Top Stories of 2024 vs 2014

December 30, 2024A lot happened in 2024, but rather than just rehash it all out, let’s revisit the world of 10 years ago. In 2014, both OnDeck and LendingClub went public, Bitcoin landed in the mainstream, Square started funding, securitizations in the industry commenced, and the world was still not totally sold on the concept of MCA. Oh how things changed!

eBay: ‘We’ve Already Done $40M in MCAs’

November 3, 2024 eBay is coming in hot to the small business financing game. The company reported that it had connected merchants with $100M in funding YTD, over $40M of it being “business cash advances” through Liberis alone.

eBay is coming in hot to the small business financing game. The company reported that it had connected merchants with $100M in funding YTD, over $40M of it being “business cash advances” through Liberis alone.

Liberis is a UK-based company that expanded into North America 4 years ago. It secured $112M in debt funding last year. The partnership between Liberis and eBay only started this past July. eBay’s other big funding partner is Funding Circle.

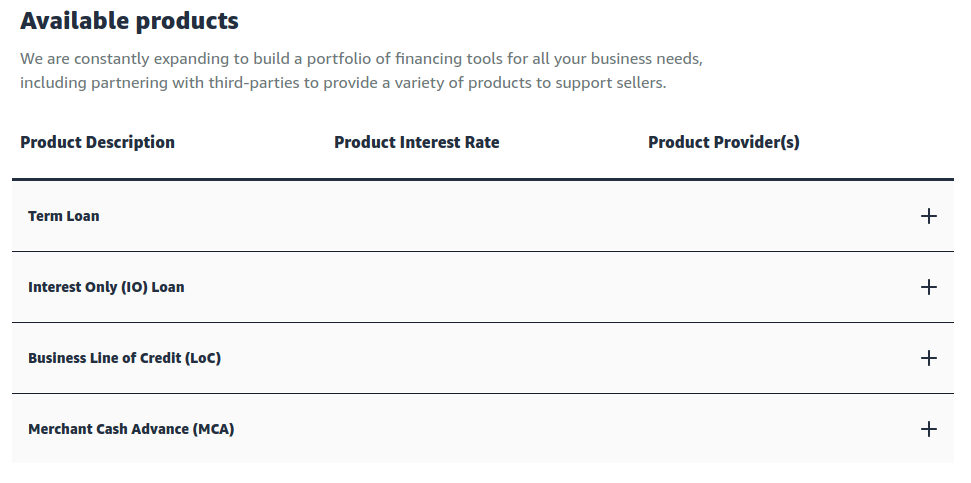

eBay’s role as a facilitator for funding follows what every other major e-commerce platform is doing. For example, Amazon, Shopify, Walmart, Lightspeed, and DoorDash all offer funding to sellers on their platforms. Technically, eBay was the first considering it had originally partnered up with Kabbage back in 2010. That relationship did not last, however.

What Big Publicly Traded Companies Say About Merchant Cash Advances

March 13, 2024AltFinanceDaily examined the public messaging from some of the largest publicly traded merchant cash advance facilitators in the US and this is what it found:

SHOPIFY

A merchant cash advance is a purchase of your future sales, also known as receivables. If your application for funding is accepted, then Shopify provides you a lump sum of money for a fixed fee. Under the Shopify capital agreement, this lump sum is known as the amount advanced, and the total to remit is the amount advanced plus the fixed fee. In return, you pay Shopify Capital a percentage of your daily sales until Shopify receives the total to remit. The percentage of your daily sales that you must remit to Shopify is known as the remittance rate. The amount advanced and the remittance rate depend on your risk profile.

For example, Shopify Capital might advance you 5,000 USD for 5,650 USD paid from your store’s future sales, with a remittance rate of 10%. The 5,000 USD amount that you receive is transferred to your business bank account specified in your admin, and Shopify Capital receives 10% of your store’s gross daily sales until the full 5,650 USD total to remit has been remitted. You have the option, at any time, to remit any outstanding balance in a single lump sum.

There is no deadline for remitting the total to Shopify Capital. The daily remittance amount in USD is determined by your store’s daily sales, because the remittance rate is a percentage of your store’s daily sales. The remittance amount is automatically debited from your business bank account.

DOORDASH

DoorDash Capital is a cash advance, not a loan. With a cash advance, the offer is based on your sales and account history, and includes a simple, transparent one-time fee that you’ll know before you decide to accept the offer. A loan operates using interest, which can compound over time, and often includes other fees in addition to the stated interest rate.

