Prosper Marketplace Originated $450M in Loans in Q2, Posted $5.8M Net Loss

August 31, 2021 Prosper Marketplace originated $450M worth of loans in Q2, according to the company’s latest financial disclosures. While the company is not publicly traded, it is required to file quarterly reports because of its note platform for retail investors. Only 13% of their loans were funded through that channel for the quarter, while the rest went through the Whole Loan Channel. Technically, the loans are funded through WebBank and Prosper earns a transaction fee from WebBank for facilitating them.

Prosper Marketplace originated $450M worth of loans in Q2, according to the company’s latest financial disclosures. While the company is not publicly traded, it is required to file quarterly reports because of its note platform for retail investors. Only 13% of their loans were funded through that channel for the quarter, while the rest went through the Whole Loan Channel. Technically, the loans are funded through WebBank and Prosper earns a transaction fee from WebBank for facilitating them.

The company also generated a net loss of $5.8M on $34.7M of net revenue, an improvement over the $44M net loss last quarter. In fairness, Q1’s whopping loss was entirely attributed to a “Change in Fair Value of Convertible Preferred Stock Warrants” which generated a $44.4M expense.

Prosper’s surviving note platform is unique. Company rival LendingClub, for example, wound its note platform down when it acquired Radius Bank.

New York’s New Governor

August 10, 2021Now that Governor Cuomo is leaving office early, the Lieutenant Governor, Kathleen Hochul, will become his replacement. This detail is relevant given that New York’s landmark legislation (SB 5470) for the small business finance industry is slated to go into effect on January 1st.

Hochul served as Erie County Clerk and as a member of Congress. She’s also long been an advocate of small business.

While running on Cuomo’s ticket in 2018 for Lieutenant Governor, she criticized her opponent in a controversial campaign ad by saying that he couldn’t be trusted to manage the state budget because he had defaulted on a small business loan.

SB 5470 is expected to be so restrictive, that at least one small business finance provider has already fled the state.

The Small Business Finance Industry is BACK

June 21, 2021 The industry is back. I say this while sitting in a Miami hotel, my third such trip to Florida since becoming fully vaccinated against Covid in May.

The industry is back. I say this while sitting in a Miami hotel, my third such trip to Florida since becoming fully vaccinated against Covid in May.

There’s a lot of action going on. I’ve sat down in multiple broker shops in both New York and Florida and the phones are ringing off the hook.

The demographic of the average customer in the post-covid recovery seems to vary. Some say the credit quality has gotten better, others have said it’s worse. Some merchants have become used to forgiveable loans and low APR financing while others appear willing to take capital at any price just to keep up with the pace of their growth. It’s one of those things where everyone is just trying to adjust to the new normal, even if there’s little consensus as to what that is.

In New York City, the return of packed bars and overflowing restaurants stands in stark contrast to the rows of abandoned stores and For Lease signs that dot the landscapes around them. And yet if one looks past all that, the only reminder that Covid was ever even there is the requirement that one still wear a mask on the subway even if they’re vaccinated.

In Florida, it’s the opposite. I recently got yelled at by a bus driver for wearing a mask in the first place.

The broker shops I’ve visited still had office space that were filled with teams that were more than happy to be occupying them in person. But at the same time, the industry has become extremely popular with the traditional work-from-home crowd.

Leo Kanell’s 7-day marathon challenge on facebook draws in more eager industry participants than I would’ve ever thought possible, an accomplishment I know to be true because I dropped in on him unannounced late one friday night while he was live.

Similarly, Oz Konar, who I did a livestream interview with in person, has trained more than 3,000 brokers in the industry, many who work for themselves from home.

We’ve also been very busy in the last couple months and have met a lot of brand new entrants on both the funding and broker side.

All this activity is setting the stage well for Broker Fair 2021 on December 6 in New York City. It is perfectly timed to discuss the new disclosure law that goes into effect in New York on Jan 1, 2022, one that is so consequential that at least one company has relocated to New Jersey.

What a time to be in the industry!

Yellowstone Capital, FTC Lawsuit Results in Settlement

April 22, 2021 The lawsuit filed by the FTC against Yellowstone Capital et al has resulted in a settlement. The defendants agreed to pay $9,837,000 for the matter to be resolved.

The lawsuit filed by the FTC against Yellowstone Capital et al has resulted in a settlement. The defendants agreed to pay $9,837,000 for the matter to be resolved.

As part of it, the defendants did not admit or deny the allegations of the complaint. They also agreed to have the FTC monitor their compliance with the agreement for varying but long periods of time.

