Should Alternative Lenders Be Regulated? (Video)

November 4, 2015Funding Circle’s Sam Hodges went back on Bloomberg TV to answer questions about the rise of marketplace lending. On the subject of regulation, Hodges explains that their business model is already pretty heavily regulated.

Meanwhile, David Stockman, a former US Congressman and former director of the Office of Management and Budget, said the regulators should stay away from alternative lenders. Video below:

Alternative Lenders Are Waiting for a Shakeout

October 28, 2015 Back in April at the LendIt conference in New York, the big consensus was that not all underwriting was created equal and therefore several players wouldn’t survive long enough to make it back to LendIt in 2016. Six months later at Money2020 and so far everyone is still standing.

Back in April at the LendIt conference in New York, the big consensus was that not all underwriting was created equal and therefore several players wouldn’t survive long enough to make it back to LendIt in 2016. Six months later at Money2020 and so far everyone is still standing.

Loan terms are getting longer, rates cheaper and the cost to acquire borrowers higher. Somebody has to be feeling the pressure but in a rather benign economic and regulatory environment, it’s clear skies.

Valuations are soaring. SoFi is valued at more than $4 billion and Kabbage at more than $1 billion.

But Robert Greifeld, the CEO of Nasdaq warned attendees about the validity of private market valuations. “A unicorn valuation in private markets could be from just two people,” he said. “whereas public markets could be 200,000 people.” At best he described a private market valuation as being just a rough indicator.

And some wonder if these valuations are based on just scale, rather than the ability to underwrite more intelligently and efficiently than a bank. OnDeck for example, had a Compound Annual Growth Rate (CAGR) in originations of 159% from 2012-2014 when the average originations CAGR for their peers is currently 56%. But OnDeck has the advantage of time. With nearly a decade of data under their belt, they’ve been able to see what works and what doesn’t.

“You have to have enough bad loans to build a good credit model,” said OnDeck CEO Noah Breslow during a Money2020 panel discussion.

For Aaron Vermut, CEO of Prosper, getting their company to the next level was about having access to institutional capital. As a marketplace, and as a company that almost died several years ago, he pointed out, institutional money was the inflection point for them to grow. The peer-to-peer model that actually depended purely on “peers” is what held their company back.

One thing several lenders seemed to agree on was the limited applicability of FICO. FICO is not the thing to use for a small business loan, said Sam Hodges, Managing Director and Co-founder of Funding Circle. His words didn’t come as a surprise since credit scores are generally the domain of consumer lending.

But doubts about FICO’s ability to predict performance didn’t just come from the commercial finance side. Prosper’s Vermut explained that consumers still think their FICO score is the most important factor in the rate they get. So even though they’ve got a system to predict repayment outside of FICO, they’re kind of forced to incorporate it because consumers are being educated to believe that’s what matters most.

The irony was not lost that as Vermut said that on a panel, he was seated next to Kenneth Lin, the CEO and founder of Credit Karma, a company that educates consumers about credit. “A credit score is one of the most important components of a consumer’s financial profile,” says Credit Karma’s website. Such language puts a tech-based lender with their own scoring model perhaps at odds with what their own prospects believe.

For instance if a potential borrower with a 750 FICO score is offered a high interest rate because the lender’s advanced and more in-depth underwriting determined them to be high risk, they’re going to walk away confused.

That of course begs the question, who needs to change? Those educating consumers about credit scores or the lenders who are moving away from them?

Before educational services shift though, it would probably make sense if the lenders can prove that their non-FICO dependent systems will work in the long run. And the sentiment among many lenders is that there are plenty of flawed models out there that will inevitably fail. That makes a shakeout not just a matter of if, but when.

Six months after LendIt, everybody is still standing. Whispers from in and around Money2020’s halls and exhibit floor revealed that the confident lenders wish the correction would happen sooner rather than later but that they are prepared to wait however long it takes.

Right now, confidence about the future on the commercial finance side came in at an 83.7 out of 100, according to the Small Business Financing Report. While there are no other points of reference to compare that to, industry captains are generally very bullish.

