Enova Posts Q3 Results, Admits It is Dealing With Regulatory Situation

October 28, 2021 Enova’s Q3 report is very brief and to the point. Through both its consumer loan and business loan operations, the company generated a net income of $52M on $320M in revenue.

Enova’s Q3 report is very brief and to the point. Through both its consumer loan and business loan operations, the company generated a net income of $52M on $320M in revenue.

“We are pleased to again report a strong quarter of growth across all of our businesses,” said David Fisher, Enova’s CEO.

There was no mention of OnDeck by name this time around, its major small business lending division. Instead, Enova was sure to draw attention to a regulatory inquiry it had received from the CFPB.

“The Company has received a Civil Investigative Demand (‘CID’) from the Consumer Financial Protection Bureau (‘CFPB’) concerning certain loan processing issues,” the company stated. “Enova has been cooperating fully with the CFPB by providing data and information in response to the CID. Enova anticipates being able to expeditiously complete the investigation as several of the issues were self-disclosed and the Company has provided, and will continue to provide, restitution to customers who may have been negatively impacted.”

The language is particularly concessive. Whatever happened, they felt the need to self-report it and to provide restitution to customers.

This is likely to be queried in more detail during the company’s earnings call this evening.

Enova Originated $400M in Small Business Loans in Q2

August 3, 2021 Enova, the international lending firm that owns the OnDeck brand, reported Q2 small business loan originations of $400M. That brings the year-to-date figure to $722M, approximately half of the volume OnDeck was producing prior to Covid. (OnDeck’s 2019 originations were $2.475B)

Enova, the international lending firm that owns the OnDeck brand, reported Q2 small business loan originations of $400M. That brings the year-to-date figure to $722M, approximately half of the volume OnDeck was producing prior to Covid. (OnDeck’s 2019 originations were $2.475B)

“OnDeck’s performance continues to exceed our expectations,” said Enova CEO David Fisher during the quarterly earnings call, “and we will easily exceed our forecast of $50 million of annual cost synergies, primarily from eliminated duplicative resources, as well as $15 million in run rate net revenue synergies.”

Cash has also come pouring in.

“…While we originally thought that OnDeck’s legacy portfolio would have very little value, we now expect to receive over $220 million of total cash from the acquired portfolio, net of securitization repayments,” Fisher said. “In fact, we’ve already realized over $100 million from the legacy portfolio.”

Although ISOs (aka brokers) will remain an important part of driving OnDeck’s growth, Enova is happy that OnDeck brings more to the table.

“The good news about OnDeck, is at least they had a direct channel and a pretty good direct channel because of their terrific brand on the small business side, where our small business products had no direct channel,” Fisher said. “It was all through ISOs. So, we gain that capability through OnDeck.”

Enova reported $80M in net income for the quarter on $265M in revenue.

OnDeck Proving to be Extremely Valuable Acquisition for Enova

April 30, 2021 When Enova acquired OnDeck, it thought that the company’s legacy portfolio would have very little value. Now that the dust has settled, it’s become a gold mine. “We now expect to receive over $200 million of total cash from the acquired portfolio, net of securitization repayments,” said Enova CEO David Fisher in the company’s quarterly earnings call.

When Enova acquired OnDeck, it thought that the company’s legacy portfolio would have very little value. Now that the dust has settled, it’s become a gold mine. “We now expect to receive over $200 million of total cash from the acquired portfolio, net of securitization repayments,” said Enova CEO David Fisher in the company’s quarterly earnings call.

Enova reported that small business lending was now more than 50% of their portfolio and that they recorded originations of $322 million in small business funding in Q1.

“From an operational perspective, the integration of OnDeck is largely complete,” Fisher added. “Our three SMB products are working together as a single business, and we are on track to deliver more than the forecasted $50 million of annual cost synergies, primarily from eliminated duplicative resources as well as $15 million in run rate net revenue synergies.”

OnDeck’s lending business has also allowed the company to price a $300 million securitization debt facility, backed by OnDeck term loans and lines of credit.