Aside from the cost, the FTC made its point in two areas, the requirement that the defendants comply with a specific system of customer disclosure and that they not debit or cause withdrawals to be made from any customer’s bank account without the customer’s express informed consent. On the former, they must (roughly speaking) disclose clearly and conspicuously the amount and timing of any fees, the specific amount a customer will receive at the time of funding, and the total amount customers will repay.

The announcement coincides with the Supreme Court decision that revoked the agency’s presumed authority to obtain restitution or disgorgement under Section 13(b), the basis that the FTC brought against Yellowstone Capital in August 2020.

The FTC signed and filed the agreement less than 24 hours before the SCOTUS decision.

Steve Denis, SBFA on Why Maryland MCA Bill Failed

March 22, 2021 “In a lot of these places, a lot of the bills are well intended, believe it or not,” Steve Denis, executive director of the Small Business Finance Association, said. “Legislators just don’t understand enough about our industry to understand the nuances. We’ve worked really hard educating policymakers in Maryland, and frankly, they now understand our industry better.”

“In a lot of these places, a lot of the bills are well intended, believe it or not,” Steve Denis, executive director of the Small Business Finance Association, said. “Legislators just don’t understand enough about our industry to understand the nuances. We’ve worked really hard educating policymakers in Maryland, and frankly, they now understand our industry better.”

Denis was referring to the nearly unanimous canning of Maryland’s MCA “Prohibition” bill last week. The bill failed to get enough support to leave the committee, blocked by a 19 to 3 vote against bringing the law out to the House floor. Denis, a proponent of the MCA and alt financing industry for years, said it was due to legislators understanding the need for capital “out there during the pandemic” and how harmful an APR cap could be for both business owners and the broker industry.

The law was originally proposed last year before covid shutdowns, but that also failed to make it to the floor. It now appears to be an annual event.

“Our goal as an organization is to make sure that small businesses have access to all different types of financial products and that we believe that small businesses are in the best position to make good decisions for their businesses,” Denis said. “The bill in Maryland narrowly targeted MCA products, and as you know and a lot of folks in the industry know, that sometimes MCA is in the best interest of the business, there’s a lot of benefits to an MCA.”

Denis punctuated his statement with the mantra- we were not out of the woods yet. An APR disclosure bill was just introduced in the Connecticut State Senate last month, modeled off the New York APR bill set to go into effect this year. Denis was hopeful the legislators could learn from speaking to industry interests and change their course like in Maryland.

“We are engaged, I think we’re in a good spot. With any of these bills, Maryland, Connecticut, I caution you know we’re not out of the woods yet,” Denis said. “We still want to work really closely with policymakers. We’re for meaningful disclosure, we think there needs to be some guardrails on our industry, but I think that the most important thing we can do is continue to educate folks in states.”

Maryland’s Latest Merchant Cash Advance Prohibition Bill Failed to Advance

March 18, 2021 Despite the rapid advancement of the newest merchant cash advance prohibition bill in the Maryland state legislature, the bill failed to jump over the final hurdle in a House Committee hearing on Thursday. Delegate Seth Howard (R), who introduced the bill, vigorously advocated for it to move forward so that it could proceed to the Floor, going so far as to say he was willing to make some concessions to at least get “the regulatory structure” of the bill into law.

Despite the rapid advancement of the newest merchant cash advance prohibition bill in the Maryland state legislature, the bill failed to jump over the final hurdle in a House Committee hearing on Thursday. Delegate Seth Howard (R), who introduced the bill, vigorously advocated for it to move forward so that it could proceed to the Floor, going so far as to say he was willing to make some concessions to at least get “the regulatory structure” of the bill into law.

“I don’t want to snatch defeat from the jaws of victory,” he maintained.

There were several amendments up for consideration, including the inclusion or removal of a 24% APR rate cap on MCA transactions. The subject of APR dominated the light Q&A that took place, but one delegate voiced concern that creating restrictions on capital providers to businesses that might not be able to obtain funding elsewhere would probably be counterproductive. And when a roll call of votes was taken to determine if the Bill should advance to the Floor, he voted no, as did nineteen of his colleagues. Only three voted yes, so the bill did not advance, ending its prospects for the 2021 legislative session. However, it could be reintroduced again in 2022.

Committee Vice-Chair Kathleen Dumais (D) said that she thought the bill “was not ready” despite Delegate Howard “having worked hard on it.” This was Howard’s second try in two years to move it forward. His first attempt, introduced on February 7, 2020, was called the Merchant Cash Advance Prohibition Bill. The more recent one dropped the “prohibition” label but used language that would have effectively prohibited them in the state of Maryland.

ODX Merges with Fundation

February 25, 2021 The ODX brand from OnDeck is splitting off to combine with Fundation, forming a new SMB digital banking company called Linear Financial Technologies.

