Alan Heide, CFO Of 1 Global Capital, Hit With Criminal Charge & SEC Violations

August 15, 2019

Update: Alan Heide has pleaded guilty to one count of conspiracy to commit securities fraud.

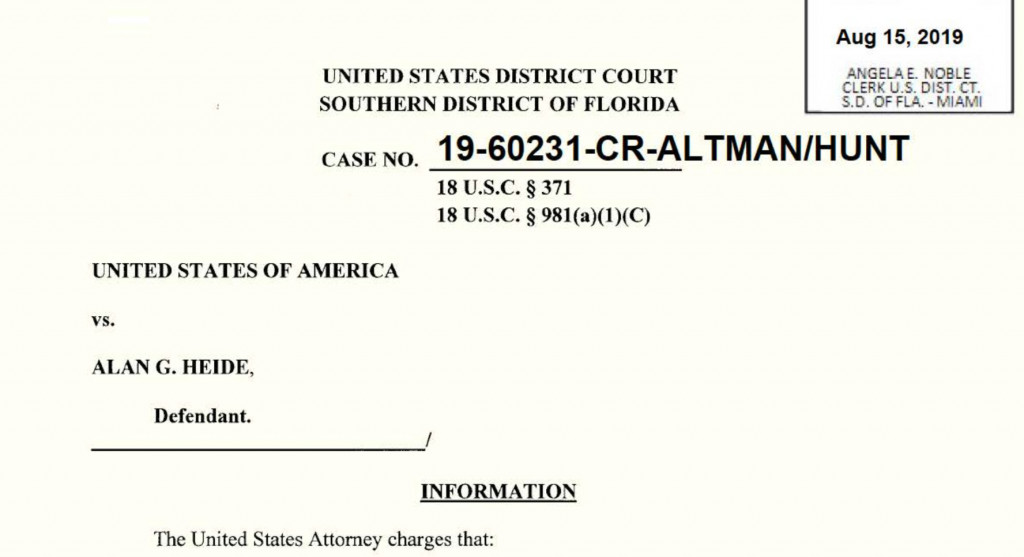

The former CFO of 1 Global Capital, Alan Heide, was stacked with bad news on Thursday. The US Attorney’s Office for the Southern District of Florida lodged criminal charges against him at the same time the Securities & Exchange Commission announced a civil suit for defrauding retail investors.

Heide was criminally charged with conspiracy to commit securities fraud.

According to the criminal complaint:

It was a purpose of the conspiracy for the defendant and his conspirators to use false and fraudulent statements to investors concerning the operation and profitability of 1 Global, so that investors would provide funds to 1 Global, and continue to make false statements to investors thereafter so that investors would not seek to withdraw funds from 1 Global, all so that the conspirators could misappropriate investors’ funds for their personal use and enjoyment.

He is facing a maximum of 5 years in prison.

1 Global Capital CEO Carl Ruderman, who recently consented to judgment with the SEC, has not been charged criminally to-date. However, he is mentioned throughout the pleading against Heide as “Individual #1 who acted as the CEO of 1 Global.”

Civil charges were simultaneously lodged by the SEC.

According to the SEC’s complaint:

Although 1 Global promised investors profits from its short-term merchant cash advances to businesses, the company used substantial investor funds for other purposes, including paying operating expenses and funding Ruderman’s lavish lifestyle. The SEC alleges that Heide, a certified public accountant, for nine months regularly signed investors’ monthly account statements that he knew overstated the value of their accounts and falsely represented that 1 Global had an independent auditor that had endorsed the company’s method of calculating investor returns.

According to an SEC statement, Heide agreed to settle the SEC’s charges as to liability, without admitting or denying the allegations, and agreed to be subject to an injunction, with the court to determine the penalty amount at a later date.

1 Global Capital filed for bankruptcy last year after investigations by the SEC and US Attorney’s Office hampered their ability to raise capital. Ruderman’s recent settlement with the SEC put him on the hook for $50 million to repay investors.

1 Global Capital’s Carl Ruderman Consents To Judgment With The SEC

August 10, 2019Update 10/4/19: According to the docket, Ruderman has satisfied the judgment in full, with only the sale of his condo remaining.

The SEC’s lawsuit against Carl Ruderman, the former CEO of Hallandale Beach-based 1 Global Capital, has come to an end. He has consented to judgment in a settlement and the penalties are devastating, papers filed on friday with the Court show.

The SEC’s lawsuit against Carl Ruderman, the former CEO of Hallandale Beach-based 1 Global Capital, has come to an end. He has consented to judgment in a settlement and the penalties are devastating, papers filed on friday with the Court show.

Specifically, Ruderman is liable for disgorgement of $32,587,166 representing profits gained as a result of the conduct alleged together with prejudgment interest on disgorgement of $1,517,273 and a civil penalty of $15,000,000. He must also sell his Condominium and disgorge 50% of the equity. Online real estate websites estimate his property to have 5 bedrooms, 8 bathrooms, and be worth in the range of $5,000,000 – $6,000,000.

