AltFinanceDaily’s Most Watched Videos of 2022

December 19, 2022deBanked TV continued its strong showing throughout 2022. For the second time ever, we’ve ranked the most watched videos for the year.

1. Equipping The Dream

AltFinanceDaily debuted a sales-based reality show called Equipping the Dream, a real inside experience of an equipment finance sales shop. Episode #1 was not only the most watched video on AltFinanceDaily for the year, it was the most viewed piece of content on AltFinanceDaily for the year period. Episodes 1-6 also managed to fall within the top 7 most watched videos for the year as well, all of them beating out every other single video except one. If you haven’t watched it, do you even work in small business finance sales?! Episode 1 | All Episodes Here

2. Merchant Cash Advance’s Big Day – The David Goldin Story

The only video to compete with episodes of Equipping the Dream was the documentary on David Goldin’s journey to winning a landmark patent lawsuit that allowed the merchant cash advance industry to grow into what it became. You can’t work in the industry and not know this amazing piece of history!

3. Banned From the MCA Industry

A discussion about an FTC settlement order banning individuals from the MCA industry was among the most watched videos of 2022.

4. Brokering Small Business Funding in 2022

AltFinanceDaily interviewed two small business finance brokers to gather their thoughts on the state of the industry.

5. Virginia Disclosure Law Discussed

On June 30, 2022, we at AltFinanceDaily discussed as much as we knew about the Virginia disclosure law one day before it went into effect. Are you complying with the law there?!

Welp, It’s December, Are You Ready for California’s New Law?

November 30, 2022 We’re now 9 days away from the commencement of California’s Commercial Financing Disclosure Law. Despite the industry’s best efforts to spread the word about the upcoming changes, AltFinanceDaily has informally queried several industry participants over the last few weeks to assess their preparedness and in the process learned that a significant percentage of funders and brokers still believe that the law is just about some kind of new form that has to be included with the contract.

We’re now 9 days away from the commencement of California’s Commercial Financing Disclosure Law. Despite the industry’s best efforts to spread the word about the upcoming changes, AltFinanceDaily has informally queried several industry participants over the last few weeks to assess their preparedness and in the process learned that a significant percentage of funders and brokers still believe that the law is just about some kind of new form that has to be included with the contract.

This despite a widely read September 9th story that conveyed that there was much more to it than that.

Since then, however, a number of brokers in the market have been asked to resign ISO agreements or to prepare for compliance with the necessary processes governing disclosure trigger events (wait, the what now?). Brokers may also have noticed that a number of funders have also made changes to their stip requirements as they narrow down which permissible method they’ll use to calculate an estimated APR while at the same time formulating a mathematical model to be able to comply with the reasonably anticipated true-up scenario disclosures (huh?).

Some participants have heralded the law as a turning point for eliminating bad actors while later discovering only recently for the first time that the law may actually adversely impact their business as well. From there it’s like a roller coaster through the five stages of grief, in which they all do the math and realize that California is 12% of the population and can’t be written off. The acceptance phase is when they finally decide that they will figure out what form they need to include, only to find out that it really is more than just a form.

To be sure, several participants have also communicated that they’re feeling good about preparedness for compliance, so the world won’t end. It just might be tricky now for the segment of the industry that’s been putting off addressing this change to be ready in time. It’s a lot more complicated than it sounds. Are you ready?

How the Amazon / Parafin Merchant Cash Advance Deal Came to Be

November 2, 2022Back in December, Parafin, then a fintech startup with 20 employees, submitted a proposal to Amazon to roll out a potential Amazon merchant cash advance product. At the time, Parafin was little known to the general public and its surprise deal with DoorDash wouldn’t even become public until a month later.

