Why Funders Are Investing in Real Estate As Their Side Hustle of Choice

January 25, 2021

After five years in finance, Peter Ribeiro decided to strike out on his own and start US Business Funding in 2008, providing equipment leasing and financing for businesses. But when the housing market collapsed four months later, Ribeiro saw a second major business opportunity emerge. Earlier that year, he had purchased a $250,000 home in southern California that appraised for $355,000 at the time he bought it. Within seven months, the home’s value plummeted to $95,000. “I told myself I knew the area really well, so I might as well start buying some properties.”

After five years in finance, Peter Ribeiro decided to strike out on his own and start US Business Funding in 2008, providing equipment leasing and financing for businesses. But when the housing market collapsed four months later, Ribeiro saw a second major business opportunity emerge. Earlier that year, he had purchased a $250,000 home in southern California that appraised for $355,000 at the time he bought it. Within seven months, the home’s value plummeted to $95,000. “I told myself I knew the area really well, so I might as well start buying some properties.”

At that point, Ribeiro’s fledgling company still wasn’t generating much revenue. “I thought, ‘Man, I just can’t get a lot of loans done right now. I only have three or four employees.’ That’s how I got into the real estate industry.” Twelve years later and at the height of a global pandemic, Ribeiro is simultaneously running two thriving ventures —US Business Funding, and a portfolio of hundreds of rental properties he now owns.

At a time when fintech startups and other industry innovators are looking for investors, alternative lending execs like Ribeiro are instead choosing to put their money in real estate to beef up their investment portfolios. Although some execs shy away from talking publicly about their real estate dealings, citing the fact that they don’t want too much exposure, the consensus is that there’s a lot of money to be made in buying, selling and renting property – if you know what you’re doing.

“I think real estate is lucrative because when you look at the history of investments, there are two or three ways to really make money: You can put your money in the stock market, or you can put it in bonds. And the other one guaranteed to go up in value is real estate,” Ribeiro says.

“I think real estate is lucrative because when you look at the history of investments, there are two or three ways to really make money: You can put your money in the stock market, or you can put it in bonds. And the other one guaranteed to go up in value is real estate,” Ribeiro says.

To Ribeiro, real estate offers a few major advantages: It’s a tangible asset. You can leverage it as it appreciates in value. Deductions make it so you pay very little in taxes. And it offers significant cash flow. “It’s the best investment you can make,” he says.

What makes real estate an especially good fit for alternative lending and fintech execs is that they possess the skills, resources and financial literacy to succeed at it.

“Real estate is a long-term gain,” Ribeiro says. “The industry we’re in is a cash-flow cow. People who are doing well are printing money. But what can you do with that money? You can put it in the stock market, but you won’t control much. Then you pay capital gains on it.”

Attorney Paul Rianda, who represents both cash advance clients and real estate investors, says it makes sense that real estate investing appeals to alternative lenders – especially amidst the uncertainty of COVID-19.

Attorney Paul Rianda, who represents both cash advance clients and real estate investors, says it makes sense that real estate investing appeals to alternative lenders – especially amidst the uncertainty of COVID-19.

“If you’re a cash advance guy and COVID happened, then you’re not doing very well,” he says. “If you diversified your assets by doing real estate and cash advance, you’re able to weather these downturns a lot more easily than you would otherwise.”

Rianda has not yet counseled any of his own cash advance clients on real estate matters. But based on his insights from working with both areas, he says real estate would be a logical move for MCA executives, and he’s seen some of his clients in the bankcard industry buy up properties.

“One of my clients had a portfolio of merchants and sold it for a few million, then flipped over to real estate. So it’s a means (to an end),” Rianda says.

‘Snowball effect’

Ribeiro has relied on a simple strategy to steadily build his portfolio of residential properties: Buy. Fix. Leverage. Repeat.

“I feel like the portfolio is doubling every couple of years. It’s just a snowball effect,” he says.

After Ribeiro buys a home, he waits about six months before he has it appraised and fixes it up in the meantime.

“If you go to the bank within the first six months of purchasing it, they’re going to give you the actual market value of whatever you purchased the house for,” he says. “If you wait six months, they’ll reappraise the home and give its true market value, which could be another 40, 50 or 60 percent. And so now you’re going to have a lot more equity in the house, and you’re going to get a lot more money when you leverage that home to go buy the next one.”

Ribeiro says he sees lots of people making the mistake of buying a home, and then going to the bank a week or two later for a loan.

Constantly maintaining a positive cash flow is Ribeiro’s number one rule of real estate investing. “Your best friend is depreciation,” he says.

