The Top Small Business Lending Platform Finalists Named By LendIt

January 20, 2017The LendIt Industry Awards has named six finalists for the Top Small Business Lending Platform. They are:

- OnDeck

- Kabbage

- SmartBiz

- StreetShares

- Ascentium Capital

- iwoca

OnDeck you should know by now. They are publicly traded on the NYSE under ticker ONDK. We last sat down with them in October, shortly before they announced a $200 million credit facility with Credit Suisse.

Kabbage was one of the first online small business lenders to truly experiment with complete automation. In the last year the company has partnered with banking giants Santander and Bank of Nova Scotia.

SmartBiz ranked as the number one provider of non-Express, SBA 7(a) loans under $350,000 for fiscal year 2016. An online platform, they generated $200 million in funded SBA 7(a) loans through its bank lending partners during that period.

StreetShares has a strong focus on funding veteran small businesses. The company is also one of a very few to get approved for Reg A+ under the JOBS Act, which allows them to accept investments from unaccredited retail investors (with some limitations).

Ascentium Capital actually funded nearly $900 million to small businesses in 2016 and was acquired by PE firm Warburg Pincus just a few months ago.

iwoca is based in the UK but also operates in Germany, Spain, and Poland. They offer lines of credit to small businesses up to £100,000 with repayment terms of up to 12 months. Interest rates range from 2% to 6% per month. iwoca has raised £46 million through debt and equity.

According to LendIt, finalists for this category were awarded to the top small business lending platform based on a combination of loan performance, volume, growth, product diversity and responsiveness to stakeholders.

A similar category, the greatest Emerging Small Business Lending Platform also had six finalists. They include:

- ApplePie Capital

- Capital Float

- Credibility Capital

- Lendio

- Lendix

- Wunder Capital

More than 30 industry experts will judge and select award winners. You can view all categories, finalists and judges here.

You can also get 15% off the LendIt Conference registration with promo code: AltFinanceDaily17USA.

Brief: LendIt Brings First Fintech Awards to the Industry

November 28, 2016

Marketplace lending conference LendIt, has announced the first fintech industry awards and is inviting nominations to recognize top-performing companies and executives.

Nominations are now being accepted (closes December 21st) for 18 different categories including executive of the year, fintech woman of the year, emerging consumer lending platform and most innovative bank. The award ceremony will be held during LendIt’s 2017 conference in March.

“The lending industry is entering its 2.0 phase, after maturing in 2016,” said Peter Renton, co-founder and chairman of LendIt in a statement. “As we seek to connect the global online lending community and foster innovation and industry growth, we must recognize those that are making the biggest contributions and innovations and moving our industry forward.”

The entries will be judged by a panel of 30+ industry experts including Gilles Gade, CEO of Cross River Bank, Glenn Goldman of Credibly, and Angela Ceresnie, COO of ClimbCredit.

LendIt’s Peter Renton is Still Earning 8.72%

August 25, 2016

LendIt, speaking to LendIt USA 2016 conference in San Francisco, California, USA on April 11, 2016. (photo by Gabe Palacio)

LendIt Conference founder Peter Renton made more from his marketplace lending investments in the last twelve months than some people earn in a year just from their nine-to-five job. $54,936 to be exact, according to his latest blog post detailing his performance. That’s a result of investments on the Lending Club platform, Prosper, P2Binvestor (which requires you to be an accredited investor), the LendAcademy P2P Fund (which includes Funding Circle, Upstart, Lending Club and Prosper), and the Direct Lending Income Fund managed by Brendan Ross (which invests with lenders such as Quarterspot and IOU Financial).

Unsurprisingly, his business loan performance through the Direct Lending Income Fund has earned the highest yield, a TTM return of 12.77%.

While reporters and critics seem to be planning the funeral for several lending platforms, Renton remains steadfast in his optimism. “Eventually, I plan to have a diversified seven-figure portfolio made up of consumer, small business and real estate loans,” he wrote on his Lend Academy website.