That could mean that for those secretly under tremendous pressure already, you could be left waiting for a shakeout for a very long time.

Sam Hodges on Fox Business

September 30, 2015Funding Circle’s Sam Hodges appeared on Fox Business on Monday, September 28th. One of the things he said is that loans under $1 million are still out of reach for most small businesses.

He also mentioned that his company has the lowest loss level of any digital small business lender anywhere in the world.

Details about Funding Circle disclosed:

- $1 billion lent to more than 10,000 businesses

- 40,000 investors globally

- $25,000 to $500,000 small business loans

Watch the full video below:

Alternative Fintech Pioneer Merchant Cash and Capital Transforms into Bizfi

September 15, 2015NEW YORK–(BUSINESS WIRE)–Merchant Cash and Capital, one of the pioneers in the alternative finance space, announced today that MCC has transformed into Bizfi, an online lending and aggregation platform. Due to the success of Bizfi.com, launched earlier this year, Merchant Cash and Capital is completing its operational and brand metamorphosis in a way that better reflects the Company’s commitment to financial technology. The name change is a consideration of the Company’s rapid growth – in the second quarter of 2015 alone, the Company provided $115 million to more than 3,000 small business owners – as well as its online expansion.

Bizfi’s aggregation platform provides small businesses access to products from more than 35 funding partners including OnDeck, Funding Circle, CAN Capital, IMCA, Bluevine, Kabbage, and SBA lender SmartBiz. Bizfi, which is also a direct lender on the platform, can finance a small business owner in as little as 24 hours. It is the only funding platform that allows a business owner to go directly to contract online.

“Since the launch of Bizfi.com, we have received an overwhelming response from both business owners and funding partners,” said Stephen Sheinbaum, Founder of Bizfi. Bizfi and its family of companies over the past two years has doubled originations to fund more than 25,000 small businesses totaling $1.3 billion. Sheinbaum continued, “Bizfi stands at the nexus of alternative finance and financial technology. With Merchant Cash and Capital becoming Bizfi, we will provide fast and unparalleled funding options to businesses across all types of sectors in the United States and internationally.”

With 80 percent of small business owners today turning online to search for financing, and 66 percent making loan applications after traditional banking hours, Bizfi is positioned to be the leader in the future of small business financing. Bizfi offers a range of funding options including short-term funding, medium term-loans, SBA loans, equipment financing, invoice financing, medical financing, lines of credit, and franchise financing.

Mr. Sheinbaum concluded, “The marketplace for business funding has changed dramatically throughout the ten years that we have been in the industry. We are continuing to grow, adapt and combine our deep expertise with cutting-edge technology to meet the needs of small business owners around the country.”

About Bizfi

Bizfi.com is the premier alternative finance company combining both aggregation and funding on one platform with proprietary technology and unmatched customer service. Bizfi’s connected marketplace instantly provides multiple funding options to businesses with a wide variety of funding partners and real-time approvals. Bizfi.com’s funding options include short-term financing, franchise funding, equipment financing and invoice financing, medium-term loans and long-term loans guaranteed by the U.S. Small Business Administration. A process that once took hours, now takes minutes.

Formerly Merchant Cash and Capital, Bizfi and its proprietary marketplace and funding technologies have provided more than $1.3 billion in financing to over 25,000 small businesses across the United States since 2005. Businesses across all industries and sectors have received funding through Bizfi, including restaurants, retailers, health service providers, franchises, automotive service shops and many others.

Generating Leads and Acquiring Borrowers Not Easy in Business Lending

July 21, 2015 “Banks are almost always losing money on small business lending,” said Manish Mohnot, TD Bank’s Head of Small Business Lending, on a panel at the AltLend conference in New York City. It’s a loss leader within the small business segment, he explained, because banks want to bring in deposits.

“Banks are almost always losing money on small business lending,” said Manish Mohnot, TD Bank’s Head of Small Business Lending, on a panel at the AltLend conference in New York City. It’s a loss leader within the small business segment, he explained, because banks want to bring in deposits.

Funding Circle’s Rana Mookherje concurred. “Banks just can’t make a loan under $500,000 profitably,” he said.

