This Just In: Crypto Transactions Aren’t Tax Free

January 20, 2022 Patrick White, CEO, Bitwave

Patrick White, CEO, Bitwave“I don’t always believe people that say they are surprised about having to pay taxes on crypto. There’s a field on your tax form to say where you’ve made money doing illegal things. If you sell drugs, there’s a place to report how much money you’ve spent selling drugs. The IRS doesn’t care. Everything is taxed in this country.”

There is no such thing as too many crypto transactions when it comes to accounting purposes according to Patrick White, CEO of Bitwave. Bitwave operates the software that does the accounting for major blockchain companies and retailers who have taken crypto as payment.

White says that the high volume of crypto transactions aren’t coming from individuals sending digital assets back and forth, but rather from the companies that host the infrastructure of these transactions.

“It’s not just trading, trading is fun and we all love the rat race that is trading, but where it’s a lot more interesting is how some of our customers who are in the NFT space are seeing millions of revenue transactions a month.”

These sites like OpenSea, a client of Bitwave, are seeing sky high amounts of these types of transactions. When asked about the cost of accounting for an individual doing ten-thousand trades a month, White laughed.

“Ten-thousand trades a month is nothing,” he said.

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

When asked about how digital assets have impacted the accounting world, White stressed that the amount of transactions have resulted in companies appearing larger than they are from a transactional-perspective. According to him, some of his clients are doing as many transactions as some of the largest companies in the world.

“[One client] is a one-year old company that is doing the volume of a sixty year-old retail business, it’s unheard of.”

When asked further about the difference of cost in accounting digital assets versus dollars, White explained that it isn’t much different than how larger companies have maintained their books for some time.

“No matter what, if you are a high frequency trader and you’re making hundreds of millions of trades a year, you will need software to deal with that,” said White. “I wouldn’t say that [the amount of transactions] are increasing costs across the board, it is a cost that you would already be expected to [have].”

When asked about the apparent vacuum of crypto-native accountants, White seemed to cast blame on the approach of the information. When hiring, he says he finds more value in people with engineering experience over accounting experience, and blockchain experience over anything else.

“[Other accountants] are trying to apply finance 1.0 things to this crypto world,” said White. “We look for good engineers. A good engineer can figure anything out, a bad engineer with accounting experience can’t. We’re looking for blockchain experience, as blockchain [technology] is more difficult than accounting in many ways.”

While most businesses will file extensions this time around and finish their taxes in October, White believes that blockchain accounting will become more widespread as new firms leverage the infancy of the space and settle into their niches.

“Cottage industries will come up in order to enable the IRS,” said White. “I don’t expect the IRS to build this technology or this understanding in-house. There will be people and businesses that will do it for them.”

With the IRS’ decisions about taxing crypto having the potential to change at any notice, White stressed the necessity for malleability when developing this kind of accounting technology in such an unpredictable space.

“We’ve designed Bitwave from the very beginning to be able to rapidly adjust to the new laws that are coming out,” he said. “Even back then, it was very obvious that we couldn’t build this tech in such a way that it is inflexible.”

Five Things Small Business Financing Should Look out for in 2022

January 3, 2022 With another year in the books, below is a list of things that the small business finance community should think about in 2022.

With another year in the books, below is a list of things that the small business finance community should think about in 2022.

Disclosure Laws are Coming

The laws in New York are changing. While the date for the new law was pushed back at least until June, the state is about to make it very difficult to finance small businesses. California, New Jersey, Maryland, Connecticut, and North Carolina are among other states to also keep an eye on regarding disclosures in 2022.

Blockchains, Blockchains, Blockchains

Regardless of the legitimacy of things like cryptocurrencies and NFTs, blockchain technology is on its way to the initial states of implementation in the financial world. In a further effort to eliminate paperwork, redundancy, and time, the idea of a decentralized ledger has all corners of the financial world watching closely.

