The Top 10 Alternative Small Business Funders

April 12, 2016At Lendit yesterday, I learned the 2015 origination volume of two additional small business funders that I was not able to ascertain previously. They are CA-based National Funding and GA-based Kabbage. Below is a list of the original top 8 funders that has been amended to form the top 10.

RANKINGS

| Company Name | 2015 Funding Volume | 2014 Funding Volume |

| OnDeck | $1,900,000,000 | $1,200,000,000 |

| CAN Capital | $1,500,000,000 | $1,000,000,000 |

| Funding Circle | $1,200,000,000 | $600,000,000 |

| Kabbage | $1,000,000,000 | $400,000,000 |

| PayPal Working Capital | $900,000,000 | $250,000,000 |

| Bizfi | $480,000,000 | $277,000,000 |

| Fundry (Yellowstone Capital) | $422,000,000 | $290,000,000 |

| Square Capital | $400,000,000 | $100,000,000 |

| Strategic Funding Source | $375,000,000 | $280,000,000 |

| National Funding | $293,000,000 |

An even larger list exists in the current issue of our magazine. To subscribe to future issues for free, click here.

LendingRobot is Now Your On-The-Go Marketplace Lending Robo-Advisor

April 8, 2016

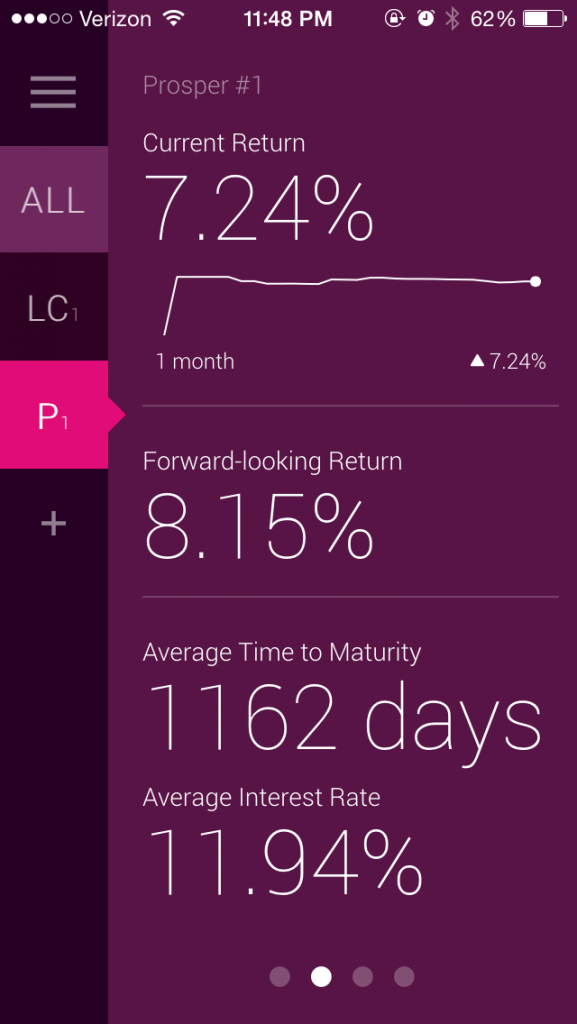

Checking your marketplace lending portfolio is now as easy as checking a stock quote

Marketplace Lending just became a little bit more friendly for investors thanks to LendingRobot’s new mobile app. The app allows investors to track the daily performance of their Lending Club, Prosper and Funding Circle portfolios all in one place. Its utility valued is bolstered by the fact that none of the three integrated platforms have published their own investor-oriented mobile apps, which came as a surprise even to LendingRobot CEO Emmanuel Marot.

The app complements the existing web service where investors can set custom filters to automatically buy notes that meet their criteria from the platforms whenever they become available. To date, more than 5,000 investors have signed up to use LendingRobot and more than $80 million of their collective investments are being measured by the service. Most of those users have only integrated their Lending Club or Prosper portfolios as of now, and not just because Funding Circle is a new addition, but also because their model is slightly different. “You have to be an accredited investor,” Marot said of using Funding Circle. There is no such requirement for the other two platforms.

