Is Online Lending the Cream of the Fintech Crop?

March 10, 2016 American fintech companies raised $7 billion over 351 venture capital-backed deals in 2015 and leading the pack were online lenders like SoFi, Zenefits, Avant and Prosper Loans.

American fintech companies raised $7 billion over 351 venture capital-backed deals in 2015 and leading the pack were online lenders like SoFi, Zenefits, Avant and Prosper Loans.

A new report released by CB Insights and KPMG shows a record spike in VC-backed fintech deals, hitting $14 billion globally and making up 73 percent of all VC funding. The purview of fintech included companies in lending, payments, personal finance, bitcoin and equity crowdfunding.

In the U.S., the pack was led by marketplace lender SoFi raising over $1.35 billion, with SoftBank investing a billion in the San Francisco-based startup. Other noteworthy investments included $500 million into payroll service startup Zenefits, online lenders Avant and Affirm, which provide installment loans and credit scoring services.

Other Highlights

- Major corporations participated in one of every four fintech deals

- Investment in bitcoin and blockchain was up 76 percent annually

- 14 of the 19 fintech ‘unicorns’ (startups with a billion dollar valuation) were in lending and payments

- Citigroup (13 deals) and Goldman Sachs (10 deals) led investing in VC-backed fintech startups in the past four years.

- Top fintech companies of the year were Lending Club, Square and OnDeck Capital.

Lending Club Class Action Lawsuit Predicated on Madden v Midland Risk

March 2, 2016UPDATE: This case is unrelated to another class action filed against Lending Club on April 6th

Lending Club is the latest publicly traded online lender to get hit by a shareholder class action lawsuit (OnDeck was first). Filed in the Superior Court of the State of California, plaintiff alleges in the complaint that Lending Club misleadingly concealed the fact that:

- Lending Club had an unsustainable business model that was predicated on it being able to issue loans with extremely high and/or usurious rates across the country

- that their loan investors would not be able to enforce the extremely high and/or usurious rates imposed by Lending Club because they violated state usury laws

- that without the extremely high and/or usurious rates, the loans generated through Lending Club’s marketplace would not be attractive to investors because the loans had very high credit risk and were subject to issues concerning insufficient documentation

- that a substantial portion of its loans were issued with rates in excess of those allowed by applicable state usury laws

The action seeks “recovery, including rescission, for innocent purchasers who suffered many millions of dollars in losses when the truth about Lending Club emerged and the its stock price plummeted.”

Among the Defendants is former US Treasury Secretary Larry Summers.

The complaint alleges that the truth about Lending Club began to emerge after “the Second Circuit affirmed [in Madden v Midland] that the business model used by Lending Club was not valid because loans sold by banks to non-banks, third parties (such as Lending Club and its investors) are not exempt from state usury laws that limit interest rates.”

–In actuality, no such affirmation was made. Lending Club does not specifically use Midland Funding’s business model and the case was not about Lending Club, nor was Lending Club mentioned in it.

“Specifically, the Second Circuit observed that assignees and third-party debt buyers could not rely on the National Bank Act to export interest rates that were legal in one state but usurious in another, to the states where those rates were impermissible,” the complaint states.

–Perhaps, but Lending Club’s bank makes loans under the Federal Deposit Insurance Act, not the National Bank Act.

As supporting evidence, the complaint cites statements from Moody’s analysts, Morgan Stanley, Cross River Bank CEO Gilles Gade, and Lending Club CEO Renaud Laplanche himself in a quarterly earnings call.

While the impact of Madden v Midland has been seriously overblown, Lending Club’s stock has no doubt taken a beating since its IPO. The complaint states a loss of 43% from the original offering price. Among the defendants are:

- LendingClub Corporation

- Renaud Laplanche

- Carrie Dolan

- Daniel Ciporin

- Jeffrey Crowe

- Rebecca Lynn

- John J. Mack

- Mary Meeker

- John C. (Hans) Morris

- Lawrence Summers

- Simon Williams

- Morgan Stanley & Co. LLC

- Goldman, Sachs & Co.

- Credit Suisse Securities (USA) LLC

- Citigroup Global Markets Inc.

- Allen & Company LLC

- Stifel, Nicolaus & Company, Incorporated

- BMO Capital markets Corp.

- William Blair & Company, L.L.C.

- Wells Fargo Securities, LLC

NOTE: This case is unrelated to another class action filed against Lending Club on April 6th

Loan Brokers or Self Origination? Here’s What Experts Say

February 22, 2016 Last year belonged to the brokers in alternative finance — with a phone and a few leads pulled up online, anyone could sell a loan. With seemingly no barriers to entry, alternative lending attracted auto and insurance salesmen fleeing their jobs to cash in on the gold rush in an economy which was coming out of the shadows of distrust for big banks. And it found quick ascension to grow into a trillion dollar market.

Last year belonged to the brokers in alternative finance — with a phone and a few leads pulled up online, anyone could sell a loan. With seemingly no barriers to entry, alternative lending attracted auto and insurance salesmen fleeing their jobs to cash in on the gold rush in an economy which was coming out of the shadows of distrust for big banks. And it found quick ascension to grow into a trillion dollar market.

But a year on, as the dust has settled, we asked industry veterans what it means to remain successful in this business and what is the key to sustainability — is it in going for the ISO/broker channel to find deals or originating your own.

Here’s what they had to say

Don’t Break the Broker

Tom Abramov of MFS Global voted for the ISO/broker channel and said that that’s how the company strictly does deals, working with brokers who have a track record as a part of their recruitment system. The six year old company that started as an broker shop now focuses only on funding with products that are a mix of merchant cash advances and lines of credit.

“We don’t look at FICO scores or SIC codes, we only look at cash flows of businesses,” said Abramov. “I want to see if I give a someone a dollar whether they can turn it into two.”

