

Sharp alludes to Ponzi-like characteristics but refrains from using that term. “From inception through 2019, [Par] paid $231 million to investors, consisting of principal repayments totaling $135.6 million and interest payments totaling $95.4 million. [Par] could not have made these principal and interest payments to the investors without additional funds from the investors.”

Par explained that the key to its business is in the compounding:

“The merchant funding model is profitable because merchant funding returns are reinvested, either in a new or different merchant, or in an existing merchant with adequate receivables as a consolidation, or as a refinance of a merchant which may already have MCA funding from another provider. And the reinvestment begins on the merchant funding returns which commence immediately and occur daily. In very simple form, the math works as follows. Assuming $10,000 is funded to a merchant pursuant to a funding agreement providing for a funding return of $13,000 over the course of 100 daily ACH withdrawals, the agreement would provide for repayment to begin immediately with daily payments of $130. As those monies are returned, portions are used to pay operating expenses, but most of the monies are re-invested to fund other merchants. Mathematically, this means that the original $10,000 is being used to fund more than one merchant. Over the life of a single $10,000 funding, that same $10,000 can be used to fund multiple merchants, all of whom are paying funding fees in excess of the principal amount received. Thus, the original $10,000, at a 1.30 factor rate, generates $13,000 on the first merchant cash advance (MCA). Those funds are reinvested and generate $16,900 on the second MCA, and $21,970 by the third MCA – an increase of $11,970 over and above the initial $10,000. And that can happen within a year. This is the powerful compounding effect of the financial model.

That is the simplest version of the model. In practice, the model is far more sophisticated than that because the leveraging to new merchants of the MCA returns begins as soon as the MCA payments come in.”

Par additionally said:

“At the conference on October 8, 2020, the Receiver’s counsel told this Court, and many investors, that out of $1.5 million received per day from merchants prior to July 28, 2020, $1.2 million was used for new MCA funding. Thus, according to the Receiver’s counsel, only $300,000 constituted net collections, about 20%. The Receiver’s counsel appears to be suggesting that the company is not holding on to receivables but, instead, is refunding the same merchants 80% of receipts. This proposition is wrong and its assertion shows that the Receiver and his counsel do not understand the MCA business.”

One could assess that a large element of this case consists of the Receiver being like, ha! well look at this! and Par responding, well, yes, that is actually how our business works.

In fact, that is precisely the angle Par took in defending its use of funding new deals with money collected from deals previously funded.

“First, the numbers show that collections are used to fund new MCA deals,” Par’s attorneys wrote. “This may come as a total surprise to the Receiver and his counsel, but funding merchants is the business of Par. That is like criticizing Ford Motor Corp. for using its car sales income to build and sell more cars.”

Both sides agree that Par advanced over $1 billion to small businesses but Sharp says that “reloads” distorted the numbers.

“Use of reloads escalates the obligations of the merchant as each reload adds an additional ‘factor’ along with any new funds advanced,” Sharp wrote. “In [one example the reloaded funds are] subject to the factor twice; once when the funds were originally sent and again when they are included in the reload advance. The use of reloads also significantly distorts the calculation of loss rates as the advances are simply refinanced without becoming a loss.”

Sharp concludes that the true end result for Par is a much higher default rate than it lets on to.

And then there’s this

Sharp has repeatedly brought attention to a list of merchants with unusual payment and funding activity. Par countered by saying there are good explanations for each.

Amongst all of this is that company insiders are alleged to have received tens of millions in payments from Par and the Receiver is confident, in part due to DSI’s report, that Par was majorly unprofitable.

“Based on our review to date, it is apparent that [Par] would not have been able to continue to provide payments to investors, or to continue to operate, without additional funds from investors,” Sharp wrote in a December 13th report.

This case is not the first rodeo for Sharp and DSI in the merchant cash advance business. They were also assigned to manage the 1 Global Capital case.

The case is ongoing. The Court recently approved a motion to expand the Receivership estate.