The app complements the existing web service where investors can set custom filters to automatically buy notes that meet their criteria from the platforms whenever they become available. To date, more than 5,000 investors have signed up to use LendingRobot and more than $80 million of their collective investments are being measured by the service. Most of those users have only integrated their Lending Club or Prosper portfolios as of now, and not just because Funding Circle is a new addition, but also because their model is slightly different. “You have to be an accredited investor,” Marot said of using Funding Circle. There is no such requirement for the other two platforms.

The app is unique because it makes your aggregate marketplace lending portfolio data as handy as the latest stock quote. “It was kind of surprising actually for us to see that we have about 30% of our clients coming several times per week just to check it,” Marot said.

But perhaps as adoption of marketplace lending continues to catch on as part of a normal everyday diversified investment strategy, this will become more of a trend. For investors with large portfolios for example, the robo-advisor is likely acquiring notes for them multiple times per day every day, increasing the likelihood an investor will want to check in regularly to see how they’re doing.

Along with calculating the aggregate and individualized returns based on formulas that LendingRobot devised themselves, users can quickly refer to a baseline value known as their “portfolio health.” This number is not based on some proprietary advanced formula, Marot explained, but is rather the straightforward percentage of notes that are in good standing relative to all “live” notes. Charged-off notes are no longer considered live, Marot said.

Along with calculating the aggregate and individualized returns based on formulas that LendingRobot devised themselves, users can quickly refer to a baseline value known as their “portfolio health.” This number is not based on some proprietary advanced formula, Marot explained, but is rather the straightforward percentage of notes that are in good standing relative to all “live” notes. Charged-off notes are no longer considered live, Marot said.

Users can also check their portfolio composition, the average time to maturity and the average interest rate being assessed, in addition to being able to review raw figures such as how many notes became late in the last week or paid in full, for example.

Lending Club, Prosper and Funding Circle are just the beginning, Marot said, while expressing optimism about adding other platforms in the future. They saw the original three platforms they’re integrated with now as being a good fit because they are “safe.” “We are very cautious,” he said. Notably, those companies are also the three founders of the newly formed Marketplace Lending Association, of which he voiced support for.

Michael Raneri, a PwC Managing Director and Fintech Advisory Lead, wrote on Forbes that millennials will serve as early adopters for robo-advisors. “The next generation of investors has been quick to embrace new technologies and experiences, and this should apply to robo-advisors,” he wrote. “Furthermore, millennials have a general mistrust of large financial institutions, particularly in the wake of the financial crisis of 2008. Unlike their parents, who forged close relationships with advisors—even using their phones to have conversations with them, as primitive as that sounds—millennials are equally comfortable with making digital connections. They’ve been conditioned to accept that technology can match the performance of its human predecessors, while offering reduced fees and providing greater convenience.”

Marketplace Lending Association Formed to Defend Investor Marketplaces

April 6, 2016

Funding Circle, Lending Club and Prosper have joined forces to create a collaborative non-profit body, i.e. a trade association. Its mission is “to promote a more transparent, efficient, and customer-friendly financial system by supporting the responsible growth of marketplace lending, fostering innovation in financial technology, and encouraging sound public policy.”

Among the already available resources on the association’s website is a white paper dictating “operating standards.”

The standards are broken down into five broad categories:

- Investor Transparency and Fairness

- Responsible Lending

- Safety and Soundness

- Governance and Controls

- Risk Management

The group’s initial members are notable because Prosper only does consumer loans and Funding Circle only does business loans. Lending Club bridges the gap by doing a combination of both. That means that the group’s prospective membership will be fantastically broad. After all, what does a commercial lender providing capital to a $10 million/year business have in common with a personal lender helping a single mother refinance a credit card? The answer is their investor base.

All 3 companies allow investors to invest in loans on their respective marketplaces and lo and behold “investor transparency and fairness” is the first, foremost and most detailed category of their white paper.

All 3 companies allow investors to invest in loans on their respective marketplaces and lo and behold “investor transparency and fairness” is the first, foremost and most detailed category of their white paper.

