Kabbage Re-enters Small Business Funding Arena

December 8, 2021 When Kabbage stopped lending in the Spring of 2020, many assumed they would pick up where they left off when they were acquired by American Express. Not quite. Since the deal in August 2020, Kabbage had been repurposed as a checking account service.

When Kabbage stopped lending in the Spring of 2020, many assumed they would pick up where they left off when they were acquired by American Express. Not quite. Since the deal in August 2020, Kabbage had been repurposed as a checking account service.

On Wednesday, however, Kabbage finally announced a return to funding.

“Kabbage from American Express today launched Kabbage Funding™, offering eligible small businesses flexible lines of credit between $1,000 and $150,000—now with the powerful backing of American Express. With Kabbage Funding, small businesses can apply in minutes to access working capital 24/7 to help manage their company’s cash flow.”

The only strange thing about it is the marketing that makes it sound as if Kabbage had never actually been in the funding business until just now.

Kabbage had been one of the largest online small business lenders in the country in 2019, generating approximately $2.7 billion in loan originations. At the time, it was more than Square, OnDeck, ClearCo, Funding Circle, Amazon, and Shopify.

Square Loans Originated $594M in Business Funding in Q3

November 5, 2021 Square Loans, formerly known as Square Capital, originated $594M in small business funding in Q3, bringing the company to $1.6B originated YTD. Square had already been recognized among the largest small business lenders this year so far.

Square Loans, formerly known as Square Capital, originated $594M in small business funding in Q3, bringing the company to $1.6B originated YTD. Square had already been recognized among the largest small business lenders this year so far.

The Q3 figure boils down to 83,000 individual loans.

Overall, Square Loans was mentioned very little in the company’s quarterly earnings call. Company CEO Jack Dorsey said “…there’s still a lot of opportunity for us to open more of our products in more of the markets that we’re already in, such as Square Loans in more of the places that we already exist.”

The coming of Hyperinflation, a prediction made by Dorsey on Twitter just weeks prior, went completely unmentioned in Square’s official reports.

On October 22, he tweeted, “Hyperinflation is going to change everything. It’s happening.”

Miami May Become the New Small Business Funding Hub

September 22, 2021 At least two funding companies have told AltFinanceDaily off the record that they plan on opening offices in the Miami area in the new year.

At least two funding companies have told AltFinanceDaily off the record that they plan on opening offices in the Miami area in the new year.

It seems that South Florida, particularly Miami, is where the small business finance industry may be moving for a fresh start, and with that potentially ditching the suit and tie for flip flops and shades in the process. The social, political, and economical elements of South Florida make it a well-suited landing spot for an industry that is looking to evolve with the shifting environment.

One catalyst to the potential industry-wide migration could be the S5470B regulations that go into effect in New York on January 1. The new law will require funding companies to navigate a complex system of disclosure to any interested small business finance prospect.

There are other benefits to Florida, of course.

Jordan Fein, CEO of Greenbox Capital, whose operated his business out of Miami since 2012, prides his choice of locale on all the factors that are seemingly pushing those in New York down south. “We do not have state and city tax, we are near water and have a better lifestyle than most companies in New York, or in other areas where it gets very cold in the winter,” he said.

Fein stressed the relaxing Miami lifestyle as the reason why he has only called South Florida home to his company. “The lifestyle here is second to none. Being near the ocean, it makes it much more enjoyable to be able to go to the beach or on a boat to relax and take a load off from the busy work week. New York and other large cities seem to add more stress from [New York’s] super-fast-paced style.”

Despite his love for Miami, Fein respects New York’s ability to churn out top tier employees in the industry. “The talent pool is still among the best,” Fein said, when asked if there were any reasons he or others would ever consider maintaining a connection with the area should an exodus occur.

Fein isn’t worried about the incoming competition should offices relocate to his area. “Location of a funding company has no bearing on competition,” he said. “We all do business over the internet and the competition of funding is dependent on new companies entering the space, not on their location.”

If it is true that the industry is moving to a fully digital competitive space, the idea of a warm weather city with great tax benefits, comparatively low costs of living, and a low-stress atmosphere may be a no-brainer when it comes to finding the funding industry a much needed new home. Not to mention, the mayor of Miami also really wants small business finance companies to relocate there.

