Following Nine Lawsuits, OnDeck Discloses Supplementary Details Behind Planned Enova Merger

September 28, 2020

After OnDeck announced its planned merger with Enova, it was sued nine different times (See here and here) by shareholders that accused the company’s Board of Directors that they had failed to disclose material information about the deal.

OnDeck formally responded on Monday, September 28th, wherein they disclosed that plaintiffs in all of those actions had agreed to dismiss their claims in light of the release of this supplemental information:

The Company and Enova believe that the claims asserted in the Actions are without merit and that no supplemental disclosures are required under applicable law. However, in an effort to put the claims that were or could have been asserted to rest, to avoid nuisance, minimize costs and avoid potential transaction delays, and without admitting any liability or wrongdoing, the Company has determined to voluntarily supplement the Proxy Statement/Prospectus as described in this Current Report on Form 8-K to address claims asserted in the Actions, and the plaintiffs in the Actions have agreed to voluntarily dismiss the Actions in light of, among other things, this supplemental disclosure. Nothing in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality of any of the disclosures set forth herein. To the contrary, the Company and the other defendants specifically deny all allegations in the Actions that any additional disclosure was or is required and expressly maintain that, to the extent applicable, they have complied with their respective legal obligations.

OnDeck first re-explained its background situation leading up to the Enova deal:

Starting in April 2020, OnDeck management commenced a review of potential financing options to secure additional liquidity and potentially replace the Corporate Line Facility and began contacting potential sources of alternative financing, including mezzanine debt. OnDeck contacted, or was contacted by, more than ten potential sources of mezzanine or alternative financing, and received pricing indications from four sources. The interest rates offered by those alternative financing sources ranged from 1-month LIBOR plus 900 basis points to 1,700 basis points (in addition to an upfront fee) and all but one required a significantly dilutive equity component. The one proposal that did not include an equity component was at an interest rate of 1-month LIBOR plus 1,400 basis points to 1,700 basis points. Based on the initial term sheets proposed, OnDeck engaged in negotiations with each of the four potential sources of alternative financing. As these negotiations progressed and COVID-19’s impact on the macro economy and OnDeck’s loan portfolio intensified, two of the four potential sources of alternative financing ceased to actively participate in negotiations. Discussions with the final two potential sources of alternative financing remained ongoing through the time that OnDeck and Enova entered into the merger agreement. Throughout the Process, OnDeck management reported the status of such negotiations on a frequent and ongoing basis to the OnDeck Board for its deliberation in the context of OnDeck’s standalone plan, and the OnDeck Board considered the significant uncertainty of being able to reach agreement on alternative financing in its decision to enter into the merger agreement.

Of particular contention in the deal were OnDeck’s financial projections, prepared to estimate OnDeck’s trajectory as an independent entity. Shareholders complained that there were two sets of books and that they only got to see one. The other set, dubbed Scenario 1, had been used to shop OnDeck around to other suitors. OnDeck published both sets in their supplemental materials on Monday.

The difference is stark. Originally disclosed to shareholders was a projected cumulative net loss of $20.4 million through the end of 2024. The other set of projections, Scenario 1, state a cumulative net income of $33.5 million over the same time period, a difference of over $50 million.

The original predicted a 2021 net loss of $19.4 million while Scenario 1 predicted a net income of $14.3 million.

One reason offered for selecting the less optimistic of the two is that OnDeck’s management determined that loan originations were trending below both sets of projections as of July 12th. OnDeck announced the Enova deal about two weeks later.

Shareholders will cast their votes on the merger on October 7th. OnDeck’s Board “unanimously recommends” that they vote in favor of the proposed merger with Enova.

How An Online Lending Hedge Fund Manager Became “Unwound”

August 12, 2020 In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

I first encountered Ross in 2014 on the alternative finance conference circuit. Ross’s major theory was that small businesses overpay for credit and that the padded cost served as a hedge against defaults and economic downturns.

“The asset class works even when the collection process doesn’t,” Ross said during a Short Term Business Lending panel at a conference in May 2014. “The model works with no legal recovery.”

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

Ross stressed that his fund invested in the underlying loans of online lenders, not in the online lenders themselves. “I need to be the owner of the loan. I need it sold to me in a way that is completely clean.”

