Congressional Resolution Aims to Undo CFPB’s Small Business Lending Rules

June 12, 2023 After 13 years of regulatory debate and 888-pages of official rules finally ready to go into effect, some members of Congress have decided that the whole thing is all wrong. At issue is a section of a 2010 federal law that requires the CFPB to collect data from companies engaged in small business financing. However, for more than a decade the statute became a political football, creating delays and sowing confusion over who it is that is supposed to be covered. Lawsuits filed against the CFPB finally prompted it to move forward with its mandate which culminated in an 888-page rulebook that was published in March.

After 13 years of regulatory debate and 888-pages of official rules finally ready to go into effect, some members of Congress have decided that the whole thing is all wrong. At issue is a section of a 2010 federal law that requires the CFPB to collect data from companies engaged in small business financing. However, for more than a decade the statute became a political football, creating delays and sowing confusion over who it is that is supposed to be covered. Lawsuits filed against the CFPB finally prompted it to move forward with its mandate which culminated in an 888-page rulebook that was published in March.

On May 31, however, members of the House and Senate introduced a Joint Resolution to invalidate the rules.

“Resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That Congress disapproves the rule submitted by the Consumer Financial Protection Bureau relating to “Small Business Lending Under the Equal Credit Opportunity Act (Regulation B)” (88 Fed. Reg. 35150), and such rule shall have no force or effect.”

A hearing on the matter is scheduled to be heard on June 14 at 10am. As part of it, CFPB Director Rohit Chopra is expected to testify.

Update: Hearing is here:

It remains to be seen whether the Resolution will carry weight. There are 23 Republican co-sponsors of the bill and 0 Democrats.

Murray Loses Election for ENS Foundation Directorship

May 21, 2023 deBanked president Sean Murray was one of two nominees earlier this month for an open director position of the ENS Foundation. ENS stands for the Ethereum Name Service, a protocol that allows users to substitute human readable usernames for long hexadecimal strings commonly associated with crypto addresses.

deBanked president Sean Murray was one of two nominees earlier this month for an open director position of the ENS Foundation. ENS stands for the Ethereum Name Service, a protocol that allows users to substitute human readable usernames for long hexadecimal strings commonly associated with crypto addresses.

Instead of one’s address looking like this: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829, it could be altfinancedaily.eth or debanked.com or sean.debanked.com or some other domain name owned by the user.

Murray has been an advocate for ENS names as a form of web-based identity. He was one of the first 500 people in the world to use a .com address as an ENS name and the first in the world to turn a .com address into an NFT on mainnet using the official ENS Namewrapper contract. debanked.com, for example, is not only a website address, but also a crypto address and an NFT. Murray has been studying crypto since 2014 and deployed his first AltFinanceDaily smart contract to ethereum in 2021.

Murray lost the election in a blowout but has expressed that his candidacy led to some positive changes in the ENS ecosystem. The ENS Foundation represents the technology’s official DAO. Murray’s competition was more qualified than he was for the role. The victor, Alex Van de Sande, helped launch ethereum, launched the first Ethereum wallet and Web3 Browser, and was a co-founder of ENS.

“I anticipate there eventually being some crossover between the traditional financial system and blockchain technology,” Murray said. “A username system would be an integral part of that. I’m not into speculating on coins or anything of that nature.”

