StreetShares to Change Fee Policy

May 22, 2018StreetShares sent out an email on Monday saying that they will no longer automatically deduct origination fees from their loans to small businesses. Instead, according to the email, merchants will receive their full amount and it will be up to the merchant to decide whether they would like to pay off the origination fee immediately or include it in their weekly payment.

StreetShares Completes $23 Million Investment, Sticking With Their Plan

January 30, 2018 StreetShares, the small business lender focused on making loans to veteran-owned businesses, completed a $23 million series B funding round last week. The round was led by a $20 million investment from Rotunda Capital Partners, LLC, with an additional $3 million from existing investors, including Stoney Lonesome Group.

StreetShares, the small business lender focused on making loans to veteran-owned businesses, completed a $23 million series B funding round last week. The round was led by a $20 million investment from Rotunda Capital Partners, LLC, with an additional $3 million from existing investors, including Stoney Lonesome Group.

According to the company’s June 30th 2017 fiscal year-end financial statements, it only made 751 loans in a 12-month period. Other companies may make thousands in the same period.

However, this is because StreetShares approach to earning is different than most online lending companies. Rather than relying primarily on increasing the volume of loans to generate revenue, they also earn by co-investing in loans, according to Mark Rockefeller, CEO and Co-founder of the three and a half year-old Reston, VA-based company.

In an email, Rockefeller, who is himself a veteran, also conveyed that they have sought out VC equity investors who are patient and want them to issue high quality loans.

According to StreetShares’ June 30th fiscal year-end financial statements, the company’s revenues were $2,168,067 and its losses were $6,193,154. While this might be of concern to other companies, this isn’t alarming to Rockefeller. It’s part of the plan.

“Our patient approach means we’re not going to be profitable for a couple more years. But it also means we’ll still be here in 50 years.”

StreetShares Reports $6.2M Loss For Fiscal Year 2017

October 31, 2017StreetShares, the veteran-run small business lender, continued to post sizable losses, according to their June 30th fiscal year-end financial statements. The company had a $6,193,154 loss on only $2,168,067 in revenue. While StreetShares has generated significant buzz for their particular focus on military-owned small businesses, the lender only made 751 loans in the 12-month period and there is no requirement that the businesses they lend to actually be military-owned.

The company spent more on payroll and payroll taxes alone ($3,258,960) than they earned in revenue. They had 32 full-time employees and 1 part-time employee as of June 30th.

“As an early stage, venture-funded company that is not yet profitable, we rely heavily on capital investments to fund our operations,” the company wrote in their annual report. “Based on our current financial situation, it is likely we will require additional capital within the next twelve months beyond our currently anticipated amounts to fund the operations of the Company.”

The chart plotting their loan performances by grade below is from their annual report:

Their loan amounts typically range from $2,000 to $150,000 and require weekly payments for anywhere from 3 months to 3 years.

Even though the company spent nearly triple on marketing in this fiscal year ($1,727,478) versus the previous year ($579,331), revenue only doubled.

StreetShares plans to raise additional capital towards the end of this year through a Series B Round.

StreetShares Reports $2.8M Loss on Just $277,000 in Revenue For Last Six-Month Period

March 30, 2017 StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares, an online small business lender that is self-described as proudly veteran-run, published their most recent financial statements with the SEC earlier this week. For the six-month period ending December 31st, 2016, StreetShares recorded a $2.8 million loss on $277,883 in revenue. Over the same period in the prior year, they recorded a $1.35 million loss on $145,019 in revenue. To-date, the lender has issued $20 million in loans since they first began in July 2014.

StreetShares has so far charged off 23 loans for a combined principal balance of $380,804. Charge-off determinations are made after 150 days of delinquency.

The company made history last year by becoming the first lender in the US to be approved by the SEC to use funds from public investors to back loans to small businesses. This was done through Regulation A+ of the Jumpstart Our Business Startups (JOBS) Act. Reg A+ investors make up $656,675 of StreetShares’ liabilities on the balance sheet.