Indeed, one requirement to join the association is to be matching 75% of loans, by dollar, with commitments for funding from investors before the loans are issued.

The Marketplace Lending Association therefore probably seeks above all else, permanent acceptance of the ability for investors to buy loans or securities backed by loans in online marketplaces.

And it’s no wonder, just last week SEC Chairman Mary Jo White questioned these marketplaces during a keynote speech at Stanford University. “We expect that investors will receive disclosures about the loans underlying their investments, including information about the borrowers as well as the platform’s proprietary risk and lending models, that will enable them to make informed investment decisions – both at the time of investment and on an ongoing basis,” she said.

The SEC is not alone in their interest, hence the need for and now the emergence of, a Marketplace Lending Association.

Santander Cuts Branches, Partners with Kabbage

April 4, 2016

Santander is putting its money where its mouth is and launching Kabbage in UK.

The Spanish banking giant, an investor in Kabbage will use its technology to underwrite quick loans up to 100,000 pounds the same day for loans that typically take 2-12 weeks to process.

The service will roll out over the next two months and will be the bank’s second attempt at allying with an online partner. In 2014, it set up a referral program with UK-based Funding Circle for small business borrowers.

The announcement comes at a time when big banks are shedding weight and becoming leaner to adapt to the digital times. Last Friday (April 1st), Santander said that it will close up to 450 of its 3,467 (13 percent) branches to transition into “cheaper digital channels.”

The road to saving 3 billion euros by 2018 is paved in working with lean businesses like Kabbage. “The way we internalise and adapt to new technology in the coming years will determine our success,” Ana Botin, chairman of Santander said.

This isn’t a one off announcement by Santander. Through its venture arm, Innoventures set up in 2014, the bank dedicated $100 million to invest in fintech startups. The fund participated in Kabbage’s Series E funding last year along with Scotiabank, ING and Reverence Capital Partners.

The bank also set up what it called a “tech-focused international advisory board” led by former US Treasury Secretary Larry Summers with a panel consisting of Red Hat CEO Jim Whitehurst, former Oracle president Charles Phillips and Francisco D’Souza, CEO of software services company Cognizant.

As the alternative lending industry shapes itself into stability with regulation, reducing its dependency on Wall Street’s institutional money, there are doubts whether the industry will stand the test of time in tough credit markets. While venture dollars are increasing in these companies, investors demand more. Fintech upstarts raised $19 billion in 2015 and in the same time, bank staff has been slimming down as investors bet on automated finance to eventually overthrow banking. Already, 46 percent of private funding has gone to lending companies selling cheaper loans easily while the banks focus on the shift of a branch’s transactionary functions to a strategic, consultancy role.

Will we see more such debanking?

Online Lender Avant Hires Ex-FDIC Chief to Board

April 1, 2016 Soon, non banking lending will be made up of ex bankers.

Soon, non banking lending will be made up of ex bankers.

The latest announcement comes from Chicago-based online lender Avant which hired the former head of Federal Deposit Insurance Corporation Sheila Bair to its board. Avant sells unsecured personal loans from $1,000 to $35,000 and has issued loans worth $3 billion.

Bair joins Avant after months of due diligence and said she was impressed Avant’s lending standards are similar to big banks where it retains half the loans on its balance sheet. At the FDIC where she spent five years between 2006 to 2011, she pushed for stricter lending standards with capital and risk. In 2014, she joined the board of Spanish bank Santander for a brief stint.

In the recent months, the new crop of fintech upstarts, backed by venture dollars and fiery ambition have clocked fast growth to justify the impressive hires. Stealth P2P insurance startup Lemonade brought on famous behavioral economist Dan Ariely to design risk models. Student lender SoFi hired Deustche Bank chief Anshu Jain to its board, Funding Circle appointed ex ECB chief Jorg Asmussen and last year Prosper hired former CFPB chief Raj Date.

The alternative lending space is garnering a lot of regulatory attention. SEC Chairwoman Mary Jo White called for more disclosure to investors as well as proprietary risk and lending models adopted by companies. The Small Business Finance Association is working on building a guide for industry best practices.

