FIRE DRILL IN ILLINOIS: BUSINESS FUNDING COMPANIES TARGETED IN REPRESSIVE BILL

June 30, 2016* Update 6/30 AM: Sen. Jacqueline Collins, D-Chicago is expected to introduce a revised bill today.

** Update 6/30 PM: Reintroduction of the bill has been delayed while they wait for comments from additional parties

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Foes say the measure was created to promote disclosure and regulate underwriting. They don’t argue with the need for transparency when it comes to stating loan terms, but they maintain that a provision of the bill that would cap loan payments at 50 percent of net profits would disrupt the market needlessly.

Opponents also regard the bill as an encroachment on free trade. “The government shouldn’t be picking winners or losers – the market should be,” said Steve Denis, executive director of the Small Business Finance Association, a trade group for alternative funders.

The states or the federal government may need to protect merchants from a few predatory lenders, but most lenders operate reputably and have a vested interest in helping clients succeed so they can pay back their obligations and become repeat customers, several members of the industry maintained.

“The ability to pay is really a non-issue,” noted Matt Patterson, CEO of Expansion Capital Group and an organizer of the Commercial Finance Coalition, another industry trade group. “I don’t make any money if a borrower doesn’t pay me back, so I don’t make loans where I think there is an inability to pay.”

Outsiders may find interest rates high for alternative loans, but companies providing the capital face high risk and have a short risk horizon, said Scott Talbott, senior vice president of government affairs for the Electronic Transactions Association, whose members include purveyors and recipients of alternative financing. Several other sources said the risks justify the rates.

Besides, a consensus seems to exist among industry leaders that most merchants – unlike many consumers – have the sophistication to make their own decisions on borrowing. Business owners are accustomed to dealing with large amounts of money, and they understand the need to keep investing in their enterprises, sources agreed.

In fact, no one has complained of any small-business lending problems in Illinois to state regulators, said Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation and a member of Gov. Bruce Rauner’s cabinet.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

But the proposed legislation could itself cause problems by placing entrepreneurs at risk, according to Rob Karr, president and CEO of the Illinois Retail Merchants Association, which has 400 members operating 20,000 stores. “It would stifle potential access to capital for small businesses,” he warned.

Quantifying the resulting damage would present a monumental task, but a shortage of capital would clearly burden merchants who need to bridge cash-flow problems, Karr said. Shortfalls can result, for example, when clothing stores need to buy apparel for the coming season or hardware stores place orders in the summer for snow blowers they’ll need in six to eight months, he said.

Restaurant owners and other merchants who rely on expensive equipment also need access to capital when there’s a breakdown or a need to expand to meet competition or take advantage of a market opportunity, Karr observed.

Capital for those purposes could dry up because just about anyone providing non-bank loans to small merchants could find themselves subject to the proposed legislation, including factoring companies, merchant cash advance companies, alternative lenders and non-bank commercial lenders, said the CFC’s Patterson.

Banks and credit unions are exempt, the bill says, but a page or two later it includes provisions written so broadly that it actually includes those institutions, said Ben Jackson, vice president of government relations at the Illinois Bankers Association.

Trade groups representing all of those financial institutions – including banks and non-banks – have joined small-business associations in working against passage SB 2865. “The most important thing is to make sure we’re coordinating with the other groups out there,” the SBFA’s Denis contended. “Actually, Illinois was good practice for the industry in how we’re going to go about dealing with attempts at regulation.”

Patterson of the CFC agreed that associations should coordinate their responses to proposed legislation. “We’ve tried to gather all the affected players in the space and have dialogue with them,” he maintained.

Even though that various associations reacting to the bill generally agreed on principles, their competing messages at first created a cacophony of proposals, according to some. “There was a lot of noise, and I think we’ll all learn from that,” Denis said. “The industry has to learn to speak with one voice to legislators.”

Citing the complexity of dealing with 50 states, 435 members of Congress and 100 senators, Denis said everyone with an interest in small-business lending must work together. “If we don’t, we lose,” he warned.

Many of the groups came together for the first time as they converged upon the Illinois capital of Springfield last month when the state’s Senate Committee on Financial Institutions convened a hearing on the bill. The committee allowed testimony at the hearing from three groups representing opponents. The groups huddled and chose Denis, Jackson and Martha Dreiling, OnDeck Capital Inc. vice president and head of operations.

