Ireland is Funding Fintech Through Government Investment

November 2, 2021 The Irish government has taken a serious liking to fintech. With a broad history of being active in financial services, the nation believes they can attract companies from around the world to reap the benefits of employing Irish citizens, while also tapping a major source of export revenue through an up-and-coming industry.

The Irish government has taken a serious liking to fintech. With a broad history of being active in financial services, the nation believes they can attract companies from around the world to reap the benefits of employing Irish citizens, while also tapping a major source of export revenue through an up-and-coming industry.

With access to capital for small businesses just as difficult here as it is in the US, a new fintech company looking for start-up cash may be able to turn to Dublin to get a major investment, rather than dealing with a retail investor or a venture capital firm here in the states. Enterprise Ireland, the organzation that runs these programs, is trying to tempt fintech companies looking for a fresh start or an international expansion to start that process in Ireland.

“Enterprise Ireland is the trade development and venture capital arm of the Irish Government,” said Claire Verville, Senior Vice President of Fintech and Financial Services at Enterprise Ireland. “We are a semi state agency and our mandate is to help support indigenous Irish enterprise to grow and expand in global markets.”

Just like in the United States, it is extremely difficult for an Irish business to walk into a big bank and get a loan. It’s in these situations where the Irish government has decided to make a direct investment themselves. Through Enterprise Ireland, according to Verville, the Irish government can provide capital to startups across a range of areas, in exchange for things like loan repayment or government equity in the company.

“In addition to the kind of more traditional trade development stuff that you would see from any government promoting their indigenous businesses abroad, we do invest directly in companies through equity and participate directly as a [limited partner] in funds to funds.”

Verville spoke about how the Irish government has been looking to extend funding to fintech startups for some time. “Our fintech portfolio is over 200 companies now, we have been one of the most active investors in Europe in a long time. We are one of the most active global investors across all sectors, and we’re really focused on early stage capital for fintech.”

When asked about the decision making process that goes into Irish investments, Verville portrayed it the same as if it was a private firm making the same move. “We will vet like any other investment, make sure we’re comfortable with it, make sure that the business is verifiable, and that we understand the track record of the team,” she said.

When asked about the decision making process that goes into Irish investments, Verville portrayed it the same as if it was a private firm making the same move. “We will vet like any other investment, make sure we’re comfortable with it, make sure that the business is verifiable, and that we understand the track record of the team,” she said.

Through investing in fintech, Enterprise Ireland appears to believe they will give their small business owners better access to capital. If the industry can create a Euro-American hub in Ireland, the latest tech and funding innovations will develop there, giving access to that technology to Irish businesses first. If Irish small business lenders can use Irish technology to help an Irish merchant, everyone wins.

With financial innovation in Europe being leaps ahead of the US, Verville believes the Irish employees working in finance would be better suited to deal with some of these new innovations over Americans because of their familiarity with these systems that are already in place. She hinted at things like EMV cards being around in Ireland for years at the consumer level before they ever made it to the United States.

As far as incentive for profit, Enterprise Ireland isn’t concerned with the success of their investment from a financial perspective as other investment groups are. They instead focus on things like employment numbers and longterm sustainability for those jobs acquired through their efforts in investing in industries like fintech.

“Because we are attached to the government, we aren’t a money-making mission as far as venture capitalists go. We are focused on employment in Ireland, which is partly why it’s so important that the companies are founded in Ireland and that they are building their employee base in Ireland, and on export revenue.”

Verville spoke about how only when businesses in Ireland do well, Enterprise Ireland only does well, too. “We do make money off some of our investments, and that’s government money. We get our budget set by the government department every year, just like any other government agency.”

To be eligible for funding from Enterprise Ireland, a business needs to be based in Ireland, have an Irish LLC, and must have a significant amount of Irish employees. According to Verville, the Irish market is ripe for American small businesses, especially alternative finance.

