2M7 Financial Solutions and the State of Alternative Funding in Canada

July 1, 2019 “What’s a cash advance?”

“What’s a cash advance?”

This is how Avi Bernstein, CEO of 2M7 Financial Solutions, recalled a typical conversation in 2008, when his company was founded in the Canadian market. According to him, customer knowledge of alternative financing methods was dismal, partly due to a handful of homogenous banks dominating the scene as well as a void of funders in the country.

Flash forward to 2019 and 2M7 is operating within a Canadian market that is much more trusting and knowledgeable of merchant cash advances, although it is not yet at the levels witnessed in the U.S.

“Low hanging fruit,” is how Bernstein describes the industry now, as small and medium-sized businesses are flocking to 2M7 and its contemporaries, which offer higher approval ratings and faster confirmation of funding than their more traditional counterparts. In fact, according to a 2018 study conducted by Smarter Loans, 24% of those Canadians surveyed stated that they sought their first loan with an alternative lender that year. As well as this, only 29% reported that they pursued funding from more established, traditional financial institutions and 85% of those that received financing confirmed their satisfaction.

Figures like these help to explain why the Canadian market has seen a rise in interest from foreign businesses in the previous five years. Greenbox Capital, First Down Funding, and Funding Circle are examples of those companies who have successfully implanted themselves within the market, a feat that Bernstein claims isn’t easy.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

Warning against half measures, Bernstein explains that “You’ve gotta put boots on the ground” if you want to succeed in Canada. Giving the impression that unless you’re willing to learn the rules applied in the market, hire people, and house them in an office north of the American border, Bernstein is keen to highlight what’s required of foreign companies looking with interest at Canada.

But it’s a risk-reward situation. The market is opening up as more funders enter it, and with the arrival of larger companies, such as OnDeck Capital, more resources are being devoted to raising awareness of alternative financing amongst Canadians.

Meanwhile, homogenous firms like 2M7 are continuing to grow in this developing market. Receiving an average of 200-300 applications for funds per month, 2M7 is capitalizing off opportunities by proving themselves to be open to a wider range of applications. Bernstein asserts that “we try to fund everything,” and that they keep an “open mind to every opportunity” that lands on their desk. Perhaps this is a mindset not shared by more conservative of funders in the industry, but, as Bernstein says, “we’re here, we’re funding, and we’re ready to rock n’ roll.”

You can meet Avi Bernstein and 2M7 at deBanked CONNECT Toronto on July 25th.

Yellowstone Capital Introduces a Smarter Box In Move Towards Transparency

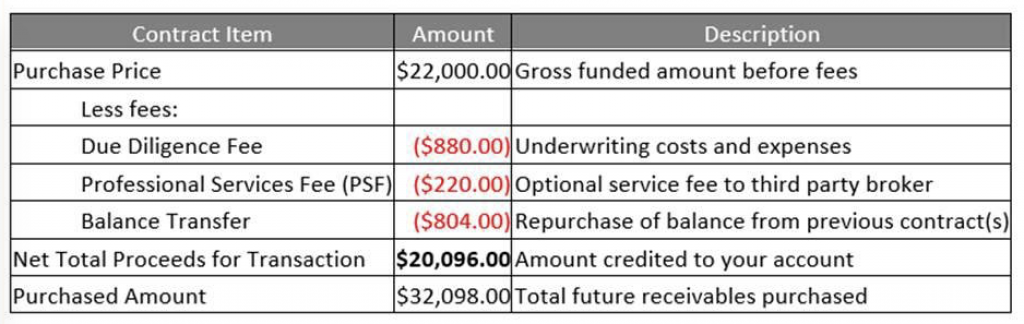

September 26, 2018Yellowstone Capital CEO Isaac Stern announced a “Smarter Box” through social media channels this morning. The itemized box will be provided to merchants through a post-funding email as part of a company effort to maximize transparency.

