Online SME lender Capify secures $125 million credit facility from Pollen Street Capital

April 29, 2024Leading online SME lender Capify has today secured a $125 million credit facility from Pollen Street Capital (“Pollen Street”), an alternative asset manager dedicated to investing within financial and business services.

The new facility will support the lender’s ambitious future growth plans and provide working capital to thousands of SMEs over the coming years.

Founded initially in the United States in 2002, Capify was one of the world’s first online alternative financing companies for SMEs. It was launched in the UK and Australia in 2008, against the backdrop of the global financial crisis, when many small and medium-sized businesses were struggling to access vital funding from banks. Last year it was named the UK Credit Awards SME Lender of the Year (up to £1m).

“We are extremely excited about our future relationship with Pollen Street, a capital provider with a proven track record of partnering with impactful and innovative businesses. This deal represents another significant milestone for Capify and underlines the strength of our business model in providing fast, flexible and responsible support to SMEs”, said David Goldin, Founder and CEO of Capify.

“We are absolutely delighted to secure this financing deal with Pollen Street” added John Rozenbroek, CFO/COO at Capify. “The credit facility will enable us to continue on our growth trajectory while offering even more attractive and innovative solutions to the growing number of small businesses in need of funding. We are passionate about the vital role SMEs play in the success of any economy . This new multi-year credit facility allows us to provide much-needed access to capital for SMEs to help them manage and prosper, whilst also enabling us to deliver on our own growth plans”.

“With continued investment in our platforms and customer experience, we will streamline our processes and provide even faster decisions to brokers and SMEs,” said Rozenbroek. “These enhancements underline our commitment to leveraging technology to meet the fast-evolving needs of small businesses, ensuring they have quick access to capital and can seize growth opportunities more effectively.”

“We are impressed by Capify’s seasoned management team and their enduring presence in the market. Since its inception in 2008, Capify has been at the forefront of online SME lending in both the UK and Australia, consistently demonstrating its commitment to the sector. Capify successfully addresses the needs of the underserved market segment, resulting from a chronic undersupply of bank financing, and promotes both financial inclusion as well as regional economic growth, aligning closely to Pollen Street Capital’s ESG framework. We are delighted to partner with Capify and support their ongoing growth” added Ethan Saggu, Investment Director at Pollen Street Capital.

About Capify

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Originally started in the US over twenty years ago, the fintech businesses have been serving the SME market in the UK and Australia for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit:

http://www.capify.co.uk

http://www.capify.com.au

About Pollen Street Capital

Pollen Street is a purpose led and high performing private capital asset manager. Established in 2013, the firm has built deep capability across the financial and business services sector aligned with mega-trends shaping the future of the industry. Pollen Street manages over £4.2bn AUM across private equity and credit strategies on behalf of investors including leading public and corporate pension funds, insurance companies, sovereign wealth funds, endowments and foundations, asset managers, banks, and family offices from around the world. Pollen Street has a team of over 80 professionals with offices in London and the US.

For more information, visit: www.pollenstreetgroup.com

Media enquiries

Capify

Ash Yazdani

Ash.yazdani@capify.co.uk

Pollen Street Capital

PollenStreetCapital-LON@fgsglobal.com

Update on the Kris Roglieri Saga

April 24, 2024 The trustee overseeing Kris Roglieri’s Chapter 11 bankruptcy case asked the Court on Tuesday to convert it to a Chapter 7. That’s because among the facts to come out of that and related proceedings thus far is that Roglieri did not ever maintain financial records for his various business entities, has no revenue coming in, and has no path to keeping his businesses going. The trustee also noted the added complexity of an FBI investigation and that the Receiver in a related civil case believes Roglieri owes creditors more than $100 million, funds that were allegedly derived from a ponzi scheme.

