Hillary Clinton Wants to Harness the Potential of “Online Lending Platforms”

August 24, 2016 Presidential candidate Hillary Clinton acknowledged online lending on Tuesday when she published her plan to help small businesses. “Small businesses owners cite insufficient access to capital as a primary inhibitor to starting, growing, and sustaining a small business,” she asserted in a fact sheet posted to her website.

Presidential candidate Hillary Clinton acknowledged online lending on Tuesday when she published her plan to help small businesses. “Small businesses owners cite insufficient access to capital as a primary inhibitor to starting, growing, and sustaining a small business,” she asserted in a fact sheet posted to her website.

To solve that dilemma, she wants to:

- Harness the potential of online lending platforms and work to safeguard against unfair and deceptive lending practices.

- Streamline regulation and cut red tape for community banks and credit unions while defending the new rules on Wall Street.

- Give the SBA administrator the authority to continue providing 7(a) loan guarantees to small businesses if demand is higher than the yearly cap, helping even more small businesses get affordable bank loans.

- Etc.

The WSJ and other media outlets have claimed Clinton’s reference to online lending means “marketplace lending” but that appears to be an exaggeration. The two are not synonymous. One company for example that just secured a $100 million credit facility from Goldman Sachs to make more loans online is not a marketplace, but rather a balance sheet lender that helps banks make loans to their clients.

Hillary Clinton’s plan for small business growth is focused on community banks, the SBA and tax incentives. Fintech and marketplaces were not mentioned. You can read it here.

A Recession Could Turn Marketplace Lending Into The Hunger Games

January 13, 2016 When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

Just last year, OnDeck partnered up with Chase while Fundation partnered up with Regions bank. Dozens of other “lenders” have partnered up in a different way with WebBank, Bank of Internet and Celtic Bank. Marketplace lending platforms that serve as centralized matchmakers have partnered up with hundreds of lenders and merchant cash advance companies. And Wells Fargo has had an arrangement with CAN Capital for what seems like forever.

Bank of America however, has vowed to fight on alone. According to the Wall Street Journal, BoA CEO Brian Moynihan “has no plans to partner with online or alternative lenders in part because of potential dings to its reputation.” Is that decision at their own peril?

While 2015 became the year of alternative lenders gushing about partnerships with banks (and that supposedly being the plan all along), Broadmoor Consulting Managing Principal Todd Baker relegated these alleged disruptors to a lesser status he refers to as “enablers.” Baker posits that OnDeck’s future for example, “may be brighter as a technology provider to banks than as a freestanding finance company subject to the vagaries of economic, credit, liquidity and regulatory cycles.” While perhaps not intentional, he seems to suggest that overtaking banks through technological innovation was unlikely and that alternative lenders are destined to a life of impotence, one that merely “enables” the competitors they were never going to beat.

Somewhere out there in the arena, Baker’s best friend Mike Cagney of SoFi is gearing up to win the 2016 Hunger Games. By openly admitting that banks like Wells Fargo and First Republic are the enemy, Cagney exhibits the ferocity one would expect of a tribute from District 2. SoFi has made nearly $7 billion in loans and wants their borrowers to leave their banks.

Behind the scenes, the Head Gamemaker is threatening to shower the arena with regulations and rising interest rates. While the alternative lending contestants partner up to ensure survival at least until the later rounds, there is potential trouble brewing in and around Panem, another recession. To hear most companies tell it, they would welcome a recession because they believe their models are built to withstand boom and bust cycles. Indeed, the atmosphere at Money2020 was exactly that, that it would be really convenient if the weak could hurry up and die already.

We should however consider that the consequences of a recession may go one step further and tip the scales of lending in a way that the “enablers” almost unwittingly become the new masters few now believe they’re destined to be. The Royal Bank of Scotland chief credit officer for example has already gone on record and told the public to sell bloody everything and prepare for the impending end of the world. 2016 will be a “cataclysmic year,” Andrew Roberts said. Fortune and Forbes have run less harrowing stories in recent days but warned that China, declining oil prices, and market signals indicate a recession could happen this year or the next. Reuters says we’re just facing a little thing called a “profit recession.” But whether these issues are false flags or indications of something more, an environment where credit once again becomes frozen in the traditional banking system could mean a suspension of partnerships between banks and alternative lenders. For alternative lenders that rely entirely on traditional banks for capital to begin with, the end for them will be swift and painful.