Though Renton is reaping the benefits of being a platform investor, it’s the platforms themselves that may be in trouble, according to a recent op-ed by Todd Baker, a senior fellow at the Mossavar-Rahmani Center for Business and Government at Harvard University’s John F. Kennedy School of Government. On American Banker, Baker wrote, “Almost all [Marketplace Lending] revenue is generated from ‘gain on sale’ fees earned from new loan sales. This dependence on origination volume and gain-on-sale margins makes MPL results exquisitely sensitive to macro and micro trends in investor demand and risk appetite.”

And if a platform isn’t sustainable, the theory is that future investment opportunities may not be as available as they have been historically.

“MPLs need to shift to a more sustainable mode — either as banks or as nonbank balance-sheet lenders — before the end of the current credit cycle brings on a real shakeout and the MPL experiment becomes a financial failure,” Baker wrote.

Renton himself acknowledged a downward trend in his yield, conceding that it may never return to previous levels. “While I would love to be earning more than 10% again I don’t expect to get back there any time soon,” Renton wrote.

He also recently rebutted a Bloomberg article that argued Lending Club was being shady with repeat borrowers.

LendIt Recap: News Headlines You Need to Know

April 13, 2016

Al Goldstein of Avant speaking at the LendIt USA 2016 conference in San Francisco, CA, USA on April 11, 2016. (photo by Gabe Palacio)

As the industry wrapped up one of the biggest conferences of the year, here are some notable company announcements worth filing away:

Chicago-based online lender Avant named former UBS executive Raj Vora to lead the company’s capital raising efforts. Vora will lead strategy for its investment vehicles.

New York-based Student loan refinancer Lendkey crossed $1 billion in origination and deployment

Small business lender National Funding appointed first female president Torrie Inouye. Inouye headed data and analytics for the firm where she drove customer acquisition and underwriting.

Another millennial lender on the block raised Series A funding. New York-based online lender Pave Inc raised $8 million from Maxfield Capital that included existing investors C4 Ventures and Seer Capital. The four year old company lends unsecured personal loans to millennials.

Small business lender Streetshares won SEC approval to launch business bonds to the masses. The product will pay a fixed 5 percent interest (regardless of the performance of a particular underlying loan), is ensured by a provision fund, and provides liquidity as investors can access their funds at a 1 percent fee.

Prosper decided to end its loan sale agreement with Citi and might be in talks with Goldman Sachs. This move comes after a lukewarm reception on a batch of Prosper bonds after investors demanded as much as 5 percent points higher compared to last year.

Is Alternative Lending An Illusion? (LendIt 2015 Summary)

April 18, 2015More than 2,400 people packed into the LendIt conference last week in New York City and everywhere you turned, startups were boasting of their ability to lend billions of dollars to underserved consumers and businesses. Companies not even old enough to have attended last year’s LendIt conference had reportedly lent tens of millions or hundreds of millions of dollars already. Is it all an illusion?

Investors circled like hawks to try and grab an opportunity into this exploding market. Alternative lenders were practically being tackled by VCs, Private Equity firms, and specialty finance lenders:

Technological innovation is disrupting the status quo, attendees echoed. Surely banks can afford to develop new technology to compete, so why haven’t they? Lendio’s Brock Blake wasn’t afraid to challenge the Short Term Business Lending Panel on this. “Is there real innovation happening or is there regulatory arbitrage?” he asked.

The panelists mostly agreed that it was a combination of both. Stephen Sheinbaum, founder of Merchant Cash and Capital (MCC) and BizFi, said “regulation is not something that scares us in any way.” That’s not surprising considering MCC has survived more than ten years in business and fellow panelist CAN Capital has survived more than seventeen.

But for the newer players entirely reliant on third party brokers or dependent on a Reg D exemption to issue securities, their success may indeed be regulatory arbitrage. And time is on their side.

Karen Mills, the former head of the Small Business Administration asked several regulatory bodies who would stand up to oversee small business lending. “No one stood up,” she said.

It’s the brokers that worry some folks most, an issue that PayPal and Square Capital do not have to contend with at all. OnDeck CEO Noah Breslow stated, “there is always going to be a set of customers that want to shop and want to have help.”

Kabbage’s Kathryn Petralia explained that only 2% of their business comes from brokers and their fees are capped at 4%. CAN Capital’s Jason Rockman argued that it’s about working with brokers that share their values. MCC’s Sheinbaum said, “you have to be willing to not do business with some of the unscrupulous players out there.”