Ross would eventually connect with Senturia at Dealstruck, an online small business lender whose philosophy seemed to contradict Ross’s mantra of small businesses overpaying for credit. Dealstruck, it would turn out, had a tendency to have them underpay…

Senturia told the New York Times that year that Dealstruck’s mission was “not about disintermediating the banks but the very high-yield lenders.”

It’s a concept that failed pretty miserably. Senturia recalled in his book that “We had taken to the time-honored Silicon Valley tradition of not making money. Fintech lenders had made a bad habit of covering out-of-pocket costs, waiving fees, and reducing prices to uphold the perception that borrowers loved owing money to us, but hated owing money to our predecessors.”

As the loans underperformed, Senturia became aware that the hedge fund backing them, Ross’s Direct Lending Investments, might also be doomed. Senturia recalled an exchange with Ross in 2016 in which Ross allegedly said of their mutually assured destruction, “I am like, literally staring over the edge. My life is over.”

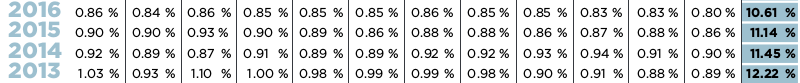

One would expect that in light of that conversation being made public through a book, that investors would question Ross’s report that his fund delivered a double digit annual return (10.61%) the same year his life was over.

Some actually did question it. AltFinanceDaily received tidbits of information in the ensuing years, always seemingly off the record, that something was not right at Ross’s fund. There was little to go off other than the unlikelihood of his consistently stable stellar returns. Ross had been an especially popular investment manager with the peer-to-peer lending crowd and a regular face and speaker at fintech events. CNBC also had him on their network several times as a featured expert.

All told, Ross managed to amass nearly $1 billion worth of capital under management before his demise.

In 2019, Ross suddenly resigned. His fund, Direct Lending Investments, LLC, was then charged by the SEC with running a “multi-year fraud that resulted in approximately $11 million in over-charges of management and performance fees to its private funds, as well as the inflation of the private funds’ returns.”

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

The SEC simultaneously filed civil charges against him.

No reference is made to Dealstruck in any of it. The Dealstruck brand was later sold to another company that has no connection to Ross or Senturia where it is still in use to this day. Instead, the SEC and US Attorney focus on Ross’s actions allegedly undertaken with another online lender named Quarterspot. Quartersport stopped originating loans in January of this year.

Ross allegedly directed the online lender to make “rebate” payments on more than 1,000 delinquent loans to create the impression that they were current. Quarterspot has not been accused of any civil or criminal wrongdoing.

The SEC included in its complaint that Ross expressed concern about the scale of loan delinquencies.

“…more loans are going late each month than I can afford and still have normal returns, so that the can we are kicking down the road is growing in size,” he wrote in an email. It was dated February 8, 2015.

It’s a sentiment that seems to disprove his early premise that “the asset class works even when the collection process doesn’t.”

Ross is innocent until proven guilty, but an excerpt of an interview with him in 2014 is now somewhat ironic.

“I [understand] that people end up sometimes in the [industry] who have had colorful careers in the securities space. It doesn’t make it impossible for me to work with them,” he said. “But if they had been in the big house for white collar crime, then that is probably a non-starter.”

Will Online Lenders Be Approved to Make PPP Loans?

March 31, 2020 Lend Academy, the publishing arm of LenditFintech, ran the headline yesterday that said “Fintechs Authorized to Make Small Business Loans as Part of Government Stimulus.” The statement seems to stem from a quote by Treasury Secretary Steve Mnuchin in which he said that “Any FDIC bank, any credit union, any fintech lender will be authorized to make these loans to a small business subject to certain approvals.”

Lend Academy, the publishing arm of LenditFintech, ran the headline yesterday that said “Fintechs Authorized to Make Small Business Loans as Part of Government Stimulus.” The statement seems to stem from a quote by Treasury Secretary Steve Mnuchin in which he said that “Any FDIC bank, any credit union, any fintech lender will be authorized to make these loans to a small business subject to certain approvals.”

That proclamation is not quite definitive, but online lenders like Kabbage are optimistic that such an arrangement will come to fruition. Kabbage CEO Rob Frohwein said on LinkedIn that he believes his company will be approved to make Payroll Protection Program (PPP) loans on behalf of the SBA, though he further explained that they are also partnering with banks so that they’ll be able to help small businesses in this regard either way.

Time is running out as retailers begin furloughing or laying off employees that the stimulus was designed to keep.

