Congressman Tom MacArthur Visits CFG Merchant Solutions’ NYC Office

October 15, 2018United States Representative Tom MacArthur, who represents New Jersey’s 3rd District, visited the NYC office of CFG Merchant Solutions on Monday. MacArthur has been in office since 2014.

CFG Merchant Solutions moved into the 180 Maiden Lane office earlier this year. The company is a member of the Commercial Finance Coalition (CFC). Adam Sloane of Cresthill Capital, another CFC member, was also in attendance.

NJ Legislature Aims to Classify Merchant Cash Advance as a Loan in New Disclosure Bill

October 15, 2018 S2262 in New Jersey, a bill to require disclosures in small business lending, was amended this afternoon to define merchant cash advances as small business loans for the purposes of disclosure.

S2262 in New Jersey, a bill to require disclosures in small business lending, was amended this afternoon to define merchant cash advances as small business loans for the purposes of disclosure.

Banks and equipment leasing companies are exempt from the bill.

You can listen to the hearing here. Debate on S2262 begins at the 6 minute, 12 second mark.

The bill’s author (image at right) is Democratic Senator Troy Singleton who represents New Jersey’s 7th legislative district.

Testifying on Monday’s hearing against the bill were Kate Fisher of the Commercial Finance Coalition and PJ Hoffman of the Electronic Transactions Association.

New Jersey Moves to Regulate Small Business Loan Disclosures and Brokers

October 15, 2018 A committee within the New Jersey State Senate convened today at 1:30pm to discuss S2262, a new small business loan disclosure bill. Similar to SB1235 in California, this bill would require all of the following on small business loan contracts less than $100,000:

A committee within the New Jersey State Senate convened today at 1:30pm to discuss S2262, a new small business loan disclosure bill. Similar to SB1235 in California, this bill would require all of the following on small business loan contracts less than $100,000:

The APR(This was removed during the committee hearing)- The annualized interest rate

- The finance charge

- The maximum credit limit available

- The payment schedule

- A list of all broker fees and a description of the broker’s relationship with the lender and any conflicts of interest the broker may have

- These terms must be presented before a business accepts a loan

In addition, any change to the terms that would significantly affect the responsibilities or obligations of the small business concern under the loan must be noticed 45 days in advance.

During the hearing, the bill was amended to define merchant cash advances as small business loans. Kate Fisher of Hudson Cook, LLP who represented the Commercial Finance Coalition (CFC) during the hearing, strongly opposed that amendment. The CFC is a trade association representing small business lending and MCA companies.

Also testifying against it was PJ Hoffman of the Electronic Transactions Association. Other Trade groups are gearing up to oppose the bill as well, AltFinanceDaily has learned.

The bill was voted through the committee and will continue to move forward.

Kate Fisher’s testimony has been transcribed below:

Senator Pou and committee members: Thank you for the opportunity to present testimony today regarding business loan disclosures.

My name is Kate Fisher and I am here today on behalf of the Commercial Finance Coalition, a group of responsible finance companies that provide capital to small and medium-sized businesses through innovative methods. I also am an attorney who helps providers of commercial financing comply with state and federal law.

The Commercial Finance Coalition supports efforts to make business financing more transparent.

The problem is the proposed amendment would define a merchant cash advance as a loan. A merchant cash advance is not a loan.

We all know how a loan works – the lender advances money and the borrower promises to pay it back.

A merchant cash advance is a factoring transaction, in which a business sells a percentage of its future receivables at a discount.

Take for example, a pizza shop. The pizza oven breaks and the owner needs cash to replace it.

In a loan, the pizza shop borrows the money and promises to pay the money back to the lender with interest.

In a merchant cash advance, the pizza shop sells its future receivables to a merchant cash advance company. In exchange for the money to buy that pizza oven, the merchant cash advance company will take 10% of each dollar the pizza shop makes.

If the pizza shop’s sales go down, it will pay less. If the pizza shop’s sales go up, it will pay more. And if the pizza shop is damaged by a hurricane and has to close for repairs, it will pay nothing until it can reopen its doors.

This uncertainty of repayment is why a merchant cash advance is not a loan – the pizza shop in our example, only pays if it sells pizza. Courts have overwhelmingly agreed that a merchant cash advance is not a loan. To quote a recent court decision:

“Receivables purchasing is an accepted form of business transaction, and is not a loan.”

Because a merchant cash advance is not a loan, and there is no fixed payment term, requiring an APR or annual interest rate disclosure would be misleading. For a small business looking for financing, these types of disclosures would only add confusion.

