Puerto Rico Bankers Association Calls Section 1071 Absurd and Unreasonable

June 28, 2017Section 1071, the law that grants the CFPB authority to collect loan application data on minority and women-owned businesses, is under fire, again. This time it’s the Puerto Rico Bankers Association in response to the CFPB’s RFI on the matter. In a letter, the PRBA points out the sheer irony of conducting costly disparate impact studies on minorities in minority-only communities.

An excerpt from their statement:

According to the 2010 US Census Bureau, 99% of the population of Puerto Rico is Hispanic.

[…]

The direct and evident effect of Section 704B of ECOA for the financial institutions in Puerto Rico will inevitably be the collection, recordkeeping and reporting of virtually all commercial loan applications received within the Puerto Rico marketplace, since most of such applicants would be regarded as “Minority Owned Business”, in accordance with Section 704B.

The PRBA believes that this absurd and unreasonable result must not have been intended by Congress when it enacted Section 1071 of the Dodd-Frank Act. The data so collected, maintained and reported will not serve the purposes for with Section 1071 was enacted since, for the reasons set forth above, it will be completely inaccurate and unreliable. The potential complexity and cost of compliance with the minority-owned businesses data collection and reporting requirements of Section 704(B), will impose on our banks an unintended and unreasonable burden.

Other responses to the CFPB’s RFI have so far called Section 1071, “literally impossible to comply with” and a duplicated effort.

US Treasury Calls for Section 1071 to Be Repealed

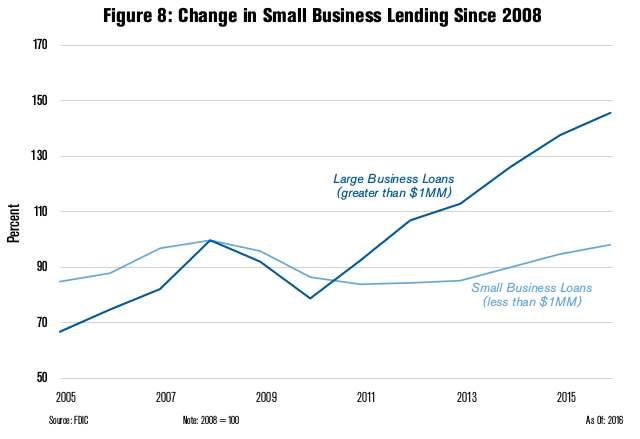

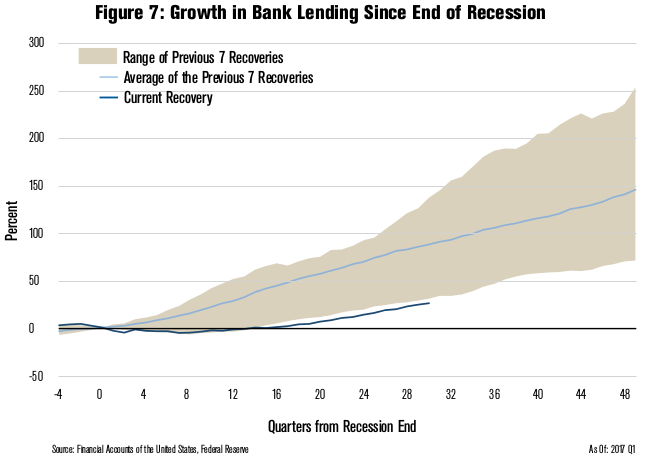

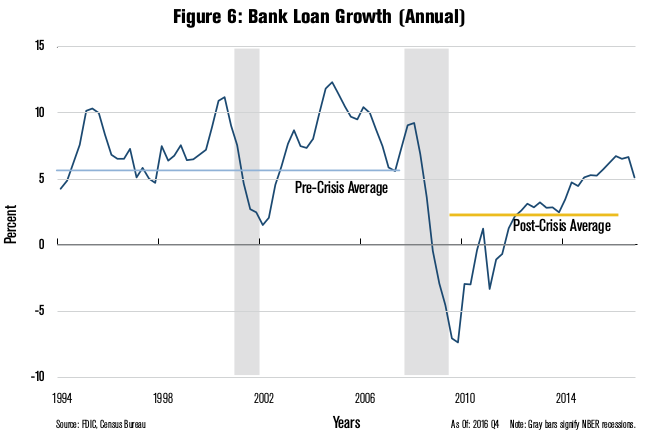

June 19, 2017In a 149-page report prepared for President Trump, the US Treasury has called for the repeal of Section 1071 of Dodd-Frank. Section 1071 is the governing law behind the CFPB’s jump into small business lending data collection. Citing the cost of data collection and anemic small business loan growth since 2008, the Treasury says, “Although financial institutions are not currently required to gather such information [required by the law], many lenders have expressed concern that this requirement will be costly to implement, will directly contribute to higher small business borrowing costs, and reduce access to small business loans.”

