The Front Line of PPP Lending

April 24, 2020

Susan Lyon, managing director at an independent commercial film company in Solana Beach, California, can’t say enough good things about the quick action her bank took to help her secure emergency government funding during the current pandemic. “They sent out all the forms right away” enabling her to file an application on Friday, April 3 — “the earliest day possible” — she says of the Bank of Southern California. “Then they kept in touch after we sent all the pdf’s back, and they started uploading the loan applications when the Small Business Administration’s website went live the following Thursday.

Susan Lyon, managing director at an independent commercial film company in Solana Beach, California, can’t say enough good things about the quick action her bank took to help her secure emergency government funding during the current pandemic. “They sent out all the forms right away” enabling her to file an application on Friday, April 3 — “the earliest day possible” — she says of the Bank of Southern California. “Then they kept in touch after we sent all the pdf’s back, and they started uploading the loan applications when the Small Business Administration’s website went live the following Thursday.

“The very next day, which was Good Friday,” she adds of the San Diego-based bank, “they e-mailed me at 7 p.m. to say the funds are coming — and two hours later they e-mailed me to say that ‘the funds are in your account.’ It was a high-touch experience.”

Lyon says she will use the bulk of the $130,000, which she received under the government’s Paycheck Protection Program, to pay the salaries of the eight fulltime employees at Lyon & Associates, of which she and husband Mark own 90%.

Lyon’s friend Jennifer Biddle was not so fortunate. Biddle, who operates a flower-growing and distribution business with her husband Frank, has been emotionally devastated, she says, since Torrey Pines Bank dropped the ball on her application for $285,000 to pay employees during the crisis.

“They created an administrative nightmare,” Biddle says of her San Diego-based bank, which failed to forward her paperwork to the SBA. “Being disappointed doesn’t begin to describe my feelings,” she adds.

Based in Vista, California, FBI Flowers has roughly $6 million in annual sales, 40 employees, and a monthly payroll of $114,000. Like her friend Susan Lyon, Biddle also applied for PPP funding on April 3. But she didn’t hear back from her bank for several days “and we thought (the application) was processing,” she reports. When the bank did get back to her a week later, it was to say, “‘We need this other form,’” she says, quoting the bank. “And then they wanted our addendum revised.”

By the time the SBA made the announcement on April 16 that the agency had exhausted the $349 billion allocated by Congress, Torrey Pines was still sitting on her application. “To me it’s negligence,” Biddle says.

“We’re in the middle of our growing season and money is hardly coming in,” she adds. “Our employees are part of a vulnerable population, We were really counting on our bank to do their part and get the application to the SBA. This was what my kids would call ‘an epic fail.’”

Neither Torrey Pines Bank nor its Phoenix-based parent company would comment. “Unfortunately,” Robyn Young, chief marketing officer at Western Alliance Bancorporation, told AltFinanceDaily, “our bankers are not able to share any information about our clients or client transactions.” (According to a tagline in the e-mail, Forbes magazine has named Western Alliance to its list of the “Ten Best Banks in America” for the past five years in a row.)

Lyon’s and Biddle’s accounts are just two stories – one a rousing success, the other an abject failure – emerging from the Paycheck Protection Program, which was created as part of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Since the bipartisan bill was signed into law by President Trump on March 27, the SBA has approved 1.66 million small business applications.

Lyon’s and Biddle’s accounts are just two stories – one a rousing success, the other an abject failure – emerging from the Paycheck Protection Program, which was created as part of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Since the bipartisan bill was signed into law by President Trump on March 27, the SBA has approved 1.66 million small business applications.

Under the PPP, small businesses and self-employed individuals must apply for emergency funding through banks and designated non-bank lenders. Congress authorized the SBA to make emergency, low-interest loans of up to 2½ times a business’s monthly payroll to pay their employees’ wages for eight weeks.

If, after eight weeks, businesses can show they’d spent 75% of the government money keeping furloughed employees on the payroll and covering their health insurance, the loan will be forgiven. The remaining 25% of PPP funding will convert to a grant if it’s spent on rent and utilities.

Now, as the program is being rebooted with new Congressional action for a second round of funding totaling more than $300 billion, many applicants fear that they will again be left out in the cold. “We’ve been hearing that many banks have not been able to handle the torrent of applications,” says Gerri Detweiler, education director at Nav, Inc., a Utah-based online company that aggregates data and acts as a financial matchmaker for small businesses.

Detweiler reports that she and her team at Nav have been working 14-hour days since the CARES Act was signed into law fielding calls and responding to e-mails from the company’s 1.5 million members looking for assistance in navigating the PPP rules. One common experience for small business applicants has been that “many of the banks have been prioritizing customers with deeper and more longstanding relationships,” she says.