I’m very optimistic that New Jersey can lead the way in providing businesses with disclosures that are helpful – and not misleading.

Thank you.

The California Business Loan & MCA Disclosure Bill Has Passed

August 30, 2018The bill has passed. With the governor’s signature, all business loan contracts and merchant cash advance contracts in California will soon require a uniform set of formal disclosures including an annualized rate of the total cost. The precise formula for that rate will be determined by the state’s regulatory agency, the Department of Business Oversight.

Update: The bill’s death in committee was challenged by the bill’s author, Senator Steve Glazer, and ultimately allowed to come up for a vote after he complained to the senate majority leader that a committee’s decision is merely a recommendation, not a deciding factor on the bill itself. At 2:10 AM EST, it passed.

Update: The bill has died in the Senate Banking Committee. Daniel Weintraub, who serves as chief of staff to the bill’s author, tweeted after midnight eastern time that the bill was not moving forward.

Thanks to all who supported small business and #SB1235. Unfortunately the Senate Banking Committee killed the bill tonight. We fell one vote short of the four we needed to send the bill to the Senate floor. https://t.co/30ztdW2LbD

— Daniel Weintraub (@DMWeintraub) September 1, 2018

Update: The bill passed the Assembly unopposed and is slated for a late night vote by the Senate Banking Committee.

Update 8/31/18: Today is the last day for the legislature to pass this bill. We will keep you updated

California’s bill to mandate certain disclosures on business loan and merchant cash advance contracts is looking a little bit worse. The Annualized Cost of Capital method (Explained here) that some folks in the industry were accepting of, has been scrapped in favor of whatever formula a state regulator decides to pick. That means if the Commissioner of Business Oversight decides on an APR disclosure, which many industry trade groups believed they had already successfully lobbied against, all loans and non-loans alike would have to report an APR, a mathematical impossibility for a product like merchant cash advance. At present, however, all that is known is that the Commissioner’s choice must be an annualized metric.

According to Bloomberg, the amended version of the bill needs to get approval in both the Assembly and the Senate by Friday before the legislative session ends.

Trade associations that have weighed in on this bill include the Electronic Transactions Association, Commercial Finance Coalition, Small Business Finance Association, and the Innovative Lending Platform Association.

You can view all of our previous coverage about the bill here.

Despite Movement of Negative Bill for MCA and Factoring Industries, Hope for a Solution

April 23, 2018 Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

Last week, California State politicians gathered for a hearing on SB 1235, a bill that would require the disclosure of an Annual Percentage Rate (APR) for all loans and non-loans, including MCA and factoring products. This is very problematic because APR (which includes interest rate) cannot be calculated for most MCA and factoring products for one reason: time. What makes merchant cash advance and factoring unique is that the timing of payments is flexible, and therefore unknown.

“It’s impossible to compute,” said veteran factoring lawyer Bob Zadek about calculating APR for most MCA and factoring products. “Interest = principal x rate x time. Since [they] cannot determine how long the advance will be outstanding – since repayment is a function of the borrower’s cash flow – the algebra doesn’t work.”

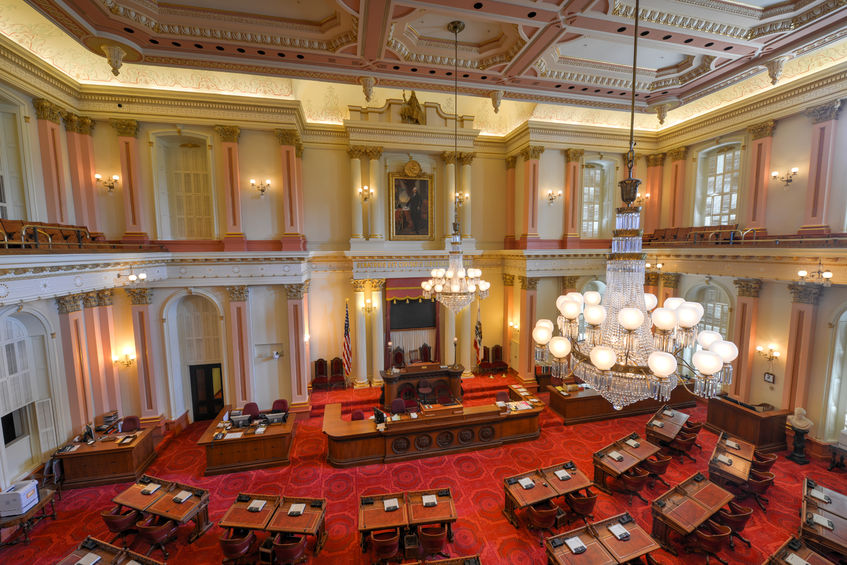

The bill, introduced by California State Senator Steve Glazer, moved out of the Senate committee on Banking and Financial Institutions and is headed to the Judiciary committee – closer to potential passage. Yet advocates of the MCA industry, one of whom testified in the assembly room in Sacramento, are hopeful.