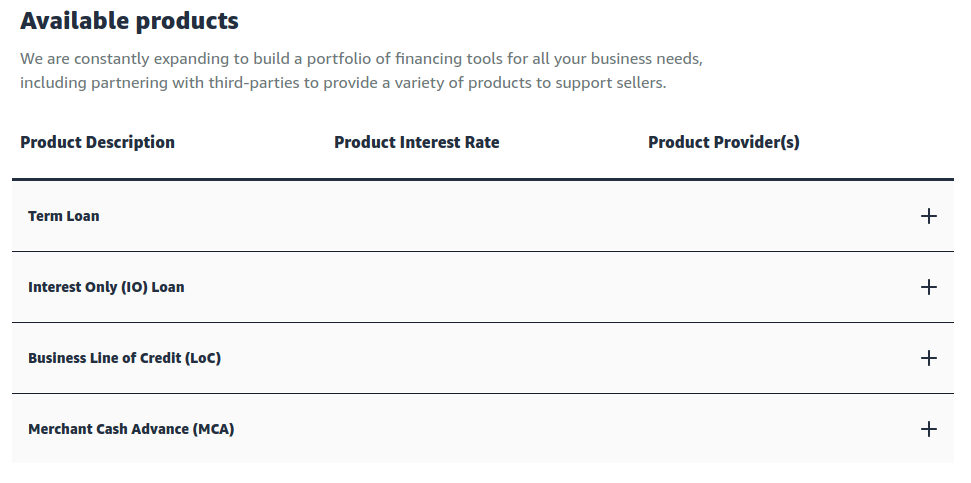

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

Coincidentally, more than a dozen people employed by Parafin, including the co-founders, are former Robinhood employees, according to profiles reviewed on LinkedIn. It’s part of a trend, it appears, as other members of their team hail from well known Silicon Valley firms like Lending Club, Stripe, Funding Circle, Google, Amazon, Facebook, StreetShares, and more.

Ultimately, Parafin’s big bet paid off. On Tuesday, November 1st, Amazon announced that the Parafin team was the one it had chosen to debut its official merchant cash advance product.

“Amazon is committed to providing convenient and flexible access to capital for our sellers, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending, in the announcement. “Today’s launch is another milestone in strengthening Amazon’s commitment to sellers, and builds on the strong portfolio of financial solutions we already provide. This latest offering significantly expands sellers’ reach and capabilities, and broadens their access to capital in a flexible way—one that helps them control their cashflow, and by extension, their entire business.”

“We founded Parafin with the mission to grow small businesses, and we’re thrilled that we have the opportunity to do that by providing Amazon sellers with this merchant cash advance option,” said Vineet Goel, co-founder of Parafin. “It’s a privilege to count ourselves among Amazon’s suite of financial solutions, and we look forward to making a difference for Amazon.com sellers looking to expand their business.”

The product is already listed on Amazon’s website and was rolled out to some US businesses immediately. It will be available to hundreds of thousands of additional sellers by early 2023, the company claims.

Unique to an Amazon MCA is that funding amounts can start as low as $500 and go up to $10 million.

Amazon’s entrance into the merchant cash advance market coincides wih a unique moment in the product’s history as several states are in the midst of imposing strict regulations on their sale.

The Flair at Broker Fair

October 27, 2022

Times Square this weekend was filled with representatives of the alternative finance and fintech industry for this year’s Broker Fair.

Times Square this weekend was filled with representatives of the alternative finance and fintech industry for this year’s Broker Fair.

“There’s just lots of opportunities to network, I mean there’s certainly breakout sessions and things like that, I think many people are excited about those, but I think everybody’s here to network,” said Mike Mroszak, Vice President of Strategic Partnership at Dedicated Financial GBC. “…there’s ample opportunities to do that, the trade show room here is always packed with people, which is not always the case in every conference, so that’s a little bit unique to Broker Fair.”

Funder, brokers, and lenders flooded the sponsor showcase room to talk business and give out swag.

“The best tchotchke is the Lendini tchotchke. Okay, what it is, it’s just a little tool kit, very practical, very handy,” said Michael O’Hare, President at Cashyew Leads. “…the funniest one is actually from FinTap and basically, it’s a button and it says, funded, kind of based off of what Staples says, that was easy, instead it says funded.”

Speakers included Jay Shaw from OnDeck discussing what makes a successful sales team and Keynote speaker Kaplan Mobray inspiring attendees to be excellent. Mobray even surprised the audience with a quick clarinet show. Other sessions that took place include: Bad Deals, The Great Debate, Building America, Equipping the Dream Behind the Scenes, Successful Sales Team (Panel), The State of Real Estate, Truck and Equipment Financing 101, and legal panels surrounding litigation alternatives and the new disclosure laws.

Speakers included Jay Shaw from OnDeck discussing what makes a successful sales team and Keynote speaker Kaplan Mobray inspiring attendees to be excellent. Mobray even surprised the audience with a quick clarinet show. Other sessions that took place include: Bad Deals, The Great Debate, Building America, Equipping the Dream Behind the Scenes, Successful Sales Team (Panel), The State of Real Estate, Truck and Equipment Financing 101, and legal panels surrounding litigation alternatives and the new disclosure laws.

Platinum sponsors Lendini, Rapid Finance, and National Funding also took the stage in between sessions.

