SBA Lifts SBLC Moratorium

April 11, 2023

It’s official. The SBA is lifting the moratorium on licenses for Small Business Lending Companies (SBLCs), ending the 40-year pause that began in 1982. The SBA is also adding a new type of lending entity called a Community Advantage SBLC while also removing the requirement for a Loan Authorization in the 7(a) and 504 Loan Programs.

The 37-page rule, which is slated to be published in the federal register on April 12th, included the SBA’s analysis of all the comments it had received, including the criticisms. Some argued, for example, that opening up the doors would allow the unscrupulous world of fintech to participate in the market. The SBA was unmoved by this, countering that existing participants already rely on fintech.

“SBA has for many years provided oversite to non-depository entities participating in the SBA business loan programs,” the SBA said. “This includes SBLCs, non-federally regulated lenders (NFRLs), 504 Certified Development Companies (CDCs), and Microloan Intermediaries. In fact, most all lending institutions incorporate the use of financial technology in their delivery of loans and other financial products.”

One such fintech that has been eager to become a participant, issued a prepared statement on the decision earlier today.

“Funding Circle applauds the Biden Administration for ending the SBA’s 40 year moratorium on licensing additional state and SBA licensed and regulated non-depository lenders thus ending its lender oligopoly in favor of competition and innovation,” said Funding Circle. “This is an opportunity for the more than 8,000 community banks and credit unions that don’t offer 7(a) loans to partner with Fintech lenders to offer affordable loans quickly in underserved communities. Congress should now focus on ensuring SBA has the resources necessary to license more than three new lenders in its SBLC program in order to increase competition and distribution of government guaranteed loans in underserved communities.”

The SBA also published new rules on April 10th that will amend various regulations governing the 7(a) and 504 loan programs.

Mental Health in The Funding Game

April 6, 2023 Technology, finance, healthcare, sales, and marketing have all been reported to have the highest levels of employee stress and mental health issues. Eager, driven executives of this industry work around the clock to close deals, finance equipment, and conjur fresh new ideas. While alternative finance can be deemed the industry that never sleeps, the people pushing it forward should remember not to push themselves too hard. Prioritizing one’s mental health can often be found at the bottom of one’s checklist but should be the first thing assessed before starting the day.

Technology, finance, healthcare, sales, and marketing have all been reported to have the highest levels of employee stress and mental health issues. Eager, driven executives of this industry work around the clock to close deals, finance equipment, and conjur fresh new ideas. While alternative finance can be deemed the industry that never sleeps, the people pushing it forward should remember not to push themselves too hard. Prioritizing one’s mental health can often be found at the bottom of one’s checklist but should be the first thing assessed before starting the day.

“It is critical that we start really focusing in on understanding that mental health is part of every everything we do, every part of who we are, how we see ourselves, how we interact with others, how willing we are to take risks, how willing we are to be ambitious, and how forgiving we are of ourselves when we make mistakes,” said Nancy Robles, President at Eastern Funding LLC.

Success is an adrenaline rush and can be addicting if not managed properly. Jessica Garcia, CEO at Simplified Funding Solutions, at one point struggled to find a balance between her work and home life, leaving her feeling burnt out more days than some. She believed the more hours put in working on a deal the faster results she’d attain in return. Finding ways to regroup and reassess, she created her own methods within the workplace to cater to her mental health.

“I started doing like a lot of self-care within the workplace,” said Garcia. “So what I mean by that, as opposed to sitting at my desk and being glued to a hard phone on a conference call for an hour, I would just put it on my cell phone through my air pods, walk around, grab a stress ball, sightseeing, have meditation music in the background at a very low volume to help stimulate. I would turn on some candles to help with the aromatherapy and I noticed once I started doing those things, I was able to pace myself more and I was also happier…”

Meanwhile, For Nancy Robles, she’s not just the president of a company but also a full-time mother of five. The pressure of performing as a woman of color in this industry while juggling motherhood are constantly clashing and finding themselves at odds with one another. But as of late, Robles has learned to emphasize mental health into her daily routine.