It’s a conundrum few outside banking think about. When consumers and businesses picture banks, they might think of loans, but when banks think of consumers and businesses, they think of deposits. The sentiment amongst the experts at AltLend was that traditional banks and alternative business lenders were not competing with each other for the same customers because each party was after a different objective.

And even when banks think about loans, because obviously they do, they just don’t approach them the way that alternative business lenders do. To that end, ApplePie Capital CEO Denise Thomas said, “Most community banks are looking to make loans backed by an asset. They just don’t want to underwrite [loans] one by one under a million dollars.”

Bankers are genuinely surprised by how alternative lenders subjectively or manually approach business loans, a subject covered just yesterday here on AltFinanceDaily. Charles Green, the Managing Director of the Small Business Finance Institute and moderator of the New Pioneers panel said he never saw banks use bank transaction history to make underwriting decisions in his 35 years of banking.

The factors paraded as being more important above everything else in alternative lending today have apparently been non-factors in traditional lending for years. “There is no substitute for banking information when reviewing a client for approval,” said Andrew Hernandez, a co-founder of Central Diligence Group, in Do Bank Statements Matter in Lending? Business Lenders and Consumer Lenders Disagree. These kind of statements are mind-blowing in traditional lending circles.

Nevertheless, banks watch in awe as alternative lenders not only make small commercial loans, but do it profitably. But how they source borrowers isn’t rocket science. Jim Salters, the CEO of The Business Backer pointed out that some alternative lenders are marketing on a large scale by running TV or radio commercials. But that level of investment isn’t for everyone, especially younger companies.

“Direct mail isn’t sexy, but it converts,” said Candace Klein, the Chief Strategy Officer of Dealstruck. She also said that her company is doing radio advertising.

Matt Patterson of Expansion Capital Group is well versed in digital marketing and incorporates SEO and online paid advertising such as Facebook in his strategy. There’s a difference in the conversion rate in advertising on Facebook versus something like Google, he explained. On Google, business owners are looking for something whereas on Facebook they stumble across it.

Everyone agreed that Pay-Per-Click marketing such as Google Adwords was very expensive in this competitive landscape.

Jim Salters, CEO of The Business BackerBut where can funders and lenders reliably turn to acquire deal flow cost effectively? Salters revealed the industry’s worst kept secret, brokers. The Business Backer acquires about half of its volume from brokers and the other half directly, according to Salters.

“The broker channel is one of the most cost effective channels for us,” said Klein, who would not say on the record exactly how much of Dealstruck’s total business was from brokers.

Patterson agreed with the favorable ROI of using brokers, but saw benefits to communicating with small businesses directly. “Everything about that relationship is better when you’re talking directly to that merchant,” he said. And yet, “our direct leads convert much lower than our broker leads will,” he added.

The panelists generally agreed that this was because brokers have essentially already gathered the documents and closed the deal by the time the lender or funder is finally seeing it.

But aren’t brokers and humans the antithesis of tech-based lending?

Brett Baris, the CEO of up-and-coming lender Credibility Capital said, “We were actually a little surprised by how much a human is needed.” Baris’ company acquires most of its leads through a partnership it has with Dun & Bradstreet. Most of their borrowers are prime credit quality.

“The human element is very important to get the higher quality borrowers to the finish line,” Baris noted. TD’s Mohnot was not surprised. For applicants doing $5 million to $6 million a year in revenue, they want somebody to walk them through the loan process, he opined.

“Merchants love talking to people,” Patterson said. “Some of that comes from the frustration of calling their bank and not being able to talk to people.”

But would that mean the assumptions about automation are wrong? Not quite, explained Mohnot. It’s the younger business owners who have the impulse desire to do things fast or online, he said.

And Klein said that observing merchant behavior at least at her company has shown that those all too eager to apply for a loan in an automated online fashion are typically looking for smaller amounts like $20,000 to $40,000. Meanwhile Dealstruck’s loan minimum is $50,000.

Not everyone is as fortunate as Baris, who is able to generate leads through the trust inherent in a conversation that originated with a D&B rep, but real actual bank declines are making their way to alternative lenders. They’re not the holy grail that everyone thinks they would be though.