AltFinanceDaily CONNECT Miami was also announced for January 19th, 2023, at the Miami Beach Convention Center. With reoccurring faces at this year’s event, attendees, sponsors and speakers are very excited to reconvene once again in Miami.

“It’s been a good time, not my first actually, my second, but I’m looking to do a lot more and definitely the Miami one in January,” said Charles Wolff, VP of Loan Originations at Financial Lynx.

Funding Circle US Originates $168M in 1st Half of 2022

September 8, 2022 Funding Circle’s US arm originated $168M worth of small business loans in the first two quarters of 2022.

Funding Circle’s US arm originated $168M worth of small business loans in the first two quarters of 2022.

“In the US, we continued to offer our commercial loan product during the six months to June 2022 and we have expanded this offering to serve super-prime businesses,” the company said in its latest financial disclosures.

Notably, Funding Circle closed funding deals with four banks and credit unions during the period and anticipates adding new investors as the year continues.

Globally, Funding Circle says it has helped 130,000 small businesses access $19.4B in funding since inception.

“Lending investor returns through the platform remain robust and attractive,” the company said on LinkedIn. “We’re making early progress against our medium-term plan to transform the business into a multi-product platform, as we continue to help more small businesses get the funding they need to win.”

Thoughts on Inflation, a Recession, and Regulation From Someone Who’s Seen ‘This Movie’ Before

July 7, 2022 “I can tell you that in the US that originators are starting to adjust their underwriting policies,” said David Goldin, CEO of Capify and Head of Originations at Lender Capital Partners, “I don’t know about pricing. I haven’t heard that yet.”

“I can tell you that in the US that originators are starting to adjust their underwriting policies,” said David Goldin, CEO of Capify and Head of Originations at Lender Capital Partners, “I don’t know about pricing. I haven’t heard that yet.”

Goldin, who has been a small business finance chief executive for 20 years, believes that the economy, inflation, and interest rates are front-and-center issues that the industry should be thinking about right now. In the UK, one region that Capify operates in, Goldin said that several small business finance executives there are already talking about raising margin and doing shorter term deals to prepare for the increased risk.

“Some originators are smart enough to be proactive and others are saying, ‘oh we’ll just watch it.’ So it’s either going to take trickling down through the economy globally or defaults to go up for these adjustment to happen,” he said.

During the Great Recession of ’08/’09, Goldin was right in the thick of it as the CEO of AmeriMerchant, one of the first MCA companies in the US. He explained that there’s a notable difference between now versus then.

“One of the things that didn’t exist back then, someone doing a second [position] was like unheard of in 2008,” he said. “Now, what is it now? first, 2nd, 3rd, 4th, 5th? 6, 7, 8, 9. It’s like a horse race. Ten horses in the race in some cases. […] You have to be careful, right? You have to make sure you’re covering your margin by charging enough and going shorter.”

But in a competitive environment where nobody wants to reveal their cards or risk losing business, not every funder is keen to start making changes right now. Goldin said that many funding companies will wait to see if their competitors start tightening up first especially if they’re driven by their ISOs and brokers. The downside of becoming more conservative is that brokers might just decide to take all of their business elsewhere.

But a looming recession isn’t all bad. “There are some positives,” he said. “The positives are the banks do tighten up. It’s just a question of when not if. So, you may get applicants that come to alternative financing that may have never taken or considered these types of products because they got bank financing.”

Complicating the landscape now, however, is that funding companies are wrangling with new state regulations. Goldin is aware of several originators that have temporarily paused business in Virginia, for example, where a disclosure requirement went into effect just last week. The soon-to-be implemented New York and California laws are also causing rumblings about funding suspensions respectively. In each of those states it was “sales-based financing” products that were specifically targeted, a trend that looks sure to continue as states like Maryland, Connecticut, and others are determined to reintroduce disclosure legislation next year.

“I think more and more originators will eventually get away from the MCA model,” Goldin said, “and go more towards the business loan model by partnering with a bank. I think you’re going to see more companies trying to implement bank programs to become full business loans and not deal with all the nuances of a state by state and MCA program.”

Goldin’s point of view, wisdom, and predictions are aggressively sobering. Only three months ago, industry sources were telling AltFinanceDaily that their outlook for 2022 was optimistic and that the end of covid-era government stimulus suggested that there would be growth for non-bank finance companies. Suddenly the tone has shifted, the stock market has plummeted, and interest rates are rising.