Merchants are Becoming Digitally Native

As business owners are continuing to emerge as younger and more technologically sound, lenders should embrace fintech in any area of their processes that they can. Just to appear as a tech company may become a marketing strategy for some brokers or lenders, as those who offer the smoothest, simplest, and most technological form of funding will win over their competition with this new emerging business owner.

Brokers Using Motivational Social Media Posts to Develop Brands

As small business financiers continue to try and find their place on social media, there seems to be a gathering of those in the broker space to create motivational content. Keep a lookout for more brokers to continue internet marketing via motivational posts to not only give a face to their company, but legitimize themselves as a go-to in the space; so maybe they can launch some type of broker training program in the future.

Networking Will Continue to Re-Emerge as Top Tool

As 2021 concluded with in-person events slowly approaching normalcy after pandemic induced restrictions, the industry is showing an unprecedented amount of desire to get together multiple times a year to build their books of business. Look for events across finance, technology, and cryptocurrency spaces to increase in both numbers and attendees.

Q&A with Rachel Sanders on how Small Businesses Can Utilize Blockchain Tech

December 3, 2021 At the NFT BZL conference in Miami on Tuesday, AltFinanceDaily bumped into Rootine, a vitamin company that is looking to expand into the crypto space. Rootine is a small business that exists fully in the tangible world and sells a tangible product. They offer a completely customized vitamin concoction to their customers via questionnaires that identify biomarkers on their online platform.

At the NFT BZL conference in Miami on Tuesday, AltFinanceDaily bumped into Rootine, a vitamin company that is looking to expand into the crypto space. Rootine is a small business that exists fully in the tangible world and sells a tangible product. They offer a completely customized vitamin concoction to their customers via questionnaires that identify biomarkers on their online platform.

This all begs the question, how do small businesses like Rootine leverage crypto? Rachel Sanders, CEO and co-founder of Rootine, shared her thoughts.

Q (Adam Zaki)- Your product is obviously inspired by tech and customer experience. Why are these fundamentals of Rootine?

A (Rachel Sanders)- We are in the middle of a health data revolution. More consumers than ever before have access to critical data about their health and this access will only grow. People should be able to leverage their data to optimize their health with precision health products and actionable insights tailored to their unique data and goals. Technology is the key to make this possible.

At Rootine, our mission is to empower members to leverage their data to achieve optimal health and fuel their potential. Rootine analyzes your body to deliver a precision daily multivitamin engineered to optimize your health, and then fine-tunes your formula over time to continuously provide optimal support for your body. Our team has worked hard to build with a human-first mentality, creating a brand that both delights our members and makes a real, and positive impact on their health. We are proud to empower thousands of members to improve their health and are excited to make an even bigger impact in 2022!”

Q-What was Rootine doing at an NFT conference?

A- As the world of web3 and NFTs ballooned in the second half of 2021, we saw a community emerging celebrating vices and fueled by alcohol. There was also this odd dichotomy occurring where health influencers were changing their profile pictures to NFTs depicting un-healthy vices. We believed that heath should be a central part of the conversation in web3, so we dove in.

Rather than build a branded NFT project, we spearheaded a collaborative effort to launch Apex Optimizers, the first NFT project exclusively focused on health and human performance optimization. Community members represent brands like Eight Sleep, Rootine, Hydrant, Span Health, Bioloop, Aloha, Gwella, OneSkin, and Bristle. Early team members from Levels and founders at Bristle, health experts like Louisa Nicole and Dr. Sohaib Imitaz, professional athletes like Justin Gatlin, as well as a number of high performers and crypto and NFT heavy hitters like Steve Aoki.

It has been difficult working in unchartered territory (as a project like this has never been done before), but we were driven by a mission to build an inclusive community highlighting the importance of data-driven health and to deliver tangible real life utility to holders. We have been fortunate to collaborate with some of the top health experts, brands, athletes, and founders in human performance while building a community that is already inspiring its members to improve in areas like sleep, stress, nutrition, fitness, mental health and more.

