NerdWallet: Still Pressure in SMB Loan Originations

March 2, 2025NerdWallet’s CEO Tim Chen explained during the company’s Q4 earnings call that headwinds across both consumer and SMB lending have not let up.

“We continue to see pressure in SMB loan originations with rates remaining elevated and underwriting remaining tight, while also seeing increased pressure in our renewals portfolio as the 10-year rates reversed course and began to climb,” he said.

NerdWallet originates borrowers through the internet, a significant portion of which comes from organic search traffic. That organic traffic dipped about a year ago after changes to Google’s algorithm but has been recovering over the last two quarters for SMB loans. During the earning’s call, one analyst, Ralph Schackart of William Blair & Company LLC, had a question about the continued reliance on that channel given the rise of competing AI chat assistants.

“I guess as you are sitting here today and sort of operating this business, obviously for a while here, how different do you think these changes are to the business with AI overviews?” Schackart asked. “And some digital buyers are saying that the ads that are generated from Gen-AI are actually performing better than some of the organic results. Just kind of curious, what’s your confidence that this is something you’ll be able to navigate longer term versus your previous history? ”

This was Chen’s response:

“I’ll split it up between kind of the shorter-term stuff we’re seeing and longer-term thoughts. I mean in the near term, there’s two drivers here. Which is, one is more ads and modules on top of the search results. And the other factor is rank. Where in the very recent past, financial institutions and some government websites are winning in some areas where they traditionally haven’t, which as I’ve alluded to in past calls, is a bit of a head scratcher when considering consumer intent.

We do think this period of frenetic testing will eventually stabilize, and when that happens, it should play to our favor. Longer term, I do think that it’s important to look at broader industry trends. First, AI search engines or chatbots, are they taking share from traditional search engines?

I mean from what we can tell, not really. If you look top-down, more people are using search engines than they did last year, but you also see triple-digit growth in AI usage. Which says to me that people are basically just asking more questions that they weren’t asking before. And second, the things like AI overviews, how is that affecting the ecosystem?

So I know we’re not focusing on MUUs operationally, but it’s helpful to understand that if simple questions have simple answers, and if a search engine can serve that up in a faster way that consumers prefer, then that’s good for the ecosystem.

And for us, we’re seeing these features do a really good job of answering simple educational questions, and that’s affecting traffic to some of our noncommercial pages. That has not been the case yet for our monetizing pages, which are fundamentally just a little more complicated.

Like if you need to shop for a mortgage for instance, you really need to go through a marketplace experience. So yes, on balance, we think that this period of frenetic testing will stabilize. We’ve seen a few things like this in the past, and we can grow from there.”

A Glimpse at Simply Funding

January 14, 2025 In around 2018 Jacob Kleinberger began calling merchants for a well known small business finance brokerage—a job he not only enjoyed but one that sparked his curiosity. “I always wanted to understand what my funders were doing,” Kleinberger says. He frequently asked questions to learn how decisions were being made across the board.

In around 2018 Jacob Kleinberger began calling merchants for a well known small business finance brokerage—a job he not only enjoyed but one that sparked his curiosity. “I always wanted to understand what my funders were doing,” Kleinberger says. He frequently asked questions to learn how decisions were being made across the board.

Though he worked closely with funders, being on the sales side didn’t give him the full picture. That changed in 2021 when an opportunity arose to join Simply Funding, a direct funder, as a partner. Today, he serves as Head of Operations.Transitioning from broker to funder was an eye-opener, leading Kleinberger to half-jokingly call the funders he used to work with to apologize for the challenges he had unwittingly created. Despite the learning curve, Kleinberger hit the ground running. Simply Funding, founded in 2017 by Bernard Mittelman, was a relatively small operation when he joined, but his mission was to help it grow. “We more than doubled the following year in funding and more than doubled the year after that,” Kleinberger says, reflecting the impact he’s been able to have with the team, which he’s said has been crucial to the success.

“We’re all a team, all here to show off each other’s strong points,” he says. For instance, the company already had a really good core foundation and underwriter in place when he got there.

The company describes itself as an A/B paper shop, with the majority of its revenue-based financing deals involving weekly payments, though they do daily payments as well. They also offer merchant processing splits.