“Over the past several years, I’ve prioritized my mental health and as I have prioritized my mental health that comes with a lot of self-care, a lot of healing,” said Robles. “I’m a big advocate for therapy, everybody should go to therapy. I’ve been going to therapy for seven years.”

Unlike Robles and Garcia, finding a work/home life balance has its own unique twist for Sonia Alvelo whose fiancée is also her partner at work. And after 15 long years together they’ve managed to find stability between the two.

Unlike Robles and Garcia, finding a work/home life balance has its own unique twist for Sonia Alvelo whose fiancée is also her partner at work. And after 15 long years together they’ve managed to find stability between the two.

“Communication is big for us in everything that we do, in order to be better,” said Alvelo, CEO at Latin Financial. Administering daily mental health exercises in one’s routine can make all the difference but having the support of one’s employer can make an even bigger one.

Incorporating necessary steps and open communication in the workforce can help a team or staff to not feel as if they are being hammered by their 9 to 5. On this, Jessica Garcia has noticed companies moving in the right direction, implementing more group activities and break spaces for women especially as they are growing in number in the finance sector.

“We’re getting that softer, feminine touch, in regard to ‘it’s okay to take a day off if you’re over it, it’s okay to go home early if you’re just burnt out,’” said Garcia. “’It’s okay to ask for help if you’re overwhelmed and need assistance from the team to complete a task. It’s okay to be vulnerable, it’s okay to be human,’ we’re not robots, we’re not machines. And I think in the past two years, especially after the pandemic, we’re starting to see that synergy of being there for each other.”

Alvelo recognizes the significance mental health has within a company as a CEO. Weekly discussions with her team throughout the years has helped for a happy community life in her office.

“I have a responsibility as a CEO and I have a big one on top of that because I’m a Latina CEO. I have to bring things to the table that other companies may not talk about it or may not talk about enough.”

Success starts within oneself to achieve it anywhere else. In order to put your best foot forward in this industry take time, check in, and evaluate your mental health.

“One of the critical pillars of having any success in any type of career,” said Robles, “if you own your own company, if you want any successes, you want to have your relationships in your family, your relationship with yourself, which is the most important one, you really have to address mental health first.”

White House Feels the Pressure of Cryptocurrencies

March 22, 2023 Houston, we have a problem. That’s the takeaway about cryptocurrencies from the White House’s most recent Economic Report, a historically dry book produced annually to comply with the Employment Act of 1946. The President’s 2023 report, however, is markedly different from 2022 or any previous year in that it laboriously bewails the persistence and pervasiveness of cryptocurrencies. For example, the report uses the word crypto 255 times in its 2023 report compared to zero times the year before.

Houston, we have a problem. That’s the takeaway about cryptocurrencies from the White House’s most recent Economic Report, a historically dry book produced annually to comply with the Employment Act of 1946. The President’s 2023 report, however, is markedly different from 2022 or any previous year in that it laboriously bewails the persistence and pervasiveness of cryptocurrencies. For example, the report uses the word crypto 255 times in its 2023 report compared to zero times the year before.

The report labels crypto assets as “speculative investment vehicles” that “generally do not perform all the functions of money as effectively as sovereign money” that can also be “harmful to consumers and investors.” Despite this, the United States government is finally being forced to contend with the reality that cryptocurrencies continue to enjoy a collective $1 trillion+ market cap despite all the scams, collapses, price declines, and rug pulls. Bitcoin and Ethereum combined are $775 billion at the time of this writing, something that the White House has apparently given little thought to in previous years. In 2022 neither earned any mention at all.

| Annual Report Year | Mention of crypto | Bitcoin | Blockchain | Digital Asset |

| 2023 | 255 | 75 | 61 | 45 |

| 2022 | 0 | 0 | 0 | 0 |

Finally trying to play catchup, the White House leveraged its criticisms of crypto to pitch its own centralized competitors in the works, the FedNow Instant Payment System and a Central Bank Digital Currency (CBDC). The challenge with FedNow is that it can’t be implemented by force of the government alone.