“There were a number of state senators who clearly understood the problems with applying an APR to a commercial transaction and to a purchase and sale of receivables transaction,” said Katherine Fisher, a partner at Hudson Cook, LLP who spoke on behalf of the Commercial Finance Coalition (CFC). CFC is an alliance of financial companies that educates government regulators and elected officials on issues related to non-bank commercial finance. CFC Executive Director, Dan Gans, told AltFinanceDaily that he believed the committee really understood what Fisher was trying to convey.

Another major advocacy group is the Small Business Finance Association (SBFA). They brought Joseph Looney, COO and General Counsel of RapidAdvance, to testify against SB 1235, and SBFA Chief of Staff Steve Denis sounded optimistic, saying that they have a very good relationship with State Senator Glazer’s office.

“To me, despite the fact that they moved [on] a bill that we’re opposed to through the process,” Denis said. “I think the folks that we’ve been meeting with out there – the senators – they’re all very open to our industry and open to having broader discussion about how to [best] disclose these terms and how to make sure we’re doing what’s in the best interest of small business owners. That’s a real positive, and I’m optimistic that we can get something done.”

As for concern about the bill moving forward, Denis said it’s what he expected.

“It’s just the way the process works in California,” Denis said. “If you look at committee history, they don’t really reject a lot of bills. They like to move bills forward so they can be discussed and negotiated.”

As of this story’s publication, SB 1235’s Judiciary committee hearing had not yet been scheduled.

Update 4/26/18: The hearing is scheduled for May 8, 2018 at 1:30 p.m. PST in Room 112.

Full video of the April 18th hearing below:

Meet at the 2018 Financial Services Conference

April 22, 2018I will be attending the 2018 Financial Services conference by CounselorLibrary and Hudson Cook, LLP on Monday, April 23rd in Baltimore, MD. AltFinanceDaily is a sponsor of the event. If you would like to meet, please email me at sean@debanked.com.

April 23rd is a Special One-Day Program with Merchant Cash Advance and Small Business Lending Breakout Sessions.

AltFinanceDaily is a partner with CounselorLibrary in the Merchant Cash Advance Basics online course, the only certification course available for MCA.

A partner from Hudson Cook, LLP, Katherine Fisher, also recently testified on behalf of the Commercial Finance Coalition at a state Senate hearing in California on commercial loan disclosures. You can read her transcript here.

Industry Representatives to Testify at California Hearing

April 18, 2018

Several people will be testifying in front of the Senate Committee on Banking and Financial Institutions in California today. Among them are Joe Looney, COO & GC at RapidAdvance, who will be speaking on behalf of the Small Business Finance Association, and Katherine Fisher, Partner at Hudson Cook LLP, who will be speaking on behalf of the Commercial Finance Coalition.

At issue is SB 1235, a bill that would require providers of commercial financing to provide disclosures about the cost of that financing to the recipients of the financing.

Industry analysts believe the bill could have implications not just for small business lending but also for factoring and merchant cash advance.

Update: Full video of the hearing below

CFC on the Front Lines of the MCA Regulation Battle

November 6, 2017

As the US Senate attempts to reach a bipartisan agreement on relaxing some of the rules in the Dodd Frank legislation of 2010 that would treat banks more favorably, the MCA industry is having to fend off legislation and regulation of its own at the state and federal levels that could position funders in a similarly crippling position.

MCA regulation has been thrust into the spotlight for a number of reasons, not the least of which has been the Consumer Financial Production Bureau (CFPB). The CFPB is moving forward with the Dodd-Frank Section 1071 rulemaking process for data collection regarding small business lending, a sector of the market for which they do not have jurisdiction, sources say.

Front and center in the policy discussions has been the Commercial Finance Coalition (CFC), a merchant cash advance trade association that is coming up on its two-year anniversary in December. While federal policymakers appear to be listening, state legislatures have been a more difficult nut to crack.