The trustee overseeing Kris Roglieri’s Chapter 11 bankruptcy case asked the Court on Tuesday to convert it to a Chapter 7. That’s because among the facts to come out of that and related proceedings thus far is that Roglieri did not ever maintain financial records for his various business entities, has no revenue coming in, and has no path to keeping his businesses going. The trustee also noted the added complexity of an FBI investigation and that the Receiver in a related civil case believes Roglieri owes creditors more than $100 million, funds that were allegedly derived from a ponzi scheme.

A Chapter 7 is a liquidation. The Court still has to approve it. A Chapter 7 trustee would have added powers that allows them to pursue assets for the benefit of creditors. The assets would be sold off.

Up until at least one month ago, Roglieri’s wholly owned business, the National Alliance of Commercial Loan Brokers conference (NACLB), was still soliciting for sponsorships. However, the ability to purchase tickets was shut off in early April and as of last week the conference website has gone completely offline. Roglieri previously attested that $436,237 was outstanding and due to Caesars Entertainment in Las Vegas for their 2023 conference. The Receiver in the Prime Capital Ventures case has also argued that the NACLB bank account had been the recipient of at least $20,000 in allegedly misappropriated funds and that $200,000 had been withdrawn from the NACLB’s bank account to aid in the present legal defense of Roglieri.

How Merchant Cash Advance Companies Can Avoid Problems This Tax Season

April 2, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies. To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

In the fast-paced and ever changing world of cash advance, tax season can often present a labyrinth of compliance and reporting challenges. These challenges are not just bureaucratic hurdles that must be overcome; they also serve as crucial tests of a company’s financial health and operational integrity. Given the intense scrutiny the cash advance industry faces from regulatory bodies, particularly in light of recent industry shaking events, alongside the unique nature of how its financial transactions can be structured, ensuring tax compliance is not just advisable—it’s essential. Let’s discuss frequent speed bumps cash advance companies encounter during tax season, and some solutions for these problems.

In the fast-paced and ever changing world of cash advance, tax season can often present a labyrinth of compliance and reporting challenges. These challenges are not just bureaucratic hurdles that must be overcome; they also serve as crucial tests of a company’s financial health and operational integrity. Given the intense scrutiny the cash advance industry faces from regulatory bodies, particularly in light of recent industry shaking events, alongside the unique nature of how its financial transactions can be structured, ensuring tax compliance is not just advisable—it’s essential. Let’s discuss frequent speed bumps cash advance companies encounter during tax season, and some solutions for these problems.

Misclassification of Income and Advances

One of the most significant stumbling blocks for cash advance businesses lies in the misclassification of the funds they advance to customers. This misstep can lead to serious tax implications, distorting the financial understanding of a company in the eyes of the law. A robust accounting system that accurately differentiates loans, advances, and income is not just a recommendation; it’s a necessity. Each category must be meticulously reported for tax purposes, a task that underscores the importance of seeking guidance from a tax professional well-versed in the nuances and implications of these classifications.

Misreporting Income

A common oversight among cash advance companies is the inaccurate reporting of income. Whether it’s underreporting or misclassifying earnings, the repercussions can be severe, and include the possibility of triggering an audit or incurring a severe financial penalty. The remedy? An accounting software tailored for the funding industry (such as Orgmeter, MCA-Track, OnyxIQ, Centrex, or LendSaas), capable of automating the calculation and reporting all necessary metrics and income. This ensures not only compliance but also a transparent overview of a company’s financial health that benefits you as well.

State-Specific Tax Obligations

Just over 5 years ago, Wayfair was successfully sued by South Dakota for failing to tax online sales even though they had no physical presence in the state, beginning a new era of legal understanding of state tax obligations in the internet and cross-state trade era.The complexity of tax compliance is magnified for cash advance companies operating across state lines, each with its unique tax laws and regulations. This multi-state maze can easily lead to oversight or misunderstanding, risking non-compliance. The solution is twofold: developing a comprehensive compliance checklist for each state and consulting with tax professionals who specialize in navigating these multi-state operations. Together, these strategies form a bulwark against the many possible blind spots of state-specific tax obligations.