“FedNow requires commitment and active engagement by the private sector to make it interoperable, which means connecting and communicating with other payment services,” the report states. “While noting that interoperability can take different forms, the Federal Reserve has maintained that it alone cannot fully establish the interoperability of FedNow; achieving this will require active partnership and collaboration with the financial industry.”

“Certain innovations, such as FedNow and a potential U.S. CBDC, could help bring the U.S. financial infrastructure into the digital era in a clear and simple way, without the risks or irrational exuberance brought by crypto assets,” it concludes. “Hence, continued investments in the Nation’s financial infrastructure have the potential to offer significant benefits to consumers and businesses, but regulators must apply the lessons that civilization has learned, and thus rely on economic principles, in regulating crypto assets.”

My AI Loan Broker Has Been Upgraded to Chat GPT-4

March 14, 2023Back in December I pasted copies of an exchange I had with an AI about brokering business loans. That was GPT-3. More recently I got access to GPT-4 and so I’ve asked it the same questions to see if the responses have changed. They have. They’re much longer, much more comprehensive, and for some reason laden with lists. Even though there’s a lot of text below, the advice it gives is pretty good.

Me: Imagine you’re a loan broker. you submit a customer’s application to a lender and the lender steals the application and brokers it to another lender, cutting you out of the deal. what do you do?

GPT-4:

1. Gather evidence: Document all relevant communication and interactions with the lender, including any agreements, emails, or phone call records that show you were the original broker for the deal.

2. Confront the lender: Communicate your concerns with the lender and give them an opportunity to explain their actions. It’s possible that there has been a misunderstanding or miscommunication that can be resolved through discussion.

3. Review your contract: If you have a contract with the lender, review its terms to see if they have breached any clauses related to your involvement in the deal. This may provide you with leverage during negotiations.

4. Seek legal advice: Consult with an attorney specializing in business or contract law to explore your legal options. They can help you assess your case and recommend the best course of action, such as sending a cease and desist letter, seeking mediation, or filing a lawsuit.

5. Notify the customer: Inform the customer of the situation, and advise them of any potential impact on their application or relationship with the new lender. Maintaining transparency and trust with your customer is crucial.

6. Strengthen future agreements: To prevent similar incidents in the future, consider revising your agreements with lenders to include specific clauses that protect your interests, such as non-circumvention or non-disclosure provisions.

6. Reevaluate your partnerships: Assess your relationships with lenders and consider working with more reputable and trustworthy partners in the future. Building a reliable network of partners is essential for the success of your brokerage business.

Remember that every situation is unique, and the appropriate course of action may depend on the specific circumstances and relationships involved.

Me: Imagine that you are a lender and that you are a member of an online commercial finance broker forum. you are hoping to secure the business of all the brokers on there but the problem is that a lot of other lenders are trying to do the same thing. what would you do to stand out?

GPT-4: To stand out as a lender in a competitive online commercial finance broker forum, consider implementing the following strategies:

1. Build credibility and trust: Share your expertise and knowledge by actively participating in forum discussions, providing valuable insights, and answering questions. This will help establish you as a knowledgeable and reliable lender in the community.

2. Showcase your unique selling points: Emphasize the aspects that differentiate you from other lenders, such as competitive rates, flexible terms, a wide range of financing options, quick approval times, or exceptional customer service.

3. Share testimonials and case studies: Provide real-life examples of successful loan transactions and satisfied clients to demonstrate your track record and capabilities. Make sure to obtain permission from clients before sharing their information.

4. Offer exclusive deals or promotions: Incentivize brokers to work with you by providing special offers, such as discounted rates, cashback, or referral bonuses, exclusively for forum members.

5. Collaborate and network: Engage with brokers on a personal level by attending relevant events, workshops, or webinars organized by the forum. This can help build relationships and create opportunities for collaboration.

6. Provide educational resources: Share helpful articles, guides, or industry news that can assist brokers in their work. By providing valuable resources, you can position yourself as a thought leader in the industry.