One small business owner in Texas, Edward L. Scherer, filed a federal lawsuit in Houston on Easter Sunday charging that Frost Bank, which is headquartered in San Antonio, violated the CARES Act and SBA rules by refusing to accept PPP applications from non-customers. Class action suits alleging illegal favoritism have also been filed against Bank of America, Wells Fargo, J.P. Morgan Chase, and US Bancorp.

For customers and non-customers calling on Bank of America, this would come as no surprise. The Charlotte (N.C.) based giant makes clear that it will only process applications for regular customers. A notice on the bank’s website, declares that only “small business clients who have a lending and checking relationship with Bank of America as of February 15, 2020, and do not have a business credit or borrowing relationship with another bank, are eligible to apply for the Paycheck Protection Program through our bank.”

Although the PPP has been heralded as a way to rescue mom-and-pop businesses, national chain restaurants like Ruth’s Chris Steak House and hotels operating franchises have benefited handsomely. Ruth’s Chris alone received $20 million in crisis funding, according to The Wall Street Journal, which first reported the story.

Although the PPP has been heralded as a way to rescue mom-and-pop businesses, national chain restaurants like Ruth’s Chris Steak House and hotels operating franchises have benefited handsomely. Ruth’s Chris alone received $20 million in crisis funding, according to The Wall Street Journal, which first reported the story.

For the bulk of the country’s small businesses “the money has been trickling in very slowly,” says Sarah Crozier, senior communications manager at the Main Street Alliance, a Washington, D.C.-based advocacy organization that counts 300,000 members. Even for many businesses that have received funding, there remains widespread uncertainty that the loan will be converted to a grant. “There’s not a lot of trust that the PPP loan will be forgiven,” Crozier says. “There’s a lot of confusion.”

That’s a major concern for Randy George, owner of Red Hen Bakery in Middlesex, Vermont – a speck of a place off I-89 near Montpelier, the state capital – who does not want to take on extra debt. Until a month ago, George had been running a $4 million (sales) operation which employed 48 employees. He’s closed down the café, he says, which accounts for about 60% of annual receipts, while keeping on 20 workers to run the bakery.

That operation – which turns out baguettes, croissants, sticky buns and other baked goods for wholesale distribution – has actually ramped up. With most restaurants temporarily shuttered, more New Englanders are eating at home, resulting in the bakery’s nearly doubling its sales to regional grocery stores and supermarkets.

Meanwhile, George has received $411,000 in PPP funding, which he applied for through Community National Bank, located in Barre, Vt., and he’s paying many of his 28 furloughed employees to remain idle. Because of the way the CARES Act program is structured, he says, it’s in his interest to convince laid-off employees not to collect unemployment compensation which includes an extra $600-a-week federal benefit and lasts longer than the eight-week PPP.

“I just called one of my fulltime employees and told him he’ll get to keep his health care if he stays on the payroll,” George explains. “But for part-time people it’s awkward. I’m incentivized to get people back to work and they’re incentivized to go on unemployment.”

At the Portland Hunt & Alpine Club, a bar and restaurant in Maine with the reputation for having the tastiest cocktails in town, if not the entire Pine Tree State, the PPP is not working out for owner Andrew Volk. He secured funding “in the low six figures,” he says, but so far he’s keeping his powder dry. Instead of paying out-of-work employees, he’s letting them collect employment insurance and using a portion of PPP funding for rent and utilities. As for the remaining PPP funds, the question is whether to return the money or keep it as a loan.

Volk says the government program has done little to help him with his most pressing needs. For starters, he was forced to toss out “thousands upon thousands of dollars” worth of perishable foods since his establishment went dark on March 16. All meat, cheeses, sauces, citrus fruit, shrimp, fish and, of course, Maine lobster, went into the dumpster.

Because of a force majeure clause in his insurance policy that explicitly denies indemnification for an “act of God” – “Almost every business interruption insurance policy has a virus and pandemic exclusion,” Volk adds – he will have to eat those losses. “As a small business,” he adds, “we really need support beyond payroll.”

Even many qualified business people who have been approved for PPP funding are still waiting for their funds. Charles Wendel, president of Financial Institutions Consulting, based in Miami, applied for funding “in the five figures,” he says, through Citibank on April 4. That was nearly three weeks ago. “If I were a guy who really needed this money, I’d be screwed,” he says.

In the next round of PPP funding, those who missed out now hope they will be approved quickly by their banks or lenders and that the coronavirus pandemic is brought under control. Meanwhile, the massive unemployment and shutdown of small businesses nationwide are reshaping the contours of the U.S. economy. “Ultimately,” warns Crozier of the Main Street Alliance, “the result of this will be more corporate consolidation and monopolization. That’s what we saw coming out of the ‘Great Recession’ in 2008.”