“THE PROVISIONS IN THIS SECTION OF DODD-FRANK PERTAINING TO SMALL BUSINESSES SHOULD BE REPEALED TO ENSURE THAT THE INTENDED BENEFITS DO NOT INADVERTENTLY REDUCE THE ABILITY OF SMALL BUSINESSES TO ACCESS CREDIT AT A REASONABLE COST” – US Treasury

The current deadline to reply to the CFPB’s Request For Information is July 14th though industry sources expect the deadline will be pushed back. Of course, if Section 1071 were successfully repealed, the RFI would be moot.

The Choice Act, a bill that just passed the House of Representatives, does indeed repeal Section 1071, but industry sources following the legislation believe the bill will die in the Senate.

Even if a repeal never happens, it is possible that regulations pursuant to Section 1071 may not even go into effect until the early 2020s if similar rulemaking trajectories are to be used as a guide. With payday lending, for example, the CFPB RFI on the matter ended in early 2012 but to-date there still has been no final rule.

CFPB to Collect Data on Small Business Lending, Implement Section 1071 and Circulate RFI

May 10, 2017

Update: We are streaming the hearing LIVE on our home page.

Update: You can download the CFPB’s Request for Information here. A transcript of Cordray’s prepared remarks are at the bottom of the page.

Update: CFPB White paper estimates that merchant cash advances are less than 1% of the small business finance market on an aggregate dollar volume basis, factoring 7%, and equipment leasing 13%. They estimate that the small business financing market is roughly $1.4 trillion in size. They also estimate that there are less than 1.5 million merchant cash advance “accounts” in the US, more than 6 million term loan accounts, and more than 7 million factoring accounts.

Update: The CFPB is releasing a Request for Information (RFI), asking industry participants to define a small business, explain where small businesses seek financing and the kinds of products that are made available to them, reveal the categories of data that small business lenders are using and maintaining, and to provide input on privacy implications that may arise from disclosing information to the CFPB.

Update: The CFPB is indeed announcing their plans to implement Section 1071 of Dodd-Frank.

Beginning at 1:45PM EST on Wednesday, the CFPB will be holding a hearing in Los Angeles on small business lending. According to the agenda, “the hearing will feature remarks from Director Cordray, as well as testimony from consumer groups, members of the public, and industry representatives.”

Sources contend that the director will use the hearing as an opportunity to announce the agency’s plans for the implementation of Section 1071 of Dodd-Frank which grants the CFPB the authority to collect data from small business finance companies. Some critics have characterized the law as an attempt to push affirmative action into small business lending, while others worry the CFPB will attempt to exceed its statutory authority and exact penalties based on the data it collects.

Unless Trump fires Cordray for cause, the director’s term will continue until July 2018.

industry representatives making remarks at the hearing include:

- Todd Hollander, Managing Director, Union Bank

- Makini Howell, Executive Chef and Owner, Plum Restaurants, and Main Street Alliance Member

- Kate Larson, Director, U.S. Chamber of Commerce

- Elba Schildcrout, Director of Community Wealth, East Los Angeles Community Corporation

- Josh Silver, Senior Advisor, National Community Reinvestment Coalition

- Robert Villarreal, Senior Vice President, CDC Small Business Finance

If possible, we will attempt to embed the live stream on our site.

Full transcript of Cordray’s prepared remarks below

Thank you all for coming. It is good to be here again in Los Angeles. Today, the Consumer Financial Protection Bureau is announcing an inquiry into ways to collect and publish information about the financing and credit needs of small businesses, especially those owned by women and minorities. We are well aware of the key role they play in our lives. Small businesses help drive America’s economic engine by creating jobs and nurturing local communities. It is estimated that they have created two out of every three jobs since 1993 and now provide work for almost half of all employees in the private sector. Yet we perceive large gaps in the public’s understanding of how well the financing and credit needs of these entrepreneurs are being served.