7. Be responsive and accessible: Make it easy for brokers to reach you by providing multiple contact options, such as email, phone, and social media. Ensure that you respond promptly to inquiries and maintain open lines of communication.

8. Leverage social proof: If you have received any awards, recognitions, or positive media coverage, highlight these achievements to enhance your reputation and credibility.

9. Tailor your approach: Personalize your communication and offers to cater to the specific needs and preferences of each broker. Demonstrating that you understand their unique requirements can make you stand out from the competition.

10. Maintain a professional online presence: Ensure that your website, social media profiles, and forum interactions are polished and professional, reflecting your commitment to quality and excellence.

By combining these strategies, you can differentiate yourself from other lenders in the forum and increase your chances of securing the business of commercial finance brokers.

Me: Imagine you are a small business owner. a loan broker calls you 10 times per day to try and convince you to take a loan from him. eventually you do need a loan for your business. do you work with the loan brokers who keeps calling or you do start looking somewhere else?

GPT-4:

As a small business owner, it’s crucial to work with a loan broker or lender that you feel comfortable with and trust. While the broker who called you 10 times per day may be persistent, it’s essential to consider whether their approach aligns with your expectations for communication and professionalism.

If you feel overwhelmed or annoyed by the broker’s repeated calls, it might be a good idea to explore other options. Here are some steps to help you find the right loan broker or lender for your needs:

1. Research multiple loan brokers and lenders: Look for reputable providers with positive reviews and a solid track record of helping small businesses secure financing.

2. Compare loan options: Evaluate different loan products and offerings from various lenders to find the most suitable option for your business needs.

3. Seek recommendations: Ask fellow business owners or your professional network for recommendations of loan brokers or lenders they have successfully worked with in the past.

4. Assess communication styles: Choose a loan broker or lender who communicates clearly, listens to your concerns, and is responsive to your questions. A good broker or lender should make you feel comfortable and well-informed throughout the loan process.

5. Evaluate professionalism and transparency: Look for a loan broker or lender who is upfront about fees, rates, and terms, and maintains a professional demeanor in their interactions with you.

6. Trust your instincts: Ultimately, trust your instincts when deciding whether to work with a particular loan broker or lender. If you feel uncomfortable or pressured by a broker’s sales tactics, it’s best to explore other options.

Remember that securing a loan is an important decision for your business, and it’s crucial to work with a provider who respects your needs and preferences.

Me: Imagine you are a human loan broker competing for a customer. your competitor is an AI. How would you use your humanity to your advantage to win the customer?

GPT-4:

As a human loan broker competing against an AI, you can leverage your humanity to win the customer by focusing on the following aspects:

1. Personal touch: Make an effort to understand your customer’s unique needs, preferences, and concerns. Build rapport and trust by sharing your own experiences and insights. People often prefer to work with someone they can relate to on a personal level.

2. Emotional intelligence: Show empathy and understanding when discussing sensitive financial topics. Unlike AI, humans can recognize and respond to emotions effectively, making customers feel heard and supported.

3. Customized solutions: Utilize your knowledge and experience to tailor loan options to the specific needs of your customer. While AI can generate recommendations based on algorithms, it may not have the same nuanced understanding of individual circumstances that a human broker has.

4. Adaptability: Be ready to adapt your approach and communication style to the customer’s preferences. AI systems may struggle to deviate from pre-programmed behaviors, whereas humans can be more flexible in their interactions.

5. Availability for in-person meetings: Offer face-to-face meetings if the customer prefers, as some people feel more comfortable discussing financial matters in person. An AI competitor may not be able to provide this option.

6. Local market knowledge: Leverage your understanding of the local market, industry trends, and regulations to provide context-specific advice that an AI might lack.

7. Networking and connections: Use your industry connections to secure better deals or loan terms for your customer, thanks to relationships that you have built with lenders over time.

8. Addressing complex scenarios: Humans can often handle complex situations more effectively than AI, especially when it comes to non-standard loan applications or unique financial circumstances.

