< 5% Annual Returns On Small Business Loans?

April 25, 2019 If you were to invest in small business loans with 4-year terms, what kind of return would you hope to get?

If you were to invest in small business loans with 4-year terms, what kind of return would you hope to get?

Retail investors that put their money in a mix of high-risk and low-risk loans on Funding Circle’s UK platform should expect to achieve a return of 4.5% to 6.5% a year (after defaults and 1% servicing fee), the company recently announced. That’s down from their previous projections. Meanwhile, their conservative loans could achieve returns of 4.3% to 4.7% a year.

A Marcus By Goldman Sachs savings account in the UK by comparison earns 1.50%

Funding Circle explained in a blog post that the returns could actually be higher or lower than projected.

To-date, investor interest has continued to grow with peers on the platform investing £1.5 billion in 2018 and £419 million in the 1st quarter of 2019.

Lending Club Calls It Quits On Underwriting Small Business Loans

April 23, 2019

Lending Club will no longer be underwriting small business loans, according to Lending Club Head of Communication VP Anuj Nayar. The company will still accept applications for them, but will direct them instead to Opportunity Fund and Funding Circle in exchange for referral fees. Less established businesses, or those with lesser credit, will be sent to Opportunity Fund, while more established businesses with better credit will go to Funding Circle.

According to Nayar, there will be no layoffs. Some employees who had worked in small business underwriting will move elsewhere within Lending Club while others will become contractors for Opportunity Fund. Opportunity Fund is a non-profit with the mission of investing in small businesses that have been shut out of the financial mainstream. It is backed by major financial institutions including Bank of America, Goldman Sachs and the JP Morgan Chase and Knight Foundations. In fiscal year 2017, Opportunity Fund made over $92.5 million in loans to more than 2,900 small business owners.

“[These two partnerships] enables us to both deliver greater value to our applicants and capture a new revenue stream for Lending Club, while further simplifying our business and setting the stage for more partnerships and innovations for Club Members,” said Lending Club CEO Scott Sanborn.

The new revenue stream Sanborn refers to is the referral fees Lending Club will get from its new funding partners when they fund loans sent to them from Lending Club. And Lending Club’s business will be streamlined as it jettisons small business lending backend operations. They will now focus exclusively on consumer loans, which has been the company’s primary business since it was founded in 2006.

Lending Club expanded into small business lending several years ago, but this component of its business never really took off, and was declining over the last few years. At the end of December 2016, Lending Club’s non-consumer loan originations (including small business loans) accounted for 10% of its business. In December 2017, it was 9%. And in the fourth quarter of 2018, it was 7%.

Nayar said that these new partnerships will allow Lending Club to focus even more on consumer lending. Headquartered in San Francisco, Lending Club has lent more than $44 billion to 2.5 million customers.

Funding Circle SME Income Fund to Consider Winding Down

April 6, 2019The Funding Circle SME Income Fund (FCIF), a fund whose objective is to provide shareholders with a sustainable and attractive level of dividend income by lending, both directly and indirectly, to small businesses through Funding Circle’s platform, may soon be winding down. Earlier this week, the fund’s major shareholders expressed a desire to withdraw their capital and a vote will be scheduled to put this plan in motion.

The decision is not a surprise. The fund suffered a sharp decline in Net Asset Value late last year in part due to increasing business loan defaults.

Funding Circle Holdings (FCH), which trades on the London Stock Exchange, announced that a windup of FCIF would not affect the overall company’s 2019 guidance.

FCH CEO Samir Desai said of the news, “A global income fund providing access to a diversified portfolio of Funding Circle small business loans was the right strategy for investors and Funding Circle in 2015. However, there are now more appropriate and varied ways for investors to participate on the platform. We’re pleased to soon introduce two new investor products to the UK market. They will further expand the universe of investors that can access loans on our platform and continue to diversify our sources of funding, in line with the strategy we set out at IPO.”

Kapitus Rolls Out Fully Automated Funding Process

April 2, 2019 New York, NY – Kapitus, a leading provider of alternative financing to small and midsize businesses, announces the roll-out of auto-checkout – a fully automated funding process for qualified deals. The new process allows for not only a faster, more streamlined experience for its partners; but it also provides more flexible financing options, by providing multiple offers at once. At the same time, the new process provides merchants with secure and quick access to funds for their business.

New York, NY – Kapitus, a leading provider of alternative financing to small and midsize businesses, announces the roll-out of auto-checkout – a fully automated funding process for qualified deals. The new process allows for not only a faster, more streamlined experience for its partners; but it also provides more flexible financing options, by providing multiple offers at once. At the same time, the new process provides merchants with secure and quick access to funds for their business.

Unlike competing models where only an “option of approval” or “conditional approval” is provided at the time of checkout, Kapitus is able to determine approval eligibility with only an application and bank statements without the need for multiple upfront stipulations to confirm bank information, ownership and identity. Utilizing proprietary machine learning models – eligible deals can be closed without any additional documentation.