Pearl Capital Business Funding LLC Resumes Merchant Cash Advances After Processing $1.75 B in PPP Loans

November 5, 2020JERSEY CITY, N.J. – November 5, 2020 — Pearl Capital Business Funding, LLC, a leading provider of direct financing to small and midsize businesses, today announced that it will resume funding merchant cash advances for U.S. small businesses after suspending funding for a period of time due to the COVID-19 crisis. The move comes after a seven month hiatus during which the company utilized its technology platform to process over $1.75 Billion in SBA Paycheck Protection Program (PPP) Loans.

Pearl Capital provides innovative alternative financial solutions, specializing in the underbanked and subprime business sector. Their financing solutions are available throughout the U.S. to businesses of virtually any industry that are unable to access sufficient traditional financing from banks and non-bank lenders. Pearl’s solutions are not dependent on the business owner’s FICO score and present a compelling solution to underwriting credit even during the current COVID-19 crisis. With the relaunch, Pearl’s ISO Partners can expect lighter stipulation requirements with fewer requested documentation than before and updated pricing. Virtually all business types are eligible for funding from Pearl including high risk industries like auto sales, real estate, home-based businesses, and insurance.

“When the COVID-19 pandemic hit last March, we weren’t sure what our future looked like. With so much uncertainty of the economic climate, like many other funders, we temporarily ceased funding. We pivoted and partnered with Cross River Bank and were able to transition our fully-automated processing and anti-fraud technology to process SBA Paycheck Protection Program (PPP) Loans.” Chief Revenue Officer, Jake Lerner, says, “Using our technology platform, we were able to process over $1.75 Billion in PPP loans for businesses affected by COVID-19.”The Paycheck Protection Program (PPP) was a SBA loan program established under the CARES Act to help small businesses keep workers on their payrolls during the pandemic. The program ended on August 8, 2020 but is likely to resume.

“We’re thrilled to have the ability again to continue to provide financing for companies during an especially difficult time for businesses across the country and give much needed financial support to businesses” CEO, Sol Lax, says, “Pearl did not default on its senior credit line due to its superior underwriting and has added $250 Million in committed financing to expand its activities. If you are a small business and you have survived COVID, you shouldn’t have to shut your doors because you have limited access to capital. We are going to be there for small business both in further iterations of PPP as well as MCA.”

About Pearl Capital

Pearl Capital was founded in 2012 and acquired by private equity firm Capital Z Partners in 2015. Since then, they have become a leader in the fintech industry specializing in short term capital advance solutions for under-banked and credit-challenged businesses, in just about every industry. Over the years, they have provided over 23,000 MCA financings to small businesses across the country, by working with their network of ISOs. Their advanced online application technology platform and machine learning SMB credit score allows them to provide flexible terms and some of the fastest response times in the industry for deals up to one-million dollars. Most recently, Pearl Capital partnered with Cross River Bank to process over $1.75 Billion in Paycheck Protection Program (PPP) loans.

Contact:

Jake Lerner, Chief Revenue Officer

press@pearlcapital.com

+1 347-584-8653

“Panic Induces Panic”: David Goldin on Small Business Funding and the Coronavirus

March 12, 2020With companies in Australia, Britain, and the United States, David Goldin has weathered storms of various sizes and seriousness over the past two decades. Whether it was the recent wildfires that saw state-sized infernos engulf the Australian countryside, the regulatory upheaval that is Brexit, or the unprecedented shockwaves sent by the 2008 financial crisis, the CEO has seen his fair share of global disruption.

So when AltFinanceDaily got in touch with Goldin about his perspective on the coronavirus pandemic, how it compares to what he’s seen before, and what funders should do to combat contagion, he was happy to discuss the insights he’s garnered from twenty years in business.

The following Q&A has been lightly edited for clarity and succinctness:

AltFinanceDaily: Generally speaking, how bad do you think the coronavirus pandemic is going to get?

“I don’t think anyone knows the outcome. I think what you’re going to see is the industry completely change over the next few days. In the last 48 hours you went from mild cancellations to, today alone, the NBA, NHL, and MLB. And Cuomo just announced in New York that there can be no more than 500 people at events, colleges are shutting down left and right, and schools as well. Basically, we’re heading in the direction of shutting down the entire country at some point.