For those that don’t, let’s just say there’s a certain long-term advantage to being open for business when everyone else is closed. The merchant cash advance industry for example, which operated in an abyss between 1998 and 2008, suddenly awoke like a sleeping dragon during the Great Recession. In what is now a $7 billion/year industry or a $20 billion/year industry depending on how you define a merchant cash advance, the concept is now widely accepted as an alternative to traditional financing, even if at times criticized.

Foundation Capital’s Charles Moldow believes that “marketplace lending” will be a trillion dollar industry by 2025. “Consumers are fed up,” writes Moldow in his white paper. “Banks are no longer part of their communities. Rates are high for borrowers and not even keeping up with inflation for depositors. During the Great Recession of 2008-2009, when consumers and small businesses needed access to credit more than ever, many banks stopped offering loans and lines of credit.”

71% of Millenials would rather go to their dentist than listen to what banks are saying, according to Viacom’s Scratch. 33% believe they won’t need a bank at all in 5 years.

The presumption is often that banks will prevail in the lending tug-of-war anyway because they are more or less tasked by the federal government to be the arbiters of all lending activity. An economy where consumers and businesses regularly conducted their finances outside the purview of the banking system would be a nightmare scenario for a government that relies on the ability to monitor and control everything. Ergo alternative lenders should partner up with these banks, “enable them” and surrender to a future of impotence in which their only purpose is to serve their masters until perhaps one day the banks replace them with something else.

With alternative lenders still operating unfettered for now, today’s developing regulatory pressure would in all likelihood be traded for support in a recession, even if that support came in the form of willful ignorance.

If Millenials would already rather get a root canal than talk to their bank, then it’s probably not a good time for banks to become even less friendly, as would happen in a recession. The timing of one in the near future is almost to be expected considering how long it’s been since the last one, but the next one could be one of those transformative moments in history in which the world actually comes out looking a little bit different. Make no mistake, today’s alternative lenders are disruptive, they’ve just been playing the game rather safely. Partner up, work together, “enable” if they must, whatever it takes to ensure their survival into the later rounds. From student loans to consumer loans to business loans, 2016’s tributes are a force to be reckoned with.

There was only supposed to be one victor of the 74th hunger games, the banks. And there was always one until one year there were two. They surprisingly weren’t there to serve and enable their master either. The system that always was, was irreversibly disrupted.

The next recession could produce a similar outcome. Partnering with banks now seems like a great idea, but absent an actual merger or acquisition, they should be considered temporary alliances. You know what that means…

To the marketplace lenders and the technologies that power them, happy 2016! And may the odds be ever in your favor.

Join us at the Marketplace Lending and Investing Conference This Week

November 2, 2015The Marketplace Lending & Investing Conference produced by Source Media begins November 4th in New York City. Hosted at the New York Hilton Midtown, attendees are promised an all-star speaker lineup that includes Noah Breslow of OnDeck, Stephen Sheinbaum of Bizfi, Angela Ceresnie of Orchard, Sam Graziano of Fundation, Candace Klein of Dealstruck, Peter Renton of Lend Academy, and many more.

In the meantime, check out this preview podcast between the conference hosts and Sam Granziano, the CEO of Fundation.

Alternative Business Funding’s Decade Club

October 22, 2015 The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

“At that time, the industry was a bunch of cowboys. It was an opportunistic industry of very small players,” says Andy Reiser, chairman and chief executive of Strategic Funding Source Inc., a New York-based alternative funder that’s been in business since 2006. “The industry has gone from this cottage industry to a professionally managed industry.”

Indeed, the alternative funding industry for small businesses has grown by leaps and bounds over the past decade. To put it in perspective, more than $11 billion out of a total $150 billion in profits is at risk to leave the banking system over the next five plus years to marketplace lenders, according to a March research report by Goldman Sachs. The proliferation of non-bank funders has taken such a huge toll on traditional lenders that in his annual letter to shareholders, J.P. Morgan Chase & Co. chief executive officer Jamie Dimon warned that “Silicon Valley is coming” and that online lenders in particular “are very good at reducing the ‘pain points’ in that they can make loans in minutes, which might take banks weeks.”

