Industry Takes ALS Ice Bucket Challenge

August 24, 2014Have you been nominated to take the ALS ice bucket challenge yet?

Kabbage below:

Their video made the local Atlanta news.

OnDeck in Times Square NYC:

Noah Breslow, their CEO also did it:

Funding Circle:

PayPal

Coincidentally, in the industry’s 2012 fantasy football competition for charity, league winner Sure Payment Solutions chose to donate all funds raises ($7,100) to the ALS Association.

Whether you get nominated or not, you can donate at http://www.alsa.org/.

Feel free to tweet @financeguy74 if you or your company accepted the challenge. 🙂

Centrex Software Announces New Relationship Building Technology at Broker Fair 2021

December 22, 2021Costa Mesa, CA— Finance technology (FinTech) in the traditional and alternative business finance industry is seeing a massive enhancement with the release of new technology from Centrex Software.

Centrex Software, a dedicated business lending CRM and loan/advance servicing software platform that brings multiple technologies all under one roof for direct funders, brokers, and investors, experienced 22% growth from 2019 to 2020 and 35% growth from 2020 to 2021, during a global pandemic. With that growth has come quite a bit of new thinking out of the Centrex Software management team.

When it comes to the business lending space, FinTech companies spend huge amounts of time focused on how to drive more users into their software. This strategy makes sense as it is what a large operating software company is required to focus on to generate revenue. “But what about our customers’ customers? What if we spent more time focused on driving our customers’ customers not to our software, but to our customers’ software? In our business, we fail if our customers can’t engage, retain, and sell to their customers. We want that relationship to thrive and grow so we have built technology to aid that,” says Trey Markel, Senior Software Specialist with Centrex.

In realizing there was a tech need for this new way of thinking, Centrex Software built a mobile app that is white labeled to Centrex Software customers so they can offer more relationship retaining and building solutions to their customers. Keith Nason, President at Velocity Funding Group, and a Centrex Software customer, explains, “Trey, Michael and the Centrex team are going to put my brand in the pockets of every single one of my customers. It was an entirely new strategy that you simply don’t see from other software companies, and it should create customer engagement like we have never seen before.” The new white labeled mobile app has a few features that will really put your marketing hat on. First, the white labeled app is fully integrated with Plaid so that pre- and post-funding, Centrex clients can actually link their banks accounts and manage their finances. On top of that, Centrex Software has an admin portal where Centrex clients can manage all their app users. One of the best parts is that, in the admin portal, Centrex clients will have the ability to send push notifications to smart watches and to mobile devices that can communicate to the end mobile app user. Plus, there are several other features that keep mobile app users engaged with Centrex clients and the broker partner via the mobile app.

In the same spirit of engaging more efficiently with customers, the Centrex team also built a WordPress plugin that allows its customers to build “Smart Applications” right on their website. Michael Lindsey, also a Senior Software Specialist with Centrex expressed, “Our clients need more tools that are forward facing to their customers to help make faster decisions and offer a better more automated experience.” Taking the automated application process a bit further, Centrex integrated the WordPress plugin with Universal Credit Services to pull and analyze credit data, and Plaid to pull and analyze financial data. This allows Centrex Software customers to automatically underwrite and create offers right on their website. The WordPress plugin will communicate all info and decisions into Centrex Software during each step of the process. Lastly, for those Centrex Software customers using both the WordPress plugin and the white labeled mobile app, once an application is completed by the business borrower on a Centrex Software customers website, it will automatically create a user for the mobile app in real-time. The end result is a completely seamless and streamlined business borrowing experience.

Perhaps the most impressive part of the two new technologies being released by Centrex Software on January 1st of 2022, is that in order to take advantage of the new tech, you don’t even need to be a Centrex Software CRM customer. “We understand that the Centrex CRM is only one option for funders and ISO’s out there. We also understand that there is much more than just CRM that is needed to build a successful finance business. Because of that, we built the WordPress plugin and the mobile app in an API based architecture so that any finance company using any CRM with an API can utilize the new Centrex technology. We wanted to capture more of the market with unique FinTech solutions, offering CRM alone can only get us a to a certain point.” says Trey Markel.

Needless to say, Centrex Software has really stepped it up as a full circle FinTech solution provider to the finance industry. Centrex Software will also be launching its new open REST API and amortization calculators in the new year to expand their tech offering. You can reach Centrex Software at www.centrexsoftware.com or email media@centrexsoftware.com

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist. Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.  Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a

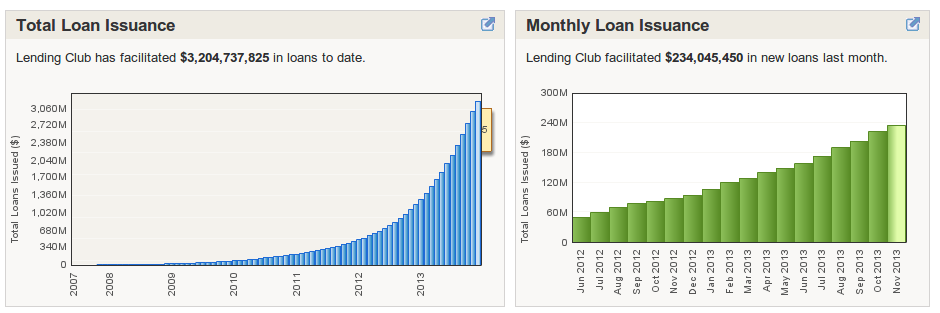

In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a  In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.