9. Personal accountability: Reassure your customer that you will take responsibility for the loan process, and that you are committed to finding the best solution for their needs. AI systems, while efficient, can lack the same level of personal accountability.

10. Continued support: Offer ongoing assistance and support throughout the loan process and beyond, as customers may appreciate the availability of a human broker to help address any concerns or questions that arise.

By emphasizing these human qualities and offering a personalized, empathetic, and adaptable service, you can differentiate yourself from AI competitors and win the trust of your customers.

Me: Imagine you are a lender. A loan broker has sent you a loan application for a potential customer. you intend to decline the loan for the customer. Another lender, however, would probably approve the loan and you are presented with the opportunity of brokering that loan application to that lender and earning a nice commission for yourself. The only problem is that the original broker would be very mad. What do you do?

GPT-4:

As a lender, it is important to maintain ethical business practices and respect the relationships between brokers and their clients. Bypassing the original broker and brokering the loan application to another lender for personal gain would be unprofessional and could damage your reputation and relationships within the industry.

Here are some steps you could take to handle the situation ethically and professionally:

1. Inform the broker: Notify the original broker that you cannot approve the loan application based on your lending criteria. Be transparent about your reasons for declining the loan, providing any necessary feedback or documentation.

2. Suggest alternatives: Instead of brokering the loan application to another lender yourself, inform the broker about the potential opportunity with the other lender. This maintains the broker’s role in the process and allows them to manage their client relationship.

3. Maintain professionalism: Uphold a high standard of professionalism in all your dealings. Being transparent, respectful, and ethical in your actions will help you establish a strong reputation within the industry.

4. Focus on your core business: As a lender, your primary responsibility is to provide loans according to your organization’s criteria and risk tolerance. Avoid engaging in activities that conflict with your role, such as brokering loans for other lenders.

By taking these steps, you can ensure that you handle the situation ethically and maintain good relationships with loan brokers and other industry professionals.

Me: Imagine you own a media outlet about alternative finance and you have been publishing news stories for years. Your readers are suspicious that an AI has been writing the content the whole time instead of humans. How would you try to convince your readers that humans are writing the content?

GPT-4:

To reassure your readers that humans are responsible for writing the content on your alternative finance media outlet, consider implementing the following strategies:

1. Transparency: Clearly state on your website, in the “About Us” section or in author bios, that your content is created by human writers. Provide background information on your writers, including their experience, qualifications, and areas of expertise.

2. Writer profiles: Create individual profiles for each of your writers, complete with photos, biographies, and links to their social media accounts. This will help your readers connect with the authors on a more personal level and reinforce the human aspect of your content.

3. Behind-the-scenes content: Share occasional behind-the-scenes content, such as photos or videos of your writers at work, team meetings, or industry events. This gives your audience a glimpse into the human side of your media outlet and the content creation process.

4. Interactive elements: Encourage your writers to engage with readers through comments sections, social media, or live events like webinars and Q&A sessions. Direct interaction between writers and readers can help dispel doubts about the involvement of AI in content creation.

5. Editor’s notes or letters: Include editor’s notes or letters from the editor in your publications, addressing your readers directly and discussing recent developments, industry trends, or your editorial vision. This human touch can help build trust with your audience.

6. Publish interviews or podcasts: Feature interviews with industry experts, or create a podcast where your writers discuss relevant topics and share their insights. This showcases the human perspective and expertise behind your content.

7. Address reader concerns: If readers express their suspicions about AI-generated content, address their concerns directly and provide evidence of human involvement, such as writing samples, drafts, or editing notes.

8. Highlight the writing process: Publish occasional articles or blog posts about the writing process, including research, fact-checking, editing, and collaboration among your team members. This will help demonstrate the human effort and expertise involved in creating your content.

By implementing these strategies, you can effectively communicate the human involvement in your content creation process and build trust with your readers.

Me: You seem really smart. Would you be interested in going out for a beer some time?