Got a Mantle, Bryant, or Mahomes Card? This Company Wants to Fund You

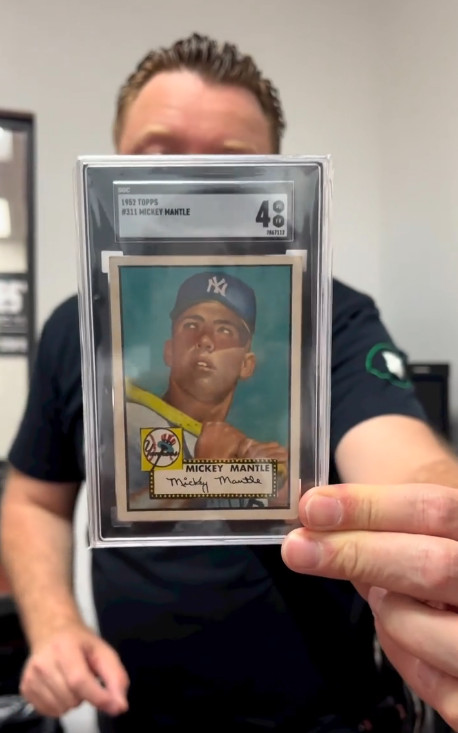

September 12, 2022 Last month, an anonymous bidder paid $12.6M for a 1952 mint condition Topps Mickey Mantle baseball card, the highest amount ever fetched for a piece of sports memorabilia at an auction. Understandably, the news electrified a fast growing market of collectors, traders, and financiers that predicted the next big asset class wasn’t just going to be real estate or crypto or NFTs, but physical sports trading cards.

Last month, an anonymous bidder paid $12.6M for a 1952 mint condition Topps Mickey Mantle baseball card, the highest amount ever fetched for a piece of sports memorabilia at an auction. Understandably, the news electrified a fast growing market of collectors, traders, and financiers that predicted the next big asset class wasn’t just going to be real estate or crypto or NFTs, but physical sports trading cards.

The value of the Mantle sale came as no surprise to one budding entrepreneur in South Florida. On Instagram, he’d been talking about Mantle cards for weeks, even going so far as to hold up another ’52 Topps Mantle card to the camera to promote what his company can do, which is provide quick cash advances to owners of valuable sports cards.

The entrepreneur’s name is Edward Siegel, CEO of Card Fi. Siegel’s no stranger to the alternative finance space because he spent about a decade in the MCA industry, most recently as the founder of Bitty Advance, which he sold in 2020. Since then, Siegel returned to his roots and early passion of his youth.

“I had a background in sports cards as a collector, you know as a kid, but then in my early twenties, I was promoting card shows at malls,” Siegel said. “I was heavily into the hobby, setting up the card shows and promoting them and doing player appearances where players come in and do an autograph appearance.”

That was back in the late 80s, early 90s, according to Siegel.

When Covid hit and he exited his most recent company, he noticed a massive resurgence in the sports trading card market. His next business ultimately became Card Fi, a company that will evaluate the market value of a card and make an advance against it. There’s obviously risk involved so they take possession of the card for the duration.

“We have to get a hold of these cards and we’re responsible for them and then we vault them in our in-house bank vault,” Siegel said. The cards are stored in a highly secure climate controlled environment. Card Fi shows the vault off frequently in its Instagram videos.

Such a business requires large amounts of capital so Siegel went searching for investors, a pursuit that led him to a unique place, an Instagram Live pitch competition hosted by famed CEO and reality TV star Marcus Lemonis. Siegel entered himself in as a contestant, knowing full well that the odds of even being chosen to present his business to Lemonis were about a million-to-one.

Somehow, he was called up to pitch.

“So [businesses] went on there during the quarantine and you pitched your business,” Siegel explained. “I went on there and I pitched it […] And he understood it and he thought it made sense.”

The moment eventually led to a deal with Lemonis’ company and Card Fi was on its way.

Siegel, meanwhile, dispels the notion that the burgeoning trading card industry or his business hinges upon old vintage cards or that it’s a baseball-card-centric universe.

Siegel, meanwhile, dispels the notion that the burgeoning trading card industry or his business hinges upon old vintage cards or that it’s a baseball-card-centric universe.

“If we look at it, there’s two different markets, you have the modern card market [where] I would say it’s basketball [that leads the pack],” he said. “For the vintage card market it’s baseball.”

Football is huge as well, he explained. A Patrick Mahomes rookie card, for example, an NFL Quarterback that’s still currently playing, recently fetched $861,000. There are only one of five like it in the world, the scarcity playing a major role in the value. Meanwhile, a Justin Herbert rookie card, an NFL Quarterback who’s only in his third year was already receiving bids above $1 million at the time this story was being written.

“It really depends on the card itself,” Siegel explained. “Some players might be known for having better careers but then you have cards that have more scarcity to them. Something that’s a one of one or maybe a very low populated card and a graded PSA 10 could very well be worth more than a [Michael] Jordan rookie because it has scarcity in it.”

PSA refers to cards that have been verified as authentic and graded on the condition of the card itself. Ten is the highest level a card can receive. Card Fi will only work with graded cards to avoid any funny business when it comes to advancing funds based upon the value.