The burgeoning growth of alternative providers is certainly driving banks to rethink how they do business. But increased competition is also having a profound effect on more seasoned alternative funders as well. One of the latest threats to their livelihood is from fintech companies, like Lendio and Fundera,for example, that are using technology to drive efficiency and gaining market share with small businesses in the process.

“Established lenders who want to effectively compete against the new entrants will need to automate as much decisioning as possible, diversify acquisition sources and ensure sufficient growth capital as a means to capture as much market share as possible over the next 12 to 18 months,” says Kim Anderson, chief executive of Longitude Partners, a Tampa-based strategy consulting firm for specialty finance firms.

Of course, there is truth to the adage that age breeds wisdom. Established players understand the market, have a proven track record and have years of data to back up their underwriting decisions. At the same time, however, experience isn’t the only factor that can ensure a company will continue to thrive over the long haul.

WORKING TOWARD THE FUTURE

Indeed, established players have a strong understanding of what they are up against—that they can’t afford to live in the glory of the past if they want to survive far into the future.

“With every business you have to reinvent yourself all the time. That’s what a successful business is about,” says Reiser of Strategic Funding. “You see so many businesses over the years that didn’t reinvent themselves, and that’s why they’re not around.”

Strategic Funding has gone through a number of changes since Reiser, a former investment banker, founded it with six employees. The company, which has grown to around 165 employees, now has regional offices in Virginia, Washington and Florida and has funded roughly $1 billion in loans and cash advances for small to mid-sized businesses since its inception.

One of the ways Strategic Funding has tried to distinguish itself is through its Colonial Funding Network, which was launched in early 2009. CFN is Strategic Funding’s secure servicing platform which enables other companies who provide merchant cash advances, business loans and factoring to “white label” Strategic Funding’s technology and reporting systems to operate their businesses.

“When you’re in a commodity-driven business, you have to find something to differentiate yourself,” Reiser says.

FINDING WAYS TO BE DIFFERENT

That’s exactly what Stephen Sheinbaum, founder of Bizfi (formerly Merchant Cash and Capital) in New York, has tried to do over the years. When the company was founded in 2005, it was solely a funding business. But over the years, it has grown to around 170 employees and has become multi-faceted, adding a greater amount of technology and a direct sales force. Since inception, the Bizfi family of companies has originated more than $1.2 billion in funding to about 24,000 business owners.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Sheinbaum credits newer entrants for continually coming up with new technology that’s better and faster and keeping more established funders on their toes.

“If you don’t adapt, you die,” he says. “Change is the one constant that you face as a business owner.”

David Goldin, chief executive of Capify, a New York-based funder, has a similar outlook, noting that the moment his company comes out with a new idea, it has to come up with another one. “If you’re not constantly innovating you’re in trouble,” he says. “It’s a 24/7 global job.”

Capify, which was known as AmeriMerchant until July, was founded by Goldin in 2002 as a credit card processing ISO. In 2003, the company began focusing all of its efforts on merchant cash advances. Four years later, the company made its first international foray by opening an office in Toronto. The company continued to expand its international presence by opening up offices in the United Kingdom and Australia in 2008. The company now has more than 200 employees globally and hopes to be around 300 or more in the next 12 months, Goldin says. The company has funded about $500 million in business loans and MCAs to date, adjusted for currency rates.

THE CULTURE OF CHANGE

Five or six years ago, Capify’s main competitors were other MCA companies. Now the competition primarily comes from fintech players, and to keep pace Capify has made certain changes in the way it operates. From a human resources standpoint, for instance, Capify switched from business casual attire to casual dress in the office. The company has also been doing more employee-bonding events to make sure morale remains high as new people join the ranks. “We’ve been in hyper-growth mode,” he says.

CAN Capital in New York, another player in the alternative small business finance space with many years of experience under its belt, has also grown significantly (and changed its name several times) since its inception in 1998. The company which began with a handful of employees now has about 450 and has offices in NYC, Georgia, Salt Lake City and Costa Rica. For the first 13 years, the company focused mostly on MCA. Now its business loan product accounts for a larger chunk of its origination dollars.