1 Global Capital filed for bankruptcy last year after its business was hampered by investigations being conducted by the SEC and US Attorney’s Office. The SEC brought its case against Ruderman and his company a month later and alleged that it “fraudulently raised more than $287 million from more than 3,400 investors to fund its business offering short-term financing to small and medium-size businesses.” The investments were alleged to be unregistered securities and that millions of the funds raised from investors were misappropriated by Ruderman. The settlement stipulates that he does not admit or deny the allegations.

No criminal charges have been brought to date.

The SEC settlement was technically entered into in June but had to be reviewed and approved by the five SEC commissioners.

The unopposed motion for judgment was filed last week. It was signed by the judge on Monday, August 12th.

Star Fundraiser For 1 Global Capital Settles With The SEC

July 15, 2019 Henry J. “Trae” Wieniewitz, III was charged by the SEC on Monday for his role in allegedly selling unregistered securities in two companies, 1 Global Capital (the now defunct merchant cash advance provider) and Woodbridge Group of Companies (a purported real estate lending business revealed to be a $1.2 billion ponzi scheme).

Henry J. “Trae” Wieniewitz, III was charged by the SEC on Monday for his role in allegedly selling unregistered securities in two companies, 1 Global Capital (the now defunct merchant cash advance provider) and Woodbridge Group of Companies (a purported real estate lending business revealed to be a $1.2 billion ponzi scheme).

“Wieniewitz and Wieniewitz Financial raised more than $11.4 million and reaped approximately $500,000 in commissions from unlawful sales of Woodbridge securities, and raised more than $53 million and obtained approximately $3 million in commissions from unlawful sales of 1 Global securities,” the SEC stated.

Wieniewitz was not a registered broker-dealer nor associated with a registered broker-dealer.

A settlement was announced simultaneously. “Wieniewitz and Wieniewitz Financial settled the SEC’s charges as to liability without admitting or denying the allegations, and agreed to be subject to injunctions, with the court to determine the amounts of disgorgement, interest, and penalties at a later date,” an SEC statement said.

Wieniewitz was not alone in selling investments in both 1 Global and Woodbridge.

Separately, the owner of Woodbridge and two former directors of the company were recently charged criminally.

No criminal charges have been brought to date in the 1 Global Capital saga. That could change. 1 Global Capital revealed in 2018 that it was being investigated by the US Attorney’s office. That along with the SEC investigation prompted the company to file for bankruptcy. The SEC subsequently brought civil charges.

Documents filed in the SEC case against 1 Global’s former owner, Carl Ruderman, have since revealed that at least one former employee had been approached by the FBI about the operations of 1 Global.

Last month, it appeared Ruderman and the SEC were heading towards a settlement.

One notable fact about 1 Global Capital is that the company participated in the largest merchant cash advance in history at $40 million. That transaction has become a point of significant controversy and litigation. The recipient of those funds, a conglomerate of car dealerships in California, have shut their doors.

SEC Seeks Partial Summary Judgment Against Ruderman in 1 Global Capital Case

June 10, 2019The SEC filed a motion for summary judgment against defendant Carl Ruderman last week as part of its ongoing lawsuit against 1 Global Capital and related parties. The motion applies to Ruderman on Count 1 of the SEC’s amended complaint alleging violations of 5(a) and (c) of the Securities Act of 1933 in addition to summary judgment on Ruderman’s second affirmative defense alleging the instruments he and Defendant 1 Global Capital LLC sold were not securities.

Ruderman has until June 18th to file his opposition to the motion.

1 Global Capital Issued Securities, Court Rules

February 17, 2019 1 Global Capital founder Carl Ruderman suffered a major setback in his case with the SEC earlier this month, when the Court ruled that his company’s Syndication Partner Agreements and Memorandums of Indebtedness were in fact, securities. Ruderman had filed a motion to dismiss the SEC’s claims against him personally but the Court struck it down.

1 Global Capital founder Carl Ruderman suffered a major setback in his case with the SEC earlier this month, when the Court ruled that his company’s Syndication Partner Agreements and Memorandums of Indebtedness were in fact, securities. Ruderman had filed a motion to dismiss the SEC’s claims against him personally but the Court struck it down.

1 Global sold its notes to more than 3,400 investors in at least 25 states, who collectively invested at least $287 million. The company declared bankruptcy last year amid parallel criminal and civil investigations that hampered its ability to raise capital. The SEC filed suit soon after but no criminal charges have been brought to date.

In the ensuing legal discovery, it was revealed that the company funded the largest merchant cash advance in history, a collective $40 million funded over several transactions to an auto dealership group in California. Those dealerships closed not longer after 1 Global Capital’s bankruptcy. Those closures have sparked a lawsuit of its own and with it the revelation that several of 1 Global Capital’s competitors had also funneled millions into the dealerships.

The Court’s ruling in the motion to dismiss whereby the investments were deemed securities can be downloaded here.

1 Global Capital Charged With Fraud by SEC

August 29, 2018

The Securities & Exchange Commission unsealed a 10-count complaint against 1 Global Capital LLC (“1st Global Capital”), its owner Carl Ruderman, and related parties on Wednesday.