Goldin’s point of view, wisdom, and predictions are aggressively sobering. Only three months ago, industry sources were telling AltFinanceDaily that their outlook for 2022 was optimistic and that the end of covid-era government stimulus suggested that there would be growth for non-bank finance companies. Suddenly the tone has shifted, the stock market has plummeted, and interest rates are rising.

“I think if you resurveyed originators now, I think you’d get a different response than you did eight weeks ago or even four weeks ago,” Goldin said. “I can tell you right now that capital providers are asking their originators about how they’re making adjusments in this environment…”

Indeed, AltFinanceDaily did speak with several players just last week and did notice that the general sentiment had shifted to one of concern and caution.

“I think funders should be thinking about redundancy,” Goldin said. “More than ever the best time to raise capital is when you don’t need it. And I don’t know if [funding sources] will pull lines, yes if defaults go up, but they may not be as inclined to enter into new relationships in this environment.” Because of that, now might be the last best opportunity to secure additional credit sources even they’re not necessarily needed, he suggested.

With that, he said that funders should be thinking about tightening up the bottom of their credit profile, increasing their margins, doing shorter term deals, looking for more mature businesses, and working with businesses with higher credit scores.

“I think that those that don’t make credit adjustments, raise margin, and go shorter are going to have their you-know-what handed to them,” he said. “I’ve seen this movie too many times. It doesn’t have to be called a recession. […] It’s all about affordability to repay, and the more debt [the customers] have, and the more their margins are squeezed, or the more their sales go down. That’s when problems begin. You’re less likely to have a problem if you’re only out six months instead of eighteen months. I’ve used this saying a million times: ‘When the ships are too far out to sea and it’s a tidal wave, you can’t get them back.'”

Five Takeaways from AltFinanceDaily CONNECT MIAMI

March 31, 2022 Among the networking, dealmaking, and new connections made at AltFinanceDaily CONNECT MIAMI last week, conversations were had that touched on the past, present and future of the small business finance space. Those in attendance had all different types of ideas of where and how tomorrow’s deals will be funded.

Among the networking, dealmaking, and new connections made at AltFinanceDaily CONNECT MIAMI last week, conversations were had that touched on the past, present and future of the small business finance space. Those in attendance had all different types of ideas of where and how tomorrow’s deals will be funded.

Below are five takeaways from the industry’s most heavily trafficked event in South Florida this year.

-Networking is still key

In an industry dependent on making connections, events like these hold such a value to anybody looking to close deals. While the internet has taken geographic restrictions out of doing business, shaking hands and conversing in-person still holds true as the most valuable form of communication in both a personal and professional setting.

-Miami won’t replace everywhere else

It seems that the city that once opened its gates to alternative finance has now decided to pivot towards crypto. There’s strong interest in DeFi among those who live and work in Miami, especially the Floridians that attended the event. Several non-Floridian attendees were quick to argue that although the Miami weather and lifestyle is nice for a change of pace, it couldn’t replace their current residences. The idea of a satellite office in the Miami area didn’t sound like a bad thing to anybody, however.

-The disclosure impact is unclear

As disclosure laws pop up all over the country, it seems brokers and funders alike expressed little concern that it would lead to sweeping changes. Whether it’s a matter of awareness or an apathy derived from ongoing rollout delays in larger states, talk about governmental changes prompted little to no commentary.

-Brokers galore

It felt like there were more brokers at AltFinanceDaily CONNECT Miami than at other AltFinanceDaily events in the past. The sponsor showcase rooms on both sides were overflowing with brokers of all different experience levels and backgrounds. Brokers from the Miami area, New York, California, and Texas all said they were there to find new funders to work with. Funders that shared their thoughts said that they felt like this show was the most productive and beneficial one for them because of the amount of brokers in attendance.

-The people wanted more!

The genuine desire to make connections with potential business in a shared experience is real. People were not only making connections for future deals, but catching up with old friends. Many companies that attended the show had after parties that kept the event going after AltFinanceDaily CONNECT had officially concluded. Brokers and funders alike wanted as much opportunity to speak in-person as possible.

Update on Maryland Commercial Financing Bill

March 20, 2022Maryland’s commercial financing disclosure bill is continuing to move through the state legislature. After debate with potentially affected parties, some changes were made to the bill’s language. The APR requirement on sales-based financing transactions remains in the bill, however.

The bill passed through the Senate unanimously (47-0) and has been referred to the House. The original version in the House had been withdrawn but that was most likely because the members of that chamber anticipated that substantive edits would take place in the Senate. The House will now resume review and consideration of the Senate’s version going forward.