MCA Skeptic Rohit Chopra Confirmed by Senate to Head CFPB

October 1, 2021 More than eight months after AltFinanceDaily announced that FTC Commissioner Rohit Chopra would be the next head of the Consumer Financial Protection Bureau, his appointment has finally been confirmed by the Senate.

More than eight months after AltFinanceDaily announced that FTC Commissioner Rohit Chopra would be the next head of the Consumer Financial Protection Bureau, his appointment has finally been confirmed by the Senate.

The confirmation of Chopra is notable given the agency’s objectives to collect data from small business finance companies and the fact that Chopra himself has been very vocal about merchant cash advances in particular.

One year ago, in his capacity as an FTC commissioner, he referred to the industry as “opaque” with “pay-day style” products whose structure “may be a sham.”

In an interview with NBC around the same time, he used stronger language, saying that he was “looking for a systemic solution that makes sure they can all be wiped out before they do more damage.”

Chopra knows his way around the CFPB. He worked for the agency when it first started in 2010 and was there for five years as the Assistant Director & Student Loan Ombudsman. He later moved to the FTC as a commissioner and now returns back at the CFPB in the director’s seat.

CFPB Publishes Long Awaited Proposed Rule on Small Business Loan Data Collection

September 1, 2021 A 918-page proposed rule published by the Consumer Financial Protection Bureau (if you don’t know what this bureau is, now is a good time to read up), is finally out.

A 918-page proposed rule published by the Consumer Financial Protection Bureau (if you don’t know what this bureau is, now is a good time to read up), is finally out.

Its application is broad, extending to “loans, lines of credit, credit cards, and merchant cash advances,” the CFPB said today. Initially, the Bureau’s intent was to exclude merchant cash advances, but that has apparently changed. (side note: I predicted this could happen as early as 2014.) Meanwhile, “factoring, leases, consumer-designated credit used for business purposes, and credit secured by certain investment properties” are exempt from the rule.

The rule is designed to assess whether there are disparities in sex, race, and ethnicity, when it comes to small businesses being able to access credit.

Covered financing providers would have to request that applicants disclose these things, which applicants can refuse to answer if they so choose. It could get a bit awkward from there because “if an applicant does not provide any ethnicity, race, or sex information for at least one principal owner, the Bureau is proposing that the financial institution must collect at least one principal owner’s race and ethnicity (but not sex) via visual observation and/or surname if the financial institution meets in person with any principal owners (including meeting via electronic media with an enabled video component).

BUT “minority-owned business status and women-owned business status would only be reported on the basis of information the applicant provides specifically for Section 1071 purposes, and financial institutions would not be permitted or required to report these data points based on visual observation, surname, or any other basis.”

Further, no one involved in the underwriting of the loan or advance would be allowed to know or access the ethnicity, race, or sex of the applicant. However, this would not apply if it isn’t “feasible” to do so.

All of the nuances, which seem to contradict themselves on the surface level, are specified in greater detail in the 918 page document.

When the proposed rule becomes final, lenders and MCA providers would have 18 months before they would be required by law to not only collect this data in the properly established manner, but also be prepared to submit it annually to the CFPB.

This rule will become a standard operating part of the business for companies both large and small whether one agrees with it or not. This law was passed in 2010 and it has taken this long to get to this point. This is a link to the CFPB’s official summary.

Snapchat Acquired Mobile Shopping App Founded By Former MCA Execs

July 2, 2021 A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

Recently, their app was acquired by Snapchat, according to various news outlets, and the tech has since been integrated into the Snapchat app.

Molly and Meir Hurwitz, both original stalwarts of the old Pearl Capital in New York, co-founded Screenshop in 2017, an app that integrated shopping with fashion and social media. Its initial launch received added buzz thanks to Kim Kardashian’s early involvement as an advisor. Notably, Screenshop CEO Mark Fishman was previously a Risk Manager at Pearl Capital, rounding out the former MCA crew.

“We’re No. 5 on the app store category of fashion,” Meir Hurwitz told AltFinanceDaily in November 2017. “We’re just getting started.”

The success continued.

“Screenshop gives shopping recommendations from hundreds of brands when you Scan a friend’s outfit,” Snapchat wrote in a published announcement this past May.