Marketplace Lending Association Members Take Steps To Help Borrowers During The Coronavirus Crisis

March 17, 2020 Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

Members of the Marketplace Lending Association are taking steps to alleviate financial pressure facing borrowers during the recent crisis.

“This includes providing impacted borrowers with forbearance, loan extensions, and other repayment flexibility that is typically provided to borrowers impacted by natural disasters. During the time of payment forbearance, marketplace lenders are also electing not to report borrowers as ‘late on payment’ to the credit bureaus,” a letter to senior members of Congress signed by Exec Director Nathaniel Hoopes states. “Members are also waiving any late fees for borrowers in forbearance due to the COVID-19 pandemic, posting helplines on company homepages, and communicating options via company servicing portals.”

Members of the MLA include:

- Affirm

- Avant

- Funding Circle

- LendingClub

- Marlette Funding

- Prosper

- SoFi

- Upstart

- College Ave Student Loans

- Commonbond

- LendingPoint

- PeerStreet

- Yieldstreet

- Arcadia Funds, LLC

- Citadel SPV

- Colchis Capital

- Community Investment Management

- cross river

- dv01

- eOriginal

- Equifax

- experian

- Fintech Credit Innovations Inc.

- FutureFuel

- Laurel road

- LendIt

- pwc

- Scratch

- SouthEast bank

- TransUnion

- tuition.io

- VantageScore

- Victory Park Capital

- WebBank

Fears of Possible Recession Don’t Phase CRE Lenders

December 16, 2019 Depending on your vantage point, a slowdown is either already in progress, just around the bend or several years away. But some alternative commercial real estate professionals are trying to filter out the noise.

Depending on your vantage point, a slowdown is either already in progress, just around the bend or several years away. But some alternative commercial real estate professionals are trying to filter out the noise.

Instead, they are more aggressively forging ahead with growth plans, including trying to grab market share from banks.

The commercial real estate lending market remains highly competitive and alternative lenders say they remain focused on looking for opportunities to expand their business, even as the possibility of recession looms. At present, a number of professionals don’t see an imminent threat of recession, and even if there is one, they say they stand to benefit from picking up business banks don’t want to take on—or can’t—because of increased regulatory controls imposed on them since the last recession.

There are plenty of opportunities for alternative commercial real estate lenders to get ahead, even in this environment, says Chris Hurn, founder and chief executive of Fountainhead Commercial Capital, a Lake Mary FL-based, non-bank direct small business lender in the commercial real estate lending space.

To be sure, alternative commercial real estate lenders say that for the most part, there hasn’t been a major pullback in their space. But due in part to mounting economic concerns and changing business priorities, banks—which had already scaled back from their pre- Great Recession exuberance—have been taking an even more cautious approach to lending. This is especially true in certain regions of the country, or in sectors deemed higher-risk such as hospitality and retail, alternative lenders say. While the pullback hasn’t been broad-based, it’s been enough in some cases to create strategic pockets of opportunity for opportunistic non-bank lenders such as private equity funds, debt funds, crowdfunding portals and others.

To be sure, alternative commercial real estate lenders say that for the most part, there hasn’t been a major pullback in their space. But due in part to mounting economic concerns and changing business priorities, banks—which had already scaled back from their pre- Great Recession exuberance—have been taking an even more cautious approach to lending. This is especially true in certain regions of the country, or in sectors deemed higher-risk such as hospitality and retail, alternative lenders say. While the pullback hasn’t been broad-based, it’s been enough in some cases to create strategic pockets of opportunity for opportunistic non-bank lenders such as private equity funds, debt funds, crowdfunding portals and others.

For many of these commercial real estate professionals, whether or not a recession is on the horizon is not a guessing game that’s worth playing. And with good reason, given how much disagreement there is among market watchers, investment management professionals and others about where the economy is headed.

Certain economic data continues to be strong, for instance, but political and geopolitical factors such as trade wars continue to raise red flags. Then there’s the fatalistic notion that the economy has been on a tear for so long that it’s due for a pullback at some point. This all translates into a hodgepodge of speculation and indecision about the economy’s direction. The dichotomy is evident from the difference in sentiment expressed in two fund manager surveys from Bank of America Merrill Lynch taken a month apart. October’s survey was decidedly bearish; by November, the bulls were back, muddying the waters even more.

Instead of wavering in indecision, however, some alternative commercial real estate players are hunkering down and highly focused on building their business in a cautiously optimistic and strategic manner.