Now a 28-person company, Simply Funding was originally located in Manhattan’s financial district but has since relocated to Jersey City. Kleinberger recalls the transition vividly, flying straight from the AltFinanceDaily CONNECT Miami conference in 2023 to the new office to assemble all the furniture—an ordeal that lasted nearly 24 hours straight. One benefit of the move, he says, is access to a large talent pool in the area. But of course, it had to be accessible for the current team.

“A very big part [of the decision] was I had really good staff, and how would my staff come to work?” he says, since they make the whole operation hum. As a New York native from north of the city, Kleinberger is a commuter himself. The office now is just across the street from the PATH train station on the Hudson River. One can see the Simply team in person in the corporate high-rise there if they drop by.

“A very big part [of the decision] was I had really good staff, and how would my staff come to work?” he says, since they make the whole operation hum. As a New York native from north of the city, Kleinberger is a commuter himself. The office now is just across the street from the PATH train station on the Hudson River. One can see the Simply team in person in the corporate high-rise there if they drop by.

When asked about the importance of security at Simply, Kleinberger is unequivocal: “It’s the most important.” The company takes no chances with data access, even to the extent that Kleinberger himself refuses to store work-related information on a laptop. He also emphasizes the need for clear, unambiguous rules in business operations to ensure everyone understands expectations and outcomes.

The company has no inside sales force, so Kleinberger gets a thrill when an ISO seeks his help with merchant communication—it reminds him of his early days. However, he remains acutely aware that, since it’s the company’s funds on the line, transparency and directness with customers are non-negotiable. From his perspective, some brokers in the industry walk a fine ethical line, and he and the Simply crew are determined to ensure things are done the right way.

“I do feel like there needs to be something to help make brokers accountable,” he says. Despite the challenges, Kleinberger remains optimistic about the future and is excited about what lies ahead as Simply Funding continues to grow.

“I think 2025 is going to be a sick year,” he says.

Intuit: Consumers Expected to Spend 34% Less This Holiday Season

October 21, 2024It’s not all good news with the economy. According to Intuit, a QuickBooks-commissioned survey predicts a 34% drop in consumer holiday spending, an $85 billion decrease from last year.

Of those who plan to spend less this year, more than 6 in 10 say grocery and gas prices are to blame, the survey revealed. Another 4 in 10 say their wages haven’t kept up with inflation over the past year.

Ironically, small business owners are anticipating the opposite trend. Eighty-two percent of business owners surveyed, for example, said that they expect to earn the same or more revenue in total holiday sales than they did last year. Perhaps they need the optimism. Twenty-three percent of business owners surveyed said that if the holidays are not a success, it will make it a really difficult year. Five percent said they might have to close.

And of the revenue they do earn, the majority said it will just go toward paying down business debt.

Meanwhile, 59% of consumers that plan to shop online plan to do so through a business's website directly.

The full report can be viewed here.

WTF, From Credit Card Processing to Funding Deals

August 6, 2024“My first name is William, my son’s name is Torre and he’s my partner, and our last name is Failla, so WTF was the name of the acronym that we came up with.”

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

“I approached my son who was a business major and a finance major out of Hofstra and I said to him, ‘you’re graduating any day now so why don’t we do some diligence, look into this business and see what you think.'”

His son, Torre, who is now the company’s CFO, signaled his approval so long as they paced themselves and mastered the most fundamental component of it first, the credit card processing side of the business. Thus 2021 kickstarted WTF Merchant Services as a shop on Long Island that focused entirely on boarding merchant accounts. They started by approaching their friends, family, and contacts and then expanded it to where they had a referral incentive program and continued to acquire more and more accounts.

The most attractive part of the business to them is the residual revenue component to it. “That’s the greatest. That’s what made us get into it because now we get paid every month. As long as you keep that customer, you get paid every month,” Failla explained.

And keeping those clients means providing great customer service, which he said they’ve placed a strong emphasis on. They’ve also gotten a firsthand look at the financial trends of the various businesses they’ve worked with, something they figured would come in handy for when they were ready to take the next step.

“We didn’t do an MCA deal until the beginning of this year,” Failla said. “We really wanted to learn the business in and out, and then we were just an ISO.”

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

“When you do the split, it’s so much easier because you take, let’s say 15 or 20% or whatever the merchant can handle at the time,” Failla said. “It’s just so much better of a direction to get paid because it doesn’t hit their bank, it doesn’t hurt them as much. When they see it coming out daily like that, it’s a little different. When it comes out of the credit cards it’s just early and it helps a lot. Mindset changes.”