According to the announcement:

“[We are] very serious about maximum transparency and disclosure to our funding partners’ great merchant customers. In addition to our new Purchase and Sale Agreement we will be using with each of the funding partners on our platform, we are also implementing a transaction summary email to ensure that all applicable fees, costs, disbursements and hold-backs are clearly understood by all parties. Our new contract will increase disclosure while simplifying the product, while our summary confirmation ensures greater understanding and improved communication between our funding partners and their customers.”

Example of the box:

Based in Jersey City, NJ, Yellowstone Capital has originated more than $2 billion to small businesses since inception.

The 2018 Top Small Business Funders By Revenue

August 16, 2018The below chart ranks several companies in the non-bank small business financing space by revenue over the last 5 years. The data is primarily drawn from reports submitted to the Inc. 5000 list, public earnings statements, or published media reports. It is not comprehensive. Companies for which no data is publicly available are excluded. Want to add your figures? Email Sean@debanked.com

| Company | 2017 | 2016 | 2015 | 2014 | 2013 |

| Square | $2,214,253,000 | $1,708,721,000 | $1,267,118,000 | $850,192,000 | $552,433,000 |

| OnDeck | $350,950,000 | $291,300,000 | $254,700,000 | $158,100,000 | $65,200,000 |

| Kabbage | $200,000,000+* | $171,784,000 | $97,461,712 | $40,193,000 | |

| Bankers Healthcare Group | $160,300,000 | $93,825,129 | $61,332,289 | ||

| Global Lending Services | $125,700,000 | ||||

| National Funding | $94,500,000 | $75,693,096 | $59,075,878 | $39,048,959 | $26,707,000 |

| Reliant Funding | $55,400,000 | $51,946,000 | $11,294,044 | $9,723,924 | $5,968,009 |

| Fora Financial | $50,800,000 | $41,590,720 | $33,974,000 | $26,932,581 | $18,418,300 |

| Forward Financing | $42,100,000 | $28,305,078 | |||

| SmartBiz Loans | $23,600,000 | ||||

| Expansion Capital Group | $23,400,000 | ||||

| 1st Global Capital | $22,600,000 | ||||

| IOU Financial | $17,415,096 | $17,400,527 | $11,971,148 | $6,160,017 | $4,047,105 |

| Quicksilver Capital | $16,500,000 | ||||

| Channel Partners Capital | $14,500,000 | $2,207,927 | $4,013,608 | $3,673,990 | |

| Wellen Capital | $13,200,000 | $15,984,688 | |||

| Lighter Capital | $11,900,000 | $6,364,417 | $4,364,907 | ||

| Lendr | $11,800,000 | ||||

| United Capital Source | $9,735,350 | $8,465,260 | $3,917,193 | ||

| US Business Funding | $9,100,000 | $5,794,936 | |||

| Fundera | $8,800,000 | ||||

| Nav | $5,900,000 | $2,663,344 | |||

| Fund&Grow | $5,700,000 | $4,082,130 | |||

| Shore Funding Solutions | $4,300,000 | ||||

| StreetShares | $3,701,210 | $647,119 | $239,593 | ||

| FitSmallBusiness.com | $3,000,000 | ||||

| Eagle Business Credit | $2,600,000 | ||||

| Swift Capital | $88,600,000 | $51,400,000 | $27,540,900 | $11,703,500 | |

| Blue Bridge Financial | $6,569,714 | $5,470,564 | |||

| Fast Capital 360 | $6,264,924 | ||||

| Cashbloom | $5,404,123 | $4,804,112 | $3,941,819 | $3,823,893 | |

| Priority Funding Solutions | $2,599,931 |

Shopify’s Funding Automation Key to Its Growth

May 2, 2018 Canadian e-commerce company Shopify (NYSE:SHOP) has a business funding arm called Shopify Capital that issued $60.4 million in merchant cash advances in Q1 this year, according to the company’s earnings report yesterday.

Canadian e-commerce company Shopify (NYSE:SHOP) has a business funding arm called Shopify Capital that issued $60.4 million in merchant cash advances in Q1 this year, according to the company’s earnings report yesterday.