“Conversions tend to be lower from bank leads because they’re expecting 6% and are insulted when they hear [a higher %],” said Klein. And Salters who refers to his company as a “turndown partner of choice for upstream lenders,” shared how hard it is for a bank to partner with an alternative lender in the first place. Years ago, banks were aghast by his hands-on, manual underwriting approach that he felt was his company’s core competency. The banks were afraid their regulators would freak out over something so subjective.

And yet Merchant Cash and Capital’s founder, Stephen Sheinbaum and Credit Junction’s CEO Michael Finkelstein both told an audience that they saw banks as collaborative partners.

Meanwhile, Dealstruck actually has a graduation system where merchants graduate out of their loan program and become eligible for a real bank loan. Klein explained that a small business could be referred to them by the bank and then after a couple of years of good history, they’ll refer it back to them.

The acquisition secret however seems to be in finding your strength. ApplePie is focused exclusively on franchises. Expansion Capital Group has formed relationships with several trade organizations. Credibility Capital goes hand-in-hand with D&B.

Still, there is no doubt that the broker channel is alluring, but it can be a slippery slope. Raiseworks CEO Gary Chodes cautioned that “brokers are incentivized to follow the money.” Klein also expressed concern. She knows firsthand how challenging brokers can be since she’s had to terminate some in the past for bad behavior.

“Transparency is extremely important,” Finkelstein proclaimed in regards to the customer experience. This means that lenders can’t simply work off the ROI metric alone. But that ROI is the envy of banks nationwide.

Banks want to refer their clients to alternative lenders because if they get approved, then the lender is going to deposit those funds at their bank, Mohnot alluded.

It would seem that there is not one particular methodology that works better than all the others to acquire a borrower and that’s okay. Alternative lenders struggling to maximize their ROI can take comfort in the fact that banks, with all the resources they have at their disposal, accepted a long time ago that it was impossible to even make money at all in small business lending.

If you’re at least in the black, you’re probably doing just fine…

Manual Underwriting Still Dominates in Tech-based Lending Environment

July 21, 2015For all the talk that technology is changing the way people lend and borrow, the commercial side appears stubbornly reluctant to relinquish control to algorithms. At the AltLend conference in NYC, business lenders and merchant cash advance companies alike were mostly united on the idea that somebody needs to be double checking the computers.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

Like most of the others that spoke on the topic, Schaefer was in favor of a scoring model and he believes an automated underwriting system creates consistency when assessing risk. He was steadfast in his assertion though that humans had to be the last line of defense in fraud detection.

“We’ve got guarantors that have nothing to do with the business,” he said, offering an example of an applicant that was more than 80-years old, yet was passing themselves off as a hands-on construction worker.

“I’m still a big believer in the review and subjectivity,” he concluded.

Funding Circle’s Rana Mookherje expressed similar views. “[Humans] pick up things that an algorithm really can’t do,” he told the crowd.

“We have an experienced underwriter sitting there and calling every borrower that we give money to,” he added.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

“If you need money in an hour, we’re not the right place for you,” Mookherje stated.

Funding Circle’s reliance on manual reviews may have to do with the loan terms being extended so long. Even Schaefer had said earlier, “I think it’s a lot easier to determine the behavior of a loan that’s less than twelve months as opposed to one that’s sixty months.”

But do other companies feel differently? Kabbage’s Alan Reeves said that 95% of their customers are 100% automated since there are merchants who get stuck trying to connect their bank account in the online application process.

When Kabbage was asked over a year ago how much of a role computers should play in the underwriting of a deal, COO Kathryn Petralia responded, “Huge.” She also went on to say then that, “it is not going to be like the “Matrix” where machines are making all the decisions. You won’t see an underwriting world without humans.”

It’s ironic however that while Alan Reeves was introduced at the conference as the Head of Risk Analytics, both the printed agenda and his LinkedIn profile cite his title as being the Head of Manual Underwriting. It’s a telling title for a company that is often heralded as the pinnacle of automation and computational decisioning.