As you probably know, Congress provided the Consumer Bureau with certain responsibilities in the area of small business lending. And there is a strong logic behind this. When I served as the Ohio Attorney General, we recognized the need to protect small businesses and nonprofit organizations by accepting and handling complaints on their behalf, just as we did for individual consumers – an approach that proved to be very productive. In addition, the line between consumer finance and small business finance is quite blurred. More than 22 million Americans are small business owners and have no employees. And, according to data from the Federal Reserve, almost two-thirds of them rely on their business as their primary source of income.

Congress specifically has charged the Consumer Bureau with the responsibility to administer and enforce various laws, including the Equal Credit Opportunity Act. Unlike other consumer financial laws, the ECOA governs not only personal lending, but some commercial lending as well. In fact, we have now conducted a number of ECOA supervisory examinations of small business lending programs. Through that work, we are learning about the challenges financial institutions face in identifying areas where fair lending risk may exist, and we are assisting them in developing the proper tools to manage that risk.

In the Dodd-Frank Wall Street Reform and Consumer Protection Act, Congress took a further step to learn more about how to encourage and promote small businesses. To help determine how well the market is functioning and to facilitate enforcement of the fair lending laws, Congress directed the Consumer Bureau to develop regulations for financial institutions that lend to small businesses to collect certain information and report it to the Bureau. The Request for Information we are releasing today asks for public feedback to help us better understand how to carry out this directive in a way that is careful, thoughtful, and cost-effective.

***

We have considerable enthusiasm for this project. In my own case, I have seen firsthand how small business financing can have a big economic impact. When I served as the Treasurer of Ohio, we had a reduced-interest loan program to support job creation and retention by small businesses. The way the program worked was that the state could put money on deposit with banks at a below-market rate of interest, and this deposit was then linked to a same-sized loan to a small business at a correspondingly below-market rate. This so-called “Linked Deposit” program had been authorized more than twenty years earlier, but had gradually fallen into disuse.

At its core, however, the program made good sense. Small businesses are often in desperate need of financing to update and expand their operations, and if they can get inexpensive financing, they often can fertilize their ideas for growth and be even more successful. So we diagnosed the program and found that after its initial success, it had become too bureaucratic. We heard from both banks and businesses that the program, which was still paper-based, was so slow and cumbersome that nobody wanted to use it.

So we changed all that. We put the process online, rebranded it as the “Grow Now” program, and made specific commitments to those who wanted to participate in it. We told them they could fill out a typical application in 30-60 minutes, and we promised them they would have a yes-or-no answer on their application within 72 hours. That was not easy, and it required very close coordination with the banks that took part in the program. But we did it, and the “Grow Now” program really took off. Only about $20 million had been allocated when we started, but in less than two years we deployed more than $350 million, helping about 1,500 small businesses create or retain approximately 15,000 jobs across the State.

It was also exciting and interesting to see how the businesses were able to use the loan funds. I can recall a construction business in northeast Ohio that needed a loan to buy a large piece of equipment so the company could compete for new and different jobs. They got the money, they got the equipment, and they thrived. I recall a manufacturer in northern Ohio that needed money to turn their factory sideways on their property so they could utilize more space and employ more people. We funded the build-out, they executed on it, and they met their goals for growth of output, revenue, and jobs. And I recall a company in western Ohio that started out as a caterer, began making their own tents for events, recognized that they might be able to succeed as tentmakers, and needed financing to be able to bid on a major project with the U.S. Department of Defense. We got them the loan, they got the bid, and Inc. magazine named them one of its 500 fastest-growing businesses of that year!

***

The moral of this story is that business opportunity – especially opportunities for small businesses – often hinges on the availability of financing. People have immense reserves of energy and imagination. Human ingenuity is the overwhelming power that allows human beings to reinvent the future and make it so. These forces unleash what Joseph Schumpeter called the “gales of creative destruction” that constantly mold and reshape the patterns of our economic life. Innovation has sharpened our nation’s economic edge for generation after generation, but when credit is unavailable, creativity is stifled.

To make the kind of meaningful contributions they are capable of making to the American economy, small businesses – particularly women-owned and minority-owned businesses – need access to credit. Without it, they cannot take advantage of opportunities to grow. And with small businesses so deeply woven into the nation’s economic fabric, it is essential that the public – along with small business owners themselves – can have a more complete picture of the financing available to this key sector.