“I don’t think anyone knows the outcome. I think what you’re going to see is the industry completely change over the next few days. In the last 48 hours you went from mild cancellations to, today alone, the NBA, NHL, and MLB. And Cuomo just announced in New York that there can be no more than 500 people at events, colleges are shutting down left and right, and schools as well. Basically, we’re heading in the direction of shutting down the entire country at some point.

So I think funders have two issues. One is their existing customers, right? And how do you lend in this market? There’s the obvious and the not so obvious, because, for example, a deal that may have been great a few days ago, let’s say there’s a college bar near SUNY Albany, and they just announced this shutting down of schools, that bar may not see any business for who knows how long.

I’m not the CDC, I’m not the WHO, I’m not a medical expert, but I know in life, people are always afraid of the unknown and panic induces panic, but this is just my opinion. So I think once people start getting this virus, which is inevitable, and they recover from it, I think that’s going to offset some of the panic.

I think you’re going to have a couple of more shock factors. I would not be surprised if we learn in the next few weeks that the President of the United States has it.”

And what about our industry specifically?

“I think right now, lenders will say, ‘Well, if I [tighten up], typically what happens in our industry is if a company runs into trouble, it’s usually just that company,’ right? So if they start tightening up, they lose the business.

The entire playing field will be level by Monday or Tuesday of next week, by the latest. I think some of the playbook will be that some funders may take the position to stop funding for the next couple of weeks and look to see what happens because no one knows how bad this is going to get.”

Do you have any advice for funders?

“I think you have to price the risk because I think everyone is foolish to think that the bolts are not going to go off. So you’re either going to have to increase the pricing to the customer or raise the rates to the broker and limit the amount they could charge the customer temporarily for the increased risk your portfolio is now going to take.

I think you need to shorten the term. During the 2008 recession, the industry was at a 1.35 to a 1.37 factor rate, averaging six or seven months. There weren’t too many providers back then going past a year, there really was no such things as a second or third position.

This is a much different world we live in. So I think, unfortunately, some of the platforms that tend to be longer-term players which do one year, two years, three years, even four years, I think they’re going to be in a lot of trouble. Their ships are too far out to sea and I think they’re really going to have to focus on portfolio management and collections.

There’s going to be opportunities in the marketplace for those that don’t take a prudent approach, but I think in the short term people have to shorten their terms, potentially raise pricing for risk, and decrease the amount of capital that they’re taking out of a customer’s gross sales.”

What lessons do you think can be learned from this?

“I think as a platform you have to look at redundancy of capital, and that the time to raise money is when you don’t need it. So I think this could be a lesson for all to perhaps have more than one funding source.

I think brokers are going to really have to diversify. There’s good and bad, I think the approval rates at companies are going to fall through the floor, but I think you’ll get a lot of borrowers over the next few weeks that can typically go to a bank that won’t be able to go to a bank. But you’re going to see a lot of watching and waiting right now. And you’re going to see the industry revert back to where it was a while ago: shorter term deals, pricing in the risk, lower gross sales taken.”

How does this compare to previous crises?

“So I think this one’s a little bit different. It’s affecting everything and your playbook is going to change literally daily. This will be affecting the majority of the major cities. When you’re shutting down things like the MLB, the NBA, the NHL, shutting down colleges and universities, I don’t think this country or the world has ever experienced anything like this for this extended period of time.

Now that doesn’t mean everyone’s going to go out of business, there’ll be a redistribution. For example, if it was a restaurant in midtown Manhattan that relied a lot on people going from work, and these people are now working from home, perhaps their local restaurants or supermarket may see an uptick in business.

I think you’re going to see decisions slowing down and really digging a lot deeper into the underwriting, understanding what the business actually does, how it’s potentially affected.”

What should funders be doing to combat contagion?

“They should be testing a disaster recovery plan to work remotely.

But most importantly it’s really about everyone being healthy, helping their families and their employees. That’s first and foremost.”