Siegel explained that Card Fi’s average advance is about $40,000 – $50,000. The max right now is $500,000. There’s a big market for this type of funding it turns out because Card Fi’s much larger rival, PWCC, just raised $175 million to make similar offerings to sports card owners.

Siegel explained that Card Fi’s average advance is about $40,000 – $50,000. The max right now is $500,000. There’s a big market for this type of funding it turns out because Card Fi’s much larger rival, PWCC, just raised $175 million to make similar offerings to sports card owners.

“This financing benefits the market as loans and cash advances have become an increasingly asked-for offering among trading card collectors,” said Chad Fister, PWCC’s CFO in a story that originally appeared on Sportico. “Enabling our clients to access liquidity through a menu of capital offerings is key as trading cards continue to prove themselves to be a valuable tangible asset class.”

For Card Fi, customers that take an advance can track everything through an online portal, including details about their cards, payments, and balance.

“We want to note that we built a full-service automated underwriting and collection platform to where, whether it’s the customer or the broker, they can log into our system and put the description of the card into the system and it’s going to automatically underwrite it and price it out,” Siegel said.

That description sounded like something straight out of the fintech industry of his past, especially the component about brokers.

“Just like the MCA space, we have a whole partnership side, a broker side, where brokers can refer us customers just as an affiliate where they just send the info over,” Siegel said. Similarly, they can earn a commission if a transaction is completed, he explained.

In this industry, brands like Topps, Upper Deck, and Panini have become the bread and butter for Card Fi. Even though it’s all business for Siegel these days, he couldn’t help but mention a particular card he had a personal attachment to.

“My personal favorite card in my collection is the 1965 Topps Joe Namath rookie card,” Siegel said. “Of course being a die hard New York Jets fan, that has to be my favorite card.”

Join the AltFinanceDaily Team in NYC for a Night of Networking in Web3 & Crypto

May 8, 2022 The team behind AltFinanceDaily is hosting a 3-hour open bar in New York City this Wednesday night on May 11th from 6-9pm. It’s called deCashed. AltFinanceDaily readers interested in Web3, NFTs, and crypto are welcome to attend the event being held at The Refinery Rooftop.

The team behind AltFinanceDaily is hosting a 3-hour open bar in New York City this Wednesday night on May 11th from 6-9pm. It’s called deCashed. AltFinanceDaily readers interested in Web3, NFTs, and crypto are welcome to attend the event being held at The Refinery Rooftop.

Sponsored by Artchive and designated as the first in-real-life meetup for enthusiasts of the Ethereum Name Service’s recently formed “10KClub,” deCashed intends to bring crypto-capable folks together for a night of fun, networking, and cocktails.

“I think there is a big misconception among folks who associate crypto with things like the value of bitcoin,” said Sean Murray. “In my opinion, cryptocurrencies are not investments. They’re payment tools and a means of identity. If you’ve soured on crypto because you were told a coin was going to go up and then it went down instead, that is unfortunate because the actual use-cases for crypto are just starting to be used and are on the verge of mass adoption. You don’t need to invest in any coins, just be knowledgeable of the infrastructure.”

Twitter, for example, has already implemented a limited Web3 mechanism in which ethereum-based NFTs can be used as profile pictures for users that connect their wallets. Instagram too is slated to roll out integrations with ethereum, solana, flow, and polygon THIS WEEK as social media the world over begins its slow evolution forward. Coinbase too rolled out its own social network last week. Similarly, a handful of non-bank lenders have already pivoted to smart-contract-based loans in which lenders are effectively 100% insulated from loss.

Seven years ago there was a big rush for small business lenders to incorporate social media activity into the underwriting process with the premise that much could be learned by what businesses say, share, and present themselves as on social media. Today, social media users are slowly gravitating toward a blockchain-based experience connected to their digital wallets in which their bank statements and their online photos are effectively accounted for in the same system. Do you know how to examine that?

See you at the deCashed three-hour open bar this Wednesday night in NYC at The Refinery Rooftop from 6-9pm if Web3 and crypto appeals to you. Please register in advance. If you need help, e-mail events@decashed.com or call 917-722-0808.