“This is a true turning-point for us from a technology perspective and we’re very excited about it,” said Andrew Reiser, Chief Executive Officer at Kapitus. “With this new automated process, we’re able to provide our partners an extremely simple process with an exceptionally quick time-to-funding. At the same time, merchants are provided with a more seamless experience with enhanced security”

Major features in the roll-out include:

- True auto-check functionality with full approval at time of checkout

- Progress tracking and customizable notifications to follow merchants through the checkout process

- Intuitive user interface with precise, easy-to-understand instructions for both merchants and partners

- Simple, seamless secure checkout functionality for merchants

“This is the first of many technology advancements we will be rolling out over the next year,” adds Arun Narayan, Chief Product Officer. “We are committed to creating exceptional experiences for both our partners and merchants. Incorporating the right technology is paramount in building out the right environment and the best experience for all of our audiences.”

ABOUT Kapitus

Founded in 2006 and headquartered in NYC, Kapitus is one of the most reliable and respected names in small business financing. As both a direct lender and a marketplace built with a trusted network of lending partners, Kapitus is able to provide small businesses the financing they need, when and how it is needed. With one application business owners can save time and money, while eliminating the stress that comes with applying to different lenders. At Kapitus, we believe that business owners should be able to focus on running their business, while we take care of the financing. Learn more at https://kapitus.com

CONTACT: Bernadette Abel

Kapitus

babel@kapitus.com

646-722-1484

New Jersey Bill Seeks to Eliminate Quick Easy Access to Small Business Loans

March 21, 2019 The speed at which a small business owner can access capital to grow and create jobs in New Jersey is too dangerous and must be stopped. This is the takeaway from a bill (S3617) proposed by New Jersey State Senator Nellie Pou that calls for a minimum 3-day waiting period between when contract terms are disclosed to an applicant and when they can actually go through with getting a business loan or merchant cash advance. If the transaction does not fund within 10 days of the terms being disclosed, it implies that the waiting process must start over if the applicant wishes to still go forward.

The speed at which a small business owner can access capital to grow and create jobs in New Jersey is too dangerous and must be stopped. This is the takeaway from a bill (S3617) proposed by New Jersey State Senator Nellie Pou that calls for a minimum 3-day waiting period between when contract terms are disclosed to an applicant and when they can actually go through with getting a business loan or merchant cash advance. If the transaction does not fund within 10 days of the terms being disclosed, it implies that the waiting process must start over if the applicant wishes to still go forward.

The motivation behind the bill is to presumably force small business owners to think about the terms for awhile. It would apply where the payment frequency is greater than bi-weekly or the maturity is less than two years. There’s other little caveats too. If it passed, funding small businesses same-day or next-day would effectively become illegal.

In addition, the bill calls for detailed contract disclosures, proof that the funds will be used to economically benefit the small business applicant, lenders to set up their own complaint departments, licensing, bonding requirements for brokers & lenders, a minimum net worth for a broker of $100,000, background checks, written examinations, and ethics classes as part of continuing required education.

Pou’s bill, which at this point has not had the opportunity to get traction yet, is separate from another bill, S2262, which in addition to disclosures, calls for merchant cash advances to be defined as loans in the state. S2262 passed the Senate in February and is now under consideration in the Assembly.

WeWork, The Home Office of Small Business Finance Startups

March 20, 2019 Kunal Bhasin, owner of brokerage 1 West Finance, funded three A paper deals for companies that all happened to work out of the same Manhattan office building on the corner of 42nd Street and Third Avenue. It’s actually not as big a coincidence as it sounds because it’s the same building where 1 West Finance operated out of, along with likely hundreds of others at a midtown WeWork, the giant co-working company that has 59 offices in New York City alone.

Kunal Bhasin, owner of brokerage 1 West Finance, funded three A paper deals for companies that all happened to work out of the same Manhattan office building on the corner of 42nd Street and Third Avenue. It’s actually not as big a coincidence as it sounds because it’s the same building where 1 West Finance operated out of, along with likely hundreds of others at a midtown WeWork, the giant co-working company that has 59 offices in New York City alone.

What is remarkable is that the co-working concept (where companies work alongside each other for the benefit of all) actually works. At least it did for Bhasin. Because Bhasin’s company was expanding and needed to find space very quickly, he was unable to find a larger office at that same WeWork office. And because location was critical, he relocated to a Regus right nearby. Regus, which preceded WeWork, also rents space to companies, but focuses less on encouraging resident companies to get to know each other.

“I already miss it a lot,” Bhasin said of his old office at WeWork.

Bhasin said he met his former WeWork colleagues, who became clients, at the communal coffee stations and lunch events organized by WeWork.

Peter Graves, founder of Two Trees Funding, a one-man ISO shop, runs his business out of the WeWork office at 110 Wall Street. He said that he has gotten referrals from colleagues at other companies in his WeWork office. And he really appreciates the ability to to expand without having to change your lease.