Declined For Funding? Lack of Time in Business Beats Out Lack of Credit Worthiness

January 20, 2020 A study conducted by Square Capital and the Stevens Center for Innovation in Finance at the Wharton School at the University of Pennsylvania, pulled back the curtain on small businesses and the financing process.

A study conducted by Square Capital and the Stevens Center for Innovation in Finance at the Wharton School at the University of Pennsylvania, pulled back the curtain on small businesses and the financing process.

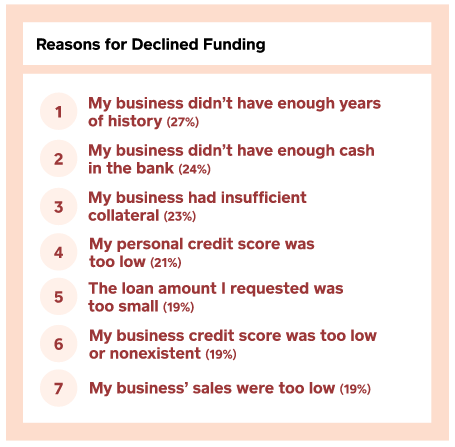

Notably, the #1 reason that businesses said they had been declined for funding (regardless of the source) wasn’t credit, it was that they hadn’t been in business long enough.

#2 was (ironically) a lack of cash in the bank.

#3 was insufficient collateral.

Personal credit worthiness and business credit worthiness ranked #4 and #6 respectively.

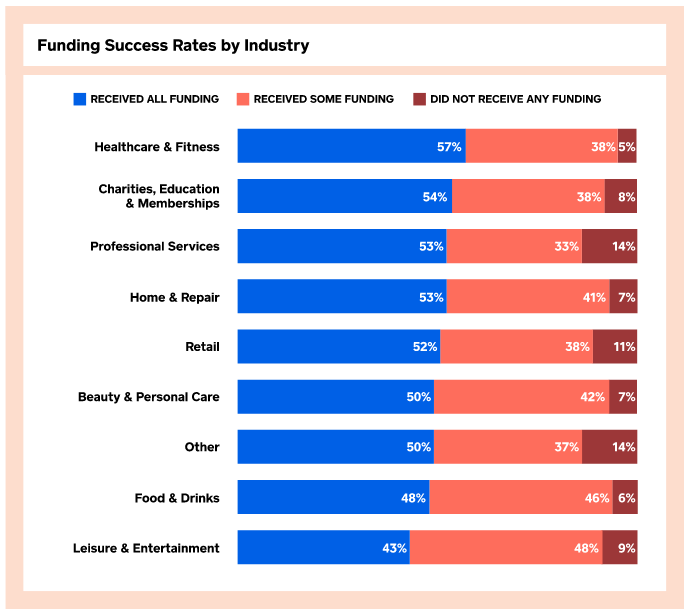

These findings were one of many in the report published by Square last week. Among other key details were that healthcare & fitness businesses were the most likely to receive all the funding they sought whereas leisure & entertainment businesses were the least likely to receive all the funding they sought.

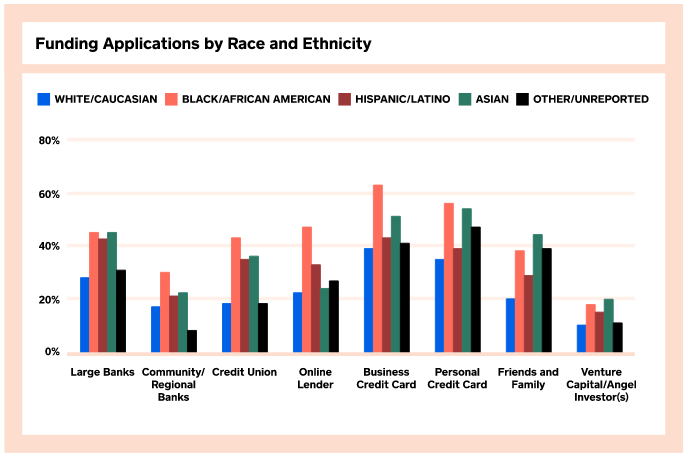

Black/African American business owners were more likely to apply for financing in the last 12 months than any other ethnic/racial group. A chart in the report shows that they were more than twice as likely to apply to an online lender or credit union than white business owners.