This year, the company reached the significant milestone of providing small businesses with access to more than $5 billion of working capital, more than any other company in the space. To date, CAN Capital has facilitated the funding of more than 160,000 small businesses in more than 540 unique industries.

Throughout its metamorphosis to what it is today, the company has put into place more formalized processes and procedures. At the same time, the company has tried very hard to maintain its entrepreneurial spirit, says Daniel DeMeo, chief executive of CAN Capital.

One of the challenges established companies face as they grow is to not become so rule-driven that they lose their ability to be flexible. After all, you still need to take calculated risk in order to realize your full potential, he explains. “It’s about accepting failure and stretching and testing enough that there are more wins than there are losses,” says DeMeo who joined the company in March 2010.

ADVICE FOR NEWCOMERS

As the industry continues to grow and new alternative funders enter the marketplace, experience provides a comfort level for many established players.

“The benefit we have that newcomers don’t have is 10 years of data and an understanding of what works and what doesn’t work,” says Reiser of Strategic Funding. With the benefit of experience, Reiser says his company is in a better position to make smarter underwriting decisions. “There are many industries we funded years back that we wouldn’t touch today for a variety of reasons,” he says.

Experienced players like to see themselves as role models for new entrants and say newcomers can learn a lot from their collective experiences, both good and bad. Noting the power of hindsight, Reiser of Strategic Funding strongly advises newcomers to look at what made others in the business successful and internalize these best practices.

One of the dangers he sees is with new companies who think their technology is the key to long-term survival. “Technology alone won’t do it because that too will become a commodity in time,” he says.

Over the years Strategic Funding has learned that as important as technology is, the human touch is also a crucial element in the underwriting process. For example, the last but critical step of the underwriting process at Strategic Funding is a recorded funding call. All of the data may point to the idea that a particular would-be borrower should be financed. But on the call, Strategic Funding’s underwriting team may get a bad vibe and therefore decide not to go forward.

“We look at the data as a tool to help us make decisions. But it’s not the absolute answer,” Reiser says. “We are a combination of human insight and technology. I think in business you need human insight.”

Seasoned alternative funding companies also say that newbies need to implement strong underwritingcontrols that will enable them to weather both up and down markets.

The vast majority of newcomers have never experienced a downturn like the 2008 Financial Crisis, which is where seasoned alternative financing companies say they have a leg up. Until you’ve lived through down cycles, you’re not as focused as protecting against the next one, notes Sheinbaum of Bizfi. “Every 10 years or 15 years or so, there seems to be a systemic crisis. It passes. You just have to be ready for it,” he says.

Goldin of Capify believes that many of today’s start-ups don’t understand underwriting and are throwing money at every business that comes their way instead of taking a more cautious approach. As a funder that has lived through a down market cycle, he’s more circumspect about long-term risk.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

Having a solid capital base is also a key to long-term success, according to veteran funders. Many of the upstarts don’t have an established track record and need to raise equity capital just to stay afloat—an obstacle many long-time funders have already overcome.

Goldin of Capify believes that over time consolidation will swallow up many of the newbies who don’t have a good handle on their business. Hethinks these companies will eventually be shuttered by margin compression and defaults. “It can’t last like this forever,” he says.

In the meantime, competition for small business customers continues to be fierce, which in turn helps keep seasoned players focused on being at the top of their game. Getting too comfortable or complacent isn’t the answer, notes DeMeo of CAN Capital. Instead, established funders should seek to better understand the competition and hopefully surpass it. “Competition should make you stronger if you react to it properly,” he says.

Manual Underwriting Still Dominates in Tech-based Lending Environment

July 21, 2015For all the talk that technology is changing the way people lend and borrow, the commercial side appears stubbornly reluctant to relinquish control to algorithms. At the AltLend conference in NYC, business lenders and merchant cash advance companies alike were mostly united on the idea that somebody needs to be double checking the computers.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

Like most of the others that spoke on the topic, Schaefer was in favor of a scoring model and he believes an automated underwriting system creates consistency when assessing risk. He was steadfast in his assertion though that humans had to be the last line of defense in fraud detection.