The South Florida firm “fraudulently raised more than $287 million from more than 3,400 investors to fund its business offering short-term financing to small and medium-size businesses,” the complaint begins.

Investors were offered low-risk, high-return investments that 1st Global would use to fund merchant cash advance deals. Ruderman, who owned the company through a trust, misappropriated $35 million of the funds, paying a lot of it to himself and companies he controlled that had nothing to do with MCA, the SEC alleges. Beyond that, millions more went towards other pet projects like a $50 million purchase of distressed credit card debt.

But the deception went deep, the complaint lays out. 1st Global touted a default rate of only 4% despite the fact that 15-18% of their deals over the last 2 years had resulted in collections lawsuits.

By October 2017, the statements investors received showing their monthly performance were faked with the value and performance significantly inflated. By June 2018, one line item on monthly statements (labeled “cash not deployed”) reported that investors collectively had $70 million in idle cash ready to be put into deals. Meanwhile, the company itself only had about $20 million in all of its bank accounts combined, money that was being used for everything including operating expenses, salaries, and commissions.

1st Global’s alleged auditor, Daszkal Bolton, LLP, says they never audited 1st Global’s statements and haven’t had anything to do with the company since 2016. Nonetheless, 1st Global placed Daszkal Bolton’s name on statements given to investors and stated on their website that investor balances were validated by an accounting firm quarterly.

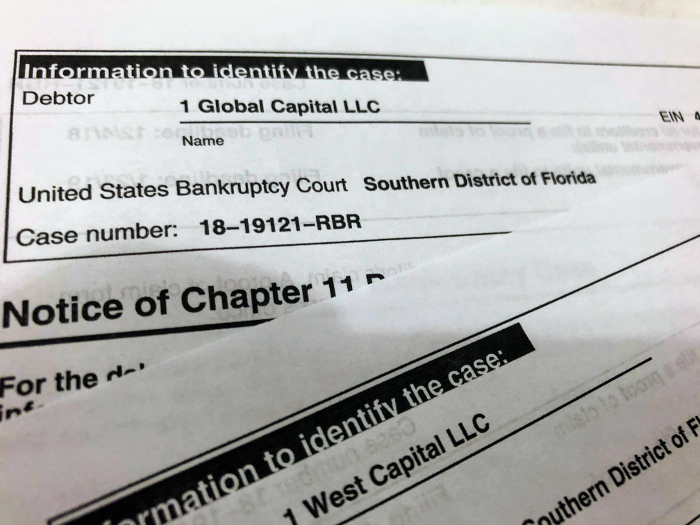

1 Global Capital Files Chapter 11

July 30, 2018

UPDATE: A joint motion filed this morning explained that the companies were forced to file bankruptcy “in order to address a sudden and acute liquidity crisis and to preserve their assets and business operations for the benefit of the individual lenders and all other constituencies. As a result of the investigations commenced by the US Attorney’s Office and Securities and Exchange Commission, with which the Debtors have been and will continue cooperating, the Debtors have ceased their pre-petition effort to raise capital.”

1 Global Capital LLC filed for Chapter 11 on Friday, according to a voluntary petition filed in the Southern District of Florida. The company’s estimated assets and liabilities exceed $100 million while the number of estimated creditors was listed as between 1,000 and 5,000.

A related company, 1 West Capital LLC, also filed for Chapter 11.

Greenberg Traurig, LLP has been retained to assist on the companies’ behalves.

In a joint motion filed this morning, both entities described themselves as “providing direct merchant cash advances to small businesses across the United States.”

For Sale: 60,000+ Leads From 1st Global Capital

December 21, 2018 Since 1st Global Capital went out of business, the company’s treasure trove of leads has been up for sale. Beginning in October, 41 companies were propositioned by 1st Global Capital’s bankruptcy advisors to make a bid on the company’s data. Ten companies actually entered into non-disclosure agreements to access a data room. That led to four official proposals which was narrowed down to two formal negotiations and ultimately the selection of one final stalking horse bidder.

Since 1st Global Capital went out of business, the company’s treasure trove of leads has been up for sale. Beginning in October, 41 companies were propositioned by 1st Global Capital’s bankruptcy advisors to make a bid on the company’s data. Ten companies actually entered into non-disclosure agreements to access a data room. That led to four official proposals which was narrowed down to two formal negotiations and ultimately the selection of one final stalking horse bidder.

In Advance Capital’s high bid came in at $105,000 for data that includes 57,000 non-funded applications and 4,760 funded applications. That dollar figure is actually an upfront fee against future commissions because the arrangement requires the buyer to pay 1st Global Capital a commission for every merchant on the list that they end up funding in-house or elsewhere. The total purchase price therefore is likely to exceed $105,000 over time. The buyer is not permitted to stack any merchant on the list.

As the stalking horse, In Advance’s bid will be honored unless new companies outbid them between now and January 7. If two or more qualified bids are received, a formal auction will take place on January 8. A hearing on the outcome will take place on January 9.