Some things we do know. We are releasing a white paper today that lays out the limited information we currently have about key dimensions of the small business lending landscape. According to Census data, and depending on the definition used, there are an estimated 27.6 million small businesses in the United States. We estimate that together they access about $1.4 trillion in credit. Businesses owned by women and minorities play an especially important role in this space. Women-owned businesses account for over one-third (36 percent) of all non-farming, private sector firms. The 2012 Survey of Business Owners, the most recent such information available, indicates that women-owned firms employed more than 8.4 million people, and minority-owned firms employed more than 7 million people. Those are huge numbers: by comparison, in 2014 fewer than 8 million people were employed in the entire financial services sector.

When small businesses succeed, they send constant ripples of energy across the economy and throughout our communities. For example, a 2013 study by the Federal Reserve Bank of Atlanta found that counties with higher percentages of their workforce employed by small businesses showed higher local income, higher employment rates, and lower poverty rates. In order to succeed, businesses need access to financing to smooth their cash flows for current operations, meet unexpected contingencies, and invest in their enterprises to take advantage of opportunities as they arise. Another study found that the inability to obtain financing may have prompted one-in-three small businesses to trim their workforces and one-in-five to cut benefits.

Unfortunately, much of the available data on small business lending is too dated or too spotty to paint a full picture of the current state of access to credit for small businesses, especially those owned by women and minorities. For example, we do not know whether certain types of businesses, or those in particular places, may have more or less access to credit. We do not know the extent to which small business lending is shifting from banks to alternative lenders. Nor do we know the extent to which the credit constraints that resulted from the Great Recession persist and to what extent. The Beige Book produced by the Federal Reserve on a regular basis is a survey of economic conditions that contains a huge amount of anecdotal information about business activity around the country. But it has no systematic data on how small businesses are faring and whether or how much they are being held back by financing constraints.

Given the importance of small businesses to our economy and their critical need to access financing if they are to prosper and grow, it is vitally important to fill in the blanks on how small businesses are able to engage with the credit markets. That is why Congress required financial institutions to report information about their applications for credit from small businesses in accordance with regulations to be issued by the Consumer Bureau. And that is why we are here today for this field hearing.

***

The inquiry we are launching today is a first step toward crafting this mandated rule to collect and report on small business lending data. To prepare for the project, we have been building an outstanding team of experts in small business lending. We are enhancing our knowledge and understanding based on our Equal Credit Opportunity Act compliance work with small business lenders, which is helping us learn more about the credit application process; existing data collection processes; and the nature, extent, and management of fair lending risk. We also have learned much from our work on the reporting of home loans under the Home Mortgage Disclosure Act, which has evolved and improved considerably over the past forty years.

At the same time, we recognize that the small business lending market is much different from the mortgage market. It is even more diverse in its range of products and providers, which range from large banks and community banks to marketplace lenders and other emerging players in the fintech space. Community banks play an outsized role in making credit available to small businesses in their local communities. And unlike the mortgage market, many small business lenders have no standard underwriting criteria or widely accepted scoring models. For these reasons and more, we will proceed carefully as we work toward meeting our statutory responsibilities. And we will seek to do so in ways that minimize the burdens on industry. Our Request for Information released today focuses on several issues.

First, we want to determine how best to define “small business” for these purposes. Despite the great importance of these firms to our economy, there is surprisingly little consensus on what constitutes a small business. For example, the Small Business Administration, in overseeing federal contracting, sometimes looks at the number of employees, sometimes looks at the annual receipts, and applies different thresholds for different industries. For our part, the Consumer Bureau is thinking about how to develop a definition that is consistent with the Small Business Act, but can be tailored to the purposes of collecting business lending data. So we are looking at how the lending industry defines small businesses and how that affects their credit application processes. Having this information will help us develop a practical definition that advances our goals and aligns with the common practices of those who lend to small businesses.