The ODX brand from OnDeck is splitting off to combine with Fundation, forming a new SMB digital banking company called Linear Financial Technologies.

The news follows the recent disclosure from Enova that it was looking to divest ODX in addition to OnDeck Canada and OnDeck Australia.

The new firm, headed by the current CEO of Fundation, Sam Graziano, will be an online banking service provider. Linear will take on Fundation’s service of processing loans for big and small banks, reportedly processing a total of $13 billion.

“Over the years, our combined platforms have served hundreds of thousands of business customers through many of the leading business banking providers in the market, deploying modern banking experiences that their customers and front-line colleagues expect in the digital era,” said Graziano in the published announcement. “Together as Linear, we’ll have the resources to more rapidly expand the breadth of our solutions to bring more value to our clients.”

Enova will retain a minority stake in the new firm.

Game Stopped? Short Selling, Social Media, and Retail Investors Collided in House Hearing

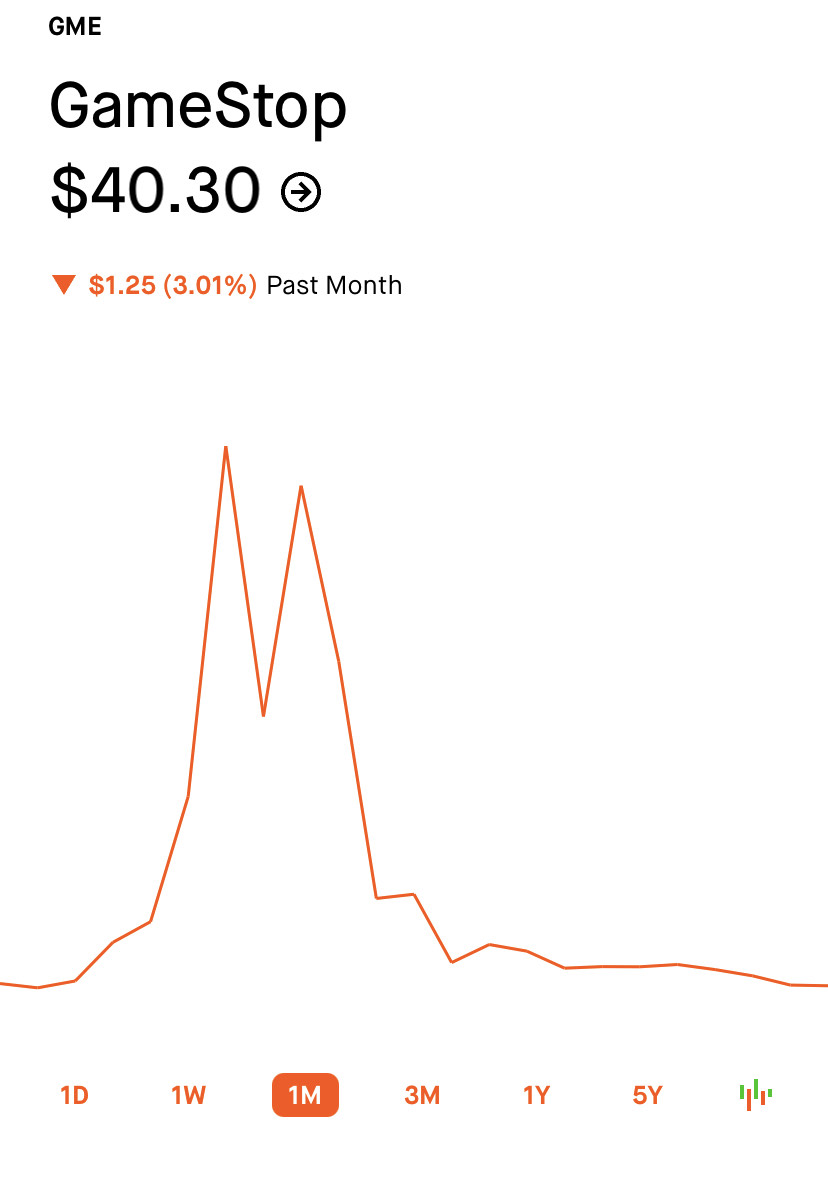

February 21, 2021 Nearly a month after the GameStop (GME) stock price shot halfway to the moon, the House Committee on Financial Services gathered representatives from the trading conflict in a hearing to examine what happened.

Nearly a month after the GameStop (GME) stock price shot halfway to the moon, the House Committee on Financial Services gathered representatives from the trading conflict in a hearing to examine what happened.