Documentation for Audits

Not having the correct documentation and record-keeping on hand can transform a routine tax audit into a nightmare scenario, and cause businesses to be slapped with heavy penalties and fines. To counter this risk, cash advance companies need to maintain meticulous records of all transactions. Experts often recommend businesses conduct regular audits, whether internal or external, to ensure these records are both accurate and will back you up when they are needed.

Planning for Tax Liabilities

Perhaps one of the easiest mistakes to avoid is not adequately planning for surprise tax liabilities. Without planning in advance and setting aside sufficient funds to cover these obligations, companies can find themselves in a precarious cash flow situation when taxes are due. A proactive strategy to counter that involves specifically marking off a portion of income in a dedicated account for unforeseen expenditures (tax liabilities included), calculated with an estimated effective tax rate. This approach, developed with the assistance of a tax professional, can prevent the unwelcome surprise of a hefty tax bill when you’re not ready for it.

At the end of the day, tax compliance, while definitely not fun, should not be viewed (just) as a regulatory pain-in-the-butt, but as a way to ensure a cash advance business’s success and longevity. By embracing proactive tax planning and compliance, companies can not only successfully navigate the complexities of tax season but also reinforce the integrity and sustainability of their business and ensure their success and viability for years to come, free from any stress or government microscope.

Capify Announces New Growth Phase with Global Marketing Director Appointment

April 2, 2024Leading online SME lender, Capify, has appointed Ash Yazdani to oversee its marketing and customer experience functions in both the UK and Australia.

Yazdani joins from Stockholm-based Hoist Finance, where he spent four years as Global Head of Marketing, Product and Customer Experience.

Having worked previously for two of the largest global media networks WPP and Dentsu Aegis, Yazdani made the move into financial services with Think Money Group, before joining Hoist.

“To be joining Capify at this stage of its growth journey is a massively exciting opportunity,” said Yazdani.

“This is a hugely ambitious business, with an innovative vision to improve access to SME finance for under-supplied areas of the UK and Australian economy. My experience in reaching new segments, developing propositions that meet their needs, and delivering seamless end-to-end customer experience will help us on our mission to do that”.

Capify was launched in the UK and Australia in 2008, against the backdrop of the global financial crisis, when many small and medium-sized businesses were struggling to access funding from banks. Last year it was named the UK Credit Awards SME Lender of the Year (up to £1m). Founded initially in the United States in 2002, it was one of the world’s first online alternative financing companies for SMEs.

Yazdani’s appointment is the latest in a series of high-profile hires made by the alternative lender. Earlier this year, Mike Morris moved from Funding Circle to lead Capify’s advisor and introducer network in the UK.

John Rozenbroek, COO/CFO at Capify, said: “We’re absolutely delighted to welcome Ash to our growing team. In these volatile trading times, the funding needs of business changes fast. Having someone with Ash’s experience will enable us to ensure that SMEs know about – and understand – our funding options.”

“As we scale, he will also help ensure our customer touch points are efficiently optimised to continue to deliver an excellent customer experience. His appointment underlines our commitment to our UK and Australian SME market and represents a further milestone in Capify’s continued growth.”

About Capify

Capify is an online lender that provides flexible financing solutions to SMEs seeking working capital to sustain or grow their business. Originally started in the US over twenty years ago, the fintech businesses have been serving the SME market in the UK and Australia for over 15 years. In that time, it has provided finance to thousands of businesses, ensuring the vibrant and vital SME community can meet the challenges of today and the opportunities of tomorrow.

For more details about Capify, visit:

http://www.capify.co.uk

http://www.capify.com.au

Media enquiries

Sam Gallagher, Director

LendSaaS Partners with Actum Processing to Pioneer Real-Time Payments in MCA Sector

March 28, 2024In an industry-first initiative, LendSaaS, the premier Merchant Cash Advance (MCA) origination and servicing platform, is thrilled to announce its integrated partnership with Actum Processing, a leader in ACH and real-time payment processing.