National Business Capital & Services Expands into Cannabis Funding with CannaBusiness Financing Solution

October 15, 2019 Today National Business Capital & Services (NBC&S) announced it has begun serving cannabis companies. Through its new program, CannaBusiness Financing Solution, NBC&S is now accepting applications for loans starting at a minimum of $10,000 from firms in the industry that are over one year old.

Today National Business Capital & Services (NBC&S) announced it has begun serving cannabis companies. Through its new program, CannaBusiness Financing Solution, NBC&S is now accepting applications for loans starting at a minimum of $10,000 from firms in the industry that are over one year old.

“The CannaBusiness Financial Solution will allow business owners to seamlessly obtain the capital they need, and allocate funding toward either hiring new employees, purchasing inventory, marketing strategies, or any other business need right away, without government regulations hindering growth opportunities or having to give up equity,” explained NBC&S President Joseph Camberato. “We’re not a bank and the lenders we work with aren’t banks either, so it falls into a different area of commercial lending.”

CannaBusiness is available in the 33 states where cannabis is legal, be it for medicinal or recreational uses, as well as in Canada.

“It’s a rapidly growing space, no pun intended,” joked Camberato when asked about the differences in funding cannabis companies compared to the industries NBC&S has served in its 12 years of business. “It would still be underwritten, just like one of our normal businesses. But we’re definitely going to want to know a little bit more about the business and understand what exactly they’re doing, how they’re operating, and exactly what are they’re focused on.” They’ll also examine if the business is in compliance with state laws. Qualifying cannabis companies must be in business for at least 1 year, with a minimum of $10K in monthly revenue. There is no minimum FICO score requirement.

While it’s not the first funder for cannabis companies, NBC&S views the move as a step in the right direction to “get ahead of the curve” according to Camberato. “We’re living through a modern-day prohibition, I think in 20 years we’ll look back on it and talk about it with our grandchildren and be like, ‘wow’ … I don’t think people realize how big of a deal this really is, but it is a business and it is another industry that has bloomed in front of us, again no pun intended. I think it’s fascinating that we get to witness this and that we’re really at the forefront of it and helping folks get the funds they need to grow.”

While it’s not the first funder for cannabis companies, NBC&S views the move as a step in the right direction to “get ahead of the curve” according to Camberato. “We’re living through a modern-day prohibition, I think in 20 years we’ll look back on it and talk about it with our grandchildren and be like, ‘wow’ … I don’t think people realize how big of a deal this really is, but it is a business and it is another industry that has bloomed in front of us, again no pun intended. I think it’s fascinating that we get to witness this and that we’re really at the forefront of it and helping folks get the funds they need to grow.”

Jumping off from the politically charged word of ‘prohibition,’ NBC&S’ Vice President of Marketing, T.J. Muro, noted that he believed cannabis legislation to be one of the few issues that can be bipartisan, saying, “Out of everything today in our political climate, I think it’s the one thing that has unified people in the political parties. The liberal side appreciates the cultural influence and significance there, and then on the more conservative side it’s the tax revenue.”

The upcoming Senate vote on the SAFE Banking Act will put this theory to the test. The bill, which would allow the cannabis industry wider access to banking, has already passed the House.

The Broker: Funding Businesses The Irish Way

October 10, 2019 I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

When he arrives, he doesn’t disappoint. Hogan is full of energy and enthusiasm. He has a natural charisma and friendly manner that’s well-suited for a relationship-based business. It just so happens that SME finance in Ireland is still heavily reliant on person-to-person contact and Hogan is at the forefront of helping potential borrowers look beyond the bank for their financing needs.