Hurn of Fountainhead Commercial Capital predicts a number of increased opportunities for alternative commercial real estate lenders due to pullback from banks and a growing need for capital. He cautions alternative lenders against being too pessimistic and losing out on potentially lucrative market opportunities as a result.

“I think we might be going into a period of slightly slower growth, but none of the indicators suggest we’re remotely close to where things were 10 years ago,” Hurn says. “If we’re not careful, we’re going to talk our way into recession. It’s a self-fulfilling prophecy.”

Indeed, even as perplexing questions about the economy’s long-term health persist, some alternative commercial lenders anticipate growth in the coming year. Evan Gentry, chief executive and founder of Money360, a tech-enabled direct lender specializing in commercial real estate, says the company’s loan origination business is on track to close between $650 million and $700 million in 2019. That’s expected to increase to about $1 billion in 2020, fueled by growth in some strategic markets, including Washington DC, Atlanta, Miami and Charlotte, N.C., where the company is seeking to add loan origination personnel. Gentry says the company also continues to experience strength in many of the western markets, including the intermountain west markets of Colorado, Utah and Idaho, where growth is expected to continue.

CommLoan, a commercial real-estate lending marketplace in Scottsdale, Ariz., also sees strategic opportunities to grow in this environment. Mitch Ginsberg, the company’s co-founder and chief executive, predicts 2020 will be a strong growth year for his company, after a several-year beta period. CommLoan has plans, for example, to start hiring account executives to build relationships in additional states. Initially, the focus will be on institutions in the Southwestern U.S., with plans to add lenders in Texas, Utah, Colorado and New Mexico in the early part of 2020, Ginsberg says.

Though certain regions or business lines within commercial real estate may be experiencing some pullback, he says his overall outlook for the economy and commercial real estate remains strong. “There is still an enormous amount of activity,” he says. “If and when a correction does happen, it’s going to be a lot softer and not that deep and not that long because of the fundamentals in the economy.”

FINDING WAYS TO COMPETE MORE EFFECTIVELY WITH BANKS AND OTHERS

Some commercial real estate professionals say they are focusing more attention on sectors, regions and concentrations that the banks aren’t going after so readily.

If an alternative lender can offer more money than a bank on a particular deal or offer more flexible terms, or do deals that traditional lenders simply won’t do, for example, then it’s a boon for them. For a slightly higher price, alternative lenders—especially those whose business model relies heavily on technology—are able to take on slightly riskier deals than a bank might be able to stomach, says Jacob Goldsmith, managing partner of Goldwolf Ventures LLC, a privately held alternative investment and asset management company with offices in Miami and Austin.

“Alternative lenders are a lot more nimble,” says Goldsmith, who keeps close tabs on the commercial real estate lending industry.

Especially given the ambiguous economic climate, there are several areas that could be prime opportunities for savvy alternative commercial real estate lenders to gain a leg up. For instance, some banks of late have shied away from certain special purchase property types like hotels, day care facilities and free-standing restaurants, says Hurn of Fountainhead Commercial Capital. These types of properties are traditionally seen as riskier in the latter part of an economic cycle.

Especially given the ambiguous economic climate, there are several areas that could be prime opportunities for savvy alternative commercial real estate lenders to gain a leg up. For instance, some banks of late have shied away from certain special purchase property types like hotels, day care facilities and free-standing restaurants, says Hurn of Fountainhead Commercial Capital. These types of properties are traditionally seen as riskier in the latter part of an economic cycle.

Nonetheless, “there’s opportunity here for non-traditional lenders to step in and fill that gap,” he says. Retail loans are another category where banks have been pulling back. One reason banks are being more cautious is the sentiment that as online shopping becomes more pervasive, there’s less of a need for brick-and-mortar shops. This trend is underscored by the recent announcement of Transform Holdco—the company formed to buy the remaining assets of bankrupt retailer Sears Holdings Corp.—that it would close 96 Sears and Kmart stores by the end of February. Still, some industry watchers aren’t ready to concede retail’s demise.

While these types of announcements fan fears, concern over the death of retail is largely overblown, according to Troy Merkel, a partner and real estate senior analyst at RSM, which provides audit, tax and consulting services. “The banks are being too overly cautious,” he opines.

The opportunity for alternative lenders, he says, is not in funding loans that add to the supply, but rather in funding loans that change the existing supply. While the need for new development may not be as great, there is a growing demand for repurposed properties, he says. This includes upscaling an older mall or turning an existing retail building into a mixed use property, namely a mix of retail stores and multi-family apartment complexes. There is still a real need for these types of developments, Merkel says, and with banks shying away, the door is open for alternative lenders to “make a play,” he says.