Innovative Integration for Instant Merchant Funding

LendSaaS has integrated Actum’s cutting-edge RTP technology, positioning itself as the first platform in the MCA space to offer instant funding solutions to lenders. This transformative feature enables MCA lenders on the LendSaaS platform to instantly transfer funds to their merchants 24/7/365, streamlining the funding process and significantly reducing the transaction costs associated with traditional wire transfers.

Revolutionizing MCA Funding

With the integration of Actum’s RTP capabilities, LendSaaS is setting a new standard in the MCA industry. Lenders can now enjoy the dual benefits of immediate fund disbursement and cost savings, providing their merchants with unparalleled financial support and operational efficiency.

Commitment to Excellence

Both LendSaaS and Actum are committed to leveraging technology to enhance the lending experience. This partnership reflects their dedication to innovation, security, and customer satisfaction, ensuring that MCA lenders and their clients receive the best service possible.

About LendSaaS

LendSaaS is a leading software solution in the MCA industry, known for its comprehensive suite of tools designed to streamline and optimize the lending process. From origination to servicing, LendSaaS provides lenders with the technology they need to succeed in a competitive market.

About Actum

Actum is at the forefront of payment processing solutions, offering secure and efficient ACH and RTP services. With a focus on innovation and reliability, Actum empowers businesses across various sectors to maximize their payment strategies.

Contact LendSaaS and Actum processing to learn more about this partnership and the benefits of real-time payments in the MCA sector.

LendSaaS / sales@lendsaas.com / (888) 369-5376

Actum Processing / sales@actumprocessing.com / (800) 975-5640

Nerdwallet Generated $101M in Revenue from SMB Products in 2023

March 10, 2024 Nerdwallet, a financial service shopping site, generated $101.2M in revenue across 2023 from SMB loans, business credit cards, and other financial products & services, according to the company’s latest earnings report. That was an increase of 11% over the previous year.

Nerdwallet, a financial service shopping site, generated $101.2M in revenue across 2023 from SMB loans, business credit cards, and other financial products & services, according to the company’s latest earnings report. That was an increase of 11% over the previous year.

Nerdwallet said that it has been seeing “positive momentum” for SMB products.

“As we look to the rest of the year, we expect to return to double-digit revenue growth during the second half, given recent recovery in SMB products and insurance,” said Nerdwallet CEO Tim Chen.

Nerdwallet had 14 million registered users as of December 31, 2023, which creates a strong base to generate revenue.

“Critical to our aspiration of delivering consumers and SMBs with a trusted financial ecosystem is our ability to register and engage users – in turn allowing us to drive repeat visits, collect data and provide users with unique insights via nudges,” the company said. “We are focused on growing the traffic and engagement on our platform, as well as increasing our number of registered users, who have a lifetime revenue value five times greater than our non-registered users and more than twice the transactions and sessions, on average.”

Cash (Basis) is King

March 1, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies. To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

Tax season is upon us, and it’s the worst.

Tax season is upon us, and it’s the worst.

Aside from wading through scores of financial documents and dealing with a million questions, it’s a fact that our government is purposely opaque in how it accounts for the tax dollars they take from business owners, and simply don’t know what it’s like to actually have a job that doesn’t involve overegulating others. On top of that, the merchant cash advance space is a difficult one to define and operate in for its different categories of advances and investors. As a result of all this, tax season can be complicated and difficult.

It’s for this reason that Better Accounting Solutions services many cash advance businesses- so let me explain what we do and why to make it easier for our clients, and-hopefully- easier for you as well.

Loans are easy to account for: there is simply the principal amount and interest. By contrast, cash advances involve the purchase of future receivables with different metrics, durations and structures for how it is paid.

Because of this, Better Accounting Solutions are big proponents of the cash basis accounting method (if a business makes less than $10 million in actual annual revenue): only recognizing the income when it is received, instead of when the transactions are made but before any money is actually seen.

To explain the concept, consider this example we’ve used before:

A merchant cash advance provider funds a merchant with $100,000 at a commission expense of 12% and a Closing Fee income of 10%. The bank fee income and RTR/Factor Rate is .5, while the merchant will pay back $150,000, $1,500 daily assuming a 100 day duration.