Second, we want to learn more about where small businesses seek financing and the kinds of loan products that are made available to them. Our initial research tells us that term loans, lines of credit, and credit cards are the all-purpose products used most often by our small businesses. In fact, they make up an estimated three-fourths of the debt in the small business financing market, excluding the financing that merchants or service providers extend to their small business customers to finance purchases of the sellers’ own goods and services. But we want to find out if other important financing sources are also being tapped by small businesses. Currently, we have limited ability to measure accurately the prevalence of lenders and the products they offer. We also want to learn more about the roles that marketplace lenders, brokers, dealers, and other third parties may play in the application process for these loans. At the same time, we are exploring whether specific types of institutions should be exempted from the requirement to collect and submit data on small business lending.

Third, we are seeking comment about the categories of data on small business lending that are currently used, maintained, and reported by financial institutions. In the statute, Congress identified specific pieces of information that should be collected and reported. They include the amount and type of financing applied for; the size and location of the business; the action taken on the application; and the race, ethnicity, and gender of the principal owners. Congress determined that the reporting and disclosure of this information would provide a major boost in understanding small business lending. At the same time, we are sensitive to the fact that various financial institutions may not currently be collecting and reporting all of this information in the context of other regulatory requirements. And we understand that the changes imposed by this rule will create implementation and operational challenges.

So we will look into clarifying the precise meaning of some of these required data elements to make sure they are understood and consistently reported. We will be considering whether to add a small number of additional data points to reduce the possibility of misinterpretations or incorrect conclusions when working with more limited information. To this end, we are seeking input on the kinds of data different types of lenders are currently considering in their application processes, as well as any technical challenges posed by collecting and reporting this data. We will put all of this information to work in thinking carefully about how to fashion the regulation mandated by Congress under Section 1071 of the Dodd-Frank Act.

Finally, the Request for Information seeks input on the privacy implications that may arise from disclosure of the information that is reported on small business lending. The law requires the Consumer Bureau to provide the public with information that will enable communities, government entities, and creditors to identify community development needs and opportunities for small businesses, especially those owned by women and minorities. But we also are authorized to limit the data that is made public to advance privacy interests. So we will be exploring options that protect the privacy of applicants and borrowers, as well as the confidentiality interests of financial institutions that are engaged in the lending process.

***

The announcement we are making today, and the work we are doing here, reflect central tenets of the Consumer Financial Protection Bureau. We are committed to evidence-based decision-making. We aim to develop rules that meet our objectives without creating unintended consequences or undue burdens. We want to see a financial marketplace that offers fairness and opportunity not just to some, but to all. A marketplace that does so without regard to race, ethnicity, gender, or any of the other elements of our fabulous American mosaic. We all know that small businesses are powerful economic engines. They supply jobs that lift people out of poverty or dependence, teach essential skills, and serve as backbones of our communities. So we mean to meet our obligation to develop data that will shed light on their ability to access much-needed financing. It is essential to their future growth and prosperity, and therefore to the growth and prosperity of us all. Because what Cicero observed in ancient Rome still holds true today. He said, “Nothing so cements and holds together all the parts of a society as faith or credit.” Our communities depend on both of those precious things just as much today.

As we launch this inquiry, I want to remind all of you that we value the feedback we get. We take it seriously, consider it carefully, and integrate it into our thinking and our approach as we figure out how best to go forward with this work. So we ask you to share your thoughts and experiences to help us get there. And we thank you again for joining us today.

New Regulations, Section 1071 of Dodd-Frank Among Them, Temporarily Frozen By Executive Order

January 23, 2017

Update 2/1/17: Disagreements abound over whether or not Trump’s recent regulatory freeze can affect the CFPB. According to the WSJ, part of this stems from the CFPB’s uncertain status as an independent agency after the the recent court decision in PHH Corp v. CFPB. “The CFPB is following a hiring freeze ordered separately by the Trump administration,” the WSJ states. This may be a signal that they do not feel totally insulated.

Section 1071 of Dodd-Frank had expanded Reg B of The Equal Credit Opportunity Act and granted the CFPB the authority to collect data from small business lenders. It’s all-encompassing considering that it oddly defined a small business lender as “any entity that engages in any financial activity.”

Although Dodd-Frank was passed in 2010 and the CFPB created in 2011, Section 1071 has been lying in wait. But just a month ago, the Federal Register said that its implementation was under way, with a pre-rule timetable of March 2017. “The Bureau is starting its work to implement section 1071 of the Dodd-Frank Act, which amends the Equal Credit Opportunity Act to require financial institutions to report information concerning credit applications made by women-owned, minority-owned, and small businesses,” it says.