The focus was on a struggle between big institutional money and retail, everyday investors. Armed with nothing but zero-commission investment apps, government stimulus, and with nothing to do but sit at home waiting for a pandemic to end, retail traders exploded onto the securities markets. One of the results was a dramatic rise and fall of GME at the end of January.

Vlad Tenev, the Robinhood app’s co-founder, faced the highest number of questions after the firm blocked trading of GME on January 28th. Across the videocall-octagon was Keith Gill, a r/WallStreetBets retail investor long on GME since the summer, known by some as u/DeepFuckingValue.

With his signature headband hanging in the background, sitting in a gaming chair, Gill donned an uncharacteristic suit and tie while representing himself as a stand-in for the millions of retail investors who were along for the ride.

His message: he is no expert, is not responsible for the volatility of a multi-billion dollar securities market, and after everything, he still likes the stock.

“I support retail investors right to invest in what they want when they want to,” Gill said. “I do not have clients, and I do not provide personalized investment advice for fees or commissions. I am an individual investor.”

Gill went on in his testimony to state that his posts and video appearances about GME to other investors were not trading advice and no different than talking in a bar about a stock he liked.

Before the run-up of GME, Gill had a small audience of around 500 viewers. After GME started gaining ground, Gills’s online popularity exploded alongside the Reddit stock betting forum r/WallStreetBets.

Gill gained hundreds of thousands of followers, while WSB saw a rise of 8 million members in just one week. In the end, his positions in the stock earned him $22 million, as he shared with his extended family over the holidays, “we’re millionaires.” Many were not as lucky, and some have looked toward social influencers like Gill as speculators and market manipulators.

The Congressional Committee were light on their interrogation of Gill, acknowledging the importance of protecting retail investor rights. In challenging Tenev of Robinhood, Committee Chairwoman Maxine Waters set the tone, stating: “The market volatility around GameStop has highlighted how many people believe the cards are stacked against them.”

Waters asked numerous yes or no questions to Robinhood’s Tenev, who could only respond with drawn-out statements. Overall, the fintech founder was apologetic but still insisted Robinhood did nothing wrong and does not answer to hedge funds.

“Look, I’m sorry for what happened, and I apologize. I’m not going to say Robinhood hasn’t made mistakes in the past,” Tenev said. “We’re going to learn from this and make sure it doesn’t make the same mistake in the future.”

At the height of the trading frenzy Thursday, January 28th, Robinhood suddenly restricted the purchase of GME and other “meme” stocks and only allowed selling. Demand plummeted because, despite problems in the past, Robinhood is still a favorite in the r/WallStreetBets community. Prices roller coasted downward. From a high of $468/share, the GME price dropped down to trading in the $40 range in the month that followed.

Tenev was explaining his financial responsibilities to clearinghouses as a brokerage firm.

On the morning of January 28th, Robinhood suddenly received an email from a subsidiary of the DTCC, holder of all U.S. traded securities. It asked for an increase of $3 billion to ensure Robinhood could back the explosion of GME trading, an astronomical price. Robinhood complied by shutting down buying, offering sell-only, bringing the insurance price down to more than $700 million. The firm also reached out to existing investors to raise billions in capital, yet Tenev still insists there was never a liquidity problem.

Representing traditional, “smart money” investors was Ken Griffin of Chicago hedge-fund Citadel LLC and market-maker Citadel Securities, known for its short-selling positions. Alongside was Gabe Plotkin, the founder of Melvin Capital, a hedge fund with many short positions in GME, lost $6 billion in just 20 trading days. During the crazy trading week, Melvin was offered $2.7 billion in new investment from Citidel funds after losing 30% of its value.

Citadel is also a prime market maker for Robinhood, completing many of the app’s trades. Some, including those house members lobbing questions, saw a firm that self describes its mission as “to democratize investing,” cut out the poor and give to the rich. It looked like a collaboration between a major investor making up for losses due to app trading while retail investors were left out.

Chair member Blaine Luetkemeyer, a Republican from Missouri, expressed his concern that GME had been an over shorted stock and that “naked shorting” drove the price down.

“You have stated in your testimony that you had no intention of manipulating the stock,” he said. “If you’re short selling your stock 140%, for me from the outside, that looks like what you’re doing.”

Both Citidel and Melvin Capital representatives said there was no collusion to drive the price down, no over shorting, and no buy-out when the short positions failed.

The end of Gills’ testimony, read in front of a “hang in there” cat poster summed up the hearing well.

“It’s alarming how little we know about the inner-workings of the market, and I am thankful that this Committee is examining what happened,” He wrote. “I’m as bullish as I’ve ever been on a potential turnaround. In short, I like the stock.”