Shopify Capital Originated $393.6M in MCAs and Business Loans in Q3

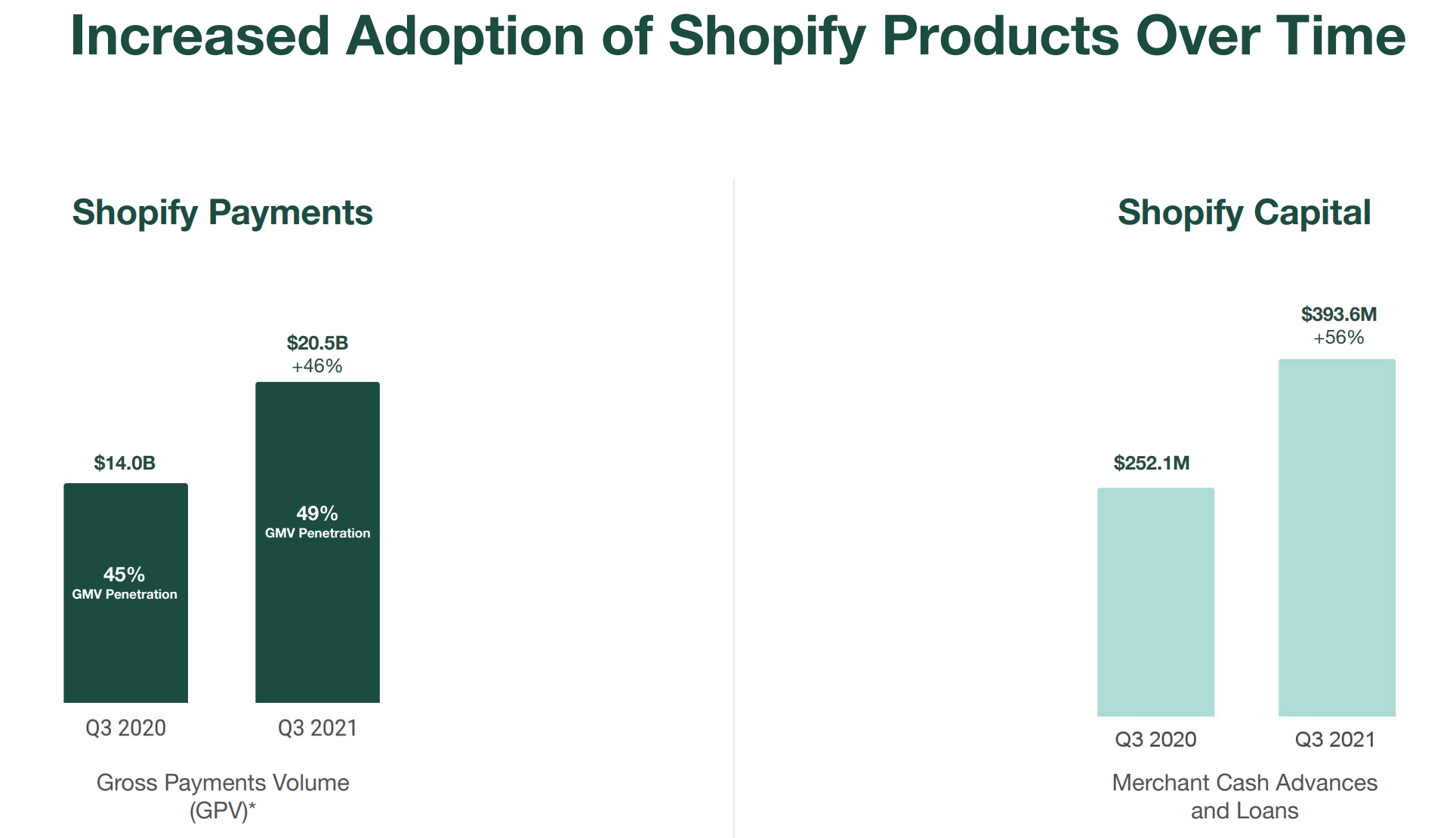

October 28, 2021Shopify Capital, the funding arm of e-commerce giant Shopify, originated $393.6M in merchant cash advances and business loans in Q3, the company reported. That’s up from the $363M in the previous quarter.

Covid was a boon to Shopify Capital given its dependence on e-commerce businesses. Its 2020 funding volume was almost double that of 2019.

“Shopify Capital has grown to approximately $2.7 billion in cumulative capital funded since its launch in April 2016,” the company announced. The large volume and continued success has landed the Shopify Capital division in the company’s “core” bucket of “near-term initiatives” that will build the company for the long term, according to a presentation accompanying Q3 earnings.

Fintech Happy Hour Discussion Prioritizes Data, Innovation, and Potential

October 22, 2021 In celebration of New York Fintech week, Ocrolus and Codat hosted Thursday’s happy hour with a panel discussion on “the power of combined data”. Pete Lord, CEO of Codat and David Snitkof, Head of Analytics at Ocrolus, discussed how their respective companies are working to innovate the fintech space by harnessing how to most productively make use of their most valuable commodity—data.

In celebration of New York Fintech week, Ocrolus and Codat hosted Thursday’s happy hour with a panel discussion on “the power of combined data”. Pete Lord, CEO of Codat and David Snitkof, Head of Analytics at Ocrolus, discussed how their respective companies are working to innovate the fintech space by harnessing how to most productively make use of their most valuable commodity—data.