In a taped episode of AltFinanceDaily TV, Miami Mayor Francis Suarez told reporter Johny Fernandez that he really wants small business lenders and MCA companies to set up shop in his city.

Watch: Miami Mayor Francis Suarez talks with AltFinanceDaily in March 2021“We definitely want to make sure that small business, merchants, and lenders are able to capitalize small businesses in our community,” he said. “Miami’s a very thriving small business community. One of the things that people have criticized us for is we don’t have those big massive companies. We’re actually really built on small businesses. So for us, having fluidity of capital, liquidity of capital, access to capital are enormous things in terms of scaling. And I think that’s one of the things that we’re seeing change now is because of technologies. We’re getting a tremendous amount of access to capital that we weren’t getting before.”

Stacey Huddleston Joins Seacoast Business Funding

August 17, 2021 Boynton Beach, FL – August 16, 2021 – Seacoast Business Funding is pleased to announce the addition of Stacey Huddleston as Vice President, Business Development Officer. Mr. Huddleston is based in the Midwest and will focus on expanding the Seacoast portfolio in the region. He brings over twenty years of expertise in the financial and alternative lending space providing creative solutions for businesses with complex financial needs.

Boynton Beach, FL – August 16, 2021 – Seacoast Business Funding is pleased to announce the addition of Stacey Huddleston as Vice President, Business Development Officer. Mr. Huddleston is based in the Midwest and will focus on expanding the Seacoast portfolio in the region. He brings over twenty years of expertise in the financial and alternative lending space providing creative solutions for businesses with complex financial needs.

Seacoast is focused on driving growth and cultivating client relationships to meet the increasing financial needs of businesses throughout their lifecycles. I am confident Stacey’s extensive industry knowledge and relationship-driven approach will drive growth and strengthen our presence across the Midwest region. He will make a welcomed addition to the team,” remarked, Jay Atkins, President of Seacoast Business Funding.

Huddleston is a US Army Veteran who holds a bachelor’s degree from Illinois State University and an MBA from Baker University. He has held many distinguished positions throughout his career dedicated to providing businesses with financing to meet their strategic goals. “I am pleased to be joining Seacoast Business Funding. Their focus on ensuring businesses receive the right custom funding solutions is what sets them apart. The opportunity to be part of such an experienced and client-focused team is exciting, and I look forward to driving successful growth for Seacoast in the Midwest,” commented Huddleston. Mr. Huddleston is a member of the SF Net, International Factoring Association, and Association for Corporate Growth. For deal inquiries, Stacey may be contacted by email at stacey.huddleston@seacoastbf.com or by phone at 816-372-5223.

About Seacoast Business Funding

Seacoast Business Funding provides customized and timely working capital financing solutions to small and middle-market companies engaged mainly in business services, distribution, manufacturing and staffing with annual sales ranging from $1 million to $200 Million. Credit facilities are in the form of Factoring, Invoice Purchasing or Asset-Based agreements. Seacoast Business Funding is a Division of Seacoast National Bank. Member FDIC. For more information visit SeacoastBusinessFunding.com.

###

Funding E-Commerce Businesses Helped This Startup Get Acquired Right After They Launched

June 23, 2021 Less than eight months after Yardline announced their launch in the e-commerce financing space, they were acquired by Thrasio. The blazing fast progression from launching to selling the company suggests that Yardline’s niche presents a unique opportunity.

Less than eight months after Yardline announced their launch in the e-commerce financing space, they were acquired by Thrasio. The blazing fast progression from launching to selling the company suggests that Yardline’s niche presents a unique opportunity.

“There are many companies out there that look at e-commerce businesses in the space and say, ‘there’s no barrier for entry to operate in e-commerce, they’re all drop shippers, it’s a hobby, they have no skin in the game,'” said Seth Broman, Chief Revenue Officer of Yardline. “What Yardline does is really unique: One, we obviously have a lot more information and understanding of how they operate their business, and we can really break down on a deal by deal basis, what their margins look like, to get them a more customized offering that meets their needs.”

Yardline will fund Amazon sellers, for example.