The company’s traditional approach has already attracted the attention of some of their peers in the industry who like the idea of residual income but don’t have the time or the patience to worry about merchant accouts.

“We have different MCA offices that we actually do this with already,” Failla said. “We do all their credit card processing. We handle all the back-end. We handle all the front-end. All they do is give us the referral and they become what we call a referral partner, and they get paid every single month as long as we keep the account.”

Will was sure to give credit to those that have helped shorten his learning curve along the way. He has since discovered that others in the poker scene are also in the same business as he and it’s created a valuable community. WTF even has a poker table in its office as a sort of tribute to his background which he has not actually retired from. The Hendon Mob poker tracker states that Will recently placed 259th out of 10,112 players in the World Series of Poker in Las Vegas earlier this month. Meanwhile, the company name itself, a bold strategy, seems to be working out so far.

“If you look under our logo, it says our names right underneath it. William, Torre Failla, and listen there’s going to be some pushback, but the amount of pushback we’ve had is so minimal that I think it’s worth it, and we’re going to stick with it as long as we can.”

eBay Brings Back Revenue Based Financing Product

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which AltFinanceDaily first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”

Real-time Reconciliations on Revenue Based Finance Deals?

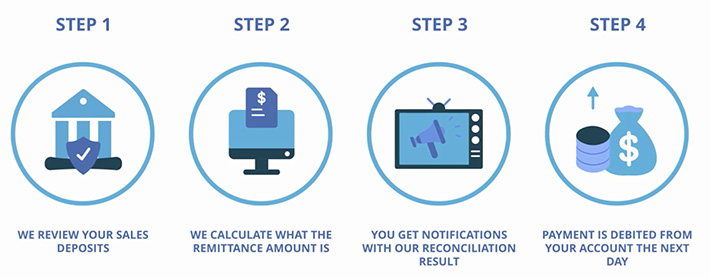

June 25, 2024In the finance world, taking a percentage of a merchant’s sales at the time a sale is consummated is called a split. It’s how revenue based financing often works when the purchased future receivables are card-based. When it’s all revenue, funding providers often rely on a combination of ACH debits and reconciliations, the frequency of which are governed by the contract. On some big e-commerce platforms, like Walmart Marketplace, for example, sales data is monitored in real-time and the appropriate split is debited out from the merchant’s bank account the next day. Some refer to this as a real-time reconciliation.

Real-time reconciliations have been attempted outside of e-commerce ever since Merchant Cash and Capital aka BizFi (RIP) pioneered this 15 years ago, but it was a manual process riddled with challenges that would hardly hold up in today’s technological world. In 2021, revenue based financing provider FundKite introduced its own system, one that was documented by AltFinanceDaily at the time.

Back then, FundKite CEO Alex Shvarts said, “This product [where debits vary daily based upon true sales] works better for merchants, it works better for portfolios, if you’re actually reconciling and pulling what you’re supposed to, and not what you’re anticipating.”

Three years later, Shvarts still feels the same way and told AltFinanceDaily that his daily reconciliation method has been a success and is now a leading driver of its business.

“In order to reconcile we must have access to the merchant bank accounts,” Shvarts said. “We use priority technology to do the reconciliation after we have the data. We use a combination of live Logins, Plaid, Decision logic and another piece of code we wrote. Merchants are automatically notified of the reconciliation and adjustment to the payments before we debit the accounts.”

The company touts this system as its edge on its homepage.

“Payments are based on sales, offering protection during slower periods or when no sales occur,” the site says.

Backdooring Deals? You’re a Loser

April 24, 2024 “Backdooring is just for losers,” says Thomas Chillemi, founder and CEO of Harvest Lending, a small business finance brokerage. “Like I think anybody who participates in it is just a loser.”

“Backdooring is just for losers,” says Thomas Chillemi, founder and CEO of Harvest Lending, a small business finance brokerage. “Like I think anybody who participates in it is just a loser.”

Backdooring, as colorfully referenced by Chillemi, is a colloquial term used widely across the industry to describe how leads, apps, or entire deals are stolen from brokers. The deal gets submitted through the front door and then leaks out the back door to an unauthorized third party. Chillemi sums it up as such: “backdooring is ‘I secured a lead, I secured a file in some way, shape or form. And that merchant is being contacted through my efforts somehow that I didn’t give permission to.'”