City of Chicago Treasurer Kurt Summers was the only witness who testified in favor of the bill, according to Jackson. The idea of regulating non-bank commercial lenders in much the same way Illinois oversees lending to individuals arose in Summers’ office, said an aide to Illinois Sen. Jacqueline Collins, D-Chicago. Sen. Collins serves as chairperson of the Financial Institutions Committee and introduced to the bill in the senate.

Sen. Collins declined to be interviewed for this article, and Treasurer Summers and other officials in his of office did not respond to interview requests. However, published reports said Drew Beres, general counsel for Summers, has maintained that transparency, not underwriting, is the main goal. Talbott has met with Sen. Collins and said she’s interested primarily in transparency.

Support for the bill isn’t limited to the Chicago treasurer’s office. Some non-profit lending groups and think tanks back the proposed legislation, opponents agreed. The bill appeals to progressives attempting to shield the public from unsavory lending practices, they maintained.

Politicians may view their support of the bill as a way of burnishing their progressive credentials and establishing themselves as consumer advocates, said opponents of the legislation who requested anonymity. “It’s an important constituency,” one noted. “No one is against small business.”

After listening to testimony at the hearing, committee members voted to move the bill out of committee for further progress through the senate, Jackson said. Eight on the committee voted to move the bill forward, while two voted “present” and one was absent. But most of the senators on the committee said the legislation needs revision through amendments before it could become law, according to Jackson.

The legislative session was scheduled to end May 31. If the bill didn’t pass by then it could come up for consideration in a summer session if the General Assembly chooses to have one, Jackson said. If it does not pass during the summer, it could come to a vote during a two-week “veto session” in the fall or in an early January 2017 “lame duck session.” Unpassed legislation dies at that point and would have to be reintroduced in the regular session that begins later in January 2017, he noted.

Although time is becoming short for the proposed legislation, it’s a high-profile measure that could prompt action, particularly if amendments weaken the rule for underwriting, Jackson said. The Illinois General Assembly sometimes passes important legislation during lame duck sessions, he said, noting that a temporary increase in the state sales tax was enacted that way.

Whatever fate awaits SB 2865, some in the alternative funding business have suspected that the bill came about through an effort by banks to push non-banks out of the market. But cooperation among groups opposed to the proposed legislation appears to lay that notion to rest, according to several sources.

“I don’t get that impression,” Denis said of the allegation that bankers are colluding against alternative commercial lenders. “I think this shows banks and our industry can get together and share the same mission.”

Talbott of the ETA also counted himself among the disbelievers when it comes to conspiracy theories against alternative lenders. “I’d say that’s a misreading of the law and not the case,” he said. “Traditional banks oppose this because it would effectively reduce their options in the same space.”

The interests of banks and non-banks are beginning to coincide as the two sectors intertwine by forming coalitions, noted Jackson of the state bankers’ association. A number of sources cited mergers and partnerships that are occurring among the two types of institutions.

In one example, J.P. Morgan Chase & Co. is using OnDeck’s online technology to help make loans to small businesses. Meanwhile, in another example, SunTrust Banks Inc. has established an online lending division called LightStream.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

And however the industries structure themselves, the need for small-business funding remains acute. Banks, non-banks and merchants agree that the Great Recession that began in 2007 and the regulation it spawned have discouraged banks from lending to small-businesses. The alternative small-business finance industry arose to fill the vacuum, sources said.

That demand draws attention and could lead to bouts of regulation. Although industry leaders say they’re not aware of legislation similar to Illinois SB 2865 pending in other states, they note that New York state legislators discussed small-business lending in April during a subject matter hearing. They also point out that California regulates commercial lending.

Many dread the potential for unintended results as a crazy quilt of regulation spreads across the nation with each state devising its own inconsistent or even conflicting standards. Keeping up with activity in 50 states – not to mention a few territories or protectorates – seems likely to prove daunting.

But mechanisms have been developed to ease the burden of tracking so many legislative and regulatory bodies. The CFC, for instance, employs a government relations team to monitor the states, Patterson said. The ETA combines software and people in the field to deal with the monitoring challenge.

And regulation at the state level can make sense because officials there live “close to the ground,” and thus have a better feel for how rules affect state residents than federal regulators could develop, Sec. Schneider said.

Easier accessibility can also keep make regulators more responsive than federal regulators, according to Sec. Schneider. “It’s easier to get ahold of me than (Director) Richard Cordray at the Consumer Financial Protection Bureau,” he said.

Also, state regulators don’t want to take a provincial view of commerce, Sec. Schneider noted. “As wonderful as Illinois is, we want to do business nationwide,” he joked.