Q-How will NFTs enhance your product? Why do you think your customers would be more willing to buy products that have some type of blockchain component?

A– As we think about the future of the metaverse, consumer products and brands will play a large role. Exactly what that role looks like is yet to be determined. What we do know is that health will continue to matter and that consumer health brands will need to have a strategy around how they will tie their physical products and experiences into the digital world. As for Rootine, creating a trusted brand and impactful community is always top of mind. To do that, we want to be where our members are and offer unique opportunities that members will not find elsewhere.

One example of that is helping to launch Apex Optimizers. Apex Optimizers is just one of the offerings of the Precision Health Club and it is first and foremost an awesome community of like-minded data-driven health enthusiasts looking to improve how they look, feel, and perform everyday. Gaining access to that community is something Rootine can offer that others cannot, and that is valuable. Through Apex Optimizers we are also able to offer loyal Rootine members access to exclusive perks like 1:1 lessons with pro-athletes, multi-brand discounts and product drops, and real-life wellness experiences.

Q-What are you thoughts on access to capital for small businesses? Has Rootine ever found it difficult to get a loan? Do you think crypto could help the imbalance of access to funds for small businesses?

A- Access to VC capital is a challenge for many. In the VC world, only 2.2% of funding goes to female founded companies, and other minorities and underrepresented founders have similar difficulty. For others, the capital markets have been very founder-friendly recently, with companies raising VC funding at unprecedented valuations.

In the non-VC world, there are a number of new options coming to market that make it easier to get non-dilutive funding. Pipe and Clearco are two great examples. However, to get access to that funding, you have to meet specific size and business model criteria.

Crypto certainly has the ability to put more fundraising power into the hands of creators and builders. There will be more companies using crypto as a way to raise seed capital, and we are already seeing this trend. One thing to note here, is that as the barrier to enter web3 drops, there is going to be more competition for dollars, which will raise the bar on the projects and teams that will succeed in getting funding this way.

Q-Is crypto a topic of conversation in the office? I’m trying to gauge whether your staff has an interest in crypto or if this is just a pure marketing strategy.

A- We have a combination of people very into crypto (e.g. our lead product designer who was an early advocate and continues to be a key thought leader on the team) as well as crypto novices.

It has been exciting to see how the conversations on slack have created an environment of learning and support, helping more people get into the space in a way they are comfortable with. Apex Optimizers’ mission is to make an impact at scale through community, democratizing access to innovation, and by elevating the message around the importance of data-driven health.

For the brands involved, there is of course a marketing component, but at the core, we all came together to help more people live healthier lives because all brands involved support better health.

Q- The crypto space wants to move into the Metaverse. How will Rootine, a company that sells a physical product- vitamins nonetheless- pivot if the crypto community lives in a world where a desire to be healthy may decrease? (If I live in the digital world, with digital art, digital money, digital games, a remote job, and digital friends, why would I want to buy vitamins?)

A- Even if the majority of your life is spent in the digital world, you will still want to feel and perform your best on a daily basis. If people start to neglect health, their productivity decreases, their ability to be their best self at-home with their families and partners decreases, and their stress levels, fatigue and risk for chronic conditions increases. Rootine offers a convenient, at-home way to test your body and get precision multivitamins that can support better overall health, stress levels, energy, focus and more, fueling your potential.

Another interesting thing to note, is if you look at the people building the meta world, a vast majority are the same people who love to compete in athletic feats, biohack their bodies to optimize their productivity, or focus on specific diets. Because of this, health will always be a part of digital communities.

Q- What is the strategy here? Why mint an NFT? Is it to expose the brand? Attract investors? Corner a niche market? Who thought of this, and what’s the end goal?

A-Apex Optimizers’ mission is to make an impact at scale through community, democratizing access to innovation, and by elevating the message around the importance of data-driven health. IJ on the Rootine team originally came up with an idea to explore NFTs and the project has been a collaboration ever since. All people involved have helped shape the design, launch, community and the 30+ perks (and growing) that holders will gain access too.