It’s a scenario that’s been top of mind at brokerages across the country for years, and it’s a problem that’s getting worse, according to sources that AltFinanceDaily has spoken with.

“I would say backdooring is the worst of the worst right now,” says Josh Feinberg, CEO of Everlasting Capital, another small business finance brokerage. “I think as far as rogue employees go at direct funders, it’s the worst it’s ever been.”

Feinberg’s reference to “rogue employees” is just one such way that backdooring can occur. It can be an employee of a lender, management of a lender, an employee of the broker, a broker pretending to be a lender, and possibly in a worst case scenario even a cyber intruder like a hacker. Sometimes it’s a clandestine operation structured in a way to make it difficult for the broker to detect that their client’s file has been intercepted while other times backdooring is such a normalized function of one’s business that accepting a submission from a broker and then shopping it elsewhere to circumvent them is practically firm policy and done on an automated basis.

Some of the more seasoned brokers who are used to being on guard with what a lender intends to do with their file advise that their peers approach any proposed ISO agreement with a fine-tooth comb to establish what is or isn’t allowed. After all, if the agreement grants the lender the contractual right to backdoor the broker, is it really backdooring?

Others say the contract’s language can only carry the relationship so far.

“I only try to board up with people that seem to be good actors, but then you never know what an employee might do, right?” says Chillemi.

Whether it’s a jaded underwriter, a slick admin, or Bob in accounting who never says a peep, it only takes one individual to set eyes on an application to be in a position to transfer the information elsewhere for personal gain. AltFinanceDaily examined this subject in years past and learned the lengths that rogue employees go through to extract deal data. For example, when one funding company blocked the ability to transfer data outside of the company’s network, an employee took photos of their screen with their phone. When the employer banned cell phones in the office in response, one employee wrote down deal data on scrap paper, threw it in the garbage, and then returned to the office building after hours to try and fish it out of the dumpster.

Whether it’s a jaded underwriter, a slick admin, or Bob in accounting who never says a peep, it only takes one individual to set eyes on an application to be in a position to transfer the information elsewhere for personal gain. AltFinanceDaily examined this subject in years past and learned the lengths that rogue employees go through to extract deal data. For example, when one funding company blocked the ability to transfer data outside of the company’s network, an employee took photos of their screen with their phone. When the employer banned cell phones in the office in response, one employee wrote down deal data on scrap paper, threw it in the garbage, and then returned to the office building after hours to try and fish it out of the dumpster.

The absurdity of that visual alone implies there must be big bucks in the backdoor business. Indeed, according to screenshots forwarded to AltFinanceDaily of what appears to be an underground Whatsapp group, backdoored deals are currently being marketed for sale with bank statements, social security numbers, and all. A single fresh backdoored file can go for $20 – $35 or buyers can purchase them in bulk, up to 600 at a time, for a discounted price.

“Fresh Packs” apparently fetch more because the applicants may not have signed a funding contract with anyone yet and are theoretically more warm to doing a deal even if they’re not quite sure how the company approaching them got all of their information. And it’s this speed and efficiency of the backdooring happening that’s making things extra difficult for brokers. For Chillemi, he says the backdooring in earlier years would reveal itself when someone would try to call his customer a month or two after the fact. “Like even if it happened after two or three days that felt really fast,” he says. “But now, you’re talking hours, like these people have it within hours and I just don’t even know how anybody could really compete with that.”

Brokers, ready for this, developed a tactic that is still used today as a front-line defense mechanism. They replace the applicant’s email address and phone number on the application with ones they control, so that when an attempted backdooring occurs, the caller is unsuspectingly contacting the very broker they are trying to steal the deal from. The result? They’re caught red-handed.

Brokers, ready for this, developed a tactic that is still used today as a front-line defense mechanism. They replace the applicant’s email address and phone number on the application with ones they control, so that when an attempted backdooring occurs, the caller is unsuspectingly contacting the very broker they are trying to steal the deal from. The result? They’re caught red-handed.

“I got a text from somebody claiming that they worked at Fidelity,” says Chillemi. “They texted me a picture of my own application. They’re so brazen that they’re just texting the merchant… they thought they were texting the merchant.”