But why can’t lenders simply give in entirely to the machines? Mookherje said at one point that, “those that live and die by their underwriting are going to be the ones that survive.” And if that’s the case, then relinquishing control to the computers perhaps risks the chance of death if things don’t work properly.

But humans, with all their natural flaws and imperfections pose the same risk. “Banks want to know that underwriting is consistent, that for any given customer, that you would underwrite them the same,” said Sam Graziano, CEO of Fundation. “And it’s not just having written policies and procedures,” he added. “But having programs in place to ensure these policies are upheld.”

The widespread dependence on humans to tie up loose ends in assessing risk may seem both practical and prudent, but to some traditional bankers, that system carries nightmarish implications.

Jim Salters, CEO of The Business Backer for example shared an experience his company went through years ago when trying to partner with a bank. Salters placed a high value on the manual review process, explaining that it was basically a strength of their core competency. The problem however, was that the bank said that would totally freak out their regulators.

The recurring message from the event’s panelists was that banks not only want, but may actually require a firm credit model to make decisions. They need to be able to explain to regulators why some loans got approved and others got declined in a perfectly uniform and consistent manner.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

But building an automated system and telling the humans to take a hike isn’t an easy process. There’s a high upfront cost associated with development and it can take years to generate statistically relevant conclusions. And a multivariate decline issued by an algorithm can potentially worsen the customer experience, especially if the customer asks for the specific reason they were declined. Reeves said it can be difficult to explain to the customer that their FICO score was too low relative to their sales volume but that their FICO score on its own was good enough.

And yet once an automated underwriting system is developed, the cost of underwriting should drop significantly according to panelists. With that comes a decision consistency that the company can rely on and a system that bankers can get comfortable with.

But despite it all, Credit Junction CEO Michael Finklestein bluntly stated, “We’re never going to approve a $2 million loan with an algorithm.”

The unifying concept that everyone seemed to agree on was that although credit models were undeniably important, human review would remain a complementary part of the process for the foreseeable future at least in the commercial finance space.

“At the end of the day, it all comes down to underwriting,” said Mookherjee.

Investing in the Industry: Break Out of Your Bubble

June 29, 2015 Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

“Most people don’t know everything that’s out there. There are huge opportunities,” says Peter Renton, an investor and analyst who founded Lend Academy LLC of Denver, Colorado, a popular resource for the online lending industry.

Indeed, there are a growing number of online alternative lending sites that theoretically allow a person to invest in all shapes and sizes of loans. There are sites like Lending Club and Prosper that allow smaller investors to tap into the burgeoning P2P market. There are also a plethora of platforms that cater only to wealthier, more sophisticated investors in a host of areas like small business, real estate, student loans and consumer loans.

Even though there is a surplus of options, prudent investing is not quite as simple as depositing ample funds in an account and clicking the “go” button. Before you get started, you need to carefully consider factors such as your own finances and risk tolerance. You should also have a good handle on the specifics about the online platform—how it works, its history and track record, the types of investments it offers, the platform’s management team, technology and your ability to diversify based on available investment opportunities.

One of the first things you’ll have to think about as a potential investor is whether you have the financial wherewithal to be considered accredited by the SEC. If the answer’s yes, you’ll have a lot more choices of online marketplaces to choose from as well as types of investments. Basically, to meet the SEC’s threshold, you’ll need to have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect to earn the same for the current year. Alternatively, you need to have a net worth over $1 million, either alone or together with a spouse (excluding the value of your home). (Check out the SEC’s website for more detailed info.)

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

But smaller investors do have options. Two San Francisco-based online lending platforms, Lending Club and Prosper, cater to individual investors, and you can still make a pretty penny plunking down money with these venues. You’ll also find a wealth of information about investing with them by perusing their websites as well as by reading the blog posts of media-savvy financiers.

“Right now, Lending Club and Prosper provide a great entry point for people who want to get involved in investing in alternative lending,” says Renton of Lend Academy.