“We’re pleased to report a record first quarter of profitability, driven by solid credit performance, improving originations, and disciplined expense management,” said Fisher. “We are encouraged by the recent signs of a recovery in demand and believe that our diverse product offerings, nimble machine-learning-powered credit risk management capabilities, and solid balance sheet position us well to profitably accelerate growth as the economy continues to recover.”

LoanMe, Liberty Tax Merger to Take on Intuit, Enova

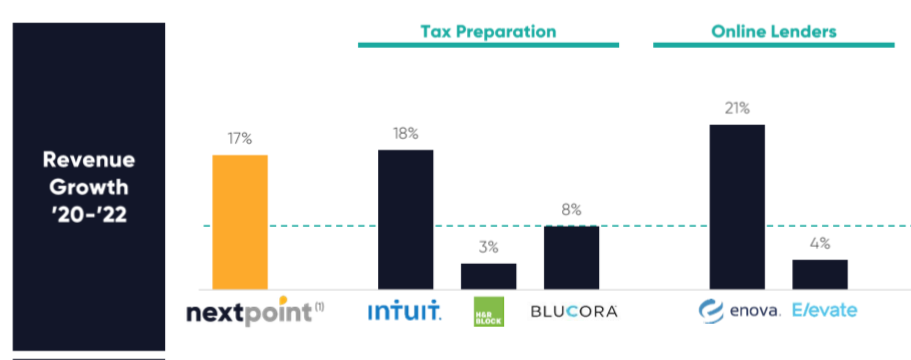

February 22, 2021NextPoint Financial will combine LoanMe’s business, consumer, and mortgage lending with Liberty Tax’s tax preparation business, according to merger announced on Monday. Liberty’s “2,700+ locations in the US and Canada” will become consumer and SMB loan shops.

The new firm will also offer Merchant Cash Advances; LoanMe launched MCA funding in January and expects to fund $15 million in MCAs in 2021. Based on the acquisition prospectus, NextPoint will be a tax readiness firm, with the added suite of financial products as a value and growth builder.

Ramping up consumer, installment, and MCA lending, paired with the third-largest tax-prep business in the U.S, NextPoint expects to compete directly with Intuit, H&R Block, Enova, and Elevate.

Fintech firms are setting themselves apart from the competition as one-stop shops for everything a business needs, including MCA products. Why branch into financial services now? NextPoint found that this year alt lenders have outperformed the S&P500 three times over.

“We are a one-stop financial services destination empowering hardworking and credit-challenged consumers and small businesses,” the investor presentation reads. “To get to the next point in their financial futures.”

Intuit offers a variety of financial products, like business loans through Quickbooks Capital, alongside their popular, 60%+ market share of tax prep software. H&R began offering small $1,000 lines of credit this year, but not much more.

The team leading the new company, NextPoint Financial, will feature execs like Brent Turner as CEO, Mike Piper CFO, both keeping their previous Liberty Tax positions. Jonathan Williams, former president and founding shareholder of LoanMe, will become president of lending.

Enova Pleased With The OnDeck Acquisition, Looking to Divest ODX, OnDeck Canada, OnDeck Australia

February 5, 2021 “We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

“We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

Growing those originations will continue to be their primary agenda as the economy improves, the company said, while the ODX side of the business may be shown the door.

“While ODX has been able to sign some high-profile bank clients, divesting ODX will allow for more efficient use of capital as the business has over 70 employees but less than $10 million in revenue,” Fisher said.

OnDeck Canada and OnDeck Australia may also be on the chopping block.

“The Australian and Canadian businesses are viable businesses in their respective market,” Fisher said, “but are small compared to OnDeck US operations and are unlikely to have a significant impact on Enova’s overall growth. In addition, OnDeck only has partial ownership of those two businesses.”

Meanwile, OnDeck’s portfolio outlook is improving.