Abramov added that his firm offers brokers 20 percent commission and their default rates are sub 5 percent.

The advantages of scoring deals through a broker channel can be alluring. It involves no overhead, no staff that needs compensation, motivation and incentives, and makes use of the existing broker-merchant relationships.

Jordan Feinstein of NuLook Capital said that his firm works with brokers exclusively and the model has helped them respond to merchants faster. “We do not have a sales team speaking to merchants directly, that’s in conflict with our model,” said Feinstein. “We decided that the best way to grow is to build relationships to avoid the overhead, compliance, training and manpower that a sales team would require,” he said.

Building a Hybrid Model

There are some others who want to make the best of both the models and work with brokers while originating and funding their own deals. Forward Financing which uses a hybrid model has strategic partnerships with some brokers while still originating their own deals. “We have a hybrid model because our goal is to have a program for any type of business and work with companies across the spectrum of risk,” said Justin Bakes, CEO of Forward Financing. “While our priority is to self originate, it is essential to create and maintain partnerships in this business,” he said.

The Original Origination

While the allure of a lean business is certainly attractive, there are some who are in the industry to build a bigger business and create value by making it robust — Jared Weitz of United Capital Source is one of them. “There is a big market for both analytical process as well as sales process. It’s important to go after your strength,” said Jared Weitz, founder and CEO of United Capital Source. “When you originate and fund your own deals, you’re in a rewarding position and in control of how merchants get treated.”

Industry Trends

Speaking of the industry in general, these experts agreed that the business was undergoing a change with new entrants coming in and experimenting with better services and technologies.

“Last year was the year of brokers but we are still missing the education with merchants. Some brokers are interested while some are not,” said Abramov.

“I notice a clear difference between the old and the new in terms of technology and pricing model,” said Bakes.

“New funders are coming in with different products and terms with increased competition in the ISO market,” said Feinstein.

“Marketing is getting more expensive and only the ones who can afford to pay can play,” said Weitz.

Me-Too Lenders Reject The Opportunity to be Unique

January 15, 2016 IMITATION IS THE BEST FORM OF FLATTERY

IMITATION IS THE BEST FORM OF FLATTERY

You know they say that the imitation is the best form of flattery, the only problem is that flattery is insincere praise, or praise only given to further one’s own selfish interests.

Surely new funders and lenders in our space are looking to further their own selfish interests by stealing away market share from existing players, which is perfectly fine seeing as though we operate in a free market society. However, what doesn’t make sense to me is thinking that you can steal away a competitor’s clientele by looking, sounding, and behaving exactly like he does.

THEY ALL SOUND THE SAME

I have no idea how many direct funders are present in our space today, but from what I’ve heard it’s well into the hundreds, and I receive recruiting emails along with invites on LinkedIn from these new players all of the time. What’s strange about just about all of these new players is that they all sound, specialize in, and operate the same as my current funders, leaving me scratching my head wondering why in the hell should I bring my volume over to you, if you do nothing different? I can hear them now:

– “John, we can consolidate your merchant’s balances as long as they net 50%!” (This isn’t anything new, the 50% net rule has been around for 17 years.)

– “John, we can approve some of your merchants for as low as a 1.12!” (This isn’t anything new, A+ and A Paper merchants have been receiving proper risk based pricing for years now.)

– “John, you will receive a dedicated account manager!” (This isn’t anything new, funders and lenders have been providing their broker houses with dedicated ISO Managers for around 17 years.)

– “John, we can fund just about every deal if the deal makes sense!” (This could be a new concept, the problem is that I have heard this before, only to submit a “restricted industry” merchant and it be declined just like it’s declined everywhere else.)

– “John, we fund deals as small as $5,000 to as high as $5 million!” (This isn’t anything new, this has been the standard funding range for years now. Plus, it’s rare that a broker in our space would get a merchant that needs $5 million, as those merchants would usually rely on the traditional lending system.)

– “John, we get deals done fast!” (Everybody says this, the reality is that unless a lender has automated the majority of their closing process as well as eliminated many portions of said closing process, then that means they are still doing a good chunk of it “manually”, which means it will always take 2 – 10 business days to complete everything.)

NOT EVERY “DIRECT FUNDER” IS A “DIRECT FUNDER”

There are a number of small firms that might market themselves as a direct funder, but the reality is that all they do is fund their deals through some type of syndication platform. My definition of a direct funder or lender is one that has built their own underwriting platforms and produced their own formulas to complete merchant cash advance transactions or alternative business loans. Thus, to be a direct funder (based on my definition), it’s going to “cost you something” in terms of real investment in your infrastructure, your people, as well as needing to raise millions of dollars in lending capital.

OUR TRUE PURPOSE IS DISRUPTION

Understand that our true purpose here on the alternative side of the debt financing space is to innovate how financing is underwritten, approved and delivered, seeking to steal market share away from traditional lending systems. The media calls this process “disruption.” Our system is so efficient, that with one of our industry’s most popular platforms, a small business owner can go online at 11:30 a.m. to apply for a loan, get an approval by 12:15 p.m., then complete their entire closing process online by 12:25 p.m. Within 60 minutes, a small business can start, sign for, and close their small business loan application for amounts including $25k, $75k, $150k, $200k, etc., and receive the funds in their bank accounts the next morning. The traditional lending system cannot underwrite, approve and deliver financing with this amount of efficiency, speed and proficiency.

IF YOU ARE GOING TO BE A DIRECT FUNDER, WHY NOT CONTRIBUTE TO CHANGING THE GAME?