Broman said that while most MCA funders know how to look at a merchant’s fixed costs like rent, payroll, taxes, and inventory to provide funding based on a gross revenue, those same funders don’t have a risk tolerance for e-commerce.

Yardline pulls data from digital marketplaces like Amazon and online storefront platforms like Shopify to make better credit decisions, Broman said, and this was a banner year for digital shopping.

“During COVID, you were seeing such an increase of demand for e-commerce goods; Amazon, Shopify, if you look at their stock price over the last 15 months, it’s incredible,” he said. “And the reason being retails closed, everybody’s shopping from home, and the demand for all my goods is through the roof.”

Before everyone was stuck inside, e-commerce already made up 20% of consumer commerce, Broman estimated. Then everything was online-only, and demand became nearly unlimited, he said. Amazon’s third-party sellers transact 60% of all products sold on the site, and Thrasio is one of the largest consolidators of those sellers in the world, Broman said.

Now, Yardline will have access to Thrasio’s international seller network.

Now, Yardline will have access to Thrasio’s international seller network.

“We’re confident in saying that untapped ecosystem can be very profitable for ISOs if they were to start focusing on e-commerce businesses,” Broman said. “There’s less demand for it, less competition, and now they have a home for where they can get these deals done.”

Broman said after the pandemic, typical brick and mortar stores were hit hard and required PPP to keep the doors open while e-commerce flourished.

“It’s not a matter if shopping online is the future; shopping online is the present. People will continue to shop at brick and mortar, people want to eat out, just look at New York City,” Broman said. “If you look at what Amazon offers, what Walmart’s doing, what Target’s doing, what these online marketplaces are doing to make commerce quicker and easier, there’s no doubt that it’s going to continue to grow.”

Tune In Tuesday at 10:30 AM EST: AltFinanceDaily TV Live – With Guests From the Business Funding Industry

March 22, 2021 deBanked is hosting a livestream broadcast tomorrow beginning at 10:30 AM from a venue in Midtown Manhattan with guest speakers from two broker shops and a business funding company. There is no need to register for anything. Anyone can tune in live at deBanked.com/tv to watch it. The broadcast will run for 2.5 hours and end at 1 PM. This is an-person event being broadcast with no Zoom or virtual conversation. The event will also be recorded and made available free.

deBanked is hosting a livestream broadcast tomorrow beginning at 10:30 AM from a venue in Midtown Manhattan with guest speakers from two broker shops and a business funding company. There is no need to register for anything. Anyone can tune in live at deBanked.com/tv to watch it. The broadcast will run for 2.5 hours and end at 1 PM. This is an-person event being broadcast with no Zoom or virtual conversation. The event will also be recorded and made available free.

AltFinanceDaily’s massive in-person conference, Broker Fair, will return to NYC later in the year on December 6th at Convene at Brookfield Place in lower Manhattan.

Forward Financing Reaches $1 Billion in Funding to Underserved Small Business

March 1, 2021Boston-based Fintech Company Expands Main Street’s Access to Capital During Pandemic, Achieves Major Growth Milestone

Boston, Mass., March 1, 2021 – Forward Financing, a financial technology company that provides flexible revenue-based financing to small businesses, today announced that they have provided $1 billion in funding since their inception in 2012. The majority of this funding has gone to underserved small businesses nationwide; those that are unable to obtain financing through traditional sources like banks or the Small Business Administration.

“Nine years ago, we started this company upon the realization that so many small businesses lacked access to working capital,” said Forward Financing co-founder and CEO Justin Bakes. “As we look ahead to our next $1 billion milestone, we will continue to focus on providing best-in-class customer service and on helping our small business customers reach their full potential, no matter what challenges may arise.”

The COVID-19 pandemic has severely impacted the U.S. economy and many small businesses have needed additional financial resources to get by. Despite over $600 billion in loans provided through the Payroll Protection Program, this alone has been insufficient in fulfilling the need for capital. As a result, many small business owners have turned to funders like Forward Financing for support.

Forward Financing is uniquely suited to help small businesses during this economic downturn because it offers financing that is based on revenue, and is not a loan. Therefore, small business customers who may be experiencing a revenue slowdown can reduce their payments proportionately.