Lender / Broker Ecosystem Transparency Solved

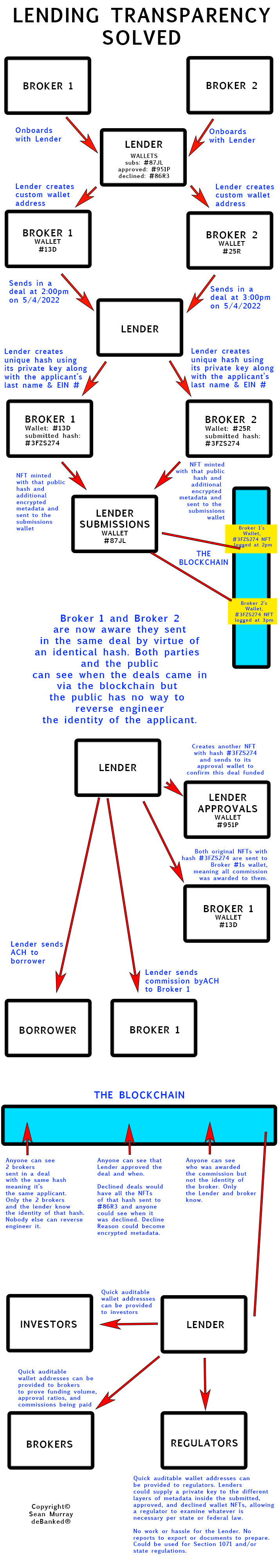

May 4, 2022What happens when a broker sends in a deal and is told it’s declined, only to find out that it was approved and funded for another broker? Usually, a very angry post on social media. The problem is that everyone wants maximum transparency, but how to get it? Who can trust who? What can be done? When will someone do it?

Well, call me insane, but I’ve taken a crack at solving it. And don’t get mad at me because I use the word blockchain because I promise this is not about crypto. Everything would still be ACH-based and recorded just as you already do it, but this little piece of tech would sit underneath it without any manual effort. All automated. No work. Also, it’s possible I’m just totally wrong or have missed some possibilities. You be the judge. Realistic or dream world?

1. Brokers and Merchants don’t need to use the blockchain or know how to use it.

2. A dev at a lender justs need to understand digital wallet addresses and a little feature about them called Non-Fungible Tokens to build or implement a third-party add-on of this. (These “NFTs” have nothing to do with art, they are just uniquely identifiable text files logged into the blockchain with metadata inside them.)

First, here’s my diagram:

Here’s what it’s doing:

1. When brokers sign up with a lender, the lender assigns a uniquely identifiable blockchain wallet address to them on an automated basis.

2. When a broker sends in a deal, the lender creates a unique encrypted hash of the applicant’s bare minimum identifiable data (like last name and EIN #). This hash is placed into a text file in plain english along with the applicant’s application data encrypted. (also automated).

3. The lender creates a Non-Fungible Token from the broker’s wallet address and sends it to the lenders’s official submission wallet. (automated). This wallet will show the NFTs for every deal ever submitted to this lender. Nobody will be able to reverse engineer info about the deals and only the broker who submitted the deal will be aware of what the hash of the deal is. This gives them a chance to view exactly when their deal was logged and if there’s any duplicate hashes in the wallet that would signal that same deal had already been submitted by someone else and when it was submitted.

4. If the deal is approved by the lender, the lender pays the broker and funds the merchant via ACH like normal. Then the lender creates an NFT with the same public hash and sends that one to its approval wallet. The original NFT sent to its submissions wallet is now sent to the broker’s wallet, signaling that they have been awarded the commission on this deal. (automated).

5. If the deal is declined, the lender creates an NFT with the same public hash and all the NFTs for this deal are sent to the decline wallet, signaling that the deal was killed and nobody was awarded the commission on it. (automated).

Every deal’s NFT has to eventually be moved to approved or declined. They can’t sit in submissions in perpetuity.

End result: brokers that submit deals can see if their deal has been submitted before and when it was submitted. Brokers can verify if the deal was funded, when, and if commissions were paid to someone. No actual money is changing hands via crypto (though there might be transactions fees to move NFTs around.) Investors and regulators can also examine the flow and if necessary, be given access to a private key so that they can unlock and view the metadata in the submissions, approvals, and declines themselves.