State regulators should do a better job of coordinating among themselves, Sec. Schneider conceded, adding that they are making the attempt. Efforts are underway through the Conference of State Bank Supervisors, a trade association for officials, he said.

At the moment, state legislatures and federal regulators have small-business lending “squarely on their agenda,” the ETA’s Talbott observed. The U.S. Congress isn’t paying close attention to the industry right now because they’re preoccupied with the elections and the presidential nominating conventions, he said.

The goal in Illinois and elsewhere remains to encourage legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that, said Talbott.

At any rate, the industry should unite in a proactive effort to explain the business to legislators, according to Denis. “We need to work with them so that they understand how we fund small businesses,” he said. “That’s the way we can all win.”

Business Finance Companies Visit Capitol Hill

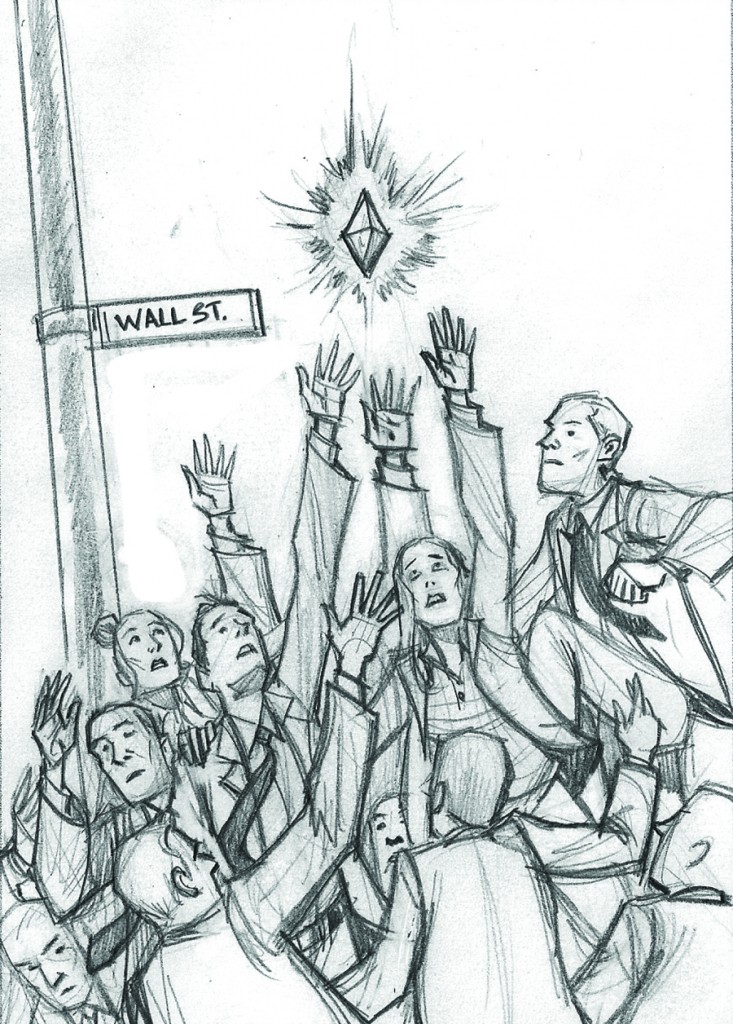

June 17, 2016 Scores of companies providing working capital to small businesses descended on Capitol Hill in early May to educate policymakers about the benefits they provide to the economy. Among them was the Coalition for Responsible Business Finance (CRBF), the Electronic Transactions Association (ETA) and the Commercial Finance Coalition (CFC).

Scores of companies providing working capital to small businesses descended on Capitol Hill in early May to educate policymakers about the benefits they provide to the economy. Among them was the Coalition for Responsible Business Finance (CRBF), the Electronic Transactions Association (ETA) and the Commercial Finance Coalition (CFC).

The inability of banks to satisfy the demands of small businesses is not new, nor is it a problem purely borne out of the recession, data indicates. That’s partially why the Small Business Administration (SBA) exists, according to a 2014 report co-authored by former SBA Administrator Karen Mills.

“If the market will give a small business a loan, there is no need for taxpayer support,” the report states. “However, there are small businesses for which the bank would like to make a loan but that business may not meet the bank’s standard credit criteria.” That occurs so often that the SBA actually had to temporarily suspend guarantees last year because they had reached their limit.