“Forward Financing has helped me grow my business and take advantage of opportunities,” a retail business owner recently said. “Their service has been excellent and when COVID hit, they easily and efficiently helped me adjust my payment schedule so I remained current and my business was not interrupted. I will use them again and again in the future!”

Over the past six months, Forward Financing has grown daily funding volume at an average rate of 17% per month as they continue to help small businesses navigate the pandemic economy. In order to help meet rapidly growing demand, they are currently expanding headcount in Boston by 20%.

About Forward Financing

Forward Financing is a Boston-based financial technology company that provides fast, flexible working capital to small businesses nationwide. Their dedicated account representatives and advanced proprietary technology help customers spend less time finding capital and more time growing their business. With a simple, secure online application, business owners can trust that Forward Financing works to get them approvals within minutes, funding within hours, and personalized support when they need it most.

Since 2012, Forward Financing has expanded Main Street’s access to capital by providing over $1 billion in funding to nearly 30,000 small businesses. The company is rated A+ by the Better Business Bureau and ‘Excellent / 4.9 stars’ on Trustpilot.com. Forward Financing was named a Best Place To Work by both

the Boston Business Journal and Built In Boston, and has been named by both Inc. Magazine and the Boston Business Journal as one of Massachusetts’ fastest-growing companies each year since 2017. Forward Financing is committed to helping more small business owners succeed and achieve their full potential. To learn more, visit www.forwardfinancing.com.

Media Contact

Lauren Groccia

lmelaugh@forwardfinancing.com

508-314-3574

###

Over Half of Small Businesses Had Unmet Funding Needs

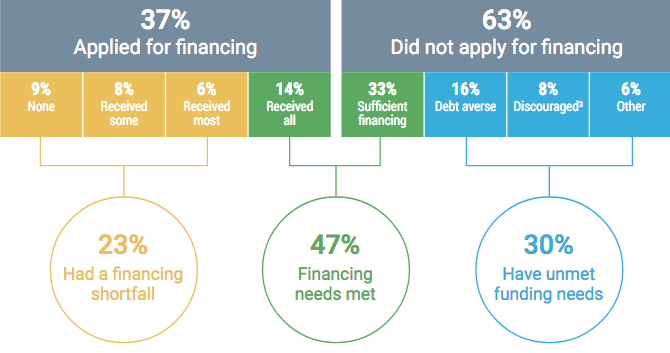

February 8, 2021The Federal Reserve’s analysis of overall funding efforts for all small businesses demonstrates a market of unmet financial needs. In 2020, a total of 47% of firms met their funding needs, while the other half (53%) still needed capital.

23% of firms saw a “financing shortfall.” They were partially approved but still needed more funds. The other 30% have unmet funding needs because they never applied according to the survey- they’re scared of debt, risk-averse, or don’t meet requirements.

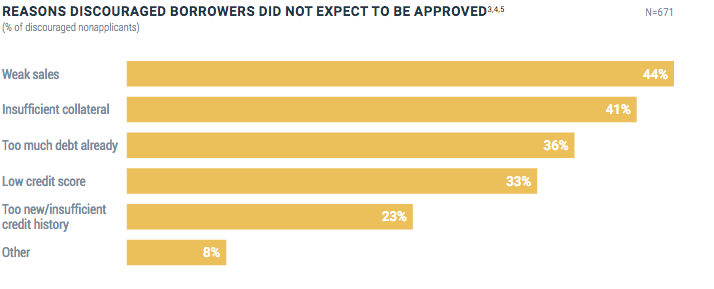

Those that did not apply for funds would have if they were not discouraged by weak sales (44%), insufficient collateral (41%), low credit (33%), and too much debt already (36%).

83% of companies used a bank or small bank as their primary financial service provider, while only 11% said an online lender or fintech was their primary.

Meanwhile, in the funding world, MCAs were only sought by 8% of all funding applicants last year, compared to 89% of firms applying for a loan or line of credit.

Most firms that went for an MCA went with a bank. 85% percent of firms that applied for a loan, credit, or cash advance used a large or small bank. In contrast, only 20% of firms applied to an online lender, falling from 33% since last year.

42% of firms that worked with online lenders or fintech companies were dissatisfied with support during the pandemic. Comparatively, firms that did receive some funding from an online lender were far happier: only 18% were dissatisfied.