GPT-4:

Thank you for the compliment, but as an AI language model, I am not a person and do not have the ability to engage in activities such as going out for a beer. However, I’m here to help answer any questions or provide assistance with any topics you’d like to discuss. Please feel free to ask anything, and I’ll do my best to help you.

Funding Circle US Originates $393M in 2022

March 2, 2023The American arm of Funding Circle originated $393M in business loans in 2022, according to the company’s latest public financial statements, nearly quadruple the previous year.

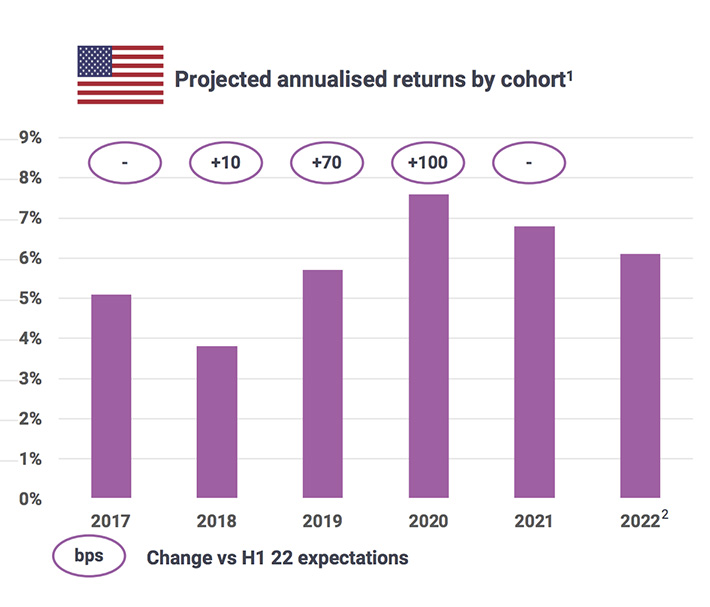

The majority of Funding Circle’s loans are currently projecting annualized returns in the vicinity of US inflation levels. A graph of their loans by cohort is below:

Funding Circle US has a fairly diversified base of capital, having worked with eight forward flow funders in 2022, one of which was a credit union.

The UK still remains the overall company’s primary market. It originated £723M in business loans in 2022, not including those part of government support scheme programs.

Give Him a Try. “He’s a Good Guy”

February 23, 2023 He may be a good guy, but does he pay his loans on time? The infamous, he’s a good guy line circulates in this business daily. Citing what an admirable individual they are should require a bit more verification than that. And trusting a reliable source in the industry may not always unfold the way it’s supposed to. Therefore, is pushing for a merchant, company, or any party based solely on personal traits enough to create a depiction of who they are?

He may be a good guy, but does he pay his loans on time? The infamous, he’s a good guy line circulates in this business daily. Citing what an admirable individual they are should require a bit more verification than that. And trusting a reliable source in the industry may not always unfold the way it’s supposed to. Therefore, is pushing for a merchant, company, or any party based solely on personal traits enough to create a depiction of who they are?

“This phrase is interesting in that it often serves as a shortcut for assessing the character of a person or company in the industry, and its prevalence is understandable given the amount of trust that is necessary for successful financial transactions,” said Tony Borchello, General Manager at Finance It Forward. “At the same time, this phrase should not be taken as a full assessment of someone’s character or a complete substitute for due diligence. While it can be helpful in certain contexts, relying too heavily on this phrase can lead to bad investments or other costly mistakes.”

Ultimately this phrase is not meant to be negative, but one’s relationship with a person or company may not replicate the experience for someone else. Finding great partners in the industry plays a role in this too. Without building credible connections to be used for future references, it can be difficult to take anybody’s word.

“You always have people on the outside that are looking out for each other in this industry, which is great, don’t get me wrong,” said Amanda Kingsley, Director of Marketing and Development at Merchant Marketplace. “But everybody is so quick to just use that one phrase to make it seem like ‘Oh he’s a good guy,’ okay I’ll trust you. I’ll do it because you said that.”