And that work is no doubt a big undertaking, especially if it is really supposed to cover any entity that engages in any financial activity.

“The amendments to ECOA made by the Dodd-Frank Act require that certain data be collected and maintained, including the number of the application and date the application was received; the type and purpose of loan or credit applied for; the amount of credit applied for and approved; the type of action taken with regard to each application and the date of such action; the census tract of the principal place of business; the gross annual revenue of the business; and the race, sex, and ethnicity of the principal owners of the business. The Dodd-Frank Act also provides authority for the CFPB to require any additional data that the CFPB determines would aid in fulfilling the purposes of this section.”

Fear exists in the commercial finance community that the CFPB will use such data in a misinformed way to levy penalties and exert control over business-to-business transactions even though its statutory power is limited to just the collection of information.

Although the CFPB is still in the information gathering stage on Section 1071, the President’s regulatory freeze is likely only the first step of many to delay or dismantle their rules. And that’s at a minimum. Presently, the CFPB is faced with the threat that Trump will fire its director or abolish the agency altogether. There is strong support for this among Republicans, especially given that a federal court recently held that the CFPB’s structure is unconstitutional. In PHH Corp v. CFPB, the court offered two ways for the agency to come into compliance with its order, either reconfigure into a multi-member directorship or yield the director’s power to the President of the United States. Sitting CFPB Director Richard Cordray rebuffed the order as “wrongly decided” and declined both. His term ends in 2018.

The CFPB’s brash refusal to make concessions or accept court orders has made it a prime target of Trump’s administration. Because of the battles with the agency still to come, it is possible that Section 1071 may not begin to see the light of day for at least another four years.

Lenders Subject to Section 1071 of Dodd-Frank May Find Silver Lining in CFPB’s Roll Out of New HMDA Rules

October 23, 2015 Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Given the breadth of the new rules and the additional compliance efforts they will require, the CFPB has set January 1, 2018 as the effective date of the new regulations. Given that the Bureau could have chosen January 1, 2017 as the effective date, the longer lead time is welcome news for many in the mortgage industry.

The longer lead time may also be positive news for small business lenders that will be subject to the new Small Business Data Collection rule required by the Dodd-Frank act. Section 1071 of the act requires the CFPB to issue implementing regulations. The Bureau has yet to begin its work on the new rule but some small business lenders have already voiced concerns about the costs of other regulations implemented pursuant to Dodd-Frank. They argue that these costs have already begun to restrict access to small business credit.

A well-timed roll out of the new data collection rule could reduce some of these costs. Having adequate time to develop and implement regulatory compliance procedures in a cost-effective manner will lessen the financial impact to small business lenders. This in turn will allow lenders to minimize the new rule’s impact on credit availability to small businesses.

Once the Small Business Data Collection rule is finalized, small business lenders should be given a sufficient period to adjust to the new requirements, just as the CPFB has done for mortgage lenders with the new HMDA rules. HMDA was enacted in 1975 and lenders have been subject its reporting rules for decades. Yet the increased reporting requirements of the revised rules more than justify a two year lead period.

A similar lead period is just as, if not more important for the small business lenders that will be subject to the new data collection rule. The Dodd-Frank act was enacted just five years ago and requires reporting about small business lending that has never been required before. Lenders will need adequate time to develop the new systems required to meet their reporting obligations.

The CFPB’s conscientious roll out of the HMDA revisions is a rare regulatory silver lining. Let’s hope small business lenders get one too.

Dodd-Frank 1071: Regulatory Uncertainty in Small Business Financing

May 28, 2025Jeffrey S. Paige is the Chief Legal Officer of CFG Merchant Solutions. Visit: https://cfgmerchantsolutions.com

A Changing Regulatory Landscape for Commercial Finance in New York & Beyond

When President Trump returned to office on January 20, 2025, he signed several executive orders with significant implications, particularly for New York’s commercial finance sector and the revenue-based financing industry. One such order was a regulatory freeze that could impact rules issued by the Consumer Financial Protection Bureau (CFPB), specifically those concerning small business financing data collection under Dodd-Frank Section 1071. The rationale behind this freeze is that the CFPB, an agency not directly controlled by Congress, exceeded its intended regulatory scope.