Various reports on marketplace lending have estimated that the global lending size of our space is near $60 billion per the end of 2015, but it’s also estimated that by 2020 we will be near $300 billion of the total global lending market (includes lending on the consumer and commercial sides). Understanding this, what baffles me with new funders and lenders, is why in the hell are you going through the hassles of setting up your own platform, raising millions of dollars in lending capital, and setting up an experienced underwriting team, only to come into the market and do absolutely nothing different?

That makes absolutely no sense. You have the technology, the people, the capital and the formula behind you, so please add a unique contribution to our space to assist our industry as a whole (consumer and commercial side) in growing to this $300 billion in global lending metric by around 2020.

SPECIALIZATION RECOMMENDATIONS

When you enter the market and send brokers information on your program, it should be clear what separates you from everybody else and what your unique role will be going forward in helping our space achieve this $300 billion in global lending metric. Here are a couple of recommendations off the top of my head that you could utilize for specialization:

#1.) A True High Risk Funder/Lender

How about actually funding industries that nobody else will fund? I’ve seen this promoted before but I’m talking about going all the way by taking a look at our market’s standard underwriting practices across the board, then asking the question of, “What merchants are being pushed out and why? How can we start saying YES to these merchants rather than saying NO like everybody else is doing?” You could begin by putting together a list of industries on just about every funder or lender’s restricted list, then trying to figure out how to fund these categories with risk based pricing.

#2.) Bring Efficiency To Global Lending

How about funding in countries that other funders aren’t funding in? Basically, bringing the efficiency of the US market to the global markets in a way that currently is lacking? It’s hot over here in the US market with many players and competitors, but what about in the UK, Australia, China, etc.?

#3.) A Completely New Product

How about creating a new alternative working capital product that we’ve never heard of before?

#4.) Further Lowering Of Pricing

How about find a way to continue bringing down your cost of operations, administration and lending, so that brokers are able to have lower base pricing to increase profitability on lending to merchants, even those in A+ and A Paper categories? This can also help open up the market to attract higher credit grade merchants due to the lower pricing available, but still with “liberal” underwriting procedures.

#5.) A More Efficient Alternative Asset Based Lending Product

How about creating a more efficient alternative asset based lending product, that competes with the current crop of alternative asset based lenders? The current crop that we have today has a lot of inefficiencies within their product, such as having the merchant put up luxury items or even their house to obtain approval, but still charging the merchant rates that resemble traditional merchant cash advance factor rates or even higher. Shouldn’t the fact that a merchant is putting up tangible collateral lower the risk on the deal, which should also lower the pricing and extend the term? So I say, how about some innovation be done in this area so more of these products could be sold?

#6.) Innovation in Factoring, Purchase Order Financing and Equipment Leasing

How about providing accounts receivable factoring, purchasing order financing and equipment leasing, but finding a way to provide such services in an innovative fashion that’s different than the current crop of funders or lenders offering said services?

#7.) A Real Alternative Based Line Of Credit

There are certainly alternative line of credit programs out in our market today, but they are not as efficient as they should be. How about you create a real alternative based line of credit that would resemble something similar to a credit card line of credit, where the merchant can take it out and have it on the side, without it interfering with that of other financing programs such as a merchant cash advance or an alternative business loan?

#8.) Innovation In Consumer Lending

I know that regulations are much higher on this side, but could it be possible for you to find a way to create some innovative consumer lending products as well?

THE FINAL WORD

You have the technology, the people, the capital and the formula, so why in the world do you want to copy a current player instead of doing something different?

While I’m not saying that you shouldn’t also offer said programs of the current players to steal market share away from them, it’s just my opinion that the biggest opportunity today for new funders and lenders is to specialize in other niche areas that aren’t being catered to by our current market players.

Doing so should allow you to come in, specialize, make a name for yourself, and brand your organization as the “go to” funder/lender for (insert innovative concept here) for years to come. It might take you some time to “perfect” your unique brand and approach, but as long as you have investors that believe in your concept, you should be able to survive through the growing pains. To quote Herman Melville, always remember the following: It is better to fail in originality than to succeed in imitation.

Meet the Lending Platform With 0% Interest (Kiva)

January 6, 2016 Chany of Angela’s Boutique in Philadelphia, PA needs $5,000 to help purchase new signage and lighting to improve her storefront. She’s been turned down by banks even though she’s been in business for more than five years. 61 participants have already contributed to her loan thanks to a marketplace lending platform, which puts her very close to her goal. If it funds, all of the participants will get back their principal from her payments over the next 24 months and NO interest.

Chany of Angela’s Boutique in Philadelphia, PA needs $5,000 to help purchase new signage and lighting to improve her storefront. She’s been turned down by banks even though she’s been in business for more than five years. 61 participants have already contributed to her loan thanks to a marketplace lending platform, which puts her very close to her goal. If it funds, all of the participants will get back their principal from her payments over the next 24 months and NO interest.

Meet Kiva Zip, the anti-Lending Club because the borrowers are far from anonymous and the yield delivered to investors is negative due to inflation.

Angela’s Boutique, which is a real prospect on the Kiva Zip platform, includes a picture of the owner, her bio, endorsements, and comments from supporters.

According to Jessica Feingold, Kiva’s East Coast Manager of Development, “Kiva is the world’s first and largest crowdfunding platform for social good with a mission to connect people through lending to alleviate poverty and expand economic opportunity.”

And just like Lending Club, contributions as small as $25 are accepted. Obviously structured as a non-profit, “Kiva and its growing global community of 1.2 million lenders has crowdfunded more than $775 million in microloans to over 1.7 million entrepreneurs in 83 countries, all the while maintaining a 98% repayment rate,” according to Feingold.

Normally thought of as an overseas endeavor, Feingold said that “in 2011, Kiva launched Kiva Zip, a pilot program in the US that provides 0% interest crowdfunded loans to small business entrepreneurs.” Their underlying purpose and target market sounds very much like those being served by for-profit alternative lenders. “Kiva doesn’t require a minimum FICO score, collateral, or a minimum operations period for the business,” Feingold said.