“The PPP is designed to provide a direct incentive for small businesses to keep their workers on payroll by providing each small business a loan up to $10 million for payroll and certain other expenses,” the SBA’s website says. “If all employees are kept on payroll for eight weeks, SBA will forgive the portion of the loans used for payroll, rent, mortgage interest, or utilities. Up to 100 percent of the loan is forgivable.”

As the clock ticks and workers around the country lose their jobs, the pressure on the federal government to approve some limited number of online lenders to assist in the process potentially increases.

Nearly two dozen fintech companies are collectively lobbying to particpate in that effort including Kabbage, OnDeck, and Lendio.

Views from the Small Business Finance Industry, March 27

March 27, 2020 As the coronavirus pandemic continues to disrupt the economy and affect small businesses as well as funders, AltFinanceDaily will keep up with how various figures from the alternative finance sector are managing under the stresses of covid-19. Ranging from funders, to brokers, to those figures on the periphery of the industry, this series aims to highlight a variety of voices and we encourage you to reach out to AltFinanceDaily to discuss how your business is doing.

As the coronavirus pandemic continues to disrupt the economy and affect small businesses as well as funders, AltFinanceDaily will keep up with how various figures from the alternative finance sector are managing under the stresses of covid-19. Ranging from funders, to brokers, to those figures on the periphery of the industry, this series aims to highlight a variety of voices and we encourage you to reach out to AltFinanceDaily to discuss how your business is doing.

—

One such voice this week was Shawn Smith, CEO of Dedicated Commercial Recovery. Specializing in debt recovery and legal enforcement, Smith told AltFinanceDaily that his business has already seen a jump in demand, but that he reckons, for now, most demand will be for modifications on existing deals. According to Smith, many of his clients have explained to him that merchants have been requesting changes to the terms of the financing, either by tweaking the rates or length of repayment.

“Just in two weeks we can see an uptick, but by and large, it hasn’t majorly spiked. I think it’s spiking with the funders or the creditors right now. And we’ll be next on that … a major thing I’m hearing is a dramatic increase in inbound calls to our clients for modifications.”

In Smith’s view, this back and forth between merchants and funders is a better scenario than the alternative, making clear that honest communication is necessary in a crisis like this.

“Hopefully everybody’s working together through this, which does seem to be the case right now. I honestly think we’re past the point of some people calling this a hoax, or it’s not to be taken seriously. And I’m seeing a lot of rallying around the idea of ‘we’re in this together even though we can’t stand next to each other.’ A kind of American spirit of we’re going to beat this, we’re going to get through it.”

—

For Idea Financial, the idea of working together has manifested, just as it has for many companies across the world, digitally. CEO Justin Leto and President Larry Bassuk explained to AltFinanceDaily that since their entire company is working remotely, the communication app Slack has stepped in for continual conversation between employees and Zoom is being used to check in with the team multiple times throughout the day.

“In many ways, our teams interact more now than they did when they were in the office together. We hold competitions, share personal stories, and really support one another. At Idea, the sentiment that we feel is that everyone appreciated each other more now than before, and we all look forward to seeing each other again in person soon.”

—

On Thursday, industry leaders took part in a webinar hosted by LendIt Co-Founder and Chairman Peter Renton. Various subjects relating to Covid-19 were up for discussion by Lendio’s Brock Blake, Kabbage’s Kathryn Petralia, and Luz Urrutia of Opportunity Fund, with the $2 trillion government bill being foremost among them.

Blake, who had been in touch with Senators Romney and Rubio, explained that most small businesses will be eligible for a loan out of the $350 billion fund that would be allotted to the SBA under the $2 trillion bill, saying that “a tsunami of loan applications is coming because almost all small business owners in America will qualify for this product.” The Lendio CEO also noted that business can expect to pay an interest rate of 3.75% on these loans, only a portion of each individual loan may be forgivable, and the max amount loaned out will be two and a half times the business’s monthly payroll, rent, and utilities combined.

Beyond the specifics of the 7(a) loan program, Blake expressed concern over the SBA’s bandwidth, saying that he was unsure whether or not the organization and the banks that it will partner with to deliver these loans will have the capacity to process them, a point echoed by Urrutia. “We’re talking about businesses that are going to need a ton of support,” the Opportunity Fund CEO said. “With these programs, the money doesn’t really get down to the bottom of the pyramid.”