But while these industry captains minimized the role that brokers play, 2015 is already being dubbed the Year of the Broker.

The regulatory environment isn’t the only issue to be worried about, skeptics argued. There was cautious alarm about the market’s viability when interest rates rise or the economy takes a turn for the worse.

“I think there’s going to be a shakeout,” said Steve Allocca of PayPal. MCC’s Sheinbaum explained that when he sees other funders doing deals that don’t appear to make sense, to not feel pressured to do them as well. “Stick to your disciplines. Stick to your guns,” he preached.

Fundation CEO Sam Graziano argued that small business lending is already very risky. The lifetime default rate on 7(a) SBA Loans is 20%, he said. Graziano, who hates the term alternative lending prefers to refer to the industry as digitally enabled lending.

And digitally enabling is something that OnDeck has focused on. In Breslow’s presentation, he said that applying offline for a loan takes 33 hours of work on average. Banks are shuttering branches at a record rate, he added.

Banks are dead, said many in attendance. Kathryn Petralia of Kabbage disagreed. “The death of banks has been greatly exaggerated,” she argued on a panel.

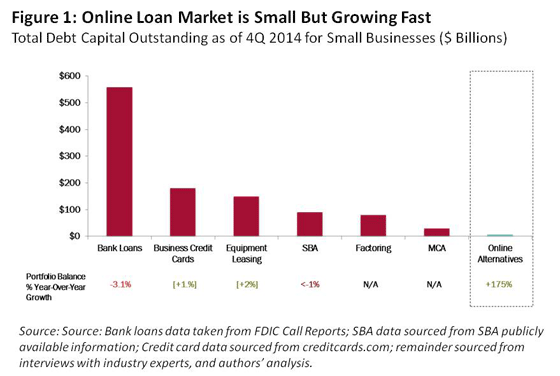

Indeed, Mills’ report shows that total outstanding debt on business loans by banks dwarfs the alternatives by more than 50 to 1.

But former U.S. Treasury Secretary Larry Summers is convinced the tide is turning.”The conventional financial sector has, in important respects, let all of its main constituents down over the last generation, and technology-based businesses have the opportunity to transform finance over the next generation,” he said during the keynote speech.

With conference sessions looking and feeling like a cramped NYC subway during rush hour, the popularity of alternative lending is no illusion.

But healthy skepticism is at least creeping in while the industry marches forward. Changes in regulations, interest rates, and economic activity will separate those simply riding a wave from those that have created something real. Expect companies that exhibited at this year’s conference to be gone by 2016 or 2017, said several panelists.

The final count of LendIt attendees was 2,493 people. 150 people who tried to register at the last minute were turned away. More are expected to attend next year.

Objectively, alternative lending appears to be very real.

Fintech Nexus Files for Chapter 7

June 23, 2024 As mentioned on the Fintech Nexus blog last week, the former conference company turned fintech digital media operator is shutting down. On Friday, Lendit Conference LLC DBA Lendit DBA Lendit Fintech DBA Fintech Nexus, filed for Chapter 7 bankruptcy.

As mentioned on the Fintech Nexus blog last week, the former conference company turned fintech digital media operator is shutting down. On Friday, Lendit Conference LLC DBA Lendit DBA Lendit Fintech DBA Fintech Nexus, filed for Chapter 7 bankruptcy.

Fintech Nexus ran conferences from 2013 – 2023, originally under the name LendIt. It exited the conference business last year as part of a deal with Fintech Meetup. It then focused primarily on online news.

“The website will also remain online for at least the next few months, subject to the judgment of the Chapter 7 Bankruptcy Trustee,” the company said.

How Much Fintech News Are You Consuming On The Internet?

December 22, 2020LendIt Fintech distributed a marketing flyer via email yesterday to its subscribers and it got us thinking about how much online fintech news people are consuming, especially in this era of 2020.

LendIt reported 65,000+ monthly page views for its LendIt Fintech News and that it had 800,000+ podcast downloads.

Meanwhile, AltFinanceDaily and DailyFunder combined are recording 311,000+ in average monthly page views. Visitors are also spending 7,300 hours on our sites combined each month on average.

These figures are enormous. Thanks for reading!

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.