The funding operation offers an MCA product exclusively to merchants that are customers of Shopify. The company helps small business owners create online stores, with products ranging from web design to marketing and analytics. Currently, Shopify supports more than 600,000 small businesses worldwide.

Shopify Capital was launched in April 2016, but a company representative said it wasn’t until April 2017 that it started using algorithms 100 percent to automate offers of capital to merchants.

“What Shopify can see is a lot of patterns in a merchant’s [online] store,” a company spokesperson told AltFinanceDaily. “How engaged is that merchant? What has their GMV (Gross Merchant Volume) been? How spotty is their GMV? How often do they sell? There’s a bunch of different factors that help us predict GMV going forward. And as [our] algorithm gets better and smarter, we are able to get more granular in our offers.”

Many of Shopify Capital’s small business owner clients are new business owners who would not qualify for loans from banks, but need money to expand their businesses.

“Business owners typically spend copious hours putting an application together and funds typically take two to three weeks to receive,” a different Shopify spokesperson said. “Shopify Capital is designed to provide our merchants with timely access to Capital without putting them through additional financial stress…[And] merchants receive financing based on our predictive technology to determine what makes sense for their business in their trajectory.”

Shopify was founded in 2004 and is headquartered in Ottawa, Canada.

Minority-Owned Businesses Present Opportunities for Online Lenders

February 27, 2018

Research consistently shows that minority-owned businesses have a harder time accessing capital than other businesses. Online financing has the potential to change this.

Most of the online funding process is based on objective factors such as your business type and revenue. When you apply for funds online, it’s harder to discern things like the color of your skin or your ethnicity—factors which research shows can sometimes play into the face-to-face lending process, even though it’s illegal and immoral. What’s more, applying for funds online eliminates the stigma that keeps many minority-owned businesses from walking into a bank to apply for a loan, according to industry participants.

“Many minorities are hesitant to go into a bank,” says Louis Green, interim president of The National Minority Supplier Development Council, which provides business development opportunities for certified minority-owned businesses. He says the growth of online lending platforms will potentially open more doors for minority-owned businesses to get much-needed capital to operate and expand.

“The beauty of things on the Internet is that it has the ability to take away discriminatory issues,” says Green, who is also the chief executive of Supplier Success LLC, a Detroit-based business that offers online business financing solutions.

Certainly, minority-owned small businesses are a large and growing market. There were 8 million minority-owned firms in the U.S. as of 2012, according to U.S. Census Bureau data. Minority-owned firms represented 28.8% of all U.S. firms in 2012.

Historically, however, minority-owned businesses have had trouble getting access to credit for a host of reasons, and recent research suggests the problems persist.

A report published in November by the Federal Reserve Banks of Cleveland and Atlanta examines the results of an annual survey of small business owners. The report found that while many minority small businesses were profitable, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances.

A report published in November by the Federal Reserve Banks of Cleveland and Atlanta examines the results of an annual survey of small business owners. The report found that while many minority small businesses were profitable, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances.

Some of the trouble obtaining financing may have discriminatory underpinnings. For instance, a recent working paper by researchers at Utah State University, Brigham Young University and Rutgers University, among others, suggests that minorities were more highly scrutinized for loans than other applicants. For instance, African American “mystery shoppers” underwent a higher level of scrutiny and received a lower level of assistance than their less-creditworthy Caucasian counterparts, according to the study.

Also, African American testers were asked significantly more often about their marital status and their spouse’s employment. This “marks another and even illegal differential experience for these minority entrepreneurial consumers compared with the Caucasian shoppers,” the study finds.

To be sure, other factors are also likely to blame. For instance, the average credit score of a minority small-business owner is 707, which is 15 points lower than the overall average for small-business owners in the U.S., according to a 2016 study by credit bureau Experian.

Even so, the bias issue remains a stark possibility in at least some cases. A 2010 report by the Minority Business Development Agency (MBDA) offers data to show that minority-owned firms are less likely to receive bank loans than non-minority-owned firms. Among all minority firms, 7.2 percent received a business loan from a bank compared with 12.0 percent of non-minority firms, according to the report. High sales minority-owned firms were more likely to receive bank loans with 23.3 percent receiving this source of startup capital. By contrast, 29.2 percent of high sales non-minority firms received bank loans, the data shows.