“The SBA has a portfolio of over $100 billion of loans that lenders would not make without credit support,” according to Mills’ report. If that number looks big, it’s because it’s comprised mainly of loans to the larger end of the small business spectrum. Smaller businesses or businesses with smaller needs anyway, continue to be underserved. The average 7(a) loan guaranteed by the SBA in fiscal year 2015 for example was $371,628. Compare that to the $20,000 – $35,000 average deal size reported by some members of the CFC.

“Small firms were hit harder than large firms during the crisis, with the smallest firms hit the hardest,” Mills’ report states, but it adds that small businesses have been responsible for adding two out of every three net new jobs since 2010.

Tom Sullivan, who leads the CRBF, emphasized to AltFinanceDaily that job creation plays a crucial role in what their organization represents and stressed that it was very important to get the input of small business owners when policymakers consider new regulations.

The CFC meanwhile, estimates that aggregate funding between its members have preserved at least 1 million jobs. And OnDeck, who was on the Hill with the ETA, announced late last year that their first $3 billion in loans have generated an estimated $11 billion in US economic impact and actually created 74,000 jobs.

While the schedules and agendas of each group were different, the CFC reportedly met with nearly two-dozen House and Senate members or their staff in a single day.

Online Small Business Lending Task Force Initiated by the ETA

April 30, 2016 The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

The Electronic Transactions Association (ETA) is now advocating on behalf of online small business lenders.

Though you might not have suspected it last week at Transact16, the ETA very much plans to involve themselves in the affairs of marketplace lending. That might not have been obvious from a Bloomberg article that reported that OnDeck, Kabbage and PayPal were forming a splinter organization as an “extension” of the ETA known as the Online Small Business Lending Task Force. Referred to as a new initiative in the announcement, the group’s mission is described as striving to “prevent hasty or overly restrictive regulations.”

But the group’s named lobbyist, Scott Talbott, is also the ETA’s lobbyist. And the three lenders named, were already members of the ETA. When Talbott was asked by AltFinanceDaily to clarify the relationship between the “task force” and the ETA, he said that the two weren’t separate. The “ETA organized its members to lobby on the issue. It’s what we do every day,” he wrote.

The “task force” merely highlights members in the trade group that share a common interest.

Formed in 1990 and comprising of over 550 companies across 7 countries, the ETA has served the payments industry well. OnDeck, Kabbage and PayPal therefore find themselves in good company and led by advocates with well-established government relationships.

Along with the ETA, the online small business lending industry has found support from the Marketplace Lending Association, the Small Business Finance Association, the Commercial Finance Coalition and the Coalition for Responsible Business Finance.

Splits Glitz or Fritz? – Transact 16 highlighted strange chapter in merchant cash advance history

April 21, 2016

It’s Opposite Day in the alternative business funding industry. Lenders are splitting card payments and merchant cash advance companies are doing ACH debits.

Jacqueline Reses was not an odd choice for Transact 16’s Wednesday morning keynote. Square, the company she works for, has continued to be a hot topic in the payments world for years. But what was striking is that Reses heads the lending division, the group that allows merchants to pay back loans through their future card sales. If that sounds very merchant-cash-advance-like, it’s because that’s exactly the product they used to offer before changing the legal structure behind them.

Split-payments, not ACH payments, have literally propelled Square and PayPal to the top of the charts of the alternative business funding industry. One individual on the exhibit hall floor posited that Square’s ability to originate loans through their payments ecosystem was the company’s real value; Payments itself was secondary. It’s a testament to the opportunities that split-payments affords to (as I argued 3 years ago on the ETA’s blog) a company well positioned to benefit from it.

Meanwhile, the companies at Transact that one would have historically described as merchant cash advance companies have mostly transitioned away from split-payments to ACH. Essentially, Square and PayPal embraced splits as an incredible strength while yesterday’s merchant cash advance companies viewed splits as a handcuff that limited scalability. The payment companies became merchant cash advance companies and the merchant cash advance companies became something else entirely, a diverse breed of loan and future receivable originators operating under a label people are now calling “marketplace lenders.” But even Square and PayPal, arguably the two companies at Transact doing the most split-payment transactions, claim to make loans, not advances.

Merchant Cash Advance as anyone knew it previously is dead

Ten years. That’s the average age of the small business funding companies that exhibited at Transact this week. They are but the last remaining players that probably considered the debit card interchange cap imposed by the Durbin Amendment of Dodd-Frank as being among the most significant legislation that affected their businesses.