Collectively, the group hoped that the SBA would open up their channels and allow non-bank lenders to use some of the $350 billion to fund small businesses, citing that neither government agencies nor banks have the technology nor processes to hastily deal with the amount of applications that will come. In other words, the SBA is working with “dinosaur technology,” as Blake called it.

One point of concern that continually arose during the conversation was the situation lenders will find themselves in as the pandemic continues. With Blake saying that an estimated 50% of non-bank lenders on his platform have hit the pause button on new loans, each of the other participants expressed worry about lenders being wiped off the map during and in the aftermath of this crisis.

As well as this, Petralia explained that funders can expect to encounter increased rates of fraud during this time: “In times like this, the bad guys come out in force … criminals are very creative and smart, so I promise you they’ll come up with new ways to fraud the system.” Discussing how they are dealing with this, the group mentioned that they were incorporating additional revenue and cash balance checks, as well as social media checks to see whether the business announced that it had closed due to the coronavirus.

Altogether, the conversation was one of uncertainty, but also one of hope to keep the wheels of the industry turning as more and more small business owners look for financing to keep their payroll flowing. As Renton said closing the session, “This is our time to shine, this is fintech’s time to show what it’s been working on for the last decade.”

Can The SBA Handle The Stimulus On Their Own?

March 27, 2020 As the market cheers the upcoming passage of a $2 Trillion stimulus bill that is intended to provide much needed support to small businesses, industry insiders are beginning to raise concerns about the SBA’s infrastructural ability to process applications in a timely manner.

As the market cheers the upcoming passage of a $2 Trillion stimulus bill that is intended to provide much needed support to small businesses, industry insiders are beginning to raise concerns about the SBA’s infrastructural ability to process applications in a timely manner.

In a webinar hosted by LendIt Fintech yesterday, Opportunity Fund CEO Luz Urrutia estimated that conservatively, it could take the SBA up to two months to even begin disbursing loans offered by the bill. Kabbage President Kathryn Petralia offered the most optimistic estimate of 10 days, while Lendio CEO Brock Blake thinks that perhaps it could take around 3 weeks.

Blake followed up the webinar by sharing a post on LinkedIn that said that small businesses were reporting that the SBA’s website was so slow, so riddled with crashes, that the SBA had to temporarily take their site offline.

Most skeptics raising alarms are not referring to the SBA’s staff as being unprepared, but rather the systems the SBA has in place.

A March 25th tweet by the SBA reported that the site was undergoing “scheduled” improvements and maintenance.

The website is currently undergoing continued scheduled improvements and maintenance. For more info on SBA #COVID19 resources, visit https://t.co/yG2N17KF63

— SBA (@SBAgov) March 25, 2020

This all while the demand for capital is surging. Blake reported in the webinar that loan applications had just recently increased by 5x at the same time that around 50% of non-bank lenders they work with have suspended lending.

Some informal surveying by AltFinanceDaily of non-bank small business finance companies is finding that among many that still claim to be operating, origination volumes have dropped by more than 80% in recent weeks, mainly driven by stay-at-home and essential-business-only orders issued by state governments.

It’s a circular loop that puts further pressure on the SBA to come through, none of which is made easier by the manual application process they’re advising eager borrowers to take on. The SBA’s website asks that borrowers seeking Economic Injury Disaster Loan Assistance download an application to fill out by hand, upload that into their system and then await further instructions from an SBA officer about additional documentation they should physically mail in.

Perhaps there’s another way, according to letters sent to members of Congress by online lenders. 22 Fintech companies recently made the case that they are equipped to advance the capital provided for in the stimulus bill.

“We seek no gain from this crisis. Our only aim is to protect the millions of small businesses that we are proud to call our customers,” the letter states.

Members of the Small Business Finance Association made a similar appeal in a letter dated March 18th to SBA Administrator Jovita Carranza. “In this time of need, we want to leverage the experience and expertise we have with our companies to help provide efficient funding to those impacted in this tough economic climate. We want to serve as a resource to governments as they build up underwriting models to ensure emergency funding will be the most impactful.”

How fast things come together next will be key. The House is scheduled to vote on the Senate Bill today. If a plan to distribute the capital cannot be expedited and the crisis drags on, the consequences could be dire.

“Hundreds of thousands of businesses are going to be out of business,” Urrutia warned in the webinar.