The event was open to those in the fintech space, but primarily served as a mixer and networking event. The panel had discussion topics, moderator questions, and an audience question-and-answer session.

After the event, Snitkof spoke about how the choices available to potential borrowers are so vast, that this vastness of funding sources may be creating a knowledge gap between borrowers and funders. Through fintech, Snitkof appears to believe this knowledge gap can be bridged.

“I think awareness is a really big deal where in many cases people think the only place they can go get a loan is their bank,” said Snitkof. “In fact, there are more lenders out there and they’re all different, which is the important thing. They all use different data, they all use different technology, they all might offer different types of products, and if you’re a borrower, it pays to do some learning.”

When speaking about fintech companies themselves, Snitkof stressed the need for a company to find their niche. “I think what fintech companies can do is really try to make clear how they’re different. The most successful fintech companies that I know of, at least the most exciting ones right now, are ones that don’t try to be everything to everyone.”

Codat, the main showcaser of the event, have people that are equally as excited about both their company and industry’s potential outlook.“I think fintech is just getting started,” said Lord, when asked about Codat’s role in innovating the fintech space. “[Our] role is in connecting the different systems that are used by small businesses that enable them to thrive and to be able to do more business.”

Lord spoke about the increase in speed of the logistical processes that his company creates by innovating antiquated data entry systems via the Codat platform. “[We] provide a layer of intelligence on top of the data that we make available to clients to allow them to get more value faster, and then provide a better experience using that to their small business customers.”

Codat employees also spoke about the state of fintech, along with their direct involvement in changing the way financial transactions occur across a vast array of industries and institutions.

“I think small business owners and people who work at large corporations or medium sized businesses are now expecting similar experiences [like] the financial services they use to power their everyday activities,” said Nick Codron, Codat’s Strategic Account Manager of North America. “All of these software companies are moving into financial services, there is a big play for being the [top] platform and the central business operating system.”

Other employees believe that it is not just a desire for business owners to integrate technology into the financial services space, but a game of catchup; hinting that fintech, as a community, is behind the eight-ball when it comes to the pace of innovation.

“I think there’s a lot of catching up the world needs to do in terms of digitizing financial services not just for small businesses, but for consumers and large corporations,” said Andrew Rho, who recently just transitioned to a Strategy Management position at Codat. “If you can have easy access to those products, services and design concepts and materials that help your dreams come true, that’s an e-commerce business right there.”

“In that sense, you see fintech touch everything,” said Rho.

Old Hill Partners Upsizes Funding Commitment to ByzFunder up to $40 million

October 19, 2021 New York, October 19, 2021: ByzFunder, the leading non-bank Fintech company, announced a significant upsizing of existing financing from strategic partner Old Hill Partners of up to $40 million. This financing round comes as a substantial increase from Old Hill Partners’ first facility of $12 million in 2020.

New York, October 19, 2021: ByzFunder, the leading non-bank Fintech company, announced a significant upsizing of existing financing from strategic partner Old Hill Partners of up to $40 million. This financing round comes as a substantial increase from Old Hill Partners’ first facility of $12 million in 2020.

In September, ByzFunder closed its record financial performance exceeding $12 million in originations. The finance upsizing from Old Hill enhances ByzFunder’s position as an emerging leader in the business alternative financing space. It provides the assistance needed to advance near-term and long-term priorities in preparation for an anticipated period of significant innovation, growth, and expansion into additional credit tiers.

Ilya Fridman, CEO expressed enthusiasm and confidence about the path ahead; “We have a very exciting journey ahead of us. Our people continue to rally together and outperform with an absolute commitment to excellence, and our platform continues to grow stronger, more advanced, and more capable. With Old Hill, the exceptional team of investors, and upsizing of financial resources that their partnership brings, we can accelerate ByzFunder’s already impressive growth trajectory, expanding our balance sheet to fully service business owners.”

Old Hill Partners Inc. is an alternative asset manager focused on asset-based lending transactions with borrowers seeking $10 to $50 million in financing. The firm structures senior secured debt in the form of term, drawdown, and revolving-to-term facilities of up to four years and loan-to-value ratios in the range of 35% to 85%. Collateral types include pools of loans or leases (specialty finance), receivables, inventory, machinery, and equipment.

“We have been impressed by the quality of ByzFunder’s originations, performance to date, exceptional leadership, disruptive business model, innovative technology, and the overall quality of their operations. We believe the company is well-positioned for further growth, and we are pleased to be part of it,” said Peter Faigl, Senior Portfolio Manager at Old Hill.