“We’ve got guarantors that have nothing to do with the business,” he said, offering an example of an applicant that was more than 80-years old, yet was passing themselves off as a hands-on construction worker.

“I’m still a big believer in the review and subjectivity,” he concluded.

Funding Circle’s Rana Mookherje expressed similar views. “[Humans] pick up things that an algorithm really can’t do,” he told the crowd.

“We have an experienced underwriter sitting there and calling every borrower that we give money to,” he added.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

“If you need money in an hour, we’re not the right place for you,” Mookherje stated.

Funding Circle’s reliance on manual reviews may have to do with the loan terms being extended so long. Even Schaefer had said earlier, “I think it’s a lot easier to determine the behavior of a loan that’s less than twelve months as opposed to one that’s sixty months.”

But do other companies feel differently? Kabbage’s Alan Reeves said that 95% of their customers are 100% automated since there are merchants who get stuck trying to connect their bank account in the online application process.

When Kabbage was asked over a year ago how much of a role computers should play in the underwriting of a deal, COO Kathryn Petralia responded, “Huge.” She also went on to say then that, “it is not going to be like the “Matrix” where machines are making all the decisions. You won’t see an underwriting world without humans.”

It’s ironic however that while Alan Reeves was introduced at the conference as the Head of Risk Analytics, both the printed agenda and his LinkedIn profile cite his title as being the Head of Manual Underwriting. It’s a telling title for a company that is often heralded as the pinnacle of automation and computational decisioning.

But why can’t lenders simply give in entirely to the machines? Mookherje said at one point that, “those that live and die by their underwriting are going to be the ones that survive.” And if that’s the case, then relinquishing control to the computers perhaps risks the chance of death if things don’t work properly.

But humans, with all their natural flaws and imperfections pose the same risk. “Banks want to know that underwriting is consistent, that for any given customer, that you would underwrite them the same,” said Sam Graziano, CEO of Fundation. “And it’s not just having written policies and procedures,” he added. “But having programs in place to ensure these policies are upheld.”

The widespread dependence on humans to tie up loose ends in assessing risk may seem both practical and prudent, but to some traditional bankers, that system carries nightmarish implications.

Jim Salters, CEO of The Business Backer for example shared an experience his company went through years ago when trying to partner with a bank. Salters placed a high value on the manual review process, explaining that it was basically a strength of their core competency. The problem however, was that the bank said that would totally freak out their regulators.

The recurring message from the event’s panelists was that banks not only want, but may actually require a firm credit model to make decisions. They need to be able to explain to regulators why some loans got approved and others got declined in a perfectly uniform and consistent manner.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

But building an automated system and telling the humans to take a hike isn’t an easy process. There’s a high upfront cost associated with development and it can take years to generate statistically relevant conclusions. And a multivariate decline issued by an algorithm can potentially worsen the customer experience, especially if the customer asks for the specific reason they were declined. Reeves said it can be difficult to explain to the customer that their FICO score was too low relative to their sales volume but that their FICO score on its own was good enough.

And yet once an automated underwriting system is developed, the cost of underwriting should drop significantly according to panelists. With that comes a decision consistency that the company can rely on and a system that bankers can get comfortable with.

But despite it all, Credit Junction CEO Michael Finklestein bluntly stated, “We’re never going to approve a $2 million loan with an algorithm.”

The unifying concept that everyone seemed to agree on was that although credit models were undeniably important, human review would remain a complementary part of the process for the foreseeable future at least in the commercial finance space.

“At the end of the day, it all comes down to underwriting,” said Mookherjee.

Is Alternative Lending An Illusion? (LendIt 2015 Summary)

April 18, 2015More than 2,400 people packed into the LendIt conference last week in New York City and everywhere you turned, startups were boasting of their ability to lend billions of dollars to underserved consumers and businesses. Companies not even old enough to have attended last year’s LendIt conference had reportedly lent tens of millions or hundreds of millions of dollars already. Is it all an illusion?