StreetShares currently makes loans to small businesses between $2,000 to $500,000 for terms of three months to three years.

The company also spent more than 5x their revenue on payroll and payroll tax for the six-month period and more than 3x their revenue on marketing expenses.

Earlier this month, StreetShares announced a partnership with Nor-Cal FDC “to assist small business and veteran business owners in obtaining funding needed to win new opportunities.”

In the release, StreetShares CEO Mark Rockefeller said, “we’re eager to provide veteran-owned small businesses with the funding solutions they need to grow.”

Retail Investors Can Invest In Business Loans – Thanks To StreetShares Regulatory Approval

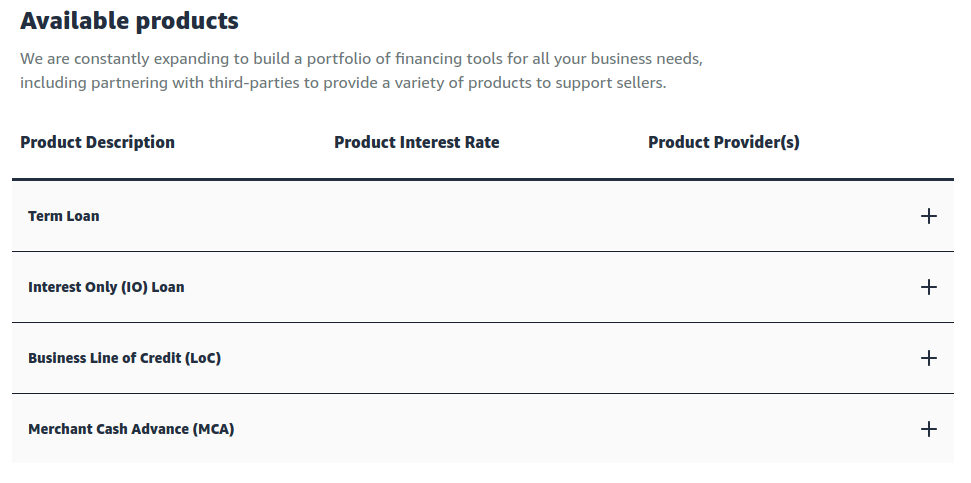

March 16, 2016 If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

Unlike the laborious process that Lending Club and Prosper took with the SEC to sell loan performance-dependent notes to unaccredited investors, StreetShares got a special approval under the JOBS Act’s Regulation A+. That only allows them to raise up to $50 million over a 12-month period so investing availability may be limited.

In a press release, the company specified that “repayment to investors is not tied to the performance of a particular underlying loan.” The LendAcademy blog is reporting that “StreetShares will provide a vehicle for investors to become diversified through some kind of fund” and that details should be revealed around the time of the LendIt Conference.

Though company CEO Mark Rockefeller of StreetShares might not remember this, we spoke during a lunch break at LendIt 2014 when his company was a brand new startup. At that time, he told me about his “veterans funding veterans” lending marketplace model where the costs would be much lower than what can be experienced in the merchant cash advance industry. Since then his company has won the 2015 #1 global Best Investment Award from Harvard Business School and is now the first small business lender to get approval under Regulation A+.

One other person that is trying to bring small business lending investing to the unaccredited investor community is hedge fund manager Brendan Ross. Ross’s Direct Lending Income Fund filed an N-2 with the SEC at the conclusion of last year to become a “40 Act fund,” a special investment company permitted under The Investment Company Act of 1940 that can accept investments from retail investors. In January, Ross explained to CNBC during an interview that the fund’s structure would be converted so that investors become shareholders in what would essentially be a lending business.

StreetShares plans to officially debut their new program at LendIt next month.