Naturally, everyone’s first question is: what happens if the lender tries to bypass this?

1. A broker who submits a deal that does not see an NFT created for it in the lender’s submissions wallet, already knows that the lender is trying to operate outside the system. Time to move on!

2. A lender that shows a deal was declined and commissions paid to nobody could be easily discovered if the borrower shows a statement with proof that they received a deposit. No need to speculate what happened. Time to move on!

3. A broker that submitted a deal first can show that its deal was logged first in the submissions wallet. Anyone on social media or the public square could also confirm that and the lender could not manipulate the data to play favorites.

4. Lenders that operate outside of it would show little-to-no submissions or approval volume, signaling to a broker that for some reason they do not want the anonymized data auditable.

5. Lenders that are not real that go around pretending to be a lender just to scoop up deals would be hard-pressed to provide the three verifiable wallet addresses showing the volume of submissions, approvals, declines, and the respective ratios for the latter two. If they can’t show that they’ve ever done any deals or paid commissions, even if you can’t see what the individual details are, they’re not real.

6. After a lender moves the deal’s NFT to a broker’s wallet to signal they’re being awarded the commission, it’s possible the lender does NOT actually ACH the broker the commission. In that case, the broker would have a nice verifiable public display that shows it was supposed to be paid the commission for all to see. Public pressure ensues.

7. If the lender secretly pays a broker the commission but then publicly marks the deal as declined so that another broker who sent in the same deal doesn’t suspect what happened, well then the broker who got paid is going to be suspicious that the lender could do the same thing to them. There’s an incentive to be honest.

8. Merchants need not know about any of this. It doesn’t concern them.

9. The broker does not interact with the blockchain in any way except in the case it just wanted to view the data.

10. The lender does not have to manually interact with the blockchain at all. The system would just be bolted on to an existing CRM. It would do all the above by itself.

New Domain Name Gold Rush Sets Up Possible Battle for Future of SMB Finance

April 25, 2022 If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

It’s evident that the market for keyword-based domains has evolved over time. Couldn’t get the .com? You could’ve tried to get the less coveted .net or .org. Don’t like those? Today, you can get the .business, .deals, .financial, .loan, .loans, or hundreds of other customized tlds. With so many to choose from, most experts in the field would advise that if you don’t own the .com version, to not even bother getting cute with customizations for your brand or keyword because customers will just get confused.

But recently, another domain name market has quietly been gaining steam. It’s for something called a .eth, an Ethereum blockchain-based crypto address shortener by the Ethereum Name Service. It’s not necessarily something one could use to build a website with, at least not yet. Originally envisioned as a way to condense long impossible-to-remember crypto wallet addresses into memorable words, users have started to buy up a bunch of keywords that may be familiar to AltFinanceDaily readers. Just to name a few:

- businessloan.eth

- businessloans.eth

- smbloans.eth

- merchantcashadvance.eth

- ach.eth

- syndication.eth

- lending.eth

- ppploan.eth

- underwriting.eth

- brokers.eth

- loanbroker.eth

- mca.eth

- factoring.eth

- funding.eth

- backdoored.eth

At face-value, this might appear to be a vanity crypto play, one in which one could send crypto to your-name-here.eth instead of trying to type out a long address like: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. But an ENS domain name holds much more potential than just that. It’s moving towards becoming the backbone of one’s identity in the upcoming era of the web called web 3.0 (web3 for short). Instead of having to remember passwords for hundreds of websites, identity can be validated through one’s digital wallet. Such a concept is not theoretical. It’s already being used.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Crypto is already starting to creep into the small business finance industry. In August, a funding company announced that it would begin offering commissions and fundings in crypto because of the speed potential. Far from being a gimmick, brokers started to choose crypto payments over ACH or a wire because of how fast it would be. There’s also no chargeback risk with crypto.

Currently, the owner of mca.eth has listed the domain for sale on OpenSea at a price of 20 eth (approximately $60,000). That’s less than what MerchantCashInAdvance.com sold for in 2011. Perhaps the value of an Ethereum Name Service domain holds less promise than a website that ranked well on Google in 2011. But then again, being well ranked on Google is not as important as it used to be. It’s impossible to say what, if any impact web3 will have on the small business finance industry long term, but for now there are those out there quietly buying up names like ach and funding and syndication on the chance that they will become something.