Since inception they’ve made loans to over 1,800 borrowers in 47 days states, Peru, and Guam.

Notably, Lending Club promises borrowers that their “identity will at all times remain confidential and not be disclosed to anyone,” according to their website. Kiva by contrast is looking to “instill empathy” in their lenders. “We want to show that whether in East New York or Uganda, underserved entrepreneurs are credit-worthy, and will pay you back,” Feingold said. “All of these features on the Kiva websites enhance our ability to do so.”

While there is definitely a certain allure about being able to see the borrower for yourself, the concept seems to fly in the face of Dodd-Frank’s Section 1071 which stipulated that lenders are prohibited from knowing the sex and gender of business loan applicants. While the CFPB is not currently enforcing the law until the rules can be clarified, Democratic members of Congress have been pushing them to take action.

While there is definitely a certain allure about being able to see the borrower for yourself, the concept seems to fly in the face of Dodd-Frank’s Section 1071 which stipulated that lenders are prohibited from knowing the sex and gender of business loan applicants. While the CFPB is not currently enforcing the law until the rules can be clarified, Democratic members of Congress have been pushing them to take action.

According to the law, no loan underwriter or other officer or employee of a financial institution, or any affiliate of a financial institution, involved in making any determination concerning an application for credit shall have access to any information provided by the applicant about whether or not the business is women-owned or minority owned.

As small businesses often celebrate the heritage of their founders, and at times that can be the entire reason customers buy from them in the first place, the law has presumably put the small business lending world in an awkward position (and that’s why the law should be repealed). Non-profits like Kiva have embraced the very things that make a small business bankable outside of a credit score, like the owner, their background, and their story.

Borrowers on the Kiva Zip platform don’t raise all the money from strangers though. Their credit-worthiness is based on their ability to recruit friends and family to fund a small portion of their loan. The other lenders though of course may make their decisions based on the numbers or entirely on the perceived cultural, racial, or gender values of the borrower, all of the things that the CFPB is attempting to eradicate in the for-profit arena.

I didn’t ask Kiva any questions about Dodd Frank or Section 1071, but many people might empathize with their empathy approach as a way to fund small businesses that otherwise don’t qualify for bank loans. Its reminiscent of the subjective underwriting that a lot of alternative lenders and merchant cash advance companies employ to get deals done that banks won’t touch.

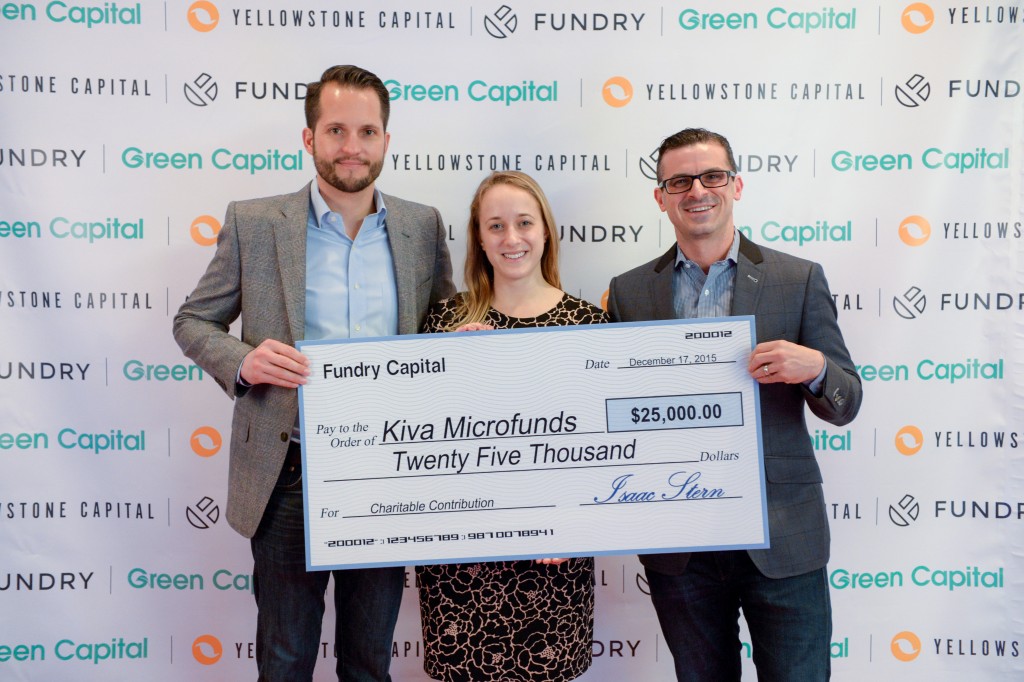

Not so coincidentally, Fundry, Yellowstone Capital’s parent company, donated $25,000 to Kiva just last month to support their cause.

Kiva’s Feingold (pictured at center above) said in regards to that, “Kiva is thrilled to receive a grant from Fundry to further our work to make credit more affordable.”

Brokers: It’s Okay To Delay Starting A Family

December 25, 2015 WE HAVE NO “MINIMUM” GUARANTEE

WE HAVE NO “MINIMUM” GUARANTEE

The debate to increase the minimum wage across the board in the US to $15 per hour has been going on for quite some time now, with marches in the street from fast food workers, people protesting by walking off the job, and strong political debate with passionate views on both sides.

What’s been strange to me about this debate, in relation to the argument of those that are in favor of increasing the minimum wage, is their reference to workers being “slave labor” by working excessively hard and long, but not making enough in a lot of cases to support a household. The reason this has been strange to me is because for close to 9 years, I operated on a 1099, independent, 100% commission basis, as a solopreneur managing my own one man show sales office. I received no salary, base pay, hourly pay, “floor”, nor company benefits (even though I am fully insured individually). The Harvard Business School report from July 2014 by Karen Gordon Mills and Brayden McCarthy, said that there’s 23 million businesses in the country that do not have any employees and are classified as Solopreneurs.