“The percentage of OnDeck receivables past due 30 days and more declined during the quarter from 23.2% in closing to 15.6% at December 31,” said Enova CFO Steve Cunningham.

On the call, JMP analyst David Scharf asked when OnDeck would return to quarterly origination levels of $550M to $650M as it had been enjoying prior to the pandemic.

“I mean I think there’s just way too much uncertainty to be able to answer that,” Fisher replied. “I mean, does the vaccine work great and the economy opens up soon or is there a new strain of the COVID virus that requires lockdowns during the summer? I mean, there’s no way to know. But I think there’s a couple trends that are super encouraging for us and we saw great sequential growth as we talked about throughout the call.”

Fisher also added that they’ve seen a bunch of competitors go out of business. “We think we have a lot of share in the market that we don’t think has shrunk and so we think we’re really well positioned as this pandemic winds down,” he said.

Enova Appoints James J. Lee to Chief Accounting Officer

November 30, 2020Enova International announced the appointment of James J Lee to the position of Chief Accounting Officer. The new role went into effect on November 23rd.

Lee was previously the Controller of Life & Health of Kemper Corporation.

OnDeck Originated $148M in Loans in Q3, is Moving Full Speed Ahead Under Enova

October 27, 2020 OnDeck more than doubled its Q2 loan volume, according to statements made on Enova’s latest quarterly earnings call. OnDeck originated $148M in Q3 versus the $66M in originated in Q2.

OnDeck more than doubled its Q2 loan volume, according to statements made on Enova’s latest quarterly earnings call. OnDeck originated $148M in Q3 versus the $66M in originated in Q2.

For frame of reference, this is still down significantly from the $618M that the company originated in Q4 2019, well before covid became a factor.

But expect the numbers to ramp up.

“We have basically all of our marketing channels turned on across consumer and small business [lending],” said David Fisher, Enova’s CEO.

“OnDeck is probably a little bit ahead of where we are on the Enova side. We were a little bit more cautious in our re-acceleration of our lending kind of going into the 3rd quarter but we are totally comfortable with that decision. If the biggest mistake we make during all of covid is waiting an extra 60 days to re-accelerate lending, we think that’s a great position to be in. We think that extra conservatism makes sense and with the rate that we’re re-accelerating lending, it won’t hurt that much in the long run.”

And apparently demand and credit quality are looking quite normal, despite covid, according to Fisher.

“On the small business side, the makeup of the demand is surprisingly similar to a year ago. You would expect so many differences given what the economy has been through but there’s actually very very few. It’s pretty broad based. Credit quality look really really strong. If anything it’s stronger- I think it’s the stronger businesses that are trying to borrow at this point that are trying to lean into covid, not the ones that are just trying to survive so if anything on the demand there is a slight improvement on credit quality in small business.”

OnDeck’s annualized quarterly net charge-off rate for the third quarter was 23% and its 15 day+ delinquency rate decreased from 40% at June 30th to 27% at September 30th.

Enova reported monster quarterly earnings of $94M. CEO David Fisher and CFO Steve Cunningham said it was a record-breaking quarter for profitability.

Enova Posts $94M Profit for Q3

October 27, 2020Enova, the international lending conglomerate that recently acquired OnDeck, reported a Q3 profit of $93.67M, bringing the company to over $147M in profit for the year so far.

“We are pleased to report strong earnings as the credit quality of the portfolio continued to improve during the third quarter,” said David Fisher, Enova’s CEO in an official announcement. “Encouraged by the better than expected portfolio performance and the stable and predictable credit risk seen in our testing, we thoughtfully began reaccelerating lending in the third quarter.”

Speaking about OnDeck, Fisher said that “OnDeck experienced growth in originations, improving credit quality and solid profitability. Our integration plans and recognition of the expected synergies and financial benefits of the transaction remain on track. With the combination of Enova’s and OnDeck’s complementary, market-leading businesses and our extensive experience navigating changes in the operating environment, we believe we are well positioned to grow profitably and drive long-term shareholder value.”