Real estate professionals say they also see opportunities for alternative commercial real estate lenders to make loans in areas outside major metro cities, where the competition isn’t as strong.

“There will always be opportunities in the ups and downs, the ebbs and flows of the cycle. You just have to be a lot smarter in this part of the cycle,” says Goldsmith of Goldwolf Ventures.

BECOMING RECESSION-PROOF

Pockets of opportunity notwithstanding, alternative commercial real estate lenders have to play it smart, professionals say. For instance, they should not be overly bullish on a particular sector or throw caution to the wind when it comes to their underwriting practices.

That’s because when the market turns—as it inevitably will at some point—there will likely be more defaults and lenders that haven’t dotted their I’s and crossed their T’s will understandably face stronger headwinds. They need to keep their close eye on expenses as well, which may have ticked upward over the past several years. “People get complacent when times are good. This is probably not the time to be complacent anymore,” says Hurn of Fountainhead Commercial Capital.

Another protective measure against an eventual downturn is to diversify sales channels and property types. “If you put too many eggs in one basket, it’s a problem,” Hurn says.

It’s also important for lenders to have their guards up since higher risk deals can lead to losses if a recession hits. Lenders have to be smart when it comes to taking on risk, says Tim Milazzo, co-founder and chief executive of StackSource, an online marketplace for commercial real estate loans. “They have to have a certain expertise in underwriting these transactions correctly and assessing risk,” Milazzo says.

It’s also important for lenders to have their guards up since higher risk deals can lead to losses if a recession hits. Lenders have to be smart when it comes to taking on risk, says Tim Milazzo, co-founder and chief executive of StackSource, an online marketplace for commercial real estate loans. “They have to have a certain expertise in underwriting these transactions correctly and assessing risk,” Milazzo says.

In light of significant ambiguity about where the economy is heading, Gentry of Money360 says his company is protecting itself by taking an ultra- conservative approach. This means, for instance, only making first-lien position loans secured against income producing properties at a loan-to-value ratio on average of 65 percent, he says. Some alternative lenders are making these loans at a loan-to-value ratio of 80 percent or 85 percent, but Gentry says this is too high a rate for his taste. Also, Money360’s loans are also generally short- term—in the two-to-three-year range, which reduces some of the risk and seems especially prudent at this point in the cycle, he says.

When the market turns—as it inevitably will at some point—there will be more loan defaults, and those that are on the more aggressive end of lending will bear most of the challenges, he says.

He cautions other alternative lenders to avoid taking on excessive risk. “You’ve got to be thinking ahead and planning and lending as if the downturn is right around the corner—because it could be,” he says. Even taking a conservative approach, there are still significant business opportunities, he says.

BE ON THE LOOKOUT FOR RECESSIONARY OPPORTUNITIES

Meanwhile, if a recession does hit, alternative commercial real estate lenders say they will have even more opportunities to gain market share, participate in workout financing and hire key personnel. Alternative lenders that are more steeped in technology may potentially have even more of an upper hand since this can enable them to close deals much more efficiently and quickly and at a lower cost, while at the same time giving borrowers broader access.

“In a tighter market, every reduction in rate and cost will make more of a significant difference to borrowers than it does at the moment,” says Ginsberg of CommLoan, the commercial real-estate lending marketplace.

Although there are a growing number of alternative commercial real estate lenders who are relying more heavily on technology than they did in the past, commercial real estate lending still hasn’t flourished online to the extent personal and small business lending has. One reason is that the loans are larger and human intervention is often seen as beneficial, says Gentry of Money360.

However, online lending within the commercial real estate lending space is still on the horizon, according to Ginsberg of CommLoan. “It’s slow-go, but it’s inevitable,” he says.