AltFinanceDaily Spins Off Crypto News into a Separate New Brand

February 28, 2022 Move over de-banked, one segment of fintech is becoming completely de-cashed as crypto transactions continue to flourish. The universe of bitcoin, ethereum, blockchain, smart transactions, and NFTs only scratch the surface of the innovation and potential that could one day replace the financial system as we know it.

Move over de-banked, one segment of fintech is becoming completely de-cashed as crypto transactions continue to flourish. The universe of bitcoin, ethereum, blockchain, smart transactions, and NFTs only scratch the surface of the innovation and potential that could one day replace the financial system as we know it.

AltFinanceDaily began reporting on crypto in 2014 in the early days of Bitcoin and since then, through fits and starts, has increased the amount of coverage in that space. After much internal deliberation, our team decided at the end of 2021 to create an off-shoot brand focused entirely on crypto-related news, deCashed.

deCashed will cover everything from crypto-lending to fintech to smart contracts to NFTs. AltFinanceDaily launched its own NFT smart contract on the Ethereum blockchain last September and AltFinanceDaily Chief Editor Sean Murray will be speaking at NFT NYC in June 2022.

“Everything with the AltFinanceDaily brand and business will remain the same,” said Murray. “I’ve been using and following cryptocurrency for eight years at this point. deCashed will finally provide us with the journalistic runway to expand our horizons into a market we already know and one that has so much untapped opportunity.”

As independent media, deCashed is still in its early days. “It’s live already but stay tuned,” Murray said. “We’ve been talking about doing this for a really long time.”

Flash Loans: The Seemingly Risk Free, Instantly Repaid Lending Trend Taking Over DeFi

January 27, 2022 It’s a loan that can never be defaulted on, is paid back in seconds, and brings massive return potential. There are no qualification minimums for the borrower, no collateral needed, and minimal risk for the lender. That’s because the loan is funded and repaid in the same transaction.

It’s a loan that can never be defaulted on, is paid back in seconds, and brings massive return potential. There are no qualification minimums for the borrower, no collateral needed, and minimal risk for the lender. That’s because the loan is funded and repaid in the same transaction.

This type of lending is highly prevalent in the NFT market, where JPEGS are being bought and sold for hundreds of thousands, sometimes millions of dollars, according to a source close to AltFinanceDaily.

The source, who recently made the switch from nearly a decade in traditional finance to being a major proponent in the web3 online community, said that this type of funding is particularly dominant with the purchasing of CryptoPunks— a collection of ten-thousand NFTs that can cost upwards of $10 million each.

A flash loan is atomic, meaning that it is indivisible. In computer science, things are atomic when they must be executed in full in-order for a particular thing to take place.

Due to the way smart contracts on the blockchain work, if the contract is broken, it’s nulled. With flash loans being written on smart contracts, the funds are immediately sent back to the lender if anything out of the ordinary occurs in the funding process. Thus, the loan can never be defaulted on.

A hypothetical real-world example of this could be an auto dealer flipping vehicles. If a dealership borrows money to purchase two-million dollars of inventory that they already have buyers for, they could work it into the contract with the lender that the only way the funds would be released is if every car in that inventory is sold for a predetermined amount. If the lender, dealer, and buyers all hold up their end of the deal, the funding can instantly take place and then be repaid.

In what some have called ‘lending on steroids’, the movement of money in flash loans is tremendous. According to Aave, an open source and non-custodial liquidity protocol, flash loans as high as $200,000,000 have been reported as funded and repaid.

It’s seemingly a lender’s dream, a set-it and forget-it smart contract that does all the work without risk. But the purpose of the loan may not be known. For example, a flash loan for $532 million last October had the appearance of being used to finance the most expensive NFT purchase in history. The problem? Both the borrower and the lender were the same person.

Which all begs the question, why is a loan necessary in the first place if the borrower can repay it in the same transaction? Perhaps because it eliminates counter-party risk in a type of transaction considered among the most risky, crypto. The cost of a flash loan, borrowing funds for mere seconds, is probably more attractive than a flash loss, in which the other side doesn’t live up to the terms of the deal and in a flash… is gone.