To be sure, it’s very difficult to prove discrimination when a bank loan is denied. A few years ago, a mortgage banker who asked not to be named, says he suspected discrimination when an Asian couple he worked with was denied a small bank loan. While he didn’t have rock solid proof, he felt the bank’s stated reasoning for turning down the loan was unjustified and he tried going to bat for the couple. His efforts were rebuffed, however, and the loan was denied.

Based on the size of the loan and the couple’s finances, the banker says the loan would have easily been approved by an online provider that was looking only at objective factors. “They see the numbers they’ve been given and calculate risk and make decisions based purely on numbers,” he says.

Indeed, this is where online lending has already shown significant potential. Alicia Robb, a research fellow at the Atlanta Federal Reserve who co-authored the November report by the Cleveland and Atlanta Federal Reserves, says when controlling for credit score and other business-related factors, the data shows that minority businesses have a better shot at getting loans approved online than they do at a large or small bank.

Industry participants say the online funding process can be a boon for minority business owners because it strips subjective reasoning out of the decision-making process. Instead of presenting themselves, applicants are presenting what their business looks like financially, and funders are making highly automated decisions based on the information provided.

“Humans make terrible decisions. The more you can eliminate human bias in the process the better,” says Kathryn Petralia, co-founder and president of Kabbage. She says 95 percent of the online lender’s customers have an entirely automated experience, which includes validating their identity using digital processes. “We never see a picture of them or know anything about their ethnicity or demography,” she says.

Even funders who do ask for photo identification say that doesn’t happen until after applicants have been approved. And even then, it’s just to “make sure that the person you are funding is actually the person you are funding and no one is trying to defraud you,” says Isaac D. Stern, chief executive of Yellowstone Capital LLC, a MCA funder in Jersey City, N.J. “Online financing is colorblind. It doesn’t matter if [you’re] white or Hispanic or black,” he says.

Even funders who do ask for photo identification say that doesn’t happen until after applicants have been approved. And even then, it’s just to “make sure that the person you are funding is actually the person you are funding and no one is trying to defraud you,” says Isaac D. Stern, chief executive of Yellowstone Capital LLC, a MCA funder in Jersey City, N.J. “Online financing is colorblind. It doesn’t matter if [you’re] white or Hispanic or black,” he says.

Dean Sioukas, chief executive of Magilla Loans, an online search engine that matches prospective borrowers and lenders, has hope that the anonymity of the online funding process could eventually make the off-line process more equitable for all applicants. After accepting a number of solid proposals from viable lending opportunities—without knowing any personal information about the applicant—his hope is that whatever biases a loan officer may previously have had will dissipate, he says. Funding decisions should only be made on objective criteria, he says. “The rest has no place in the process.”

While in theory online lending should improve access to funds for minority-owned businesses, several industry observers say barriers remain.

One major challenge is getting the news out to minority business owners, many of whom don’t know about the online funding opportunities that exist, says Lyneir Richardson, executive director of The Center for Urban Entrepreneurship and Economic Development, a research and practitioner-oriented center at Rutgers Business School in Newark, N.J.

He suggests online lenders and funders need to do a better job of connecting with minority-owned businesses and explaining what they have to offer. He works with about 300 entrepreneurs, 70 percent of whom are minority-owned businesses. He’s held this position for 10 years, but says he’s never been approached by an online lending company to market its services, speak at one of his events, provide funding advice to business owners or in any other capacity.

“There is an opportunity for online small business lenders to market and make known, particularly to minority business owners, that they have viable, market rate lending products that can help them grow,” he says.

“There is an opportunity for online small business lenders to market and make known, particularly to minority business owners, that they have viable, market rate lending products that can help them grow,” he says.

One caveat is that rates online are often higher than traditional bank loans, so there is a trade-off for minority-owned businesses, says Brett Barkley, a senior research analyst in the community development department at the Federal Reserve Bank of Cleveland, who co-authored the November report.

