Google Culls Online Lenders – Pay or Else?

March 15, 2016Can you become one of the biggest or most successful online lenders without Google? A search layout update may be inadvertently culling the herd.

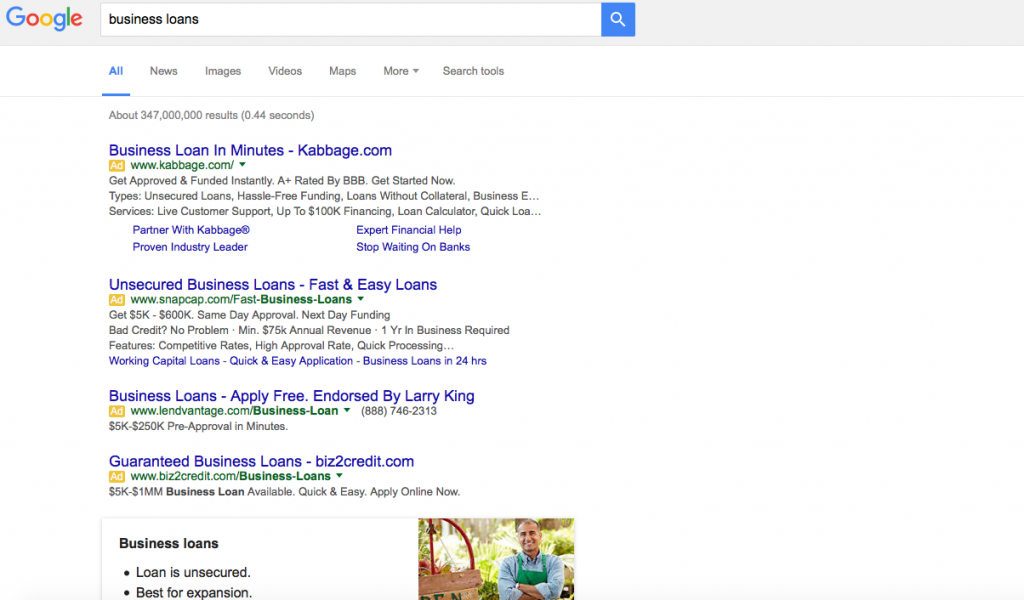

In late February, Google eliminated ads from the right side of the page while adding another layer to the top and bottom. When factoring in features like site links, the effects on organic search has been devastating. Non-paid links are now entirely below the fold for many commercial keywords, which means users may limit their selections entirely to ads. Here’s an example of a full screen browser window on a Macbook Air when searching for Business Loans:

Brad Geddes, a Google Adwords marketing author, expert and consultant, has said the Click-through rate (CTR) on this new 4th ad placement is skyrocketing. “Depending on the keyword, position 4 is going to have a 400%-1000% CTR increase,” he said on Webmaster world. And while side links and bottom links were never a huge factor anyway (less than 15% of click-throughs), Geddes believes a consequence of this change is that fewer ad slots means higher cost bids to rank on the 1st page. “Companies with thin margins are going to have a lot of words fall to page 2,” he wrote.

In summary: Fewer ad placements, higher costs per click, decreased likelihood of organic click-throughs.

And the online lending industry is already feeling the burn. Several funders and ISOs on the commercial side have told AltFinanceDaily in confidence that the online lead gen battle has been lost or that they have been temporarily sidelined by the increase in costs. At least one funder is refocusing their efforts entirely on the ISO channel after a horrible experience with Pay-Per-Click.

And it’s not just the costs, it’s the quality of leads, they say. The searchers clicking their expensive ads and running up their bills sometimes literally meet none of the qualifications their ads stipulate. Yet many searchers click anyway, rendering the ads’ carefully scripted messages moot. One study might explain why that is. In it, users spent around .764 seconds considering the first paid search result and a total of only 4.5 seconds scanning the first five results. That’s not a whole lot of time to read each ad, digest them and consider whether or not there’s an appropriate fit.

And it’s not just the costs, it’s the quality of leads, they say. The searchers clicking their expensive ads and running up their bills sometimes literally meet none of the qualifications their ads stipulate. Yet many searchers click anyway, rendering the ads’ carefully scripted messages moot. One study might explain why that is. In it, users spent around .764 seconds considering the first paid search result and a total of only 4.5 seconds scanning the first five results. That’s not a whole lot of time to read each ad, digest them and consider whether or not there’s an appropriate fit.