LIGHTSPEED

AMAZON

A [merchant cash advance is a] non-revolving sum of funding with flexible payment, no personal collateral required and no late fees. With flexible payment, no personal collateral required and no late fees, a merchant cash advance provides sellers funding to help run and grow their business. Unlike interest-bearing loans, the advance ties payment to a portion of a seller’s future sales for a fixed capital fee, there are no additional fees or interest charged.

NERDWALLET

Fixed withdrawals from a bank account

Merchant cash advance companies can also withdraw funds directly from your business bank account. In this case, fixed repayments are made daily or weekly from your account regardless of how much you earn in sales, and the fixed repayment amount is determined based on an estimate of your monthly revenue.

PAYPAL

A merchant cash advance is not a loan, but rather a type of financing that business owners pay back with a percentage of their future sales.

AltFinanceDaily’s Top Five Stories of 2022

December 20, 2022 deBanked’s most read stories of 2022 are in and they’re a bit different from the hits of 2021. These were the results!

deBanked’s most read stories of 2022 are in and they’re a bit different from the hits of 2021. These were the results!

1. DoorDash Goes into MCA

It was nearly a tie for two stories related to the same company, DoorDash. Who would’ve thought? But in early 2022 the mega restaurant delivery service announced to the world that it was getting into the merchant cash advance business courtesy of a new funding industry challenger named Parafin.

Here’s what you may have missed as the biggest story of the whole year!

DoorDash Now Offers Merchant Cash Advances

DoorDash Expands its Cash Advance Program to the Dashers Themselves

2. Scandal

Not everyone had a good year. Some had to face the music. It was a close race between two stories for the 2nd spot but we’re only linking to one because the second involved a lawsuit that has since been dropped by the plaintiff.

Man Who Defrauded MCA Companies Indicted | This case is still ongoing.

3. The Demise of LoanMe

NextPoint Financial’s abrupt decision to wind down LoanMe after a celebratory acquisition of it was one of the biggest surprises of 2022. Very little information has been shared publicly about what led to it. Given NextPoint’s status as a publicly traded company, details could’ve been inferred from their regularly filed financial statements, but they’ve failed to file them for a whole year. Instead, they’ve provided regular investor updates that have communicated that they’ll eventually be forthcoming but they keep missing the deadlines they set for themselves.

LoanMe Has Stopped Originating Business Loans

NextPoint Financial Formally Announces End of LoanMe Business

4. The California Disclosure Law

Reality struck in 2022 as the 4 years of debate over California’s commercial financing disclosure law finally came to an end. It went into effect on December 9th. This story, published leading up to it, was the 4th most read of 2022:

Think The New California Disclosure Law is Just About a Disclosure Form? Think Again

This one, published two weeks ago, followed close behind:

Funding Companies Sue California Regulator Over Looming Disclosure Law

5. Reality TV

Technically, the first episode of Equipping The Dream was the most viewed content on AltFinanceDaily throughout all of 2022, but if we’re going just by stories, then this one, talking about its fast rise, placed 5th for the year:

Reality Show About SMB Finance Sales Rockets to The Top Spot

How the Amazon / Parafin Merchant Cash Advance Deal Came to Be

November 2, 2022Back in December, Parafin, then a fintech startup with 20 employees, submitted a proposal to Amazon to roll out a potential Amazon merchant cash advance product. At the time, Parafin was little known to the general public and its surprise deal with DoorDash wouldn’t even become public until a month later.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

Coincidentally, more than a dozen people employed by Parafin, including the co-founders, are former Robinhood employees, according to profiles reviewed on LinkedIn. It’s part of a trend, it appears, as other members of their team hail from well known Silicon Valley firms like Lending Club, Stripe, Funding Circle, Google, Amazon, Facebook, StreetShares, and more.

Ultimately, Parafin’s big bet paid off. On Tuesday, November 1st, Amazon announced that the Parafin team was the one it had chosen to debut its official merchant cash advance product.

“Amazon is committed to providing convenient and flexible access to capital for our sellers, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending, in the announcement. “Today’s launch is another milestone in strengthening Amazon’s commitment to sellers, and builds on the strong portfolio of financial solutions we already provide. This latest offering significantly expands sellers’ reach and capabilities, and broadens their access to capital in a flexible way—one that helps them control their cashflow, and by extension, their entire business.”