Not only was the Fidelity component a deception, but the mistake of texting the broker who was just waiting to catch them is causing the backdoor shops to evolve. New backdoor callers know the application contact info might be booby-trapped so they’re now skip-tracing the applicants on an automated basis and getting their real contact info and using that instead.

For Feinberg at Everlasting, he says the method of substituting out an applicant’s contact info is not something they do, though he’s aware that it’s done by others in the working capital space. He says that it’s not something that would really be tolerated in the equipment finance side of the industry which operates much cleaner with no backdooring, at least in his experience. The lenders there hate it and everyone involved needs to be able to communicate with the customer. It’s just the working capital deals where all these problems happen.

“It’s defeating, and it’s a very very difficult thing to diagnose,” Feinberg says. He adds that the feeling is worse when realizing that it has happened even when submitting to top tier A players. There’s no delay either. He says that the customer can be called literally within the same hour of submitting it, which puts them in an awkward position.

“They lose complete trust in our company,” Feinberg says. “And it makes it very difficult to be able to work with these clients.”

According to Chillemi of Harvest, “Most of the time what happens is the merchant calls us and says, ‘Now I’m getting all these phone calls people saying they’re working with you,’ and it’s just kind of like an embarrassment of where I’ve got to explain to this person that somebody at these companies leaked their information that wasn’t supposed to. And it just makes me look bad, right?”

According to Chillemi of Harvest, “Most of the time what happens is the merchant calls us and says, ‘Now I’m getting all these phone calls people saying they’re working with you,’ and it’s just kind of like an embarrassment of where I’ve got to explain to this person that somebody at these companies leaked their information that wasn’t supposed to. And it just makes me look bad, right?”

Another owner of a large broker shop, who did not authorize his name to be used in connection with this story, says that while everyone’s mind immediately goes to the lending companies, the most common source of backdoored deals is actually from rogue employees inside the brokerages themselves. Whether it’s the rep backdooring their own deals to circumvent splitting commissions with their employer or someone else in the chain that has access to the data, his advice was that brokerage owners first need to look extremely inwards before pointing fingers outwards. Investing in proper security is critical, he says.

But assuming that base is covered, Feinberg says that brokers should do a background check on the lenders and interview them like a lender would interview a merchant for funding.

“We absolutely look into the agreements that we sign but a lot of due diligence happens just on the first phone call,” Feinberg says. “Just on the first phone call we can judge whether this is going to be a real lender…”

A key question to ask, he says, is how compensation works. And that’s because an individual lender will have a defined fixed system whereas a backdoor broker pretending to be a lender is subject to the different compensation structures they have at all their different lending relationships and would not be able to guarantee any fixed commission pricing to the broker they are trying to trick into submitting, that is if they are intending to pay them out a percentage of the deals they backdoor them on in the first place.

“Trust is the number one thing with us,” Feinberg says. “And if trust gets broken, then it’s over. So we really try to work with people that we know personally. And the way that we’ve met people personally is through trade shows, specifically AltFinanceDaily events.”

Chillemi argues that someone who tries to make their living off of backdoored deals are not salespeople at all, but as he reiterates, losers.

“[the backdoor broker] knows he’s a liar,” says Chillemi, “He’s calling these people saying he’s an underwriter… he’s not strong, he’s not learning. They don’t know what they’re doing. They’re putting the lenders at risk.”

Checking in On Stripe Capital

April 15, 2024 Everyone is well aware that Square does revenue-based financing loans, but lesser talked about is that Stripe does too. Stripe has been offering financing to merchants since at least 2019. Valued at more than $65 billion with IPO rumors swirling, Stripe has the potential to become one of the largest online small business lenders in the United States.

Everyone is well aware that Square does revenue-based financing loans, but lesser talked about is that Stripe does too. Stripe has been offering financing to merchants since at least 2019. Valued at more than $65 billion with IPO rumors swirling, Stripe has the potential to become one of the largest online small business lenders in the United States.

Stripe’s loan program is big enough to leave a trail of discussions across the web about their product, including on Reddit where some users have discussed getting loans well into the six figures. In February, one tech founder shared on X that a Stripe Capital loan had been very beneficial for his business.

Originally, Stripe offered a merchant cash advance but has since switched to doing revenue-based loans. In both cases, merchants pay by Stripe withholding a percentage of their card sales in what’s known industry-wide as a split.