More than 170 million Snapchatters use scan features every month, the company revealed.

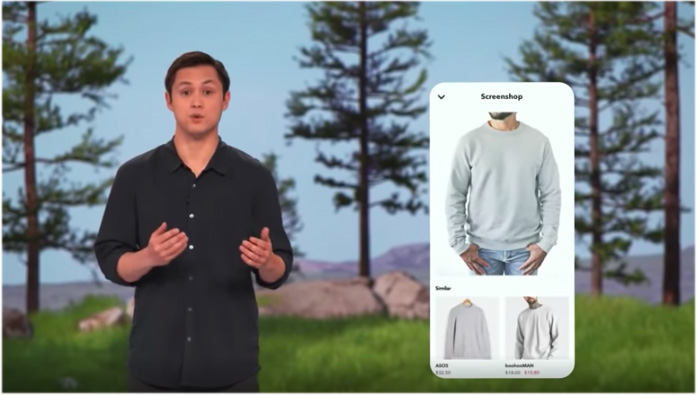

“Screenshop is now a part of ‘Scan’ said Snapchat CTO Bobby Murphy during the company’s annual Partner Summit broadcast on May 20. The above screenshot is of Murphy demonstrating the Screenshop technology.

CFPB’s Reach May Extend to PPP Lending

February 16, 2021 The CFPB’s Winter 2021 Supervisory Highlights Report that was published late last month, covered a section on small business lending. And it’s not related to the Bureau’s work on Section 1071.

The CFPB’s Winter 2021 Supervisory Highlights Report that was published late last month, covered a section on small business lending. And it’s not related to the Bureau’s work on Section 1071.

The foray into non-consumer finance was instead driven by PPP lending.

“Consistent with its authority to ensure compliance with the Equal Credit Opportunity Act (ECOA), the Bureau conducted [Prioritized Assessments] to assess potential fair lending risks attendant to the institutions’ participation in the [PPP] program,” the report said.

Accordingly, the CFPB determined that small business lenders that restricted or limited eligibility such as banks who only permitted applications from existing customers, for example, “may have a disproportionate negative impact on a prohibited basis and run a risk of violating the ECOA and Regulation B.”

The CFPB conceded that it had not actually investigated if violations occurred and noted that the majority of institutions had argued that such limitations were either in place to comply with Know Your Customer legal requirements, to prevent fraud, or both.

The CFPB did not say that it had supervisory authority over non-banks that participated in PPP, but it did signal that its purview was larger than just consumers when it came to the institutions it supervised.

The report can be viewed here.

The CFPB is expected to have more proactive involvement in small business finance under its new incoming director, Rohit Chopra. Chopra’s nomination was formally submitted on February 13th. Dave Uejio, the Bureau’s Chief Strategy Officer, has been serving as Acting Director since President Biden took office.

Official Who Wants to “Wipe Out” Merchant Cash Advance Will Be Next CFPB Head

January 18, 2021 Rohit Chopra, an FTC Commissioner, will take over as head of the Consumer Financial Protection Bureau under incoming President Joe Biden, sources say.

Rohit Chopra, an FTC Commissioner, will take over as head of the Consumer Financial Protection Bureau under incoming President Joe Biden, sources say.

Chopra’s name made the rounds in 2020 when he told NBC News that he was looking for a “systemic solution” that can “wipe out” all merchant cash advance companies.

His candid comments aligned with an official statement he put out in August in which he opined that the structure of MCAs “may be a sham since many of these products require fixed daily payments…”

He further added that there were “serious questions as to whether these merchant cash advance products are actually closed-end installment loans, subject to federal and state protections including anti-discrimination laws, such as the Equal Credit Opportunity Act, and usury caps.”

His transfer to the CFPB could be viewed as unwelcome news for the MCA industry as the agency is currently in the process of finalizing the types of financial institutions it believes it should maintain some jurisdiction over. Originally, MCA companies were poised to be excluded from the data reporting requirement set forth by Section 1071 of Dodd-Frank but that could very well soon change.