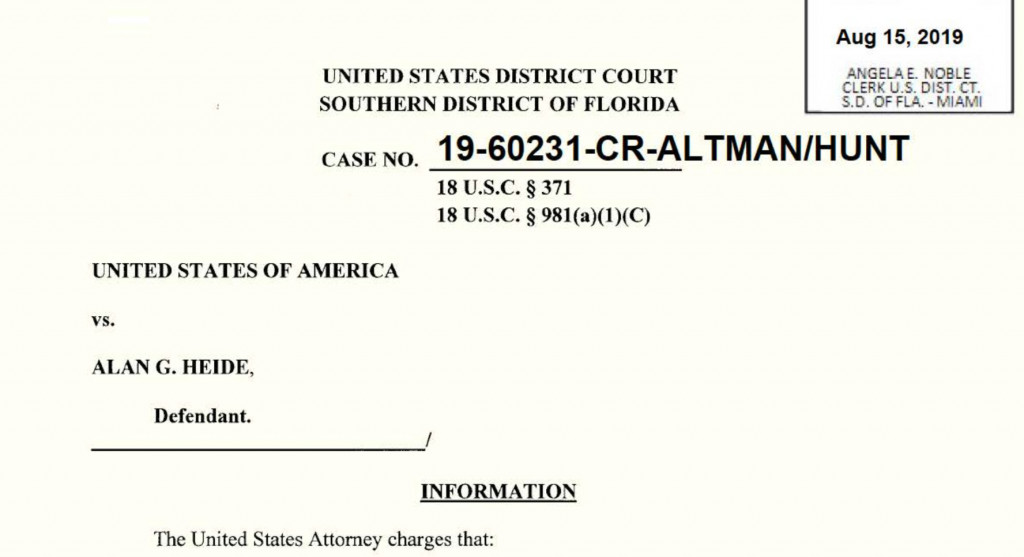

More Individuals Expected to Be Criminally Charged in 1 Global Capital Case

November 30, 2019 Federal prosecutors have asked a Court to consolidate criminal cases against 1 Global Capital defendants Alan Heide and Jan D. Atlas on the basis that there is substantial overlap between them and that additional individuals are expected to be charged. “Considerable judicial resources may be conserved if, going forward, a single judge is chosen to preside over all 1 Global-related cases,” prosecutors argue. The number of forthcoming defendants was not revealed but has been described as “multiple additional co-conspirators.”

Federal prosecutors have asked a Court to consolidate criminal cases against 1 Global Capital defendants Alan Heide and Jan D. Atlas on the basis that there is substantial overlap between them and that additional individuals are expected to be charged. “Considerable judicial resources may be conserved if, going forward, a single judge is chosen to preside over all 1 Global-related cases,” prosecutors argue. The number of forthcoming defendants was not revealed but has been described as “multiple additional co-conspirators.”

The case, far from over, is being characterized as an active investigation.

Heide, 1 Global’s former CFO, pled guilty on August 23, 2019. He is scheduled to be sentenced on December 18th. Atlas, an attorney who provided fraudulent legal cover for 1 Global via knowingly false opinion letters, pled guilty to 1 count of securities fraud in October. He is scheduled to be sentenced on January 10th.

Hallandale Beach-based 1 Global Capital was once ranked among the largest alternative small business funders by AltFinanceDaily. That all changed in July 2018 with a sudden bankruptcy filing that revealed concurrent investigations being carried out by the SEC and a US Attorney’s Office.

Prosecutors are calling the company a multi-faceted securities fraud and Ponzi scheme that victimized at least 3,600 investors across the country. While the company took in more than $330 million, $100 million of it is expected to be returned to investors through a bankruptcy court liquidation.

The company’s former chairman and CEO has already consented to judgment with the SEC and agreed to be liable for disgorgement of $32,587,166 + $1,517,273 in interest and a civil penalty of $15,000,000. Shortly thereafter, the SEC reported that he had satisfied the judgment in full with the exception of the stipulation that he sell his condo. Although he has not been criminally charged, prosecutors say that Heide and Atlas both ultimately took direction from, and reported to the company’s former chairman and CEO.

Individuals familiar with the firm may recall that 1 Global Capital was previously reported as being named 1st Global Capital. However, another company bearing the same name sued them for trademark infringment. Since then, news related to the South Florida ponzi scheme have referred to the company by its legal name, 1 Global Capital, LLC.

BFS Capital Eliminates Upfront Fees to Simplify Financing for Small Business Owners

October 1, 2019 CORAL SPRINGS, FLA. (Oct. 1, 2019)—BFS Capital, a leader in small business financing, today announced it has eliminated all upfront fees on its financing solutions, including loans and business advances, as it simplifies pricing for small business owners.

CORAL SPRINGS, FLA. (Oct. 1, 2019)—BFS Capital, a leader in small business financing, today announced it has eliminated all upfront fees on its financing solutions, including loans and business advances, as it simplifies pricing for small business owners.

With pricing that is transparent, flexible and easy to understand, BFS Capital is leading the evolution of small business financing. BFS Capital customers can now apply for and receive up to $500,000 in financing with no origination fees, no processing fees and no upfront costs. Customers are able to pay back a loan with a fixed daily or weekly payment, or as a flexible payment calculated as a percentage of credit card sales.

“There will be no hidden costs or unexpected surprises. What customers borrow is what gets funded into their accounts,” said BFS Capital CEO Mark Ruddock. “We are committed to empowering small businesses by meeting their needs with straightforward, cost-effective and timely online financing, whether it be to smooth cash flow, invest in adding staff, purchase equipment or upgrade a space.”