Bizfi Partners With West Coast Banking Group

March 17, 2016Bizfi will be the exclusive alternative finance solutions provider for small businesses that are members of the Western Independent Bankers, a trade association of community banks in the west coast.

Small businesses in the midwest and west coast in states including Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada New Mexico, Oregon, Utah, Washington and Wyoming can benefit from this partnership. Bizfi’s marketplace partners with lenders like OnDeck, Funding Circle and Kabbage.

“WIB member banks are the leading funders of America’s small businesses,” said Michael Delucchi, President and Chief Executive Officer of WIB and WIB Service Corporation. “With Bizfi as a WIB Premier Solutions Provider we are able to offer their expertise in alternative financing and superior technology to our member banks and deliver a complete solution for small business funding.”

Earlier this month, Bizfi partnered with The New York State Restaurant Association to provide business financing for its 2,000 small businesses in the restaurant space.

Fed’s Steady Interest Rates: What Does This Mean for You?

March 16, 2016The Federal Reserve kept interest rates unchanged citing a global economic slowdown and market volatility in the US.

The central bank kept the benchmark federal funds rate at 0.25-0.5 percent and scaled back forecasts of higher interest rates noting that the economy is exposed to the “uncertain global economy.”

What does this mean for online lenders? Not much directly as marketplace lenders don’t use the prime rate as a benchmark. But by association, it could affect demand for loans, credit performance and capital supply as the Fed rates play with investors’ expectations of yield.

But a small increase in rates wouldn’t have affected the industry too adversely. “Given the cushion we’ve already built into our loan pricing, we don’t plan to increase rates if there’s a small shift in the base rate,” Sam Hodges, co-founder and managing director of Funding Circle told WSJ last year, ahead of the rate hike in December.

But policymakers expect the central bank to raise rates by 0.5 percent by the end of this year. Will that affect be of any consequence? Hard to tell.

Retail Investors Can Invest In Business Loans – Thanks To StreetShares Regulatory Approval

March 16, 2016 If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

If not being an accredited investor has kept you on the sidelines of marketplace lending, you’ll soon be able to invest in business loans on the StreetShares platform, thanks to a special regulatory approval by the SEC. While you’re not going to the earn the yields you’d get with merchant cash advance (MCA) syndication, StreetShares makes loans for as short as three months. The available products are 3, 6, 12, 18, 24 & 36 month term loans, according to their website, which are desirable lengths for investors used to MCA. The Funding Circle platform by contrast, requires investors be accredited and loan terms range from 1 to 5 years. If you aren’t eligible to invest through Funding Circle, well that is what will make StreetShares different.

Unlike the laborious process that Lending Club and Prosper took with the SEC to sell loan performance-dependent notes to unaccredited investors, StreetShares got a special approval under the JOBS Act’s Regulation A+. That only allows them to raise up to $50 million over a 12-month period so investing availability may be limited.

In a press release, the company specified that “repayment to investors is not tied to the performance of a particular underlying loan.” The LendAcademy blog is reporting that “StreetShares will provide a vehicle for investors to become diversified through some kind of fund” and that details should be revealed around the time of the LendIt Conference.

Though company CEO Mark Rockefeller of StreetShares might not remember this, we spoke during a lunch break at LendIt 2014 when his company was a brand new startup. At that time, he told me about his “veterans funding veterans” lending marketplace model where the costs would be much lower than what can be experienced in the merchant cash advance industry. Since then his company has won the 2015 #1 global Best Investment Award from Harvard Business School and is now the first small business lender to get approval under Regulation A+.

One other person that is trying to bring small business lending investing to the unaccredited investor community is hedge fund manager Brendan Ross. Ross’s Direct Lending Income Fund filed an N-2 with the SEC at the conclusion of last year to become a “40 Act fund,” a special investment company permitted under The Investment Company Act of 1940 that can accept investments from retail investors. In January, Ross explained to CNBC during an interview that the fund’s structure would be converted so that investors become shareholders in what would essentially be a lending business.

StreetShares plans to officially debut their new program at LendIt next month.