So, should myself and the other 23 million Solopreneurs in this country all be marching and protesting as well? And if so, marching and protesting against who? I work for 1ST Capital Loans, LLC, but I’m also the sole managing director, member and employee of said entity, so as a result, I should be marching and protesting against myself? We as independent brokers have no minimum guarantee or minimum wage, which not only makes the minimum wage debate strange, but it also points to another reality in that adding a family to our chaotic situation might not be optimal at this time.

RUNNING YOUR OWN SHOP IS VERY DIFFICULT

Running your own show is probably the hardest job you will ever have in your life. Having to juggle the various components of it with no established “minimum wage” just chokes out far too many independent brokers. Some of those various components include but surely aren’t limited to:

- Having to manage regulations, laws and other legal aspects

- Having to manage accounting, insurance and tax related aspects

- Having to design your own business plan and ROI formulas

- Having to come up with your own way of creative financing

- Having to manage your vendor, supplier along with partner negotiations and agreements

- Having to design your market strategy, solutions and spend time actually selling them

On top of this, you might have to deal with pet peeves of your Funder and Lender Partners, which could include them cheating you out of commissions, clawing back commissions after 45 days, cutting you off from your renewal and residual portfolios, among other things. These things rob you out of the hard earned commissions for deals that you fought for in one of the most competitive markets in the country (using your own capital, creativity, time and energy) to win.

MAKE A FAMILY NOW, OR DELAY DOING SO JUST A LITTLE BIT LONGER?

With all of the aspects of building your broker office that must be managed on your own, with no minimum guaranteed wage, benefits or true assistance, the next question becomes, how do you manage a family through the very early stages of all of this chaos? The reality is that there’s only so much time in the day. If you are just starting out your own shop and if you don’t currently have a present family to take care of, putting the creation of a family on hold might be your best bet. I once expressed that it was okay to be a piker, then I expressed that it was okay to be a minimalist, today I’m telling you that it’s okay to delay starting a family.

THE MILLENNIAL GENERATION FACES A LOT OF STRUCTURAL CHALLENGES

It seems as though most of the newer brokers in our space are a part of the Millennial Generation.

Generation Y (The Millennial Generation) begins usually around 1981 and lasts until about 1995, the Generation that follows (Generation Z) are those that were born just after 1995. Being a Millennial myself, I tend to keep abreast of many of the issues facing my generation, and while I currently do not have a family that I’m responsible for, I believe that many Millennials would agree that it’s seemingly more difficult today than ever before to manage a family:

- We Are Over-Educated and Under-Employed: We are in fact the most educated Generation, but some reports state that over 50% of us are under-employed, which means we are mainly a Generation of the over-educated and under-employed, saddled with student loan debt.

- Lack Of Security and Stability: Prior Generations had the luxury of working for one company, in one location and in one city, for the vast majority of their working career, and be able to retire with a pension, 401k, and strong retirement benefits from Social Security. Our Generation has no such securities, as many of us will have to change careers and work locations often during our working career, making it nearly impossible to seemingly ever purchase a home because purchasing a home only makes sense when you can estimate “staying put” in one area for at least 10 years. Also the lack of pensions, strong 401k plans, and the fact that we might not receive strong Social Security benefits further complicates the security issue.

- Our Cost Of Living Continues To Sky Rocket: From food to energy, from property taxes to rent, from insurance premiums to healthcare costs, from college tuition to day care expenses, our cost of living continues to skyrocket.

- Our Opportunities Are Being Stolen Away: Wages and business opportunities are either stagnant or flat out decreasing due to the rise of global competitive forces and IT/robotic automation stealing away our opportunities for income advancement.

So while you are trying to juggle the issues of building your broker office, you are also having to deal with competitive global forces and IT automation, along with the rising cost of living, along with deficiencies in job/income security and stability. So how in the world do you add a family of let’s say two kids on top of this chaos? Regardless of whether or not you are married or a single parent, the costs and risks of managing a family within this chaotic situation are significant.

IT’S OKAY TO DELAY STARTING A FAMILY

If you already have a family, obviously you can’t “give them back” and start over, so if you are seeking to enter this space and build your broker office, you are just going to have to find a way to juggle all of the chaos that’s present. However, if you are like me (a Millennial and Broker within this space), that hasn’t yet created a family, if you are still in the early stages of constructing your office, renewal and residual portfolios, then I would say that it’s “okay” to delay starting a family considering all of the chaotic issues that you would be facing today.

How long to delay such a very important choice is a personal one that you would have to manage, but for some of us, the choice might come down to opting out of creating a family altogether.

Got a Ferrari or Fine Art? If So, You May Have More Leverage Than You Think

December 23, 2015If you own a Ferrari, fine art or expensive wine, getting access to capital may be easier than you think.

Although it’s still a niche market, luxury asset-backed lending has been gaining traction lately, particularly with small and mid-size business owners. These executives are enticed by the ability to use certain high-priced valuables as a means of getting large amounts of cash quickly and often at a lower cost than other funding sources.

“People are increasingly learning that this is another option. It’s not for everybody, but it’s another option,” says Tom McDermott, chief commercial officer at Borro, a New York-based asset-backed lender that deals exclusively with luxury asset-based loans.

It’s notable that luxury asset-based lending by alternative funders is gaining ground at a time when unsecured money is so easy to come by. There are several reasons business owners are attracted to the idea of leveraging their valuables to attain cash. First off, they don’t need stellar credit or a proven track record in business to qualify. Secondly, they can typically get larger sums of money and at better rates than they might through other financing channels. A third reason is that many of them have already tapped out other funding options and leveraging their assets allows them to obtain additional funds quickly.