Other research from the Federal Reserve shows that satisfaction levels were lowest at nonbank online lenders for both minority- and nonminority-owned firms compared with borrower satisfaction levels at small banks and large banks, he says. The satisfaction levels seem to be related to higher interest rates and “lack of transparency,” he adds. While the study doesn’t define the latter term, the findings could “point to confusion regarding the actual terms of the loan,” Barkley says.

Some online firms have taken steps to make pricing more transparent by using the SMART Box disclosure agreement, a comparison tool developed by the online lending industry to help small businesses more fully understand their financing options. There are currently three different versions of the SMART Box disclosure –for term loans, lines of credit, and merchant cash advances.

This “is a really important metric,” says Petralia of Kabbage, which offers the tool to customers.

Green, the interim president of NMSDC, says that helping its 12,000 minority-owned business members gain access to capital is a major goal for the organization. While online financing is still a largely “untapped resource” for minority businesses, it makes borrowing money easier and more appealing. “It holds great promise for minority-owned businesses, but I think the reality hasn’t met that promise yet,” he says.

SmartBiz Becomes the Number One Provider of SBA Loans Under $350,000

February 14, 2018

SmartBiz Loans announced today that it was the number one facilitator of SBA 7(a) loans under $350,000 for the 2017 calendar year, surpassing JP Morgan Chase.

“I think the biggest factor [in hitting this milestone] is that we have been laser focused on meeting the needs of small business customers in the U.S.,” SmartBiz CEO Evan Singer told AltFinanceDaily.

SmartBiz facilitated $329 million in funded SBA 7(a) loans for $350,000 or less for the 2017 calendar year while JP Morgan Chase generated $322 million, putting it in second place. SBA loans (the acronym stands for Small Business Administration) are guaranteed by the U.S. government. Traditional SBA 7(a) loans, which SmartBiz focuses on, are backed by the government 75 to 80 percent, according to Singer, while 7(a) Express loans are only backed 50 percent, making the interest on those loans higher. Previously, SmartBiz was number one in funding SBA 7(a) loans, excluding Express loans. Now it leads in both categories.

The San Francisco-based company was incubated by PayPal and launched in 2010. Originally, it was a consumer credit platform, but then pivoted to the small business space in 2012 and started facilitating SBA loans in 2013, Singer said. The company sold off its consumer business and is now exclusively devoted to facilitating SBA loans, which typically have a repayment term of 10 years for a loan of $350,000 or less.

SmartBiz has made obtaining SBA loans easier for small businesses by making loan underwriting and origination easier for banks. The key has been technology. For instance, Singer said that many banks will not make small business loans for less than $250,000 because it isn’t profitable for them. Banks tell Singer that it takes the same amount of time to underwrite and originate a $200,000 loan as it does for a $2 million loan.

“So what we are focused on is [making] software to help automate the underwriting and origination process for banks so that smaller loans become profitable for them,” Singer said.

So far, this has been working. Singer said the company’s partner banks tell them that they are able to reduce 90 percent of the costs on the retail side when looking at smaller loans. Some of SmartBiz’s partner banks include Celtic Bank in Salt Lake City, UT, First Home Bank in St. Petersburg, FL, and Five Star Bank in Sacramento, CA.

SmartBiz also has an office in Austin, TX and employs a little over 100 people.

SBA Loans Go Online: A Q&A With SmartBiz

November 28, 2017 A while back, a merchant AltFinanceDaily interviewed told us they had obtained what sounded like impossibly good terms from an online lender not known for low rates. When I requested a fact check of it, we learned that the online lender had actually referred the borrower to SmartBiz and that SmartBiz had secured an SBA loan for them. It was so seamless that the borrower had hardly noticed.

A while back, a merchant AltFinanceDaily interviewed told us they had obtained what sounded like impossibly good terms from an online lender not known for low rates. When I requested a fact check of it, we learned that the online lender had actually referred the borrower to SmartBiz and that SmartBiz had secured an SBA loan for them. It was so seamless that the borrower had hardly noticed.