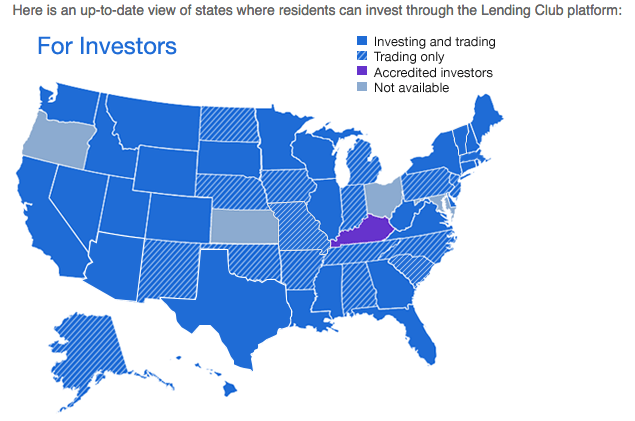

The caveat is that these platforms aren’t yet open to investors in every state, so if yours isn’t on the list you’re out of luck for now. However, with each marketplace you’ve got more than a 50 percent chance your state is on the approved list, so it’s worth digging deeper.

Assuming you meet their respective suitability requirements, you can choose to invest on one platform or both. To be sure, they are alike in many ways. Both allow you to invest with as little as $25 and fund one loan, however they recommend you buy at least 100 loans to be properly diversified, which you can do for as little as $2,500. You can manually choose which loans to buy, or enter your investment criteria so loan picking is automated. You can also invest retirement money in an IRA through Lending Club or Prosper.

There’s no fee to get started investing on either platform. For Lending Club, investors pay a service fee equal to 1 percent of the amount of payments received within 15 days of the payment due date. Prosper charges investors 1% per year on the outstanding balance of the loan. As the loan gets smaller, the servicing fee, which is charged monthly, gets smaller too.

To invest in Lending Club, in most cases you’ll need either $70,000 in income and a net worth of at least $70,000, or a net worth of at least $250,000. There may be other financial suitability requirements that vary slightly depending on the state you live in. For Prosper, individual investors must be United States residents who are 18 years of age or older and have a valid Social Security number.

At any given time, Lending Club has more than 1,000 loans visible on the platform and new ones get added every day, according to Scott Sanborn, chief operating officer and chief marketing officer. Prosper, meanwhile, on average has more than 200 loans for people to invest in, says Ron Suber, president.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

To encourage more people to start investing, some savvy investors have started to self-publish online the quarterly returns they accumulate through the Lending Club and Prosper platforms. Renton, of Lend Academy, reported a balance of $476,769 on Dec. 31, 2014 and a real-world return for the trailing 12 months of 11.11 percent. Another well-known P2P investor and blogger, Simon Cunningham—the founder of LendingMemo Media in Seattle—reported a 12-month trailing return of 12.0 percent over the same time period, with a published account value of $41,496. Both investors say they expect returns to drop back somewhat over time, however, as the online marketplaces continue to lower interest rates to attract more borrowers.

Of course, if you’re an accredited investor, you will have access to even more online marketplaces. For instance, there’s SoFi of San Francisco for student loans, Realty Mogul of Los Angeles for real estate loans and Upstart of Palo Alto, California, that focuses on loans to people with thin or no credit history. The list of possibilities goes on and on.

Generally speaking, the more money you have to invest, the more options you have. “In this country today, you’ve got well over a hundred options if you’re willing to put seven figures in,” Renton says.

The minimums at venues that focus on accredited investors tend to be more than you’d find at Lending Club or Prosper. At SoFi, accredited investors need at least $10,000 to begin investing in the company’s unsecured corporate debt. SoFi’s been in the lending business for several years now and currently focuses on student loans, mortgages, personal loans and MBA loans. Investors, however, can’t currently invest in these loans, says Christina Kramlich, co-head of marketplace investments and investor relations at SoFi. The company plans to eventually offer investment opportunities in the areas of mortgages and personal loans, she says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

Because it’s still so new, it can be hard for investors to know how to compare marketplaces. For starters, consider the platform’s historical performance. There are a lot of new marketplaces popping up, but it takes time to develop a proven track record. This isn’t to say you shouldn’t dabble with the newer platforms, but if you do, you’ll want above-average returns to balance out the higher risk, says Sanborn of Lending Club. “About three years in, we started to build a track record. At five years in, it was very solid,” he says. “You need time to see how a basic batch of loans is going to perform.”