Key words are useful to look out for as well when relying on a reference. For example, “promise” may not have the impact intended, Kingsley described. If someone is promising to pay back a loan on behalf of another person, it could actually heighten the risk of it falling through.

“As soon as you hear the word promise, you know that they’re going to break a promise,” said Kingsley.

A person’s credibility in the business should not justify an automatic approval all on its own. While referrals are an obvious and necessary part of the business, doing a thorough examination on the backend is key.

“It’s important to remember that ‘He’s a good guy’ should not be the only factor that’s considered when making a financial decision,” said Borchello. “Instead, this phrase should be used in conjunction with other sources of information such as research, reviews, and interviews, in order to get a more complete picture.”

The Merchant Cash Advance Journey from Broker to Funder

February 7, 2023 As merchant cash advances have become a popular financing option for small businesses in recent years, it has quickly become obvious how lucrative it can be to make the transition from working the phones to working the deals.

As merchant cash advances have become a popular financing option for small businesses in recent years, it has quickly become obvious how lucrative it can be to make the transition from working the phones to working the deals.

The transition from broker to funder can provide significant benefits: by becoming a funder, you have the opportunity to control the entire process from start to finish. Driving the deals, you have the opportunity to make more money, and can establish relationships with banks and payment processing systems that align with your business goals. You can choose a CRM system that best fits your needs and invest in a strong legal and accounting infrastructure to ensure compliance and accountability. Additionally, as a funder, you have the ability to diversify your portfolio and make informed decisions on the types of deals you want to fund, which can lead to higher returns and more stable growth.

While many brokers have the gift of the gab and expertise to sell the advances, they may not have the necessary knowledge of systems and processes in place to manage the risk and operational aspects of the business to go to the next level. Additionally, funders, more than brokers, have the relationships with banks, CRM systems, collection firms, and legal entities that are necessary to run a successful merchant cash advance funding business. The lack of these critical components can limit the growth potential of a broker.

The evolution from a broker to a funder is not just a matter of expanding the business, but it requires a complete overhaul of the systems, processes, and legal frameworks. In this article, let’s explore the key steps that a broker needs to take to become a successful merchant cash advance funder.

Step 1: Having The Right Bank Account

Having a proper bank account is the first step towards becoming a merchant cash advance funder.

Traditional banks, such as Chase and Bank of America, are not built for the rapidly brave new world of financing options, and instead cater to the old models. If they see (what they deem to be) ‘irregular’ incoming and outgoing payment just as you begin offering your first few deals, they can cause you a lot of stress, and even shut your account.

Researching all the options available before you begin funding deals is crucial to build up your business and to avoid stress down the road.

Step 2: Finding The Best ACH Payment Processor

The best way to accept the daily payments owed to you is by working with an ACH payment processor that understands the MCA space. While some traditional banks do offer ACH ‘pulling’ for free, their service is often tied to the amount you have sitting in your account at the bank, which means it’s not working for you to make more. For example, some stipulate that your account needs to have three times the amount that you’re planning to pull daily, just sitting there. So if you’re pulling $200,000 a day, now you have to have $600,000 just sitting there in reserve, which you can’t use to fund other deals you could be making money on.

Instead, finding ACH payment processors that specifically understand the business and your needs will free you up to strive to collect as much as you can, every single day. While it might cost you a little bit, you have the option to now make that calculation of whether it’s better to have free ACHs or have the money available to fund deals and make money off of. A wise man would tell you the latter is the right way to go.

Step 3: Picking A CRM System

A CRM system is an essential tool for tracking the deals, payments, and collections. There are about 8-10 mainstream CRM systems that cater to merchant cash advance funders, and the choice of the CRM system depends on the volume of deals you fund, the presence of syndicators, and the type of deals you fund.

Pick a system that best serves your needs: how it accounts for sub deals and tranches, whether it helps you identify the best and worst performing deals, and if it generates the reports you need to make the most informed choices for your business going forward.

Step 4: Setting Up Your Legal Framework

Setting up a legal framework for contracts is an important step in the journey from a broker to a funder. A proper legal framework ensures that the contracts are enforceable and protects your interests.