BFS Capital is also preparing to roll out a new, state-of-the-art digital lending platform. Over the next few weeks, the BFSCapital.com website will showcase a refreshed brand and exciting advances in automation across the entire loan application and approval process.

BFS Capital is also preparing to roll out a new, state-of-the-art digital lending platform. Over the next few weeks, the BFSCapital.com website will showcase a refreshed brand and exciting advances in automation across the entire loan application and approval process.

Partners, including Independent Sales Organizations (ISOs) that match small businesses to BFS Capital’s financing solutions, will also benefit from the company’s new no fee product proposition, evolving digital capabilities and dedication to transparency. ISOs and partners will soon have real-time visibility into the status of their leads across the entire customer relationship lifecycle, from the initial application through the life of the loan and beyond.

“As we embark on our mission of reimagining small business financial services, we are reinforcing support for our partners with API integration and faster, fully underwritten personalized offers, all complemented by market-leading pricing and commissions,” Ruddock added.

BFS Capital has over a decade long history of helping small business owners thrive and has provided more than $2 billion in financing. To qualify, businesses must be in operations for at least two years and generate at least $12,000 in monthly revenue. More than 23,000 businesses have been funded by BFS Capital across 400 industries.

To learn more, please visit BFSCapital.com.

About BFS Capital

BFS Capital champions the long-term growth and prosperity of small businesses by providing timely, flexible financing solutions. BFS Capital’s leading small business financing platform leverages customized underwriting and proprietary algorithms to fund businesses in the United States, Canada, and through its United Kingdom subsidiary, Boost Capital. Since 2002, BFS Capital has provided over $2 billion in total financing to over 23,000 small businesses across more than 400 industries. Headquartered in South Florida with offices in New York, California and the United Kingdom, BFS Capital is an accredited BBB company with an A+ rating.

Media Contact

Archie Group for BFS Capital

Gregory Papajohn

gregory@archiegroup.com

917.287.3626

Alan Heide, CFO Of 1 Global Capital, Hit With Criminal Charge & SEC Violations

August 15, 2019

Update: Alan Heide has pleaded guilty to one count of conspiracy to commit securities fraud.

The former CFO of 1 Global Capital, Alan Heide, was stacked with bad news on Thursday. The US Attorney’s Office for the Southern District of Florida lodged criminal charges against him at the same time the Securities & Exchange Commission announced a civil suit for defrauding retail investors.

Heide was criminally charged with conspiracy to commit securities fraud.

According to the criminal complaint:

It was a purpose of the conspiracy for the defendant and his conspirators to use false and fraudulent statements to investors concerning the operation and profitability of 1 Global, so that investors would provide funds to 1 Global, and continue to make false statements to investors thereafter so that investors would not seek to withdraw funds from 1 Global, all so that the conspirators could misappropriate investors’ funds for their personal use and enjoyment.

He is facing a maximum of 5 years in prison.

1 Global Capital CEO Carl Ruderman, who recently consented to judgment with the SEC, has not been charged criminally to-date. However, he is mentioned throughout the pleading against Heide as “Individual #1 who acted as the CEO of 1 Global.”

Civil charges were simultaneously lodged by the SEC.

According to the SEC’s complaint:

Although 1 Global promised investors profits from its short-term merchant cash advances to businesses, the company used substantial investor funds for other purposes, including paying operating expenses and funding Ruderman’s lavish lifestyle. The SEC alleges that Heide, a certified public accountant, for nine months regularly signed investors’ monthly account statements that he knew overstated the value of their accounts and falsely represented that 1 Global had an independent auditor that had endorsed the company’s method of calculating investor returns.

According to an SEC statement, Heide agreed to settle the SEC’s charges as to liability, without admitting or denying the allegations, and agreed to be subject to an injunction, with the court to determine the penalty amount at a later date.

1 Global Capital filed for bankruptcy last year after investigations by the SEC and US Attorney’s Office hampered their ability to raise capital. Ruderman’s recent settlement with the SEC put him on the hook for $50 million to repay investors.

Import/Export SMBs Introduced to Fintech Lending Options

August 2, 2019 Early this week TangoTrade announced its partnership with the online lender Fundation. TangoTrade, which deals primarily in payment assurances for US small business importers and exporters, will now offer alternative financing to SMBs with the help of Fundation.

Early this week TangoTrade announced its partnership with the online lender Fundation. TangoTrade, which deals primarily in payment assurances for US small business importers and exporters, will now offer alternative financing to SMBs with the help of Fundation.