The CFC’s Influence

In its short two-year history, the CFC has been one of the most vocal if not the most influential trade organization lobbying on behalf of the MCA industry, having attended 70 congressional meetings and having led advocacy efforts for the industry in the halls of Albany, Sacramento, Illinois and Washington, D.C.

Dan Gans, executive director of the CFC, has been the voice of the MCA industry on Capitol Hill and has been invited to testify in key congressional hearings. “For whatever reason, the CFC has really become the voice and has taken an active part in the so far successful advocacy efforts to educate and mitigate potential harm to our members’ ability to deploy capital to small businesses that need access,” Gans told AltFinanceDaily.

Most recently the CFC participated in a fly-in, one of two such events this year, to Washington, D.C. in which the association’s counsel Katherine Fisher of Hudson Cook, LLP testified.

In her testimony Fisher said: “The MCA and commercial lending spaces are sufficiently regulated by existing federal and state laws and regulations. Both MCA companies and commercial lenders must comply with laws and regulations affecting nearly every aspect of their transactions, from marketing and underwriting through servicing and collection.”

She went on to explain: “Even if they comply with every applicable law and regulation, small business financers must also be wary of the Federal Trade Commission’s powerful authority to prevent unfair or deceptive acts or practices.”

Fisher told AltFinanceDaily she received a “positive” response to her testimony from funders but has not heard anything from lawmakers.

Gans said Fisher did a fantastic job in articulating the needs and status of the industry.

“She presented a very good case as to why the industry is currently adequately regulated. We don’t feel there is a need for federal regulation. In some cases, less regulation would allow our members to deploy more capital and help more small businesses,” Gans said.

The sweet spot for MCAs, Gans explained, are transactions under $100,000 and probably in the $24,000 – $40,000 range. He said the industry does a fantastic job of being able to deploy financial resources to small businesses in a timely manner that neither banks nor SBA lenders can match. He’s not suggesting MCA is for everybody but for some businesses it’s an essential product that can help. There have been many success stories.

“Competition is all over the place. But that’s great for the merchant. The more options that merchants have, the more we can enforce best practices and more competitive rates. And the more we can keep the government from impeding people from getting into this space, the better off small businesses are going to be,” said Gans.

Setting the Record Straight

The CFC was formed with the mindset that the organization, which is currently comprised of CEOs of small- and medium-sized funders, would take a proactive rather than a reactive approach to industry regulation. In its two-year history the CFC has tasked itself not only with educating policymakers on the role of MCA funders for small businesses but also with undoing the misinformation and misconception surrounding the anatomy of an MCA.

“Unfortunately, because MCA uses the term cash advance in its product name, uninformed people will often confuse MCA as some form of payday lending. And so that has been one of our biggest challenges, educating members of congress and committees that there is absolutely no correlation between MCA products and what their views of consumer payday loans is,” said Gans, adding that the CFC has had to communicate that MCA is a version of factoring has been around for more than 1,000 years.

A common thread that the CFC has been able to weave with lawmakers has been the diverse geographical representation of both the trade group and the House and Senate.

“Most venture capital is deployed in a few spots – New York, California and Texas – and it’s a cliff to get to those three states. So, one nice thing that I take pride in is my members are looking all around the country regardless of the geographic location. That helps us with policymakers, most of whom are not from the New York City metropolitan area or Silicon Valley. It’s nice being able to look at them in the eye and tell them we care just as much about your district as you do,” he said.

The Road Ahead

The CFC has an ambitious long-term agenda, one that includes raising their profile in the industry and participating in events.

“I think one of the ambitions we have is to have an organization where funders and brokers can be at the same table and work though some of the issues impacting the industry and try to make sure people are doing things in the right and best way.”

The trade group is planning to partner up with AltFinanceDaily for Broker Fair 2018 and they’re looking to bolster membership.

“The industry has had a lot of free riders that are benefiting from our advocacy efforts but not supporting it. So, from my perspective, if you’re in this industry, particularly in the MCA space, we’d like to expand membership. If we grow our membership, we can do more things, engage more states and expand our lobbying team,” said Gans. “The more members we have, the more we can do to advance the ball and protect the interests of the industry.”

The CFC will need all the help it can muster given the fight ahead to fend off regulation particularly in Washington, Albany and Sacramento. “I think we could see some harmful regulations and potentially legislation over time. Some of those bad ideas that emanate in states have a tendency to percolate into Washington. If at some point there is a less business-friendly administration in the future, we could see all those ideas get some traction at the federal level,” Gans warned.