Curious, I caught up with Sean O’Malley, president and co-founder of SmartBiz last month at Money2020. Below is a modified excerpt of our conversation:

AltFinanceDaily: [tells the above story about the merchant who got an SBA loan] – So you actually have other alternative lenders and online lenders going through you too. What is really the biggest channel that you tap into to get small business owners to you? Is it other online lenders or do you go direct to merchants?

O’Malley: Well, there are three different areas where customers come to us. The first is through our marketing efforts. We have our own online presence and marketing initiatives that go on, where small business owners are interested in the SBA loan product. The second area lies in our strategic relationships. These are partnerships with companies like Sam’s Club where we’re actually on their lending center; we have been doing that for a number of years. Another channel would be partnerships with companies like Fundera who bring customers to us through their online channels.

AltFinanceDaily: How about like Lendio?

O’Malley: Yes. We’ve built a relationship with them over the years. Lastly, the third area is the independent financial consultant channel, like our partnerships with accountants.

AltFinanceDaily: Okay. Didn’t SmartBiz recently celebrate a major milestone?

O’Malley: Yes! We recently passed the $500 million threshold of originated capital on the platform.

AltFinanceDaily: All SBA loans?

O’Malley: Correct, all the originated capital is a result from SBA 7(a) loans. Today, we have six bank partners on our platform who are doing SBA loan origination. It’s all been facilitated through our platform. There are really four major components to what we do. The first part is we provide an online presence and origination solution for small businesses. They come through our technology solution and then they go through an application process where we’re able to pre-qualify them. So, that’s the first piece. The second piece is really the technology platform around packaging of the loan.

AltFinanceDaily: What do you mean by packaging?

O’Malley: After a business pre-qualifies, there are still documents that need to be captured and some of the specific analysis also needs to be done. A large piece of that is automated through our platform. Some of it does require sort of a white glove experience for small business. We provide that as well. Then the third piece is the bank’s underwriting platform, where we digitize the bank’s underwriting and provide them with an underwriting platform that they license from us. Leaving us with the fourth part, the marketplace.

AltFinanceDaily: Can you explain the fourth piece, marketplace?

O’Malley: The core of what we do is we connect small business owners with banks. And the interesting part of that is that because we’re the marketplace, we’re able to say yes more to the small business than any single bank because they all have their own different credit boxes. In effect, we’re able to get more customers approved because we’re able to fit more use cases for that small business owner. If you combine all these, the ultimate value prop is that we’ve reduced the time to originate a loan. It traditionally takes about 120 days for a bank to originate an SBA loan. We’ve reduced that to as little as seven days. And on the bank side, we’ve reduced their costs up to 90%. As a result, we’ve made these loans more profitable for banks. And they’re then more willing to originate as part of their standard business. Whereas you know, in the small business space, banks have not been super eager to be making smaller sized loans because it costs as much for them to originate that type of loan as it does for them to originate a $5 million loan. So, we’ve made it super efficient.

AltFinanceDaily: So you’re kind of filtering out applicants on your own that they would normally have to deal with.

O’Malley: That’s right. Our platform allows us to filter out all the applications and only feed a bank the deals that they can do. When we provide a deal to a bank, they’re funding it anywhere between 90-95 percent of the time. They’re funding the deals that come from us because we have the knowledge of how the bank looks at their deals.

AltFinanceDaily: Is there a world in which you move outside of SBA loans and potentially offer other types of bank loans or maybe even non-bank loans or facilitate them? Not necessarily make them, but facilitate them?

O’Malley: We recently just launched a conventional bank loan. So, yes, we are expanding on our product line, and we did this as a result of really looking at that type of product and filling a gap in the marketplace as well. We’re trying to help the customers out and support their needs.

AltFinanceDaily: Are you noticing a trend with maybe borrowers applying for loans on like a mobile phone? I mean, any loan is a pretty big commitment, right? They go online and apply for $5,000, you know what I mean, for a personal expense or whatever and that’s not such a huge deal because it’s a small loan. I think an SBA loan is a much bigger commitment, you know, it’s long term. Are you seeing borrowers apply for the loans you offer from a mobile device?