A senior representative for one credit card processor told me at the conference that their biggest gripe with new merchant cash advance ISOs today is that they know almost absolutely nothing about merchant accounts. It’s not that they know less, they know nothing, he said.

One company was notably absent from the floor this year, OnDeck. They’ve since embraced the marketplace lending community as their home, just as many others have.

Nine years ago, I overheard a very influential person say that the first company to be able to split payments across the Global, First Data and Paymentech platforms would be crowned the “winner” of the merchant cash advance industry and by extension the wider nonbank small business financing space.

If one were to define the winner as the first company from that era to go public, well then those 3 platforms played no role. OnDeck was the first and they relied on ACH payments the entire way. They also refer to themselves these days as a nonbank commercial lender. If that doesn’t sound very payments-like, it’s because it’s not.

What cause is being Advanced?

At least four coalitions are currently advocating on the marketplace lending industry’s behalf, the Coalition for Responsible Business Finance, the Marketplace Lending Association, the Small Business Finance Association, and the Commercial Finance Coalition. The Transact conference is put on by the Electronic Transactions Association whose tagline is “Advancing Payments Technology.” In an age where new merchant cash advance ISOs know nothing about payments, it’s no wonder there’s a growing disconnect.

Could Transact now be one of the best kept secrets?

A few people from companies exhibiting say that they believed they stood a better chance to land referral relationships from payment companies by being there and that there was still a lot of value in landing those deals. Partnerships like these may be why the average exhibitor has been in business for 10 years while today’s new companies relying solely on pay-per-click, cold calling, or handshakes are falling on hard times.

Some payment processors acknowledged that merchant cash advance companies were still a good source to acquire merchant accounts, though the process by which that happens is not the same as it used to be. A lot of it is referral based now, according to one senior respresentative for a card processor. The funding company funds a deal via ACH and then refers them to the payment guy to try and convert that as an add-on. The residual earnings may not be as good as they used to be but that’s because they don’t have to do any work in this circumstance. In a sense, funders are still leading with cash but instead of the boarding process being mandatory, it’s an entirely separate sale that sometimes works and sometimes doesn’t. In that way, small business funding companies can be a good lead source for payments companies.

When I asked the senior representative if they really had success closing merchant accounts just off of a referral from a funding company, he looked at me incredulously, and said, “you used to do this, of course we do. that’s how this whole industry started.”

“What industry?” I asked.

What industry indeed…

Nine Organizations Submit Joint Response to Bizarre Illinois Small Business Lending Bill

April 16, 2016

A bill introduced in the Illinois State Senate to “protect” small businesses from lenders is causing small businesses themselves to scratch their heads. The bill would effectively outlaw nonbank business lending, which would render those declined by a bank, restricted from accessing capital through other means.

“As we all recall what happened in 2007-2008 in the housing market, so many people went under due to these predatory lending practices. So I’m happy we’re being proactive instead of reactive with this issue,” said Illinois State Senator Emil Jones.

That proactive approach is to scorch the earth, which is creating staunch pushback from within the small business community. A letter co-signed by the following nine organizations was submitted last week to Jacqueline Collins, the Senator who introduced the bill:

- Coalition of Responsible Business Finance

- Electronic Transactions Association

- Illinois NFIB

- Illinois Retail Merchants Association

- Equipment Leasing and Finance Association

- Small Business & Entrepreneurship Council

- Small Business Investors Alliance

- National Small Business Association

- Illinois Chamber of Commerce

Dear Chair. Collins:

The undersigned organizations, companies, and coalitions who have business in Illinois and throughout the country are writing to express our concerns with SB 2865, the Small Business Lending Act.

We all share your goal of helping small businesses. However, we believe that the prescriptive underwriting standards, complex regulatory mandates, and expansion of civil and criminal liability will prevent small businesses from getting the capital they need to grow and benefit their communities and the state of Illinois.

We respectfully ask the Committee to study the issue of access to capital for small business in Illinois through a transparent process that involves the direct input from small businesses prior to moving forward with SB 2865.

We are hopeful that a deliberative, inclusive, and public process could produce a report that will assist your Committee and the Illinois legislature. Among the questions a study committee could try and answer are: what methods of transparency and disclosure by alternative lenders and finance companies would make it easier for responsible small business borrowing; should non-profit lenders be exempt from alternative lending and finance requirements; and how does the securitization and sale of alternative loans benefit small business lending?