SMEs are looking for speed and ease in the loan process, Hogan says. Historically, business owners would call on their bank for financing, invoking the sanctity and reliability of decades-old personal relationships, but Hogan explains that relationships between SMEs and banks just aren’t what they used to be. “[SMEs] feel like they’re going to get the runaround,” he says.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

“Corporate” finance may evoke images of big city corporations engaged in international commerce but Hogan’s company can connect SMEs with as little as €5,000 through an unsecured business loan or merchant cash advance. Invoice Financing, leasing, and trade finance are also tools at his disposal. It’s not all small, however, as he hands me a rate sheet for one lender that will go up to €25M. Interest rates on these products when compared with their American and UK brethren are quite reasonable, and suggest also that the target clientele is not subprime.

As we sit there drinking coffee, Americano style in my honor, an executive for a local SME lender happens to spot him while passing by. After they exchange pleasantries, Hogan explains to me that he submits deals to that lender through their online broker portal. And so I ask him if doing everything online has become the standard in Ireland.

“It’s getting there,” he says, while acknowledging there’s still a ways to go with the population that’s conditioned to handling their financial dealings offline. The company’s domain name is perhaps perfectly positioned to capture that transitioning audience. When businesses decide to look for a loan online, he explains, “I hope they go to BusinessLoans.ie”

A Side-By-Side Look At Small Business Funding Securitization Pools

September 6, 2019Several small business funding companies have closed majored securitization deals since 2018 with Kroll Bond Rating Agency rating the transactions. For the most recent transaction with National Funding, Kroll compared each securitized pool side-by-side in a chart. An abbreviated version of it is below:

| NFAS 2019-1 (National Funding) | RFS 2018-1 (Rapid Finance) | CRDBL 2018-1 (Credibly) | SFS 2018-1 (Kapitus) | |

| Weighted Avg Original Expected Time (months) | 9.9 | 11.7 | 11.5 | 7.8 |

| Weighted Avg RTR Ratio | 1.36x | 1.27x | 1.32 | 1.35 |

| Weighted Avg Credit Score | 664 | 665 | 679 | 649 |

| Weight Avg Time in Biz (years) | 9.6 | 14.6 | 12.3 | 12.5 |

| Percentage of MCA | 0.0% | 14.1% | 45.8% | 60% |

| Percentage of Loan | 100% | 85.9% | 54.2% | 40% |

Give Up Equity In Your Business?! Try Alternative Funding Instead

April 4, 2019One thing you can’t get back is your company.

Michele Romanow, a judge on Dragon’s Den, Canada’s version of Shark Tank, realized from the show that a lot of companies should not be pursuing venture capital at all. She recalled a company that was willing to give an investor 25% of their company in exchange for $100,000.

“Why use the most expensive form of capital, which is equity?”

It led her to co-found Clearbanc, a Toronto-based small business funding provider that does their own spin on merchant cash advances. The amounts range from $10,000 to $10 million and their caution against equity capital-raising is explicit.

“No equity, no fundraising, no dilution, no warrants/no covenants, no board seats, and no bullshit” is a pitch prominently displayed on the company’s homepage.

Romanow speaks from experience. In 2014, GroupOn acquired a company she co-founded and she joined Dragon’s Den shortly after at just 29 years old. She’s a serial entrepreneur with a net worth reported to be over $100 million.

VC money may be harder to obtain, regardless, even if an entrepreneur is willing to make the sacrifice. Funding from VCs tends to be unequally distributed geographically. She cited a May 2018 report by PwC and CBInsights that showed that more than half of all VC dollars invested in small businesses and startups during the first quarter of 2018 went to companies in California. And 80% of VC money in that quarter funded companies either in California, New York, Massachusetts or Texas, a trend bucked by alternatives provided by companies like Clearbanc whose backgrounds are much more diverse.

The message has worked. Clearbanc recently announced that it plans to invest $1 billion in 2,000 e-commerce companies within the next 12 months and the company has raised more than $120 million to-date. It probably helps that Romanow is a TV business celebrity. She is now on her fifth season of Dragon’s Den. And as for those pesky VCs? They tend to be big referral partners for Clearbanc. Go figure.