About ByzFunder

ByzFunder NY LLC is a leading non-bank financing company that has successfully provided small to medium-sized businesses with fast and convenient financing alternatives since 2018. ByzFunder combines technology and non-traditional credit algorithms to offer attractive pricing and exceptional customer service to a market not captured by traditional banks.

National Funding Announces the Upsize of Their Bank Credit Facility and the Issuance of Corporate Notes

October 12, 2021

SAN DIEGO, Calif. October 12, 2021 – National Funding, Inc., one of the largest U.S. specialty finance companies serving small- and medium-sized businesses, announced the recent renewal and upsize of a $60.0 million senior secured warehouse line of credit. The facility, which includes an accordion to expand to $75.0 million, was provided by a prominent U.S.-based commercial bank. The facility will continue to be used by the Company to fund new originations and support additional growth of the platform.

Concurrent with the transaction, National Funding also secured a $55.0 million investment-grade rated corporate note financing provided by a consortium of institutional investors. The transaction was assigned a BBB+ rating by a nationally recognized statistical ratings organization. Having closed this additional financing, National Funding is well positioned to support its partners and enhances the Company’s ability to take advantage of significant market opportunities.

To date, National Funding has provided more than $4.3 billion in working capital and equipment leasing for more than 75,000 small- to medium-sized businesses nationwide.

“As the economy recovers from the pandemic, this challenging environment is creating opportunities for National Funding to accelerate our growth plans and at the same time provide flexible capital solutions to our client base seeking to expand their businesses,” stated Dave Gilbert, CEO of the Company. “Our ability to close these transactions with multiple institutional partners has substantially expanded our financial capacity and flexibility and is a validation of the strength of the robust platform that National Funding has built.”

Joe Gaudio, President of National Funding, stated, “These new facilities represent the continued evolution of the Company’s funding sources, providing National Funding with a unique opportunity to reduce our cost of funding and access more diversified sources of capital. Both investments are a strong endorsement of the stability and success of our Company and of our mission to transform the way small businesses access the capital they need to grow.”

Brean Capital, LLC served as the Company’s Exclusive Financial Advisor and Placement Agent in connection with the note transaction.

About National Funding

Founded in 1999, National Funding is a leading U.S. specialty finance company serving small- and medium-sized businesses. The Company’s foundation serves American small business owners by providing funding solutions to meet their needs to reinvest in their day-to-day operations and help them grow. National Funding’s digital funding process has elevated its digital capabilities by delivering a fast and simple online application. For more information about National Funding, visit https://www.nationalfunding.com.

Contact:

Susan Almon-Pesch

Publicist for National Funding

sue@speschialpr.com

MJ Capital Funding Had More Than 5,000 Investors

October 8, 2021Investigations carried out by the Receiver for Pompano-based MJ Capital Funding, have revealed that the number of investors in the alleged ponzi is more than double than originally believed.

In August, the SEC successfully persuaded a judge to place MJ Capital in Receivership after providing a convincing argument that the company was engaged in an active securities fraud and that the assets should be preserved. At the time, the SEC estimated that there were as many as 2,150 investors and that the amount raised ranged somewhere between $70M and $129M.

Now with better access to the internal workings of the business, the Receiver says that there are actually more than 5,000 investors and that they expect this number to increase, according to recent court filings.

Also revealed is that more than 400 individuals were tasked with recruiting investors.

“While MJ Capital claimed to use investor funds to provide small business loans called Merchant Cash Advances, the Receiver’s investigation to date has revealed virtually no evidence of legitimate business activity involving the funding and collection of Merchant Cash Advances which proceeds could have funded the payments to investors,” the Receiver said in official papers.

The case is ongoing.

More than 3,200 people have come out in support of MJ Capital Funding’s CEO, believing that she is also a victim in what has befallen the company.

Fundomate Announces $50 Million Line of Credit to Bring Embedded Automated Funding and Real-Time Banking to Payments and SMB Marketplaces

September 30, 2021

Los Angeles, September 30, 2021 — Fundomate, a leading embedded finance provider of automated business funding solutions and real-time banking tools for merchant-facing platforms, announced the closing of a $50 million line of credit with Revere Capital today. The new line of credit is Fundomate’s largest to date.

Fundomate will leverage the credit facility to scale up its partnerships with merchant-facing businesses and grow the company’s new white-label banking platform. The platform enables merchant-facing platforms and marketplaces to rapidly expand their product suite and enhance engagement by offering automated financing and embedded banking tools under their own brand.