Of course, there are many additional issues that small business stakeholders will identify through a study committee in an effort to assist your Committee prior to any legislative action on SB 2865. We stand ready to assist you in that effort and we appreciate the consideration of our views.

Conflicting information has come out of the Senate since a hearing was held about it on the morning of April 12th. Fox reports that it is heading to the Senate floor for discussion with the expectation of some modifications, while those that were there say that it has been put on hold until early 2017 since it’s a presidential election year.

PSC and Hudson Cook, LLP Align to Promote Best Practices in Merchant Cash Advance Industry

May 18, 2015 Earlier today, New York-based PSC announced an alliance with nationally renowned law firm Hudson Cook, LLP to educate members of the merchant cash advance industry. PSC provides full backend systems and support staff for more than a dozen merchant cash advance companies.

The move is significant because it focuses on the adoption of best practices. The only other similar initiative has come from from the Small Business Finance Association (SBFA), but no organization has ever actually made guidelines public, at least not since the Electronic Transactions Association published a white paper in March 2008.

Both Hudson Cook and the SBFA are said to be separately working on their own public best practice frameworks in collaboration with industry participants.

Three attorneys for Hudson Cook recently took on the industry’s most polarizing topic, stacking, when they authored, Stacking: Is it Tortious Interference?. “The analysis of what is ‘improper’ interference versus vigorous, but acceptable, competition will be based on the specific facts of each case,” they wrote.

The law firm may draw from another well established best practice playbook, like the one that exists for the Online Lenders Alliance in the consumer lending space.

PSC recently hired Amanda Kingsley, the woman behind the headline, “Year of the Broker” in our last issue. Kingsley spoke often of best practices in her interview with AltFinanceDaily Magazine.

PSC recently hired Amanda Kingsley, the woman behind the headline, “Year of the Broker” in our last issue. Kingsley spoke often of best practices in her interview with AltFinanceDaily Magazine.

A month ago at the LendIt conference, Karen Mills, the former head of the Small Business Administration, said she asked several regulatory bodies who would stand up to oversee small business lending. “No one stood up,” she said.

For now, that seems to mean that the industry is on its own. “PSC also intends to maintain its commitment to its members by providing standards to help them better adhere to all new legal requirements and regulatory practices,” the release said.

It’s a step in the right direction.

Year of the Broker

April 4, 2015 Many of the newcomers are fleeing hard times in the mortgage or payday loan businesses. Others are abandoning jobs selling insurance, car warranties or search-engine optimization.

Many of the newcomers are fleeing hard times in the mortgage or payday loan businesses. Others are abandoning jobs selling insurance, car warranties or search-engine optimization.

“You have wandering souls trying to find their place in this industry, whether it be as a company or on their own,” said Amanda Kingsley, CEO of Sendto, a Florida-based company that assists new brokers.

Though exact counts appear difficult to obtain, Kingsley professed amazement at the volume of new entrants. “I’m swamped,” she said. “It’s crazy.”

Some of the new brokers discovered alternative financing in December, when OnDeck Capital’s initial public stock offering raised $200 million and valued the company at $1.3 billion. The Lending Club IPO that raised $1 billion the same month also raised public awareness of alternative loans.

Mesmerized with those whopping figures, salespeople from other businesses began committing themselves to a new career in alternative finance. In a business with virtually no barriers to entry, it’s easy to get started. To call themselves brokers, they just need a phone, someplace to sit and a list of leads they can buy online.

Virtually all of the entrants are pursuing dreams of lucrative paydays. Many even expect to make a fast buck with minimum effort.

If only it were that simple. Too often, the untutored new players are making mistakes simply because they don’t know any better, industry veterans maintained.

“A lot of people think you can just walk in and be successful,” said the sales manager of an established New York-based brokerage who asked for anonymity. “They don’t know what it takes to run a company. They don’t know what it takes to get a deal done.”

Worst of all – either unknowingly or with evil intent – new brokers are stacking deals. In other words, inexperienced salespeople pile second or third loans or advances on top of original positions. It’s an approach that clearly violates the industry’s standards, observers agreed.

In fact, virtually all contracts for a first loan or advance prohibit the merchant from taking on another similar obligation, noted Paul Rianda, an Irvine, Calif.-based attorney who specializes in payments and financing.

“I can’t remember one agreement I’ve seen that didn’t have that provision in it,” Rianda said.

Violating that stipulation could provide grounds for a lawsuit, and litigation is underway, according to David Goldin, president and CEO of New York-based AmeriMerchant and president of the North American Merchant Advance Association (NAMAA).