Constantly maintaining a positive cash flow is Ribeiro’s number one rule of real estate investing. “Your best friend is depreciation,” he says.

Depreciation refers to one of the key tax benefits of real estate. Since owning a rental property is technically a type of business because it generates income, the property is considered a business asset. The IRS allows you to deduct the cost of acquiring that asset – the property – over the span of its useful life. For residential properties, the IRS sets a standard depreciation period of 27.5 years.

So if you buy a $100,000 property with a $20,000 land value, $80,000 of the asset is considered depreciable. Over the course of 27.5 years, you can take an annual deduction of just over $2,900 a year.

The trick, Ribeiro says, is to stick to lower-priced properties with an 80/20 home-to-land value. Most of his properties are single- and multifamily homes between southern California and Las Vegas.

Like Ribeiro, Rianda’s investor clients concentrate on one geographic area to find the best properties. “They look at the area for a long time, understand the area,” he says. “In my neighborhood, three blocks can make a 50 percent difference in the price of a house. You need to focus on a particular geographic area and do a lot of transactions in it.”

Small portfolio, big impact

Real estate investing has provided a way for Jared Weitz to earn more money while being able to focus on his primary job as CEO of New York-based United Capital Source Inc., the company he founded.

Real estate investing has provided a way for Jared Weitz to earn more money while being able to focus on his primary job as CEO of New York-based United Capital Source Inc., the company he founded.

“For me, it’s just a really good second income stream and a way to have a secure return of 4.5% to 6.5% a year,” he says.

Growing up, Weitz got a feel for real estate by watching his uncles invest in multifamily properties. At one point, Weitz’s uncle owned 15 different multifamily homes, and Weitz would help do the maintenance on them.

Eight years ago, Weitz invested in his first two-family home and has fixed and flipped eight properties since then. He currently owns two two-family homes and invests primarily in multifamily homes in Long Island, Brooklyn and Queens. Over the next five years, he plans to pick up at least two more four- or eight-family properties. Working with a small portfolio of residences in his home state has allowed Weitz to have full control over managing his properties and to turn a good profit.

“I think for me, it just offers more liquidity,” he says. “It’s an asset I can sell and liquidate at any time. That’s really important for me.”

Ideally, Weitz would like for his investment to build generational wealth that he can pass down to his son. With many people in the U.S. unable to qualify for mortgages, Weitz sees real estate investing as an opportunity to help the economy by giving renters a place to live and put down roots. “Depending on the neighborhood, you can put yourself in a situation where you have good renters for 20 to 30 years. They want to raise their families and have their kids grow up there,” he says.

Litigation among the pitfalls

Even though Ribeiro has had success with his business model, he cautions that there’s considerable risk involved with real estate.

“I love the industry. It’s a passion. It’s beyond my wildest dreams of the size of the portfolio and how well it performs,” he says. “But don’t think it’s all cupcakes and unicorns. There’s a lot to the madness. That’s why not everyone can replicate the model.”

“Professional litigators” and multiple lawsuits from renters are a major downfall that Ribeiro points to. He sees at least one substantial suit each year and tries to settle outside of court whenever possible.

“Professional litigators” and multiple lawsuits from renters are a major downfall that Ribeiro points to. He sees at least one substantial suit each year and tries to settle outside of court whenever possible.

As an attorney, Rianda says his real estate clients call on him not just for the purchase of the property, but for various issues that occur during the ownership period.

Here’s one scenario: A property owner has a tenant who isn’t paying rent, so the property owner sues the tenant. But while the lawsuit proceedings are under way, the tenant declares bankruptcy, which puts a stall on further litigation.

“There are people who understand the system and can make it difficult for you to get them out (of the property),” Rianda says, adding that it’s important to have legal counsel readily available. “You need someone who has really done this a lot and knows how the system works to get that person out of the rental property as quickly as possible.”

To minimize liability, Ribeiro has divided his properties into about 10 different business entities – each with a separate umbrella insurance policy.

Rianda sees his own real estate investor clients follow this strategy by grouping multiple homes under the name of an LLC. “If you personally own all these various assets, there’s the potential that if something catastrophic happened at one, it could bleed into all your other properties and potentially put them at risk,” he says.

Dual careers

Ribeiro’s real estate investments and finance company both serve as full-time occupations for him. Some years, he’ll focus more on one area than on the other, depending on market conditions. He spent more time on real estate between 2008 and 2013; then his business needs flip-flopped when real estate prices started going back up. This past year, he’s directed more attention to the finance company because of COVID, which necessitated some operational changes and a need to help clients who had been trying to get PPP loans. But he’s also started investing in commercial real estate, which has taken a hit because of companies forgoing office space to save overhead costs while employees work remotely.