O’Malley: About a quarter of our small businesses start the applications over a mobile device. And they are able to get pre-qualified through a mobile device. That said, the majority of borrowers still want to talk to someone. There are still a lot of traditional relation-based elements to a small business lender. When somebody is taking out a couple hundred thousand dollars, like you said, there needs to be some white glove experience for that. And it can’t just be 100% automated. In fact, small businesses a lot of times don’t want 100% automation.

AltFinanceDaily: Because it’s such a big commitment.

O’Malley: That’s right. And that’s where the market is today. In the future, we look to certainly automate as much as possible, but we hyper-target where we interact with the customer so that we provide the most unique customer-centric solution so that they feel comfortable about the process. If you look at our TrustPilot customer reviews that we use on our site, you will note that people really speak very highly about their experience. We’re super proud of that because we’ve been able to match up technology with people in the right way so that we can hyper-target where human interaction is needed to make sure that the customer feels at ease with the process. We’ve been able to become the trusted source for them getting the loan that they’re looking for.

AltFinanceDaily: Do you think in the future borrowers will apply for SBA loans entirely online? Will there be an age where they’re not necessarily going to the bank to meet somebody to talk about an SBA loan? Do you think it’s all going to kind of become like an online digitized process or will it always be a layer of I wanna go and sit and talk with somebody in the bank office?

O’Malley: Well, we’re proving small businesses want to do it primarily online. In fact, you know, the point too is that if you just consider the small dollar amount category, we are now the largest provider of SBA loans in the country for loans under $350,000.

AltFinanceDaily: Anything else I should know about SmartBiz?

O’Malley: We really seek to be an advocate for small businesses. We have gone beyond SBA in supporting our customers with the more conventional product, but we’re always trying to get businesses into SBA loans because it’s the best product out there. And so, our focus is always first and foremost trying to get our businesses SBA loans if at all possible. And it appears to be working. Recently, we were named as one of the fastest growing companies in the Bay area. We’re looking at certainly scaling this solution with as many small businesses as possible.

Managing Risk in Small Business Lending

March 16, 2017 Two years ago, I left a promising career at PayPal, a major technology giant, for what some considered a risky move: I joined BlueVine, a young fintech startup. My title: vice president of risk.

Two years ago, I left a promising career at PayPal, a major technology giant, for what some considered a risky move: I joined BlueVine, a young fintech startup. My title: vice president of risk.

This year, I took on an even bigger role when I was named chief risk officer of the Silicon Valley company, which offers working capital financing to small and medium-sized businesses.

My promotion comes at a time when risk is becoming a bigger concern in fintech, which is ushering in big changes in banking and financial services.

Fintech revolutionizes financial services

Data science technology has dramatically improved access to financing and the way we manage our money. The fintech wave that began with my former company, PayPal, and the world of payments, has spread to other aspects of personal finance, from mortgages to student and auto loans to investing.

This expansion was accompanied by growing concern that the fintech boom is fraught with risks that, if left unchecked, could lead to a major bust in the financial services industry that could in turn cause harm to the broader economy.

In a speech in January, Mark Carney, the governor of the Bank of England, cited the need to “ensure that fintech develops in a way that maximises the opportunities and minimises the risks for society.” “After all, the history of financial innovation is littered with examples that led to early booms, growing unintended consequences, and eventual busts,” he said.

Risk management as key to success

Risk management certainly has been a focus area for BlueVine from the beginning.

BlueVine joined the revolution in small business financing in 2014 when it rolled out an innovative online invoice factoring platform.

Factoring is a 4,000-year old financing system that allows small businesses to get advances on their unpaid invoices by providing easy, convenient access to working capital. BlueVine transformed what had been a slow, clunky, paper-based solution into a flexible and convenient online financing system that enables entrepreneurs to plug cash flow gaps that often hamper business growth.