In terms of handling the books, we’d recommend recognizing the commission expense and closing fee income immediately (in most scenarios) on the day the advance is given, deducted from the funded amount.

But with the factor income, no additional income would be recognized until the full contract funded amount of $100,000 is received in the funder’s bank account (not just the amount wired). Once the contract amount is fully received on a cash basis, any payments received after that point constitute factor income or RTR income.

We recommend recognizing income and filing this way because, simply by reporting on a cash basis, you are deferring the recognized tax income.

This means that for all the deals in the process of being paid by the time the financial year is over do not need to be recognized for tax purposes until the next year when the full amount is back in your account, thereby deferring your tax liabilities.This means you have more time to spend that money and grow your actual business, which is obviously the reason we all do what we do.

When done simply, without over bureaucratic machinations, and with professional assistance, taxes don’t have to be a painful and difficult experience, and can even be a boon to your cash flow when done right. Make 2024 the year you show Uncle Sam you know your way around the tax system, no matter what they throw at you.

It’s essential to emphasize that this article is for informational purposes only and should not be construed as personal accounting or financial advice. It’s strongly recommended for funders and companies to seek guidance from qualified accountants or financial professionals to ensure compliance with accounting standards and tax regulations tailored to their specific circumstances.

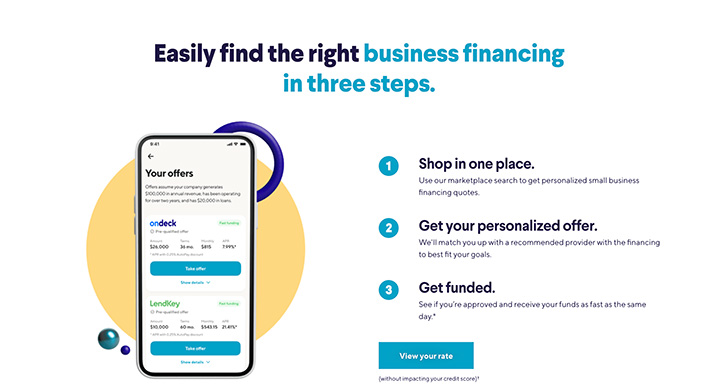

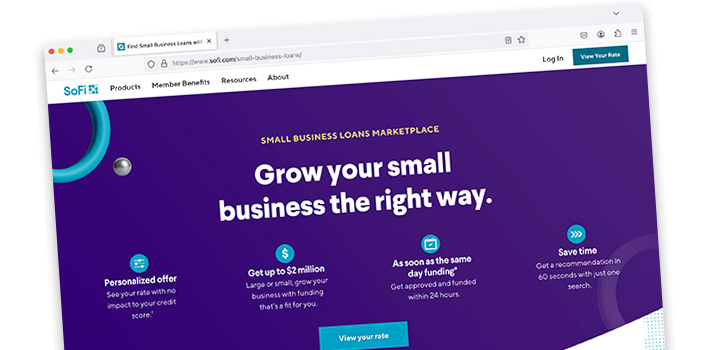

SoFi Launches Small Business Loan Marketplace

January 18, 2024 SoFi small business customers can now get approved for a loan and funded up to $2 million in 24 hours. Structured as a marketplace where SoFi itself is not the lender, the company announced that “With one quick and simple search, business owners will be connected with SoFi’s network of financial providers who can help them get the capital they need.”

SoFi small business customers can now get approved for a loan and funded up to $2 million in 24 hours. Structured as a marketplace where SoFi itself is not the lender, the company announced that “With one quick and simple search, business owners will be connected with SoFi’s network of financial providers who can help them get the capital they need.”

SoFi had flirted with the idea of small business loans previously and this appears to be their solution.

Judging by SoFi’s marketplace home page, OnDeck and LendKey are at least two of the lenders on the platform. Although the others were not immediately visible, the company said it “will continue to expand its network to include more providers and financial solutions for small businesses.”