“A lot of small business owners have assets, so it’s something else for them to utilize in getting access to attractive small business financing,” says Steven Mandis, chairman of Kalamata Capital LLC, an alternative finance company in Bethesda, Maryland.

Here’s how the process typically works at most luxury asset-based lenders. Say a business owner wants to borrow against a high-priced item such as a top-of-the-line car, fine art or wine, jewelry or a luxury watch. First the luxury-based lender hires a third-party to appraise the item. Generally, depending on the asset and its marketability, lenders will lend 50 percent to 70 percent of the asset’s value. If the owner moves forward, the item or items are held and insured in a lender’s secure storage area until the loan is paid back. Default rates on these types of loans are relatively low, lenders say.

“People don’t want to put their house at risk when they need capital,” says McDermott of Borro. “They’d rather lose the Maserati or a lovely piece of art than the house,” he says. And even then, it doesn’t happen very often, he says. Borro clients only default on their loans about 8 percent of the time, McDermott says.

Barriers to Entry

To be certain, luxury-based lending is not a business that every funder wants to be in. For starters, there are a lot of regulatory hoops a funder has to jump through in order to do it. You need a pawnbroker’s license and a second-hand dealer license. You also need a secure facility or facilities to house the collateral, have secure ways of transporting the valuables, and you need to carry large amounts of insurance for the transfer of the items as well as during the holding period.

Indeed, keeping the items secure is critical. PledgeCap, a Lynbrook, New York-based funder, says on its website that it uses “cutting edge technology, top of the line bank vaults and armed guards” to keep a customer’s items safe. What’s more, all items are insured during transit and storage. All items are shipped through secured and insured FedEx shipping vendors for pickups and drop-offs.

“There aren’t a lot of players in the market because there are a lot of operational and legal requirements to adhere to. There are a lot of barriers to entry,” says Gene Ayzenberg, the company’s chief operating officer.

Putting Things in Perspective

Luxury asset-based lending is only a small subset of the overall asset-based lending market, which as a whole has been gaining ground in the past few years. After getting badly burned in the most recent recession, many lenders have come to appreciate the security blanket that collateral offers. According to the Commercial Finance Association’s quarterly Asset Based Lending Index, U.S. ABL loan commitments rose 7.2 percent in the second quarter, compared with the year-earlier period. In addition, new ABL credit commitments were 6.3% higher than the same period a year ago.

“Asset-based lending at one time used to be the lending of last resort. Now it’s the type of lending that it is accepted globally,” says Donald Clarke, president of Asset Based Lending Consultants Inc., a Hollywood, Florida-based company that provides due diligence services for lenders. “Today, everybody wants an asset.”

There’s not a lot of public data to gauge the size of the luxury market within the broader asset-based lending market. But a 2014 report that focuses on art lending gives more perspective to at least one facet of luxury asset-based lending.

Thirty six percent of the private banks polled said they offer art lending and art financing services using art and collectibles as collateral. That’s up from 27 percent in 2012 and 22 percent in 2011, according to the report by consulting firm Deloitte and ArtBanc, a company that provides art sales alternatives, valuations and collections management services.

Meanwhile, 40 percent of private banks said this would be a strategic focus in the coming 12 months, up considerably from the 13 percent who named this as a priority in 2012.

These market changes are likely driven by client demand. The Deloitte/ArtBanc survey found that 48 percent of establishes art collectors polled said they would be interested in using their art collection as collateral for a loan, up from 41 percent in 2012.

Many big banks won’t touch asset-based lending deals unless they are worth north of $5 million. Some community banks will do smaller deals, but many don’t have the necessary infrastructure or skill sets, explains Clarke, of Asset Based Lending Consultants. This, of course, leaves an opening for alternative funders to capture market share.

Luxury asset-based lending expected to experience growth

Some lenders say they expect demand for luxury asset-based loans to continue to increase over time as more people accumulate big-ticket items and they become more aware that they can satisfy their capital needs by leveraging those assets. “A lot of times they don’t even know they have this option available to them,” says Ayzenberg of PledgeCap.

He says most of his company’s customers are small and mid-size business owners. Often they have temporary cash flow issues, but bank loans aren’t necessarily an option for them for any number of reasons. For instance, some may have bad credit. Others may have excellent credit but not enough of a business track record to qualify for a bank loan. Others may not have the cash flow to secure the amount of money they need, or they may need the money very quickly. Asset-based lenders can generally make the money available within a day, whereas bank loans require a lot of paperwork and can take months to obtain.

Mandis, of Kalamata Capital, says his company has seen an increased willingness by business owners to put up their luxury assets as collateral in order to get larger amounts of money at more favorable terms. Many times business owners have a high-priced asset that they don’t want to sell and pay a tax or can’t easily unload within a short-time frame. By borrowing against the luxury asset, they will get the capital to take advantage of a short-term opportunity and make an attractive return quickly without having to worry about finding a buyer or paying taxes on the sale of the asset, he explains.

Certainly luxury asset-based lending is not for every customer. Not only do you have to have a valuable asset to be used as collateral, but you also have to be willing to part with the item while the loan is outstanding. The risk of default and not getting the item back may also be a barrier for some people.

“I would be very hesitant to put up my wife’s diamond ring for my business. I don’t think it’s typically someone’s first choice,” says Ami Kassar, chief executive and founder of Multifunding LLC, a company in Ambler, Pennsylvania that helps small businesses find the best loan for their business. He remembers considering this option for a client only once in the past several years and the client ultimately chose another funding source.