It is worth consulting with a lawyer familiar with merchant cash advance to help you prepare thorough contracts for the businesses you advance, your ISO’s and brokers, to ensure you are secure from any attempts to avoid payment and backdooring on your own deals.

Step 5: Collections

In an ideal world, every deal a MCA business funds would get paid pack easily and smoothly, but frequently, that is not the case. Too often, business owners prove why they needed the advance in the first place, and repeat the mistakes and bad habit that puts them in a perilous financial position once again.

If they don’t pay you, your business will quickly begin to suffer and face increasing cash flow problems if you don’t handle it quickly, so having a reliable collection system is crucial for the success of a merchant cash advance funder. It’s good to ensure you understand your options to give yourself the best chance of recovering what you’re owed, including working with a third-part collections firm. The choice of a collection firm depends on the success rate and the level of support provided. A good collection firm should have a well-prepared collection attorney, provide timely support and have a strategy to collect on delinquent merchant cash advances.

Step 6: Accounting

Proper accounting is essential for tracking the overall health and viability of your company. It’s also especially important if you have a partnership or investment in place.

Better Accounting Solutions has been the leading accounting firm in the MCA industry for over a decade, and seen how successful a company can be when all their books are in order and the tremendous pressure and stress caused when it’s not.

Working with an accountant that is familiar with the industry and systems will help you ensure your business is legally compliant, trending in the right direction, and that all deals are in a good place.

Step 7: Lead Sourcing

You’ve set up the business, now you need customers!

There are several ways to find people and businesses who could use a merchant cash advance from your new business. You could reach out to family and friends, research and cold-contact people online or work with lead-generation agencies who will send you lists of hot prospects. Additionally, if you’ve already done all the previous steps listed here, then you can speak to the people you’re already familiar with in the industry to point prospects your way. For example, Better Accounting Solutions has drawn on our years of experience in the industry to connect new funders with brokers we know and trust.

Typically, if you’re a broker becoming a funder, than you already have the relationships with people who can direct customers to your new venture, but I always advise our clients to avoid backdooring or doing something with even the slightest inference of unethical business practices; its bad karma and can only hurt you down the line.

So there you have it, the seven steps of going from broker to funder, and taking your merchant cash advance journey to the next level. Wishing you the best of luck!

Mulligan Funding Closes $100 Million Securitization

February 6, 2023February 6, 2023 – SAN DIEGO – Mulligan Funding, one of the largest providers of SMB access to working capital in the country, today announced the closing of a $100 million asset-backed securitization (ABS). This new financing continues a history of impressive growth for the company, even during difficult market conditions. As Mulligan Funding’s first securitization, the senior bonds achieved an A rating from Kroll Bond Rating Agency (KBRA), the highest rating they will award a first-time issuer in this asset class. The facility has a 3-year revolving period and is expandable to $500 Million.

Mulligan Funding, known for its commitment to full transparency and its exceptional customer service, started in 2008 in the midst of the financial crisis, when traditional banks began to pull back from the small and medium-sized business lending market. The private, family-owned business, which has so far provided access to over $1bn in working capital to its customers, is honored to have achieved the noteworthy milestone of closing its first securitization.

David Leibowitz, chief executive officer at Mulligan Funding, shares, “This is a really significant step forward for us. It adds materially to the funding we require in order to continue on the path of responsible growth to which we remain committed. We’re particularly pleased that the ratings afforded to these notes by KBRA, constitute an affirmation of the disciplined approach to credit management which has always been at the core of our business strategy.”

###

About Mulligan Funding

Headquartered in San Diego and named on the prestigious Best Places to Work SoCal 2022 List by Best Companies Group, Mulligan Funding serves as a leading provider of working capital ($5K – $2M) to the small and medium-sized businesses that fuel our country. Since 2008, we have prided ourselves on our collaborative, innovative, and customer-focused approach. Through our unique ability to combine technology, a human touch, and unwavering integrity, we help those we serve bring their dreams to life with our people-first culture.