Trump’s order not only halts the issuance of new rules but also mandates the withdrawal of any rules previously sent to the Office of the Federal Register. More critically, it directs agency heads to “consider postponing” any rules that have been published but have not yet taken effect, creating a 60-day review period for reassessment of their legal and policy implications.

“Should actions be identified that were undertaken before noon on January 20, 2025, that frustrate the purpose underlying this memorandum, I may modify or extend this memorandum to require that department and agency heads consider taking steps to address those actions,” the order concludes. This places Section 1071 in limbo, leaving financial institutions uncertain about compliance obligations moving forward.

However, New York funders may still need to prepare. Under 12 U.S.C. § 5552 of the Dodd-Frank Act, individual states (including their respective financial regulators and attorneys general) have the authority to enforce federal consumer financial law, specifically, the Consumer Financial Protection Act and 18 enumerated consumer laws such as TILA, EFTA, FDCPA, GLBA, and regulations issued by the CFPB. Simply put, New York has the ability to enforce these laws and regulations, including Section 1071, by bringing suit in federal or state courts or other appropriate proceedings against any “covered person or service provider” as defined and not excluded by the Dodd-Frank Act’s terms. It is therefore prudent for non-exempt lenders and funders to take a proactive approach.

What Is Dodd-Frank 1071?

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, sought to address vulnerabilities in the financial system exposed during the 2008 financial crisis. On March 30, 2023, Section 1071 amended the Equal Credit Opportunity Act (ECOA), empowering the CFPB to collect and report key data from financial institutions on small business financing. The compliance deadline varies based on the size of the institution, with the earliest deadline set for July 18, 2025, affecting Tier 1 providers, defined as high-volume financial institutions.

The goal of Section 1071 is to identify and address disparities in small business financing by analyzing key metrics such as:

- Demographics of business owners (race, gender, ethnicity).

- Financing terms, rates, and credit outcomes.

- Geographic data, including trends in underserved regions.

By requiring funders to disclose this information, the regulation seeks to foster accountability and ensure that small businesses—especially those owned by minorities and women—have equitable access to credit and capital.

CFPB & Section 1071 Timeline

2010: Dodd-Frank Act Enacted

- Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act is established.

2011: CFPB Established

- The Consumer Financial Protection Bureau (CFPB) is created as an independent agency overseeing consumer financial protection laws, including small business lending regulations under Section 1071.

2017: CFPB Faces Legal Challenges

- Industry groups challenge the CFPB’s authority and structure, arguing that it lacks proper congressional oversight.

- Under the Trump administration, regulatory focus shifts toward deregulation, and CFPB rulemaking efforts on Section 1071 slowed down.

2020: U.S. Supreme Court Decision – Seila Law v. CFPB

- The Supreme Court rules that the president can remove the CFPB director at will, weakening its independence but allowing it to continue functioning.

2021: Biden Administration Revives Section 1071 Rulemaking

- The CFPB under Director Rohit Chopra prioritizes implementing Section 1071, aiming to enhance transparency in small business lending.

2022-2023: CFPB Proposes & Finalizes Section 1071 Rule

- The proposed rule is released in 2022, requiring lenders to collect and report loan application data, including business owner demographics.

- In March 2023, the final rule is issued, with compliance deadlines set for 2024 and 2025 based on lender size.

2023-2024: Legal Pushback & Court Challenges

- Industry groups file lawsuits, arguing that Section 1071 creates excessive regulatory burdens and violates constitutional limits on CFPB authority

- In October 2023, a Texas court stays the rule for certain plaintiffs, pausing enforcement for some lenders.

- In 2024, additional lawsuits escalate concerns over the rule’s implementation.

January 20, 2025: Trump Returns to Office & Freezes Regulations

- On his first day back in office, President Trump issues an executive order freezing pending regulations, including Section 1071.

- The order:

- Blocks new CFPB rulemaking,

- Withdraws rules not yet finalized,

- Delays implementation of already published rules for a 60-day review period.

- President Trump’s justification: The CFPB is an unelected agency that overstepped its authority, and its rules should be reassessed.

2025: Uncertainty & State-Level Action

- The CFPB’s authority remains in question, leaving financial institutions uncertain about compliance requirements.

- New York may independently implement similar reporting requirements, as it has done with previous commercial financing regulations.

- Many New York funders continue preparing for potential state-level enforcement despite the federal freeze.