Marketplace Lending Association Members Take Steps To Help Borrowers During The Coronavirus Crisis

March 17, 2020 Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

“This includes providing impacted borrowers with forbearance, loan extensions, and other repayment flexibility that is typically provided to borrowers impacted by natural disasters. During the time of payment forbearance, marketplace lenders are also electing not to report borrowers as ‘late on payment’ to the credit bureaus,” a letter to senior members of Congress signed by Exec Director Nathaniel Hoopes states. “Members are also waiving any late fees for borrowers in forbearance due to the COVID-19 pandemic, posting helplines on company homepages, and communicating options via company servicing portals.”

Members of the MLA include:

- Affirm

- Avant

- Funding Circle

- LendingClub

- Marlette Funding

- Prosper

- SoFi

- Upstart

- College Ave Student Loans

- Commonbond

- LendingPoint

- PeerStreet

- Yieldstreet

- Arcadia Funds, LLC

- Citadel SPV

- Colchis Capital

- Community Investment Management

- cross river

- dv01

- eOriginal

- Equifax

- experian

- Fintech Credit Innovations Inc.

- FutureFuel

- Laurel road

- LendIt

- pwc

- Scratch

- SouthEast bank

- TransUnion

- tuition.io

- VantageScore

- Victory Park Capital

- WebBank

Goldman Sachs-Amazon Deal to Offer Small Business Loans in the Works

February 3, 2020

Tech giant Amazon is reportedly in talks with Goldman Sachs to offer business loans to those small and medium sized merchants operating on its marketplace, according to sources that the FT describes as “two people briefed on the discussions with the online retailer.” One of these sources said that it could launch as soon as March.

The news comes after CEO David Soloman spoke at the bank’s Investor Day recently, explaining that Goldman would be pursuing a “banking-as-a-service” model this year that would see the bank white labeling their products for third parties to use. As well as this, Solomon commented on a shareholders call last week that the bank is seeking to increase revenues from new channels such as consumer banking and wealth management.

One such channel is Goldman’s partnership with Apple last summer that saw the launch of Apple Card, a credit card solely available to Apple’s +100 million users in the US. The card’s launch was lauded by Solomon; and according to Business Insider, cardholders had $736 million in loan balances by the end of September, one month after the card was released to the public.

The Apple and Amazon deals highlight how Wall Street banks are employing and partnering with Big Tech to leverage advantage over fintechs, and ultimately gain access into markets that are historically not domains of the uber rich. Traditionally a bank that catered to elites, Goldman Sachs has been edging its way into consumer and small business banking ever since the launch of Marcus, its personal banking platform.

Amazon has been offering loans to merchants on its platform since 2011, using algorithms to determine which sellers would be best positioned to receive and repay a loan. Having previously partnered with Bank of America to finance such loans, the terms of these were for 12 months or less, with amounts funded ranging from $1,000 to $750,000. According to the FT, Amazon had $863 million in outstanding SMB loans on its balance sheet as of the end of 2019.

The digital nature of Amazon’s marketplace would accommodate Goldman Sachs’ neglect of brick-and-mortars stores, which have historically been a waypoint for small- and medium-sized businesses seeking finance.

LendIt Chairman and Co-founder Peter Renton described Goldman’s progression in the fintech space as “impressive,” noting that the speed at which it has been operating isn’t to be overlooked: “I thought something like this would happen but not in such a short space of time. Apple Card was only six months ago.”

As well as this, Renton was wary of how expansive the deal would be, admitting skepticism of it being a large project for either company. Given how both Amazon and Goldman have shown themselves to be selective in who they provide financing for, this assessment may prove correct.

The End Of An Era – AltFinanceDaily Through The Decade

December 30, 2019

AltFinanceDaily estimated that approximately $524 million worth of merchant cash advances had been funded in 2010.

In 2019, merchant cash advances and daily payment small business loan products exceed more than $20 billion a year in originations.

First Funds

Merchant Cash and Capital

Business Financial Services

AmeriMerchant

Greystone Business Resources

Strategic Funding Source

Fast Capital

Sterling Funding

iFunds

Kabbage

OnDeck

Square Capital

Amazon Lending

Funding Circle USA

Yellowstone Capital

Entrust Cash Advance

Merchants Capital Access

Merchant Resources International

American Finance Solutions

Nations Advance

Bankcard Funding

Rapid Capital Funding

Paramount Merchant Funding