Ribeiro expects to start seeing more mortgage defaults on lower-level homes in 2021 and 2022, after forbearance periods are over. And he’s been leveraging his assets to start buying more properties around the second quarter of the new year. “I think it will be a good time to start buying heavy again,” he says.

An attractive investment vehicle

With the pandemic weakening business portfolios, secondary investment options might sound like just what the doctor ordered.

When COVID first hit, some of Rianda’s clients started pursuing other investments like personal protective equipment (PPE). Most of his cash advance clients closed up shop for a few months.

When COVID first hit, some of Rianda’s clients started pursuing other investments like personal protective equipment (PPE). Most of his cash advance clients closed up shop for a few months.

“As time goes on, I’m starting to see my clients go back into their lending,” Rianda says.

Even as clients start to recoup their business, Rianda sees the wisdom in other investments and says cash advance executives are well suited for real estate. “It’s just a way that people who have been successful and spin off a lot of cash for their businesses see as a safe way to diversify their income,” Rianda says. “It’s something I find that people who are doing well in their business do, regardless of what business they’re in. So cash advance guys are just following the things people have done for years.”

Ribeiro cautions that people who get into real estate should look at it as a 10-year investment minimum, and not just a two- or three-month stint.

“It’s not a lottery ticket, and it’s not an overnight race,” Ribeiro says. “This is a long-term gain. But it’s a very lucrative gain from a cash-flow perspective and a tax perspective. I don’t think there’s a more attractive vehicle than real estate.”

Double Dipped: What’s Next For New York’s Small Business ‘Truth in Lending’ Act

January 11, 2021 Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

“I’m a small business owner myself, but I also come from local government, and in local government, the committee is where the work gets done,” Borrello said. “We had the opportunity to fix this in committee. By the time it got to the floor, the governor basically reversed all the things I presented that were flaws, and he signed it.”

That’s the story of how S5470B came to be in Albany. Instead of ironing out the kinks in committee, Borrello said he watched as the bill with all its problems passed over the summer. There was a process to clean it up afterwards to make it suitable for Governor Andrew Cuomo’s signature, since it’s said that even he himself had expressed reservations about the language. But then he signed the original version and all the edits were discarded.

Politics are suspected to have played a role in that.

Politics are suspected to have played a role in that.

“When the governor finds something is flawed, he usually vetoes and sends it back,” Borrello said. “It concerns me that there is an underlying political angle that has nothing to do with the Truth in Lending.”

Steve Denis, the executive director of the Small Business Finance Association, said that he doesn’t think that the signed bill that is up on the state senate website will be the final version.

“It is so poorly drafted that even companies that support the bill have liability and will be the first to get sued,” Denis said. “The SBFA will be a lot more aggressive; the legislature has a lot to work on in the next session. It has been a wake-up call, unifying the industry. We will be more aggressive to create a more favorable version.”

Denis has attested to the harm the bill will do to the SMB finance industry in New York, costing billions of dollars in fines and litigation. He pointed out that major companies like PayPal have fought against the bill, and the proponents “recognized it was not a good bill, but passed it to fix it.”

Borrello said that it is common in Albany to encounter legislation written by lawmakers who don’t understand small business owners who deal with regulation every day. Borrello and his wife worked in the hospitality business for years before going into public service. Borello said he feels business owners’ pain during the pandemic, especially in the restaurant and hotel industry.

He said the end result of this new bill when it comes into effect this July: funding and lending companies will stop providing services in New York State, directly harming the small businesses the bill claims to help.

“One of my frustrations, being on the banking committee, is that we do things that ultimately make it more difficult for people to access credit and financing in New York State,” Borrello said. “You’re talking about small businesses that are already hurting, having financial difficulties accessing lines of credit. This disclosure law passing during this pandemic is one more nail in the coffin for small business.”

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

As the bill was argued on the legislative floor, Borrello brought up the controversial “double-dipping” term that had been inserted in the language. Borrello came to the same conclusion as Denis, that there is no double-dipping term: It was just conjured up for the bill to sound scary, negative, and damaging.

“Other than talking about potato chips, I’m not sure what you’re talking about,” Borrello said. “When you haven’t defined it, in the legislature, it comes down to a political talking point and dog whistle. You enshrine a rather vague piece of jargon in the legislation, and it shows how deeply flawed it is.”