Before investing, you’ll want to get a sense of how committed senior management is to the company and try and get a sense of whether the company seems to have enough capital for the business to run well. Try to find out about the cash position of the company, how the loans are going to be serviced, what entity is doing the underwriting and how and where your cash will be held.

“It’s not just assessing the risk of the asset and the investment, it’s assessing the risk of the enterprise that is making it available to you,” Sanborn says.

It’s also important to ask questions about the loans themselves. Where do they come from and is the volume sustainable? Ideally, a platform should offer a variety of loans so investors can properly diversify, or you might need to consider investing with multiple platforms to achieve your desired balance.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

When you’re asking all these questions, try to get a sense of how receptive the platform is to the feelers you’re putting out. Investors should only work with companies that are willing to be open about how they are investing your money, their historical returns and other important data. “I can’t stress transparency enough,” says Periu of Funding Circle.

The technology the platform uses is another key element. Is the technology easy to use, or does the platform create stumbling blocks for investors? Are there ways to automate lending, or do you have to log on every day and manually invest in loans?

Suber of Prosper says investors should also consider whether platforms work with a back-up servicer in case there’s a disruption and whether they run regular tests to make sure everything works as expected. “It’s just like a backup generator and you have to test it every once in a while and make sure it goes on.”

Certainly it pays to do your homework before you invest your hard-earned cash with an online platform. Ask around, attend industry conferences and absorb all you can from publicly available data. The good news is that there will probably be even more information for you to tap into as the industry continues to grow.

“Two years ago [marketplace lending] was very esoteric. A year ago it was still esoteric,” says Funding Circle’s Periu. Now, more and more investors are hearing about marketplace lending and want to make it part of their broader fixed income bucket. Even so, more has to happen for it to become a mainstream investment. “Awareness and education need to continue,” he says.

Once more people understand the extent of what’s out there, Suber of Prosper expects investing in online marketplaces will take off even more than it already has. “A lot of people still don’t know this as an investment opportunity,” he says.

The Official Business Financing Leaderboard

June 20, 2015A handful of funders that were large enough to make this list preferred to keep their numbers private and thus were omitted.

| Funder | 2014 |

| SBA-guaranteed 7(a) loans < $150,000 | $1,860,000,000 |

| OnDeck* | $1,200,000,000 |

| CAN Capital | $1,000,000,000 |

| AMEX Merchant Financing | $1,000,000,000 |

| Funding Circle (including UK) | $600,000,000 |

| Kabbage | $400,000,000 |

| Yellowstone Capital | $290,000,000 |

| Strategic Funding Source | $280,000,000 |

| Merchant Cash and Capital | $277,000,000 |

| Square Capital | $100,000,000 |

| IOU Central | $100,000,000 |

*According to a recent Earnings Report, OnDeck had already funded $416 million in Q1 of 2015

| Funder | Lifetime |

| CAN Capital | $5,000,000,000 |

| OnDeck | $2,000,000,000 |

| Yellowstone Capital | $1,100,000,000 |

| Funding Circle (including UK) | $1,000,000,000 |

| Merchant Cash and Capital | $1,000,000,000 |

| Business Financial Services | $1,000,000,000 |

| RapidAdvance | $700,000,000 |

| Kabbage | $500,000,000 |

| PayPal Working Capital* | $500,000,000 |

| The Business Backer | $300,000,000 |

| Fora Financial | $300,000,000 |

| Capital For Merchants | $220,000,000 |

| IOU Central | $163,000,000 |

| Credibly | $140,000,000 |

| Expansion Capital Group | $50,000,000 |

*Many reputable sources had published PayPal’s Working Capital lifetime loan figures to be approximately $200 million in early 2015, but just a couple months later PayPal blogged that the number was more than twice that amount at $500 million since inception. The print version of AltFinanceDaily’s May/June magazine issue stated the smaller amount since it had already gone to print before PayPal’s announcement was made.