How the Amazon / Parafin Merchant Cash Advance Deal Came to Be

November 2, 2022Back in December, Parafin, then a fintech startup with 20 employees, submitted a proposal to Amazon to roll out a potential Amazon merchant cash advance product. At the time, Parafin was little known to the general public and its surprise deal with DoorDash wouldn’t even become public until a month later.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

Coincidentally, more than a dozen people employed by Parafin, including the co-founders, are former Robinhood employees, according to profiles reviewed on LinkedIn. It’s part of a trend, it appears, as other members of their team hail from well known Silicon Valley firms like Lending Club, Stripe, Funding Circle, Google, Amazon, Facebook, StreetShares, and more.

Ultimately, Parafin’s big bet paid off. On Tuesday, November 1st, Amazon announced that the Parafin team was the one it had chosen to debut its official merchant cash advance product.

“Amazon is committed to providing convenient and flexible access to capital for our sellers, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending, in the announcement. “Today’s launch is another milestone in strengthening Amazon’s commitment to sellers, and builds on the strong portfolio of financial solutions we already provide. This latest offering significantly expands sellers’ reach and capabilities, and broadens their access to capital in a flexible way—one that helps them control their cashflow, and by extension, their entire business.”

“We founded Parafin with the mission to grow small businesses, and we’re thrilled that we have the opportunity to do that by providing Amazon sellers with this merchant cash advance option,” said Vineet Goel, co-founder of Parafin. “It’s a privilege to count ourselves among Amazon’s suite of financial solutions, and we look forward to making a difference for Amazon.com sellers looking to expand their business.”

The product is already listed on Amazon’s website and was rolled out to some US businesses immediately. It will be available to hundreds of thousands of additional sellers by early 2023, the company claims.

Unique to an Amazon MCA is that funding amounts can start as low as $500 and go up to $10 million.

Amazon’s entrance into the merchant cash advance market coincides wih a unique moment in the product’s history as several states are in the midst of imposing strict regulations on their sale.

Could Peer-to-Peer Lending Be Resurrected By Falling Interest Rates? At Least For Now?

September 19, 2019 As interest rates rose and yields for investors at peer-to-peer (p2p) lenders collapsed, the allure of p2p lending, at least from my perspective, was gone.

As interest rates rose and yields for investors at peer-to-peer (p2p) lenders collapsed, the allure of p2p lending, at least from my perspective, was gone.

Rates on FDIC-insured CDs hit 2.5% while annual returns at some popular p2p lenders had declined to less than 5%. That’s a very narrow spread between an investment that has no risk of loss versus one that has a risk of losing everything, is rather unpredictable, and is marred by a history of misleading investors and overstating returns.

I compared the options and made the obvious decision and started withdrawing my personally invested funds out of p2p lenders 3 years ago in favor of more traditional investments like stock index funds.

But now interest rates are falling and it’s possible that retail investors once wooed by modestly generous savings account rates could begin to consider alternative options to generate returns. Enter P2P lending, again.

At Lending Club, the percentage of individual investors has trended downward consistently. In Q1 2015 these investors accounted for 19% of all platform originations with a total of $308 million. In the most recent quarter, that group has shrunk down to 5% of originations and only $155 million.

But at StreetShares, an online small business lender that offers individual retail investors a fixed 5% annualized return, the trend is the opposite. In a recent statement the company filed with the SEC, they claimed they had actually shifted away from funds from institutional capital providers and towards funds from retail investors. It doesn’t get into the specifics about why that is but it’s certainly unusual. StreetShares’ investment offering carries a total risk of loss much like other p2p lenders.

But interest rates aren’t supposed to fall in a void where nothing else in the outside world is happening. Assuming the economy is cooling, or worse, eventually heading towards a recession, the somewhat attractive looking p2p loan yields will fall as well since defaults on the underlying loans will rise.

So what does this mean? It means that online lenders, to the extent they’re still interested, have a potentially short window to entice retail investors back. To do so, they’ll have to convince the world that past transgressions are behind them and that low savings account rates can be supplanted by people helping their peers in return for a slightly better yield. That’s how the entire concept took off to begin with. I say the window is short because once we’re actually in a recession, it will become incredibly hard to convince fearful investors to participate in making risky online loans especially if the average returns drop into the negative. Don’t be surprised when that happens.