Borrello now plans to work with the Governor, DFS, and legislature to amend and change the bill. He is also fighting for a Republican banking overhaul to provide further credit access to small businesses.

“The next step now is to go back and see what needs to be fixed,” Borrello said. “Hopefully, my role now as the ranking member of the banking committee, we can have a common-sense conversation about how to actually fix it.”

Lendio Starts Funding Engines, PPP is On The Way

December 30, 2020 President Trump officially signed the economic relief package Sunday night. While the House, President, and Senate can’t agree on the checks individual Americans will get from Uncle Sam, $284 billion for PPP is on the way.

President Trump officially signed the economic relief package Sunday night. While the House, President, and Senate can’t agree on the checks individual Americans will get from Uncle Sam, $284 billion for PPP is on the way.

In preparation, Lendio, an online loan marketplace that facilitated $8 billion in PPP funds over the summer, has already opened the application floodgates. But when is the bill landing?

“The SBA has ten days from the time it was signed into law, January sixth, when they have to give guidance,” Lendio CEO Brock Blake said. “Then, they have some time after that they’ll open it up, my guess is that it will likely go live somewhere between the 10th to 15th.”

Firms, start your funding engines; the money is coming in about two weeks. And Blake said that with the demand for capital this high—the funds would go quick.

“My guess is that it will be two to three weeks, maybe a little longer,” Blake said. “One of the reasons it will last a little bit longer is because they reduced the loan maximum size from ten million to two million. As a result, two to three weeks or more like, you know, three or four.”

Lawmakers initiated limits to the high end this time around to halt concerns that “small business” bailout money was going to larger sized firms. That isn’t the only change for what some say could be the final round of government stimulus.

“I like what they’ve done this time around, addressing some of the key issues, first of which allowing borrowers to have a second turn on PPP loans,” Blake said. “This pandemic has lasted longer than anyone expected, and there’s a lot of restrictions on these business owners.”

The first time around, the Fed handed out forgivable funds based on two and a half months of payroll, and that went real quick, Blake said. For a firm to meet the criteria for a second loan, they have to prove they have a 25% reduction in revenue from 2019 to 2020.

Blake said he was excited that the new aid is granting industries especially hard hit, like restaurants and hotels, to get larger loans “three and a half time instead of two and a half times.” Blake’s favorite part of the new program is incentivizing lenders to serve genuine smaller businesses, where last time they were not.

“Last time, so many of the smallest small businesses were at a disadvantage because we all know lenders prioritize the largest loan sizes first,” Blake said. “They left the smallest of small business out.”

Lendio and fintech lenders focused on this underserved market of small businesses last time, Blake said. After advocating on behalf of small borrowers, Blake said there are incentives for lenders to give to the underserved and actually make money.

“Thankfully, in this new PPP program, they created a new incentive package for loans smaller than $50,000,” Blake said. “That makes these smaller loans a priority, instead of put toward the back of the list.”

Ho Ho… Hold Up. NY Governor Signs Industry-Altering Small Business Lending Law

December 24, 2020 Merrrrry Christmas. New York Governor Andrew Cuomo reportedly signed SB 5470 into law late last night, a bill that forever changes and complicates nearly all forms of small business financing in the state.

Merrrrry Christmas. New York Governor Andrew Cuomo reportedly signed SB 5470 into law late last night, a bill that forever changes and complicates nearly all forms of small business financing in the state.

The law gives regulatory enforcement authority to New York’s Department of Financial Services, requires APR disclosures on contracts where one can’t be mathematically calculated, and mandates that customers be told if there is any “double dipping” going on. And that’s just the beginning of what it contains.

A coalition of small business capital providers fiercely opposed the language of the bill. Steve Denis, executive director of the Small Business Finance Association, wrote in an op-ed that “the lack of cogency and lazy approach to this legislation is a disservice to the hard-working entrepreneurs who continue to open their businesses while facing daily economic uncertainty.”

The bill was also opposed by fintech lenders like PayPal.

Proponents of the bill celebrated the news on social media in the early morning hours of Christmas Eve.

Ryan Metcalf at Funding Circle, a company not even based in New York that moved all of its tech jobs out of the US to the UK this summer, wrote on LinkedIn that the bill will “save New York #smallbiz between $369 million and $1.75 billion annually.” Funding Circle, as a member of the Responsible Business Lending Coalition (RBLC), was heavily engaged in the advocacy process.

Several of RBLC’s members have already ceased small business lending in the US, some permanently.