“With the closing of the $50 million credit line, Fundomate can scale its proven automated funding platform via its one-touch funding tool already embedded within 100+ payment processing partners and marketplaces”, says Sam Schapiro, CEO and Founder of Fundomate. “We’re excited to also focus on our new embedded real-time banking platform, which uses AI and advanced forecasting to provide our partners the ability to offer their customers free short-term working capital that’s available for immediate use.”

“With the closing of the $50 million credit line, Fundomate can scale its proven automated funding platform via its one-touch funding tool already embedded within 100+ payment processing partners and marketplaces”, says Sam Schapiro, CEO and Founder of Fundomate. “We’re excited to also focus on our new embedded real-time banking platform, which uses AI and advanced forecasting to provide our partners the ability to offer their customers free short-term working capital that’s available for immediate use.”

Revere Capital Managing Director Christopher Gilker said, “We’re incredibly excited to grow with Fundomate. As I tell all my colleagues, Fundomate is a company at the right place at the right time. The team is ambitious, and I have no doubt the company will disrupt the fintech, payments, and banking space in a big way.”

Revere Capital Managing Director Suman Mallick commented further, saying, “I’m very excited about Fundomate’s potential to change how businesses manage their banking and credit needs. I believe the company will benefit from strong secular tailwinds and has vast opportunities for growth with merchant-facing businesses throughout the US.”

Waterford Capital structured and arranged the line of credit on behalf of Fundomate. Dave Piotrowski, Managing Director at Waterford Capital, said, “Fundomate has an advantage over others in the merchant finance space through the products offered through their payment processor partners. This financing relationship with Revere Capital will help take the company to the next level and further broaden their competitive advantage.”

About Fundomate

Fundomate is an innovative fintech company that operates in the alternative lending space and provides both direct-to-business and white-labeled turnkey solutions, enabling merchant-facing platforms to offer alternative funding products to their customers as a value-added proposition.

The company has deployed over $100M to more than 2000 merchants across various industries in

the United States.

About Revere Capital

Revere Capital is a private credit manager with expertise in lower middle-market real estate bridge lending & specialty finance. The firm’s disciplined underwriting utilizes fundamental real estate analysis and research, emphasizing intrinsic value to create a diversified portfolio for investors. Revere also specializes in financing other commercial interests, consumer interests and insurance-backed interests. With a national footprint, Revere Capital offers speed, certainty of execution, and creativity to structure loans to fit borrowers’ needs and provide contractual income for investors.

About Waterford Capital

Waterford Capital is a leading arranger of structured finance and asset securitization transactions. The firm advises specialty finance companies and asset managers in connection with warehouse credit facilities, private placements of asset-backed securities, whole loan sale programs, and mezzanine and equity capital raises.

MJ Capital Funding’s Website Has Been Shut Down, Company’s Assets Being Auctioned Off

September 24, 2021 MJ Capital Funding investors holding out hope that a return to business as usual could be in the cards for the company accused of being a ponzi scheme, might find that outcome a little less likely.

MJ Capital Funding investors holding out hope that a return to business as usual could be in the cards for the company accused of being a ponzi scheme, might find that outcome a little less likely.

The Receiver has agreed to auction off all of the assets at the company’s Pompano Beach offices on September 28, and everything must go, from the 60″ TV to the garbage cans to the houseplant.

Such powers afforded to the Receiver, a law firm partner named Corali Lopez-Castro, also gives her the ability to enter into binding legal agreements on behalf of the company, the latest ones being Consent Agreements with the SEC. In doing this, the two MJ companies (MJ Capital Funding, LLC and MJ Taxes and More Inc.), have agreed to disgorge of “ill-gotten gains,” accept a civil penalty, and be permanently restrained from continuing its former business. Such an arrangement is standard fare when companies are thrust into forced Receiverships like this one. The Receiver’s job will be to collect as much money as possible so that it can be distributed to afflicted investors.

The MJ Capital Funding Website has also been shut down. It now forwards to law firm Kozyak, Tropin, Throckmorton. Regular updates on the case are available for free at: https://kttlaw.com/mjcapital/.

The consent orders do not apply to former CEO Johanna M. Garcia individually, who lost control of the company and ability to act on the company’s behalf when it was placed into Receivership.

An astounding 3,160 people have signaled their support for Garcia in this case. That’s the number of signatures on the online petition for her located on change.org.

“Our goal with this petition is to get those funds unfrozen as soon as possible,” it says. “This is Johanna’s desire as well proving once again Johanna’s unwavering support for us and in building a strong team and community. Johanna has helped countless amounts of people and charities with the work she does local and worldwide.”