Lawyers Chime in On What a Biden Administration Could Mean for Merchant Cash Advance

November 30, 2020 In the weeks following the election, the news cycle has been heavily focused on the presidential transition’s legal aspects.

In the weeks following the election, the news cycle has been heavily focused on the presidential transition’s legal aspects.

Instead of worrying about vote recounts, merchant cash advance (MCA) companies are considering what legal changes, if any, might come after Jan 20th. Will the Biden administration spell the beginning of new regulations on the world of business to business financing?

Lawyers say that while the industry is waiting on Georgia to decide the Senate’s fate, increased regulation at the federal is unlikely to occur.

“If the Republicans hold in Georgia, and we have a split legislative branch, that means gridlock, and gridlock is great for the industry,” Catherine Brennan, partner at Hudson Cook, said. “The more progressive wing of the Democratic Party would like to put merchant cash advance under the auspices of quasi-consumer [loans,] but they won’t be able to do that with the split legislative branch.”

Brennan has a wealth of experience as a commercial finance compliance and litigation lawyer and regularly contributes to the national conversation on alternative and fintech law topics. She said that even if Democrats control the Senate, moderates may still hold back progressives from making new regulatory laws.

“There’s some moderate Democrats who understand the need for this market, they understand the product, and their constituents, in particular, use the product,” Brennan said. “I don’t see anything at the federal level that should be viewed as an existential threat to the ongoing existence of the industry.”

What Brennan does see as more likely, is the gradual adoption of MCA under preexisting executive agencies like the CFPB and FTC. She pointed to the Dodd-Frank Act implementing consumer lending data collection as a possible avenue regulators might take by pushing for data collection in the MCA space.

What Brennan does see as more likely, is the gradual adoption of MCA under preexisting executive agencies like the CFPB and FTC. She pointed to the Dodd-Frank Act implementing consumer lending data collection as a possible avenue regulators might take by pushing for data collection in the MCA space.

Still, Brennan insists that MCA firms will be OK so long as they understand the FTC can already look into commercial finance practices and that it has gone after ISOs in the past. She sees that as the number one development from a regulatory standpoint because the FTC will ultimately review what took place in the financial service markets during the pandemic and decide if action is warranted. Still, if funders have been responsible and fair, they should be in a good place.

Brennan did say that the position might be up for grabs when it comes to the head of the CFPB. The previous leader, Richard Cordray, fought with the Trump administration against his re-appointment, believing his position surpassed the president’s authority to fill. Of course, it did not, and Cordray was removed, but there is nothing stopping the Democrats from re-appointing him, Brennan said, especially when other appointees may give up valuable Congressional seats.

James Huber, a partner at Global Legal Law Firm specializing in collections, believes that even if the Senate is somehow blue and passes regulation, that MCAs that are playing by the rules would benefit. The MCA business was born under the Obama administration during the last financial crisis, and if Biden beefs up the CFPB, it would only hurt payday lenders, Huber said.

“It certainly flourished under Obama, so one might think now that it’s got its foothold and it’s here you can almost guarantee that it’s going to continue to do really, really well when there’s stricter regulation,” Huber said. “Your typical AltFinanceDaily cash advance technology company: I think they’re going to do well with their bread and butter product…”

Huber said that especially when we’re seeing businesses hurting for cash right now, b2b finance will thrive. Huber was worried about Biden’s talk about bankruptcy reform, however.

“Biden’s talked about bankruptcy reform, to make it easier for people to go through bankruptcy, and yield assets like their houses and their cars and things that,” Huber said. “That’s a concern; that would mean that you’re fraudulently applying for a loan, and that’ll be accepted. It slows down collection efforts; our main role in the MCA business is on [defaults].”

Katherine Fisher, a Hudson Cook partner who, alongside Brennan, has deep experience in MCA representation and compliance, agreed with her colleague that funders need to make sure they keep an eye open toward compliance when it comes to regulation.

“Firms that have not focused on the regulatory process need to start, and companies that have looked at it need to revisit it,” Fisher said. Funders should “expect to be comfortable if they are asked to describe how they comply and prepare to do so.”