“We founded Parafin with the mission to grow small businesses, and we’re thrilled that we have the opportunity to do that by providing Amazon sellers with this merchant cash advance option,” said Vineet Goel, co-founder of Parafin. “It’s a privilege to count ourselves among Amazon’s suite of financial solutions, and we look forward to making a difference for Amazon.com sellers looking to expand their business.”

The product is already listed on Amazon’s website and was rolled out to some US businesses immediately. It will be available to hundreds of thousands of additional sellers by early 2023, the company claims.

Unique to an Amazon MCA is that funding amounts can start as low as $500 and go up to $10 million.

Amazon’s entrance into the merchant cash advance market coincides wih a unique moment in the product’s history as several states are in the midst of imposing strict regulations on their sale.

Lavu Adds MCA Product Through Partnership With Parafin

October 7, 2022 It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

“We are a restaurant software company that focuses on small and medium restaurants,” said Saleem S. Khatri, CEO of Lavu. “Think of your favorite restaurants that have one or two locations that are really really popular, that are ingrained in the community. We do everything from point of sale to online ordering, payment processing, and anything a restaurant would need to start and grow their business.”

Khatri said that one thing they noticed is that these restaurants have a fundamentally hard time getting loans and that led them to connect with Parafin. Parafin’s product is an advance on future sales, not a loan, and their offerings have been simply integrated into Lavu’s technology. Parafin automatically generates an offer for restaurant owners that they can see in their Lavu dashboard.

“…it’s just really beautifully designed,” said Khatri. “It basically says, ‘Hey, you have an offer to borrow up to $5,000. Do you want it yes or no?’ And you just click ‘yes’ and you’re good to go, the money deposits straight into your bank account, and then you have a repayment schedule. And it just pulls it directly from your bank account according to that repayment schedule.”

Khatri says they haven’t really begun to market the product yet and they’ve just started off with a limited base of customers but that the plan is to roll it out to all their customers around the US. They’d even do it with their customers outside of the US if they could, but the tech is not set up to do that just yet.

“This is going to be a feature and an offering that really really benefits our customers because it gets to the heart of what they need, which is they’re in constant need of liquidity, they’re in constant need of kind of tools to run their business better,” Khatri said. “And it just really fits our portfolio of products that we offer to these customers. So the reception has been awesome.”

Pick a Niche or Go Far and Wide? SMB Financiers Weigh in

February 18, 2022 As big tech continues to pave the way for new avenues for providing capital for small businesses, the legacy infrastructure in place has their own ideas of how to compete in funding a digitally native business owner. While some say that the strength is in finding a niche, others disagree— claiming that the key is to expand business, avoiding a one-dimensional aspect of funding. On top of this, some commercial finance brokers even claim that an ability to handle digital assets will give them an advantage over a larger tech company, too.

As big tech continues to pave the way for new avenues for providing capital for small businesses, the legacy infrastructure in place has their own ideas of how to compete in funding a digitally native business owner. While some say that the strength is in finding a niche, others disagree— claiming that the key is to expand business, avoiding a one-dimensional aspect of funding. On top of this, some commercial finance brokers even claim that an ability to handle digital assets will give them an advantage over a larger tech company, too.

“Finding the niche as far as who you’re funding, and what type of deals you’re funding, will lead to continuing growth,” said Matt Rojas, Senior Lending Officer at Ironwood Finance. While Rojas believes the strength of a smaller brokerage is the ability to service a niche client, he expressed the idea that larger companies getting into the space are going too deep too quickly—resulting in an unsustainable rate of expansion.

“I see the biggest problem with the fly-by-night brokers, these bigger MCA shops that you’re seeing entice brokers to send the clients to them,” Rojas said. “I don’t see how that will sustain long term unless they continue to meet milestones to acquire their capital. I just had a merchant [get] bought out from our firm [by another funder] for over 40K plus, [but] their cash flow could only sustain an 18K MCA max. I’ll never understand how these firms are going to operate on a larger scale unless they are bought by the big firms.”

Other people in small business lending think that the strength is to offer a variety of financial products and options to give merchants choices. “The only way to keep up with the big boys of the industry is to simply just not be a one-trick pony,” said Juan Caban, Managing Partner at Financial Lynx. “Just like they are adapting into new markets and products, we as lenders and brokers need to also enhance our offerings.”

While people like Caban are molding products based on the competitive flow of the industry, Rojas seems to believe the system will bleed the big players dry. “It’s my understanding that as a lender we don’t need to compete with each other on rates like you’re seeing,” Rojas said. “I believe they call this the cash burn stage.”