The 2019 Top Small Business Funders By Revenue

August 14, 2019The below chart ranks several companies in the non-bank small business financing space by revenue over the last 5 years. The data is primarily drawn from reports submitted to the Inc. 5000 list, public earnings statements, or published media reports. It is not comprehensive. Companies for which no data is publicly available are excluded. Want to add your figures? Email Sean@debanked.com

| Company | 2018 | 2017 | 2016 | 2015 | 2014 |

| Square | $3,298,177,000 | $2,214,253,000 | $1,708,721,000 | $1,267,118,000 | $850,192,000 |

| OnDeck | $398,376,000 | $350,950,000 | $291,300,000 | $254,700,000 | $158,100,000 |

| Kabbage | $200,000,000+* | $171,784,000 | $97,461,712 | $40,193,000 | |

| Global Lending Services | $232,200,000 | $125,700,000 | |||

| Bankers Healthcare Group | $220,300,000 | $160,300,000 | $93,825,129 | ||

| National Funding | $121,300,000 | $94,500,000 | $75,693,096 | $59,075,878 | $39,048,959 |

| Forward Financing | $75,500,000 | $42,100,000 | $28,305,078 | ||

| ApplePie Capital | $69,700,000 | ||||

| Fora Financial | $68,600,000 | $50,800,000 | $41,590,720 | $33,974,000 | $26,932,581 |

| Reliant Funding | $64,800,000 | $55,400,000 | $51,946,000 | $11,294,044 | $9,723,924 |

| Envision Capital Group | $32,700,000 | ||||

| Expansion Capital Group | $31,300,300 | $23,400,000 | |||

| SmartBiz Loans | $23,600,000 | ||||

| 1 Global Capital | bankruptcy | $22,600,000 | |||

| IOU Financial | $19,200,000 | $17,415,096 | $17,400,527 | $11,971,148 | $6,160,017 |

| Quicksilver Capital | $16,500,000 | ||||

| Channel Partners Capital | $23,000,000 | $14,500,000 | $2,207,927 | $4,013,608 | |

| Lendr | $16,500,000 | $11,800,000 | |||

| Lighter Capital | $16,000,000 | $11,900,000 | $6,364,417 | $4,364,907 | |

| United Capital Source | $9,735,350 | $8,465,260 | $3,917,193 | ||

| Fundera | $15,600,000 | $8,800,000 | |||

| US Business Funding | $14,800,000 | $9,100,000 | $5,794,936 | ||

| Wellen Capital | $12,200,000 | $13,200,000 | $15,984,688 | ||

| PIRS Capital | $11,900,000 | ||||

| Nav | $10,300,000 | $5,900,000 | $2,663,344 | ||

| P2Binvestor | $10,000,000 | ||||

| Seek Business Capital | $8,800,000 | ||||

| Fund&Grow | $7,500,000 | $5,700,000 | $4,082,130 | ||

| Funding Merchant Source | $7,500,000 | ||||

| Shore Funding Solutions | $5,000,000 | $4,300,000 | |||

| StreetShares | $4,967,426 | $3,701,210 | $647,119 | $239,593 | |

| FitSmallBusiness.com | $3,000,000 | ||||

| Eagle Business Credit | $3,600,000 | $2,600,000 | |||

| Everlasting Capital | $2,500,000 | $2,100,000 | |||

| Swift Capital | acquired by PayPal | $88,600,000 | $51,400,000 | $27,540,900 | |

| Blue Bridge Financial | $6,569,714 | $5,470,564 | |||

| Fast Capital 360 | $6,264,924 | ||||

| Cashbloom | $5,404,123 | $4,804,112 | $3,941,819 | ||

| Priority Funding Solutions | $2,599,931 |