The development is a reaction to the struggles faced by small businesses who engage in global trade. Sam Hayes, Co-founder and President of TangoTrade, said that “If you’re an SMB and a transaction goes south, it causes major problems for cash flow. There’s very little recourse you can have as a small business.”

Explaining that about one-third of all US imports and exports originate from small businesses (roughly 200,000 small businesses import and 300,000 export), Hayes notes that this is a large portion of the American economy that is potentially at risk. Especially when they are being left out to hang by banks whose debit and credit facilities come attached with lengthy approval wait times and complex application processes that are often too inconvenient for SMB owners.

The partnership with Fundation, which is backed by both Goldman-Sachs and SunTrust Bank, will enable TangoTrade to fund SMBs up to $1 million. As mentioned, TangoTrade also offers payment assurance for importers and exporters, which reduces payment risks by managing the entire payment process for both parties involved and offering imbursement via 130 currencies. As well as this, the option to wire funds globally is available through TangoTrade’s partnership with TempusFX.

These services have been centralized by TangoTrade, being made accessible through the business’s site, a decision that is key to the company’s vision of offering services through a platform, Hayes told AltFinanceDaily. “We’ve seen innovations in cross-border payments and global sourcing, but not a whole lot in this particular area,” which is why TangoTrade is pushing to incorporate fintech in their dealings.

And this impetus has attracted attention. With a diverse set of investors ranging from Hard Yaka, which has ties to Square, Ripple, and Twitter; to Village Global, a venture capital network that is backed by Bill Gates, Jeff Bezos, and Mark Zuckerberg, TangoTrade has links to large names. Such diverse connections are mirrored in the company itself, with their team bringing together experience from MasterCard, Payoneer, NASDAQ, and Oracle.

A cabal of tech heads to be sure, Fundation CEO Sam Graziano says that this approach will “enable small businesses to access low-cost capital through an integrated user-friendly digital experience on their platform.”

Expansion Capital Group Names Herk Christie Chief Operating Officer

June 28, 2019 Sioux Falls, SD — Expansion Capital Group ECG) today announced the appointment of Herk Christie from VP of Operations to Chief Operating Officer. Christie will oversee the company’s underwriting, IT, analytics, and merchant support and services departments. Christie, has been with ECG since March 2016 and has played a critical role in the growth of ECG and its many successes.

Sioux Falls, SD — Expansion Capital Group ECG) today announced the appointment of Herk Christie from VP of Operations to Chief Operating Officer. Christie will oversee the company’s underwriting, IT, analytics, and merchant support and services departments. Christie, has been with ECG since March 2016 and has played a critical role in the growth of ECG and its many successes.

ECG, headquartered in Sioux Falls, SD, is a technology-enabled specialty lender that leverages data and analytics to offer customized solutions to small businesses.

Since inception, ECG has connected over 12,000 small businesses nationwide to approximately $350 million in capital. Christie’s appointment comes as ECG continues to see increased growth in its small business lending platform that utilizes technology, data, and analytics to drive user experience and increase access to capital. Christie will lead ECG’s internal operational infrastructure to meet the growing demand for its expanded services.

“ECG continues to put Sioux Falls on the map for financial technology innovation by creating products and solutions that have won the hearts and minds of our customers,” said Christie. “I am incredibly energized to help lead the company to its next phase of innovation and operational excellence as we expand product options to suit the evolving needs of small businesses across America.”

Vincent Ney, CEO of ECG, said, “Herk understands how to create a culture and environment where our hardworking employees have the opportunity to maximize their growth potential within a range of businesses opportunities. Herk’s leadership in our operational strategy has been a key driver in ECG’s growth and success.”

——–

About Expansion Capital Group

Expansion Capital Group (“ECG”) is headquartered in Sioux Falls, SD with an additional office in Wilmington, DE. ECG is a technology-enabled specialty lender that leverages data and analytics to offer customized solutions to small businesses. Since inception in 2013, ECG has provided approximately $350 million in working capital to small businesses throughout the United States. Continued investment in its lead referral partnerships, technology platform, people, and its proprietary risk-based analytics modeling platform has positioned ECG to increase its origination volume by approximately forty percent since 2018. This investment and growth has led ECG to be recently recognized as the 802nd Fastest Growing Private Company in America and the 2nd Fastest in South Dakota by Inc. 5000, as well as the Best FinTech to Work by SourceMedia.

For business inquiries, please contact newpartners@expansioncapitalgroup.com.

For job inquiries, please contact khillberg@expansioncapitalgroup.com.

More

DeBanked: Thanks to ECG, South Dakota is on the Alternative Lending Map

Argus Leader: Here are the South Dakota firms honored on Inc. 5000 list of fastest-growing businesses

Consumer Affairs: Best Business Loan Companies