Unique circumstances also exist at an ally of the RBLC, the Innovative Lending Platform Association (ILPA), which Funding Circle is also a member of. Two out of the 11 members were acquired before the bill could even be signed, Kabbage and OnDeck.

NY State Assemblyman Ken Zebrowski and State Senator Kevin Thomas, who sponsored the bill, cheered the signing of it.

“Thanks to Governor Cuomo for signing our Small Business Truth in Lending Act,” Zebrowski tweeted. “Extremely proud to have worked with many to establish the most comprehensive small business disclosure law in the nation. With the pandemic surging on, small biz owners need these critical protections now.”

“The signing of the New York State Small Business Truth in Lending Act is a victory for New York’s small business owners,” Thomas wrote on twitter. “Thank you for signing New York’s first-ever small business lending transparency bill into law.”

“I think that the companies and organizations that support this legislation don’t fully understand what’s actually in the bill,” SBFA’s Steve Denis said to AltFinanceDaily in August. “[…] They have no problem pounding the table and taking credit for its passage, but I guess they don’t realize it will subject them and the rest of the alternative finance industry to massive liability, massive fines—upwards of billions of dollars worth of fines.”

And yet Senator Thomas tweeted, “This will help a lot of small businesses trying to get back on their feet during this pandemic.”

It is unclear, of course, who they expect to provide such capital now to do this.

Here Comes More PPP and Stimulus

December 23, 2020 Congress finally passed a new stimulus bill.

Congress finally passed a new stimulus bill.

The aid package calls for $600 payments to American adults and $284 billion for the second round of PPP, with some amended rules.

Following its passage, President Trump called the bill “a disgrace” and voiced that individuals should be receiving much more, as much as $2,000 in stimulus. He is refusing to sign it unless changes are made.

“It’s called the Covid relief bill but it has almost nothing to do with Covid,” Trump said.

And yet the passed deal was considered a watershed moment for congressional leaders. After standing in the way of a stimulus of more than $500 billion and refusing to sign a House-passed $3 trillion aid package this summer, Senate Majority Leader Mitch McConnell spoke Monday with a message: help is finally on the way.

“Moments ago, the four leaders of the senate and the house finalized an agreement,” McConnell said. “A package of nearly $900 billion, it is packed with target policies to help struggling Americans who have already waited entirely too long.”

McConnell said that around $500 billion of the package was reused money from stimulus spending allocated earlier this year, that was never used.

McConnell said that around $500 billion of the package was reused money from stimulus spending allocated earlier this year, that was never used.

The stimulus also extends unemployment benefits for another 11 weeks and adds a $300/week unemployment bonus. .

“It is a strong shot in the arm to help American families weather the storm,” Senate minority leader Chuck Schumer said. “For the 20 million people that would lose unemployment benefits the day after Christmas, help is on the way.”

This round of PPP will allow a second forgiven loan to some firms and attempt to curb larger companies’ ability to take more than $2 million. Firms will be eligible for a second share of loans if they can prove a 25% reduction in business from the same quarter in 2019 and other stipulations.

Lawmakers plan to make it easier for nonprofits and local media companies to get funding and are allocating $15 billion for performance venues hit by lockdown restrictions. The stimulus will also give billions toward school aid, protecting renters from evictions, protecting gig workers, internet broadband, funding food access.

“Our purpose has always been to crush the virus,” House majority leader Nancy Policy said. “Put money in the pockets of the American people, which we do in this legislation.”

Immigrating From Cuba With “Nothing in my pockets,” to a CEO Funding $12 Million a Month

December 15, 2020 “Work hard, don’t ask questions, and good things will happen to you,” Frank Ebanks described his keys to success in the MCA world. “Being Positive, working hard, and keeping my eyes open: If I hadn’t been looking for opportunities at 2 am in the morning on Craigslist, I would have never known about this industry, but it’s huge, it’s such a big industry.”

“Work hard, don’t ask questions, and good things will happen to you,” Frank Ebanks described his keys to success in the MCA world. “Being Positive, working hard, and keeping my eyes open: If I hadn’t been looking for opportunities at 2 am in the morning on Craigslist, I would have never known about this industry, but it’s huge, it’s such a big industry.”

Ebanks started what would become Spartan Capital shortly after seeing an ad calling for startup investors in an industry Ebanks had never heard of, called Merchant Cash Advance.

It was around 2016. Ebanks was up late in the NYU university library, putting himself through an MBA while working as a reactor operator at the Indian Point nuclear power plant in Westchester.