Q- What is the best way for a small business, regardless of industry, to educate themselves and leverage the crypto market?

A- Get started. If you don’t own an NFT, buy one. Follow web3 twitter and join some discord servers. Research what other brands in your space or adjacent spaces are doing. If specifically looking at NFTs, find whitespace where you can build a unique project that is both collaborative and on-brand

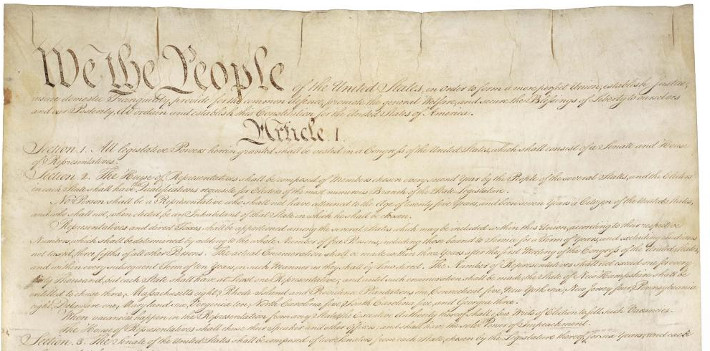

Crypto Fans Want to Buy The Constitution of the United States and They Might Actually Succeed

November 15, 2021

It’s the ultimate NFT, the Constitution of the United States. On November 18th, Sotheby’s will auction off one of the only thirteen surviving copies of the United States Constitution, an opportunity the public hasn’t had since 1988.

But a private collector hoping to pocket the national treasure will have some competition, the crypto mob on twitter. On November 11th, at least two individuals launched @ConstitutionDAO, a twitter account dedicated to crowdfunding crypto with the intent of raising enough money to be the winning bid.

The buyer would technically be a DAO, a Decentralized Autonomous Organization, a community-led entity with no central authority that is governed by a smart contract.

It’s predicted that if the DAO can raise significant cash before the auction that Sotheby’s will allow it to place legitimate bids. Sotheby’s put the estimated winning bid price at $15 million – $20 million.

It might not be out of reach, the DAO raised nearly $2 million in just the few hours since it began crowdfunding the money through a platform called juicebox.

If the DAO wins, theoretically “ownership” of the constitution would be fractionalized into shares based upon each member’s contribution. With a DAO, no one need even disclose who they are. Only a crypto address is required.

We have coordinated a DAO to acquire The Constitution of the United States.

I give you: @ConstitutionDAO

Ping me if interested in being a part of a monumental moment. https://t.co/VHkCTrq4fa

— Austin Cain (📜,📜) (@j_austincain) November 12, 2021

Members contributing to the pool of funds have the option of including a public message.

“To secure the blessings of liberty”

“Another first generation immigrant hoping to be the proud owner of the US constitution.”

“American Dream!!!”

“cant wait to explain this at Thanksgiving”

“in satoshi we trust”

The official website of the ConstitutionDAO is here.

For the sake of following the success or failure of this project accurately, AltFinanceDaily contributed a very small amount to the DAO so that it could participate in the possible ownership and community of the Constitution. Weird, I know.

Blockchain Expert says Crypto Tools will Revolutionize Lending

November 11, 2021 Blockchain technology can seem complex, but many individuals operating companies that utilize the technology are planning for their world to collide with mainstream finance very soon. Mark Shekleton, CEO of Smart Seal, a company that provides digital identifications for physical goods, believes that those in fintech and small business lending will utilize the technology that blockchains offer on a daily basis in the near future. The technology that will be most useful according to Shekleton, is a type of token he refers to as an (non-transferable token) NTT.