The office culture is one of the main reasons why another company in the small business finance space loves WeWork. “Here, we engage with other people [and] we get a fresh perspective from other people, whether it’s a graphic designer or someone who works in cryptocurrencies,” a representative who asked to remain anonymous said. They also appreciate the flexibility, acknowledging that when they started with only four people, they rented month to month. Now, they have 12 people and a lease agreement for two years.

“We could have gotten a commercial space for 5 years,” they said. “But maybe we’d need a bigger space. This allows for flexibility.”

How to Turn Your Client List Into a Business Referral Network

March 19, 2019

Excel Capital CEO Chad Otar was so impressed by a marketing company he helped obtain funding for that he turned around and emailed his other clients about the potential benefits of their service. As a result Otar said that about five of his clients actually started working with the marketing company, including Lori Miller, the owner of LGC Interior Design in Melville, Long Island. Excel Capital, in effect, started creating its own business referral network.

“[The marketing company] helped me fix my website and get me out there,” Miller told AltFinanceDaily. “It helped me significantly.”

For a year, Miller worked with the company, which helped to expand her company’s social media presence, get her work into a showhouse, and get one of her rooms published in Architectural Digest. And this was all thanks to a referral from Otar.

Kunal Bhasin, owner of 1 West Finance, said that he will sometimes introduce his clients to one another. These are usually clients he has funded, but they could include a prospective client, he said.

Jonathan Casillas, founder of Casillas Capital Partners, an ISO in North Carolina, said he will refer clients to specialists that can help them. “Our direct job is to get them money…but if I see a problem, I try to fix it,” Casillas said. “And if I can’t, I point them in the right direction. I’m here to help the entire business, not just get them money.” Casillas said that startups, in particular, need a lot more than money. They often need help with structural parts of their business and Casillas said he will refer them to a lawyer or an accountant, or whoever they need to get where they want to go.

Competition Steps Up in Canadian Small Business Lending Market

March 11, 2019 Last week’s announcement by Funding Circle that it will establish an operation in Canada later this year is part of a trend of large non-Canadian funders entering or expanding into the Canadian market, according to Adam Benaroch, President of CanaCap, a small business funder based in Montreal.

Last week’s announcement by Funding Circle that it will establish an operation in Canada later this year is part of a trend of large non-Canadian funders entering or expanding into the Canadian market, according to Adam Benaroch, President of CanaCap, a small business funder based in Montreal.

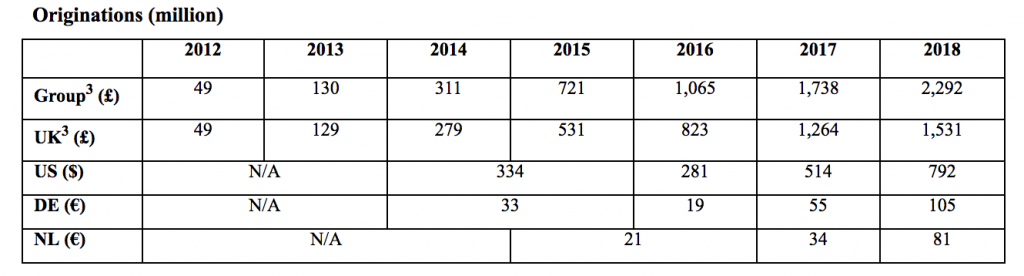

Funding Circle started in the UK and expanded outwards to the US, Germany, and The Netherlands, but the UK still comprises of more than 60% of their global origination volume. Their foray into Canada is a good thing for small business owners and lenders, according to Paul Pitcher, founder and CEO of SharpShooter, a funder based in Toronto.

“I see it as win-win,” Pitcher said.

He said that a win for Canadian small business owners is a win for SharpShooter because it means more potential merchant clients. Pitcher said that he loves OnDeck, a rival, is in Canada, in part because OnDeck’s marketing has helped educate Canadian merchants about alternative lending products.

Similarly, Benaroch said he thinks that big companies entering the Canadian market will affect CanaCap positively. For instance, Benaroch said that CanaCap hopes to capture companies that get turned down from OnDeck. And perhaps CanaCap can also capture merchants that are declined by Funding Circle.

Funding Circle’s loan originations by country by year

Funding Circle’s loan originations by country by year

Benaroch noted that not all outside funding companies have succeeded in Canada, often because they never established a physical presence there. But Funding Circle will be opening a physical office in Toronto.

“We have been evaluating options for expansion over the last year,” said Tom Eilon, who will be Managing Director of Funding Circle Canada. “Canada’s stable, growing economy coupled with good access to credit data and a progressive regulatory environment, made it the obvious choice. The most important factor [in coming to Canada] though was the clear need for additional funding options among Canadian SMEs.”

Funding Circle’s announcement comes on the heels of OnDeck’s December 2018 acquisition of Evolocity Financial Group, a small business funder based in Montreal. While OnDeck started operating in Canada as early as 2015, CanaCap’s Adam Benaroch said that the acquisition of Evolocity is a significant step for OnDeck because Evolocity has an ISO channel in Canada. That runs counter to Funding Circle’s model of mainly going direct to merchant, at least in the US.