Despite the job security Ebanks enjoyed, he said he wasn’t happy with his career, wasn’t getting the satisfaction he wanted. He had already made it a long way— starting before the millennium as a Cuban immigrant, immigrating to the Dominican Republic in 1998 and then Florida in 2002 with empty pockets. Shortly after arriving, Ebanks enlisted.

“I spent some time in the army; I wanted to put in some time,” Ebanks said. “I said: ‘I’m a new immigrant, what’s the best thing that I could do to reward these opportunities?’ To serve in the army, give the country a couple years, and payback in advance for this opportunity that I knew I was going to have.”

Ebanks said he learned early on to take every opportunity seriously. He served for two years and then became an engineer and contractor for the army, working on the Patriot Missile defense system. He went through college at NJIT, graduating in 2009, and following in his father’s footsteps to become an electrical engineer.

After working with South Jerseys PSE&G, Ebanks took the opportunity to work full time shifts at the the nuclear power plant, and by 2016 he was pursuing an MBA and looking for ways to grow what he called “my empire.” Used to investing in small businesses already, discovering MCA fit right within his world.

“I’ve always been active, throughout my professional career I had businesses in real estate, I owned several businesses such as laundromats, a lot of retail cell phone stores and things like that,” Ebanks said. “So at one or two am in the morning, I’m working on how to build my empire. I was on Craigslist looking for opportunities, seeing what’s out there, and somebody wanted an investment, to partner up and start a company in a new industry.”

He took a meeting and learned a ton. Although he did not end up going into business with that person, he was hooked on the concept.

“I looked at that ad, and $10,000 later, we had a company,” Ebanks said.

He learned what he needed and ended up opening his own MCA business shortly after in New Jersey, finding he loved setting up syndicated MCA deals.

He learned what he needed and ended up opening his own MCA business shortly after in New Jersey, finding he loved setting up syndicated MCA deals.

“I did some research, opened an office in New Jersey, secured a manager to run the operation, and we started brokering deals and learning about syndication.”

He worked with SFS Capital, now called Kapitus. He fell in love with the immediate gratification feedback of making deals, seeing returns on account receivables, and watching renewals come in. The business grew, but things were not always a straight climb to success.

“There was a point where things were not going well and I had to start a new company, find new parters and investors with a funding direct-only focus, and moved into my basement- my wife was unhappy with that. I started hiring people, processors, underwriters, and ISO managers in my basement,” Ebanks said. “At one point, she said, ‘Okay, this is enough. Ten strangers are coming into my house every day, you’ve got to get an office,’ so we secured an office in New York. And that’s when things took off in 2017.”

At that point, Ebanks had shifted his business model from securing deals to funding them all his own, using capital he raised. Ebanks said that being a broker partnered with Kapitus was great, but he wanted to grow and run his business entirely. The best way to do that was through ISO management, Ebanks said. Ebanks let the direct sales team phase out and he hired ISO managers, learning the ISO business as he went.

“So fast forward now: We have over five ISO managers, and we’re funding about $12 million a month,” Ebanks said. “It’s been a phenomenal journey and the most rewarding thing I’ve ever done in my life; I’m not shy to share how exciting every day is to me, and how other than my family and my kids and God, this is the most important thing my life.”

For brokers looking to get started in the industry, Ebanks has this advice to share: Don’t settle.

“Don’t settle, look for growth, and invest your money,” Ebanks said. “I always invested everything I could, 95%, every penny on the business. It matters especially at the beginning, the more you invest, don’t let it sit.”

That investment should go toward your business, your staff, and hiring. Ebanks said the more you invest, the bigger the bag, the more your firm would grow, and your employees will grow with you. Helping employees will mean they will eventually leave, but in Ebanks’ experience treating employees right creates partners.

“Some of them now are partners, and the employee-employer relationship is always more partnership,” Ebanks said. “Some of them own their own companies now, and we help each other out. If they have a big deal, they say: ‘Frank do you want to take $50,000 out of this deal?’ I say yea I trust you. I’ve known you for years.”

Now that he’s on track to grow with recurring customers, seeing some merchants come back to renew twenty times since 2016, Ebanks sees a possible bright future for Spartan Capital: becoming a chartered online bank.

“It is an alternative lending space but to offer the best products to people,” Ebanks said. “I think at the end of the day, and we need all the resources we can get, the next chapter is to apply and secure an online bank charter, it’s the future of the fintech industry.

“Why do people like doing business with us versus a bank? Some of them can do business with banks, but they choose to use us because they have direct access to us after 6 pm, they could call us Saturday, they can call us on a Sunday,” Ebanks said. “A great relationship that they can never get from a bank. I want to bring what we do in MCA to the banking industry to serve people that want banking products, but I want to give them that MCA experience.”