Because the BlueVine platform is based on cutting-edge data science technology that can process and analyze information to make quick funding decisions, managing risk inevitably became a major challenge in building our business. As Eyal Lifshiftz, our founder and CEO, recalled in a recent column, in BlueVine’s first month of operation, almost every other borrower defaulted.

In fact, that was partly the reason Eyal invited me to join his team. BlueVine serves small and medium-sized businesses seeking substantial working capital financing of up to $2 million. To succeed, we needed to build a robust data and risk infrastructure.

Small startup with big data needs

Joining BlueVine also posed a personal challenge.

At PayPal, where I started as a fraud analyst and then moved into the company’s data science division where I helped develop behavior-based risk models, I had enormous amounts of data to work with to do my job. Now, I was joining a young startup with very limited data history, but with big data needs.

This meant putting together exceptional and experienced teams of data scientists and underwriters and developing a technology that becomes progressively more precise and accurate as it draw lessons from our steadily expanding data and underwriting decisions. It was important for us to have a group of super smart, highly-motivated and technologically-strong people working closely with a team of experienced and sharp underwriters.

Here’s how the process works: Our underwriters develop a robust methodology which is then translated into detailed logic decision trees.

Each decision tree includes dozens, even hundreds of branches, made up of question sets on different underwriting situations.

For example, a decision tree could focus on approving new clients coming from a specific industry, such as transportation or construction, or on increasing the credit line for a client with a specific financial profile.

A typical decision tree would drill down on further financial questions: What’s the expected cash-flow of the business in three to six months? What’s the pace at which it has accumulated debt over the past year? Are the business sales seasonal in a material way?

The questions could also focus on non-financial areas: Does the company’s website look professional? How does it compare with major companies in its industry? Does the business actively maintain its Facebook and Twitter accounts?

The goal is to build a risk infrastructure that steadily becomes more efficient in answering questions in an automated, large-scale and highly accurate manner. Our data scientists leverage multiple external data sources and use dynamic advanced machine learning models to answer these questions pretty much in real-time and with a high degree of accuracy.

So it’s a combination of technology and human input. There will always be gray areas, questions and situations that cannot immediately be addressed by our computer models.

But as the models get better and more robust, the gray areas will shrink. Our models are constantly and automatically enhanced, re-trained and expanded by the most recent data and input from our underwriters.

Think of it as the fintech version of Deep Blue and AlphaGo, the powerful computer programs that famously outplayed topnotch chess grandmasters. Both programs were based on similar principles: the more they played, the more knowledge they absorbed and the more formidable they became at chess.

Technology and teamwork

An even better example is the self-driving car powered by Google’s artificial intelligence technology. Human input is still required, but the more driving the car does, the smarter and more autonomous it becomes.

Building our risk infrastructure is an ongoing process for BlueVine. But it already has helped us steadily expand our reach, making us stronger, smarter and even faster in financing small and medium-sized businesses.

In just a couple of years, the strides we’ve made in managing risk more effectively enabled us to increase our credit lines to $2 million for invoice factoring and $100,000 for business lines of credit, which means we’ve been able to serve bigger businesses with bigger financing needs.

While we initially focused mainly on small businesses with annual revenue of under $250,000, today we have an increasing number of clients with annual sales of more than $1 million and increasingly, we’ve been able to serve clients with revenue of more than $10 million a year.

By the end of 2016, BlueVine had funded roughly $200 million. We’re on track to fund half a billion dollars by the end of this year.

We’ve accomplished this in a time of heightened skepticism about fintech in general and alternative business lending in particular. But rather than scoff at this skepticism, I’d point out two things.

First, fear often accompanies the rise of a new technology. Second, in the wake of the 2009 financial crisis, it’s prudent to raise hard questions about the rapid emergence of new financial technologies.

While building technologies and companies that can provide financial services faster and easier is a laudable goal, It’s wise to move cautiously and with humility.

The BlueVine experience underscores this.

Risk is still a challenge we take on every day. But we have found ways to take it on confidently and effectively with a vigorous combination of technology and teamwork.

Ido Lustig is Chief Risk Officer of BlueVine.