On one industry forum, ISOs have reported that the cost of acquiring a merchant cash advance or business loan deal from Pay-Per-Click is ranging from $700 to $1,200. “PPC for premium keywords as high as $40 at times. Ugly. Real ugly,” one user wrote. Another user wrote, “It’s not just Adwords that is saturated. The whole market is saturated. Lenders and the onslaught of new brokers are making it tough. Lenders with programs like Funding Circle and Kabbage, and with all the advertising money in the world to burn and get direct traffic.” And still another believes that online ads are simply inviting the lowest hanging fruit. “Internet leads have the highest level of fraud,” said one sales manager.

Notably, many of the top 8 funders are only competing for a limited number of competitive keywords or may not even be running Adwords at all. PayPal and Square for example, focus only on their existing payment processing customers despite being “online lenders.”

It’s too early to tell what effects Google’s ad changes will have on the online lending industry, though a couple of companies who were paying just enough to extract clicks from side ads have indicated the change is for the worse and they have suspended their campaigns.

The natural alternative to paid search, organic search, is seldom discussed anymore as a realistic strategy these days, in part because the rankings might be rigged anyway.

One irony that’s pervasive in the online lending industry is that borrowers are being targeted offline where it’s potentially more affordable. In a discussion thread that garnered 76 posts last fall, ISOs and funders suggested that direct mail, referrals, UCCs, cold calling, radio and even going out and shaking hands, were pegged as “what’s next” for marketing. Pay-Per-Click was only mentioned once and only in the context of it being something that had long ago been made too expensive for small and mid-size companies.

The cost of making these things work might be why so many funders are hoping that brokers can figure it out. “We decided that the best way to grow is to build relationships to avoid the overhead, compliance, training and manpower that a sales team would require,” said Nulook Capital’s Jordan Feinstein in an interview with AltFinanceDaily last month.

With Google becoming even more competitive now though, perhaps United Capital Source’s Jared Weitz summed it up best. “Marketing is getting more expensive and only the ones who can afford to pay can play,” Weitz said.

Square’s Merchant Cash Advance Program Now Among Biggest in the World

March 10, 2016Square originated more than $400 million worth of merchant cash advances advances in 2015, according to their Q4 earnings report. Their average deal size was just shy of $6,000. The result is a 300% increase year-over-year and makes them one of the largest players in that industry worldwide.

RANKINGS

| Company Name | 2015 Funding Volume | 2014 Funding Volume |

| OnDeck | $1,900,000,000 | $1,200,000,000 |

| CAN Capital | $1,500,000,000 | $1,000,000,000 |

| Funding Circle | $1,200,000,000 | $600,000,000 |

| PayPal Working Capital | $900,000,000 | $250,000,000 |

| Bizfi | $480,000,000 | $277,000,000 |

| Fundry (Yellowstone Capital) | $422,000,000 | $290,000,000 |

| Square Capital | $400,000,000 | $100,000,000 |

| Strategic Funding Source | $375,000,000 | $280,000,000 |

A much longer list will be available in AltFinanceDaily’s March/April 2016 Magazine Issue. SUBSCRIBE FREE to make sure you obtain a copy.

Bizfi Woos Restaurants With Lending Products

March 3, 2016The New York State Restaurant Association signed Bizfi to provide business financing for its 2,000 members.

The New York-based financial platform will be the designated funder of equipment financing, invoice financing, lines of credit, medium term financing, short-term financing, franchise financing and long-term loans from more than 45 partners.

“Restaurants have unique funding needs and owners often do not have time to spare in order to complete the long application process at traditional lenders,” said Stephen Sheinbaum, founder of Bizfi.

Bizfi’s lending partners include all the major lenders in the industry including OnDeck, Funding Circle, Kabbage, IMCA Capital, Bluevine, and SmartBiz and the company has funded over $1.4 to over 27,000 small businesses since 2005.

![]()

Real Estate Lender Patch of Land Sells $250 Million in Loans

February 11, 2016 Real estate lending platform Patch of Land announced that it signed a $250 million agreement with an east coast based credit fund to purchase its loans in a forward flow arrangement.

Real estate lending platform Patch of Land announced that it signed a $250 million agreement with an east coast based credit fund to purchase its loans in a forward flow arrangement.

The reluctance to name the city or state of the fund suggests that in doing so would too easily reveal who it is.

Patch, an LA-based lender which uses a data-driven underwriting model, promises investors a risk adjusted return with extensive available data to support the underlying credit decision on each loan.

The company founded in 2013 had raised a million in seed funding and $125,000 in debt in 2014, followed by $23 million in Series A funding last year. And it has funded more than 200 projects, with an average blended rate of return to investors of 12 percent

This is continued evidence of institutional interest in loans generated by marketplace lenders. JP Morgan Chase bought loans worth a billion dollars from Santander Consumer USA Holdings Inc earlier this month. The bank also partnered with OnDeck in December of last year to facilitate the underwriting of the bank’s small dollar small business loan program.

In an interview with Bloomberg, Funding Circle’s CEO Sam Hodges said that it’s the first of many such partnerships to come where big banks will realize the potential of fast-growing fintech startups.

Bizfi Welcomes Record Quarter, Raises Equity

February 10, 2016![]() Bizfi, the marketplace lender for small businesses, originated a record $142 million in business financing in the last quarter of 2015.

Bizfi, the marketplace lender for small businesses, originated a record $142 million in business financing in the last quarter of 2015.

Formerly known as Merchant Cash and Capital, they have financed over 27,000 small businesses through their proprietary marketplace with over $1.4 billion since 2005. They rebranded to Bizfi in 2015 and raised $65 million from Metropolitan Equity Partners for adding products and speeding up funding.

When company founder Stephen Sheinbaum was asked by AltFinanceDaily about the possibility of exploring personal loans, they said they would only do that through their partnerships with companies like OnDeck, Funding Circle and Kabbage. Sheinbaum also said that they were considering referrals and marketing tie-ups with some of these companies.

Bizfi’s lending platform provides a host of funding options like short-term financing, medical financing and lines of credit. The company plans to add more partners enriching their product offerings, among other plans. Alluding to immediate growth plans, Sheinbaum said that the firm will raise institutional equity this year along with augmenting the underwriting process to attract more customers as well as forging new partnerships.

Experts on Marketplace Lending Featured by Experian (Video)

January 21, 2016Experian, the company many marketplace lenders are using for credit reports, recently put together a short video that features some of the industry’s experts. They include:

- Peter Renton, Founder, Lend Academy

- Scott Sanborn, COO, Lending Club

- Sam Hodges, Co-founder, Funding Circle USA

- Andrew Smith, Partner, Covington & Burling

- Joseph DePaulo, CEO, College Ave.

- Kathryn Ebner, VP, Credibly

Check out the video:

If it’s not loading on your browser, view the original here.

Bizfi Secures $65 Million in Financing

December 15, 2015NEW YORK–(BUSINESS WIRE)–Bizfi (www.bizfi.com), the premier FinTech company whose online small business finance platform combines aggregation, funding and a participation marketplace, announced that Metropolitan Equity Partners (“Metropolitan”) has provided a structured financing facility of $65 million to the company to drive growth.

Closing this financing round enables Bizfi to:

- Expand its suite of funding programs, increasing its ability to fund America’s small business capital needs.

Increase the speed at which funding applicants access direct financing from Bizfi. - Develop and implement a national marketing campaign designed to increase the awareness of the Bizfi brand and platform within the small to medium-sized business community.

- Bizfi and its proprietary marketplace and funding technologies have provided in excess of $1.3 billion in financing to over 26,000 small businesses across the United States since 2005. Since Bizfi launched its aggregation platform in 2015, the Company has experienced 72% growth in year-over-year gross originations.

“The Bizfi platform is the simplest, fastest and most frictionless process for small businesses to access funding. Metropolitan’s financing will propel our growth plans to the next stage,” said Stephen Sheinbaum, founder of Bizfi. “Every day more and more businesses are turning to Bizfi because of our strong channel partners, enabling business owners to compare all their funding options in one place. The Metropolitan partnership provides Bizfi with additional capital to develop new products and fund more small businesses from its own branded product set.”

Metropolitan’s investment provides the financial flexibility and strength to support Bizfi’s growth plans. The new investment expands upon Metropolitan’s prior involvement as an active buyer of loan participations and a mezzanine lender to the Company for the past three years.

Bizfi’s proprietary technology and aggregation platform efficiently gathers applicant information from a wide variety of sources to quickly offer commercial funding products including loans and other capital products to small businesses. Bizfi’s technology is further strengthened by strategic relationships with more than 45 funding partners, including OnDeck, Funding Circle, IMCA Capital, Bluevine and Kabbage. Bizfi also participates as a lender on the platform. Regardless of what kind of capital is sought from any of the funding partners, the small business owner is guided through the entire process by a Bizfi funding concierge that is assigned specifically to him or her.

Paul Lisiak, managing partner of Metropolitan Equity Partners stated, “Metropolitan believes that the future of small business lending is being built by Bizfi. Their aggregation and direct lending marketplace is disrupting the fast growing FinTech industry. Our new investment is the result of the impressive performance we have directly experienced as a lender and participant in the company’s financing products over the past three years. In the rapidly evolving FinTech space, Bizfi’s management team has elegantly expanded their product offerings to create a platform that holistically meets the dynamic funding needs of small businesses. We look forward to being a part of Bizfi as they further solidify their position as a leader in the financial technology space.”

Metropolitan has been an active investor in the alternative lending and FinTech space with over $100 million committed in 2015 including investments in JH Capital Group, Debt Away, New Credit America and PledgeCap.

Mr. Sheinbaum concluded, “Bizfi has seen radical growth over the last 18 months. Not only have we developed one of the most robust FinTech platforms for the small business lending space, but we have cultivated significant deals with third party companies that service small businesses. These companies will utilize white label versions of Bizfi’s platform to offer financing to their clients. Now, with the Metropolitan financing supporting our growth, we can continue to expand our products, increase our market share and provide solutions to the critical financing needs of the companies that fuel our economy.”

About Bizfi

Bizfi, is the premier FinTech company combining aggregation, funding and a participation marketplace on a single platform for small businesses. Founded in 2005, Bizfi and its family of companies have provided more than $1.3 billion in financing to over 26,000 small businesses in a wide variety of industries across the United States.

Bizfi’s connected marketplace instantly provides multiple funding options to businesses from more than 45 funding partners and real-time pre-approvals. Bizfi’s funding options include short-term financing, medical financing, lines of credit, equipment financing, invoice financing, medium-term loans and long-term loans guaranteed by the U.S. Small Business Administration. The Bizfi API provides a turnkey white label or co-branded solution that easily allows strategic partners to access the Bizfi engine and present their clients with financial offers from Bizfi lenders all while maintaining their customer’s user experience. A process that once took hours, now takes minutes.

About Metropolitan Equity Partners

Metropolitan Equity Partners Management, LLC is an alternative investment manager that provides expansion capital to growing private companies via collateralized loan structures. Metropolitan was founded by Paul Lisiak who has 20 years of experience investing in private U.S companies through both debt and equity. Metropolitan traces its roots to a successful equity strategy managed by the current Metropolitan Principals which was backed by the Man Group plc. Since 2008, Metropolitan has committed over $300MM in collateralized debt investments through call funds, blind pools and institutional managed accounts. Metropolitan is based in New York City.

Contacts

KCSA Strategic Communications

Abbie Sheridan, 212-896-1207

asheridan@kcsa.com

or

Kenneth Cousins, 212-896-1254

kcousins@kcsa.com

or

Bizfi Sales:

855-462-4934

bizfisales@bizfi.com

or

Bizfi Marketing:

212-545-3182

marketing@bizfi.com

JPMorgan Chase and OnDeck Partner Up

December 1, 2015 Coming soon, when small businesses apply at a Chase bank for a loan under $250,000, there’s a good chance that OnDeck will be doing all the work. That’s because JPMorgan Chase and OnDeck announced a strategic partnership earlier today that is expected to commence in 2016.

Coming soon, when small businesses apply at a Chase bank for a loan under $250,000, there’s a good chance that OnDeck will be doing all the work. That’s because JPMorgan Chase and OnDeck announced a strategic partnership earlier today that is expected to commence in 2016.

A comment earlier in the day by Jamie Dimon hinted that something was coming. “We haven’t announced it yet, we’re going to be doing a thing with one of these peer-to-peer, small-business lenders,” Bloomberg reported.

That caused peer-to-peer lending industry advocates like Peter Renton of LendAcademy to speculate who that might be. He originally bet on Lending Club but posited that it could also be OnDeck, Funding Circle, or Kabbage.

When I asked Lending Club on twitter if they were slated to be JPM’s partner, I received a public reply back from a VP at OnDeck saying that it would in fact be them. By then the news had already been released.

The SEC filing states, “JPM will use the Company’s small business lending platform and the OnDeck Score® to serve its small business customers” and adds that they’re still in the process of building things out and finalizing agreements.

OnDeck (ONDK) which closed at $9.01 before the announcement is expected to soar on the news for the Wednesday open.