Bigger funders would sue smaller funders because the latter appear more likely to take on riskier, more problematic multiple-position deals, said Jared Weitz, CEO at United Capital Source LLC, a New York-based broker.

Plaintiffs have a case to make because stacking harms the broker and funder of the first position by increasing the risk that the merchant won’t meet the resulting financial obligations, Weitz said. “The guys going out 18 and 24 months to make this a more bankable product are being hurt by the people coming in and stacking those three-month high-rate loans,” he noted.

Deducting fees for more than one advance also impedes cash flow, adding another risk factor, Weitz said.

To further complicate matters, the company offering the second or even third deal sometimes moves the merchant’s transaction services to another processor, Rianda said. That forces the firms that made the first advance to approach the new processor to stake a claim to card receipts, he noted.

So the companies with the original deal suffer from the effects of stacking, but the practice’s shortcomings will haunt the stackers, too, observers maintained.

“It’s not a model that’s going to allow them to succeed,” a broker who asked to remain anonymous said of stackers’ long-term prospects.

Many hardly give a thought to staying power, according to Weitz. “A lot of people entering this space think it’s about fast money and not longevity,” he said.

Longevity requires that brokers build relationships with merchants, a process stacking undermines because too much credit can drive merchants out of business or merely prop up merchants already doomed to fail, sources said.

Yet stacking has become so widespread that it constitutes a business plan for some brokerage shops, said a broker who asked that his name and company not appear in the article.

It can begin when brokers buy lists of Uniform Commercial Code filings to find out what merchants have already taken out term loans or advances, said Zach Ramirez, vice president of sales and operations at Orange, Calif.- based Core Financial Inc.

The brokers then contact those merchants, many of whom are already over-extended financially, to offer additional credit or advances, Ramirez said.

Inexperienced brokers often resort to stacking because they don’t know how to generate leads that can bring alternative lending vehicles to merchants who weren’t aware of them.

Referrals from accountants or other business owners who deal with merchants can provide some of those greenfield prospects, Ramirez noted.

And leads aren’t the only area of cluelessness among newcomers, a broker who requested anonymity maintained.

And leads aren’t the only area of cluelessness among newcomers, a broker who requested anonymity maintained.

“They don’t know why a bank declines a deal or approves a deal,” he said. “They don’t know what’s the basis for a good deal.”

To teach new brokers those basics of alternative business financing, the industry should establish standard policies and technology, according to Kingsley.

A credential, perhaps something similar to the Certified Payments Professional designation created by the Electronic Transactions Association, sources said. To earn the credential, candidates would pass an exam to show they’ve mastered the basics of the business, they proposed.

NAMAA is considering such a credential, said Goldin, the trade group’s president. It’s the kind of self-regulation that could forestall federal oversight, industry sources agreed.

But that might not matter, according to Tom McGovern, a vice president at Cypress Associates LLC, a New York-based advisory firm that raises capital for alternative lenders and merchant cash advance companies.

After all, McGovern noted, Barney Frank, former Democratic U.S. representative from Massachusetts and co-author of the Dodd-Frank Wall Street Reform and Consumer Protection Act, has gone on record as saying that piece of legislation focuses on consumers and does not govern business-to-business dealings like loans or advances to merchants.

That lack of regulation over B2B deals seems likely to continue, “especially in the world we’re in now with a Republican Congress,” said a broker who asked to remain nameless.

However, some members of the industry would welcome federal regulation as a way of barring incompetent or unscrupulous brokers. An agency patterned after the Financial Industry Regulatory Authority, know as FINRA, could do the job, suggested a broker who requested anonymity.

Whether a government regulator or an industry- supported association should police the market, problems could remain stubbornly in place, some said.

Many doubt an association could build the consensus required for united action on some issues – stacking in particular.

For one thing, cleaning up the business could reduce profits for brokerages that profit from stacking, noted a broker who asked that his name not appear in the article.

“Everybody wants to make money,” he said. “Everybody’s out for themselves.”

Another barrier to agreement arises because some brokerages fear cooperation could expose their trade secrets, said Sendto’s Kingsley.

Moreover, unscrupulous brokers want to keep their employees uninformed of the industry’s potential for big profits, Kingsley said. That way they suppress compensation for an underclass of prequalifiers who work the early stages of deals, she noted.

Prequalifiers earn from $150 to $500 a week, depending upon the location, and don’t qualify for benefits like health insurance, Kingsley said. Once they realize what a tiny portion of the profits they’re receiving, brokers terminate the prequalifiers and many go on to become brokers themselves, she observed.