Aspiria Co-Founder On Successful Funding in Mexican SME Space: Still Lots of Room to Grow

December 5, 2020 After 38 years, Guillermo Hernandez has seen the boom and busts of the Mexican financial markets, weathering seven recessions in all, he said. But until 2020, he had never led a company through a pandemic.

After 38 years, Guillermo Hernandez has seen the boom and busts of the Mexican financial markets, weathering seven recessions in all, he said. But until 2020, he had never led a company through a pandemic.

Aspria, Hernandez’s online lending firm, had planned on completing a Series A from international investor Oikocredit, but the deal went into the icebox as the cases came.

“In the beginning of the year, things were doing very well in Mexico, the whole economy was booming,” Hernandez said. “Out of nowhere, we got hit by the pandemic. And the transaction that we were supposed to be closing in March 2020, our investor said, ‘you guys are fantastic, but there are too many unknowns.'”

But due to Aspiria’s resilience and the fact that they went into 2020 with a rock-solid business, Hernandez said Oikocredit decided to complete the investment deal. Aspiria was growing and profitable, and though it was unclear if the markets were going to fall apart, Hernandez said he and his team put the nose to the grindstone and worked through it.

Oikocredit is a worldwide cooperative that provides loans and investments to promote financial inclusion while empowering people by improving livelihoods. That vision is what Aspiria aims to accomplish as an SME lender, Hernandez said, helping businesses access funds to grow.

The Mexican financial space has ample room for growth, and Hernandez said Aspiria is one of the first alternative business lending firms to capture the market.

Hernandez said the banking world in Mexico is twenty years or more behind the US, and he founded Aspiria to bring some change to the financing space.

Hernandez said the banking world in Mexico is twenty years or more behind the US, and he founded Aspiria to bring some change to the financing space.

“The whole financial services industry, I mean it’s light-years behind the US,” Hernandez said. “I saw that the way that people would do the underwriting, the way that people provided financing for small businesses was just so outdated; it was more of an old school market here. I decided there was this huge opportunity for the market.”

For example, Mexico has a third of the US population, but only 30 banks to the 7,000-10,000 the US has. That population is also a younger demographic than up north. In Mexico, the average age is 27 (It’s 38 in the US); Hernandez said: the Average Mexican is trying to establish themselves and reach the middle class, young, educated, and ready to start a business.

Hernandez has been working in finance all his life, starting in Mexico as a banker and consultant for new financial companies before leaving to get his MBA on an HSBC scholarship in Manchester, England. He worked for a time in financial services there before joining a payment startup in the US, where he found his love of startup tech culture.

Hernandez has been working in finance all his life, starting in Mexico as a banker and consultant for new financial companies before leaving to get his MBA on an HSBC scholarship in Manchester, England. He worked for a time in financial services there before joining a payment startup in the US, where he found his love of startup tech culture.

“It was my first exposure to technology, and I was completely amazed. I fell in love with it,” Hernandez said. “At that moment, I was actually thinking about changing careers. I was completely fed up with financial services because it’s boring sometimes. I thought it was not sexy anymore.”

Co-founding Aspiria, Hernandez went on to become the major funder in the space. He said there is so much demand for capital in a standard year that his firm can see 100% year-over-year growth. Even in a pandemic, his firm received a confident investment that will go directly toward building the shop, scaling up funding, hiring, and aiming toward a firm that will one day put it on par with the rest of North America’s leading alternative finance firms.