While people like Caban are molding products based on the competitive flow of the industry, Rojas seems to believe the system will bleed the big players dry. “It’s my understanding that as a lender we don’t need to compete with each other on rates like you’re seeing,” Rojas said. “I believe they call this the cash burn stage.”

“They’re going to burn as much cash to acquire clients,” Rojas continued. Then, the dominos fall. […] It’s like a story that paints itself over and over again. The same thing will happen to these bigger firms you mentioned due to the simple fact that their underwriting process doesn’t factor NSFs, non-repayments, or defaults.”

While Rojas focused on what the bigger companies are doing, Caban spoke on what brokers can do on the fly to adjust. He expanded on the idea of using old tactics in new ways, saying that traditional sales tactics may work if implemented with a well-researched and modern spin.

“Before cold calling, research and understand who your target market is and be prepared,” Caban said. “When cold calling, no one merchant has similar needs and goals. We need to ask the right questions, learn about the business, then find customized solutions that are in line with their financial needs and goals.”

A merchant will always appreciate a broker or lender who takes an interest in their business and find solutions that are in line with their goals rather than [their own] financial interests.”

Some brokers have gone outside of the box when it comes to how they will compete in the future of small business lending, saying that traditional currencies have been won over by big tech, and it’s digital assets that will open a brand new market for the next-generation small business lender.

“Since 2008, technology has changed a lot more than just the process in which small business owners find and acquire funding,” said Nicholas Saccone, Senior Funding Advisor at Proto Financial. “As you know, cryptocurrency is becoming more and more mainstream by the day with the Fed scrambling to get control over it. Whether you believe in crypto or not, it will [change] the way we see money.”

Saccone expressed that brokers who embrace learning about digital assets will not only be able to compete with large tech lenders, but beat them out.

“PayPal, DoorDash, and Square can make it easy for companies to secure fiat currency, but as crypto becomes more mainstream, brokers will fulfill a new role as they help educate clients on the new financial system that is upon us,” Saccone said. “It will be physically impossible for large tech companies to integrate crypto into their current systems without brokers doing the dirty work.”

“Mass adoption comes from the top down,” Saccone continued. “Digital collateral tokens, such as Flexa’s AMP, will change the payment processing industry forever. Transactions will become instant and it is my belief within the next ten years, merchants will be utilizing digital assets more than fiat cash.”

Cashback-Crazed Enzo Launches Deposit Accounts

January 4, 2022 Enzo Wealth, the fintech launching a neobank-esque software through Blue Ridge Bank finally came out with their initial account offerings to a select group among the 35,000 people on the account holder’s waitlist. Since the announcement, the company has marketed themselves by offering attractive cashback and equity-based incentives to account holders. According to an email sent out to the selected invitees by CEO Jeremy Shoykhet, the company is still working out the kinks to their offerings.

Enzo Wealth, the fintech launching a neobank-esque software through Blue Ridge Bank finally came out with their initial account offerings to a select group among the 35,000 people on the account holder’s waitlist. Since the announcement, the company has marketed themselves by offering attractive cashback and equity-based incentives to account holders. According to an email sent out to the selected invitees by CEO Jeremy Shoykhet, the company is still working out the kinks to their offerings.

“We launched the Enzo Early Access Beta a few weeks ago, and are thrilled with the progress so far,” said Shoykhet. “We’ve seen over one-thousand customers join the early access beta. We’ve also been excited to see the uptake in our Rent Payment Cashback Program, with a current run-rate of $1mm of rent payments we will be processing annually.”

Invited waitlist members who sign up for the trial will not only receive a $50 bonus, but any money they spend that may qualify for cashback in the future will be retroactively funded to accounts, should money spent now be qualified for cashback at a later date.

The trial period includes the originally offered 1.5% cashback on rent payments, but with a stipulation during the trial period. Enzo customers seeking cashback on rent must pay rent via ACH from the landlord’s payment portal. According to an email sent by Shoyket to invitees, Enzo account holders will be able to receive the cashback on rent regardless of their payment method as launch progresses.

Enzo caught eyes when it offered wild cashback offerings like 10% on Ubers, 5% on DoorDash, and 1.25% on pretty much everything else. Enzo accounts also pay out a 0.50% APY, which the company claims will be increased as their capabilities allow.

Shoykhet hinted at Enzo continuing to grow as the trial period takes stride. “We are excited to continue growing the platform, adding more features, and inviting more folks to use the product.”