Closers who take over from prequalifiers to wrap up the sale can earn up to 50% or occasionally even 60% of a brokerage house’s commission – if the closer originates the deal and sees it through to completion unassisted, Kingsley said.

Eventually, closers realize they could keep all of the commission if they strike out on their own and become brokers, she noted.

In a way, the progression from prequalifier to broker or closer represents a market correction. And many seasoned industry participants believe market forces will also work out other problems the influx of new brokers is causing.

A large number of the new brokers simply won’t last long because they don’t understand the industry, they’re stacking deals and they’re signing up merchants that won’t stay in business.

Meanwhile, funders are beginning to perform background checks on brokers to make sure they’re dealing with reputable people, sources said.

Some funders protect themselves by simply declining to do business with new brokers, according to observers.

And many new brokers are learning the industry with the help of experienced brokerages that act as mentors and conduits and call themselves super brokers, super ISOs, broker consultants or syndicators.

“So what I’m saying is, ‘Guys, let’s not compete. Let’s grow parallel together,’ ” Weitz said of United Capital Source’s relationships with new brokers. The company began working with new brokers in October 2014.

In such relationships new brokers get advice from the more seasoned brokers. The older brokers can also provide the newcomers with services that include accounting, marketing and reporting, he said.

New brokers can also benefit from the customer relationship management platform that United Capital Source developed, Weitz said.

The new brokers also capitalize on the older brokers’ relationships with funders. Established brokers have earned better rates and terms because of reputation and volume, Weitz noted. Companies like his also know which lenders work more quickly and thus capture more deals, he added.

Older brokers can also steer new brokers away from newer funders that offer shorter terms and demand higher rates, Weitz said. Of the 30 to 40 companies that call themselves funders, only eight or 10 deserve the name, he contended.

The less-respectable funders place only a small amount of money in a few deals, he said.

Newer brokers become aware of their need for help from more experienced brokers when they see how many sales they’re failing to close, Weitz said.

The new brokers also come to realize that the puzzle of running a brokerage office has a lot more pieces than they may have thought, said Kingsley.

The new brokers also come to realize that the puzzle of running a brokerage office has a lot more pieces than they may have thought, said Kingsley.

The percentage of the commission that the older broker charges can vary, according to Weitz.

“If someone needs a lot of hand holding and a lot more resources, they would get a different structure,” he said.

While Weitz said his company plans to acquire only about 10% of its volume through new brokers, Sendto specializes in helping newcomers. Sendto’s Kingsley described the company as “a turnkey solution that provides training and placement of deals. It’s for new brokers or sales offices that do not have what they need to be part of this industry.”

There’s room for entrants because not all merchants know about alternative business financing, said McGovern.

The market can even seem like it doesn’t have enough brokers in the estimation of experienced players skillful enough to find the many merchants who haven’t been introduced to the industry, said Ramirez of Core Financial.

And the big banks don’t really want the business because the deals aren’t big enough to interest them, McGovern said.

But the potential profits look promising to outsiders disillusioned with sales jobs in other industries.

Some experienced brokers even prefer to hire salespeople from outside the alternative financing industry, noted Kingsley. That way, they avoid employees who have picked up bad habits at other brokerage houses, she said.

Long-time members of the industry sometimes enjoy belittling new entrants who can seem clueless about the business they’re trying to master, noted Ramirez of Core Financial. But he recalled the time not so long ago that he himself had a lot to learn.

And regardless of how unsophisticated they may seem, new players have a role, McGovern said.

“They are performing a service,” he maintained. “They’re like the missionaries of the industry going out to untapped areas of the market – of which there are many – and drumming up business.”

To Kingsley, brokers in general – old and new – are beginning to earn the respect they deserve.

“A lot of people are afraid of the word ‘broker,’ ” she said. “I feel that 2015 is the year of the broker, and people should embrace what a broker can actually do. It’s a great thing.”

It’s not said often, but it has been suggested by some players in the merchant cash advance industry to introduce sales licensing requirements. Anybody can sell and broker MCAs or alternative business loans,

It’s not said often, but it has been suggested by some players in the merchant cash advance industry to introduce sales licensing requirements. Anybody can sell and broker MCAs or alternative business loans,  Now that three years have gone by, the Green Sheet is attempting to answer this question:

Now that three years have gone by, the Green Sheet is attempting to answer this question: