The Challenges in Offering Financing to Latino Businesses

June 20, 2015 The number of minority-owned businesses jumped nearly 46% from 2002 to 2007, according to the Minority Business Development Agency. The growth rate is three times as much as for U.S. businesses as a whole. These businesses increased 55% in revenues over that five-year period. There are a number of minority groups within this category. Latino businesses are leading the way. Latinos are the fastest growing ethnic group in the United States today. Like it or not these numbers are likely to increase due to economic blocs. The U.S. has created a number of free trade agreements with Mexico, Central America and South America. Latinos are our next door neighbors.

The number of minority-owned businesses jumped nearly 46% from 2002 to 2007, according to the Minority Business Development Agency. The growth rate is three times as much as for U.S. businesses as a whole. These businesses increased 55% in revenues over that five-year period. There are a number of minority groups within this category. Latino businesses are leading the way. Latinos are the fastest growing ethnic group in the United States today. Like it or not these numbers are likely to increase due to economic blocs. The U.S. has created a number of free trade agreements with Mexico, Central America and South America. Latinos are our next door neighbors.

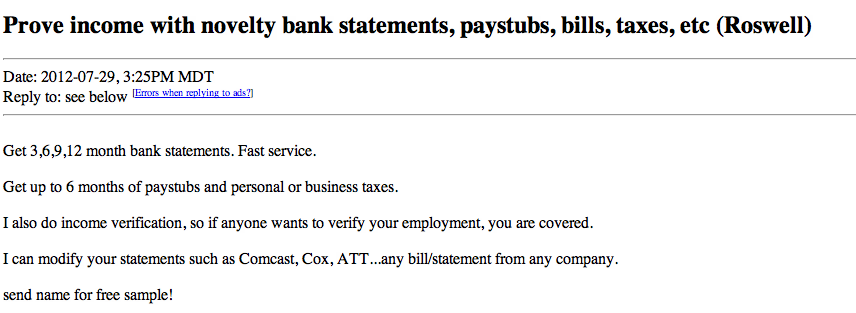

The SBA is the largest guarantor in the U.S. and does not offer any specific minority business loan program to Latinos. The U.S. Hispanic Chamber of Commerce offers advice to Latino business owners, but does not offer any loans. Traditional banks continue to maintain stringent guidelines for all businesses. Alternative finance companies and online lenders have a long way to go to tap into this

niche market.

Alternative lenders, online lenders and peer-to-peer lenders can cater to this niche market, but it requires a lot of resources and knowledge. We can categorize Latino businesses into one broad category. However, as a Hispanic entrepreneur, my experience has been that the Latino business community is complex in nature.

Latino Businesses by Age Groups

There are two types of Latino entrepreneurs. The older generation tends to be within the age range of 45 to 70 years old. These business owners are not accustomed to doing business over the Internet, email, fax, or phone. Online lenders may have difficulties in retrieving information from these clients. This group has a high level of distrust in doing business via the Internet. The majority of our clients within this age group are accustomed to doing business face to face. This sales and marketing strategy can be very expensive for lenders, unless you have a team of field agents. The younger generation of this group is made up of Latino entrepreneurs in the age range of 25 to 45. This group is more accustomed to using online banking and online systems. Forbes recently reported that, “With a median age of 28 years old, the timing is ripe for organizations/brands to make a firm commitment to the Hispanic consumer.”

Family Decisions and Delayed Gratification

Despite the age category, many Latino businesses are family-based. Based on my experience, the decision making process is made among family members. You could offer a $50,000 loan at a cost of factor of 1.30 to the husband and he may need to consult with his wife and his children before he signs his John Hancock. This makes the decision-making

process challenging.

Manuel Cosme Jr., the chair of the National Federation of Independent Businesses (NFIB) Leadership Council in California and co-founder of Professional Small Business Services in Vacaville, California has said, “Family plays a big role in Hispanic culture, so naturally it plays a big role in Hispanic-run businesses.”

Trust Factors

Even if you have a Latino staff or bilingual staff, Latino business owners need to trust you in order to gain their business. You will need to build good rapport with these businesses to get them to fill out a loan application and send it via fax, email or online. Latinos are accustomed to traditional banking methods and brick and mortar businesses.

“When we looked at online US Hispanics in 2006, there were four main roadblocks to US Hispanic e-Commerce adoption: 48% of online Hispanics did not want to give out personal financial information; 46% wanted to be able to see things before buying; 26% had heard about bad experiences purchasing online; and 23% did not have access to a credit or debit card,” says Roxana Strohmenger, Director in charge of Data Insights Innovation at Forrester. These are some of the challenges that we face by conducting our business in a digital manner.

According to mediapost.com, only 32% of online Hispanics use the Internet for their banking needs. In order for online lenders to succeed with this marketplace, U.S. banks need to do more to market to Hispanics online. Alternative lenders need to understand that there are barriers to entry in this marketplace.

Social Media

The Pew Research Center conducted a study that clearly indicates the usage of social media by Hispanics. Accordingly, 80 percent of Hispanic adults in the U.S. use social media and the same study revealed that Latino Internet users admitted to using Facebook as the leading social platform. A lot of business owners love to show the storefront, their family working in their businesses, and other images. You should consider Facebook as part of your overall marketing strategy to tap into this marketplace.

Going overseas

Going overseas

Another option to consider is going overseas. CAN Capital set up an operation in Costa Rica mostly for their business processing services. In fact, we at Lendinero decided to do something different that no one else is doing. We set up the majority of our operations in Central America, consisting of outbound agents, digital marketers, programmers and loan analysts. There are great benefits to having a full bilingual staff overseas and the cost of personnel is less expensive. At the same time, there are huge challenges. Since I am of Hispanic descent, it was easier to set up our operation in a Latin American country. However, there are cultural differences and you have to take into account the economic and political conditions of each country. Setting up a corporation can take 1 to 3 months and it is more expensive than the U.S.

The labor pool is huge, but finding the right people can be a challenge. In addition, training agents, processors, and support staff can be time consuming and you may run for a few months before you begin to see a profit. If your staff did not live in the U.S., you need to train them on U.S. culture, the economy, and other topics.

Furthermore, Internet speed and Internet services can be a challenge. Be prepared to pay a high cost for Internet. And labor laws are not like the U.S. If you fire an employee, you will be forced to pay unpaid vacation and a severance. In addition, you have to take other costs into consideration such as travel costs, lodging, auto leasing, and more.

Lastly, if you don’t know people in the country you plan on setting up in, an outsourced business processing service will charge you more money for rent and other services knowing that you are coming from the U.S. It is highly recommended you pair up with a native or someone who has done business in the countries you consider.

In summary, the Latino business community continues to lack financing. This niche market needs to be educated on the revolutionary paradigm shifts in business lending and online lending. If you can obtain these clients, they are clients for life. Once you obtain them as a client, they are loyal. They will not leave you.

I’d like to think that the term, merchant cash advance, is mainstream enough that a congressman would know what it was. I have no idea if that’s the case though. What I do know is that Renaud Laplanche, the CEO of Lending Club gave testimony before the Committee on Small Business of the United States House of Representatives on December 5, 2013.

I’d like to think that the term, merchant cash advance, is mainstream enough that a congressman would know what it was. I have no idea if that’s the case though. What I do know is that Renaud Laplanche, the CEO of Lending Club gave testimony before the Committee on Small Business of the United States House of Representatives on December 5, 2013. Which one of these three isn’t like the other two?

Which one of these three isn’t like the other two? One of Wonga’s major investors,

One of Wonga’s major investors,  But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

Aloha! The Resource’s main operator is “busy” vacationing in Hawaii, hence the long gap in site news. But since we’ve got Hawaii on the brain, we figured now is a good time to discuss Merchant Cash Advance (MCA) financing in a state that practically exists in its own universe.

Aloha! The Resource’s main operator is “busy” vacationing in Hawaii, hence the long gap in site news. But since we’ve got Hawaii on the brain, we figured now is a good time to discuss Merchant Cash Advance (MCA) financing in a state that practically exists in its own universe.  So does the MCA industry really have anything to fear in Hawaii? It depends on the risk tolerance. Travel agencies and tour companies have historically been shunned by funders, although that’s changed a lot in the last six months. Even established tour companies can disappear overnight. Tour companies in exotic locations walk a thin line every second of operation. They face constant injury liability, state and local law restrictions, and pressure from the property owners on which the tours explore to meet a certain standard of care. It can’t be omitted that a few bad online reviews can cause all their potential customers to book with their competitors instead. The Internet is the public’s best resource for researching vacation activities. No one wants to book a tour that has poor feedback.

So does the MCA industry really have anything to fear in Hawaii? It depends on the risk tolerance. Travel agencies and tour companies have historically been shunned by funders, although that’s changed a lot in the last six months. Even established tour companies can disappear overnight. Tour companies in exotic locations walk a thin line every second of operation. They face constant injury liability, state and local law restrictions, and pressure from the property owners on which the tours explore to meet a certain standard of care. It can’t be omitted that a few bad online reviews can cause all their potential customers to book with their competitors instead. The Internet is the public’s best resource for researching vacation activities. No one wants to book a tour that has poor feedback.