Investors circled like hawks to try and grab an opportunity into this exploding market. Alternative lenders were practically being tackled by VCs, Private Equity firms, and specialty finance lenders:

Technological innovation is disrupting the status quo, attendees echoed. Surely banks can afford to develop new technology to compete, so why haven’t they? Lendio’s Brock Blake wasn’t afraid to challenge the Short Term Business Lending Panel on this. “Is there real innovation happening or is there regulatory arbitrage?” he asked.

The panelists mostly agreed that it was a combination of both. Stephen Sheinbaum, founder of Merchant Cash and Capital (MCC) and BizFi, said “regulation is not something that scares us in any way.” That’s not surprising considering MCC has survived more than ten years in business and fellow panelist CAN Capital has survived more than seventeen.

But for the newer players entirely reliant on third party brokers or dependent on a Reg D exemption to issue securities, their success may indeed be regulatory arbitrage. And time is on their side.

Karen Mills, the former head of the Small Business Administration asked several regulatory bodies who would stand up to oversee small business lending. “No one stood up,” she said.

It’s the brokers that worry some folks most, an issue that PayPal and Square Capital do not have to contend with at all. OnDeck CEO Noah Breslow stated, “there is always going to be a set of customers that want to shop and want to have help.”

Kabbage’s Kathryn Petralia explained that only 2% of their business comes from brokers and their fees are capped at 4%. CAN Capital’s Jason Rockman argued that it’s about working with brokers that share their values. MCC’s Sheinbaum said, “you have to be willing to not do business with some of the unscrupulous players out there.”

But while these industry captains minimized the role that brokers play, 2015 is already being dubbed the Year of the Broker.

The regulatory environment isn’t the only issue to be worried about, skeptics argued. There was cautious alarm about the market’s viability when interest rates rise or the economy takes a turn for the worse.

“I think there’s going to be a shakeout,” said Steve Allocca of PayPal. MCC’s Sheinbaum explained that when he sees other funders doing deals that don’t appear to make sense, to not feel pressured to do them as well. “Stick to your disciplines. Stick to your guns,” he preached.

Fundation CEO Sam Graziano argued that small business lending is already very risky. The lifetime default rate on 7(a) SBA Loans is 20%, he said. Graziano, who hates the term alternative lending prefers to refer to the industry as digitally enabled lending.

And digitally enabling is something that OnDeck has focused on. In Breslow’s presentation, he said that applying offline for a loan takes 33 hours of work on average. Banks are shuttering branches at a record rate, he added.

Banks are dead, said many in attendance. Kathryn Petralia of Kabbage disagreed. “The death of banks has been greatly exaggerated,” she argued on a panel.

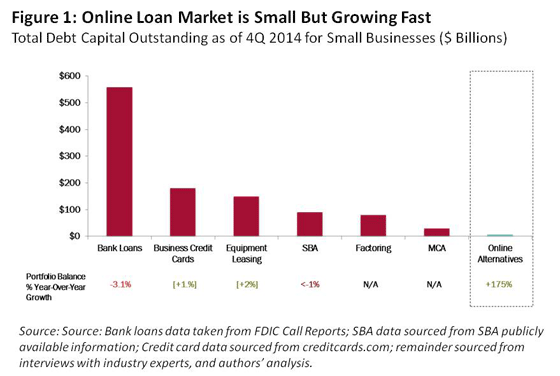

Indeed, Mills’ report shows that total outstanding debt on business loans by banks dwarfs the alternatives by more than 50 to 1.

But former U.S. Treasury Secretary Larry Summers is convinced the tide is turning.”The conventional financial sector has, in important respects, let all of its main constituents down over the last generation, and technology-based businesses have the opportunity to transform finance over the next generation,” he said during the keynote speech.

With conference sessions looking and feeling like a cramped NYC subway during rush hour, the popularity of alternative lending is no illusion.

But healthy skepticism is at least creeping in while the industry marches forward. Changes in regulations, interest rates, and economic activity will separate those simply riding a wave from those that have created something real. Expect companies that exhibited at this year’s conference to be gone by 2016 or 2017, said several panelists.

The final count of LendIt attendees was 2,493 people. 150 people who tried to register at the last minute were turned away. More are expected to attend next year.

Objectively, alternative lending appears to be very real.