But beyond that, she sees no doomsday event on the horizon; even if the Senate is no longer Republican-controlled, it would be up to the FTC and CFPB to set the tone. If the CFPB, for example, pushed for data collection under 1071 of the Dodd-Frank Act, it might signal a more attentive regulatory environment for MCA and factoring.

But beyond that, she sees no doomsday event on the horizon; even if the Senate is no longer Republican-controlled, it would be up to the FTC and CFPB to set the tone. If the CFPB, for example, pushed for data collection under 1071 of the Dodd-Frank Act, it might signal a more attentive regulatory environment for MCA and factoring.

Compared to 2008, when the last Democratic administration took office, MCA wasn’t on the radar, Fisher said. Now that it is on the map this time around, especially after MCA funders proved how vital they were to the SMB market during the pandemic, there will be more attention on B2B transactions.

But firms only need to think of this as a chance to make sure their practices are healthy, and most of the industry has already shown signs of doing so. Fisher pointed to the FTC’s small business finance forum last year, which included a panel of MCA representatives at the table.

“I don’t think it is a scary time. It’s an opportunity for MCA to improve their processes, make sure they are following the law,” Fisher said. “They don’t need to be afraid but need to batten down. Much of the industry has already done that, the MCA industry has been focused on adopting good practices.”

Greenbox Capital® Advocates For Fair Lending to Women- and Minority-owned Businesses in CFPB Panel

October 19, 2020Miami, FL: Greenbox Capital® announced it is serving as a Small Entity Representative (SER) to the Consumer Financial Protection Bureau (CFPB) that is responsible for amending the Equal Credit Opportunity Act (ECOA) protecting women-owned, minority-owned, and small businesses looking for financial assistance. Section 1071 of the Dodd-Frank Act amends the ECOA by requiring certain data be collected and submitted to the Bureau to protect these types of businesses.

“It’s an honor to be selected to the industry panel providing feedback on section 1071 of the Dodd-Frank Act ensuring fair lending laws to women- and minority-owned businesses”, said Greenbox Capital CEO Jordan Fein. “Over 2 million businesses across the U.S. are either women or minority owned and it’s vital they can secure funding as easily as non-minority owned businesses.”

Greenbox Capital, an alternative lender, serves small businesses in all industries across the United States, Puerto Rico, and Canada with the working capital needed to grow. Greenbox Capital is committed to supporting clear, secure, and fair financing solutions and is an active member of the Small Business Financial Association (SBFA).

For more information visit, www.greenboxcapital.com.

OnDeck Update 6/23

June 24, 2020On June 23rd, OnDeck filed the following statement with the SEC:

On June 23, 2020, we obtained a limited consent (“Consent”) for our corporate debt facility (“Corporate Facility”). Under the Consent, the lenders consented to delay the effectiveness of the increased monthly principal repayments until July 14, 2020 (or such later date as may be agreed by the Administrative Agent), which were triggered by an Asset Performance Payout Event (Level 2) (“APPE”) that occurred on June 17, 2020. In consideration for the Consent, the Company agreed to make a $5 million principal repayment (“Repayment”) substantially concurrent with the execution of the Consent. Under the Consent, the lenders also agreed that, at the Company’s option, the Repayment will either (i) reduce the amount of the monthly principal repayment due on July 17, 2020 by the amount of the Repayment or (ii) if the parties enter into an amendment on or prior to July 17, 2020, be credited towards any principal repayment required under that amendment. The Company entered into the Consent in contemplation of entering into a broader amendment to the Corporate Facility to address impacts stemming from the COVID-19 pandemic. If such an amendment is not entered into, the APPE triggers $21 million monthly principal repayments which, if not cured, would commence on July 17, 2020 and continue until the Corporate Facility is repaid in full. The Company made a payment of approximately $13 million on June 17, 2020 as a result of the previously disclosed Asset Performance Payout Event (Level 1), bringing the total balance outstanding as of that date to approximately $92 million. The Revolving Commitment Termination Date occurred as a result of such Level 1 event. Certain capitalized terms not defined in this section of the report are used with the meanings ascribed to them in the Corporate Facility as amended by prior amendments thereto and the Consent.

Shares of OnDeck closed at 86 cents yesterday. The company was previously warned that long-term pricing below $1/share would result in delisting from the New York Stock Exchange.