Blockchain technology can seem complex, but many individuals operating companies that utilize the technology are planning for their world to collide with mainstream finance very soon. Mark Shekleton, CEO of Smart Seal, a company that provides digital identifications for physical goods, believes that those in fintech and small business lending will utilize the technology that blockchains offer on a daily basis in the near future. The technology that will be most useful according to Shekleton, is a type of token he refers to as an (non-transferable token) NTT.

“When I’m talking about NTTs, I’m talking about a token that is like an NFT, but it can’t be transferred. It’s issued against a wallet and it can be revoked from that wallet by the issuer,” said Shekleton.

“By issuing NTTs, you allow [merchants] operating in the crypto space to gain reputation and credit for the activity they do under that wallet. So if I am operating a business, and I’m using a crypto wallet to operate, and I borrow some money, and I pay it back, the lender can issue me a positive credit report; a positive token. A token that symbolizes a positive [payment history].”

This token, issued as a one-way NFT, would be a permanent record on an objective platform that could be referenced by anyone who is looking to view the credit history of a specific merchant.

“If I go to another lender [as a merchant], they can look at all of these NTTs that are issued against my wallet and they can say ‘hey look, we saw this other lender issue one of these tokens’, [thus] you paid back your loan, and have this positive piece of reputation associated with your wallet.”

“As you go, the level of trust around a certain wallet increases. If you operate your business, and you can demonstrate that you are trustworthy, and you have people who are issuing these tokens in your wallet, you can prove to anyone else that you are a trustworthy business.”

Shekleton expanded his ideas of potential uses for blockchain technology into identity verification as well. He explained how the same process used for credit history for merchants can be used for individuals or businesses when trying to prove who they are virtually.

“Companies or banks that have services where they’re verifying the identifying of online customers, there’s a really good opportunity here for (Know Your Customer) KYC companies to issue identity tokens,” said Shekleton.

“Say I have a wallet. And right now I created a new wallet, it’s completely anonymous, I’ve never associated my identity with it. But I want to use that wallet to borrow money. I want to make sure there’s no money laundering, the lender needs to know my identity. I go to a KYC issuer, I upload my ID, meet all my requirements to verify my ID, and I sign with the wallet to prove that I’m the holder of this wallet. Then, they issue an identity token, and I can’t transfer that token to anyone else’s wallet, it can only stay in my wallet.”

According to Shekleton, an NTT’s ability to be revoked by the issuer makes it a great way to counteract fraud or identity theft, as the authenticity of the token can be revoked at any time, making the token visibly unusable to all who attempt to use it fraudulently. When asked why this idea hasn’t caught on, and why he referred to NTTs as “not talked about, and complex” at NFT.NYC last week, he blamed the infancy of NFTs and how NTTs are just too new to be widespread.

“The technology itself is just in its infancy. I think there’s a huge opportunity here, virtually untapped, but it’s still very young so it’s going to be a couple of years before anyone realizes the gains of this tech if you start building it now. I think when you start talking about NFTs as utilities to fintech and lending companies, I just don’t think they are awake to that yet. They haven’t started building.”

Slava Rubin, Founder of Indiegogo, to Keynote Broker Fair 2021

October 22, 2021 Broker Fair announced that Slava Rubin will be its keynote speaker for its 2021 conference on December 6th in New York City.

Broker Fair announced that Slava Rubin will be its keynote speaker for its 2021 conference on December 6th in New York City.

REGISTER HERE FOR BROKER FAIR 2021

Who is Slava Rubin?

Slava Rubin is an entrepreneur and innovator in the fintech space for nearly 20 years. Slava built an alternative investment platform, a venture fund, an equity crowdfunding platform, a perks crowdfunding platform, and an angel investment portfolio. Slava is a founder of Vincent, a company which has developed the largest database of alternative investments (crypto to NFTs, trading cards to art, real estate to venture and debt) and is changing how people access them. He is also founder & managing partner at humbition, a $30M early-stage operators venture fund built by founders, for founders. Slava also founded Indiegogo, a company dedicated to empowering people from all over the world to make their ideas a reality. As CEO for over 10 years from inception in 2006, Slava grew Indiegogo from an idea to over 500,000 campaigns and more than $1B distributed around the world. While at Indiegogo, Slava launched one of the nation’s first equity crowdfunding businesses. Slava’s angel portfolio includes 4 unicorns – Carta, Hedera, GOAT, & Turo. He is also a founding advisor to multiple companies including Hedera Hashgraph – a top 60 blockchain protocol.