How Alternative Financing Providers Can Adapt

Funders in the alternative financing space should remain agile and prepare for multiple scenarios. Even if Section 1071 is rolled back, transparency and fair funding practices remain critical for fostering trust and maintaining credibility in the market.

Steps funders can take include:

- Investing in technology to automate compliance processes, ensuring readiness for future regulations.

- Engaging with industry stakeholders to advocate for practical regulatory approaches that balance fairness and business efficiency.

- Maintaining transparency in financing practices to build stronger relationships with merchants and partners.

Looking Ahead

As the financial industry navigates the potential rollback of Dodd-Frank 1071 (Republican Congressman Roger Williams of Texas has introduced H.R. 976 seeking to do just that), alternative financing companies should focus on long-term strategies that prioritize both compliance and innovation. This is especially true in New York, where the legislature is currently considering a bill called the Fair Business Practices Act, modeled after Title X of Dodd-Frank, that would among other things expand the New York Attorney General’s enforcement powers and enhance penalties in this industry sector for UDAP violations. This further signals that New York as well as other states is seeking to fill any void left by the weakening of the CFPB. Whether the regulation remains in effect or is dismantled, financial institutions should stay proactive in adapting to changes while ensuring fair access to capital for small businesses.

Will the CFPB’s Small Business Data Collection Rules Change?

April 4, 2025On April 3, the CFPB filed papers agreeing with the Revenue Based Finance Coalition’s (RBFC) request to stay the litigation between them over coverage of the Small Business Lending Rule. As it last stood, a federal court was leaning toward the CFPB’s side that the 888 pages of data collection rules should apply to MCAs despite them not being loans.

As to why the CFPB would agree to a stay, the agency explained that it may now be tweaking the rules at issue.

“New leadership has been assessing the Final Rule and the issues that this case presents to determine the CFPB’s position. CFPB’s new leadership has directed staff to initiate a new Section 1071 rulemaking. The CFPB anticipates issuing a Notice of Proposed Rulemaking as expeditiously as reasonably possible. Because the anticipated rulemaking process may moot or otherwise resolve this litigation, holding this matter in abeyance would conserve the Court’s resources.”

– CFPB in its response to the Motion to Stay

“The CFPB respectfully proposes submitting periodic status reports every 90 days during the pendency of the rulemaking and will promptly inform the Court when the rulemaking process is complete,” the Agency stated. “Within 30 days of the issuance of a final rule, the CFPB proposes that the parties confer and notify the Court of whether and how they wish to proceed.”

The small business data collection rules are scheduled to go into effect in July.

CFPB HQ Temporarily Closed, Operations Frozen

February 10, 2025The CFPB’s headquarters in Washington DC will be closed this week as the agency undergoes an audit from the Department of Government Efficiency. The audit coincides with the arrival of yet another new Acting Director, Russell Vought, who is also serving officially as the Director of OMB. At the CFPB this weekend, Vought told employees not to “approve or issue any proposed or final rules or formal or informal guidance” and to “suspend the effective dates of all final rules that have been issued or published but that have not yet become effective.” He also told the Federal Reserve that the agency does not need funding at this time due to having too much on hand already.

Pursuant to the Consumer Financial Protection Act, I have notified the Federal Reserve that CFPB will not be taking its next draw of unappropriated funding because it is not "reasonably necessary" to carry out its duties. The Bureau's current balance of $711.6 million is in fact…

— Russ Vought (@russvought) February 9, 2025

While he has ordered all final rules that have been issued or published but not yet effective be suspended, some legal observers have indicated that the small business data collection process overseen by the CFPB (pursuant to Section 1071 of Dodd-Frank) that is scheduled to start on July 18 is technically bound by rules already in effect and that the deadline is merely the start date for compliance. However, that interpretation may be at odds with the spirit and intent of the suspension.

The Independent Community Bankers Association (ICBA) welcomed Vought into the role. “We look forward to working closely with Director Vought, the Trump administration, and the 119th Congress to implement needed CFPB regulatory reforms to help community banks meet the needs of local communities,” they said. The statement included a link in which they call for the small business lending data collection rules to be repealed.

“Intrusive data collection will compromise the privacy of small business applicants, effectively ‘commoditize’ small business lending, and increase the cost of credit,” they say. “ICBA urges the 119th Congress to promptly repeal or substantially revise Section 1071 to limit the implementation of a destructive rule.”