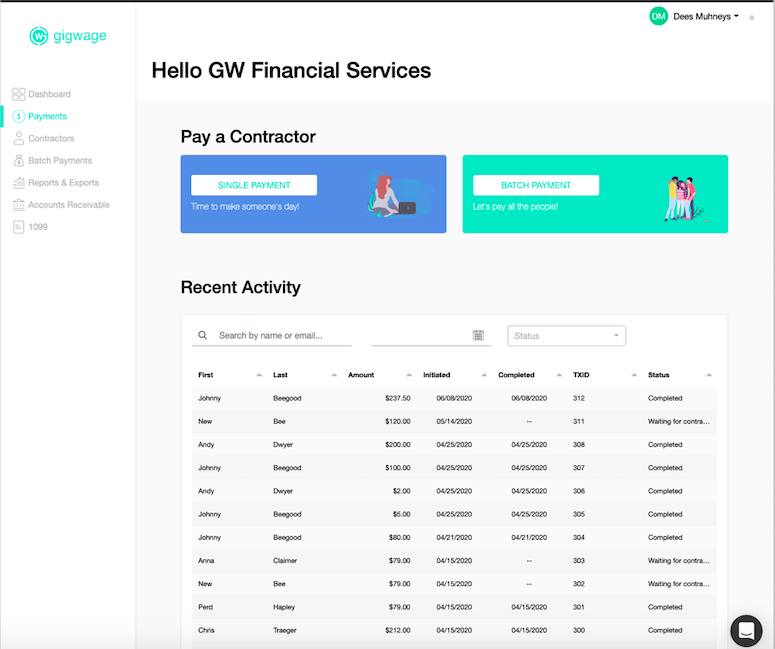

From Sales to Founder: Craig J. Lewis Talks Gig Wage’s $7.5 Million Funding Round

November 27, 2020 Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Lewis made $10 million in payroll tech sales before going on to lead a firm that has seen 30% month-to-month growth this year, during a pandemic no less.

“We help businesses pay independent contractors, but because we’re so tech-centric, it’s evolved beyond just payroll,” Lewis said. “What we ended up building was financial infrastructure for the modern workforce. We help businesses get money from their customers to their contractors as fast and as flexibly as possible.”

The way Gig Wage does this, Lewis said, is by offering an online platform for the hybridization of payroll, payments, and banking from a single login. Businesses can manage their payroll needs for 1099 workers, then shift to payment needs quickly, through direct to debit, all major cards, bank transfers, and accounts receivables.

“One of the only- the only platform in the world actually that has embedded banking into payroll and payments, which is what kind of allows for this speed and flexibility that we offer,” Lewis said. “We’re like B to B to C: We help the businesses with technology and operational excellence, and because independent contractors are separate from the workplace, we provide tools for them.”

Lewis has years of experience in the payroll space- starting as a salesman for ADP small business payroll products back in 2008. Realizing he had a passion for payroll tech and getting customers the best services possible, Lewis went on to learn anything he could about the industry. Selling $10 million in software while moving across the country, Lewis landed in Silicon Valley, where he studied what it took to start a company.

“I was just awed how they thought about technology and products and company building,” Lewis said. “And I vowed to bring that to the payroll industry.”

Lews joined a startup, learned the Silicon Valley way of creating a company through an African American tech acceleration program. In 2014, Lewis founded Gig Wage to do something disruptive in the payroll space.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

“With the maturation of Uber, Lyft, Postmates, Doordash, Grubhub, Upwork, all of these kinds of gig economy freelancer companies, we had great growth going into 2020,” Lewis said. “In Q1, we were set up to raise our series A, and then March happened, and the terms got pulled off the table.”

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

“The gig economy was right there waiting on the workforce to provide opportunities to earn, and we were positioned perfectly to help people compete for that talent and pay people in a modern way,” Lewis said. “The pandemic has been a huge growth accelerant for us, and we think those tailwinds will only continue.”

Those winds of success came during a time of protest. Amplified in the pandemic’s backdrop, the country was waking up to the unequal disenfranchisement black people faced. Only 1% of black founder entrepreneurs ever receive VC funding, and Lewis said he is proud to have raised a significant round, given that unfair stat.

“With so much controversy and negative energy around black people in general,” Lewis said. “I think putting this positive story out there and showing this black excellence, black tech, I think it’s super important, and it’s been something that I’ve embraced. We’ve been able to be a part of putting something extremely powerful and positive into the market.”

America is finally waking up to realize something Lewis said was obvious, that black people matter, even though it can be controversial to say so. He hopes his success can help others but affirms the funding round was no charity drive.

“This is a great opportunity for us to be clear about the fact that like hey, we’ve been working on this, we’ve built a good business and a good technology,” Lewis said. “This is a big business opportunity for our investors and us. It wasn’t charity, right: This isn’t like, oh he’s black, give him some money.”

The successful funding round shows confidence in the Gig Wage platform from Green Dot, which will allow Gig Wage to offer bank accounts and debit services to independent contractors. Green Dot is one of the only fintechs with a national banking license, Lewis said, and Gig Wage is joining the Banking-as-a-Service direction that the fintech industry is headed.

Beyond payroll, Lewis can’t wait to offer other financial products to businesses as the company grows.

“When you think about the gig economy, it’s important that people get paid fast and flexibly: You’ve got to have the cash to be able to do that,” Lewis said. “We see some unique opportunities to get involved in the lending space down the line as well as we continue to build out our technologies.”