Prior to Indiegogo, Slava was a strategy consultant working on behalf of clients such as MasterCard, Goldman Sachs and FedEx. He is also the founder of “Music Against Myeloma,” a charity that raises funds and awareness for cancer research in partnership with the International Myeloma Foundation. Slava is currently a member of the board for NYSE traded (WSO) Watsco Inc., and privately held, Indiegogo.

Slava represented the crowdfunding industry at the White House during the signing of the JOBS Act under the Obama administration and has helped navigate bringing equity crowdfunding to the American public. He also pioneered security tokens in the United States – having been a catalyst for selling fractionalized ownership of the St. Regis hotel in Aspen using blockchain technology. He has made many TV appearances including being a regular guest commentator on CNBC. He has also been often quoted in NYTimes and Wall Street Journal.

Slava has received numerous awards including Fortune 40 under 40, Observer 20 Heros under 40, and the Wharton Young Leadership award for 2015.

Slava holds a B.S.E. from the Wharton School of Business

The Sports World Is Going Nuts for Crypto

September 9, 2021 Miami Mayor Francis Suarez wants NFL Quarterback Tom Brady to know that he’s totally in to crypto.

Miami Mayor Francis Suarez wants NFL Quarterback Tom Brady to know that he’s totally in to crypto.

Strange times as it may be, and stranger yet with a new TV commercial that has Brady communicating agreeably with New York Jets super fan Fireman Ed, the cool place to be is “in crypto.” That’s the substance of a commercial for FTX, an international cryptocurrency exchange with a US operation known as FTX US.

Hey @GiseleOfficial @StephenCurry30 @Trevorlawrencee @mlb @kevinolearytv @LCSOfficial @MiamiHEAT @riotgames @TSM @stoolpresidente, you in? @ftx_official #FTXyouin pic.twitter.com/tGsQzgFJvs

— Tom Brady (@TomBrady) September 8, 2021

FTX already has the naming rights to Miami’s major sporting arena that is home base for the NBA’s Miami Heat. That arrangement excited the likes of Mayor Suarez, who has jumped on the crypto bandwagon so heavily that he actually launched his own crypto conference back in June.

On the other side of the country, Golden State Warrior powerhouse Steph Curry, announced he had signed on as an FTX partner/spokesperson.

“I’m excited to partner with a company that demystifies the crypto space and eliminates the intimidation factor for first-time users,” Curry said in a release.

Curry was one of several celebrities (including Brady’s supermodel wife Gisele Bundchen who also stars in it) that Tom Brady tagged in a tweet promoting his commercial.

“Whatever you do… don’t laser eyes!” Brady separately tweeted to Curry, a joke at the fact that crypto’s twitterverse has adopted “laser eye” profile pics to signal to others that “they’re in.” Brady is no different. Though his account profile description is short and to the point, “Family and Football,” his red laser-eyed pic is a signal that FTX and crypto are not just another random endorsement deal.

Brady is also a co-founder & co-chairman of the Board at Autograph, for example, a blockchain-based NFT autograph site that is currently selling digitally signed Derek Jeter autographs at high prices.

“NFTs bring an entirely new dimension to the collector experience, and I cannot wait for people to discover and engage with this first ever drop of Autograph’s official digital collectibles,” Brady said in a public statement about the company. “We created Autograph as a way for fans and collectors to own a piece of iconic moments in sports and entertainment through authenticated and official digital collectibles and we are just getting started!”