But companies that focus on luxury asset-based lending say there is a viable market for their services that will continue to grow as more people hear about it and use it successfully to fulfill their funding needs. People have been taking their small items to pawn shops for many years. Working with a licensed lender to leverage their larger and often more expensive items gives them an option they may not have had previously. “You can’t just drive a tractor into a local pawnshop and say, ‘Here just put this in your safe,’” says Ayzenberg of PledgeCap.

Also, unlike pawn shops, luxury asset-based lenders say they aren’t looking to sell the items to make a quick buck and will only sell the item as a last resort if a customer defaults and they can’t reach agreeable terms. “We want them to keep their items,” says Ayzenberg whose company has been in business since 2013. For every 100 loans, there are only a small percentage of customers that default and lose the items, he says.

Every lender runs their business slightly different. At Borro, for example, loans typically range between $20,000 and $10 million and span in time frame from three months to three years. Rates start in the mid-teens and are based on the size of the loan, the time frame and how easy the asset would be to sell. In order to work with Borro, the asset typically has to be worth more than around $40,000, McDermott says.

Borro, which has been in business since 2009, deals with customers directly. But it also gets a good number of referrals from other lenders. Let’s say a customer needs $500,000 and a particular lender can only offer a maximum of $350,000. That lender might refer the client to Borro, which kicks in $150,000 based on the value of a leveraged asset. The referring company gets a commission based on the loan value and doesn’t lose the whole deal. “It’s a way to keep your customers tied in with you,” McDermott says, adding that Borro has no intention of getting into other types of lending. “We complement each other. We don’t compete.”

PledgeCap also focuses exclusively on asset-based lending. The company typically funds loans between $1,000 and $5 million. The length of each loan is four months. Customers don’t have to pay every month, though most do. For every month the loan is outstanding customers pay a rate of 3 percent on average. Other fees, payable at the end of the loan, are assessed based on costs PledgeCap incurs and depend on factors such as the cost of insurance, the appraisal fee and the cost of transporting the item to the secure facility.

PledgeCap also focuses exclusively on asset-based lending. The company typically funds loans between $1,000 and $5 million. The length of each loan is four months. Customers don’t have to pay every month, though most do. For every month the loan is outstanding customers pay a rate of 3 percent on average. Other fees, payable at the end of the loan, are assessed based on costs PledgeCap incurs and depend on factors such as the cost of insurance, the appraisal fee and the cost of transporting the item to the secure facility.

By contrast, Kalamata Capital, which has been in business since 2013, offers asset-backed loans in connection with several other small business financing options—such as working capital loans, SBA loans, lines of credit, merchant cash advance and invoice factoring—to give customers more flexibility in terms of rates.

In Kalamata’s case, it will evaluate the cash flow and other assets of a small business for financing options. Kalamata then combines both the amount it would lend against an asset and the amount it would lend to the small business, possibly giving the business a lower rate—and more options—in the process.

While it’s not a type of funding that works for everyone, Mandis, the chairman of Kalamata, expects to see continued growth in this area. “I don’t think the loan market for luxury assets is as large as many of the traditional small business finance areas, but it is something that can be helpful to small business owners,” he says.

Alternative Business Funding’s Decade Club

October 22, 2015 The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

“At that time, the industry was a bunch of cowboys. It was an opportunistic industry of very small players,” says Andy Reiser, chairman and chief executive of Strategic Funding Source Inc., a New York-based alternative funder that’s been in business since 2006. “The industry has gone from this cottage industry to a professionally managed industry.”

Indeed, the alternative funding industry for small businesses has grown by leaps and bounds over the past decade. To put it in perspective, more than $11 billion out of a total $150 billion in profits is at risk to leave the banking system over the next five plus years to marketplace lenders, according to a March research report by Goldman Sachs. The proliferation of non-bank funders has taken such a huge toll on traditional lenders that in his annual letter to shareholders, J.P. Morgan Chase & Co. chief executive officer Jamie Dimon warned that “Silicon Valley is coming” and that online lenders in particular “are very good at reducing the ‘pain points’ in that they can make loans in minutes, which might take banks weeks.”

The burgeoning growth of alternative providers is certainly driving banks to rethink how they do business. But increased competition is also having a profound effect on more seasoned alternative funders as well. One of the latest threats to their livelihood is from fintech companies, like Lendio and Fundera,for example, that are using technology to drive efficiency and gaining market share with small businesses in the process.

“Established lenders who want to effectively compete against the new entrants will need to automate as much decisioning as possible, diversify acquisition sources and ensure sufficient growth capital as a means to capture as much market share as possible over the next 12 to 18 months,” says Kim Anderson, chief executive of Longitude Partners, a Tampa-based strategy consulting firm for specialty finance firms.

Of course, there is truth to the adage that age breeds wisdom. Established players understand the market, have a proven track record and have years of data to back up their underwriting decisions. At the same time, however, experience isn’t the only factor that can ensure a company will continue to thrive over the long haul.

WORKING TOWARD THE FUTURE

Indeed, established players have a strong understanding of what they are up against—that they can’t afford to live in the glory of the past if they want to survive far into the future.

“With every business you have to reinvent yourself all the time. That’s what a successful business is about,” says Reiser of Strategic Funding. “You see so many businesses over the years that didn’t reinvent themselves, and that’s why they’re not around.”

Strategic Funding has gone through a number of changes since Reiser, a former investment banker, founded it with six employees. The company, which has grown to around 165 employees, now has regional offices in Virginia, Washington and Florida and has funded roughly $1 billion in loans and cash advances for small to mid-sized businesses since its inception.

One of the ways Strategic Funding has tried to distinguish itself is through its Colonial Funding Network, which was launched in early 2009. CFN is Strategic Funding’s secure servicing platform which enables other companies who provide merchant cash advances, business loans and factoring to “white label” Strategic Funding’s technology and reporting systems to operate their businesses.

“When you’re in a commodity-driven business, you have to find something to differentiate yourself,” Reiser says.

FINDING WAYS TO BE DIFFERENT

That’s exactly what Stephen Sheinbaum, founder of Bizfi (formerly Merchant Cash and Capital) in New York, has tried to do over the years. When the company was founded in 2005, it was solely a funding business. But over the years, it has grown to around 170 employees and has become multi-faceted, adding a greater amount of technology and a direct sales force. Since inception, the Bizfi family of companies has originated more than $1.2 billion in funding to about 24,000 business owners.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Sheinbaum credits newer entrants for continually coming up with new technology that’s better and faster and keeping more established funders on their toes.

“If you don’t adapt, you die,” he says. “Change is the one constant that you face as a business owner.”

David Goldin, chief executive of Capify, a New York-based funder, has a similar outlook, noting that the moment his company comes out with a new idea, it has to come up with another one. “If you’re not constantly innovating you’re in trouble,” he says. “It’s a 24/7 global job.”

Capify, which was known as AmeriMerchant until July, was founded by Goldin in 2002 as a credit card processing ISO. In 2003, the company began focusing all of its efforts on merchant cash advances. Four years later, the company made its first international foray by opening an office in Toronto. The company continued to expand its international presence by opening up offices in the United Kingdom and Australia in 2008. The company now has more than 200 employees globally and hopes to be around 300 or more in the next 12 months, Goldin says. The company has funded about $500 million in business loans and MCAs to date, adjusted for currency rates.

THE CULTURE OF CHANGE

Five or six years ago, Capify’s main competitors were other MCA companies. Now the competition primarily comes from fintech players, and to keep pace Capify has made certain changes in the way it operates. From a human resources standpoint, for instance, Capify switched from business casual attire to casual dress in the office. The company has also been doing more employee-bonding events to make sure morale remains high as new people join the ranks. “We’ve been in hyper-growth mode,” he says.

CAN Capital in New York, another player in the alternative small business finance space with many years of experience under its belt, has also grown significantly (and changed its name several times) since its inception in 1998. The company which began with a handful of employees now has about 450 and has offices in NYC, Georgia, Salt Lake City and Costa Rica. For the first 13 years, the company focused mostly on MCA. Now its business loan product accounts for a larger chunk of its origination dollars.

This year, the company reached the significant milestone of providing small businesses with access to more than $5 billion of working capital, more than any other company in the space. To date, CAN Capital has facilitated the funding of more than 160,000 small businesses in more than 540 unique industries.

Throughout its metamorphosis to what it is today, the company has put into place more formalized processes and procedures. At the same time, the company has tried very hard to maintain its entrepreneurial spirit, says Daniel DeMeo, chief executive of CAN Capital.

One of the challenges established companies face as they grow is to not become so rule-driven that they lose their ability to be flexible. After all, you still need to take calculated risk in order to realize your full potential, he explains. “It’s about accepting failure and stretching and testing enough that there are more wins than there are losses,” says DeMeo who joined the company in March 2010.

ADVICE FOR NEWCOMERS

As the industry continues to grow and new alternative funders enter the marketplace, experience provides a comfort level for many established players.

“The benefit we have that newcomers don’t have is 10 years of data and an understanding of what works and what doesn’t work,” says Reiser of Strategic Funding. With the benefit of experience, Reiser says his company is in a better position to make smarter underwriting decisions. “There are many industries we funded years back that we wouldn’t touch today for a variety of reasons,” he says.

Experienced players like to see themselves as role models for new entrants and say newcomers can learn a lot from their collective experiences, both good and bad. Noting the power of hindsight, Reiser of Strategic Funding strongly advises newcomers to look at what made others in the business successful and internalize these best practices.

One of the dangers he sees is with new companies who think their technology is the key to long-term survival. “Technology alone won’t do it because that too will become a commodity in time,” he says.

Over the years Strategic Funding has learned that as important as technology is, the human touch is also a crucial element in the underwriting process. For example, the last but critical step of the underwriting process at Strategic Funding is a recorded funding call. All of the data may point to the idea that a particular would-be borrower should be financed. But on the call, Strategic Funding’s underwriting team may get a bad vibe and therefore decide not to go forward.

“We look at the data as a tool to help us make decisions. But it’s not the absolute answer,” Reiser says. “We are a combination of human insight and technology. I think in business you need human insight.”

Seasoned alternative funding companies also say that newbies need to implement strong underwritingcontrols that will enable them to weather both up and down markets.

The vast majority of newcomers have never experienced a downturn like the 2008 Financial Crisis, which is where seasoned alternative financing companies say they have a leg up. Until you’ve lived through down cycles, you’re not as focused as protecting against the next one, notes Sheinbaum of Bizfi. “Every 10 years or 15 years or so, there seems to be a systemic crisis. It passes. You just have to be ready for it,” he says.

Goldin of Capify believes that many of today’s start-ups don’t understand underwriting and are throwing money at every business that comes their way instead of taking a more cautious approach. As a funder that has lived through a down market cycle, he’s more circumspect about long-term risk.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

Having a solid capital base is also a key to long-term success, according to veteran funders. Many of the upstarts don’t have an established track record and need to raise equity capital just to stay afloat—an obstacle many long-time funders have already overcome.

Goldin of Capify believes that over time consolidation will swallow up many of the newbies who don’t have a good handle on their business. Hethinks these companies will eventually be shuttered by margin compression and defaults. “It can’t last like this forever,” he says.

In the meantime, competition for small business customers continues to be fierce, which in turn helps keep seasoned players focused on being at the top of their game. Getting too comfortable or complacent isn’t the answer, notes DeMeo of CAN Capital. Instead, established funders should seek to better understand the competition and hopefully surpass it. “Competition should make you stronger if you react to it properly,” he says.